All data in this report are not seasonally adjusted.

Source: ONS/Coresight Research

All data in this report are not seasonally adjusted.

Source: ONS/Coresight Research

Source: ONS/Coresight Research

Source: ONS/Coresight Research

RETAIL SALES GROWTH BY SECTOR

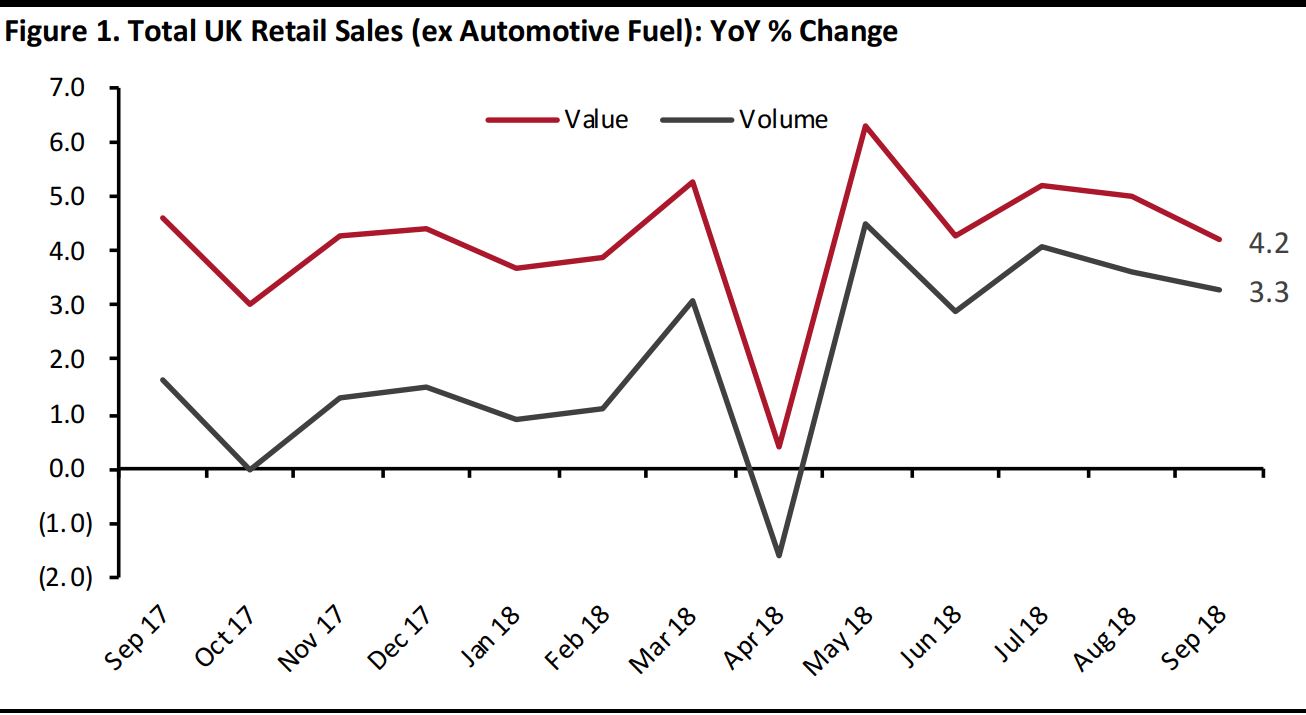

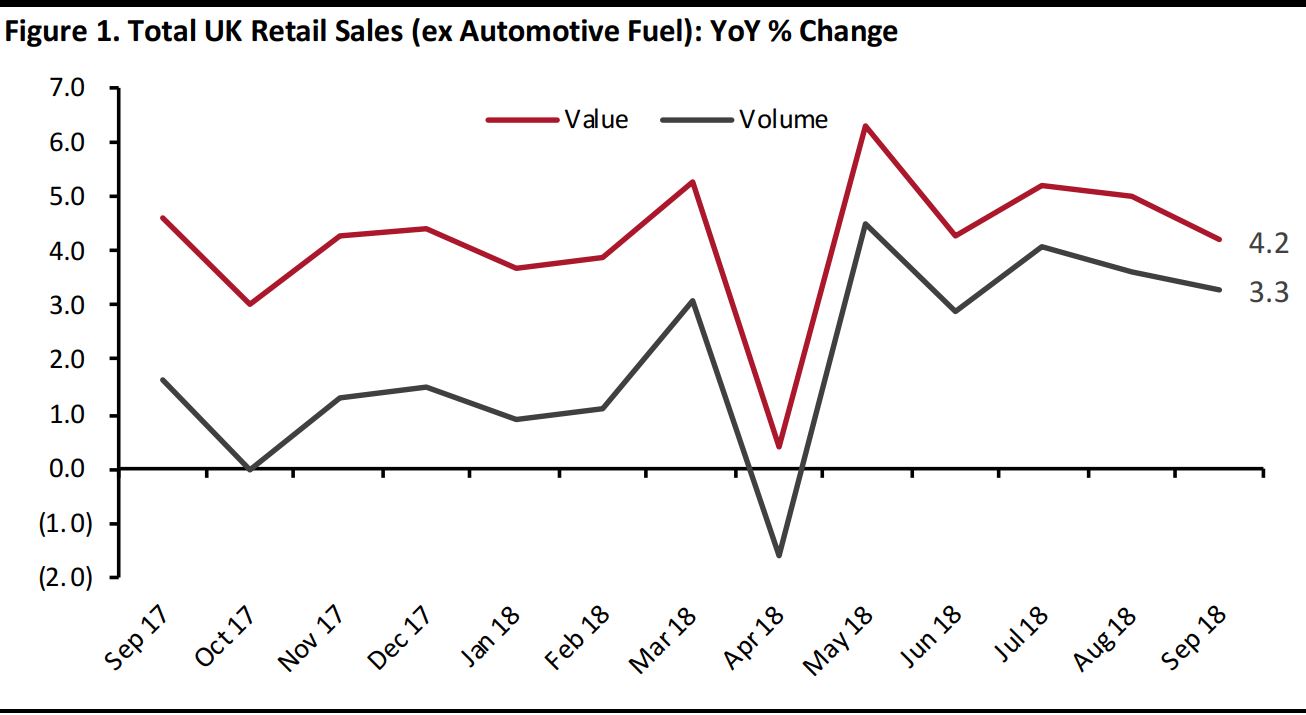

ONS data show a retail sector that is growing at a very steady pace, and that growth is being supported by solid real-terms increases. Given the recent consistency,

we are pencilling in solid, 4.5% year-over-year growth for the holiday season (November and December in aggregate).

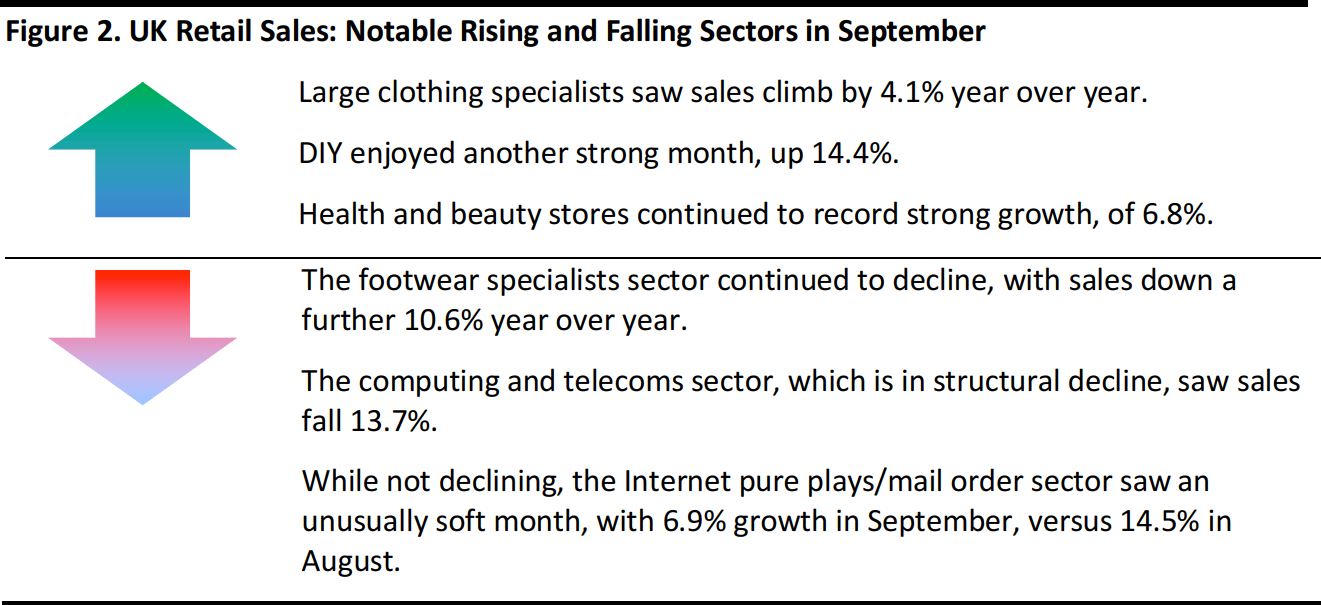

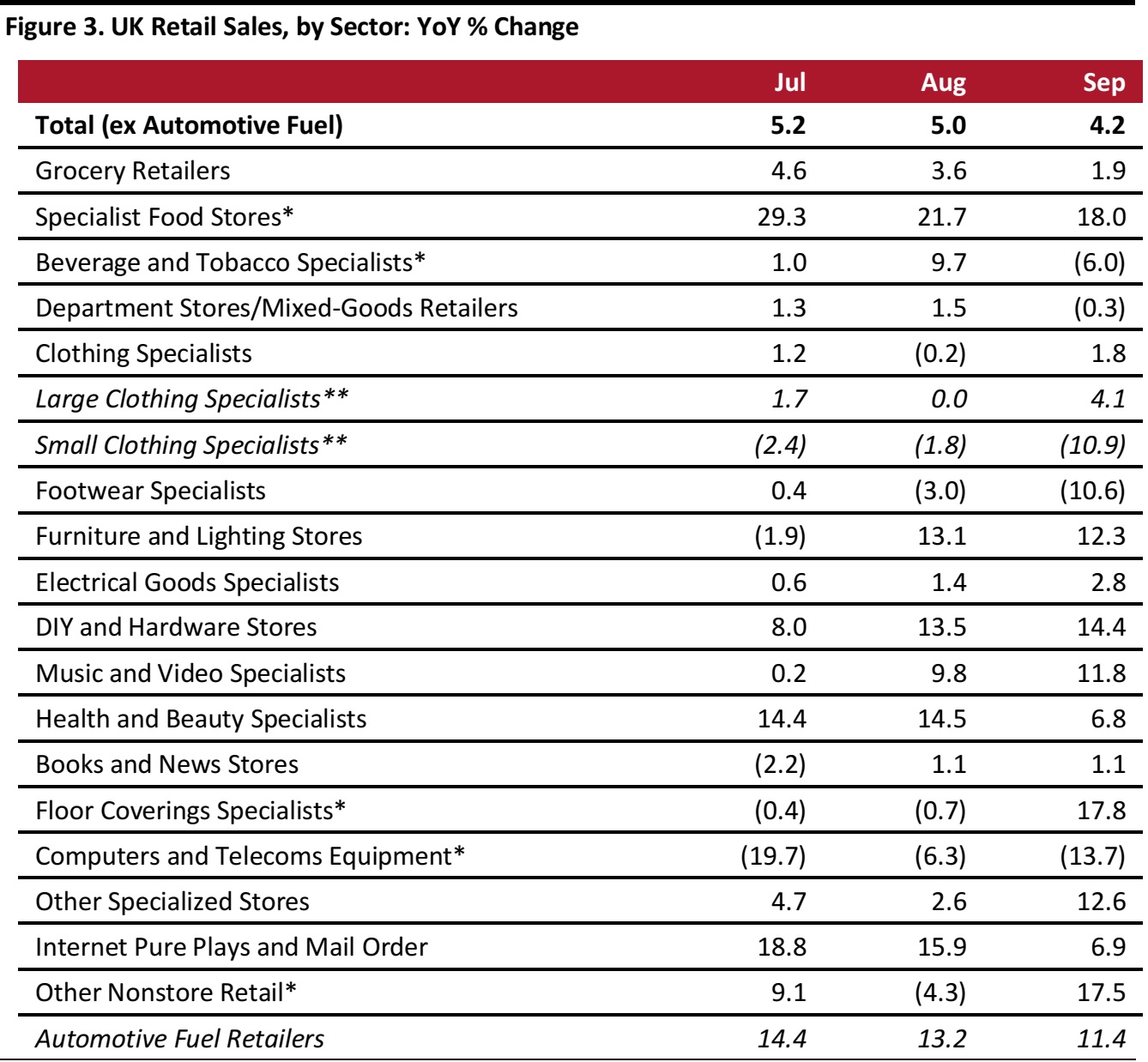

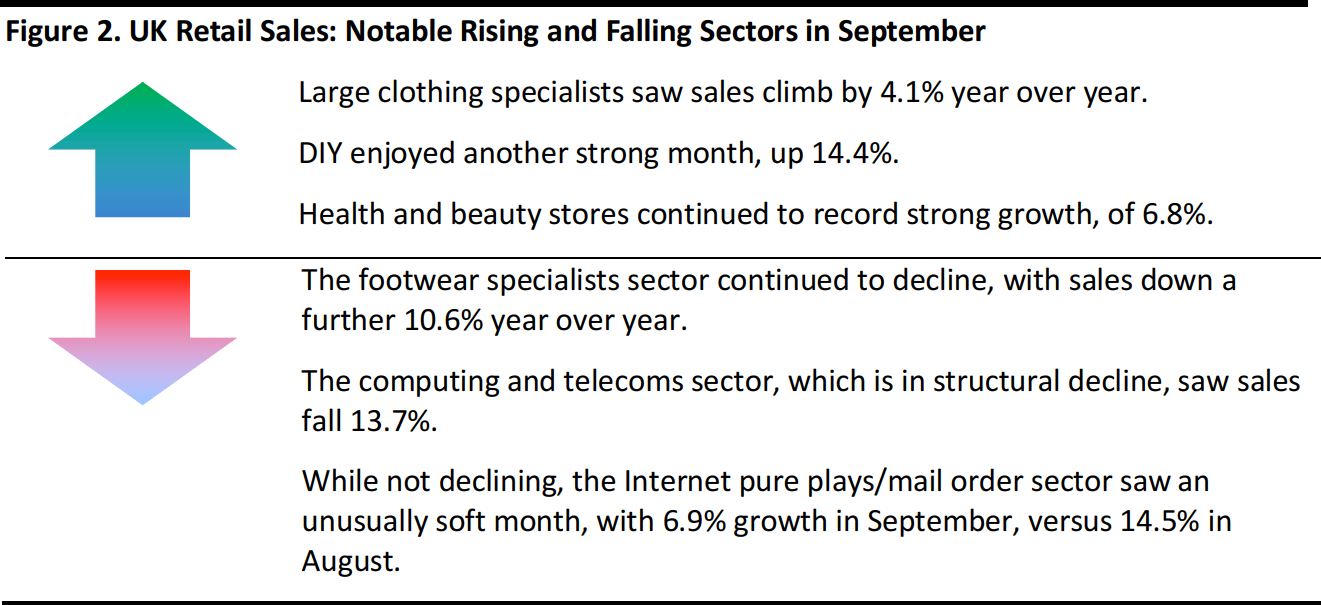

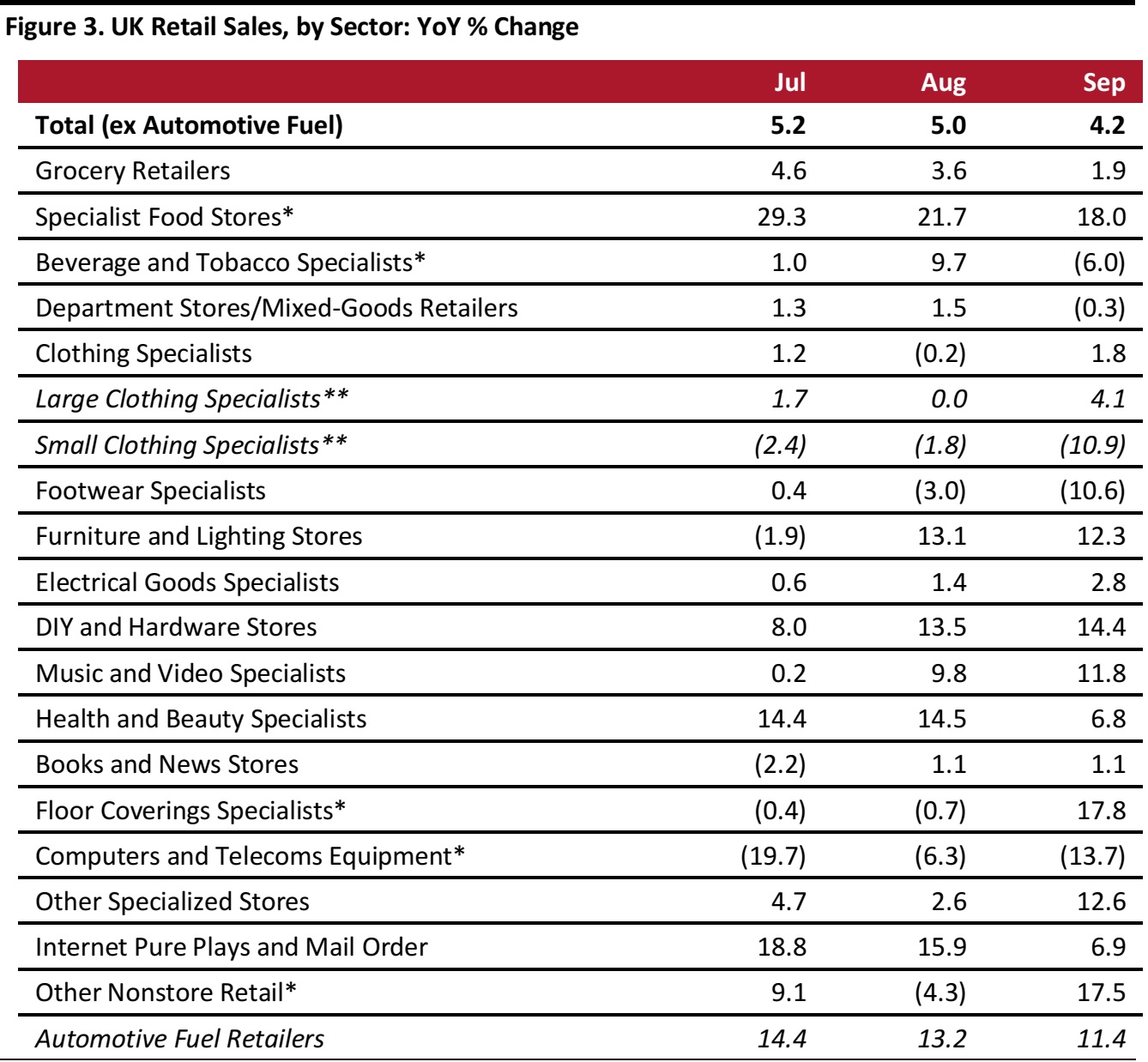

September was a good month for large clothing retailers and DIY stores while electrical appliance specialists saw growth accelerate.

We continued to see apparently structural declines at footwear specialists and computers and telecoms stores. As we have noted previously, footwear specialists look to be losing out to Internet pure play retailers as well as sportswear stores that are riding the sneaker trend. In September, we saw further volatility in the reported figures for fragmented sectors such as beverage and tobacco specialists, specialist food stores and floorcoverings sectors.

The ONS recorded total year-over-year shop-price inflation slowing to 0.9% in September, from 1.3% in August. At food stores, inflation eased to 1.6% in September from 2.0% in August. At nonfood retailers, inflation unwound from 0.6% in August to 0.3% in September. Automotive fuel inflation pulled back further, slowing from 11.3% in August to 10.3% in September—apparently confirming that we are past peak inflation for fuel.

*A relatively small or fragmented sector, where reported figures have traditionally proved volatile.

**A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.

Source: ONS

*A relatively small or fragmented sector, where reported figures have traditionally proved volatile.

**A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.

Source: ONS

ONLINE RETAIL SALES GROWTH

Total Internet retail sales were up 11.1% year over year in September, versus 14.5% growth in August. In September, Internet sales grew by 10.3% at food retailers, 15.7% at nonfood retailers and 8.3% at non-store retailers.

Internet retail sales accounted for 17.1% of all retail sales in September versus 16.8% in August. In September, e-commerce’s share of sales stood at 5.6% at food retailers and 13.1% at nonfood retailers, which included a 16.9% share of sales at clothing and footwear specialist retailers.

All data in this report are not seasonally adjusted.

Source: ONS/Coresight Research

All data in this report are not seasonally adjusted.

Source: ONS/Coresight Research Source: ONS/Coresight Research

Source: ONS/Coresight Research *A relatively small or fragmented sector, where reported figures have traditionally proved volatile.

**A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.

Source: ONS

*A relatively small or fragmented sector, where reported figures have traditionally proved volatile.

**A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.

Source: ONS