Nitheesh NH

UK Retail Sales: September 2021

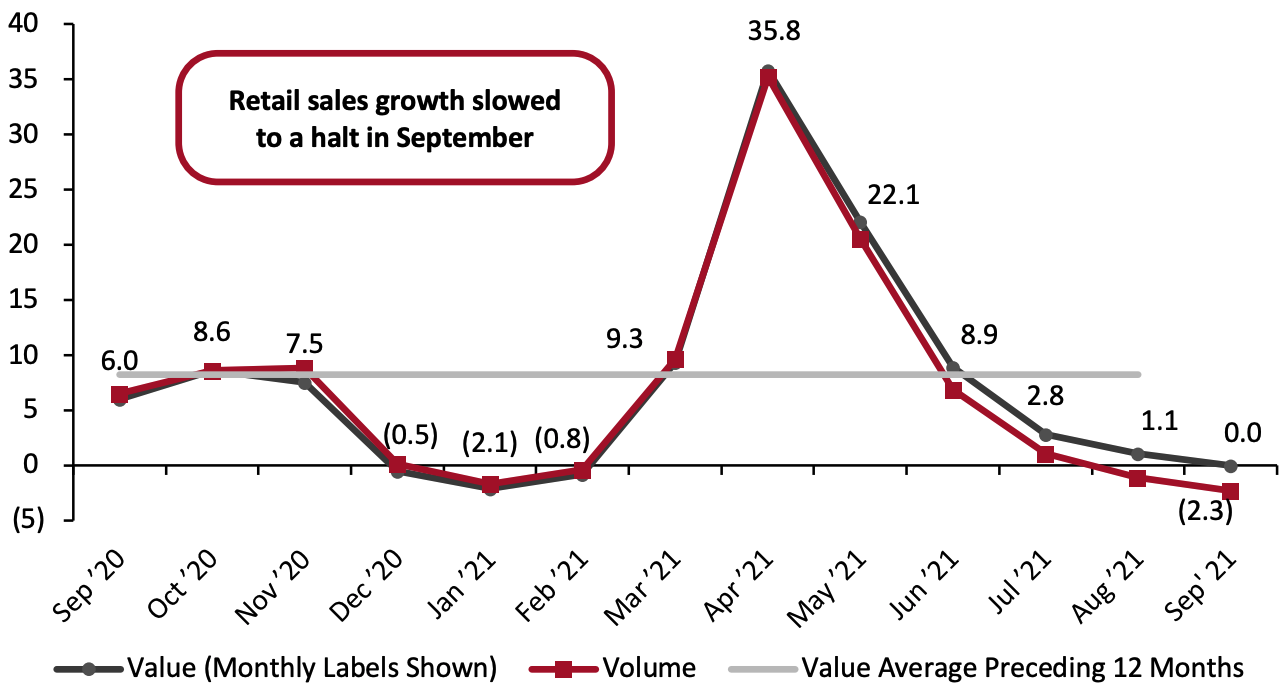

In September, total UK retail sales continued the downward trend for the fifth consecutive month, with flat year-over-year growth, according to data from the Office for National Statistics (ONS). The sustained growth slowdown may be partly attributed to a mellowing of pent-up demand combined with increasing infection rates of Covid-19 Delta cases, which are likely impacting consumer spending and visits to stores. Total growth was impacted by a reported decline in small retailers’ sales. Large retailers, which account for the bulk of retail sales, saw only modest gains of 2.0% year over year, a further deceleration from 3.0% in August. We expect the spell of deceleration in total retail sales growth to continue until November, as we cycle through demanding comparatives from last year.Figure 1. Total UK Retail Sales (ex. Automotive Fuel and Unadjusted): YoY % Change [caption id="attachment_134876" align="aligncenter" width="700"]

Data in this report are not seasonally adjusted

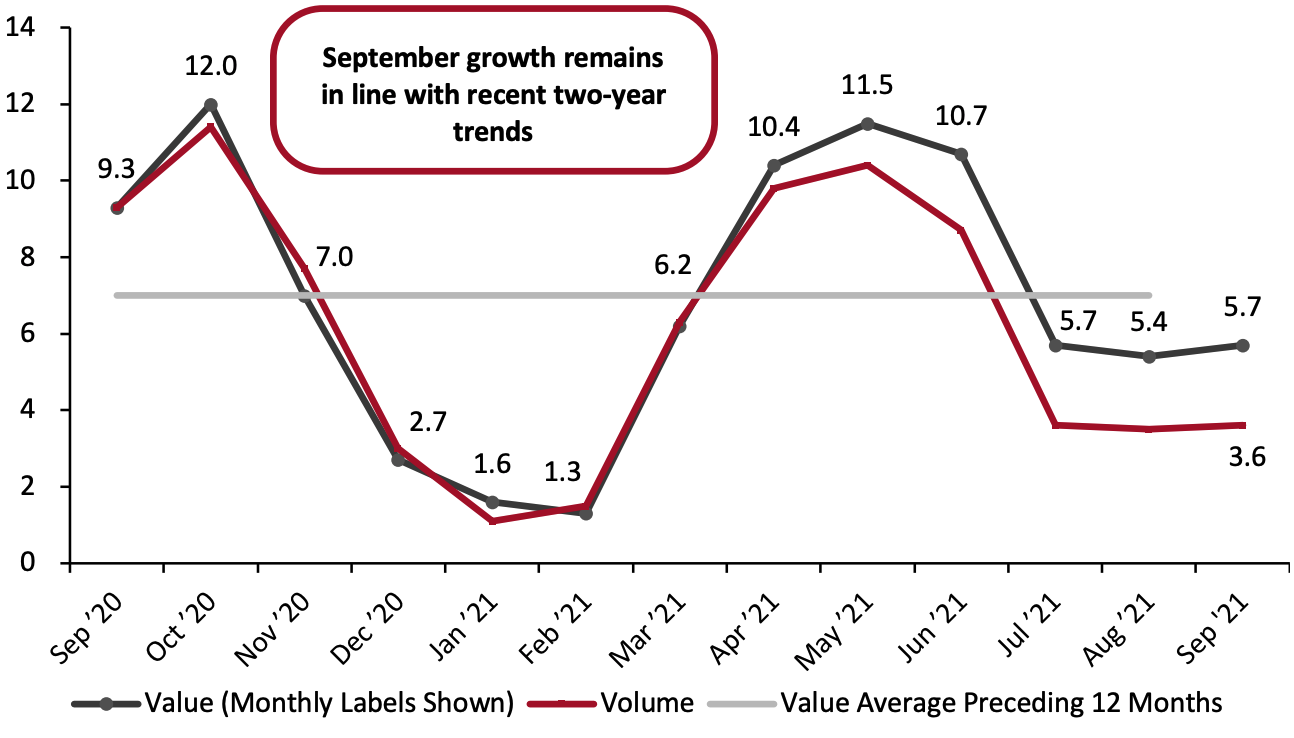

Data in this report are not seasonally adjustedSource: ONS/Coresight Research[/caption] Against the more consistent comparatives of 2019, September retail sales growth stayed in line with July and August, at 5.7% on a two-year basis.

Figure 2. Total UK Retail Sales (ex. Automotive Fuel and Unadjusted): % Change from Two Years Prior [caption id="attachment_134877" align="aligncenter" width="700"]

Data in this report are not seasonally adjusted

Data in this report are not seasonally adjustedSource: ONS/Coresight Research[/caption] Retail Sales Growth by Sector The lockdown measures imposed last year had a major detrimental impact on retail sales, causing certain sectors to see dramatic sales declines and skewing year-over-year growth numbers. To control for the effects of the pandemic in 2020’s retail sales figures, we largely compare September 2021 sales to pre-pandemic September 2019 sales in this section. Grocery retail store sales growth picked up from an August slowdown and rose above July’s growth two-year growth. Grocery sales increased by 4.4% on a two-year basis in September—reflecting the continued fluctuations in food spending to and from food at home and on-premise dining. ONS’ OpenTable data showed a decrease in online restaurant reservations in September compared to August. DIY and hardware retail sales remain strong, growing 23.5% on a two-year basis in September, after an also strong 26.2% increase in August. Furniture and lighting stores did not perform as well, with a sales decline of 2.7% compared to 2019. Declines in clothing sales have slowed for the past few months, indicating that we could see sales numbers recover to 2019 levels by the end of 2021. Clothing sales declined by 4.6% on a two-year basis on September, an improvement from the 8.1% decline in August. Footwear sales finally recovered to surpass 2019 values for the first time this year, with 0.8% two-year growth in September. Department stores—a sector particularly challenged by the pandemic—saw sales declines soften in September on a two-year basis, down by 2.9% after a 5.3% decrease in August. Sales growth in the health and beauty sector saw a large uptick in September, growing by 18.3% on a two-year basis, up from the 6.6% two-year growth posted in August.

Figure 3. UK Retail Sales, by Sector: YoY % Change [wpdatatable id=1372] [wpdatatable id=1373]

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers **A relatively fragmented sector, in which reported figures have traditionally been volatile Source: ONS

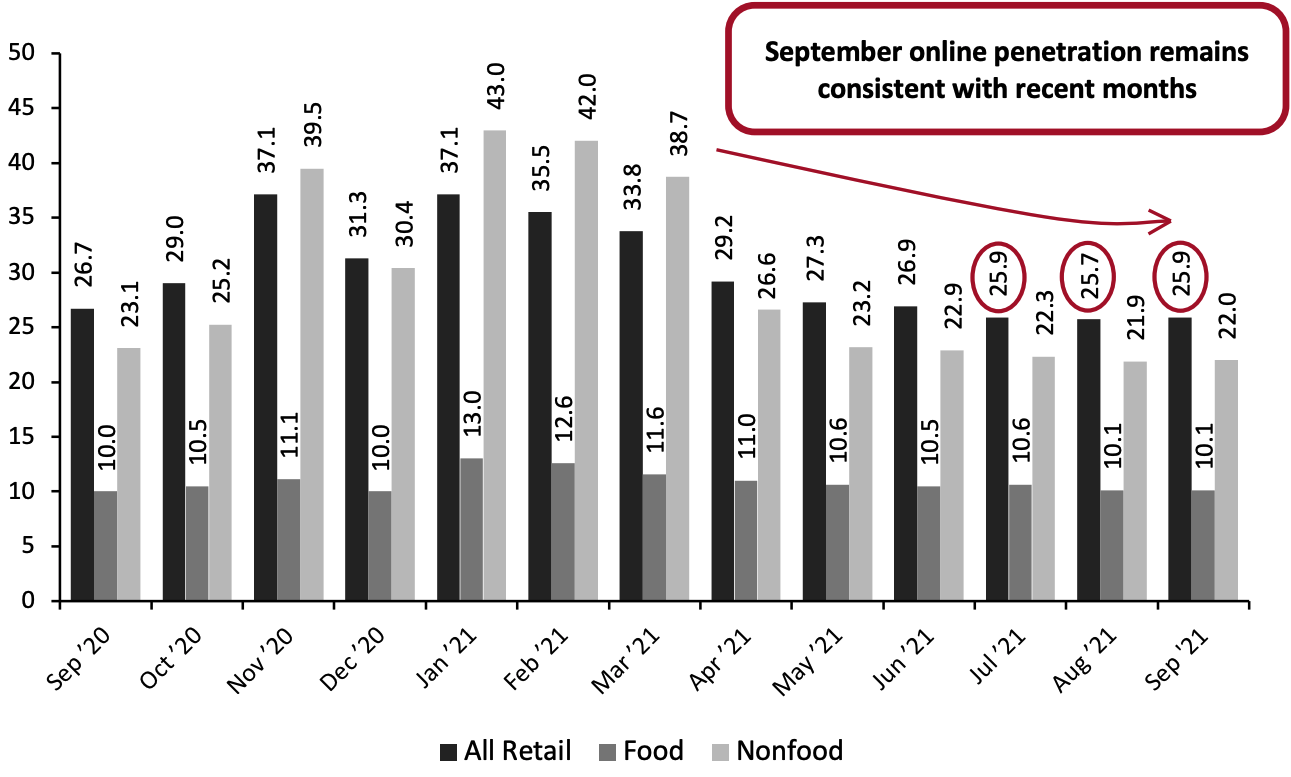

Online Retail Sales Growth Continues To Slow Total online sales growth declined by 2.9% year over year in September, following a 3.7% decrease in August. Food retailers’ e-commerce sales increased by 1.4% in September, following a flat August. Nonfood retailers’ sales saw negative growth accelerate in September, falling by 3.3% in September from the 2.3% decline in August. Apparel retailers’ online sales saw respectable year-over-year growth of 5.3% in September. As shown in the figure below, e-commerce penetration (online sales as a percentage of overall retail) in September exhibited a slight uptick, rising to 25.9% from August’s 25.7% revised figure.Figure 4. Online Retail Sales as % of Total Retail Sales [caption id="attachment_134878" align="aligncenter" width="700"]

“Food” and “Nonfood” data are for store-based sectors; “All Retail” total includes nonstore retail, which is not charted

“Food” and “Nonfood” data are for store-based sectors; “All Retail” total includes nonstore retail, which is not chartedSource: ONS[/caption] Covid-19 Lockdown Timeline Lockdown 1: The UK was put into lockdown on March 23, 2020, initially for three weeks, in an attempt to limit the spread of the coronavirus. Nonessential retail stores were closed. On April 16, the government extended the lockdown by another three weeks. On May 11, Prime Minister Boris Johnson announced that the government would begin easing restrictions in a phased manner, allowing nonessential stores to reopen from the start of June. However, garden centers were allowed to reopen from May 13 and furniture stores from May 23. On May 26, the government announced that all nonessential retailers in England and Northern Ireland—including department stores and small independent shops—would be allowed to reopen from June 15, but stores would need to implement measures to meet the necessary social distancing and hygiene standards. On June 23, Johnson announced that restaurants, pubs, museums, cinemas and hotels could reopen on July 4. On September 14, a new “rule of six” prohibited social gatherings of more than six people, unless they are from the same household. On September 22, Johnson outlined a slew of new restrictions in the wake of a fresh spike in the number of infections. These included the closing of bars, pubs and other hospitality services by 10:00 p.m., effective September 24. On October 7, the Scottish government implemented tighter restrictions, largely on the hospitality industry. Retail was not directly affected, although stores were requested to enforce two-meter distancing. On October 12, the UK government announced a three-tier lockdown system, which classifies regions based on the severity of infection rates. In the week beginning October 19, a number of regions in England, including London and Manchester, moved into higher “tiers” of control, which include restrictions on households mixing and, in some cases, some service industries; however, these did not change the direct rules for retailers. On October 23, a 17-day lockdown began in Wales, with nonessential retailers being forced to close once more. Lockdown 2: On October 31, Prime Minister Johnson announced a second lockdown for England for the period November 5 to December 2. All nonessential retail was forced to close, “including, but not limited to, clothing and electronics stores, vehicle showrooms, travel agents, betting shops, auction houses, tailors, car washes and tobacco and vape shops.” Food shops, supermarkets, garden centers and certain other retailers providing essential goods and services could remain open. Nonessential retail could remain open for delivery to customers and click- and-collect. Hospitality venues such as restaurants, bars and pubs were forced to close but could still provide takeaway and delivery services. Also forced to close were entertainment venues, indoor and outdoor leisure facilities, and personal care services. Following the lockdown, UK regions were placed into different tiers, each of which had different restrictions. On December 8, the UK’s National Health Service started vaccinations, with the aim of vaccinating the most vulnerable groups of people by February 15, 2021. On December 21, the UK government scrapped a planned easing of rules on the mixing of households over the Christmas period. In England and Scotland, households in many areas were banned from mixing; in some areas, households could mix on Christmas Day only. The devolved Welsh and Northern Irish administrations implemented their own restrictions. Lockdown 3: On January 4, 2021, Johnson announced a lockdown in England, effective January 5 and with an unspecified end date but with laws formally expiring on March 31. Scotland, Wales and Northern Ireland also implemented lockdowns. On January 19, Scotland’s First Minister Nicola Sturgeon announced that that country’s lockdown would be extended until at least the middle of February. On January 27, the government announced that travelers arriving from “red list” countries must quarantine in hotels specified by the government. On February 22, the government laid out a roadmap to ending lockdowns in England. Restrictions will start to be eased from March 29, nonessential retail stores and services such as hairdressers will be allowed to reopen from April 12, and final restrictions will be ended on June 21. On March 25, the UK lowered the Covid-19 risk level from four to three on a scale of five. On April 12, the government eased raft of restrictions across England, with gyms, zoos, theme parks, pubs and restaurants allowed to reopen for outdoor service and shops and hairdressers again permitted to serve customers. On April 20, Sturgeon announced that Scotland will move to Covid protection Level 3 from Level 4 on April 26, meaning hospitality venues such as cafés, pubs and restaurants and beauty salons can reopen. On May 17, England eased restrictions further with groups of up to six people from different households allowed to socialize indoors, pubs and restaurants can serve indoors and entertainment venues such as museums, cinemas, and theatres can reopen. On June 14, England delayed the final stage of easing lockdown restrictions by month, until July 19, due to the increase in cases of the more transmissible Delta variant. After more than a year under some form of restriction, England lifted almost all remaining Covid-19 rules on July 19, 2021. This included the opening of nightclubs and lifting capacity restrictions on big events and performances.