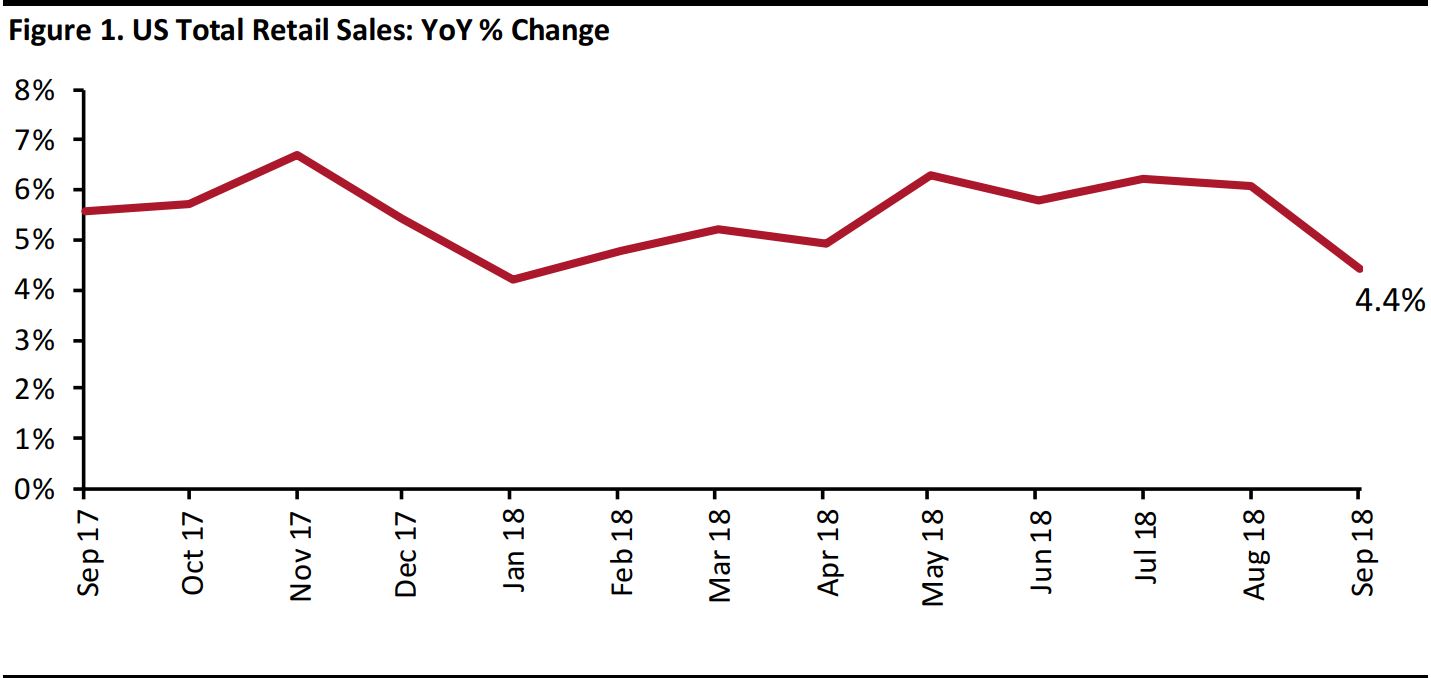

Through September 30, 2018. Data are seasonally adjusted and include automobiles and gasoline.

Source: US Census Bureau

Through September 30, 2018. Data are seasonally adjusted and include automobiles and gasoline.

Source: US Census Bureau

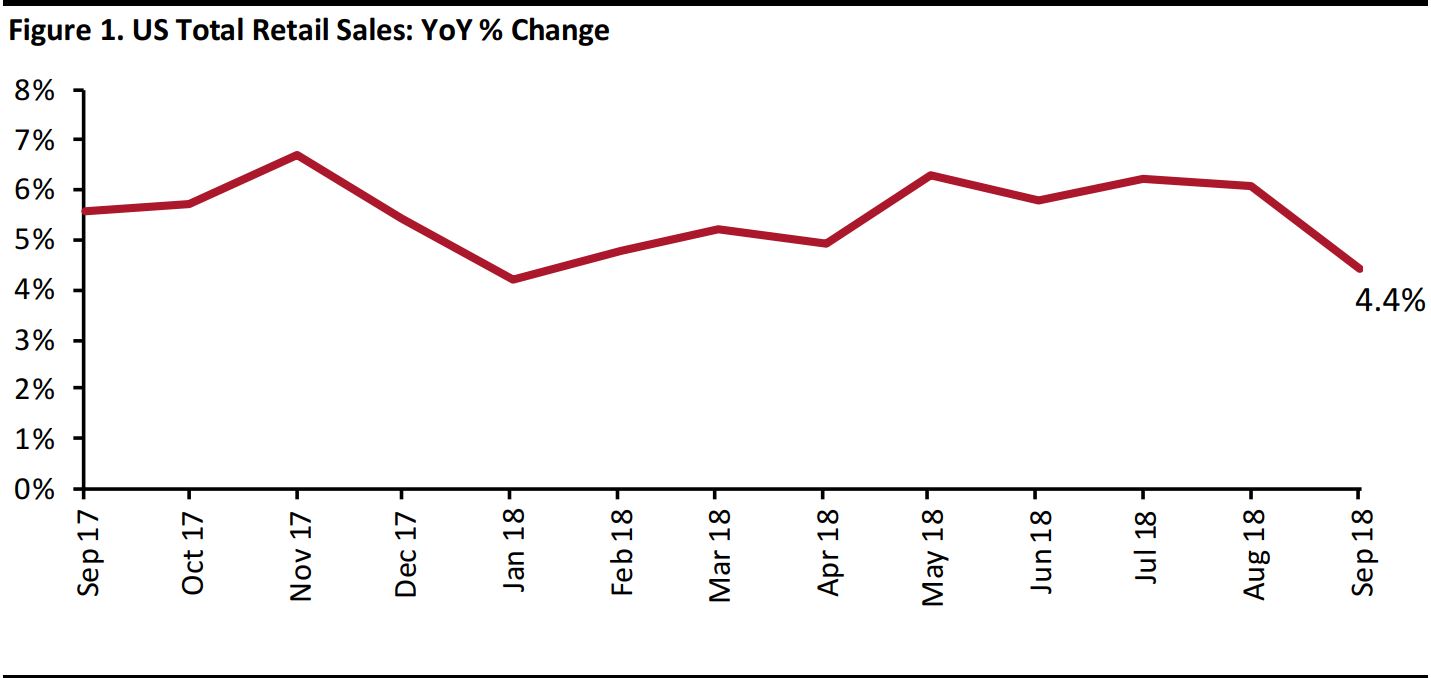

Year-over-year growth in total seasonally adjusted retail sales including automobiles and gasoline slowed markedly to 4.4% in September from 6.1% in August, according to the US Census Bureau.

Excluding automobiles and gasoline, year-over-year retail sales growth decelerated to 3.1% in September versus 5.0% in August.

Year over year in September, sales increased by 4.6% at clothing and clothing accessories stores, 2.7% at grocery stores and 3.6% at general merchandise stores, within which there was a 1.5% decline in department store sales. Non-store retailers registered year-over-year growth of 11.4% in sales.

On a month-over-month basis and seasonally adjusted, retail sales increased by 0.4% in September.

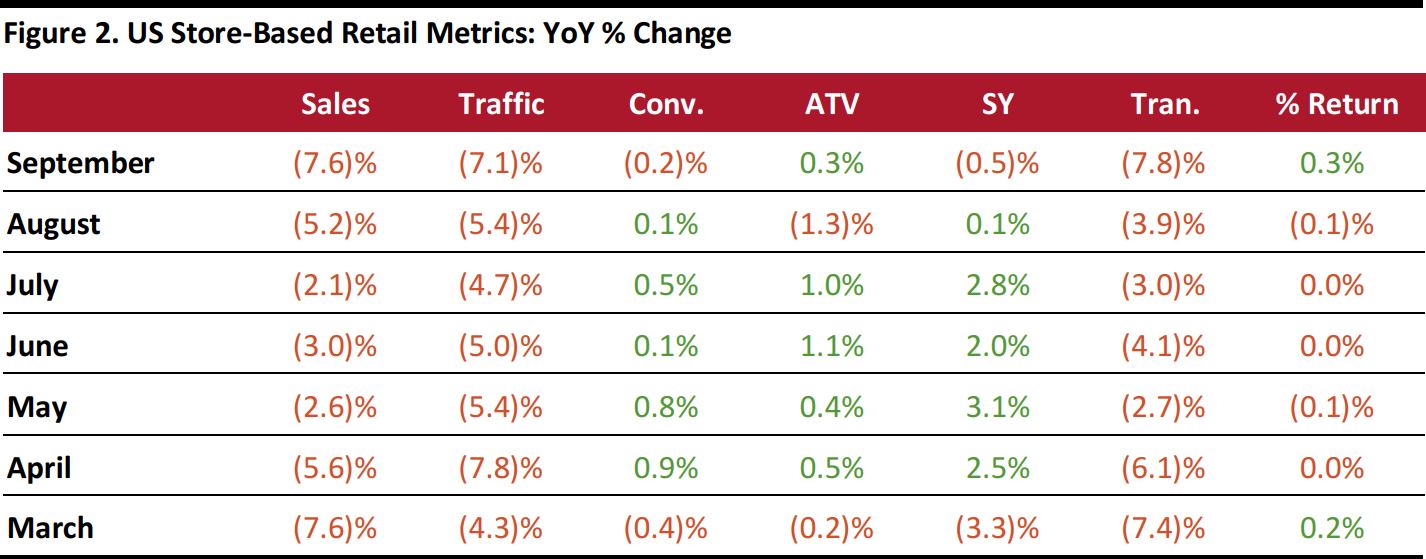

In-Store Metrics

Conv. = conversion rate, ATV = average transaction value, SY = shopper yield, Tran. = number of transactions and % Return = percentage of goods returned to stores.

Source: RetailNext

Conv. = conversion rate, ATV = average transaction value, SY = shopper yield, Tran. = number of transactions and % Return = percentage of goods returned to stores.

Source: RetailNext

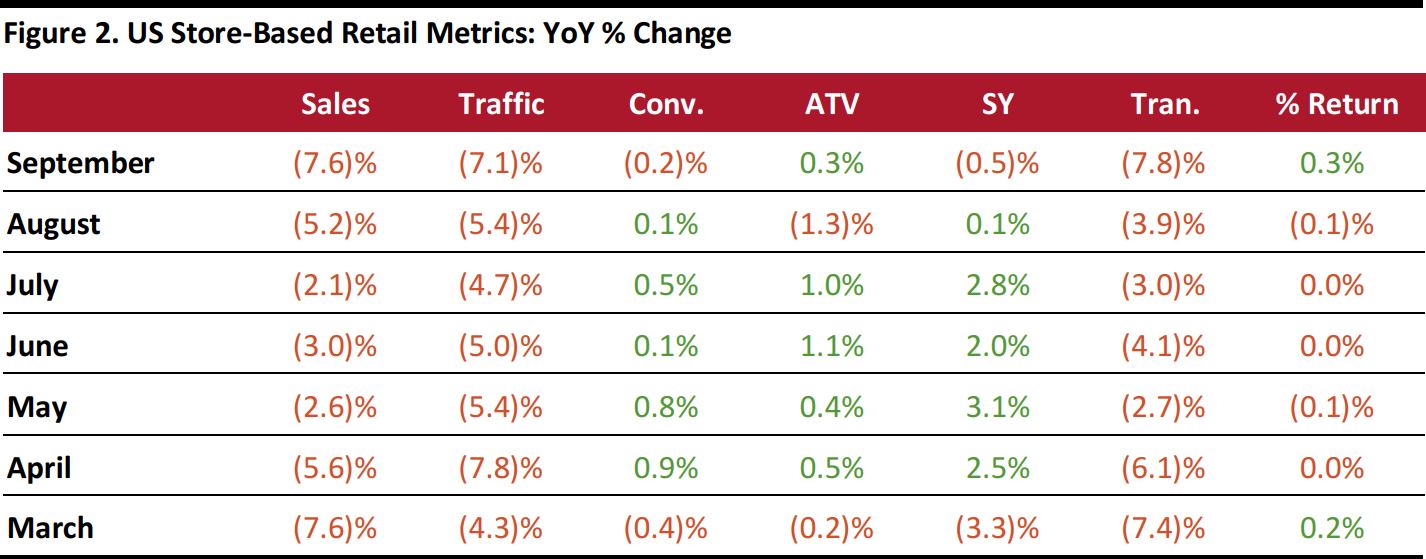

Store-based sales and traffic declined in September, while the conversion rate declined, by 0.2%, according to RetailNext. This was the first decline in the conversion rate in six months. Average transaction value (which increased by 0.3%) and return rate metrics (up 0.3%) grew marginally.

- Retail traffic declined 7.1% year over year in September in what was the steepest decline since April.

- Shopper yield declined by 0.5% year over year and the number of transactions declined 7.8%.

All geographic regions posted sales and traffic declines in September compared to the same period last year. The Northeast experienced the largest year-over-year sales decline amongst all regions, with sales down 10.8%, whereas the Midwest reported the smallest decline, with sales down 1.0%.

Through September 30, 2018. Data are seasonally adjusted and include automobiles and gasoline.

Source: US Census Bureau

Through September 30, 2018. Data are seasonally adjusted and include automobiles and gasoline.

Source: US Census Bureau Conv. = conversion rate, ATV = average transaction value, SY = shopper yield, Tran. = number of transactions and % Return = percentage of goods returned to stores.

Source: RetailNext

Conv. = conversion rate, ATV = average transaction value, SY = shopper yield, Tran. = number of transactions and % Return = percentage of goods returned to stores.

Source: RetailNext