Nitheesh NH

Introduction

What’s the Story? More consumers are experimenting with new shopping channels and alternative payment methods (APMs) in search of improved convenience in the online shopping journey, even as peak pandemic effects subside. Shifts in consumer trends, including the rising use of online checkout services, social commerce, APMs and cryptocurrency as retail payment, are prompting retailers to develop their existing payment infrastructure and technology stack to deliver an enhanced digital consumer experience. While e-commerce continues to grow, there are still numerous pain points for both merchants and shoppers in the online space. For example, shoppers often experience high friction during digital checkout due to lengthy and complicated processes. Furthermore, merchants that participate in large, centralized marketplaces (such as Amazon and eBay) to operate online and extend their consumer reach must pay high fees and have limited ability to scale. In this report, we explore consumer trends in digital payments and discuss the shift to frictionless checkout through decentralized commerce. This report is published in collaboration with Bolt, a leading innovator in the payments and checkout space. Why It Matters We estimate that total online retail sales in the US (excluding automobiles) will total $993 billion in 2022 and grow to over $1.5 trillion by 2027, representing a CAGR of 9.4%. We estimate that online retail sales will account for 27.8% of total retail sales in 2027. As online retail sales grow, consumer demand increases for retailers to develop their payment infrastructure accordingly, including by adopting digital payments, cryptocurrencies and APMs. According to Statista, the total worldwide transaction value for digital payments is set to increase at a CAGR of 12.8% between 2022 and 2026, to $13.9 trillion.Digital Payments and Checkout: Consumer Trends

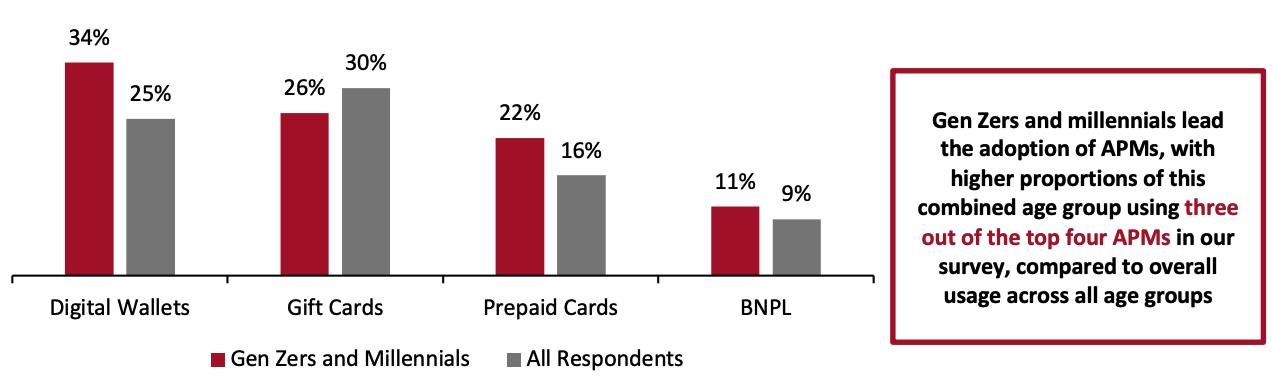

The Rise of APMs Consumers are increasingly exploring the benefits of various APMs when shopping online, amid advances in payment technology and increased engagement with innovative shopping channels. Young, tech-savvy generations—Gen Zers and millennials—are leading the APM adoption charge. A Coresight Research survey of consumers in the US and Canada, conducted in March 2022, found that higher proportions of Gen Zers and millennials used digital wallets, prepaid cards and BNPL in the 12 months prior to the survey than the proportions of respondents overall.Figure 1. APMs Used by Consumers in the Past 12 Months: Overall and by Gen Zers/Millennials (% of Respondents) [caption id="attachment_150373" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple optionsBase: 237 consumers across the US and Canada aged 18+, surveyed in March 2022

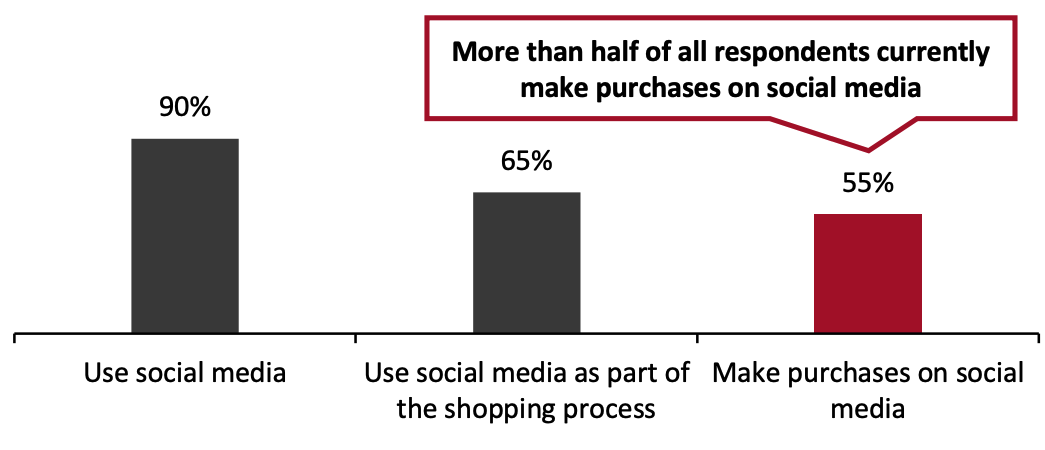

Source: Coresight Research[/caption] Below, we explore consumer adoption of two most technologically innovative APMs, digital wallets and BNPL. Digital Wallets Consumers continue to adopt digital wallets, such as Apple Pay and PayPal, as they are convenient, accessible and secure, allowing shoppers to skip entering shipping and payment information when shopping online. Juniper Research estimates that the value of mobile wallet transactions globally will grow to $9.4 trillion by 2025, up from an estimated $6.5 trillion in 2022—representing a CAGR of 13.2%. BNPL While BNPL companies such as Affirm and Afterpay gained popularity during the pandemic, our March 2022 survey shows continued momentum in consumer interest, even as pandemic effects subside: among the American and Canadian consumers who are either interested in BNPL or are already regular or occasional users of this APM, more than half expect to maintain or increase their frequency of BNPL usage in the next year. BNPL is becoming increasingly popular due to the immediate affordability granted through payment plans amid the highest inflation in four decades. Retailers should look to implement BNPL options to enhance their payment infrastructure and attract shoppers. The Role of Social Media in Shopping: Checking Out at the Point of Discovery Consumers continue to discover retail inspiration when browsing online, including on social media. Retailers that make it easy for consumers to seamlessly pay for products they are interested in can convert inspiration to sales quickly on the same platform. Coresight Research’s US social commerce survey from March 2022 found that nearly two-thirds of consumers use social media as a part of the shopping process (Figure 2).

Figure 2. US Consumers’ Use of Social Media: Overall and for Shopping (% of Respondents) [caption id="attachment_150374" align="aligncenter" width="580"]

Base: 1,375 US respondents aged 18+, surveyed in March 2022

Base: 1,375 US respondents aged 18+, surveyed in March 2022Source: Coresight Research[/caption] However, while plenty of shoppers research or discover products while browsing on social media, 75% of these respondents reported that they abandon purchases at least sometimes. Among that subset of respondents, the top reasons for giving up on making a purchase via social media are as follows:

- It is easier to buy elsewhere (cited by 41% of respondents who use social media to research/discover products but abandon purchases at least sometimes)

- The page jumps to another website (34%)

- The user does not trust shopping on social media (31%)

- There is a lack of built-in payment functionality on the site (24%)

- Checkout is time-consuming—Checking out on many retailers’ websites can take a long time due to high complexity, redirection to different websites and lengthy entry of shipping and payment information. This results in consumers thinking they would be better off using a channel with a quicker checkout system that stores shipping and payment information, such as Amazon, to buy their desired product.

- Distrust of fraud protection—Many consumers lack trust in websites’ fraud protection, especially when using a new checkout software they are not familiar with. Furthermore, the online checkout process varies greatly between retailers, increasing the likelihood of shoppers feeling uncomfortable with a new checkout experience.

- Lack of APMs—Consumers may prefer to shop with retailers that accept APMs such as digital wallets, BNPL and cryptocurrency. Upon seeing that their preferred payment method is unavailable, a consumer may choose a shop that does accept APMs.

The Evolution of Payment Technology

Applications of One-Click Checkout Technology One-click checkout technology is revolutionizing the payment space and enabling retailers to provide a quick and easy checkout experience. By using safely stored, pre-entered shipping and payment information, one-click checkout allows customers to checkout securely with a single click, impacting e-commerce, payment infrastructure and retail discovery:- E-commerce—One-click checkout technology enables a frictionless checkout experience that decreases cart abandonment by reducing third-party website usage and removing the time required to enter shipping and payment information.

- Payment infrastructure—The back-end function of one-click checkout technology utilizes several digital integrations, including with payment gateways and processors, to provide a seamless payment process.

- Retail discovery—By closing the gap between browsing and buying, one-click checkout technology bolsters the importance and use of digital platforms that consumers use as a point of retail inspiration and discovery. Retailers can work with retail technology providers to embed one-click checkout in their sales channels, allowing consumers to quickly check out at the point of discovery rather than being redirected to a different website.

Figure 3. How One-Click Checkout Impacts E-Commerce, Payment Infrastructure and Retail Discovery [caption id="attachment_150375" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Moving Toward Decentralized Commerce

Previously, e-commerce has required a centralized authority, such as Amazon or eBay, that aggregates supply and demand channels within a marketplace to facilitate transactions between buyers and sellers. While this system facilitates transactions where parties can easily trust one another, a centralized system makes it hard for many mid-market and enterprise merchants to run their own independent e-commerce business without integrating into large marketplaces.

Advances in blockchain technology and cryptocurrency are supporting the decentralization of online retail through peer-to-peer computer systems and digital tokens. Additionally, the irreversible and secure nature of blockchain technology fosters an environment of mutual trust.

Headless E-Commerce

Headless e-commerce architecture is advancing retail’s shift to decentralized commerce by deconstructing the components of large, centralized marketplaces. Headless commerce means that the front-end code (head) is decoupled from back-end commerce functionality, which handles tasks such as merchandising and payment processing, enabling quick and easy front-end updates without interfering with the back end.

Key benefits of headless e-commerce architecture include increased flexibility and scalability, and shortened launch and website-update times.

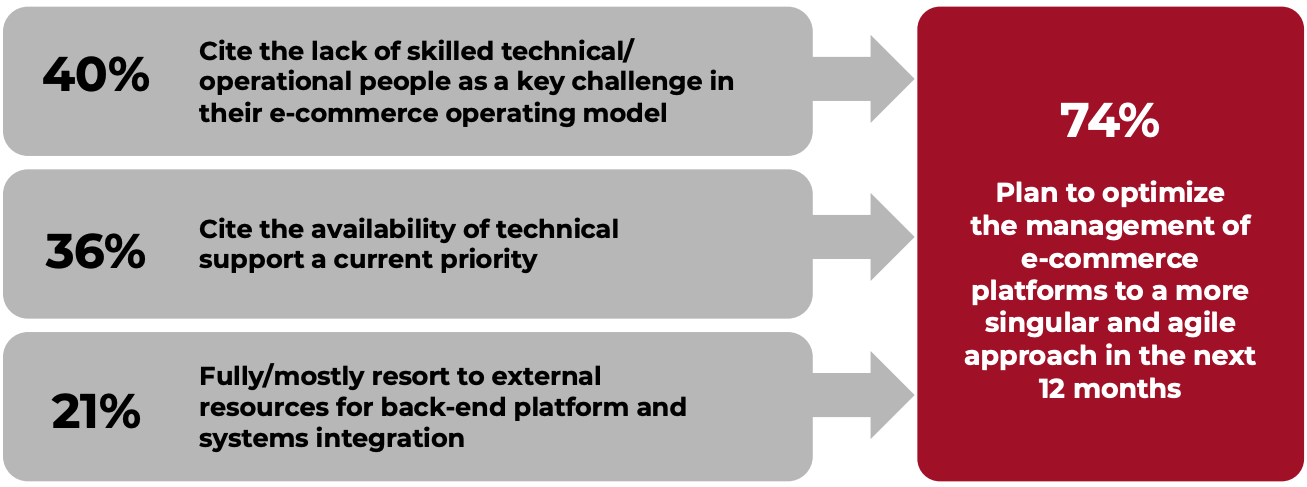

Many retailers are prioritizing technology stack upgrades to keep up with recent retail trends. A Coresight Research survey, conducted in October 2021, of e-commerce leaders at US mid-sized companies found that:

Source: Coresight Research[/caption]

Moving Toward Decentralized Commerce

Previously, e-commerce has required a centralized authority, such as Amazon or eBay, that aggregates supply and demand channels within a marketplace to facilitate transactions between buyers and sellers. While this system facilitates transactions where parties can easily trust one another, a centralized system makes it hard for many mid-market and enterprise merchants to run their own independent e-commerce business without integrating into large marketplaces.

Advances in blockchain technology and cryptocurrency are supporting the decentralization of online retail through peer-to-peer computer systems and digital tokens. Additionally, the irreversible and secure nature of blockchain technology fosters an environment of mutual trust.

Headless E-Commerce

Headless e-commerce architecture is advancing retail’s shift to decentralized commerce by deconstructing the components of large, centralized marketplaces. Headless commerce means that the front-end code (head) is decoupled from back-end commerce functionality, which handles tasks such as merchandising and payment processing, enabling quick and easy front-end updates without interfering with the back end.

Key benefits of headless e-commerce architecture include increased flexibility and scalability, and shortened launch and website-update times.

Many retailers are prioritizing technology stack upgrades to keep up with recent retail trends. A Coresight Research survey, conducted in October 2021, of e-commerce leaders at US mid-sized companies found that:

Figure 4. US Mid-Size Retailers on Technology Stack Challenges and E-Commerce Operations Management (% of Respondents) [caption id="attachment_150376" align="aligncenter" width="700"]

Base: 122 e-commerce leaders at US mid-size companies, surveyed in October 2021

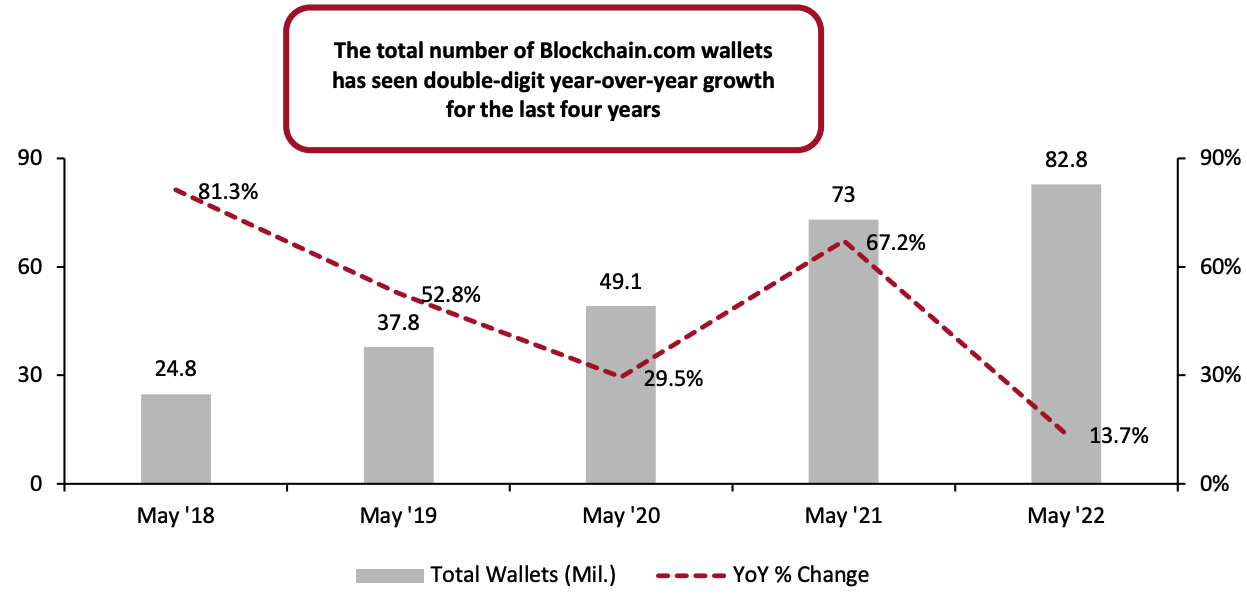

Base: 122 e-commerce leaders at US mid-size companies, surveyed in October 2021Source: Coresight Research[/caption] Many of these technical issues can be alleviated through the implementation of a headless structure, which moves away from a single code base and bolsters retailers’ operational efficiency and ability to scale. We believe that many retailers will need to—and will continue to—make the shift to a decentralized model for their e-commerce design architecture. Acceptance of Cryptocurrency as Payment The global pandemic and its impact on financial markets and technological advancement brought renewed interest in the application of cryptocurrency as a form of payment in the retail world. According to the White House’s briefing in March 2022, about 16% of the American public is already investing, trading or using cryptocurrency, indicating that many Americans have become familiar with or are already using cryptocurrency in some form, meaning retailers should weigh the benefits of accepting cryptocurrency at their establishments. Another sign of the growing interest in cryptocurrency transactions are the increasing number of blockchain wallets being created. According to data from Blockchain.com, a cryptocurrency financial services company, the total number of unique wallets on their site sits at 82.8 million as of May 16, 2022, up from 46.9 million at the onset of the pandemic in 2020—a 77% year-over-two-year increase.

Figure 5. Total Number of Unique Blockchain.com Wallets Created (Left Axis; Mil.) and YoY Change (Right Axis; %) [caption id="attachment_150377" align="aligncenter" width="700"]

Source: Blockchain.com[/caption]

Meanwhile, many retail and foodservice companies, including The Home Depot, Starbucks and Whole Foods, have started accepting cryptocurrency in some form, while others are expressing interest in doing so—80% of merchants in the both the retail & grocery and luxury goods sectors stated that they were open to receiving cryptocurrency payments, according to a survey conducted in the fourth quarter of 2021, by Worldpay and Crypto.com.

Accepting cryptocurrency payments can bring in new customers, along with other benefits. A 2020 study by BitPay, a leading provider of Bitcoin and cryptocurrency payment services, found that 40% of customers who pay with cryptocurrency are new customers to a company, and customer purchase amounts are usually double those of credit card users.

As digital shopping grows in popularity, more consumers are turning to cryptocurrency as a payment method. We expect this trend to continue, driving retailers to advance their payment infrastructure to accept cryptocurrency, so as not to be left behind in a growing retail trend.

Source: Blockchain.com[/caption]

Meanwhile, many retail and foodservice companies, including The Home Depot, Starbucks and Whole Foods, have started accepting cryptocurrency in some form, while others are expressing interest in doing so—80% of merchants in the both the retail & grocery and luxury goods sectors stated that they were open to receiving cryptocurrency payments, according to a survey conducted in the fourth quarter of 2021, by Worldpay and Crypto.com.

Accepting cryptocurrency payments can bring in new customers, along with other benefits. A 2020 study by BitPay, a leading provider of Bitcoin and cryptocurrency payment services, found that 40% of customers who pay with cryptocurrency are new customers to a company, and customer purchase amounts are usually double those of credit card users.

As digital shopping grows in popularity, more consumers are turning to cryptocurrency as a payment method. We expect this trend to continue, driving retailers to advance their payment infrastructure to accept cryptocurrency, so as not to be left behind in a growing retail trend.

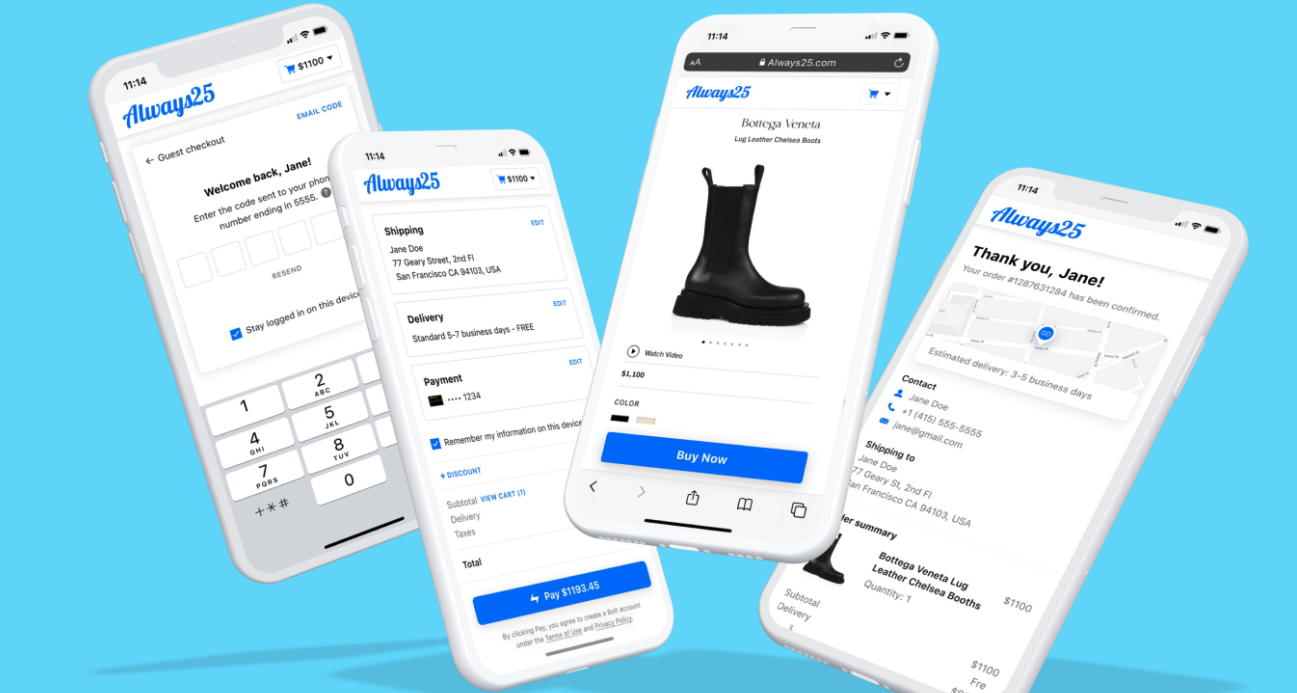

Company Overview: Bolt

Bolt is a checkout-technology company that enables retailers to provide their customers with a one-click checkout experience when shopping. The retail technology company was founded in 2014 by Ryan Breslow and is currently led by CEO Maju Kuruvilla and headquartered in San Francisco, California. By facilitating a quick and easy one-click checkout experience, the company aims to narrow the gap between browsing and buying by removing friction in the online checkout process, including the need to memorize and fill out usernames, passwords and payment information, and giving shoppers their preferred method of payment. In doing so, Bolt assists retailers in enhancing their online checkout process and lowering checkout abandonment rates. Bolt’s two core offerings to retailers are as follows:- CheckoutOS—A software that includes one-click checkout technology, payment orchestration and fraud protection among other features

- The Bolt Network—A network that provides access to millions of online shoppers

Bolt’s CheckoutOS

Bolt’s CheckoutOSSource: Bolt[/caption] How Does Bolt Enhance the Checkout Experience?

- Reduces time: Consumers often view online checkout as time-consuming due to redirection to different websites and long shipping and payment information-entry processes. By utilizing pre-stored shipping and payment information tied to a shopper’s account, Bolt greatly reduces checkout times and allows shoppers to check out with one click, even at websites they have never visited before.

- Fraud protected checkout: Fraud targeting digital payments has increased alongside the popularity of online shopping. As a result, many consumers do not trust the security of online checkout and the integrity of third-party payment websites. Bolt offers retailers and consumers assurance through its CheckoutOS software, which is equipped with fraud-protection technology that analyzes over 200 real-time behavioral signals and data points to determine if an order is fraudulent or genuine.

- Alternative payment infrastructure: Pandemic-fueled retail trends have led consumers to demand that retailers accept APMs in place of more traditional payment methods. Bolt’s checkout software includes alternative payment options such as BNPL and digital wallets. With the company’s recent acquisition of cryptocurrency infrastructure company Wyre, Bolt plans to be “one of the first companies to enable retailers to accept cryptocurrency payment for both digital and physical goods in a seamless manner” (we discuss this acquisition in more detail in a later section).

- Enables 47% higher conversion rates, according to Bolt, by removing friction points during the checkout process to facilitate a quicker end-to-end online shopping journey that narrows the gap between browsing and buying

- Increases store account creation and ownership of first-party data, which merchants can utilize to recognize their shoppers and create personalized shopping experiences that lead to higher lifetime value (LTV) and shopper loyalty

- Utilizes a headless approach to building one-click checkout options on a variety of digital surfaces, providing the flexibility to tie into different platforms and architecture

- Enables convenient and quick online checkout by removing the need to memorize and repeatedly enter usernames, passwords and payment information

- Grants the ability to use alternative forms of payment instead of the traditional debit or credit card, including digital wallets, BNPL and cryptocurrency (with the planned acquisition of Wyre)—allowing consumers to use the payment method most convenient to them when checking out

- Provides fraud protection, which assures consumers of the security behind their digital transactions, as well as real-time tracking capabilities and dashboards that enable users to stay on top of their orders

Figure 6. Bolt’s CheckoutOS: Key Features

| Metric | Key Features |

| Bolt One-Click Checkout |

|

| Digital Integrations |

|

| Fraud Protection |

|

| SSO (Single Sign-On) Commerce |

|

| Payments Orchestration |

|

| Analytics and Insights |

|

Source: Bolt/Coresight Research

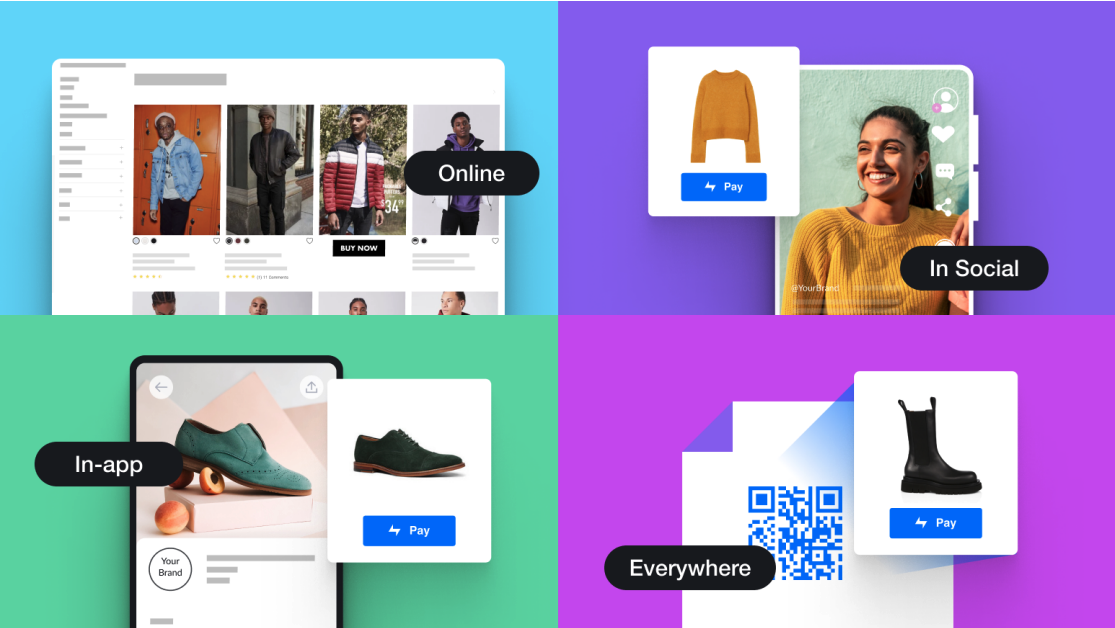

Recent Acquisitions: How Is Bolt Enhancing Existing Software? Tipser Acquisition—Checkout at the Point of Inspiration In 2021, Bolt acquired Swedish retail technology company Tipser. The company’s embedded commerce technology allows retailers and creators to turn any digital surface into a platform for purchasing. Bolt currently leverages Tipser’s turnkey publisher marketplaces, touchless merchant integrations and headless-commerce implementation capabilities to enhance Bolt’s Checkout Everywhere solution. The solution enables retailers and creators to give their consumers one-click checkout options at the point of inspiration via a variety of digital surfaces. With the solution, retailers can capitalize on consumers browsing digital advertisements and convert inspiration into sales, all while receiving real-time data on consumer patterns and trends. Wyre Acquisition—Acceptance of Cryptocurrency as Payment In 2022, Bolt has announced its planned acquisition of cryptocurrency infrastructure provider Wyre. Through this acquisition, Bolt is assembling the technology and infrastructure required to offer a seamless and secure one-click checkout using cryptocurrency as an accepted form of payment. This will enable shoppers to use cryptocurrency not only for digital assets such as non-fungible tokens (NFTs), but also for physical goods sold by Bolt merchants. The company’s integration of cryptocurrency and blockchain technology will help the company facilitate secure, peer-to-peer networks, contributing to the retail industry’s transition into a decentralized model of commerce. [caption id="attachment_150379" align="aligncenter" width="700"] Bolt’s Commerce Everywhere solution

Bolt’s Commerce Everywhere solutionSource: Bolt[/caption]