Shoptalk 2018

The Coresight Research team is in Las Vegas this week, attending and participating in Shoptalk 2018. Described as the world’s largest conference devoted to retail and e-commerce innovation, more than 7,500 attendees are expected at this year’s event, up 40% from 2017’s Las Vegas event.

The conference, which runs March 18–21, is expected to draw executives from established retailers and brands, startups and technology companies, as well as investors, media professionals and analysts. From new technologies and business models, to changes in consumer preferences and expectations, attendees are exploring disruption in the retail industry, particularly how consumers discover, shop and buy.

The event focuses on topic such as the shopping experience of the future, the evolution of the retail store, on-demand delivery and logistics, shifting e-commerce trends, the next generation of direct-to-consumer startups, engaging customer experience, the impact of artificial intelligence (AI)in retail, and more.

The event features more than 300 speakers, representing a broad cross section of countries and companies, including Allbirds, Ascena Retail Group, BJ’s Wholesale Club, DoorDash, Google, Houzz, Instacart, Macy’s and Rent the Runway.

Below, we summarize our key takeaways from the third day of Shoptalk 2018.

1. Amazon’s Global Marketplace Is Transforming the Propensity of Local Customers to Buy from Global Sellers

Eric Broussard, VP of International Marketplaces and Retail at Amazon, discussed the growth of Amazon’s global marketplace. In 2017, global sellers’ sales on Amazon grew more than 50% across 13 marketplaces, with over 300 million active customer accounts. According to Broussard, half of the items sold on Amazon worldwide are from small and medium-sized businesses.

Eric Broussard, VP of International Marketplaces and Retail, Amazon

Source: Coresight Research

Eric Broussard, VP of International Marketplaces and Retail, Amazon

Source: Coresight Research

Amazon’s global infrastructure offers a simple way for brands to reach consumers globally. By leveraging Fulfillment by Amazon (FBA), brands can make their products

Prime eligible for free delivery

. The seller ships their inventory ahead of time to one of Amazon’s 175 global fulfillment centers. Amazon then handles all of the delivery logistics and warehousing, and provides customer service and product descriptions in the local language. Broussard shared the FBA global selling process in six steps:

- Seller sends inventory to Amazon fulfillment center

- Amazon receives and stores product

- Customer orders product (in their local currency)

- Amazon fulfills, packs and ships order

- Customer service is handled by Amazon in the local language

- Amazon handles customer returns

2. Ulta Is Benefiting from Beauty Category Growth;It Prides Itself on Three Key Differentiators

Ulta Beauty’s CEO, Mary Dillon, began her keynote saying that beauty is a great space within retail today. The popular product category has high margins, frequent buyers and sales have outperformed much of the industry. Ulta’s financial performance reflects this, with net sales up 22% over five years and comparable store sales up in the low-to-mid-teens. Online sales were up more than 60% year over year in 2017, noted Dillon.

As shopping behavior continues to change, new patterns of personal consumption take shape. Shoppers, millennials in particular, place higher value on personal consumption and sharing experiences, which bodes well for product products. Dillon commented that demographic trends are in Ulta’s favor as “Close to half of all babies born today are multiracial and the growing Hispanic population over-indexes in beauty,” she said.

Ulta prides itself on three key differentiators; real-estate locations, product mix and services. In terms of services, Ulta’s loyalty program is a critical component; Ulta ended 2017 with more than 28 million loyalty club members, who drove close to 90% of sales, according to Dillon. To further elevate its service offerings, the company is exploring partnerships, Dillon said, including testing a mobile program with Spruce Labs. The mobile program will make it easier for customers to check in for appointments and allow salon associates to better manage schedules. Ulta is also working with Facebook to measure the effectiveness of social media and advertising on online shopping.

3. Pinterest Expands Shopping Ads to More Brands and Visual Search Tool to More Countries

Ben Silbermann, Cofounder and CEO of Pinterest, announced the expansion of Pinterest Shopping Ads to more brands and retailers. With Shopping Ads, Pinterest uses visual search technology to bring users to the items in retailers’ product feeds that they would most likely be interested in purchasing.

Source: Coresight Research

Source: Coresight Research

Brands and retailers can turn their product catalog into visual, actionable ads. Since Shopping Ads pull automatically from an existing product feed, they are particularly useful for brands that want to scale their Pinterest advertising. Retailers testing Pinterest Shopping Ads include Ulta, Venus, Overstock, Lowe’s eBay, Wayfair and IKEA. Pinterest also announced that its Shop the Look visual search technology is now available in France, Germany, Japan and the UK.Shop the Look is a way for users to browse and buy items they see in fashion and home Pins.

Amy Vener, Retail Vertical Strategy Lead at Pinterest, said 97% of users’ searches are unbranded—thus there is a lot of room for brands to develop visual ads and enhance its product discovery offering for consumers.

4. Online Grocery CEOS: Using Stores to Fulfill Orders Is Inefficient and Costly

Tim Steiner, CEO of British online grocer Ocado, and Jason Ackerman, Cofounder and CEO of online grocer FreshDirect, critiqued in-store grocery fulfillment models, saying the process is time consuming, expensive and threatens to diminish the in-store experience for customers. Due to growing interest and sales within grocery e-commerce, many grocery retailers have begun to offer delivery via third-party providers such asShipt and Instacart.

Ackerman said store fulfillment is a natural first step for grocers, but is ultimately too expensive. According to Ackerman, one of the keys to profitability is vertically integrating many of its manufacturing processes. FreshDirect operates its prepared foods commissary, and its operations are tied to the company's order management system. “We vertically integrated manufacturing of products on a made-to-order basis rather than a made-to stock basis, which gave us huge variety and better quality,” he said.

Ocado’s automated warehouses and logistics system deliver more than $2 billion worth of groceries each year with a 99.7% order accuracy, according to Steiner. French retailer Groupe Casino recently partnered with Ocado. Casino will build a fulfillment center using Ocado’s mechanical handling equipment, while Ocado will oversee the technology. In January 2018, Ocado made its first venture into North America, via a partnership with Sobeys, which has over 1,500 stores.

5. The Role of Digitally-Native Brands and Walmart’s E-Commerce Path

Walmart will continue to look at acquisitions as it looks to differentiate its online offering and attract millennial shoppers, according to Marc Lore, President and CEO of Walmart eCommerce US. The company is “definitely still in acquisition mode,” and that buying specialty brands can “help us get the fundamentals right”on both Walmart and Jet.com.Future acquisitions will likely be in the $50–$300 million range Lore said Tuesday at Shoptalk.

Andy Dunn, Founder and CEO of Bonobos and SVP of Digital Consumer Brands at Walmart, joined Lore on stage. The acquisitions of direct-to-consumer brands such as Bonobos, ModCloth, Moosejaw and ShoeBuy have created a portfolio of brands that provide proprietary content. Eventually these brands will be on Jet.com, which will help capture urban millennial shoppers, said Dunn.

Lore said that the company’s slowdown in online sales during the key holiday quarter was “largely planned.” In response to onstage questions from Recode, Lore said the company had taken the quarter “as an opportunity to create a healthier Q4 business.” Online sales in Q4 decelerated to 23% growth, following growth of 50%–60% in the previous three quarters.

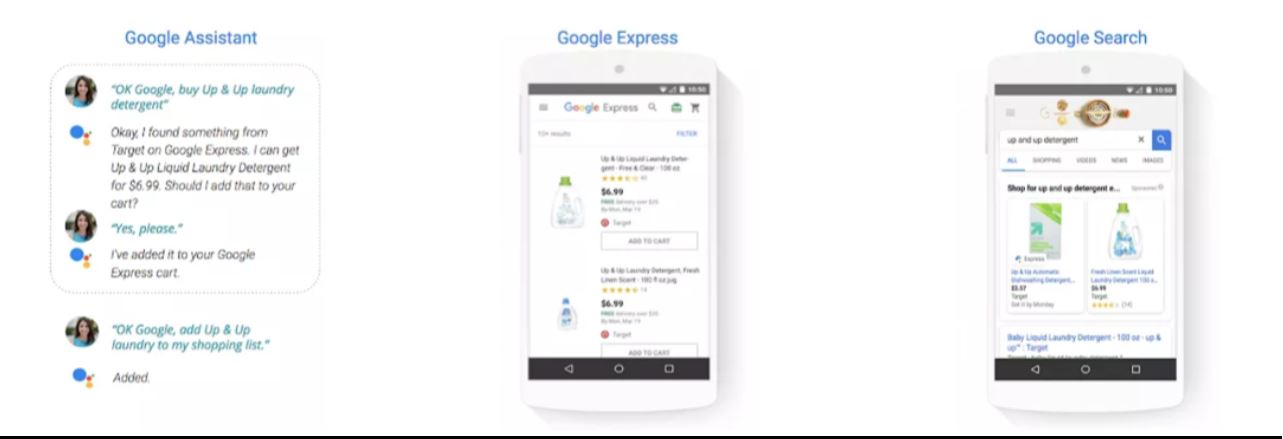

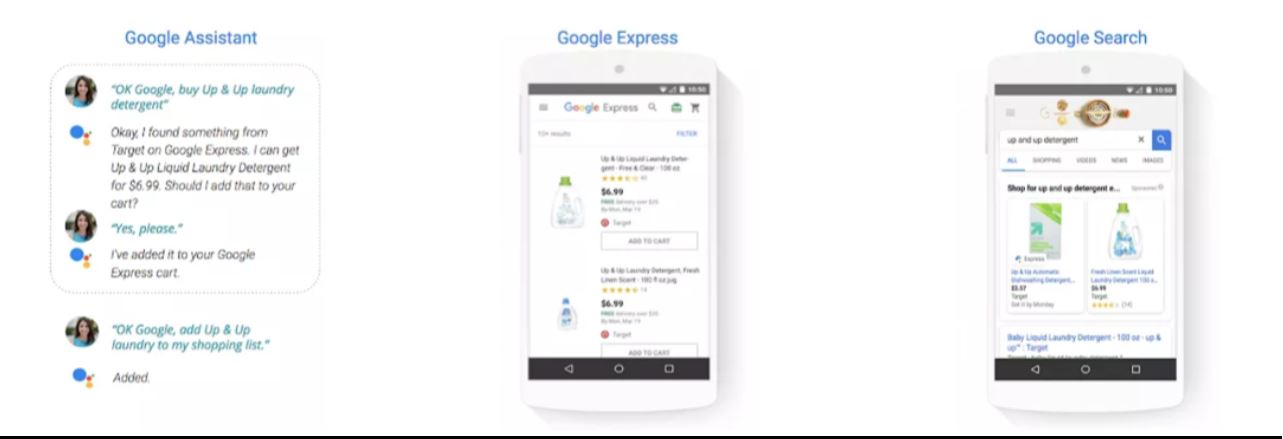

6. Google Launches Shopping Actions Tool to Let Users Buy Directly from Search Results

Google announced a new feature, Shopping Actions, which allows users to purchase items directly from search results and across Google platforms. Retailers can list their products on Google search, the Google Express shopping service, and Google Assistant on home devices and mobile. Google provides a universal shopping cart across platforms, and shoppers can save their payment credentials and make purchases from retailers with instant checkout.Google charges retailers a cost-per-sale fee.

Google started the new program after observing that mobile searches asking where to buy products had risen by 85% over the past two years, yet, most shoppers ended up buying on Amazon, said Daniel Alegre, President of Global Partnerships at Google.So far, retailers including Target, Walmart, Home Depot, Costco, Ulta Beauty and 1-800-FLOWERS have signed up for the new program. The program is open to US retailers of any size.

Target said it plans to link Target.com and Google accounts and will allow customers to use their debit and credit REDcard when making purchases through Google. Ulta Beauty shoppers who buy through Google Shopping Actions also earn loyalty points. The beauty products retailer saw a 35% increase in basket size on Google, Alegre said, pointing to early results from the Shopping Actions program.

Source: Google

Source: Google

7. New Retail from China Represents the Next Generation of Consumer Experiences and Is Putting the Fun Back in Retail

In a fireside interview titled, “Retail in E-Commerce Innovation in China,” Coresight CEO and Founder Deborah Weinswig provided insights into the China retail innovation landscape. She highlighted how China leads the world in terms of retail comp sales. Alibaba has become the catalyst for New Retail via acquisitions, and several US retailers have also embraced the concept via acquisitions and from online stores going offline.

Weinswig said that shopping in physical stores in China is different because you can bargain for a discount, so there is an element of surprise and fun. Personalization and customization will continue to trend in China, said Weinswig, with key opinion leaders (KOLs) leading this trend with live streaming. New inspirations for retail include the deployment of artificial intelligence (AI), virtual reality (VR), using facial recognition and future store models that are completely automated, such as BingoBox and Tao Cafe in China. Weinswig said there are real opportunities for rethinking the physical store and making it come alive with the use of technology with VR commerce and livestreaming.

Zia DaniellWigder, Deborah Weinswig

Source: Coresight Research

Zia DaniellWigder, Deborah Weinswig

Source: Coresight Research

8. Walmart to Add 500 FedEx Shops to Its US Stores

Walmart plans to add 500 FedEx Office locations in select Walmart stores over the next two years, the companies announced Tuesday at Shoptalk. Customers will be able to pack, ship and print from the locations. The store-within-a-store format will allow shoppers to have their packages held there for up to five business days. The small-format FedEx shops will be between 450 and 750 square feet and will be staffed by roughly a total of 2,000 FedEx employees.

Walmart and FedEx have been testing the concept in roughly 50 locations across the US. The results showed—more often than not—that customers have shopped in the Walmart store after visiting FedEx, boosting foot traffic to the store, according to Walmart. Shoppers will also be able to use the FedEx locations to process retail returns and ship the products back to distributors. “It’s a lot more efficient to consolidate one single delivery to or from a FedEx Office location than it is to make a dozen ... residential deliveries,” Philips said.

9. Coresight Research Celebratory Launch Events at Shoptalk

The Coresight Research team held two Shoptalk launch events to celebrate the official launch of the brand with industry friends and colleagues. The first event was a cocktail hour held on Monday, March 19, at the Public House, hosted by Stacy Berns, Founder of Berns Communications Group, and William Susman, Managing Director at Threadstone Advisors. The event was sponsored by Avery Dennison, RevCascade, Bamboo Rose, Predict Spring and Threadstone, and there were over 270 industry leaders that attended.

Berns Communications Group and Coresight Research hosted a private breakfast on Tuesday, March 20, for company CEOs and the press. The event was both a celebration and an opportunity for leaders to share their companies’ most current retail and technology news with peers and press.

Deborah Weinswig, FarlaEfros, Stacy Berns

Source: Coresight Research

Deborah Weinswig, FarlaEfros, Stacy Berns

Source: Coresight Research

10. HouzzIs Changing Buying Behavior with Augmented Reality (AR) with a Conversion to Purchase Increase of 11x

Houzz, the home décor company, started with a simple concept when President and Cofounder Alon Cohen was remodeling his home. He and his wife were looking for architects and designers and they said that they realized there had to be a better way. Today, Houzz has over 40 million visitors to its site every month, and over 10 million products from over 20,000 vendors. Houzz started out as a community site and has since grown as a place where consumers are able to sell services and products. Cohen said that he received so many calls requesting buy buttons, that the monetization component of Houzz evolved.

The company is using AR to change the consumer shopping experience. For over 1 million products, consumers are able to open the Houzz app, select the product they like (or multiple products), and then select “view in my room,” and they can see what these products will look like in their own home. To date, over 2 million people have viewed products in the app, and Cohen reported that it has resulted in an 11x increase in conversion to purchase. He said that AR is creating a better experience because consumers do not have to get disappointed with the wrong selections, because they are able to see what the items look like in their homes before purchasing.

Eric Broussard, VP of International Marketplaces and Retail, Amazon

Source: Coresight Research

Eric Broussard, VP of International Marketplaces and Retail, Amazon

Source: Coresight Research Source: Coresight Research

Source: Coresight Research Source: Google

Source: Google Zia DaniellWigder, Deborah Weinswig

Source: Coresight Research

Zia DaniellWigder, Deborah Weinswig

Source: Coresight Research Deborah Weinswig, FarlaEfros, Stacy Berns

Source: Coresight Research

Deborah Weinswig, FarlaEfros, Stacy Berns

Source: Coresight Research