Nitheesh NH

Introduction

The Coresight Research team is attending and participating in this year’s Shoptalk conference, held on March 27–30, 2022, in Las Vegas, US. The conference brings together almost 3,000 established retailers, brands, technology companies, investors, Wall Street analyst firms and more under one roof. Shoptalk 2022 features 250+ speakers, 150+ CEOs, 80+ sessions and over 600+ sponsors. The conference presents an opportunity to gain insights into emerging trends and recent innovations. In this report, we present our top insights from day two of the show on March 28, 2022.Shoptalk 2022 Day Two: Coresight Research Insights

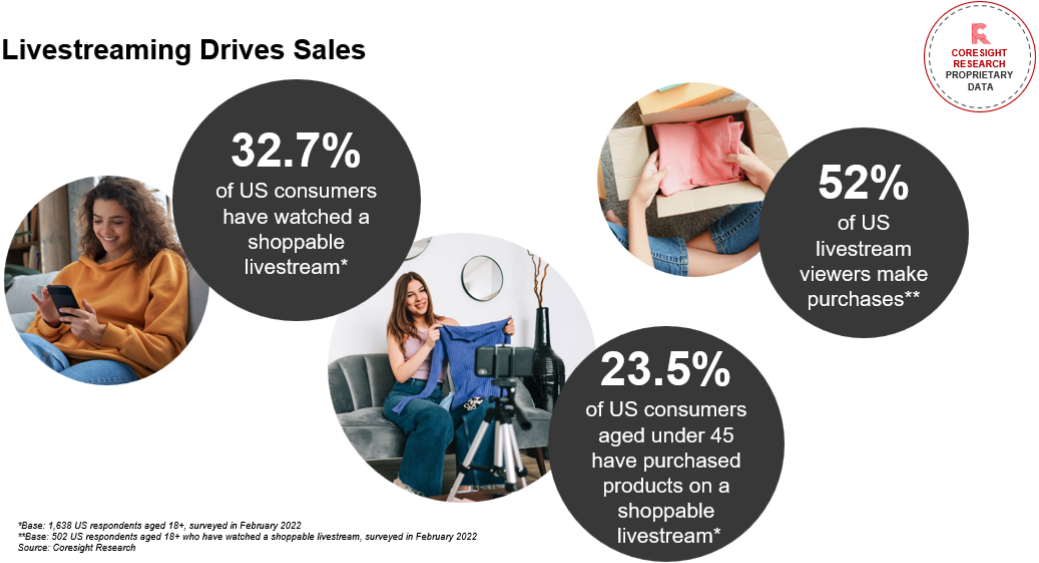

The US Livestreaming Market Is a Huge Opportunity for Growth Deborah Weinswig, CEO and Founder of Coresight Research, together with Bridget Dolan, Global Managing Director of Shopping Partnerships at YouTube, and Steve Vranes, CEO of Hot Topic, hosted a track keynote titled “Seizing the Livestreaming and Shoppable Video Opportunity” to a standing-room-only audience. Weinswig shared insights from Coresight Research’s February 2022 survey of US consumers, which found that 32.7% of consumers had watched a shoppable livestream in the past year, and over half (52%) of livestream viewers make purchases during a livestream. [caption id="attachment_144419" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Livestreaming adoption in the US lags behind China, which has seen growth in the channel in recent years. However, the US livestreaming ecosystem is developing quickly. We believe that removing friction at the point of checkout will boost sales through livestreaming, and many of the speakers featured in the “Payments” and “Checkout Innovations” tracks from day two at Shoptalk are making it a goal to do so.

Source: Coresight Research[/caption]

Livestreaming adoption in the US lags behind China, which has seen growth in the channel in recent years. However, the US livestreaming ecosystem is developing quickly. We believe that removing friction at the point of checkout will boost sales through livestreaming, and many of the speakers featured in the “Payments” and “Checkout Innovations” tracks from day two at Shoptalk are making it a goal to do so.

- Read more insights from Coresight Research on livestreaming e-commerce.

Weinswig discusses the US livestreaming e-commerce opportunity

Weinswig discusses the US livestreaming e-commerce opportunitySource: Coresight Research[/caption] Data-Driven Strategies Can Help Retailers To Fight Inflation Lorelei Bergin, VP of Retail Analytics at Nielsen IQ, shared the secrets to fighting inflation, which currently stands at a 40-year high. Bergin demonstrated how producer price growth had been outpacing consumer price growth for much of 2021, but consumer prices are rising quickly, catching up to producer price increases. Inflation is now being driven by supply chain pressures, labor shortages, strong consumer spending and consumer loyalty, according to Bergin. Coresight Research and Nielsen IQ have identified four strategies that retailers can employ to mitigate the impacts of inflation, which should be used in conjunction with each other and focus on pricing, assortment, promotion and supplier collaboration. To discover more, read Coresight Research and Nielsen IQ’s report, The Secret to Fighting Inflation: Data-Driven Strategies for Retailers. [caption id="attachment_144421" align="aligncenter" width="700"]

Bergin reveals the benefits of data-driven strategies for retailers

Bergin reveals the benefits of data-driven strategies for retailersSource: Coresight Research[/caption] Emerging Digital Technologies Are Living Up to the Hype In one fast-paced session, three industry experts—Liz Bacelar, Executive Director of Global Tech Innovation at Estée Lauder, Anshu Bhardwaj, SVP of Technology Strategy and Commercialization at Walmart Global Tech, and Meera Bhatia, Chief Operating Officer at Fabletics—debated the digital technologies that are moving the needle. Bhardwaj and Bhatia agreed that artificial intelligence (AI) is now essential in personalization at Walmart and Fabletics. Bacelar trumpeted the metaverse, and threaded references to the blockchain and non-fungible tokens (NFTs) through her comments. Bacelar described Estée Lauder’s metaverse pop-up in Decentraland last week, which used new technology to drive engagement and loyalty in a new way: The brand created a wearable NFT themed around its top-selling skincare product, Advanced Night Repair, which imbued users’ avatars with a golden glow. The speakers all agreed the early growth stage of the metaverse is a great opportunity for experimentation. Bacelar also highlighted livestreaming, which is already big at Estée Lauder in the cosmetics and skincare categories and is being rolled out to fragrance and haircare this year. Bacelar predicted, “Tik Tok and YouTube will migrate to the metaverse. Livestreaming in the metaverse, mark my words!” For Bhatia, livestreaming is especially well suited to brands, social influencers and ambassadors—the issue is finding the audience. [caption id="attachment_144422" align="aligncenter" width="700"]

From left to right: Chris Walton, CEO at Omni Talk (interviewer); Anshu Bhardwaj, SVP of Technology Strategy and Commercialization at Walmart Global Tech; Meera Bhatia, Chief Operating Officer at Fabletics; and Liz Bacelar, Executive Director of Global Tech Innovation at Estée Lauder

From left to right: Chris Walton, CEO at Omni Talk (interviewer); Anshu Bhardwaj, SVP of Technology Strategy and Commercialization at Walmart Global Tech; Meera Bhatia, Chief Operating Officer at Fabletics; and Liz Bacelar, Executive Director of Global Tech Innovation at Estée LauderSource: Coresight Research[/caption] Gen Z Is Leading PacSun into the Metaverse The midday keynote sessions focused heavily on the retail opportunities presented by the metaverse. Brieane Olson, President of US apparel brand PacSun, explained that Gen Z is leading the company’s metaverse initiatives. Pacsun’s approach to the metaverse is to lead authentically, and to build alongside the consumer. Notably, one of PacSun’s early metaverse success metrics is measuring “copycats,” recognizing imitation as the highest form of flattery. Furthermore, PacSun has leveraged crowdsourcing, as consumers have put forward “arguably stronger designs than we generated at the onset,” according to Olson. PacSun’s metaverse initiatives include seasonal apparel launches for avatars in the Roblox community that are also available for physical purchase. Notably, its “Mall Rat” NFTs celebrating each of its physical store locations sold out quickly. Perhaps the most significant initiative will be the launch of PacSun’s world within the Roblox environment on March 31, 2022. Overall, PacSun’s early metaverse approach is one that values community creation, by giving consumers the tools to create their own ways to express themselves within the metaverse.

- Read Coresight Research coverage of the metaverse in retail.

Brieane Olson, President at PacSun (left) and Joe Laszlo, VP of Content at Shoptalk (right)

Brieane Olson, President at PacSun (left) and Joe Laszlo, VP of Content at Shoptalk (right)Source: Coresight Research[/caption] Personalization Is the Moat for Many Retailers Bradford Shellhammer, VP of Buyer Experience at eBay and GM at eBay NYC, Julie Bornstein, Co-Founder and CEO at The Yes, and Nadine Graham, VP of Digital Client Experience at Sephora, discussed personalization tactics that create more relevant, engaging shopping experiences both online and offline. Cutting through the clutter of 1.5 billion items and creating a personal storefront for one is the goal at eBay. By leveraging customer data, the company is creating a different offering for every customer. Similarly, Bornstein set out to create a fashion business where the tech stack and the entire platform was built to understand the individuality of each user and create a personalized shopping experience. At The Yes, the process starts with a quiz to determine what each shopper likes and doesn’t like, and then offers up products, ranging from fast fashion to designer pieces, as the platform iteratively learns shoppers’ preferences. A shared source of truth is foundational to Sephora’s personalization strategy, with each interaction based off previous interactions used to predict consumers’ future choices. Shellhammer ended the session by urging retailers to respect their customers: “If you have 10 years of customer data and you aren’t using it, it is offensive.” Brands Must Pivot to Where Their Customers Are Natalie Mackey, Co-Founder and CEO of Winky Lux, set out to create a beauty and fashion marketplace in 2015. Winky Lux, its in-house cosmetics brand, was originally an afterthought. Mackey discovered from a focus group of 200 women that shoppers were not interested in the marketplace, but they loved the maximalism and joy of Winky Lux. She pivoted, and the brand was born. A real brand differentiator is the brand’s relationship with its customers; they decide the brand’s direction, as their feedback drives product launches. In 2021, Winky Lux launched skincare based on opportunities revealed in the skincare routines of Winky Lux advocates. The brand’s stores are designed to be fun, and Mackey wants to create that same sense of joy in the retailers where Winky Lux is sold. In 2021, Winky Lux was “Vendor of the Year” at Target. [caption id="attachment_144424" align="aligncenter" width="700"]

Monisha De La Rocha, Partner at Bain and Co. (left), and Natalie Mackey, Co-Founder and CEO of Winky Lux (right)

Monisha De La Rocha, Partner at Bain and Co. (left), and Natalie Mackey, Co-Founder and CEO of Winky Lux (right)Source: Coresight Research[/caption] Next-Generation Logistics Companies Are Seeing Continued Success The session titled, “Robotics and Other Fulfillment Techologies” featured presentations from four innovators in the delivery and fulfillment segment.

- Deliverr offers fast fulfillment services to retailers, and states that retailers that use its services see a 38% increase in sales on average. The company offers freight storage and preparation and counts Google, Shopify and Walmart as customers. Management cited an internal survey reporting that 90% of US shoppers expect two- to three-day delivery.

- Gatik provides an autonomous delivery network for the middle mile, through autonomous vehicles capable of short-haul business-to-business logistics, such as from a distribution center to a micro-distribution center.

- Invia Robotics offers a platform that digitalizes the workflow, with AI applied inside the warehouse to improve the experience for workers by positioning inventory to reduce travel times and minimizing the number of repetitive, robot-like actions they have to perform.

- MasonHub provides a cloud-based platform merging nine back-end technologies required for fulfillment, freeing retailers from having to create their own technology and offering fulfillment as a service. Use of the platform results in a dramatic increase in net promoter scores, from 14 to 78, according to MasonHub.

Gatik autonomous delivery vehicle

Gatik autonomous delivery vehicleSource: Coresight Research[/caption] Retailers Can Use Data To Gain Total Oversight of the Customer Experience Best Buy’s team is responsible for creating experiences that both its customers and employees love. The company possesses an enterprise team for analyzing customer data, plus a team of creative experience designers. The enterprise group gathers much of its data from focus groups and uses ethnography to determine the context behind the data, allowing it to compile a 360-degree view of the customer. However, Best Buy goes further by also including the employee journey. For example, if a consumer had discussed an issue with a telephone representative yet still needs to visit the store to resolve the issue, Best Buy’s system identifies that the consumer will expect the store associate to know what had been discussed on the call. Finally, the team aims to understand issues not contained within data—what caused consumers to exit the shopping journey, for example. [caption id="attachment_144426" align="aligncenter" width="700"]

Jennie Weber of Best Buy (left) and Vanessa Larco of New Enterprise Associates (right)

Jennie Weber of Best Buy (left) and Vanessa Larco of New Enterprise Associates (right)Source: Coresight Research[/caption] Online Grocery Is Continuing To Evolve Rapidly Alongside Instant Needs and Retail Media Networks Instacart has broadened its offerings beyond just delivery, recently announcing “The Instacart Platform” suite of enterprise tools, which provides e-commerce, fulfillment, in-store functions, advertising and insights to other retailers. The offering is particularly appealing to small grocers, which cannot afford to make the technology investment to go online, and Instacart’s CEO Fidji Simo expects online grocery penetration to approach the 30% figure of other segments. Competition has increased due to investment from Amazon, Walmart and instant-needs retailers, which target a younger demographic. On its new platform, Instacart can manage advertising on other grocers’ websites, and Simo highlighted the potential of retail media, commenting that the ultimate grocery business model could evolve to one in which retailers run their online grocery businesses at breakeven and earn a profit on their advertising. [caption id="attachment_144428" align="aligncenter" width="700"]

Fidji Simo of Instacart (left) and Brad Stone of Bloomberg News (right)

Fidji Simo of Instacart (left) and Brad Stone of Bloomberg News (right)Source: Coresight Research[/caption] Retailers Can Implement Multiple BNPL Options Payment and checkout innovations are a major focus at Shoptalk 2022, and BNPL (buy now, pay later) in particular was discussed in detail. Brendan Sweeney, Group General Manager of E-Commerce at Cotton On Group, argued that integrating just one BNPL platform is not enough. Through his experience at Cotton On Group, Sweeney found that retailers and brands miss out by integrating only one BNPL option. Via a poll, Cotton On Group discovered that customers use an average of 2.5 BNPL options. Sweeney further explained how BNPL adoption and use varies greatly depending on geography and other factors. For example, in the UK, the Cotton On Group has integrated three BNPL options, one of which is generating a basket size 50% higher than the others—even though it is exactly the same value proposition. Sweeney also pointed out the unexpected underperformance of BNPL in South Africa. Cotton On Group was one of the first retailers to implement BNPL in South Africa, believing it would transform the market. The opposite turned out to be true: The results were actually low penetration and a decline in conversion. While BNPL is being quickly adopted in areas such as the US and UK, its adoption is developing at differing rates around the world. [caption id="attachment_144427" align="aligncenter" width="700"]

Brendan Sweeney, Group General Manager of eCommerce at Cotton On group, and Deepa Mahajan, Partner at McKinsey and Company

Brendan Sweeney, Group General Manager of eCommerce at Cotton On group, and Deepa Mahajan, Partner at McKinsey and CompanySource: Coresight Research[/caption]