Nitheesh NH

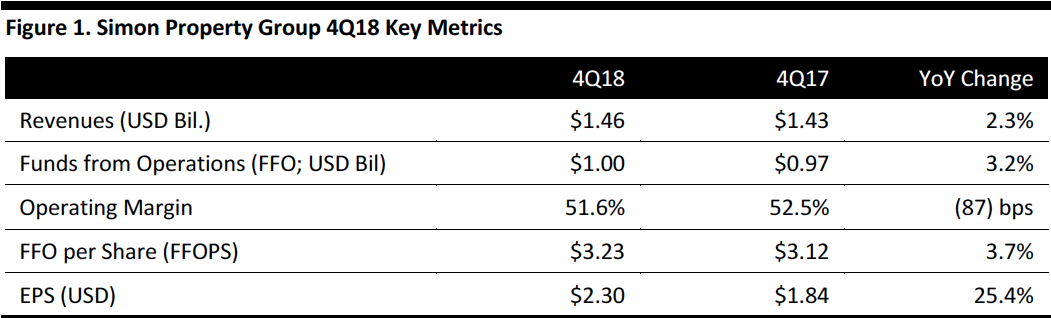

[caption id="attachment_70079" align="aligncenter" width="620"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

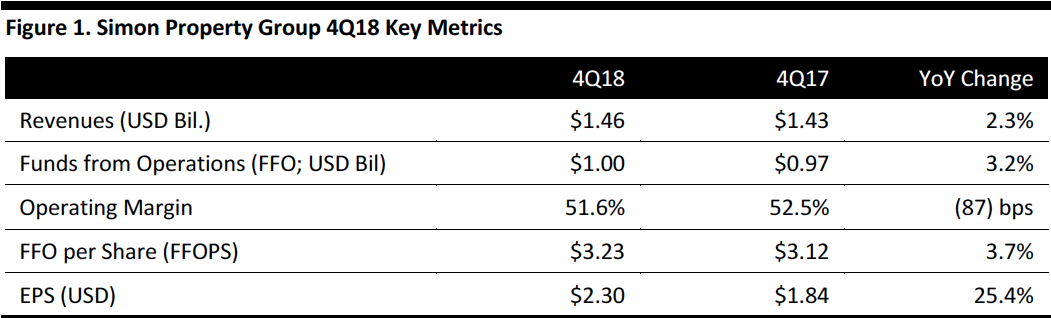

Simon reported revenues of $1.46 billion, up 2.3% year over year and ahead of the $1.44 billion consensus estimate.

In the quarter:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Simon reported revenues of $1.46 billion, up 2.3% year over year and ahead of the $1.44 billion consensus estimate.

In the quarter:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Simon reported revenues of $1.46 billion, up 2.3% year over year and ahead of the $1.44 billion consensus estimate.

In the quarter:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Simon reported revenues of $1.46 billion, up 2.3% year over year and ahead of the $1.44 billion consensus estimate.

In the quarter:

- Sales per square foot over the trailing 12 months were $661, an increase of 5.3%.

- Occupancy was 95.9% as of 12/31/18, up from 95.6% a year ago.

- The base minimum rent per square foot was $54.18 as of 12/31/18.

- The leasing spread per square foot for the trailing 12 months ended 12/31/18 was $7.75, an increase of 14.3%.

- Queretaro Premium Outlets (Queretaro, Mexico), scheduled to open in summer 2019 (in which Simon owns a 50% interest).

- Malaga Designer Outlet (Malaga, Spain), scheduled to open in fall 2019 (of which Simon owns 46%).

- Cannock Designer Outlet (Cannock, U.K.), scheduled to open in spring 2020 (of which, Simon owns 20%).

- Retail sales were strong across the portfolio, with growth in consecutive months throughout the year. Each platform ended the quarter and year at record retail sales levels.

- Leasing activity accelerated throughout the year, with occupancy for combined malls and Premium Outlets increasing 130 basis points from the end of the first quarter through year-end.

- The company expects to break ground on a new outlet in Bangkok, Thailand in the next few weeks.

- EPS of $7.30–$7.40 (down 6%–7%)

- FFO per share of (up 1%–2%)