Nitheesh NH

Introduction

The Coresight Research team attended and participated in this year’s Shoptalk conference, held on March 27–30, 2022, in Las Vegas, US. The conference brought together almost 3,000 established retailers, brands, technology companies, investors, Wall Street analyst firms and more under one roof. Shoptalk 2022 features 250+ speakers, 150+ CEOs, 80+ sessions and over 600+ sponsors. The conference presented an opportunity to gain insights into emerging trends and recent innovations. In this report, we present key insights from day four of the show on March 30, 2022. We also offer the top takeaways from the event as a whole, as discussed in the final panel of the Shoptalk 2022, which featured Marie Driscoll, Managing Director, Luxury and Retail, at Coresight Research. [caption id="attachment_144592" align="aligncenter" width="700"] The Coresight Research team at Shoptalk 2022 (from left to right): Richard Marooney, Analyst; T.J. Rau, Senior Account Manager; Marie Driscoll, Managing Director, Luxury and Retail; Deborah Weinswig, CEO and Founder; and John Harmon, Senior Analyst

The Coresight Research team at Shoptalk 2022 (from left to right): Richard Marooney, Analyst; T.J. Rau, Senior Account Manager; Marie Driscoll, Managing Director, Luxury and Retail; Deborah Weinswig, CEO and Founder; and John Harmon, Senior AnalystSource: Coresight Research[/caption]

Shoptalk 2022 Day Four: Coresight Research Insights

Businesses Are Launching in the Metaverse To Grow Brand Awareness The metaverse was a topic that featured in nearly all panels throughout Shoptalk 2022. In two separate sessions on day four, brands across a wide range of industries discussed the marketing opportunities that the metaverse presents. In food and grocery, Andrea Steele, Head of Digital Marketing Operations at The Hershey Company, discussed the trickiness of the metaverse when it comes to food. “The best thing about a peanut butter cup is that you can eat it,” she said, highlighting that while the metaverse offers an array of virtual experiences, digitally eating food will never replicate the physical action. Hershey is looking at selling NFTs from a collectible lens, selling exclusive products to grow brand awareness. Winston Fisher, CEO of AREA15, expressed a similar sentiment. AREA15 launched its first NFTs on March 29, 2022, selling functional digital artwork, with the possibility of also receiving a custom-designed physical ring or access to physical experiences. Overall, brands are leveraging the early days of the metaverse to connect with consumers and increase brand awareness, ultimately driving new customer growth. [caption id="attachment_144593" align="aligncenter" width="700"] From left to right: Gary Hawkins, Founder and CEO of Center for Advancing Retail and Technology; Anshuman Taneja, SVP of Product & Consumer Experience at Peapod Digital Labs; Abhi Ramesh, Founder and CEO of Misfits Market; and Andrea Steele, Head of Digital Marketing & Operations at The Hershey Company

From left to right: Gary Hawkins, Founder and CEO of Center for Advancing Retail and Technology; Anshuman Taneja, SVP of Product & Consumer Experience at Peapod Digital Labs; Abhi Ramesh, Founder and CEO of Misfits Market; and Andrea Steele, Head of Digital Marketing & Operations at The Hershey CompanySource: Coresight Research[/caption] Smaller Communities Drive Consumer Engagement Engaging with the consumer through community creation was a big topic at Shoptalk 2022. Notably, brands are not aiming to create one large community. Instead, community creation is centered around smaller, more loyal and local pockets of consumers. Fashion retailer Hot Topic has driven elevated consumer engagement by focusing on the few thousand customers who are logging in every day, rather than trying to engage with the hundreds of thousands of customers who are registered but “who can’t remember why they joined in the first place,” explained Ed Labay, SVP GMM Merchandise at Hot Topic. Community creation is about providing a platform for small pockets of loyal customers to engage with each other about what they are passionate about. [caption id="attachment_144594" align="aligncenter" width="700"]

From left to right: Matt Cleary, Head of Retail and E-Commerce, Global Business Solutions at TikTok; Ed Labay, SVP GMM Merchandise, Marketing and Licensing at Hot Topic; Mary Beth Trypus, Chief Revenue officer at Vera Bradley; Brian Beitler, Chief Marketing Officer at QVC US & HSN; and Veronika Sonsev, Co-Founder of CommerceNext

From left to right: Matt Cleary, Head of Retail and E-Commerce, Global Business Solutions at TikTok; Ed Labay, SVP GMM Merchandise, Marketing and Licensing at Hot Topic; Mary Beth Trypus, Chief Revenue officer at Vera Bradley; Brian Beitler, Chief Marketing Officer at QVC US & HSN; and Veronika Sonsev, Co-Founder of CommerceNextSource: Coresight Research[/caption] Retailers and Brands Have Survived Casualization and Are Likely To Resume Discounting Once Supply Stabilizes The panel discussion titled “Winning Over Apparel Shoppers” saw three brands/retailers discuss the pre-pandemic, mid-pandemic and current environments. The panelists agreed that the pandemic-led casualization trend is likely to persist to a significant degree due to some consumers continuing to work from home even after the disruption caused by Covid-19 wanes. However, as consumers resume pre-pandemic social behaviors such as attending special occasions—and as many do return to the office—dressing up trends will quickly arise. Still, brands are seeking to increase the level of comfort in dress wear to adapt to shifted consumer preferences. An interesting anecdote along the lines of “the clothes make the man” revealed that doctors’ diagnoses are better when they are wearing more formal dress such as a tie. There was also discussion that department stores are likely to resume discounting once supply catches up with demand due to ingrained habits and consumers’ love of an apparent bargain.

- Dia & Co. offers a line of clothing for plus-sized women and launched a marketplace for plus-size apparel from other vendors. Although many labels sought to enter the plus-size market during 2017 and 2018, they did not build scale and had not studied their customers sufficiently, according to Dia & Co. Its marketplace, launched in 2020, unlocked significant opportunity for other brands to enter the market.

- Randa Apparel and Accessories produces accessories, women’s sportswear and tailored clothing under the Hagger, Levi’s and Tommy Hilfiger brands. While Haggar was clearly affected by the long-term casualization trend and pandemic-driven shutdowns, the brand has since rebounded, recently becoming the number-one casual and dress pant brand, as well as receiving high ratings in golf pants, suit jackets and suit pants, according to Randa Apparel and Accessories.

- Mack Weldon, best known for its underwear, T-shirts and sweatpants, used algorithmic digital marketing to help it launch a line of clothing for daily wear, fitting profiles it calls The Operator, The Escape Artist and The Pacesetter.

From left to right: Brian Berger, Founder and CEO of Mack Weldon; David J. Katz, EVP and Chief Marketing Officer at Randa Apparel & Accessories; Nadia Boujarwah, Co-Founder and CEO of Dia & Co; and Melissa Repko, Retail and Consumer Reporter at CNBC

From left to right: Brian Berger, Founder and CEO of Mack Weldon; David J. Katz, EVP and Chief Marketing Officer at Randa Apparel & Accessories; Nadia Boujarwah, Co-Founder and CEO of Dia & Co; and Melissa Repko, Retail and Consumer Reporter at CNBCSource: Coresight Research[/caption] Visual Search and Personalization Are Top Retail-Tech Trends The panel discussion titled “Designing Tomorrow’s Retail Experiences: From Experimentation to Mass Adoption: Trending Technologies and Their Potential to Transform Retail” discussed five retail technologies. As voted by the audience, the top two technologies—by a wide margin—were visual search and personalization.

- Visual Search

- Personalization

From left to right: Holden Bale, Group VP, Head of Commerce at Huge; Courtney Kissler, Chief Technology Officer at Zulily; Jordan Berke, Founder and CEO of Tomorrow Retail Consulting; and Anne Mezzenga, Co-CEO of Omni Talk

From left to right: Holden Bale, Group VP, Head of Commerce at Huge; Courtney Kissler, Chief Technology Officer at Zulily; Jordan Berke, Founder and CEO of Tomorrow Retail Consulting; and Anne Mezzenga, Co-CEO of Omni TalkSource: Coresight Research[/caption] Influencer Marketing Requires Authenticity and Emotional Connection Influencers can connect marketers with consumers in personal and cost-effective ways. However, selecting and forging relationships with brand-appropriate influencers remains challenging. Many consumers—and brands—are starting to eschew “traditional” influencers in favor of nano-influencers and others who share more authentically. Kendra Bracken-Ferguson, Founder of BrainTrust, discussed four dominant market shifts: data-driven insights; creators as brand consultants, the missing piece and emotional ROI (return on investment). According to Bracken-Ferguson, one of the most powerful tools brands can use to capture young audiences is the emotional connections they forge throughout the customer journey. Social creators are among the most authentic voices today, allowing brands to connect with social communities and align with shared values and ethos, thereby creating long-lasting relationships and new marketing opportunities. Elysa Walk, Chief Business Officer at Burton Snowboards, said that the company is choosing influencers that enhance DEI (diversity, equity and inclusion). Expanding into a more diverse market is a significant opportunity for Burton, as snowboarding has historically been a sport involving white men. Influencers that represent the BIPOC (Black, Indigenous and people of color) and LGBTQ communities will help change the brand perception of Burton, while extending the market opportunity, Walk said. Influencers are chosen for different marketing functions. At the top of the marketing funnel, awareness is best created by celebrity influencers, such as Jennifer Lopez at Coach. At the stages of consideration and intent, influencer-generated content via blogs and paid social content on influencer channels is strategic, while at the bottom of the marketing funnel, loyalty and advocacy, dedicated influencer relationships, such as sales associates and micro- and nano-influencers, best maintain and enhance brand relationships in the most authentic manner, the panelists emphasized. Rich Fulop, Founder and CEO of Brooklinen, and Lisa Lesman, VO, Global Marketing at Coach, agreed that what happens at the store can make or break social media input from shoppers. At Coach, the sales associate is an integral part of the influencer ecosystem, Lesman said. The holy grail of influencer marketing comprises aligned values and consistency. This requires staying present, maintaining the dialogue and engaging consumers in an authentic manner for both influencer and brand. [caption id="attachment_144597" align="aligncenter" width="700"]

From left to right: Elysa Walk, Chief Business Officer at Burton Snowboards; Lisa Lesman, VP, Global Marketing at Coach; Rich Fulop, Founder and CEO of Brooklinen; and Kendra Bracken-Ferguson, Founder of BrainTrust

From left to right: Elysa Walk, Chief Business Officer at Burton Snowboards; Lisa Lesman, VP, Global Marketing at Coach; Rich Fulop, Founder and CEO of Brooklinen; and Kendra Bracken-Ferguson, Founder of BrainTrustSource: Coresight Research[/caption]

Shoptalk’s Top Takeaways: Livestreaming and the Metaverse Are Top of Mind

In the final session, Marie Driscoll, Managing Director, Luxury and Retail, at Coresight Research, and Stephanie Wissink, Managing Director at Jefferies, reviewed key takeaways from the full Shoptalk 2022 event. [caption id="attachment_144598" align="aligncenter" width="700"] (Top) Marie Driscoll, Managing Director, Luxury and Retail, at Coresight Research (Bottom) From left to right: Lockie Andrews, CEO of RICH Hair Care; Steph Wissink, Managing Director of Jefferies; Marie Driscoll, Senior Analyst at Coresight Research; and Joe Laszlo, VP of Content at Shoptalk

(Top) Marie Driscoll, Managing Director, Luxury and Retail, at Coresight Research (Bottom) From left to right: Lockie Andrews, CEO of RICH Hair Care; Steph Wissink, Managing Director of Jefferies; Marie Driscoll, Senior Analyst at Coresight Research; and Joe Laszlo, VP of Content at ShoptalkSource: Coresight Research[/caption] The top three takeaways are the most dynamic:

- The store is not dead! In multiple sessions across the four-day event, speakers addressed the importance of the store and store associates, in terms of brand engagement and expression as well as the role of the physical store as a fulfillment/reverse logistic center.

- Profits are the new sales. Profits are very much part of the conversation for investors looking at new retail concepts. No longer is growing the top line, paying handsomely to acquire new customers to amass market share, enough. A path to profitability is now part of the lexicon.

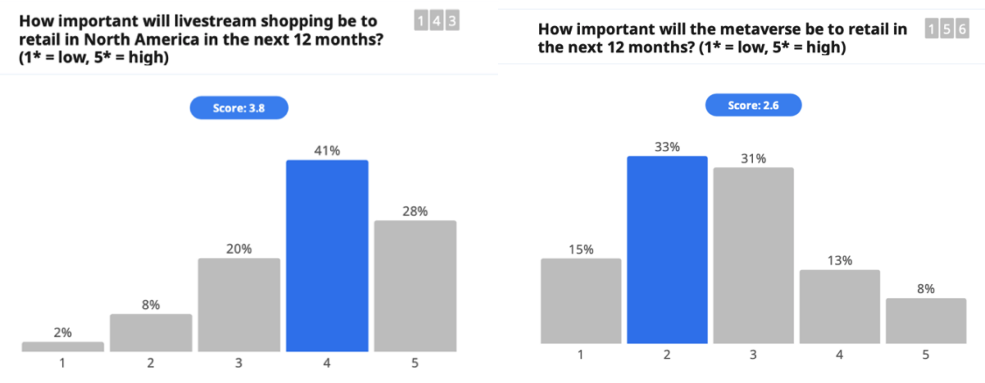

- New channels are emerging and gaining traction. By far the most interesting comments throughout Shoptalk were around new retail channels, including livestreaming and the metaverse (which we discuss further below).

Base: Shoptalk attendees polled on March 30, 2022

Base: Shoptalk attendees polled on March 30, 2022Source: Shoptalk[/caption]

- Read Coresight Research’s coverage of livestreaming e-commerce and the metaverse in retail.