Executive Summary

This is the second report in our series on startups in China, continuing our coverage of other global ecosystems and startup hubs:

India,

Berlin,

London,

Paris and

Amsterdam. In our first report,

Shenzhen—An International Hub of Hardware Innovation, we discussed how Shenzhen became the world’s hardware mecca. This report will look at Shanghai and the value proposition it offers to startups and technology entrepreneurs.

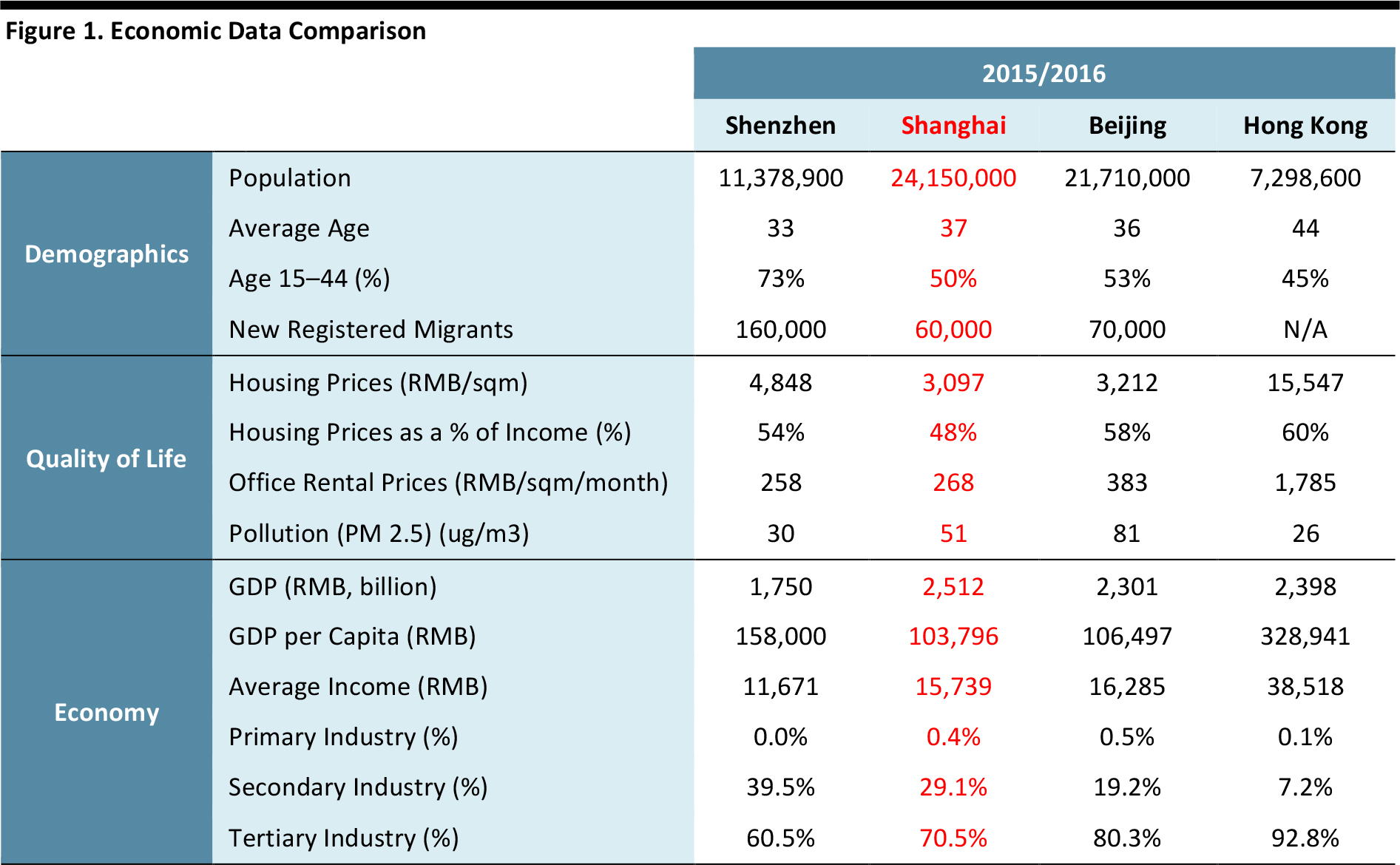

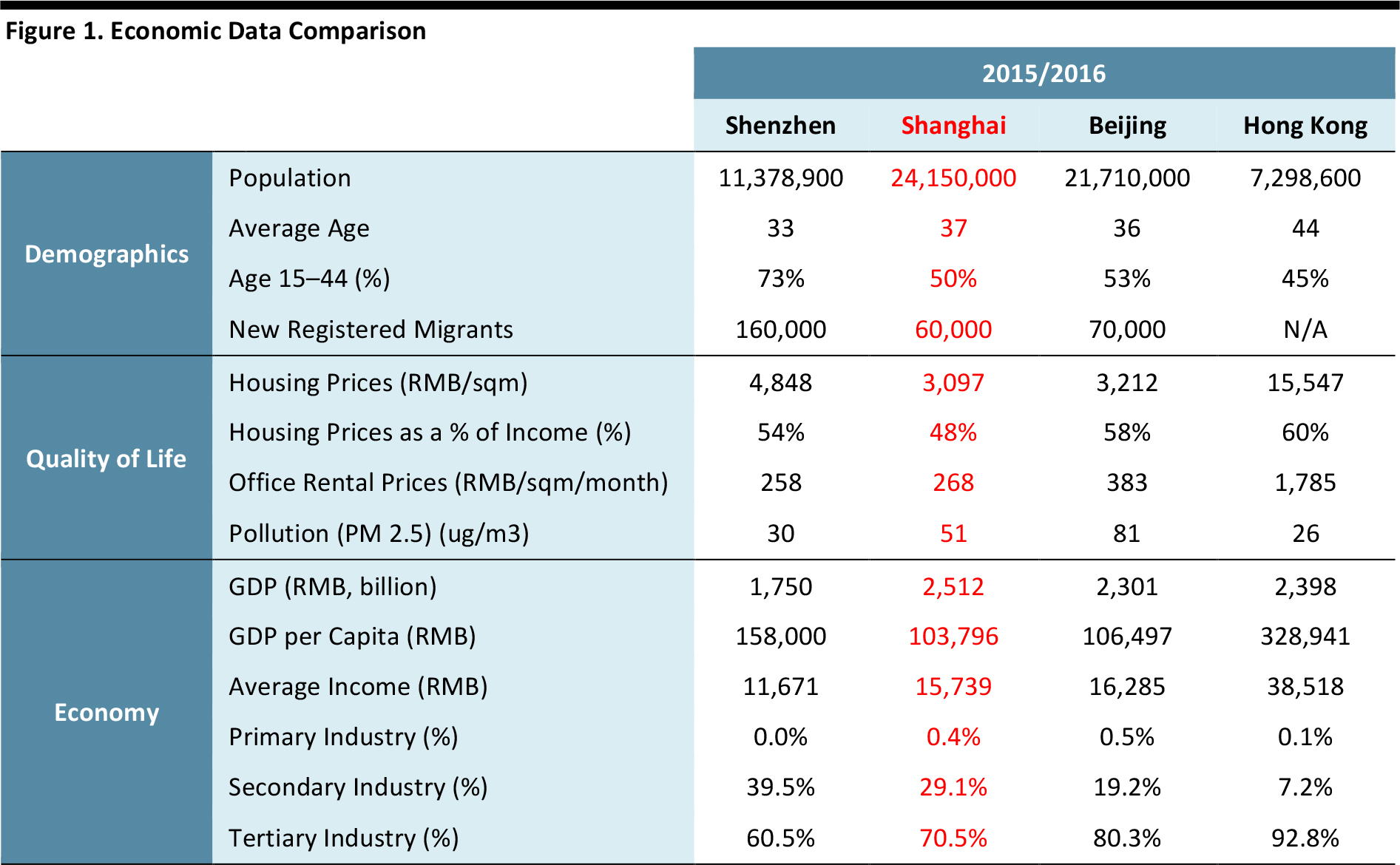

Shanghai, the largest city in China in terms of population, is well known as both a global financial center and a world-class shipping hub. We look at its potential as a startup hub by evaluating three characteristics: demographics, quality of life and economy.

- Demographics: Shanghai is the most-populated city in China, has a relatively young workforce and is home to several of the country’s top universities, which are a source of highly-skilled talent.

- Quality of life: Shanghai offers a cosmopolitan lifestyle comparable to global cities such as New York, London and Hong Kong. However,at the same time, it suffers from the environmental cost of its economic development, mostly evident in the high degree of air pollution. The city is also experiencing a buoyant housing market, which is starting to undermine its proposition as an affordable place to start a new venture.

- Economy: Shanghai is well known as both a global financial center and a logistics hub, and hosts a large consumer market by virtue of its 24-million inhabitants.

Similarly to Shenzhen, Shanghai’s government is also providing aid to boost innovation development and support startups. The various subsidy programs offered by the Shanghai government are available not only to startups, but also to VC firms and investors. One such program is a risk-compensation policy, which aims to cover as much as 60% of any actual losses due to the failure of seed investments.

In the third quarter of 2016, Shanghai ranked second among Chinese cities in terms of the total number of angel investments, according to data from PEdaily.cn, a media company that focuses on investment news, making Shanghai one of the leading cities in raising funds for startups in the country.

As a cosmopolitan city, Shanghai is one of the best places for a startup to grow in China—it is globally connected and boasts a and resourceful VC network. The ecosystem of startups in Shanghai appears to be more mature than in other cities in China, with the exception of Beijing.

Introduction

Since China’s economic reform in the late 1970s, Shanghai has become the most-populated and most-modern city in China, with an economy that has experienced annual growth in the high single-digit to double-digits. The city is lauded as the most open in China, connecting the country to the outside world, and has seized the opportunity to become a hub of professional services in finance, trade and logistics.

In May 2016, the Vice Mayor of Shanghai Zhou Bo said that more than 70,000 enterprises had been newly set up in the city, an increase of 20% year over year. The growing number of people deciding to start their own business could be attributed in part to Shanghai’s cosmopolitan nature. The city’s ability to attract foreign talent and major multinational corporations lies at the core of its path to innovation development. Because of its position as a portal into China and its potential as a startup

ecosystem, Shanghai has become a destination for many renowned VC firms such as Kleiner Perkins Caufield & Byers and Sequoia Capital.

Access to talent and funding are essential for any startup, and these are the building blocks of a successful startup ecosystem. In the following sections, we look into these and other factors that make Shanghai an attractive place to start a new business in China.

Shanghai by the Numbers

Source: Local City Statistical Bureaus/KPMG/Ernst & Young/NBS/CEIC/NDRC/IMF/Demographia/E-House

Demographics

Shanghai is the country’s most-populated city, with a population of 24 million people. The average age of the city’s population is 37, which is higher than Shenzhen, but still favorable from a technology entrepreneurship viewpoint. Shanghai is also home to two of China’s leading universities—Fudan University and Shanghai Jiao Tong University—which are ranked 40th and 62nd, respectively, in the global university rankings compiled by QS World in 2017.

Source: iStockphoto

Startup Talent

Fudan University:

Fudan University: The university has around 30,000 undergraduate and graduate students and has made a push to include entrepreneurship in its curriculum. It also established the Fudan University Student Entrepreneurship Centre, and provides student entrepreneurs with office space, equipment and mentorship. As of the end of 2016, the university had supported over 152 companies, with over ¥18.62 million in startup funding.

Shanghai Jiao Tong University:

Shanghai Jiao Tong University: In 2016, Shanghai Jiao Tong University launched a center to support entrepreneurship in collaboration with the Shanghai Human Resources and Social Security Bureau and the Bank of Shanghai, with the goal of providing theoretical and intellectual support to further innovation development in Shanghai.

Although these initiatives made by the universities are fairly recent, over time they should lead to increased awareness of the opportunities entrepreneurship provides as well as a more robust startup ecosystem.

Quality of Life

Affordable housing: Despite that Shanghai offers the most-affordable housing compared to the other three cities—Beijing, Shenzhen and Hong Kong—housing prices are rising fast. In January 2017, property prices marked a 40% year-over-year increase. Should living costs continue to rise, this could hurt Shanghai’s draw as an affordable place to set up business and potential to host early-stage ventures.

Pollution levels : Shanghai’s PM 2.5 index, a measurement of air quality, is high, at an alarming level of 51, which is a potential deterrent to attracting new talent.

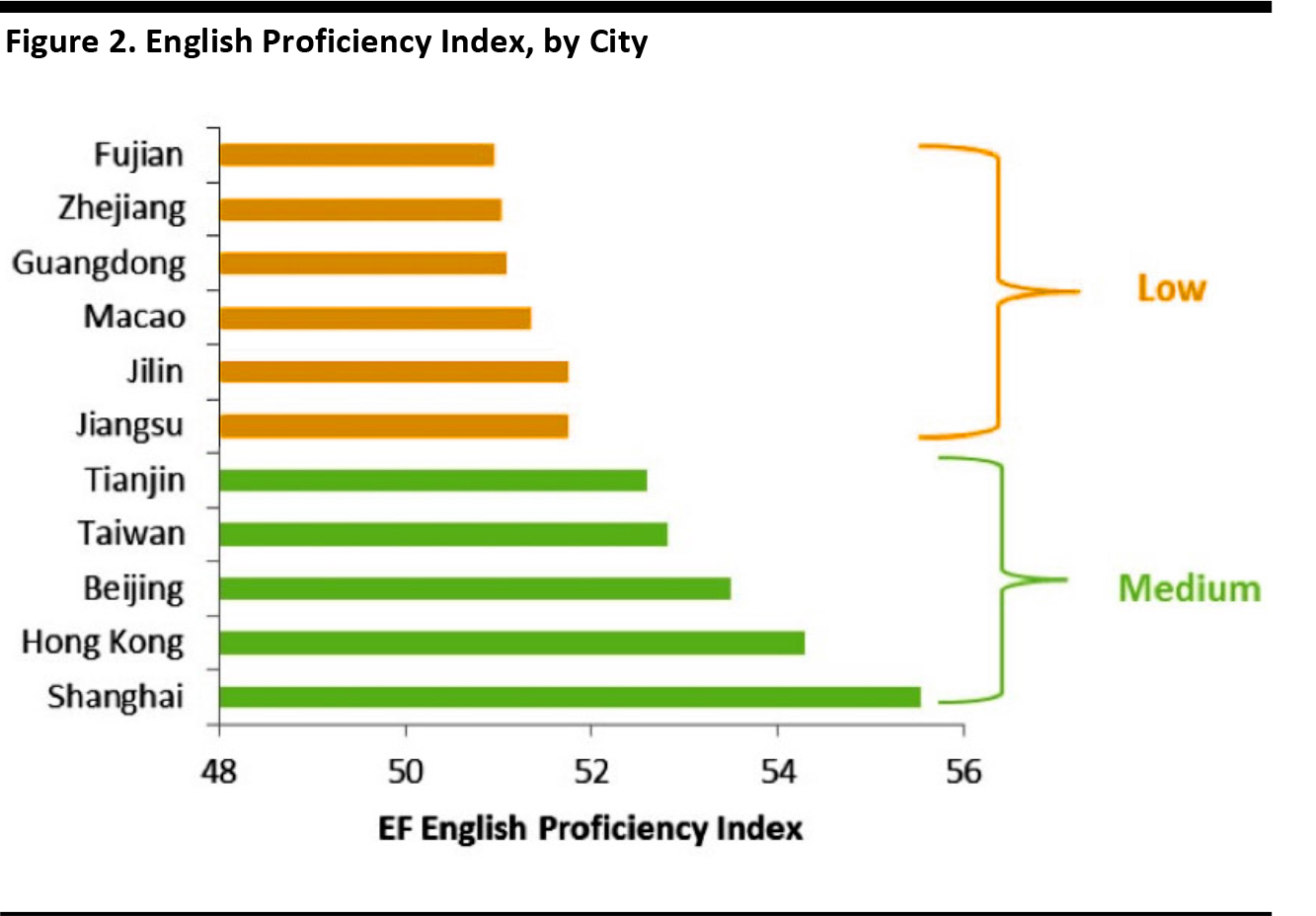

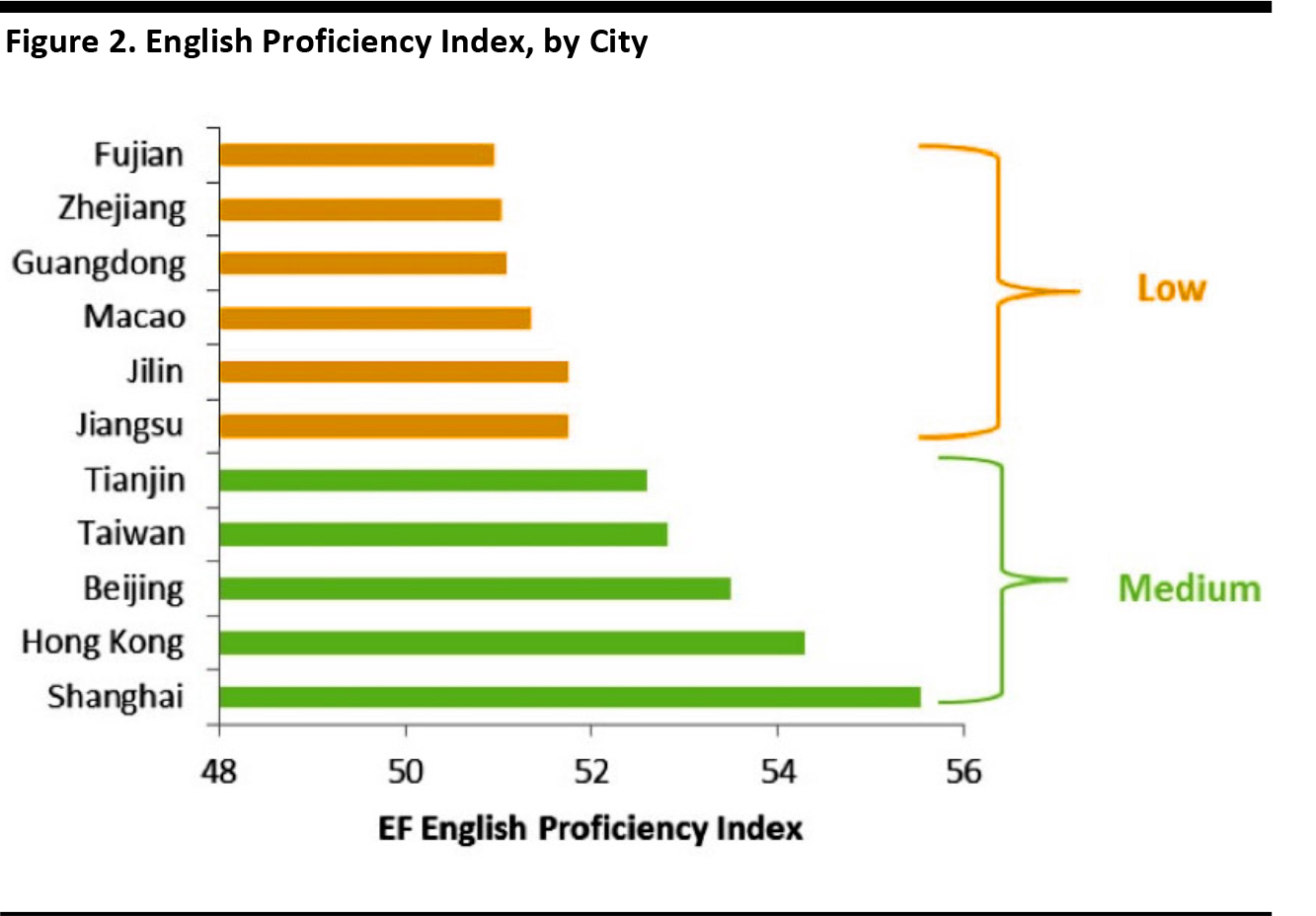

English proficiency: That being said, Shanghai is the most open and cosmopolitan city in China, due to its history and deep roots as an export hub. According to data from the EF English Proficiency Index, Shanghai ranked no.1 in English-language proficiency in China in 2017, even beating Hong Kong by a fine margin. Thanks to Shanghai’s global connectivity and openness, it has an advantage compared to other Chinese cities when it comes to attracting foreign talent.

Source: Education First/FGRT

Economy

Logistics hub: Shanghai is well known as both a global financial center and a logistics hub. Located in the Yangtze River Delta, it has the world’s busiest container port—37 million TEU was processed in 2016, according to data from the Shanghai International Port.

Financial hub: The city is also home to the biggest stock exchange in China, and has deep roots in banking and finance. It is also a large consumer market in its own right, and one that is expected to grow in affluence along with the projected growth of the Chinese middle class.

Budding entrepreneur ecosystem: More recently, Shanghai has become home to a growing entrepreneur ecosystem. According to the 2017 Startup Genome survey, 49% of founders of Shanghai companies reported having two or more years of prior experience as an employee in a startup, which is one of the highest rates globally.

The Startup Ecosystem in Shanghai

We evaluate Shanghai’s startup ecosystem by looking at: its network of accelerator and incubator programs, the funding climate, the track record of the startups that have emerged from the city and the availability of technology talent.

Accelerators and Incubators

For a detailed explanation of how we define accelerators and incubators, please refer to the appendix of this report.The incubator and accelerator network in Shanghai is relatively well developed, with a few international accelerators that bring global opportunities to local startups.

Chinaccelerator―A Shanghai-Based Startup Accelerator

Chinaccelerator―A Shanghai-Based Startup Accelerator

Chinaccelerator, a branch of SOSV—an early-stage startup investment firm with $300 million under management—was the first accelerator in Shanghai to focus on cross-border innovation—helping international startups enter China and Chinese companies expand internationally. Chinaccelerator picks a small number of promising startups twice a year.

The accelerator program includes an investment of $30,000 for approximately 6% of equity, and provides office space, training and mentorship support. In addition, startups can collaborate with a network of corporate partners through Chinaccelerator’s corporate innovation program.

Microsoft Accelerator―A Professional Network Provided by Microsoft

Microsoft Accelerator―A Professional Network Provided by Microsoft

Microsoft Accelerator provides startups with access to top Microsoft partners and customers, business connections and technical knowledge. The program has offices located in seven cities, including Seattle, London, Beijing and Shanghai. Some 647 companies worldwide have joined the accelerator program and generated an average of $5.2 million in follow-on funding.

Microsoft supports the tech startup community by offering technology enablement through programs such as BizSpark, which gives free access to Microsoft Azure cloud services, as well as funding through its Ventures Fund.

Plug and Play―A World-Leading Startup Accelerator

Plug and Play―A World-Leading Startup Accelerator

Plug and Play is a global innovation platform and startup accelerator with 22 offices across the world, including in Silicon Valley, Shanghai, Beijing and Shenzhen. Plug and Play runs 12 industry-specific accelerator programs twice a year, which act as a platform for major corporations and high-quality startups to connect and collaborate.

Plug and Play has helped market leaders such as PayPal, Danger, Google, DropBox, LendingClub, Zoosk, SoundHound, CreditSesame and Skytree, and has over 400 more early-stage startups in its portfolio.

Shanghai Valley―An Online and Offline Investment Platform

Shanghai Valley―An Online and Offline Investment Platform

Shanghai Valley is a China-focused accelerator that provides an online andoffline investment platform for institutional investors. Startups, as part ofthe platform, receive investment money from pre-screened institutional investors. Institutional investors, after investing, become local partners to provide resources and connections to help the startups grow. The online and offline platform also gives startups a secure way to communicate to build visibility and credibility with investors.

X-Node―An Accelerator with Multiple Co-Working Spaces in Shanghai

X-Node―An Accelerator with Multiple Co-Working Spaces in Shanghai

X-Node operates co-working spaces in multiple locations in Shanghai—JingAn, ZhangJiang, HongQiao and DongHu—all of which are located in core commercial areas. The company holds three to four events weekly,including lectures, networking sessions and focus workshops for small teams. X-Node also partners with 10 incubators and innovation programs from around the world, among which are Rocketspace and NUMA.

Success Stories and Notable Startups

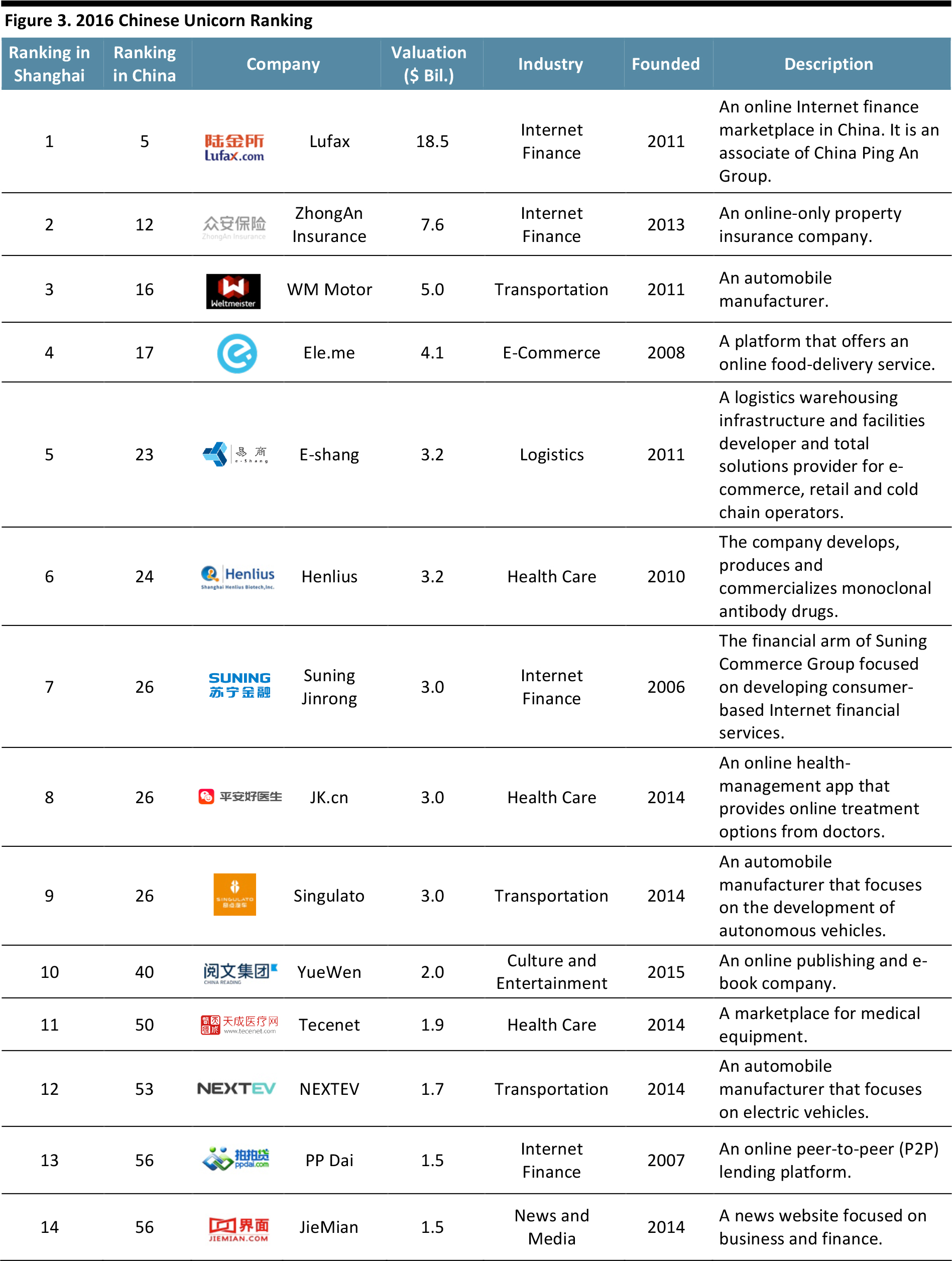

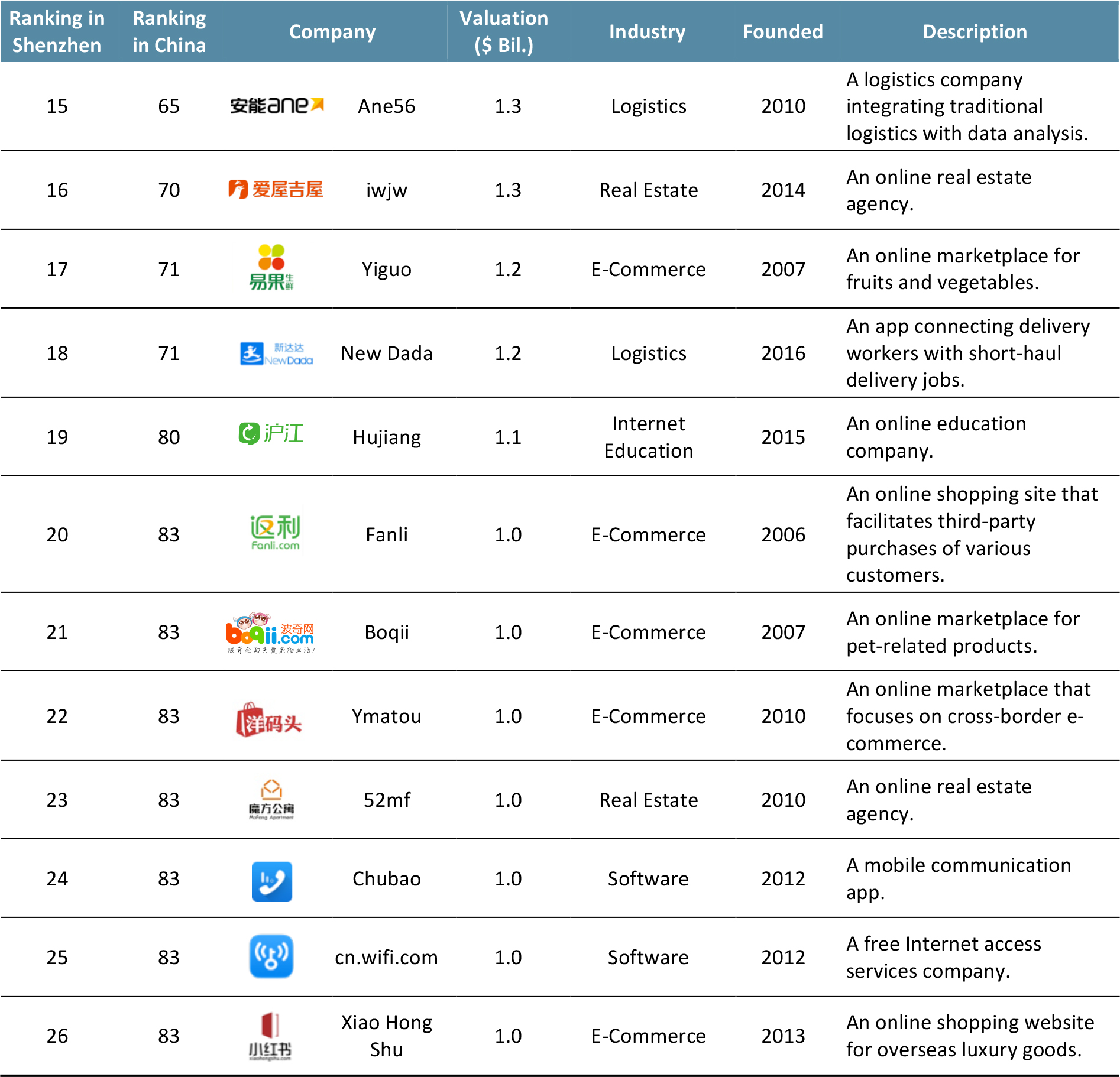

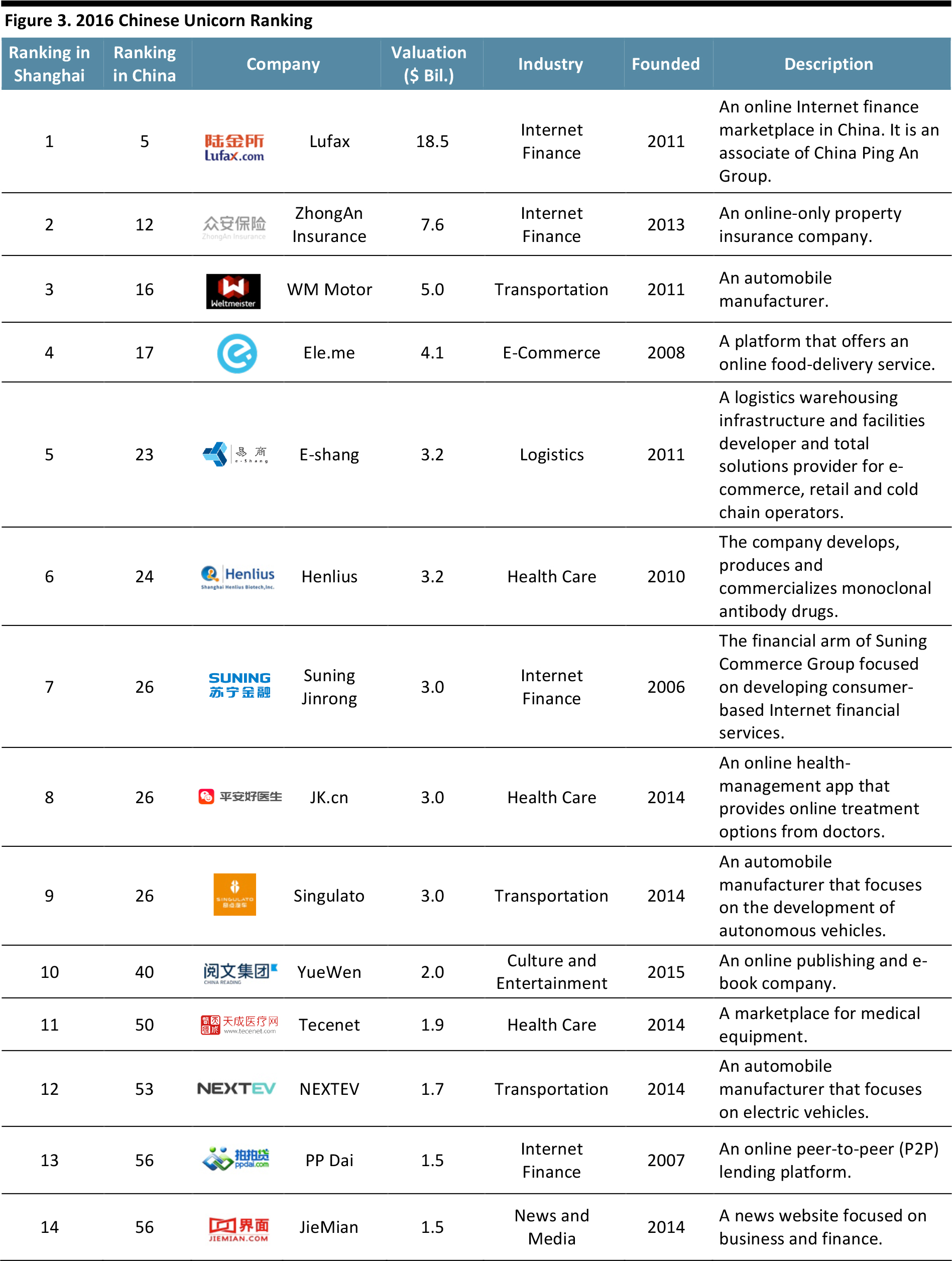

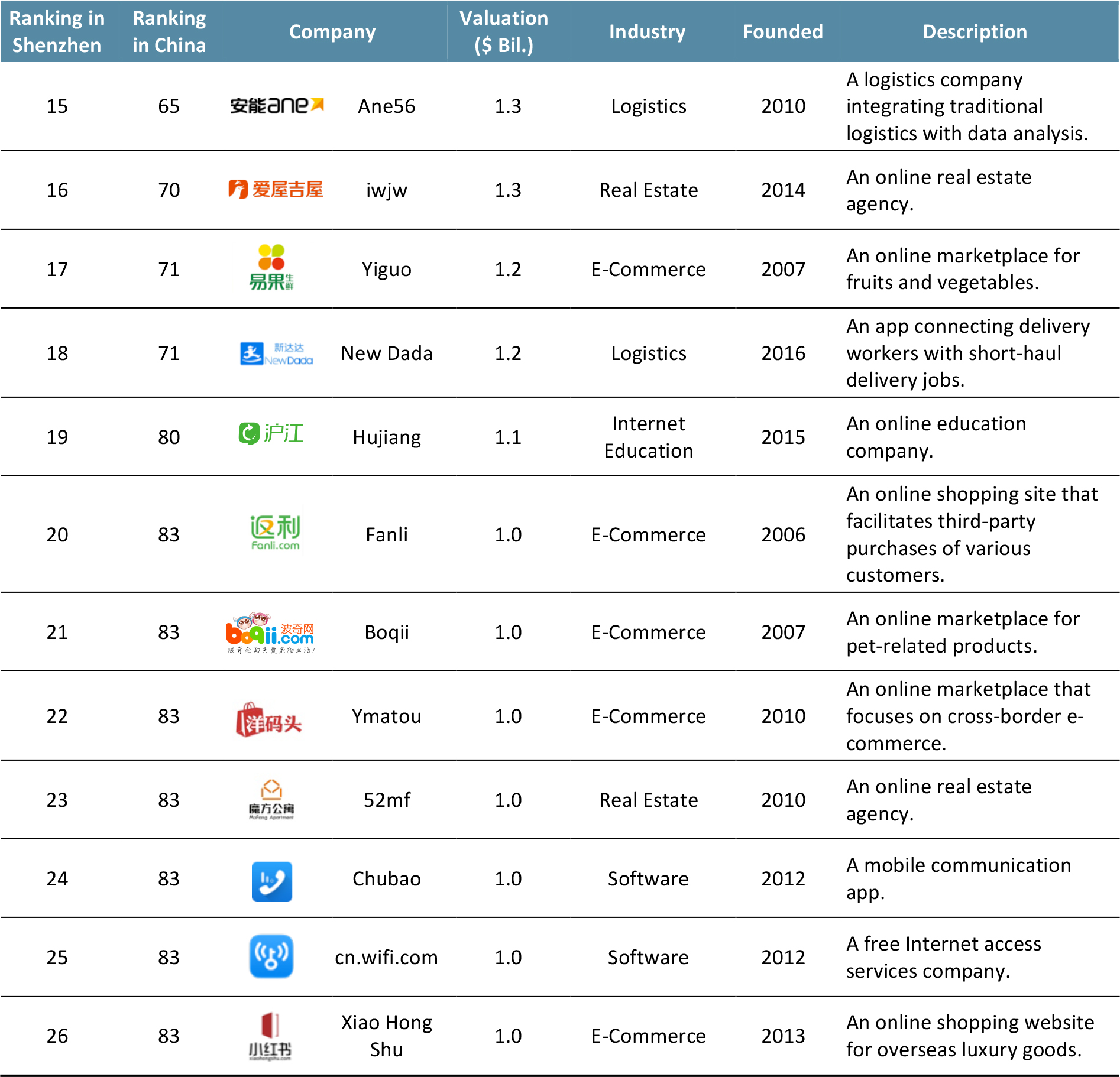

According to the report, “2016 Chinese ‘Unicorn’ Development,” there are 131 (87% year-over-year growth) Chinese companies that fit the definition of a “unicorn,” which means the businesses are:

- Registered in China

- Founded within the past 10 years (i.e., established in 2006 and later)

- Have obtained private investment, but have not yet publically listed

- Valued at more than $1 billion

Combined, these 131 companies are valued at over $487 billion, and of this, 26 are based in Shanghai with a total valuation of around $72 billion, which is higher compared to the similar metric in Shenzhen, but lower compared with Beijing.

Source: China Torch/Great Wall Enterprises’ Strategy Research Center

Unicorns Span Across Industries

The unicorns in Shanghai are in different industries, from e-commerce to online education. Lufax, backed by China Ping An Group, enjoys the highest valuation among its startup peers, partly due to Shanghai’s mature financial system. However, e-commerce is one of the hottest sectors in Shanghai, with six startups valued at over $1 billion.

Notable Retail-Related Startups

Fashory―Provides Fashion Insight by Combining Content and Online

Shopping

Fashory―Provides Fashion Insight by Combining Content and Online

Shopping

Fashory is a mobile app that merges the content element of magazine editorials with online shopping in order to provide relevant outfit suggestions. Users learn about their own preferences from the discovery process, and the browsing data is used to make personalized

recommendations to users.

Shopal―An E-Commerce Platform for Offline Retailers

Shopal―An E-Commerce Platform for Offline Retailers

Shopal is a mobile app solution for offline retailers. The e-commerce platform allows offline stores to connect and communicate with customers. Through the data from store owners, Shopal can provide customer segmentation, sales forecasts and big data analysis.

The Squirrelz―Finds Free Design Materials Nearby

The Squirrelz―Finds Free Design Materials Nearby

The Squirrelz operates two platforms—theSquirrelz.com,’ which is a business-to-consumer (B2C) platform on which designers sell products made from reusable factory materials, and ‘2Stash.com,’ a business-tobusiness (B2B) platform that connects designers and brands with factories that possess unwanted or unusable fabric—providing creatives with the materials they need to create new products.

TrustLuxeA Luxury Online Retailer

TrustLuxeA Luxury Online Retailer

Trustluxe offers niche luxury brands, such as Bea Valdes, Shaun Leane and Roy Lichtenstein, to Chinese consumers. The company collaborates with brands, designers, artists, galleries and craftsmen from all over the world to sell their creations online and offline to China.

Government Programs for Startups

The various government subsidy programs usually cover different aspects of funding needs. The scope of coverage can range from small amounts, for say training subsidies, to large amounts for loans. The programs offered by the Shanghai government cover not only startups, but also include VC firms and investors.

Government Subsidy Programs

The Shanghai government offers various subsidy programs in different districts. For example, the following programs are available in Pudong:

- Company registration subsidy: ¥2,000–¥30,000

- Entrepreneurship loan: ¥200,000–¥3,000,000

- Rental assistance program: the maximum allowance is ¥4,500 per person per year

- Social insurance subsidy: the maximum allowance is ¥100,000 per year

- Service business one-off subsidy: ¥3,000–¥5,000

- Innovative solution one-off subsidy: ¥5,000–¥10,000

- Training subsidy: a maximum of ¥3,000 per person

Risk-Compensation Policy

In February 2016, The Science and Technology Commission of Shanghai Municipality, together with the city’s Development and Reform Commission and Finance Bureau announced a risk-compensation policy for angel investors called “Provisional Measures on Managing Shanghai Angel Investor Risk Compensation.” The policy aims to compensate for as much as 60% of any actual losses due to the failure of seed investments in technology startups in Shanghai. The new policy covers up to ¥3 million for

each unsuccessful investment case, with a limit of ¥6 million per investment firm per year. For early-stage investment losses, the compensation is limited to 30% of total losses, which is effective for then first two years. Funding from Venture Capital Firms and Enterprises In the third quarter of 2016, Shanghai ranked no.2 among Chinese cities in terms of the total number of angel investments, according to data from PEdaily.cn, a media company that focuses on investment news. In the same quarter, the total amount of angel investments in Shanghai reached ¥369 million, which accounted for 11% of total angel investments in China. In fact, Shanghai is one of the leading cities in raising funds for startups. We highlight two leading VC firms below:

Funding from Venture Capital Firms and Enterprises

In the third quarter of 2016, Shanghai ranked no.2 among Chinese cities in terms of the total number of angel investments, according to data from PEdaily.cn, a media company that focuses on investment news. In the same quarter, the total amount of angel investments in Shanghai reached ¥369 million, which accounted for 11% of total angel investments in China. In fact, Shanghai is one of the leading cities in raising funds for startups. We highlight two leading VC firms below:

Kleiner Perkins Caufield & Byers

Kleiner Perkins Caufield & Byers

Kleiner Perkins Caufield & Byers is one of the top American VC firms specializing in incubation, and early-stage and growth-companies investment. With 45 years of experience in investment, the firm has already backed over 850 companies, among which are industry leaders,including Amazon, Electronic Arts, JD.com, Google and Twitter.Kleiner Perkins Caufield & Byers mainly focuses its investments in practical areas including technology and life sciences. The company has offices in Menlo Park, San Francisco and Shanghai.

Northern Light Venture Capital

Northern Light Venture Capital

Northern Light Venture Capital is a China-focused VC firm targeting earlystage opportunities of innovation and disruptive technology. The firm manages $1.7 billion and has backed over 180 companies. Northern Light focuses on three main sectors: technology, media and telecom (e.g.,intelligent solutions, enterprise solutions), advanced technology (artificial intelligence [AI], robotics, cleantech, new materials) and healthcare (e.g., e-health, in-vitro therapeutics). Some of the successful exits include Spreadtrum, one of the leading chipset makers in China, and meituan.com, a Chinese group-buying website.

The firm has six offices around the world, located in Beijing, Shanghai, Jiangsu, Shenzhen, Hong Kong and San Jose.

Conclusion

Being a cosmopolitan city, Shanghai is one of the best places for startups to grow in China—the city is globally connected and boasts a resourceful VC network. The ecosystem of startups in Shanghai appears to be more mature and diversified than in other cities in the country, with successful unicorns spanning across various industries. As such, we believe Shanghai will continue to emerge as an innovative startup hub in China. Appendix: The Role of Accelerators and Incubators Startup accelerators and incubators assist entrepreneurs as they lead their young companies toward success, but the two differ in terms of what they provide and for how long.

Appendix: The Role of Accelerators and Incubators

Startup accelerators and incubators assist entrepreneurs as they lead their young companies toward success, but the two differ in terms of what they provide and for how long.

Accelerators

These boot-camp-style programs are typically designed to guide a startup from concept to prototype, or from prototype to market. The most distinct difference between accelerators and incubators is the time frame of each.

An accelerator works with startups for a short and specific amount of time, usually ranging from 90 days to four months. Accelerators also offer startups a specific amount of capital, normally about US$20,000. In exchange for capital and guidance, accelerators typically acquire between 3% and 8% of the participating startup. These features make accelerators much more structured than incubators.

The accelerator journey is not an all-inclusive road to success. Rather, it is meant to help startups get to the point where they are ready to raise larger amounts of capital. The goal of accelerators is to grow the size and value of a company as fast as possible in preparation for an initial round of funding. This closely aligns with the equity that accelerators require in exchange for their guidance and resources.

Incubators

With mentorship periods often lasting more than a year and a half, incubators focus less on quick growth, and most have no specific goal in mind for the participating startup other than it become successful at the right pace. In fact, the goal of some incubators may be to prepare budding startups for an accelerator program. Incubators take little to no equity in the startups they work with, and can afford to do so because they do not provide upfront capital like accelerators do. Many incubators are funded by grants through universities and government entities, allowing them to provide their services without taking a cut of the company.

Getting into an incubator is often highly competitive, as many entrepreneurs are attracted by the opportunity to keep control of their startup and by the absence of the 90-day time limit that accelerators typically impose. It may also be difficult for a startup to be accepted by an incubator if the two organizations’ networks are not connected in some way, as many incubators accept pitches only from entrepreneurs with whom they already have a relationship.

Why Are Accelerators and Incubators Important for Startups?

Accelerators and incubators are key players in the startup ecosystem in technology hubs around the world. The advice and guidance of mentors can help startups avoid mistakes that could cripple them if they were trying to succeed on their own. Both options also provide access to capital that may otherwise be unavailable, whether during or after mentorship. Additionally, both accelerators and incubators provide the physical space startups need in order to develop their ideas, along with training and guidance. Lastly, being a part of an accelerator or incubator can provide young companies’ founders with an invaluable network and boost their exposure.

What Do Accelerators and Incubators Look for in a Startup?

A Sound Business Foundation

A startup’s business idea should be supported by meaningful answers to the following questions. What is the business model? What is the size of the market the company will be competing in? Who are the competitors? What advantages are there over the competition? What are the risks for the business and what are ways they can be mitigated? Although a lot oftimes, there are no right or wrong answers to these questions, the ability to address them shows to investors that the entrepreneur has a solid understanding of the business his company will be competing in.

The People

Investors want to work with people who they trust and can rely on. They also want a team whose personalities click. Ideally, the team would have a proven track record of building businesses and delivering results. Lastly, investors look for people with integrity and passion, who are determined to succeed.

Scalability

The startup needs to be able to grow its business to a substantial size over a relatively short period of time. Investors make money when they exit their investments and, naturally, they would like to exit at the biggest valuation possible. This is why the potential to scale the business is of huge importance to venture investors, and therefore, accelerators and

incubators.

Execution

In general, investors think that an idea alone has little value. It is all about the execution of the business plan, and investors invest in the people who can execute, or even better, have a history of successful execution. Execution is making things happen, and for startups, this usually means making change happen, which is even more difficult.

Chinaccelerator―A Shanghai-Based Startup Accelerator

Chinaccelerator, a branch of SOSV—an early-stage startup investment firm with $300 million under management—was the first accelerator in Shanghai to focus on cross-border innovation—helping international startups enter China and Chinese companies expand internationally. Chinaccelerator picks a small number of promising startups twice a year.

The accelerator program includes an investment of $30,000 for approximately 6% of equity, and provides office space, training and mentorship support. In addition, startups can collaborate with a network of corporate partners through Chinaccelerator’s corporate innovation program.

Chinaccelerator―A Shanghai-Based Startup Accelerator

Chinaccelerator, a branch of SOSV—an early-stage startup investment firm with $300 million under management—was the first accelerator in Shanghai to focus on cross-border innovation—helping international startups enter China and Chinese companies expand internationally. Chinaccelerator picks a small number of promising startups twice a year.

The accelerator program includes an investment of $30,000 for approximately 6% of equity, and provides office space, training and mentorship support. In addition, startups can collaborate with a network of corporate partners through Chinaccelerator’s corporate innovation program.

Fashory―Provides Fashion Insight by Combining Content and Online

Shopping

Fashory is a mobile app that merges the content element of magazine editorials with online shopping in order to provide relevant outfit suggestions. Users learn about their own preferences from the discovery process, and the browsing data is used to make personalized

recommendations to users.

Fashory―Provides Fashion Insight by Combining Content and Online

Shopping

Fashory is a mobile app that merges the content element of magazine editorials with online shopping in order to provide relevant outfit suggestions. Users learn about their own preferences from the discovery process, and the browsing data is used to make personalized

recommendations to users.

Shopal―An E-Commerce Platform for Offline Retailers

Shopal is a mobile app solution for offline retailers. The e-commerce platform allows offline stores to connect and communicate with customers. Through the data from store owners, Shopal can provide customer segmentation, sales forecasts and big data analysis.

Shopal―An E-Commerce Platform for Offline Retailers

Shopal is a mobile app solution for offline retailers. The e-commerce platform allows offline stores to connect and communicate with customers. Through the data from store owners, Shopal can provide customer segmentation, sales forecasts and big data analysis.