DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

2Q19 Results

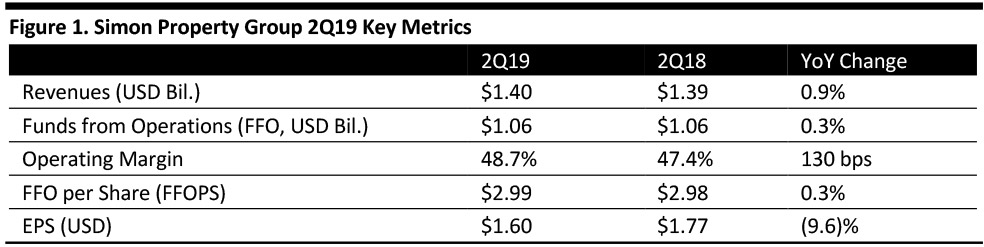

Simon reported revenues of $1.40 billion, up 0.9% year over year and ahead of the $1.34 billion consensus estimate.

Sales per square foot over the trailing 12 months ended June 30 were $669, an increase of 3.5%.

The occupancy rate was 94.4% as of 6/30/19, down from 94.7% a year ago.

The base minimum rent per square foot was $54.52 as of June 30.

The leasing spread per square foot for the trailing 12 months ended June 30 was $16.53, an increase of 32.3%.

FFOPS was $2.99, up 0.3% year over year, beating the consensus estimate of $2.98.

EPS was $1.60, down 9.6% year over year.

Details from the Quarter

During the quarter, the company started construction on a 229,000 square foot premium outlet (of which Simon owns 81%) in Normandy, France, scheduled to open in summer 2021.

Construction continued on the following international properties:

- Malaga Designer Outlet (Malaga, Spain), scheduled to open in October 2019 (of which Simon owns 46%).

- Siam Premium Outlets (Bangkok), scheduled to open in February 2020 (of which Simon owns a 50%).

- West Midland Designer Outlet (Cannock, UK), scheduled to open in October 2020 (of which Simon owns 20%).

Construction also continued on other redevelopment and expansion projects including:

- The Shops at Riverside (Hackensack, New Jersey)

- Southdale Center (Edina, near Minneapolis)

- Burlington Mall (Boston)

- Phipps Plaza (Atlanta)

- Paju Premium Outlets (Seoul)

- Gotemba Premium Outlets (Gotemba, Japan).

The company had more than 30 properties under construction at quarter-end in North America, Asia and Europe, and its share of all the construction costs for Simon was over $1.7 billion.

The company finished the first quarter with a net debt to NOI ratio of 5.1x and fixed charge coverage of 5.1x.

Outlook

The company confirmed its guidance of FFO per share of $12.30-12.40 (up 1-2%) but lowered EPS guidance to $7.04-7.14 from $7.30-7.40.