albert Chan

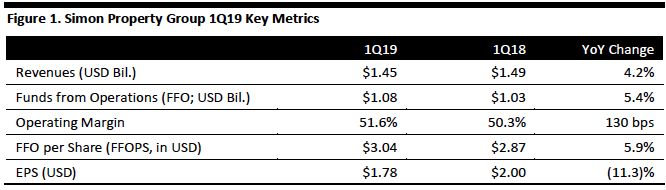

[caption id="attachment_85894" align="aligncenter" width="666"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

Simon reported revenues of $1.45 billion, up 4.2% year over year and ahead of the $1.44 billion consensus estimate.

Sales per square foot over the trailing 12 months ended March 31 were $660, an increase of 3.1%.

The occupancy rate was 95.1% as of 3/31/19, up from 94.6% a year ago.

The base minimum rent per square foot was $54.34 as of 3/31/19.

The leasing spread per square foot for the trailing 12 months ended 3/31/19 was $14.17, an increase of 27.3%.

FFOPS was $3.04, beating the consensus estimate of $3.03.

EPS was $1.78, up 9.9% year over year.

Details from the Quarter

During the quarter, the company started construction on a 251,000 square-foot premium outlet (of which Simon owns 50%) in Bangkok, scheduled to open in February 2020.

Construction continued on the following international properties:

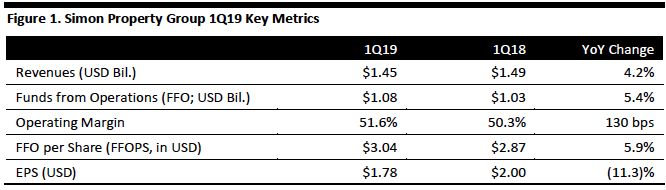

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Simon reported revenues of $1.45 billion, up 4.2% year over year and ahead of the $1.44 billion consensus estimate.

Sales per square foot over the trailing 12 months ended March 31 were $660, an increase of 3.1%.

The occupancy rate was 95.1% as of 3/31/19, up from 94.6% a year ago.

The base minimum rent per square foot was $54.34 as of 3/31/19.

The leasing spread per square foot for the trailing 12 months ended 3/31/19 was $14.17, an increase of 27.3%.

FFOPS was $3.04, beating the consensus estimate of $3.03.

EPS was $1.78, up 9.9% year over year.

Details from the Quarter

During the quarter, the company started construction on a 251,000 square-foot premium outlet (of which Simon owns 50%) in Bangkok, scheduled to open in February 2020.

Construction continued on the following international properties:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Simon reported revenues of $1.45 billion, up 4.2% year over year and ahead of the $1.44 billion consensus estimate.

Sales per square foot over the trailing 12 months ended March 31 were $660, an increase of 3.1%.

The occupancy rate was 95.1% as of 3/31/19, up from 94.6% a year ago.

The base minimum rent per square foot was $54.34 as of 3/31/19.

The leasing spread per square foot for the trailing 12 months ended 3/31/19 was $14.17, an increase of 27.3%.

FFOPS was $3.04, beating the consensus estimate of $3.03.

EPS was $1.78, up 9.9% year over year.

Details from the Quarter

During the quarter, the company started construction on a 251,000 square-foot premium outlet (of which Simon owns 50%) in Bangkok, scheduled to open in February 2020.

Construction continued on the following international properties:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Simon reported revenues of $1.45 billion, up 4.2% year over year and ahead of the $1.44 billion consensus estimate.

Sales per square foot over the trailing 12 months ended March 31 were $660, an increase of 3.1%.

The occupancy rate was 95.1% as of 3/31/19, up from 94.6% a year ago.

The base minimum rent per square foot was $54.34 as of 3/31/19.

The leasing spread per square foot for the trailing 12 months ended 3/31/19 was $14.17, an increase of 27.3%.

FFOPS was $3.04, beating the consensus estimate of $3.03.

EPS was $1.78, up 9.9% year over year.

Details from the Quarter

During the quarter, the company started construction on a 251,000 square-foot premium outlet (of which Simon owns 50%) in Bangkok, scheduled to open in February 2020.

Construction continued on the following international properties:

- Querétaro Premium Outlets (Querétaro, Mexico), scheduled to open in May 2019 (in which Simon owns a 50% interest).

- Malaga Designer Outlet (Malaga, Spain), scheduled to open in September 2019 (of which Simon owns 46%).

- West Midland Designer Outlet (Cannock, UK), scheduled to open in October 2020 (of which Simon owns 20%).

- The Shops at Riverside (Hackensack, New Jersey).

- Southdale Center (Edina, near Minneapolis).

- Northshore Mall (Peabody, near Boston).

- Paju Premium Outlets (in Seoul).

- Gotemba Premium Outlets (Gotemba, Japan).

- Redevelopment activity is moving quickly and faster than anticipated in some cases. For example, the transformation of Northgate in Seattle, which was originally planned to start next year, will start this summer with the demolition of the mall. This project will put significant pressure on corporate NOI, however, management considers it in the best interest of the company’s future growth. The retail space on this project will be replaced with an NHL corporate office, practice and public skating facilities, in addition to hotel and office space. The average base minimum rent will be $54.34 per square foot.

- Malls and outlets reported leasing spreads of $14.17 per square foot, up 27.3%.

- Reported sales for malls and outlets were $6.60 per square foot, up 3.1% from a year ago. This growth follows a strong 2018 and includes a late Easter and Passover as well as some weaker tourist spending due to a strengthening US dollar.

- The company broke ground on Siam Premium Outlets in Bangkok in the quarter, scheduled to open in 1Q2020.

- Simon also received approval to open a luxury designer outlet in Western Paris, which should benefit from both tourists and locals.

- Construction is expected in Querétaro, Mexico, in May and in Málaga, Spain, in the Fall.

- The company also plans to open an outlet in Cannock, UK, in the Fall.

- Redevelopment activities underway in 30 properties include 10 former department store redevelopment projects, plus an additional 25 properties in predevelopment. Simon continues to densify its centers by adding mixed-use components such as hotels, multifamily dwellings, office space and others.

- During the quarter, the company began construction on a 430-unit multifamily residence at Round Rock Premium Outlets in Texas, and construction began on Hotels by Marriott at Dadeland.

- Simon has identified a pipeline of more than $5 billion in new development and redevelopment opportunities across all its platforms to fuel future profit growth and reinforce its portfolio.

- EPS of $7.30-7.40 (down 6-7%).

- FFO per share of $12.30-12.40 (up 1-2%).