Nitheesh NH

Signet Jewelers

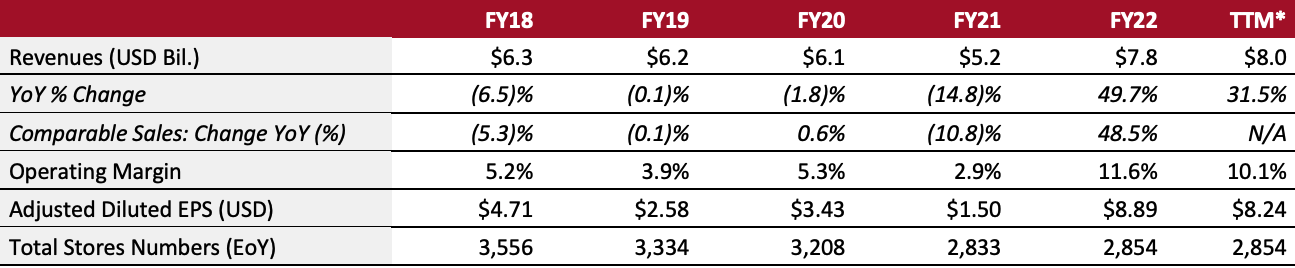

Sector: Jewelry specialty retail Countries of operation: Canada, Ireland, the UK and the US Key product categories: Bracelets, charms, earrings, necklaces and rings Annual Metrics [caption id="attachment_154094" align="aligncenter" width="700"] Fiscal year ends on January 30 of the following calendar year

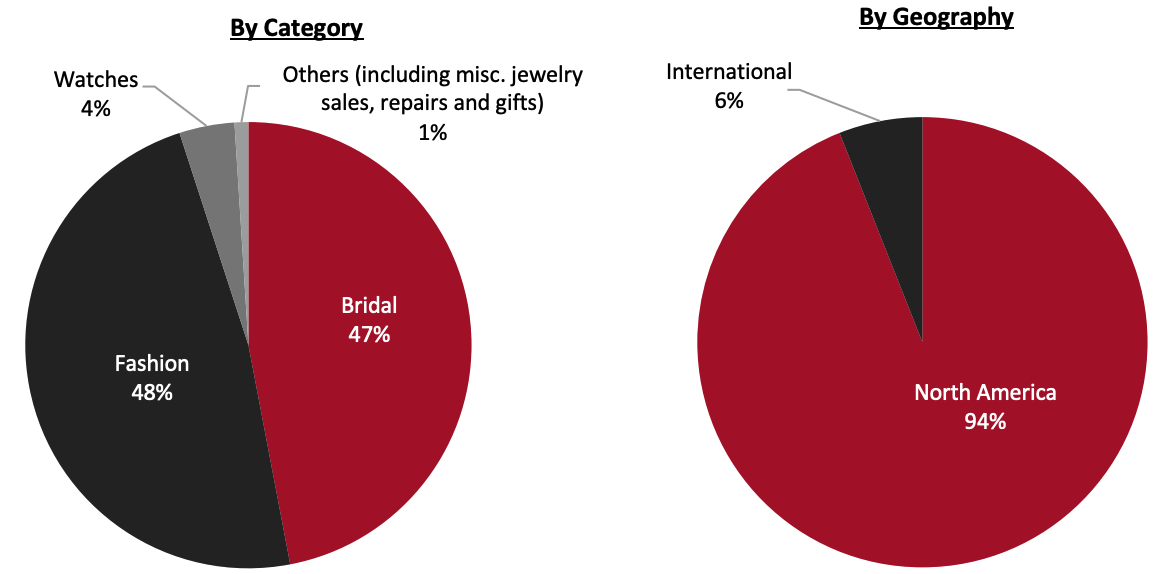

Fiscal year ends on January 30 of the following calendar year*Trailing 12 months ended April 30, 2022[/caption] Summary Founded in 1949 and headquartered in Bermuda, Signet Jewelers is a jewelry retailer that operates through three business segments: North America, international and others. The North America segment operates jewelry stores in malls, mall-based kiosks and off-mall locations throughout the US and Canada under the banners Kay, JamesAllen.com, Jared, Peoples Jewellers, Piercing Pagoda and Zales. The international segment sells jewelry, primarily in the UK and Ireland, under the H.Samuel and Ernest Jones banners. The others segment includes services, such as care/repair, gifts and extended service plans. Signet’s key product offering includes bridal and fashion jewelry, such as bracelets, charms, earrings, necklaces and rings. As of April 30, 2022, the company operates 2,854 stores globally. Company Analysis Coresight Research insight: Signet Jewelers’ key advantages include its buying scale, large distribution network, data analytics capability and distinctive portfolio of banners. The company has undergone a drastic transformation in the past couple of years, initially steered by its “Path to Brilliance” transformation plan—and in March 2021, the company introduced a new strategy, “Inspiring Brilliance,” aiming to maintain its strong momentum. Inspiring Brilliance focuses on broadening its mid-market offerings, expanding its omnichannel platform and shifting focus to off-mall stores. In its first quarter of fiscal 2023 (ended April 30, 2022), the company’s comparable sales increased by 2.5% year over year against very strong comparatives, driven by strong growth across each of its primary categories of bridal, fashion, watches and services, including care/repair and extended service plans. Signet is looking to broaden its mass-market positioning by expanding its flagship banners, Kay and Zales, which mainly cater to the jewelry market’s mid-range and contribute 60% of the retailer’s revenues. We expect that Signet will continue to post positive comps in full-year fiscal 2023, as we believe that strong growth momentum in the US jewelry market remains intact, driven by an expected surge in weddings in the US and high spending on bridal jewelry, as well as the growing adoption of male jewelry products. While sales growth at Signet has previously been led by physical store expansion, the retailer has ramped up its e-commerce initiatives in recent years—and online demand has seen a particular boost during the pandemic. The company is changing the course of its distribution, switching focus to e-commerce and shrinking its store estate, particularly at lower-tiered malls. In fiscal 2022 (ended January 29, 2022), Signet Jewelers’ global e-commerce penetration surged to nearly 20%, from just 6% in fiscal 2017. Additionally, in November 2021, Signet Jewelers acquired the US-based direct-to-consumer (DTC) jewelry retailer Diamonds Direct, which we believe will strengthen its digital and e-commerce capabilities substantially. In the near term, Signet is striving to achieve total e-commerce penetration of over 30% of its $9 billion global revenue goal.

| Tailwinds | Headwinds |

|

|

- Invest in and expand the company’s largest mid-market banners, such as Kay Jewelers in the US, H.Samuel in the UK and People’s Jewellers in Canada

- Maintain strength in the company’s largest categories, bridal and fashion

- Expand its mid-market-segment, by stretching to the top of the mid-tier through an increased focus on accessible luxury and expanding the bottom tier through greater focus on value—including growing its Piercing Pagoda business into a billion-dollar business

- Lead innovation across its banners, continuing to align them effectively with their target markets

- Increase the proportion of the company’s business coming through e-commerce and increase its share of online inventory purchases

- Increase participation in social commerce, using tailored content and influencers

- Shift from a store-centric model to a consumer-centric one, engaging customers across channels

- Encourage leadership and fast-paced, iterative learning at every level

- Empower agile teams to inspire “Design Thinking” approaches to problem-solving

- Nurture an environment in which diversity, innovation and transformation productivity are key characteristics

- Improve and expand existing services, including repair/care and extended service plans, to connect with customers more effectively

- Deepen customer relationship with new piercing and financial services, and innovate in jewelry customer services

- Accelerate the transition of traditional mall formats to highly productive off-mall locations

- Reduce exposure to declining malls in the company’s biggest Kay and Zales banners

Company Developments

Company Developments

| Date | Development |

| July 12, 2022 | Signet Jeweler’s Rocksbox banner announce the launch of Bridal by Rocksbox, its first bridal and occasion subscription service. |

| June 8, 2022 | Signet Jeweler’s Zales banner announces the launch of the Celebration Infinite diamond as part of Zales’ Celebration Diamond Collection, a premier line of certified diamonds cut for “excellent light performance.” |

| June 7, 2022 | Signet Jewelers publishes its fiscal 2022 Corporate Citizenship and Sustainability report, emphasizing advancement it is making on its 10-year corporate sustainability goals. |

| April 13, 2022 | Signet Jewelers announces that Tonia Zehrer, its Chief Merchandising Officer, is leaving the company and Signet has permanently eliminated the position. |

| March 17, 2022 | Signet suspends business interaction with Russian-owned entities amid Russia-Ukraine war tensions. |

| March 16, 2022 | Signet donates $1 million to Ukraine amid Russia-Ukraine war crisis. |

| February 16, 2022 | Signet Jewelers announces that its Senior Vice President and Chief Diversity Officer Reggie Johnson will lead a panel discussion in the Black in Jewelry Coalitions (BIJC) education program that deals with bias and racism in retail. |

| November 18, 2021 | Signet Jewelers acquires the DTC jewelry retailer Diamond Direct for $490 million in cash. Through this acquisition, Signet strategically expands its market in the accessible luxury bridal category, gaining access to a new customer base. |

| August 18, 2021 | Signet Jewelers launches the Love Inspires Foundation to support underserved women and children, and back social change advocacy. |

| August 2, 2021 | Signet Jewelers announces that it is testing a new master brand under the Piercing Pagoda banner: Banter by Piercing Pagoda. The company has plans to roll out the name to its over 500 Piercing Pagoda US locations, digital and social media channels in the near future. |

| July 13, 2021 | Signet Jewelers joins the Paradigm for Parity coalition, a movement of business leaders across industries committed to attaining full gender parity in corporate leadership by 2030. |

| June 30, 2021 | Unveils comprehensive corporate sustainability goals for 2030, deepening the company’s commitment to leading as a sustainability-focused and purpose-driven company. |

| April 6, 2021 | Acquires jewelry rental subscription platform Rocksbox. Through this acquisition, Signet aims to gain a significant foothold in the growing online jewelry service market. |

| March 15, 2021 | Joins United Nations (UN) Global Compact, the world’s largest corporate sustainability initiative, with over 12,000 member companies in more than 160 countries, covering issues such as anti-corruption, environment, human rights and labor. |

| June 19, 2020 | Announces that it has appointed of Rebecca Wooters as Chief Digital Officer. Prior to joining Signet, Wooters worked for 12 years at Citi Group, most recently as Chief Customer Experience Officer and Head of Digital Experience for the company’s Global Consumer Bank. |

| June 9, 2020 | Announces upgrades to its online shopping experience, enabling store staff to assist customers from home, using online chat, social media, video and virtual by-appointment private shopping consultations. |

| May 4, 2020 | Announces the appointment of Vincent Sinisi as Senior Vice President, Investor Relations. Sinisi has more than 15 years of experience in the retail-focused research industry, most recently serving as Executive Director, Equity Research at Morgan Stanley. |

- Virginia Drosos—CEO

- Joan Hilson—CFO and Chief Strategy Officer

- Italy Berger—President

- Steve Lovejoy—Chief Supply Chain Officer

- Oded Edelman—Chief Digital Innovation Advisor

- Howard Melnick—Chief Information Officer

- Rebecca Wooters—Chief Digital Officer

Source: Company reports/S&P Capital IQ