Nitheesh NH

Introduction

What’s the Story? Fast-fashion retailer Shein has gained strong traction among younger shoppers, particularly Gen Z consumers (born between 1997 and 2012), around the world through its highly competitive pricing and huge collection of frequently renewed trendy apparel and footwear lines. The online retailer has massively expanded into the overseas market, capitalizing on China’s comprehensive supply chain capabilities and more mature mobile-commerce know-how. We expect retailers globally to learn from Shein’s success and incorporate more innovative retail models. In this report, we analyze key elements of Shein’s business, covering the company’s major strategies and recent revenue growth, building on our report published in July 2021. We compare Shein’s key strategies with that of two other ultra-fast-fashion companies, UK-based ASOS and Boohoo Group, which are part of the Coresight 100 (our focus list of retailers, brand owners and real estate firms, spanning the US, Europe and Asia). Why It Matters Shein has been a strong beneficiary of the pandemic-related consumer shifts to online channels, becoming a dominant player in the fast-fashion market in 2020, with global revenues of $10 billion, according to industry estimates. The company generates most of its revenues from the US. In fiscal 2021, the company’s revenues increased by an inferred 57.0% year over year to an estimated ¥100 billion ($15.7 billion), following more than 100% growth for the eighth consecutive year. By comparison, ASOS saw a sales increase of 19.8% year over year to £3.9 billion ($5.4 billion) in fiscal 2021, ended August 31, 2021, while Boohoo Group’s sales grew by 28.1% year over year to £1.9 billion ($2.5 billion) in the trailing 12 months ended August 31, 2021. We believe that Shein is well positioned to capture a greater share of the US fast-fashion market in 2022 and beyond, driven by its real-time retail model, competitive pricing and aggressive social media operations, which we explore in this report. Furthermore, our recent proprietary survey data, discussed in this report, confirms strong demand for Shein products among US consumers, particularly among young shoppers aged 18–29.Shein in US Fast Fashion: Coresight Research Analysis

Company Overview Shein is developing its Singapore office and made Singapore-based software company Roadget Business its parent company in late 2021, as cited by Reuters on February 16, 2022. In addition to operating Shien’s global website, Roadget also owns Guangzhou Shein International Import & Export Co. as well as Shein trademarks; these were transferred from Hong Kong’s Zoetop Business Co. as of late 2021. By the end of 2022, Shein targets quadrupling the number of its Singapore employees to about 200. Shein has changed the company’s headquarters to Singapore from Nanjing, China, and the company’s Founder and CEO, Chris Xu, has become a permanent resident of Singapore, as cited by Reuters in February 2022. We believe that Shein is looking for a neutral base in Singapore—which is a financial hub with a substantial ethnic Chinese population—amid trade tension between the US and China.Figure 1. Company Overview: Shein [wpdatatable id=1850]

Source: Company reports/Startup Talky/Business of Fashion/Coresight Research

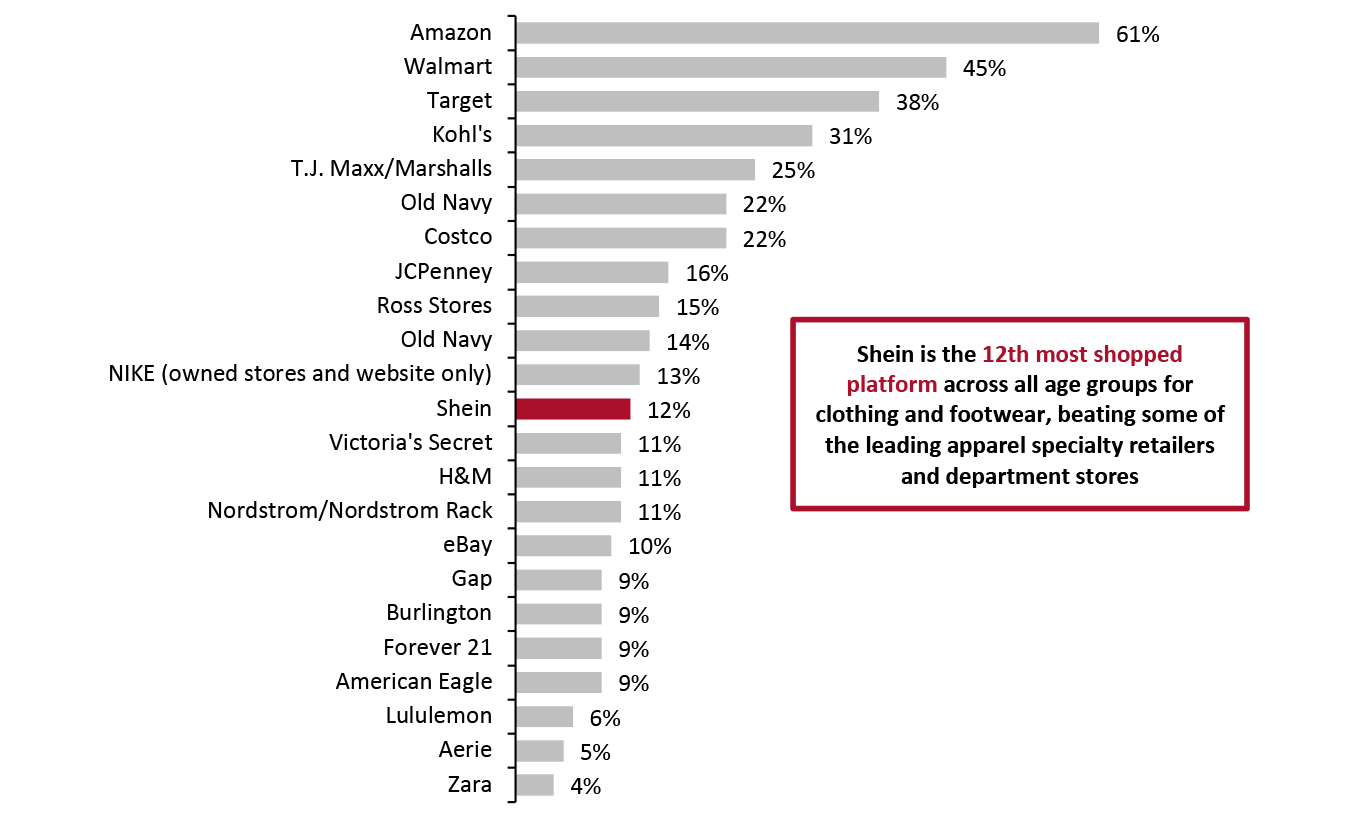

Strong Demand for Shein Products Among US Consumers We are seeing a substantial proportion of US consumers across all age groups buying clothing and footwear via the Shein platform. According to Coresight Research’s survey of US consumers conducted on March 1, 2022, Shein is the 12th-most-shopped retailer or platform for clothing and footwear in the US. With 12% of apparel shoppers reporting that they had purchased clothing and footwear from Shein in the past 12 months, the company beat out leading specialty retailers American Eagle, Gap, H&M, Lululemon, Victoria’s Secret and Zara, as well as department stores such as Nordstrom (see Figure 2). Furthermore, the proportion of young US consumers (Shein’s target audience) buying apparel and footwear from Shein is much higher, at around 22%, according to our March 2022 survey, which we discuss in detail later. Shopper numbers in consumer surveys cannot routinely be extrapolated into dollar revenues (which are impacted by average basket size and frequency of purchase), but they do give some idea of relative scale. To give some context to Shein’s position versus other retailers, we estimate from company filings that in 2020, Amazon.com generated US apparel, footwear and accessories sales of close to $39 billion; Walmart (banner) generated category sales of around $27 billion; and Target achieved category sales of $14.8 billion. Victoria’s Secret and Ross Stores, closer to Shein in our survey, achieved US sales of around $5 billion and $9 billion, respectively, in 2020.Figure 2. US Apparel Shoppers: Retailers from Which They Have Purchased Clothing or Footwear in the Past 12 Months (% of Respondents) [caption id="attachment_145144" align="aligncenter" width="700"]

Base: 2,138 US respondents aged 18+ that had bought clothing or footwear in the past 12 months, surveyed on March 1, 2022

Base: 2,138 US respondents aged 18+ that had bought clothing or footwear in the past 12 months, surveyed on March 1, 2022Source: Coresight Research[/caption] Expansion Plans for 2022 and Beyond Shein has unveiled some notable plans for business development in 2022, which we believe will help the company further expand its consumer base.

- Shein plans to substantially bolster its supply chain capabilities by investing $2.3 billion in opening a global supply chain hub in Guangzhou, China. The construction of the hub is set to begin by the end of 2022.

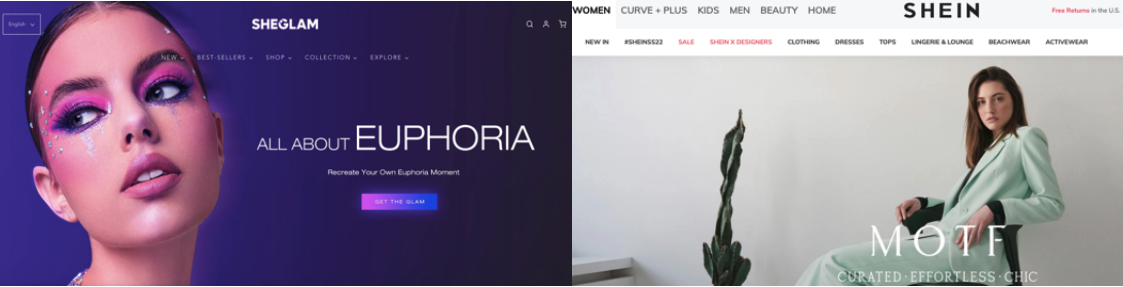

- In 2022, Shein will continue to expand its beauty category offerings by growing SHEGLAM, the independent beauty brand launched by Shein in December 2020, said George Chiao, President of US Shein, in an interview with The Business of Fashion in December 2021. Previously, in 2021, we saw Shein expand SHEGLAM into the pet products category.

- Shein is also ramping up marketing efforts for its high-end fashion offering MOTF (earlier known as Shein Premium), including launching an independent website for premium brands to better access higher-end apparel consumers across the globe, according to Chiao.

- Moreover, Shein is looking to extensively grow Shein X, an incubator program that offers independent designers with operational, manufacturing, marketing and financial support. In 2021, more than 200 designers launched their brands and business through Shein X, and the online retailer expects this number to grow to over 3,000 in 2022.

In 2022, Shein plans to expand its independent beauty brand SHEGLAM and launch an independent website for the company’s high-end fashion offering MOTF

In 2022, Shein plans to expand its independent beauty brand SHEGLAM and launch an independent website for the company’s high-end fashion offering MOTFSource: Company reports[/caption] IPO Plans on Hold Again Amid Russia-Ukraine War Shein has put its plan to debut on the New York Stock Exchange (NYSE) via an IPO (initial public offering) on hold due to growing volatility in capital markets amid Russia-Ukraine war tensions, as cited by Reuters on February 25, 2022. Earlier, in January 2022, Reuters reported that Shein revived its plan to debut on the NYSE via an IPO in 2022, and the company has reportedly hired Bank of America, Goldman Sachs and JP Morgan as investment bankers for floating its shares. This is the second time the company has put its IPO plans on hold. Shein planned for the US IPO about two years ago, but the company took a U-turn amid the rising trade tensions between the US and China. While it is not clear whether the company will revive its listing plan again in 2022, the recent developments, such as Shein making the Singaporean firm Roadget Business its de facto holding company, changing its headquarters to Singapore and Shein’s founder changing his citizenship to Singaporean to dodge China’s strict rules on overseas listings, are in line with the online retailer’s potential public listing plans. If executed, Shein’s IPO would be the first major equity deal in the US by a company founded in China since Chinese regulators clamped down on overseas listings in July 2021. Delivery Capabilities: A Major Competitive Disadvantage While Shein has established warehouses in Asia, America, Europe and the Middle East to distribute its products, it still ships the majority of orders directly from Chinese factories based on real-time customer demand. As a result, Shein takes eight to 12 days to fulfill orders from the US and Europe—an improvement from last year, when it used to take 12–17 days, but still much slower than the delivery services offered by ASOS and Boohoo Group (see Figure 3). We believe that Shein’s delivery capability continues to be a major competitive disadvantage for the company.

Figure 3. ASOS, Boohoo and Shein: Express Order Delivery Time [wpdatatable id=1851]

Source: Company reports

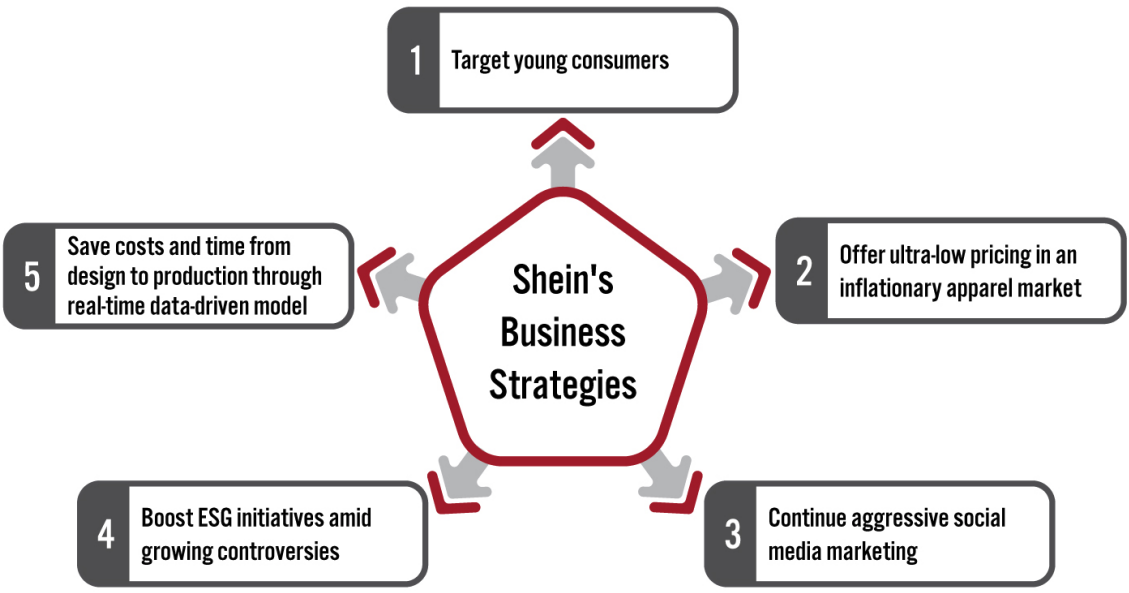

Business Strategies We summarize Shein’s key business strategies, including its target audience, pricing, marketing and manufacturing strategies, in Figure 4. We explore each element of the rapid success of the Chinese brand in the US fast-fashion apparel space in further detail below.Figure 4. Shein: Five Key Business Strategies [caption id="attachment_144539" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

1. Target Young Consumers

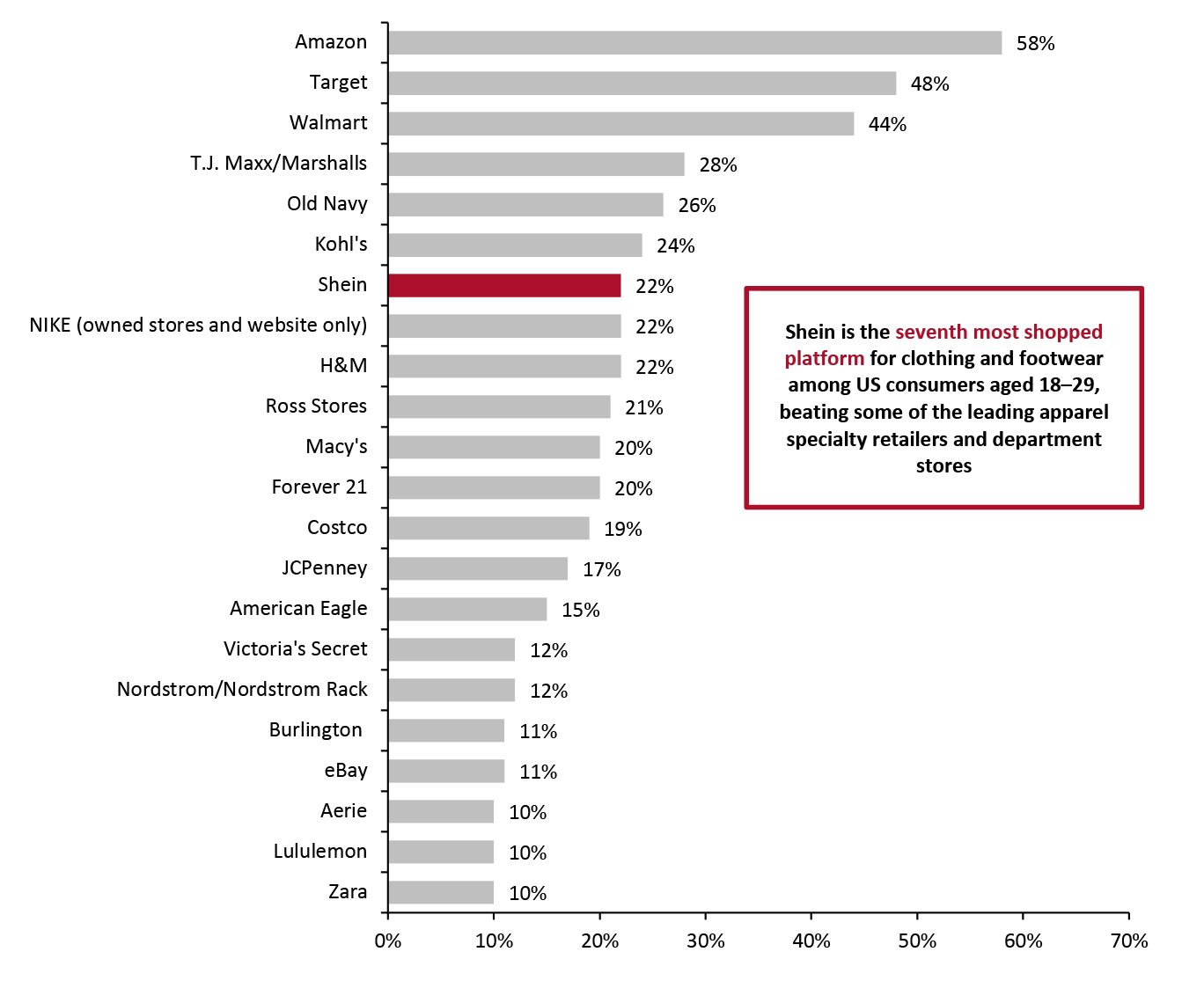

Like ASOS and Boohoo Group, Shein primarily targets young consumers, particularly Gen Z. Coresight Research’s proprietary survey conducted on March 1, 2022, found that Shein is the seventh-most-shopped retailer or platform for apparel and footwear (tied with H&M and NIKE) among consumers aged 18–29, with 22% of that age group buying from the site. This positions Shein ahead of some leading apparel specialists, including American Eagle and Victoria’s Secret, and department stores such as Macy’s (see Figure 5). It is the second-most-shopped online-only retailer or platform for this age group in our survey, after Amazon.

An August–September 2021 study from US-based investment banking company Piper Sandler further demonstrates Shein’s growing popularity among young people: Shein emerged as the second-most-preferred e-commerce site for buying apparel and footwear (after Amazon) among US teens, with a 9% share—up 400 basis points, year over year.

Source: Coresight Research[/caption]

1. Target Young Consumers

Like ASOS and Boohoo Group, Shein primarily targets young consumers, particularly Gen Z. Coresight Research’s proprietary survey conducted on March 1, 2022, found that Shein is the seventh-most-shopped retailer or platform for apparel and footwear (tied with H&M and NIKE) among consumers aged 18–29, with 22% of that age group buying from the site. This positions Shein ahead of some leading apparel specialists, including American Eagle and Victoria’s Secret, and department stores such as Macy’s (see Figure 5). It is the second-most-shopped online-only retailer or platform for this age group in our survey, after Amazon.

An August–September 2021 study from US-based investment banking company Piper Sandler further demonstrates Shein’s growing popularity among young people: Shein emerged as the second-most-preferred e-commerce site for buying apparel and footwear (after Amazon) among US teens, with a 9% share—up 400 basis points, year over year.

Figure 5. US Apparel Shoppers Aged 18–29: Retailers from Which They Have Purchased Clothing or Footwear in the Past 12 Months (% of Respondents) [caption id="attachment_145145" align="aligncenter" width="700"]

Base: 379 US respondents aged 18–29 that had bought clothing or footwear in the past 12 months, surveyed on March 1, 2022

Base: 379 US respondents aged 18–29 that had bought clothing or footwear in the past 12 months, surveyed on March 1, 2022Source: Coresight Research[/caption] 2. Offer Ultra-Low Pricing in an Inflationary Apparel Market Shein has continued its ultra-low pricing strategy, even in the current inflationary global apparel market—which has helped the company to drive sales. This means it can manufacture in bulk, which reduces costs. Shein’s prices are even lower than ultra-low-cost fast-fashion companies Boohoo (brand) and ASOS. For instance, a skirt would cost $10–$40 before markdowns at Boohoo and $11–$55 at ASOS, while Shein’s version would have a price tag of $6–$20. Furthermore, akin to several Chinese online platforms, including Alibaba, Shein frequently offers discounts, including rewards for downloading its app or buying through a Shein influencer. [caption id="attachment_144542" align="aligncenter" width="700"]

Shein’s US website pop-ups offer discounts

Shein’s US website pop-ups offer discountsSource: Shein[/caption] 3. Continue with Aggressive Social Media Marketing As discussed above, Shein targets younger audiences, which typically rely more (versus older generations) on social media channels and targeted mobile ads to discover apparel and footwear brands. Shein continues to strengthen its lead over pure-play rivals such as ASOS and Boohoo with aggressive social media marketing, including using celebrities and key opinion leaders across Facebook, Instagram, Pinterest and TikTok. Shein continues to outperform both ASOS and Boohoo in terms of followers over social media channels (as shown in Figure 6). Furthermore, Shein has dozens of partner affiliate programs on various networks, including Admitad, Awin, Pepperjam and ShareASale, along with its own affiliate program. The affiliate program allows bloggers, coupon sites, information sites, review sites and social media influencers to earn commission by referring consumers to Shein.com.

Figure 6. ASOS, Boohoo and Shein: Followers on Selected Social Media Platforms as of March 3, 2022 [wpdatatable id=1852]

Source: Facebook/Instagram/Pinterest/TikTok

4. Boost ESG Initiatives Amid Growing Controversies Sustainability and ethical sourcing remain key themes in the global apparel and footwear industry; they are important to customers, investors and employees. Shein is boosting its environmental, social and governance (ESG) initiatives, including through sourcing recycled fabrics, deploying solar power in warehouses and producing a limited quantity of new products. Shein produces only 50–100 pieces of newly launched products and updates production based on real-time consumer demand. Shein also uses thermal digital transfer and digital printing technologies to print graphics and patterns onto fabrics, rather than the screen-printing technology that is used by several fast-fashion brands. While costlier than screen printing, thermal digital transfer and digital printing technologies reduce air and water pollution. Between December 2018 and January 2022, Shein processed an average of 85% of polyester-based products using thermal digital transfer technology, thereby reducing water waste by 50%. In November 2021, Shein hired Adam Whinston as Global Head of ESG. Whinston has about 20 years of experience in sustainability, most recently working as the Head of Responsible Sourcing at Disney and in similar roles at JCPenney and Hewlett Packard. Whinston told Coresight Research in February 2022 that Shein will release its sustainability and social impact report in the first half of 2022, highlighting the online retailer’s key ESG measures. However, like many other fast-fashion retailers, including Boohoo Group, Shein lacks transparency about its production chain and has been accused of involvement in unethical practices, such as the use of sweatshops (a term for workplaces with poor, socially unacceptable or illegal working conditions). About 17 identified suppliers to Shein in the Guangzhou region are informal factories set up in residential buildings, with no emergency exits and barred windows, violating Chinese labor laws, according to a November 2021 report by Public Eye, a Swiss watchdog group. Additionally, workers in these factories worked for about 75 hours a week, with only one day off a month, according to Public Eye. Furthermore, as the company lists 500–2,000 new items on its website every day, it likely contributes huge waste arising from unsold garments that end up in landfills. Whinston has been tasked with countering criticism of the company’s business practices. In an interview with The Business of Fashion in December 2021, Whinston said that Shein is genuine in its aspiration to improve its record on sustainability, and his priority will be to audit Shein’s supply chain to unearth potential labor violations. He said he will make the audit report public. While Shein already works with auditors and a team dedicated to running a code of conduct compliance, Whinston’s role will include a more rigorous review of the 6,000 partner factories that Shein uses. We think that Shein must take big steps forward in its ethical practice and sustainable initiatives to build consumer confidence. We believe that, in addition to audits and appointing ESG officers, Shein should change fundamental aspects of how it operates, such as setting a living wage for workers in its suppliers’ factories. In January 2022, legislators in New York sent the Fashion Sustainability and Social Accountability Act to the Consumer Protection Committee for approval. The legislation, once enacted, would require fashion retailers that operate a business in New York with global revenues exceeding $100 million (a definition that Shein meets) to disclose detailed information about their social and environmental due diligence policies, including the sourcing of raw materials and factories’ working conditions. [caption id="attachment_144543" align="aligncenter" width="700"] Shein’s ESG initiatives

Shein’s ESG initiativesSource: Company website[/caption] 5. Save Costs and Time from Design to Production Through Real-Time Data-Driven Model Shein’s real-time fast-fashion model has helped the company to cut the timeframe from product design to manufacturing and shipping from three weeks to around five days. Ultra-fast-fashion companies, such as Boohoo, will find it very difficult to compete with this schedule. In fact, Boohoo’s fastest turnaround time from design to sale for some pieces of clothing is two weeks, while its standard time is four to six weeks. The real-time retail model is more realistic for pure-play retailers, which do not incur overhead costs related to maintaining store inventory. On the other hand, offline fast-fashion retailers, such as H&M and Zara, need to support the logistical costs of maintaining brick-and-mortar stores that are increasingly losing business to online retailers. Similar to Boohoo’s test-and-repeat model, Shein first produces small quantities of new designs for its online store and updates production orders based on real-time demand. However, while Boohoo and ASOS release around 500 and 1,500 new products per week, respectively, Shein adds an average of about 6,000 new items every day. This suggests that the cost of failure of trying different colors and fabrics is lower for Shein than for ASOS and Boohoo. When it comes to manufacturing in-demand styles quickly, Shein continues to benefit from China’s comprehensive clothing manufacturing and supply chain facilities. The company has collaborated with hundreds of contract manufacturers and over 6,000 small-to-midsized suppliers in Guangzhou, China, for the manufacturing of its clothing and footwear. Shein’s industrial cluster in Guangzhou is similar to Boohoo’s production headquarters in Leicester, UK—nearly 40% of Boohoo’s clothing is produced in Leicester, accounting for 75%–80% of the city’s garment output. Recent Developments Below, we outline some major recent developments at Shein.

Figure 7. Shein: A Timeline of Recent Developments [wpdatatable id=1853]

Source: Business of Fashion/Fashion.ie/Pandayoo/Stylus/Tech in Asia/TheIndustry.fashion

What We Think

Shein has grown remarkably in recent years, taking the fast-fashion market by storm. We believe that the company will continue to be a dominant player in the global fast-fashion market in the near future. The key tailwinds for Shein include its ultra-low-price offering amid the inflationary apparel environment; the pandemic-driven surge in online apparel shopping, coupled with structural shifts to e-commerce; substantial growth in the company’s online active user base; and opportunities to form partnerships with retailers and brands, and broaden collaborations with existing retail partners, including Amazon in India. We believe that Shein’s recent announcements to expand its independent beauty website SHEGLAM and the company’s high-end offering MOTF are the right steps in expanding its total addressable market. Moreover, the company’s planned opening of a global supply chain hub in Guangzhou will further expand its order fulfillment capabilities. On the other hand, the key headwinds include an investigation into recent allegations that employees’ conditions in the company’s China supplier factories are not socially responsible. While Shein has taken some visible steps recently, including rigorous audits of its factories, the appointment of Adam Whinston as Head of ESG and plans to publish new sustainability and social impact reports, the company still has a long way to go in terms of sustainable sourcing and ensuring fair wages and living working conditions for factory workers. With respect to competition from ultra-fast-fashion companies, including ASOS and Boohoo Group, Shein has a strong edge in terms of pricing, trendy and diversified clothing lines, data-driven demand forecasting, inventory management and personalization, production costs and social media operations. However, Shein is still not competitive in the delivery space—one of the major drivers of enhancing customer engagement. Although Shein has cut some time out of cross-country product delivery, it is way behind other online fast-fashion companies, including ASOS and Boohoo. Shein has temporarily put its US IPO plans on hold amid the Russia-Ukraine war and volatility in the capital market—as the company is likely avoiding the risk of IPO failure in uncertain markets, which could impact its reputation. However, considering Shein’s current strong financial position and recent shift of its base to Singapore, we believe that Shein’s IPO plan could be revived as soon as the volatility in the capital market subsides—maybe by the end of this year. Implications for Brands/Retailers- Instead of relying on one source of consumer data, retailers and brand owners should collect, sort and analyze a variety of data from several sources, such as through initial client profiling and subsequent interactions and feedback, to understand customer psychology well and offer them a unique experience.

- Automation at scale is key to sustainable personalization in fast-fashion retail. Retailers and brands should strategically decide various aspects of businesses that can be automated, such as inventory ordering or warehouse functions.

- Combining artificial intelligence with human judgment can help brand owners and retailers to upend the customers’ traditional retail clothing experience through effective personalization of offerings.

- Fast-fashion brands and retailers should continue to take proactive steps toward sustainability in order to win consumer trust and attract investors and employees in a dynamic retail landscape.