Web Developers

Source: Company reports/StreetAccount

Source: Company reports/StreetAccount

Costco’s September Comps Beat Expectations; E-Commerce Continues to Outperform

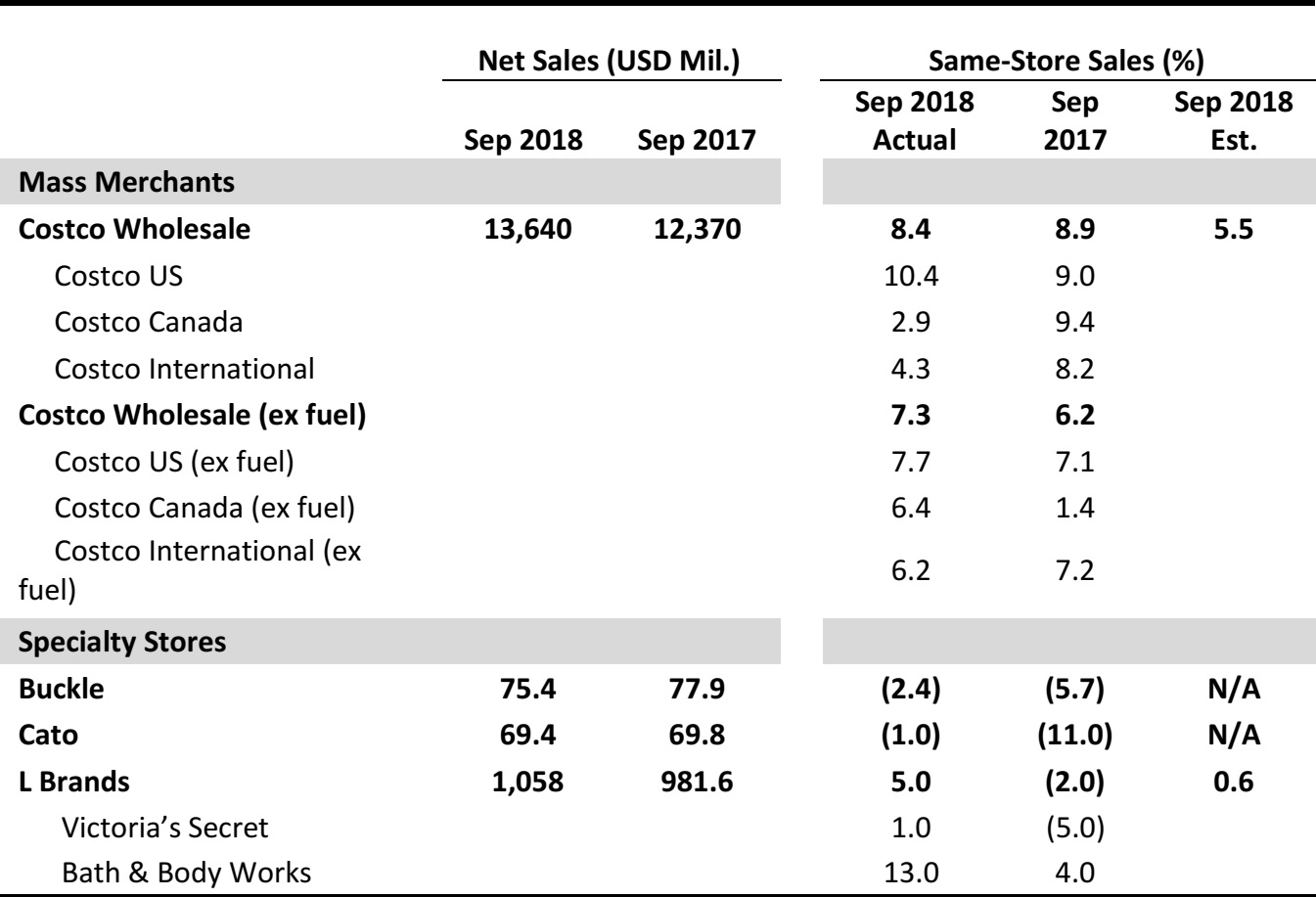

- Costco’s September same-store sales grew by 8.4% year over year, beating the consensus estimate of 5.5%, and was below the 9.2% growth reported in August.

- Costco’s e-commerce comparable sales were up 28.6% in September and above the 23.8% growth reported in August.

- In September, traffic at Costco was up 4.6% both worldwide and in the US.

- In terms of regions, the retailer witnessed strongest results in the Midwest, South West and San Diego, in the US. Internationally, Costco saw strong sales growth in Spain, Japan, Taiwan and Mexico.

- Foreign currency fluctuations negatively impacted the overall company’s comps by 120 basis points. Canada was hurt by a little more than 550 basis points, while international comps were negatively impacted by slightly more than 250 basis points.

- Cannibalization negatively impacted the US by slightly less than 50 basis points, Canada by slightly less than 60 basis points and other international segments by about 90 basis points.

- Beginning in fiscal year 2019, the company adopted revenue recognition standard ASC 606, and this new revenue recognition benefited sales by approximately 90 basis points in the US and about 70 basis points for total company.

- Food and sundries same-store sales grew by mid- to high-single digits. Departments that witnessed the strongest growths in comps were tobacco, sundries and candy. Hardlines were up by high-single digits. The better-performing departments included majors, toys and seasonal, and automotive and tires.

- Softline comps increased by low-double digits. Departments that performed well included luggage, home furnishings, apparel and kiosks. Fresh foods were up by mid-single digits, with produce and meat among the better-performing departments.

- In the ancillary business segment, gasoline, hearing aids and optical saw the strongest comps increases during the month. Gasoline price inflation added slightly more than 160 basis points to Costco’s total reported comparable sales. The average selling price of gasoline per gallon was up 14%, to $3.06, compared with $2.68 in the same month last year.

L Brands Reported a Modest Increase in Comps; Bath & Body Works Continues to Outperform Other Segments

- L Brands reported a strong increase of 5% in comparable sales this September, compared to 1% growth posted in August. Victoria’s Secret’s same-store sales grew by 1%, while comparable sales at Bath & Body Works were up 13%. Victoria’s Secret and Bath & Body Works had reported comparable sales growths of (5)% and 15%, respectively, this August.

- L Brands’ merchandise margin rate was down in September compared to the same month last year, due to promotional activity at Victoria’s Secret.

- Inventories per square-foot as of the end of September grew 20% year over year.

- At Victoria’s Secret, growth in comps was driven by lingerie and beauty, and was partially offset by a decline in PINK. The company plans to focus on bringing in new collections in the lingerie business and everyday loungewear in the PINK business.

- At Bath & Body Works, there was a 13% increase in comps, driven by strong product acceptance. The brand’s merchandise margin for the month was up compared to September last year, driven by lower promotional activity, partially offset by channel shift and logistics network cost.

Buckle Posted Negative Sales Growth Led by Sluggish Performance in the Women’s Segment

- Buckle’s comparable sales fell by 2.4% year over year in September, compared to a 0.7% decline reported in August. Net sales declined 3.2% year over year.

- Total sales in the men’s business fell marginally by 0.5% year over year. The men’s segment accounted for 49% of total sales compared with 47% in September last year. Price points were down 2% for September in the men’s segment.

- Total sales for the women’s segment fell 8% year over year. The women’s segment accounted for 51% of total monthly sales versus a slightly higher 53% share in September last year. Price points were down by about 2.5% in the women’s business.

- Accessories sales fell 7.0% year over year in September and accounted for 8.5% of total sales, which is flat compared to September 2017. Footwear sales fell 2% year over year and represented 7.0% of total sales, the same as in September 2017. The average accessory price points were down 1.0% and the average footwear price points were up 3.0%.

- In the current month, units per transaction grew by 1.5% year over year and the average transaction value fell by about 2.0% year over year, respectively.

Cato Reports Marginal Decline in Net Sales and Comps

- Cato’s sales fell by 1.0% to $69.4 million, while comparable sales fell by 1% year over year in September. Cato had reported an increase of 5% in comps this August.

- As of October 6, the company was operating 1,350 stores in 33 states, down from 1,369 in the year-ago period. Cato did not add or close any of its stores in the current month.