Shoptalk 2018

The Coresight Research team recently attended and participated in the Shoptalk 2018 conference in Las Vegas. Described as the world’s largest conference devoted to retail and e-commerce innovation, the event drew some 8,400 attendees, nearly twice as many as last year. The event featured 340 speakers, including 40 CEOs, 110 women leaders and 60 leaders from abroad. Much discussion focused on disruption in the retail industry, and presentation topics included artificial intelligence (AI), the store of the future, emerging business models, innovation in supply chains and logistics, and creating engaging customer experiences.

In his opening remarks, Anil Aggarwal, Founder, Chairman and CEO of Shoptalk, noted that retail has entered “a sustained new normal, where disruptive innovation is adopted and proactively embraced by the mainstream.”Aggarwal said that “disruptive innovation is now about who, when and how. It is not about what or why. It is getting comfortable with uncertainty and knowing that failure is essential to a culture of learning.”

Below, we summarize our top 10 takeaways from Shoptalk 20181.

1. Retailers are providing new automated checkout services that enable self-scanning and payment by mobile app or facial recognition.

The ubiquity of mobile devices is driving significant change in how consumers pay for products and services, and many retailers are now providing automated, cashierless checkout services that allow self-scanning and payment by mobile app or facial recognition.

Macy’s to Add Mobile Checkout to All Stores by the End of 2018

Macy’s CEO Jeff Gennette announced that Macy’s will roll out mobile checkout in full-line stores by the end of 2018. The checkout platform will allow shoppers to scan barcodes on items with their phones as they add merchandise to their baskets. When they finish shopping, they will head to a dedicated counter where an associate will remove security tags, but customers will pay through the Macy’s app.

Gennette said that customers will be able to pay for most merchandise with the mobile checkout option, with the exception of a few product categories, such as jewelry. The scan-and-go capability is part of a much broader expansion of the company’s overall mobile app strategy in 2018, which will also include launching in-store navigation and AR features.

Amazon Executives Share Insights About the First Amazon Go Cashierless Store

Ina keynote session at Shoptalk, Amazon Go VP Gianna Puerini and VP of Technology Dilip Kumar shared early learnings from the launch of the first Amazon Go cashierless store, which opened to the public on January 22, 2018, in Seattle. Shoppers enter the Amazon Go store by scanning a smartphone app at the door, and then cameras and sensors track what they remove from the shelves as they shop. Their account is charged accordingly when they leave the store.“It was super important to us to make [Amazon Go] feel very natural and not have the customer learn new ways to do things,” Puerini said.

Kumar explained that Amazon needed to build algorithms and use computer vision technology to track “who took what.” He said that Amazon Go uses computer vision, rather than RFID tags, to track the movement of products in the store because the operational costs of RFID were too high, given the fast-moving nature of the products sold at the store.

Puerini said that one thing that surprised the company was discovering that many first- and second-time customers are not comfortable just walking out of a store. They tend to ask themselves whether it is really “okay to just leave” before exiting. The executives declined to discuss expansion plans for Amazon Go and said there are no current plans to roll out the same cashierless checkout technology to Whole Foods Market stores.

Alipay Continues Its North American Expansion with FreedomPay Partnership

Souheil Badran, President of Alipay Americas, discussed how the Alipay mobile payment platform has become part of everyday life for Chinese consumers. Alipay has more than 600 million active users and is accepted by more than 40 million merchants in 30countries.

In 2017, Alipay partnered with Nielsen to conduct a survey of Chinese consumers. The survey revealed that China is the source of more than 100 million outbound tourists per year, 99% of which are Alipay users. According to the study, 76% of Chinese consumers shop overseas because goods are cheaper abroad. Badran announced at Shoptalk that Alipay is partnering with payments platform FreedomPay and expanding its partnership with First Data in order to better serve this growing community of travelers:

- Alipay’s agreement with FreedomPay enables thousands of merchants in North America to accept Alipay. These include vendors at airports, travel plazas, entertainment, and sports venues, resorts, and universities.

- The company’s expanded partnership with First Data enables 35,000 additional merchants—including luxury watch retailer Tourneau and Millennium Hotels and Resorts in New York, Boston and Los Angeles—to accept Alipay.

“Our partnership with FreedomPay will expand our footprint across North America and offer Alipay across targeted verticals, particularly those that cater to Chinese travelers,” Badran said.

2. Grocery may be the next retail sector to be disrupted by e-commerce.

Grocery retail is undergoing rapid change due to shifting consumer behavior and advances in technology. According to Kantar World panel, global online sales of food and alcohol could reach $170 billion by 2025, representing 10% of fast-moving consumer goods, up from 4.6% in 2017. At Shoptalk, grocery executives discussed new store formats and offerings, technology innovation in stores, and last-mile delivery.

Albertsons Announces Digital Marketplace to Connect Brands and Shoppers

Albertsons plans to launch a digital marketplace where vendors can sell directly to consumers. The platform will provide exposure for the vendors and handle several front-end e-commerce functions, including product descriptions, search and ordering. When customers purchase products on the marketplace, Albertsons will process the payment. Vendors and individual sellers will be responsible for shipping, but Albertsons may work with partners over time to help vendors handle shipping.

Brands selling through the channel will have access to proprietary marketplace data on product trends, which they will be able to use to make their case for shelf space in Albertsons stores. “We can tell you how many people who saw the ad bought the product in our store,” said Narayan Iyengar, Senior VP of Digital and E-Commerce at Albertsons. “That’s one way to monetize the data we have,” he said. The company is accepting vendor applications now and plans to launch the platform early this summer.

CEOs of Digitally Native Grocery Companies Say In-Store Fulfillment Is Inefficient and Costly

Several grocery retailers have begun to offer or test grocery delivery via third-party providers such as Shipt and Instacart. Jason Ackerman, CEO of online grocer FreshDirect, and Tim Steiner, CEO of British online grocer Ocado, critiqued in-store grocery fulfillment models, saying the process is often time-consuming and expensive and that it threatens to diminish the in-store experience for shoppers.

Ackerman said that although in-store fulfillment is a natural first step for grocers, it is ultimately too expensive, as grocery is a low-margin business. One of the keys to profitability in grocery is vertically integrating many manufacturing processes, he said. For example, FreshDirect operates its own prepared foods commissary, and its operations are linked to its order management system. “We vertically integrated manufacturing of products on a made-to-order basis rather than a made-to-stock basis, which gave us huge variety and better quality,” Ackerman said.

Steiner said that Ocado’s automated systems and warehouse model can reduce the time it takes to fulfill an online grocery order by an hour. The company delivers more than $2 billion worth of groceries each year with 99.7% order accuracy, according to Steiner.

French retailer Groupe Casino recently partnered with Ocado. Casino will build a fulfillment center using Ocado’s mechanical handling equipment, while Ocado will oversee the technology. In January 2018, Ocado made its first venture into North America, via a partnership with Sobeys, which operates more than 1,500 stores.

Kroger and BJ’s Wholesale Club Are Leveraging Stores and Mobile Technology to Connect the Online and In-Store Experiences

Yael Cosset, Kroger’s Chief Digital Officer, said most of Kroger’s online shoppers also shop in the company’s stores. Cosset said his team has found that the more customers use Kroger’s website and online shopping options, the more they visit physical stores. “The more digitally engaged you are with Kroger, the more you buy, the more you come into stores,” he said.

Cosset also discussed the importance of integrating the store experience with the online experience to provide convenient services. Kroger offers online ordering for store pickup at more than 1,000 stores through its ClickList program, and it recently expanded home delivery to 45 markets across the US.

Mobile apps can help retailers effectively bridge the online and offline worlds. BJ’s Wholesale Club’s new app, for example, offers online ordering as well as store navigation tools. Rafeh Masood, the company’s Chief Digital Officer, said that BJ’s wanted to add value to its membership program and make shopping easier—and that it wanted to do so quickly, in order to get ahead of the competition.

3. AR, VR and product visualization are set to transform fashion and retail.

AR is moving into the mainstream, with apparel, beauty, home décor, and furniture brands increasingly using the technology to provide immersive experiences. Meanwhile, VR use cases are quickly materializing in retail, and many involve retail store simulation for internal planning purposes rather than immersive experiences for consumers. Digital product visualization technology is also advancing, enabling shoppers to see 3D images of products from different angles and with various features.

Macy’s Is Offering VR Experiences in Stores

Macy’s is planning to offer VR experiences in the furniture departments of 50 stores by this summer. Unlike IKEA and Target—all of which have some sort of AR furniture experience that enables shoppers to see how a table or couch would look in their home—Macy’s is using actual VR, headsets and all, to sell furniture.

Macy’s shoppers will be able to lay out a room with furniture using a tablet and then test the design using VR. The technology will enable Macy's to display a wider range of furniture without needing to devote as much physical space to in-store displays. Macy’s CEO Jeff Gennette commented that VR demos have reduced customers’ concern about furniture fitting well in their living spaces, particularly those items that are not on display in stores.

Houzz Is Changing Buying Behavior with AR and Has Seen Conversion Increase by 11 Times

More than 40 million shoppers visit home décor company Houzz’s website every month, and the site features 10 million products from more than 20,000 vendors. More than a million of those products are viewable in AR on the Houzz app. Users simply select the products they like and then select “View in my room.”

To date, more than 2 million shoppers have viewed products in the app using AR and Houzz President and Cofounder Alon Cohen said the technology has boosted conversion by11 times. Cohen said that the AR offering creates a better experience because consumers can use it to see how items will look in their home before purchasing, so they are not disappointed later when they realize they have made the wrong selection.

Google’s ARCore Platform Is Helping Move AR Apps into the Mainstream

Google showcased more than 60 apps at Shoptalk that were built with ARCore, the company’s AR platform. Some include spatial imaging, which enables smartphone users to view 3D product demonstrations from all angles by moving their phone around. The new Pottery Barn app, for example, allows users to virtually place Pottery Barn furniture anywhere in a room. Once users view the product and choose a color, they can complete their purchase within the app. While the Pottery Barn app is more focused on the buyer, other companies are using Google’s AR platform to develop features that aid sellers.eBay, for instance, is using AR to enable sellers to select the box that best fits the product they are shipping.

4. Target, Amazon, and Walmart are innovating in fulfillment and logistics.

At Shoptalk, executives from Amazon, Target, and Walmart discussed a variety of fulfillment services designed to speed up the delivery cycle, ranging from delivery by employees to discount-driven in-store pickup.

Target Plans to Offer Same-Day Delivery Nationwide

Target CEO Brian Cornell announced that Target plans to become the first traditional retailer to offer same-day delivery nationwide. The company’s plan leverages Target’s recent acquisition of Shipt, a same-day delivery service, which currently operates in 70 markets. According to Cornell, same-day delivery is the cornerstone of Target’s mission to set the retail standard for last-mile fulfillment.

The Shipt acquisition will enable Target to expand same-day delivery across its 1,870 stores this year. In addition, Target is also expanding store pickup to 1,000 stores this year, and the company will begin offering free two-day shipping from its backrooms.

Digital Marketplaces Are Redefining Cross-Border E-Commerce

Eric Broussard, VP of International Marketplaces and Retail at Amazon, discussed the growth of Amazon’s global marketplaces. In 2017, global sellers’ sales on Amazon grew by more than 50% across 13 marketplaces, and the sites had more than 300 million active customer accounts. According to Broussard, half of the items sold on Amazon worldwide are from small and medium-sized businesses.

Eric Broussard, VP of International Marketplaces and Retail, Amazon

Source: Coresight Research

Amazon’s global infrastructure offers a simple way for brands to reach consumers across the world. By leveraging Fulfillment by Amazon (FBA), brands can make their products Prime eligible, meaning they can be delivered for free. Sellers ship inventory ahead of time to one of Amazon’s 175 global fulfillment centers, and Amazon then handles all of the warehousing and delivery logistics in addition to providing customer service and product descriptions in local languages. Broussard said the FBA global selling process has six steps:

- The seller sends inventory to an Amazon fulfillment center.

- Amazon receives and stores the product.

- The customer orders the product (in the local currency).

- Amazon fulfills, packs and ships the order.

- Amazon handles customer service (in the local language).

- Amazon handles product returns.

Walmart Is Adding 500 FedEx Office Shops in US Stores

Walmart plans to add 500 FedEx Office outlets in selected Walmart stores over the next two years. Customers will be able to pack, ship and print from the locations. The small-format FedEx shops will be 450–750 square feet in size and will be staffed by roughly 2,000 FedEx employees in total. Consumers will also have the option of having packages shipped to a Walmart-based FedEx Office, where they’ll be held for five business days.

The move is yet another way for Walmart to compete with Amazon. It leverages Walmart’s stores to offer customers more convenience and drives additional traffic to stores, which can lead to more sales. Walmart and FedEx have been testing the concept in roughly 50 locations across the US, and have found that customers shopped in-store at Walmart after visiting an in-store FedEx location more often than not. The partnership has also boosted foot traffic in the Walmart stores that are home to a FedEx Office.

5. Shoppers are embracing products and brands that reflect their unique preferences and values, contributing to the growth of DTC and niche brands.

Today’s shoppers are embracing products and brands that reflect their unique preferences and values. Traditional retailers have taken notice of this trend, and many are partnering with or acquiring DTC and niche brands in response.

Allbirds

Joey Zwillinger, Cofounder and Co-CEO of shoemaker Allbirds, discussed how the company has established itself by appealing to shoppers’ desire for products that are made sustainably and are therefore better for the environment. Launched in 2016, Allbirds makes eco-friendly wool shoes using premium natural materials instead of the petroleum-based synthetics that are typically used to make footwear. The company, which has raised $27 million in funding, uses wool that is harvested according to the strictest sustainable farming and animal welfare standards.

Glossier

Online shoppers are provided with more choice than ever before, but Emily Weiss, Founder and CEO of beauty company Glossier, argues that they’re “starved” for connection. “In the age of Amazon, who has mastered offering a breadth of product? Who has yet solved breadth of connection?” Weiss asked. Nearly 80% of Glossier customers are referred to the site by a friend, she said. For a digitally native brand, that means just being a part of the conversation is not enough: creating a platform for connections is key. Glossier allows customers to connect to share recommendations, dislikes and skincare routines, all while building a community and the brand’s image.

Walmart Is Continuing to Invest in Digitally Native Brands to Reach Millennials

Marc Lore, President and CEO of Walmart eCommerce US, said that Walmart will continue to consider brand acquisitions in order to differentiate its online offering and attract millennial shoppers. The company is “definitely still in acquisition mode,” he said, noting that buying specialty brands can “help us get the fundamentals right” for both Walmart and Jet.com. Future acquisitions will likely be in the $50–$300 million range, Lore said. The company has acquired a number of DTC brands, including Bonobos, ModCloth, Moosejaw and ShoeBuy, creating a portfolio of brands that provide proprietary content. Eventually, these brands will be on Jet.com, Lore said, which will help the company capture urban millennial shoppers.

6. Startups are transforming supply chains and logistics through innovation.

Supply chain and logistics operations are often complex, as most consist of a large number of suppliers and solutions providers. Numerous conference tracks at Shoptalk focused on technology advancements in the supply chain.

Flexport

Logistics startup Flexport has developed a software platform to coordinate the complex process of moving freight across a logistical network that includes trucks, container ships, cargo planes and warehouses. Freight forwarders—which act as middlemen between logistical partners and retailers—have traditionally relied on email, faxes, paperwork, spreadsheets and manual processes.

Flexport launched four years ago and has since raised more than$200 million in funding. The platform is digitizing all of the information involved in shipping transactions, including rates, routes and customs information. Flexport Founder and CEO Ryan Petersen said that the company indexes available carriers into a database that companies can search to see current shipping routes and rates around the world. The company analyzes its data to optimize retailers’ shipping routes, which can help speed up shipping and enable retailers to hold less inventory in stock.

Ryan Petersen, Founder and CEO, Flexport

Source: Coresight Research

Flexport has experimented with offering freight services. At the end of 2017, the company chartered planes to fulfill shipments and started building its own warehouse network, allowing companies to store goods with Flexport until they can be grouped with other shipments heading to the same destination. Flexport plans to build out a global warehouse network and continue to explore chartering flights as an additional revenue stream, Petersen said. The firm’s notable customers include Allbirds, Casper and Warby Parker.

Optoro

Optoro is a reverse logistics solution that helps retailers process, manage and sell their returned and excess inventory. Each year, consumers return about $380 billion worth of goods to retailers, and only about half of returned items make it back onto shelves, the company estimates. The rest, due to factors such as damage and opened boxes, end up with liquidators, wholesalers and resellers, or in landfills.

Once a product is returned, the retailer has to cover the cost of assessing the item and repackaging it. The returns process has become even more complicated and costly as e-commerce has grown. Optoro applies algorithm-based analytics to determine where a retailer will best recoup its losses on unwanted items. The company’s software helps retailers identify the condition and price point of returned goods and then uses data analytics to identify the path for greatest recoup value—whether that is through recycling, online resale or return to the vendor for a minor credit. Optoro has raised more than $100 million in funding to date.

7. Social media platforms are expanding retail-specific advertising capabilities.

At Shoptalk, executives from Facebook and Pinterest showcased their companies’ new and updated advertising tools that are tailored to retailers and brands.

Facebook Is Unveiling Tools to Boost In-Store Sales and Further Ad Personalization

At Shoptalk, Facebook announced new ad offerings designed to help retailers drive mobile and offline sales. The new tools use Facebook and online behavioral data and enable varying degrees of personalization.

- Store sales optimization, a new machine-learning feature, helps retailers target Facebook campaigns toward users who are most likely to shop in stores, regardless of whether those users have purchased from the retailer previously. The tool leverages Facebook’s Custom Audiences offering, which allows retailers to build audiences of Facebook users who have previously purchased from the retailers’ stores. It also enables retailers to create lookalike audiences.

- Michael Kors tested the tool for a recent Instagram campaign and reported an 11% incremental lift in in-store sales as a result.

Another new feature, Tabs for Canvas, is designed to improve the mobile shopping experience with personalized catalogs. According to Eva Press, Facebook’s Group Director of Global Marketing Solutions, 45% of retail journeys involve a mobile device, and consumers increasingly expect brands to personalize the shopping experience.

- Tabs for Canvas offers retailers new shopping templates for collection ads. When a user clicks an ad, a full screen opens for product pages that are organized based on the user’s interests.

- Sephora used Tabs for Canvas for its mobile holiday catalog and saw a 32% higher return on its ad spending.

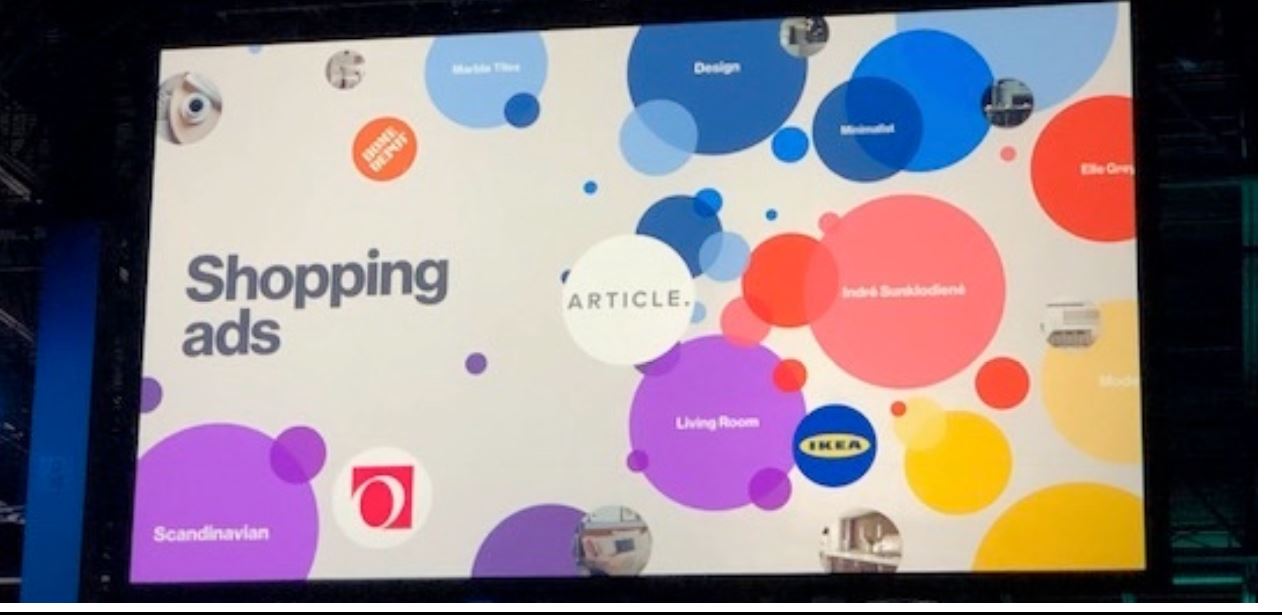

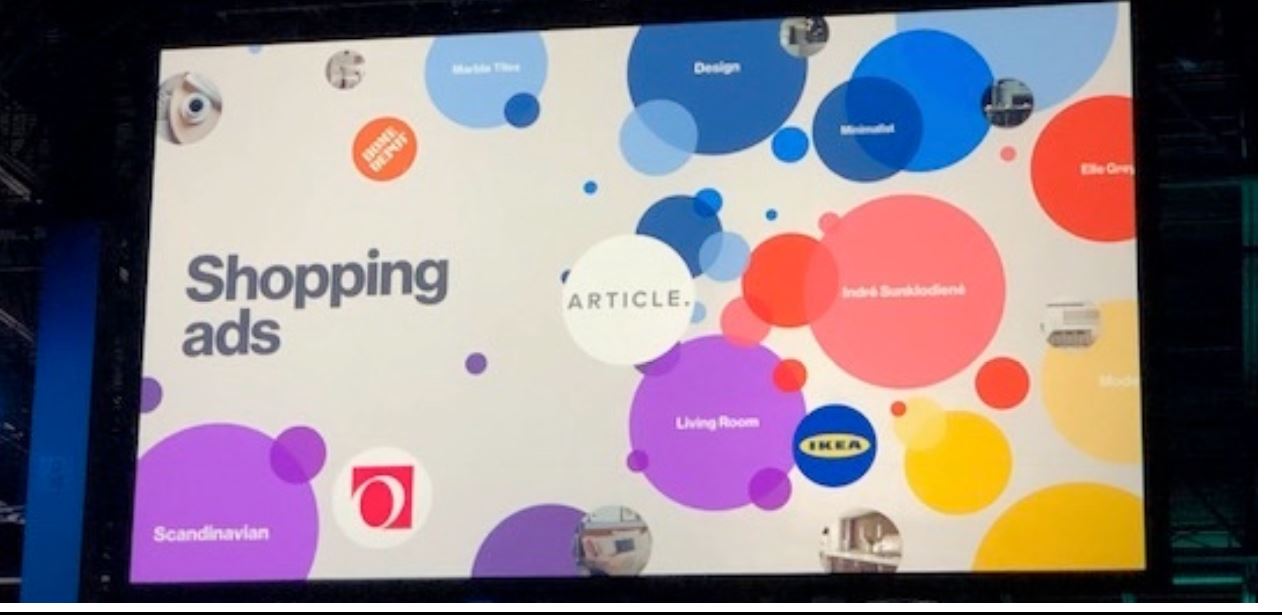

Pinterest Is Expanding Shopping Ads

Ben Silbermann, Cofounder and CEO of Pinterest, announced the expansion of Pinterest Shopping Ads, which use visual search technology to direct users to the items in retailers’ product feeds that they would most likely be interested in purchasing. Brands and retailers can turn their product catalogs into visual, actionable ads, Silbermann said. Retailers testing Pinterest Shopping Ads include eBay, IKEA, Lowe’s, Overstock, Ulta, Venus and Wayfair.

Source: Coresight Research

Amy Vener, Retail Vertical Strategy Lead at Pinterest, said that 97% of users’ searches are unbranded, which means there is plenty of room for brands to develop visual ads and enhance their product discovery offering.

8. Data is the new currency.

Data was central to nearly all discussions at Shoptalk, whether the session topic was focused on personalization, partnerships, omnichannel retail or loyalty.

Ulta Is Focusing on Data, Loyalty and Personalization

Ulta Beauty CEO Mary Dillon said that Ulta differentiates itself through its real estate locations, product mix and services, and that it is using data to enhance all three. Ulta plans to continue building meaningful relationships with customers by focusing on infrastructure for clean data, an engaging loyalty program and personalized interactions.

Attaining a 360-degree view of the customer is difficult, but “it’s the holy grail,” said Eric Messerschmidt, Ulta’s SVP of Strategic Marketing, CRM and Loyalty. The company’s loyalty program is a critical component of its success, and Ulta ended 2017 with more than 28 million loyalty club members, who Dillon says drive close to 90% of sales.

To further elevate its service offerings, the company is exploring partnerships and testing a mobile program with Spruce Labs. The program will make it easier for customers to check in for appointments and allow salon associates to better manage schedules. Ulta is also working with Facebook to measure how effectively social media and advertising influence online shopping.

Google Is Launching Shopping Actions, a Tool that Lets Users Buy Directly from Google Platforms

“Data is the backbone of retail,” said Daniel Alegre, Google’s President of Retail and Shopping. Alegre announced a new feature, Shopping Actions, which allows users to purchase items directly from search results and across Google platforms. Alegre said that Google started the new program after observing that even though mobile searches asking where to buy products had risen by 85% over the past two years, most shoppers still ended up buying on Amazon.

A few major retailers, including Target and Ulta, have already begun using the tool, and Alegre said the two companies have seen lifts of 20% and a 35%, respectively, in online basket size. Target plans to link Target.com and Google accounts and to allow customers to use their debit and credit REDcard when making purchases through Google. Ulta shoppers who buy through Google Shopping Actions will earn loyalty points.

AI Retail Startup Tophatter, the “Anti-Amazon Solution,” Is Driving Engagement Rather than Efficiency

Maha Ibrahim, General Partner at early-stage venture capital firm Canaan Partners, spoke with Tophatter Cofounder and CEO Ashvin Kumar at Shoptalk. Tophatter is a startup that created a discovery shopping app that functions much like eBay.The app runs live online auctions 24 hours a day, seven days a week. The marketplace includes thousands of items and there are 5–10 million SKUs in inventory at any given time. The auctions last 90 seconds and the bidding starts at $1.00.

Kumar called Tophatter “a modern-day QVC.” More than 90% of the company’s sales are not preceded by a search, meaning that customers are opening the app to discover products. The company uses data and AI to determine which products to show users when they first open the app.

Tophatter refers to itself as the “anti-Amazon company,” as it is focusing on engagement, not efficiency. “Amazon helps people save time. Tophatter helps people spend time,” Kumar said. The company uses a demand-prediction model, rating each inventory item to assess how well it may perform in the auction market. The company has doubled its business over the past two years and expects to earn$500 million in revenues in 2018, according to Kumar.

AI Is Making an Impact in Retail

To kick off this year’s conference, Coresight Research CEO and Founder Deborah Weinswig emceed the Shoptalk Startup Pitch Competition. Some of the startups that participated offer AI solutions designed to address retailers’ biggest pain points.

Breinify is an AI-based recommendation engine that combines external data sets such as weather and scheduled events with user behavioral data to predict and identify moments of purchase intent based on real-time events.

Keng cited spring break season as an example. As the weather gets warmer, consumer needs shift toward items such as suntan lotion. By understanding those needs before consumer demand for them appears, marketers can anticipate demand, and even generate interest early.

Afresh Technologies uses predictive intelligence powered by machine learning and AIto provide optimal demand forecasting and inventory management for fresh food retailers. The company’s AI system analyzes billions of data points to help retailers forecast demand more accurately and make better product recommendations.CEO Matt Schwartz pointed out the unique difficulties retailers in the grocery sector face when it comes to accurately measuring fresh food demand and shelflife.

TokyWoky is a peer-to-peer chat platform that enables members of a website’s community to engage with and answer other members’ questions in real time.

Companies can use the tool’s neuro-linguistic capabilities to identify customer pain points, map trends and identify needs.“I think the whole trust thing is what makes it so engaging,” said Quentin Lebeau, the company’s CEO.

9. Voice-activated assistants are changing the way consumers interact with brands and enabling discovery and commerce.

Voice-activated digital assistants such as Apple’s Siri, Amazon’s Alexa and Google’s Assistant are quickly becoming a shopping channel for product discovery and purchase. At the same time, innovative startups are building technologies that allow retailers to incorporate voice capabilities into their mobile apps and websites.

Google Assistant

Launched in 2016,Google Assistant is now available on more than 100 million devices, including smartphones, speakers, cars, smart home devices and watches. Voice-activated assistants may propel a shift from text to voice shopping, and Michael Haswell, Director of Global Business Development for Google, said retailers such as Home Depot, Target and Walmart are already leveraging Google Assistant to deliver personalized, conversational assistance to their customers at scale. According to research and advisory firm Gartner, as many as “30% of searches will be voice-only by 2020, and already 72% of voice-activated speaker owners say it’s become part of their daily routine.”

Voysis

Voysis, which has raised $8 million in funding to date, allows e-commerce companies to launch their own brand-specific, native voice experience. The company’s CEO, Peter Cahill, said that the technology enables consumers to use natural language voice to search and transact on a site. According to Cahill, Voysis initially gained recognition for its ability to create synthetic voices that sound more human than those heard from leading voice assistants in the market.

10. Shoppers continue to migrate to e-commerce, spend on leisure experiences and seek out value.

At Shoptalk 2018, there was much discussion of how shoppers today are spending in new ways, migrating to e-commerce, favoring experiences over physical goods, and seeking out value.

New Retail from China Is Putting the Fun Back in Retail and Represents the Next Generation of Consumer Experiences

In a Shoptalk session titled “Overview of Retail and Ecommerce Innovation in China,” Coresight Research CEO and Founder Deborah Weinswig noted that China is leading the world in terms of retail comp sales. She also discussed how Alibaba’s New Retail model, in which acquisitions play a key role, is being embraced by US retailers, many of which are making their own acquisitions or expanding from online-only operations into offline operations.

Weinswig said that shopping in physical stores in China is different because shoppers there can bargain for a discount, giving the experience an element of surprise and fun. Personalization and customization will continue to trend in China, Weinswig said, with key opinion leaders and influencers leading the market via live streaming. New inspirations for retail include the deployment of AI, VR, facial recognition and automated stores such as BingoBox and Tao Cafe in China. Weinswig said that there are real opportunities for rethinking the physical store and making it come alive by using technology such as VR and live streaming.

Zia Daniell Wigder and Deborah Weinswig

Source: Coresight Research

Radical Retail Thinking Requires Being Uncomfortable, Feeling Wrong and Having “One Foot on the Dock and One Foot in the Boat”

Robin Lewis, Founder and CEO of

The Robin Report, which provides insights and opinions on major topics in the retail industry, hosted a breakfast event called “The Robin Report, ‘Are You a Retail Radical?’” at which executives from Home Depot, Williams-Sonoma and Walmart’s incubator, Store No 8, discussed what “radical thinking” means in retail today.

Lewis opened the discussion by noting the radical transformation society is undergoing. He said that there are now more Ubers than taxis in New York City, and more Airbnbs than Hilton hotels. He suggested that retail is also at the beginning stages of a radical transformation.

Mark Bozek, CEO of Live Rocket, a company that combines entertainment and retail, moderated the discussion. He asked panelists to define what “radical” means to them in the context of their organization and today’s changing world. Katie Finnegan, Principal at Store No 8, said that the term refers to thinking about the future 10 or more generations out and not being distracted by what is commercially viable today. Finnegan added that this means not focusing on the small, incremental things, but looking at the big picture.

Chris Duffy, Home Depot’s VP of Merchandising – In-Store Experience, said that at his company, “radical” refers to having “one foot on the dock and one foot in the boat.” Duffy explained that Home Depot realizes it has to run a good business operationally, while also thinking about what is around the corner and what is 8–10 years out. Duffy said that what is different today is the pace of change—it has accelerated—so companies have to be more flexible than in the past in order to run an organization while continuing to look ahead with an eye on innovation.

Discussion of Future Retail Trends

Throughout the conference, panelists were asked about their predictions for the future of retail. Here are a few notable ones:

- “New business models are emerging in VR and AR, and this area will get more exciting within the next 18 months.”

— Gihad Jawhar, VP, Digital Development, Lowe’s

- “Voice is the fourth sales channel, with digital assistants such as Amazon Alexa and Google Assistant gaining traction.”

“AR is trending in the areas of furniture or fixture shopping, apparel shopping online, and providing in-store product information.”

“VR narratives are growing in the areas of brand marketing and developing brand experiences. For example, the technology is being used to help consumers explore holiday destinations, virtually explore products or services, and shop online.”

— Steve Koenig, Senior Director of Market Research, Consumer Technology Association