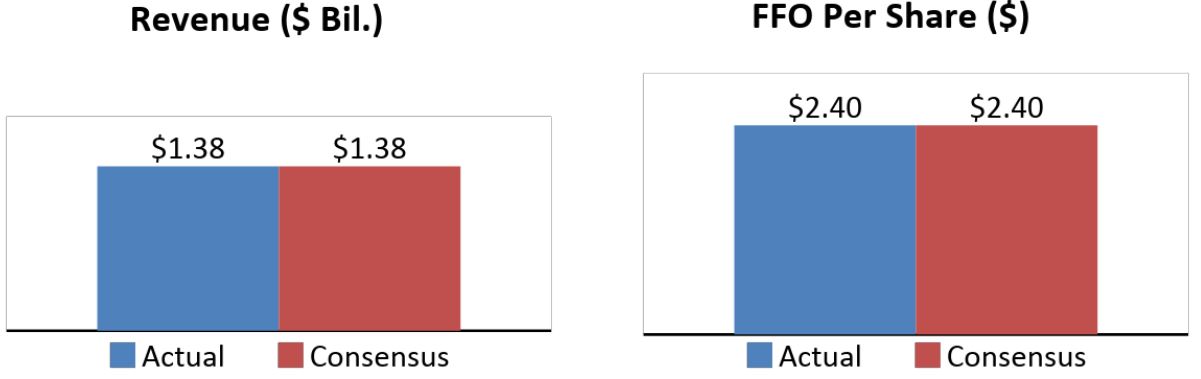

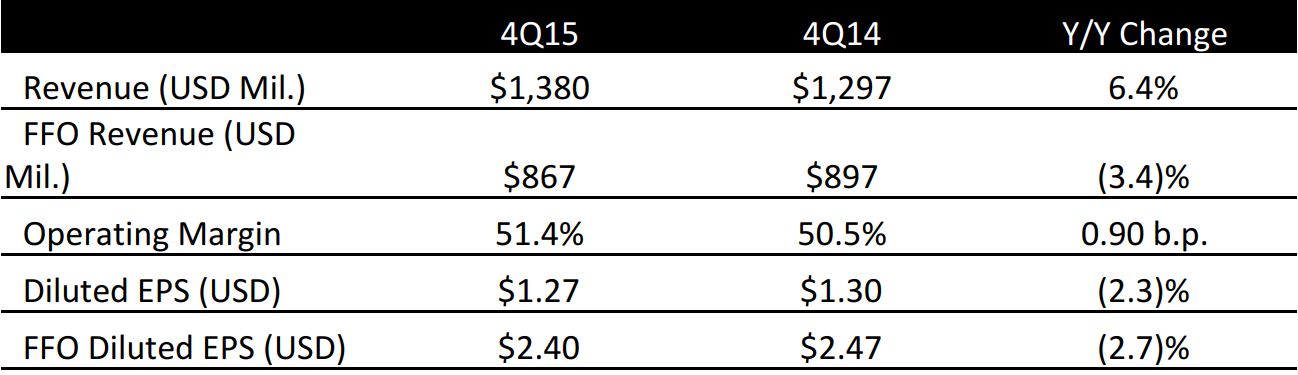

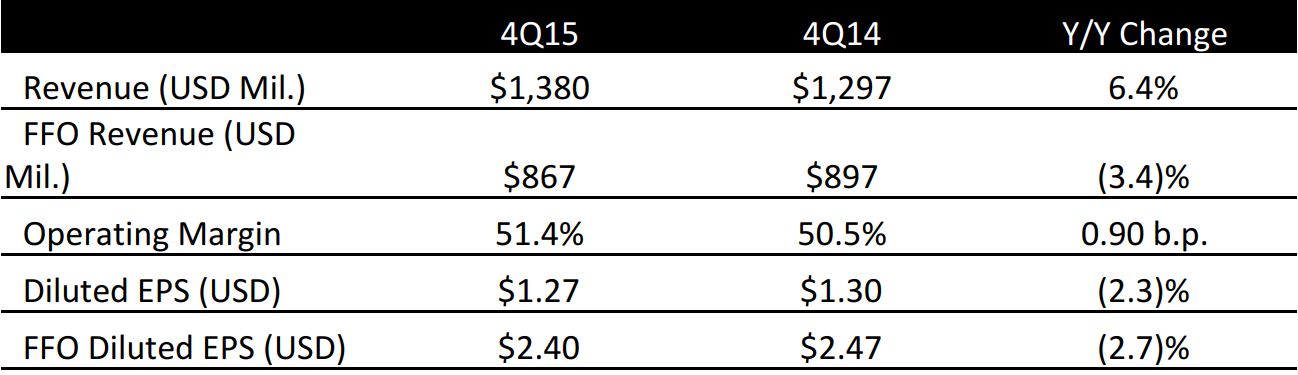

Simon Property Group reported fiscal-fourth-quarter diluted FFO of $2.40, in line with consensus expectations of $2.40. FFO, a closely watched profitability measure for real estate investment trusts, was down 2.8% year over year, from $2.47 a share in the fourth quarter of 2014. Excluding a loss on the extinguishment of debt of $121 million, (or $0.33 per diluted share) in the latest quarter, FFO increased by 10.5%, to $2.73 per share.

Total sales for the quarter rose by 6.4%, to $1.38 billion, in line with the consensus estimate of $1.38 billion.

Net operating income (NOI) for comparable properties grew by 3.4% in the quarter. Comparable properties include US malls, Premium Outlets and The Mills. Comparable property NOI in the fourth quarter was affected by a year-over-year decrease in overage (the amount to be paid by the tenant above the gross sales breaking point) due to the effect of the stronger dollar on tenant sales at the company’s tourist-oriented centers.

Occupancy at the company’s US malls was 96.1% as of December 31, compared with 97.1% a year earlier. The Indianapolis-based firm benefited in recent quarters from higher occupancy rates as the company shifted its focus to bigger malls and outlets. Total sales per square foot edged slightly higher, to $620 million, up 0.1% from $619 million a year ago. Base minimum rent per square foot rose by 4.1%, to $48.96 from $47.01 in the year-ago period.

Management indicated that the company’s occupancy and sales-per-square-foot rates have “generally improved” since 2014, when it spun off its strip centers and smaller enclosed malls into an independent trust.

Key Developments

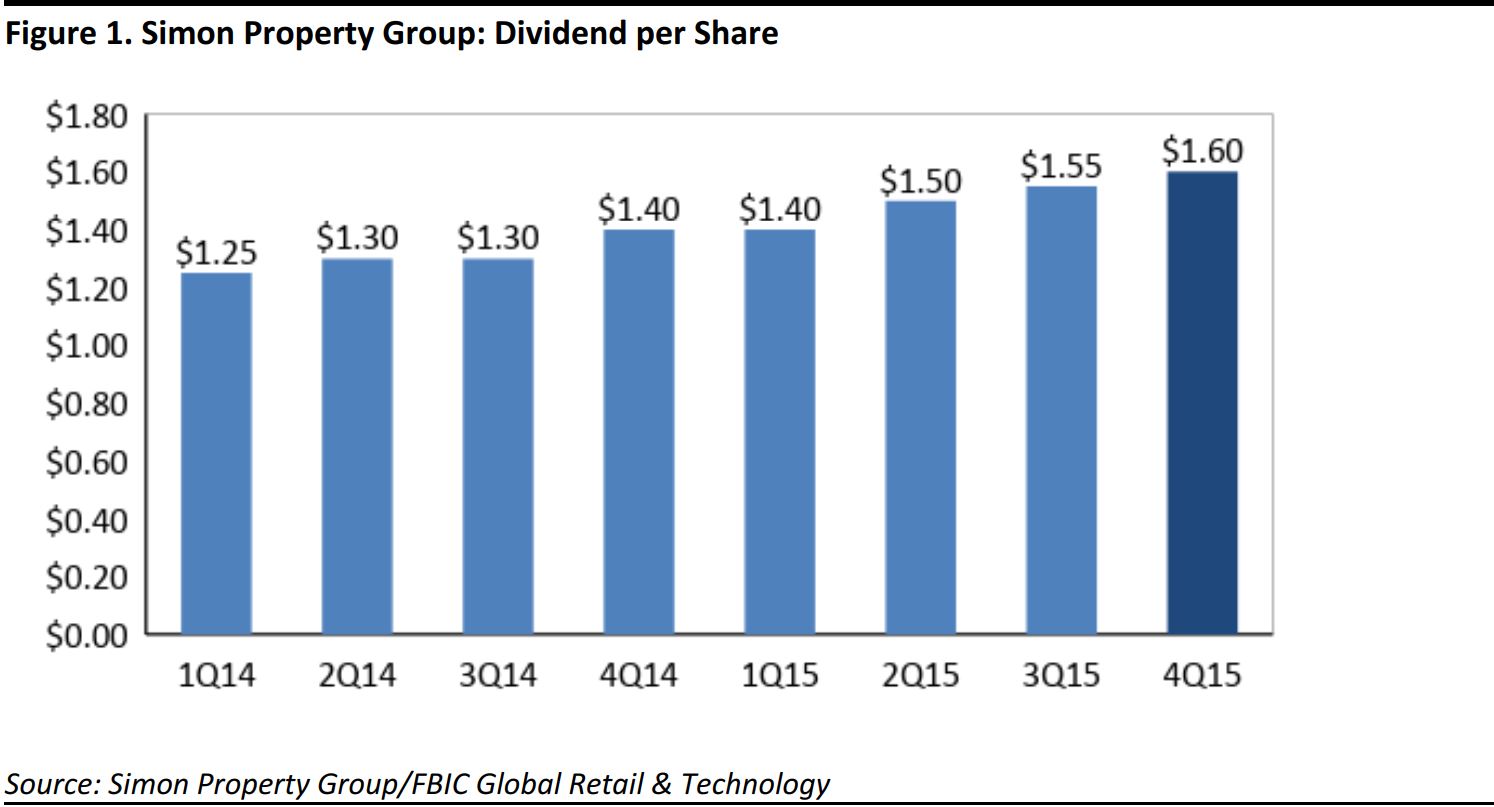

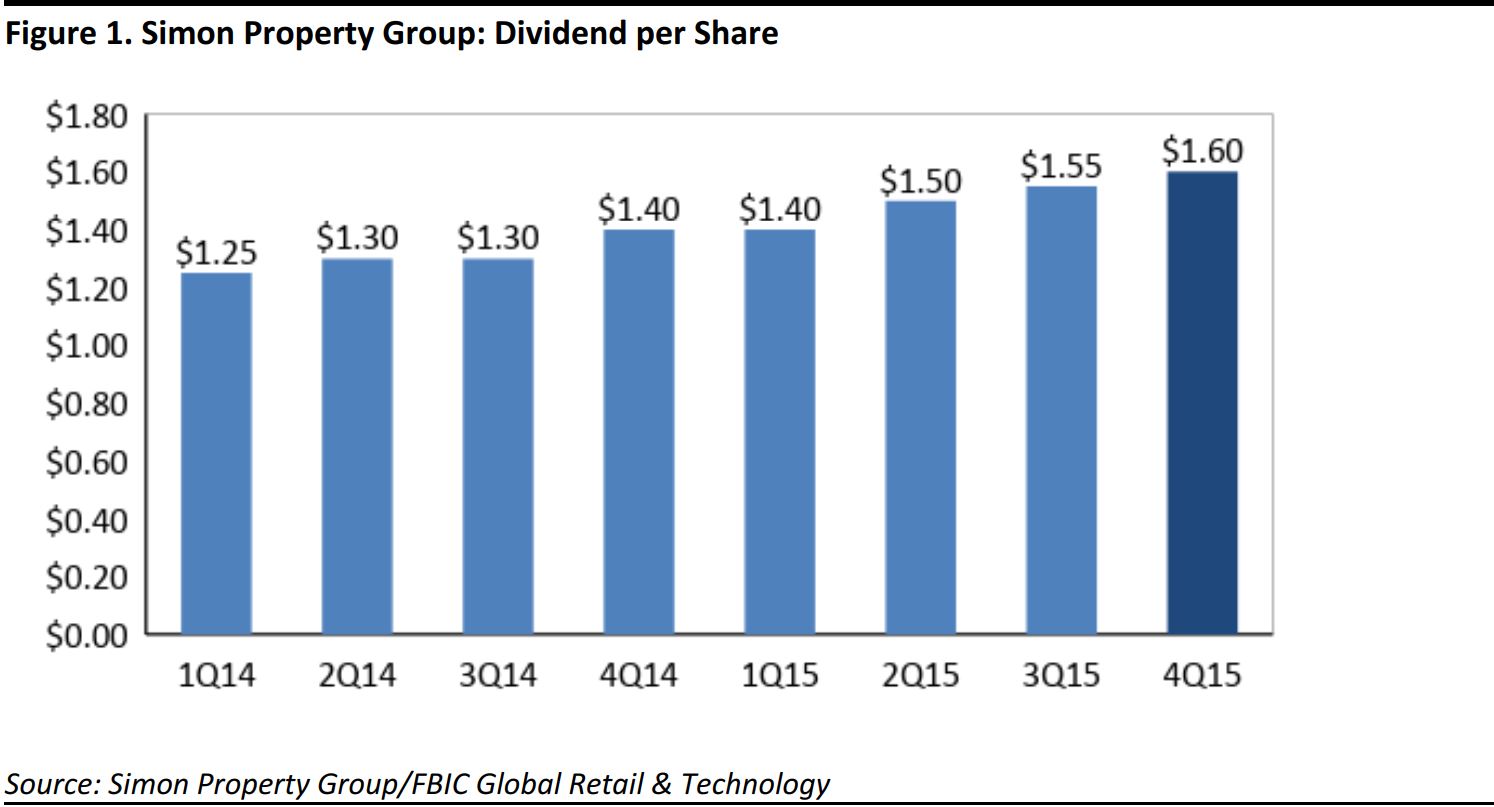

Simon Property Group declared a dividend of $1.60 per share, an increase of 14.3% year over year. The group has provided investors a record of impressive earnings-per-share growth.

Guidance

The group’s full-year guidance calls for FFO in the range of $10.70 to $10.80, which is lower than the consensus estimate of earnings of $10.89 per share. A continued focus on some of the premium markets in major metropolitan areas bodes well for long-term growth.

�

Simon Property Group reported fiscal-fourth-quarter diluted FFO of $2.40, in line with consensus expectations of $2.40. FFO, a closely watched profitability measure for real estate investment trusts, was down 2.8% year over year, from $2.47 a share in the fourth quarter of 2014. Excluding a loss on the extinguishment of debt of $121 million, (or $0.33 per diluted share) in the latest quarter, FFO increased by 10.5%, to $2.73 per share.

Total sales for the quarter rose by 6.4%, to $1.38 billion, in line with the consensus estimate of $1.38 billion.

Net operating income (NOI) for comparable properties grew by 3.4% in the quarter. Comparable properties include US malls, Premium Outlets and The Mills. Comparable property NOI in the fourth quarter was affected by a year-over-year decrease in overage (the amount to be paid by the tenant above the gross sales breaking point) due to the effect of the stronger dollar on tenant sales at the company’s tourist-oriented centers.

Occupancy at the company’s US malls was 96.1% as of December 31, compared with 97.1% a year earlier. The Indianapolis-based firm benefited in recent quarters from higher occupancy rates as the company shifted its focus to bigger malls and outlets. Total sales per square foot edged slightly higher, to $620 million, up 0.1% from $619 million a year ago. Base minimum rent per square foot rose by 4.1%, to $48.96 from $47.01 in the year-ago period.

Management indicated that the company’s occupancy and sales-per-square-foot rates have “generally improved” since 2014, when it spun off its strip centers and smaller enclosed malls into an independent trust.

Simon Property Group reported fiscal-fourth-quarter diluted FFO of $2.40, in line with consensus expectations of $2.40. FFO, a closely watched profitability measure for real estate investment trusts, was down 2.8% year over year, from $2.47 a share in the fourth quarter of 2014. Excluding a loss on the extinguishment of debt of $121 million, (or $0.33 per diluted share) in the latest quarter, FFO increased by 10.5%, to $2.73 per share.

Total sales for the quarter rose by 6.4%, to $1.38 billion, in line with the consensus estimate of $1.38 billion.

Net operating income (NOI) for comparable properties grew by 3.4% in the quarter. Comparable properties include US malls, Premium Outlets and The Mills. Comparable property NOI in the fourth quarter was affected by a year-over-year decrease in overage (the amount to be paid by the tenant above the gross sales breaking point) due to the effect of the stronger dollar on tenant sales at the company’s tourist-oriented centers.

Occupancy at the company’s US malls was 96.1% as of December 31, compared with 97.1% a year earlier. The Indianapolis-based firm benefited in recent quarters from higher occupancy rates as the company shifted its focus to bigger malls and outlets. Total sales per square foot edged slightly higher, to $620 million, up 0.1% from $619 million a year ago. Base minimum rent per square foot rose by 4.1%, to $48.96 from $47.01 in the year-ago period.

Management indicated that the company’s occupancy and sales-per-square-foot rates have “generally improved” since 2014, when it spun off its strip centers and smaller enclosed malls into an independent trust.