Nitheesh NH

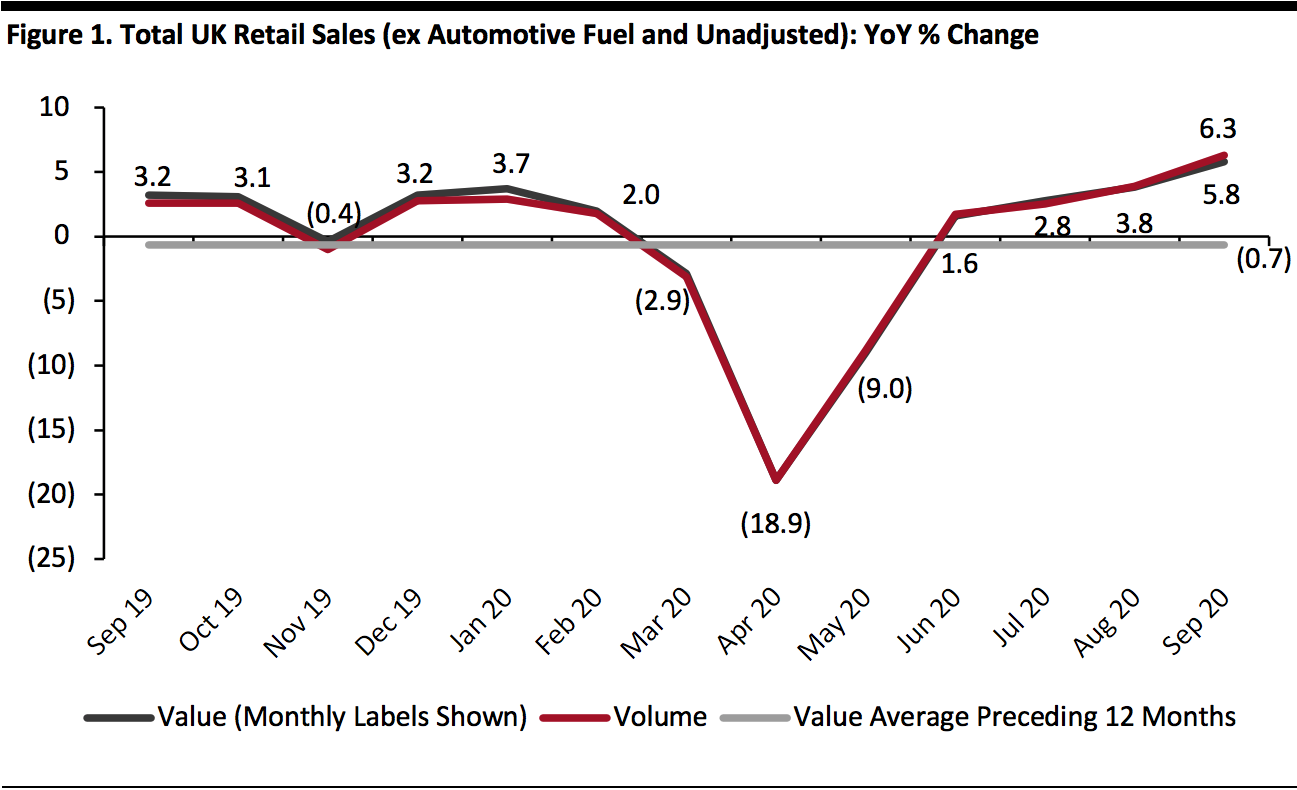

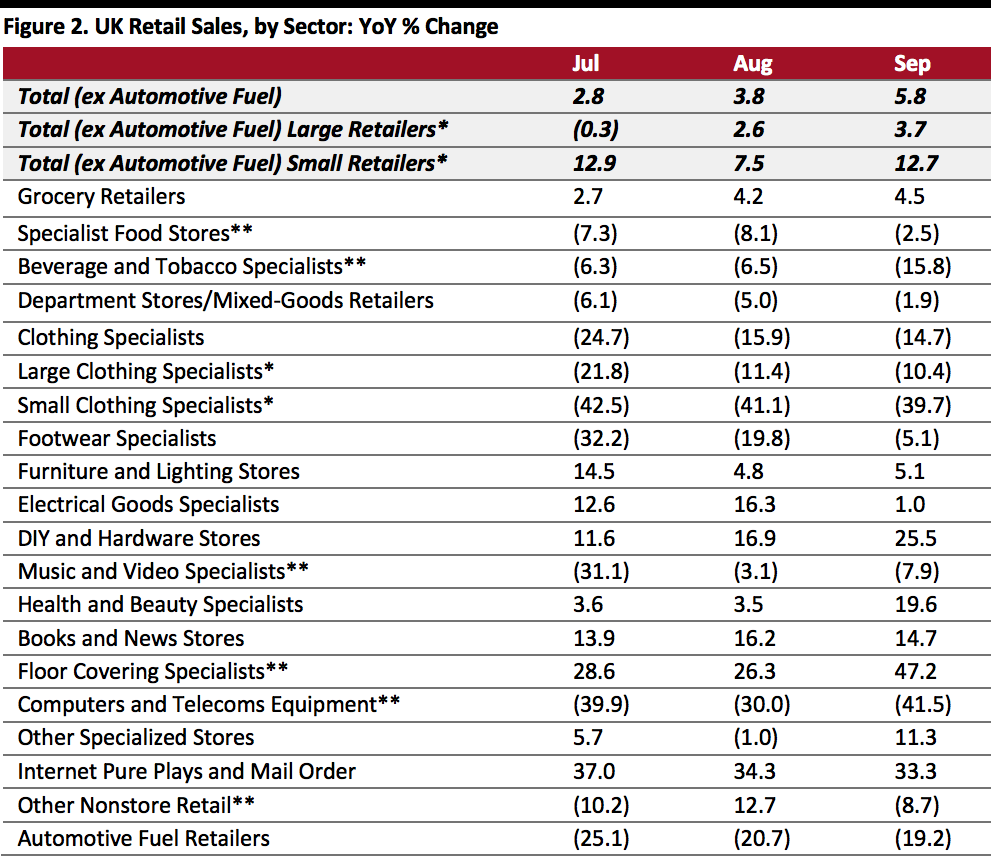

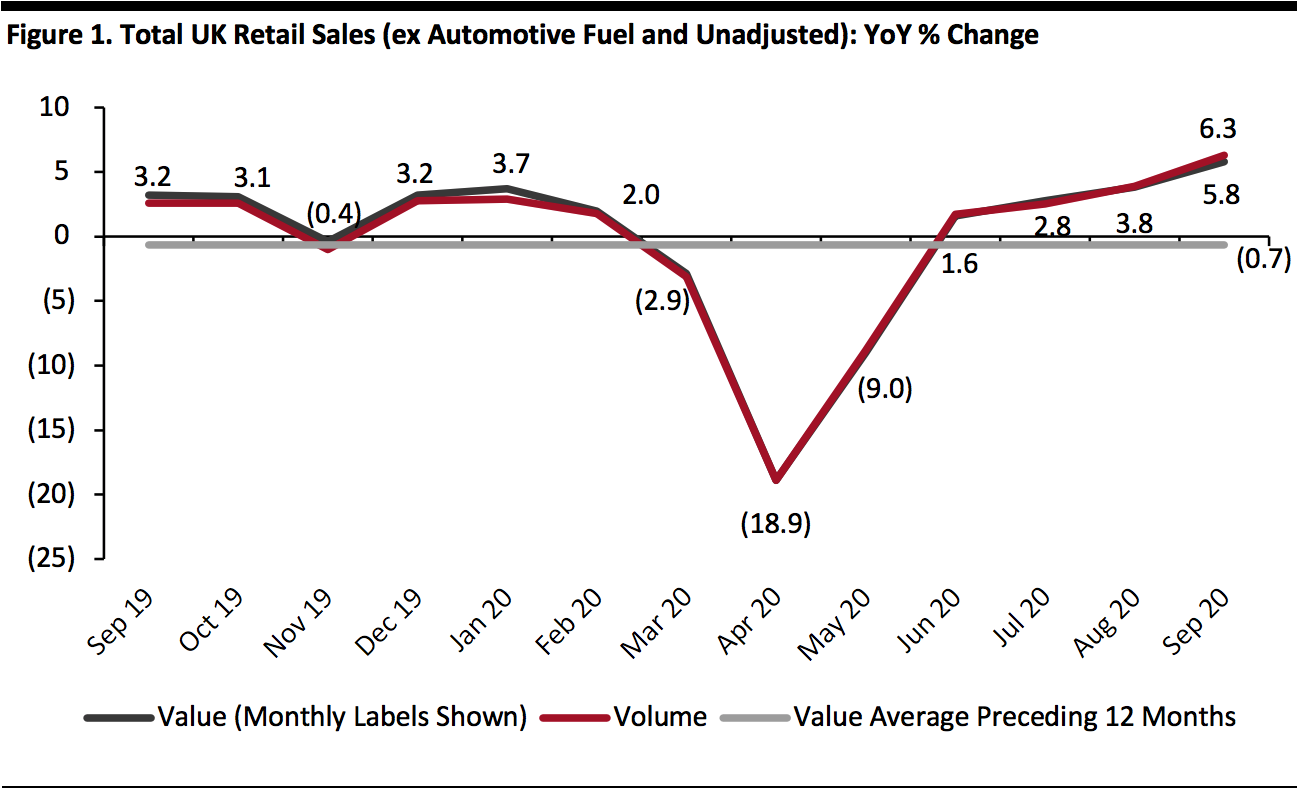

UK retail sales maintained its growth momentum, growing 5.8% in September, supported by substantial year-over-year increases in DIY and hardware stores, floor covering specialists, and health and beauty retailers.

[caption id="attachment_118112" align="aligncenter" width="700"] Data in this report are not seasonally adjusted

Data in this report are not seasonally adjusted

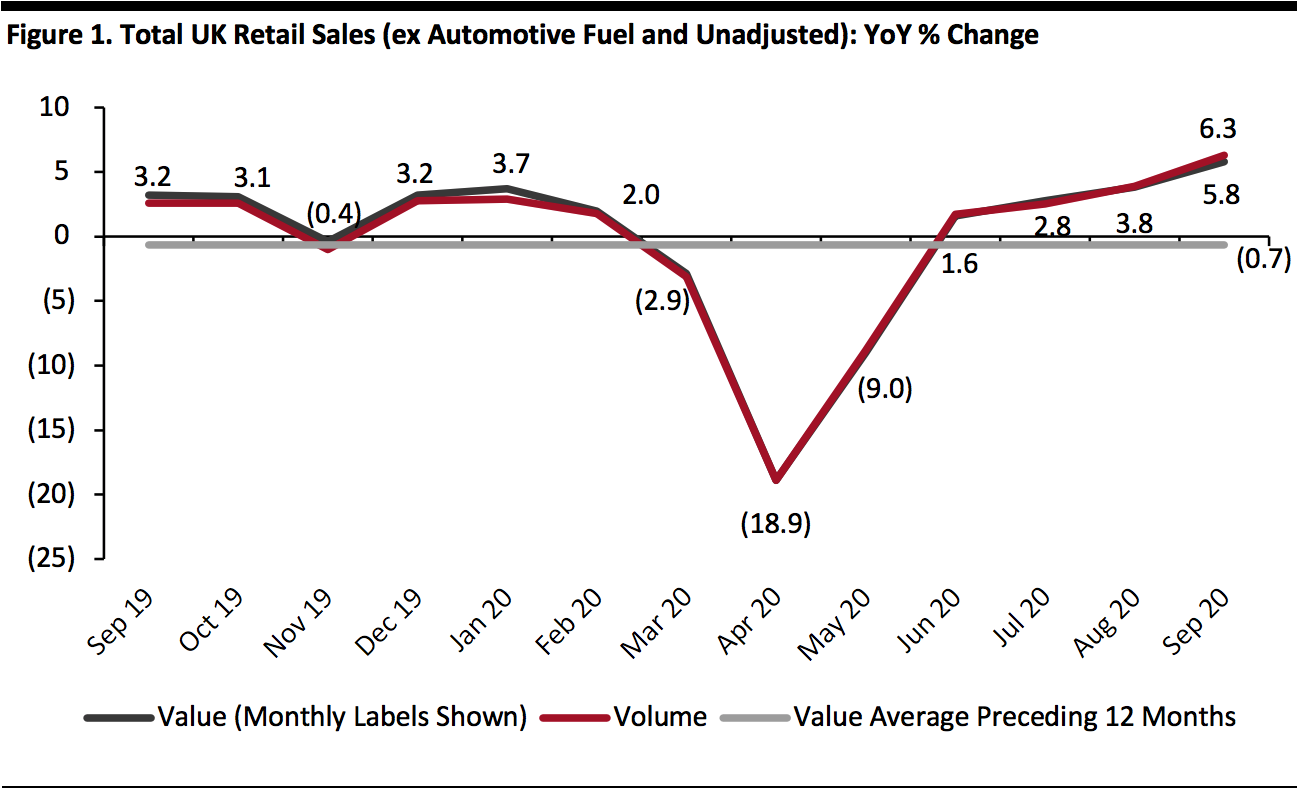

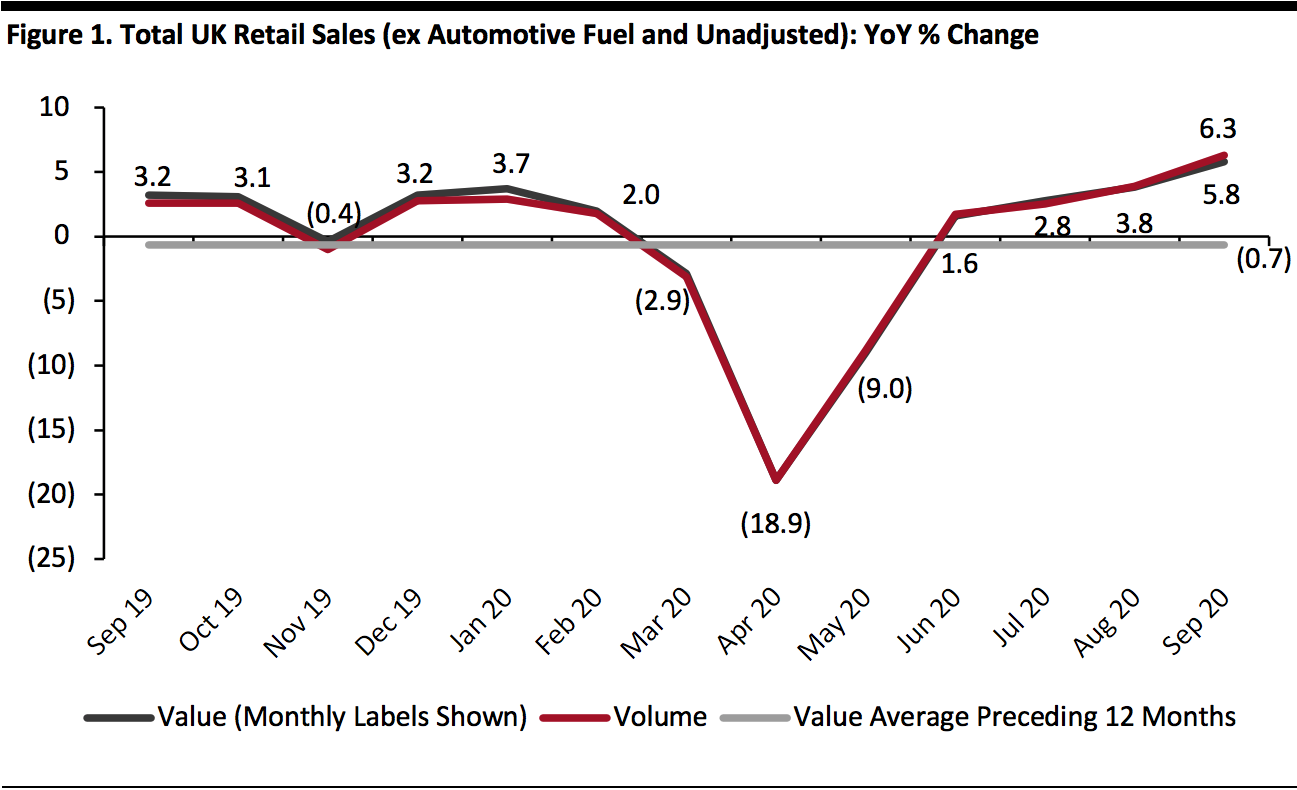

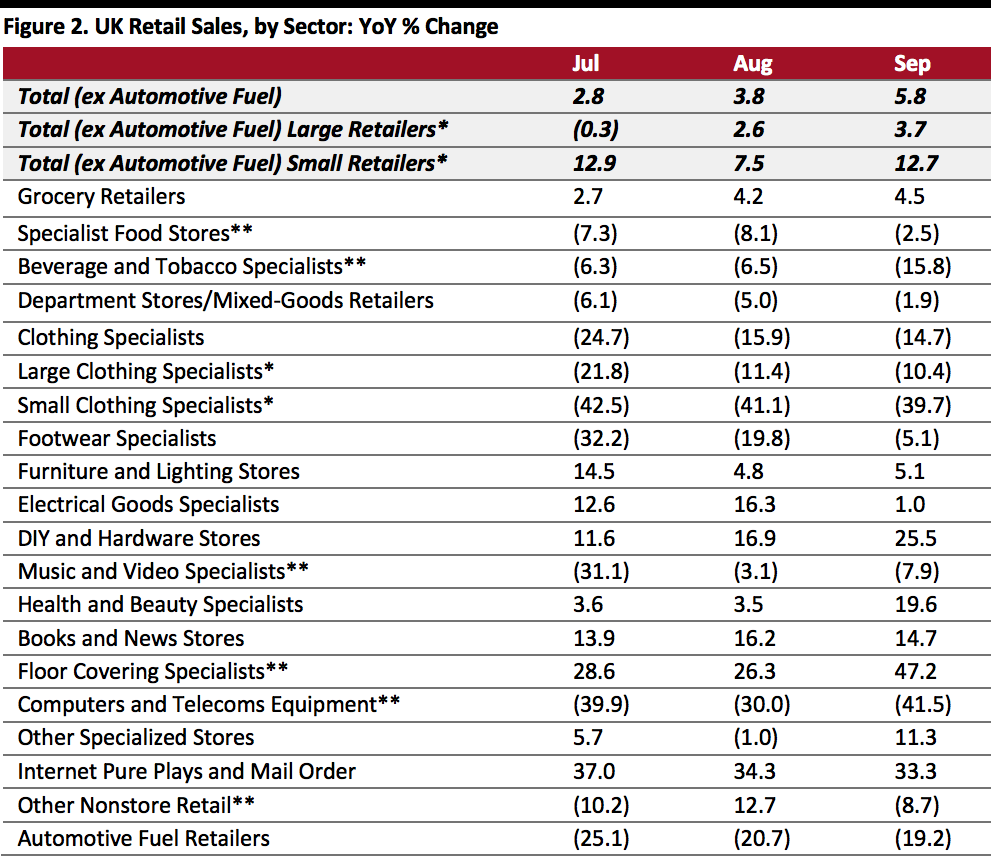

Source: ONS/Coresight Research[/caption] Covid-19 Lockdown Timeline The UK was put into lockdown on March 23, initially for three weeks in an attempt to limit the spread of the coronavirus, shuttering down nonessential retail stores. On April 16, the government extended the lockdown by another three weeks. On May 11, Prime Minister Boris Johnson announced that the government would begin easing restrictions in a phased manner, allowing nonessential stores to reopen from the start of June. However, garden centers were allowed to reopen from May 13 and furniture stores from May 23. On May 26, the government announced that all nonessential retailers in England and Northern Ireland—including department stores and small independent shops—would be allowed to reopen from June 15, but stores would need to implement measures to meet the necessary social distancing and hygiene standards. On June 23, Johnson announced that restaurants, pubs, museums, cinemas and hotels could reopen on July 4. On September 22, Johnson outlined a slew of new restrictions in the wake of a fresh spike in the number of infections. These included the closing of bars, pubs and other hospitality services by 10:00 p.m., effective September 24. The government then announced a three-tier lockdown system on October 12, which classifies regions based on the severity of infection rates. On October 7, the Scottish government implemented tighter restrictions, largely on the hospitality industry, in Central Scotland; retail was not directly affected, although stores were requested to enforce two-meter distancing. In the week beginning October 19, a number of English regions, including London and Manchester, moved into higher “tiers” of control, which include restrictions on households mixing and, in some cases, some service industries; however, these did not change the direct rules for retailers. On October 23, a 17-day lockdown began in Wales, with nonessential retailers being forced to close once more. Retail Sales Growth by Sector September was another strong month for UK retail, with reported sales growing significantly at DIY, floor-covering specialists and health and beauty. Overall growth was once again supported by small retailers, which posted 12.7% growth in September (small clothing retailers were one exception—sales fell sharply in this sector, as shown in Figure 2). Large retailers, which account for the bulk of most sectors, saw total sales growth of 3.7%. DIY and hardware stores’ growth accelerated again, surging 25.5% in September, compared to a 16.9% increase in August. Sales at grocery stores witnessed a modest increase, growing 4.5% in September. However, we expect sales in this sector to grow more significantly in the coming months, following the tightening of restrictions on food-service locations such as bars and restaurants at the end of September and further restrictions introduced in October. Health and beauty saw a sharp growth spike, increasing 19.6% in September, compared to 3.5% in August. Sales at clothing and footwear stores was still down in September, although the sector continues to see a sequential improvement in growth since the easing of lockdowns. The department stores/mixed-goods sector saw a modest recovery; this sector comprises full-range department stores, such as John Lewis, and variety-stores such as Argos and B&M Bargains—the former segment is likely to pull down this sector’s growth, given its reliance on the apparel category. Despite witnessing a softening of growth in recent months, sales at online-only retailers stayed strong, suggesting that consumers were still carrying out much of their shopping online compared to February. Growth at online-only retailers expanded 33.3% in September, compared to 34.3% in August. [caption id="attachment_118113" align="aligncenter" width="700"] *A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers

**A relatively fragmented sector, in which reported figures have traditionally been volatile

Source: ONS[/caption] Online Retail Sales Account for 26.1% of All Retail Sales Total online retail sales were up 52.6% year over year in September, compared to 52.7% in August. At food retailers, Internet sales were up 91.8% in September, versus 91.5% in August. In September, Internet sales were up 61.2% at store-based nonfood retailers, versus 60.2% in August, supported by strong sales at non-specialized stores, which were up 86.9%. Online sales were up 37.5% at nonstore retailers. As a percentage of overall retail sales, online retail sales are trending down after lockdown restrictions were eased. Online sales accounted for 26.1% of all retail sales in September, down from 26.7% in August. We chart the trend for all retail and the store-based food and nonfood sectors below. [caption id="attachment_118114" align="aligncenter" width="700"] “Food” and “Nonfood” data are for store-based sectors; “All Retail” total includes nonstore retail, which is not charted

“Food” and “Nonfood” data are for store-based sectors; “All Retail” total includes nonstore retail, which is not charted

Source: ONS[/caption]

Data in this report are not seasonally adjusted

Data in this report are not seasonally adjustedSource: ONS/Coresight Research[/caption] Covid-19 Lockdown Timeline The UK was put into lockdown on March 23, initially for three weeks in an attempt to limit the spread of the coronavirus, shuttering down nonessential retail stores. On April 16, the government extended the lockdown by another three weeks. On May 11, Prime Minister Boris Johnson announced that the government would begin easing restrictions in a phased manner, allowing nonessential stores to reopen from the start of June. However, garden centers were allowed to reopen from May 13 and furniture stores from May 23. On May 26, the government announced that all nonessential retailers in England and Northern Ireland—including department stores and small independent shops—would be allowed to reopen from June 15, but stores would need to implement measures to meet the necessary social distancing and hygiene standards. On June 23, Johnson announced that restaurants, pubs, museums, cinemas and hotels could reopen on July 4. On September 22, Johnson outlined a slew of new restrictions in the wake of a fresh spike in the number of infections. These included the closing of bars, pubs and other hospitality services by 10:00 p.m., effective September 24. The government then announced a three-tier lockdown system on October 12, which classifies regions based on the severity of infection rates. On October 7, the Scottish government implemented tighter restrictions, largely on the hospitality industry, in Central Scotland; retail was not directly affected, although stores were requested to enforce two-meter distancing. In the week beginning October 19, a number of English regions, including London and Manchester, moved into higher “tiers” of control, which include restrictions on households mixing and, in some cases, some service industries; however, these did not change the direct rules for retailers. On October 23, a 17-day lockdown began in Wales, with nonessential retailers being forced to close once more. Retail Sales Growth by Sector September was another strong month for UK retail, with reported sales growing significantly at DIY, floor-covering specialists and health and beauty. Overall growth was once again supported by small retailers, which posted 12.7% growth in September (small clothing retailers were one exception—sales fell sharply in this sector, as shown in Figure 2). Large retailers, which account for the bulk of most sectors, saw total sales growth of 3.7%. DIY and hardware stores’ growth accelerated again, surging 25.5% in September, compared to a 16.9% increase in August. Sales at grocery stores witnessed a modest increase, growing 4.5% in September. However, we expect sales in this sector to grow more significantly in the coming months, following the tightening of restrictions on food-service locations such as bars and restaurants at the end of September and further restrictions introduced in October. Health and beauty saw a sharp growth spike, increasing 19.6% in September, compared to 3.5% in August. Sales at clothing and footwear stores was still down in September, although the sector continues to see a sequential improvement in growth since the easing of lockdowns. The department stores/mixed-goods sector saw a modest recovery; this sector comprises full-range department stores, such as John Lewis, and variety-stores such as Argos and B&M Bargains—the former segment is likely to pull down this sector’s growth, given its reliance on the apparel category. Despite witnessing a softening of growth in recent months, sales at online-only retailers stayed strong, suggesting that consumers were still carrying out much of their shopping online compared to February. Growth at online-only retailers expanded 33.3% in September, compared to 34.3% in August. [caption id="attachment_118113" align="aligncenter" width="700"]

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers**A relatively fragmented sector, in which reported figures have traditionally been volatile

Source: ONS[/caption] Online Retail Sales Account for 26.1% of All Retail Sales Total online retail sales were up 52.6% year over year in September, compared to 52.7% in August. At food retailers, Internet sales were up 91.8% in September, versus 91.5% in August. In September, Internet sales were up 61.2% at store-based nonfood retailers, versus 60.2% in August, supported by strong sales at non-specialized stores, which were up 86.9%. Online sales were up 37.5% at nonstore retailers. As a percentage of overall retail sales, online retail sales are trending down after lockdown restrictions were eased. Online sales accounted for 26.1% of all retail sales in September, down from 26.7% in August. We chart the trend for all retail and the store-based food and nonfood sectors below. [caption id="attachment_118114" align="aligncenter" width="700"]

“Food” and “Nonfood” data are for store-based sectors; “All Retail” total includes nonstore retail, which is not charted

“Food” and “Nonfood” data are for store-based sectors; “All Retail” total includes nonstore retail, which is not chartedSource: ONS[/caption]