DIpil Das

Introduction

What’s the Story? Department store apparel portfolios have heavily leaned toward dressier styles, occasion wear and work wear. The Covid-19 pandemic was a catalyst for change as consumers’ daily lives transformed, and the need for occasion wear, work attire and travel attire diminished. Activewear, athleisure and casual wear have become wardrobe staples as many consumers continue to work remotely or in hybrid work scenarios and consumers continue to prioritize activewear, wearing fitness styles (such as leggings) as everyday fashion. Why It Matters To remain competitive, department stores need to diversify their apparel categories. While department stores are reporting that consumers are shopping for occasion wear and work wear again, we expect activewear, athleisure and casualwear categories will remain consumer apparel essentials. The opportunity to diversify apparel portfolios is a critical issue in retail.- Department stores’ apparel portfolios have traditionally been focused on a mix of dressier styles, work wear and occasion wear, categories that have been hit hard by the pandemic.

- Casualization was a well-known consumer trend prior to the Covid-19 pandemic. The pandemic supercharged casualization, as consumers no longer needed occasion wear or work wear. Consumers lifestyles have changed permanently; casualization is propelling athleisure and sports-inspired clothing growth by 7% in 2022, Coresight Research expects, following 20% growth in 2021.

- Consumers’ focus on health, wellness and maintaining active lifestyles is driving category growth. As 61% of Americans reported weight increases since the start of the Covid-19 pandemic, according to The Harris Poll for the American Psychological Association conducted in February 2021, we expect this to drive apparel sales in athleisure, casual categories and sportswear. We expect consumers will be seeking out new sizes and some may seek out activewear as they engage in activities to lose weight gained during Covid-19.

Seizing Opportunities in Active, Athleisure and Casual Apparel: Coresight Research Analysis

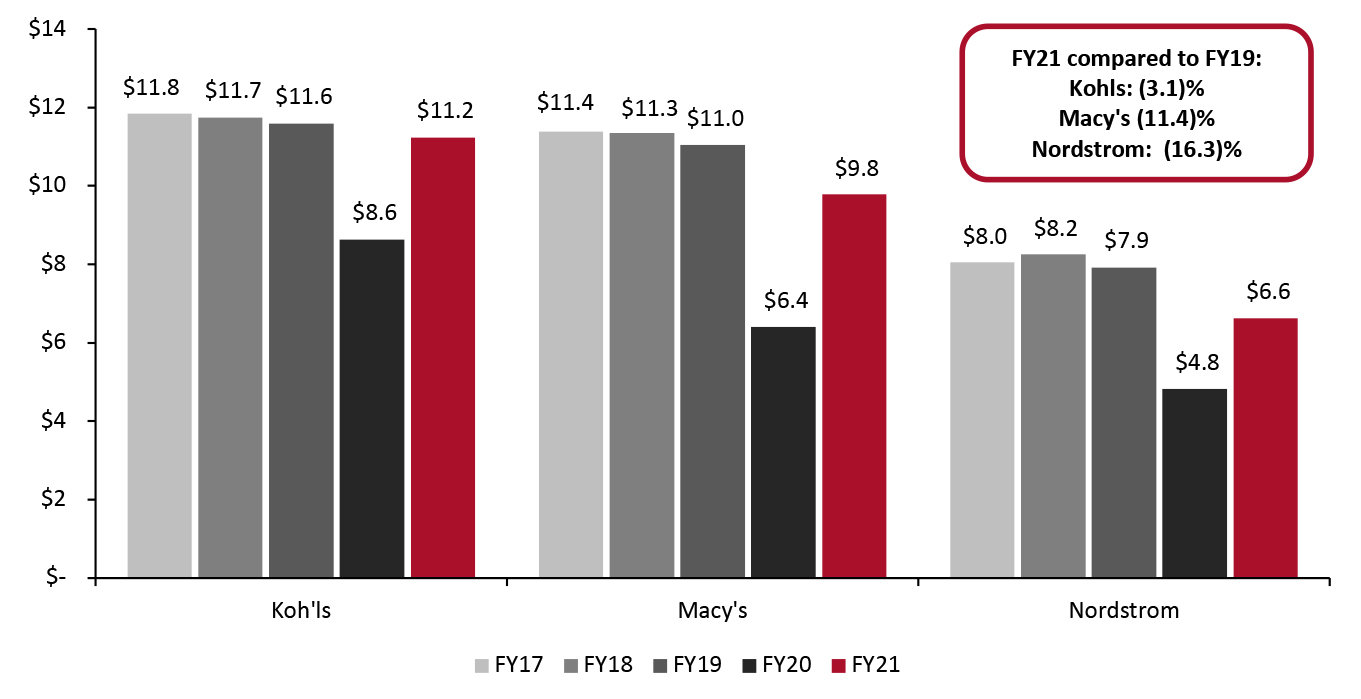

Apparel Overview: Women’s, Men’s and Children’s Apparel Here we analyze the apparel category performance of the three major department stores, Kohl’s, Macy’s and Nordstrom, for the past five fiscal years. The apparel category includes women’s, men’s, and children’s apparel. The department stores do not report in their financial documents on the distinction between casualwear apparel as compared to occasion wear and active wear; however, management frequently provides commentary on these categories on earnings calls which we discuss in this report.- Apparel revenue declined by 35.0% in fiscal year 2020 across the three major department stores, Kohl’s, Nordstrom and Macy’s, compared to overall industry declines of 9.2%. In fiscal year 2021, apparel revenue across the three major department stores remains 9.5% below fiscal year 2019.

- Kohl’s apparel portfolio is the most active and casual of the three department stores, and its apparel sales were most resilient among the three major department stores, remaining at 3.1% below fiscal year 2019 at the end of fiscal year 2021. Additionally, compared to the other major department stores, apparel is the largest contributor of revenue for Kohl’s, comprising 61% of its total revenue in fiscal year 2021.

- Macy’s apparel revenue was most impacted by Covid-19 of the three major department stores, declining by 42.1% at the end of fiscal year 2020 and remaining 11.4% below fiscal year 2019 apparel revenues at the end of fiscal year 2021. Macy’s women’s category was impacted significantly during fiscal year 2020, declining by 46.2%. The category has been the slowest to recover across the major retailers’ women’s categories, and also the slowest category across Macy’s own apparel portfolio, down by 18.6% compared to fiscal year 2019. Macy’s apparel revenue comprised 40% of its total revenue in fiscal year 2021, the lowest of the three department stores.

- Nordstrom’s apparel revenue in 2021 has rebounded the slowest of the three major department stores as compared to fiscal year 2019, down by 16.3%. Nordstrom’s men’s and kids’ apparel was more impacted by the pandemic as compared to its women’s apparel. Men’s and kids’ apparel was down by 44.8% in fiscal year 2020 compared to a 35.4% decline in women’s apparel. Nordstrom’s apparel comprised 46% of its total revenue in fiscal year 2021.

Figure 1. Department Store Apparel Revenue at Kohl’s, Macy’s and Nordstrom [caption id="attachment_146694" align="aligncenter" width="701"]

Department store fiscal years end on the Saturday closest to January 31 of the following calendar year, i.e,. fiscal year 2021 is the period ending January 29, 2022, and fiscal year 2020 is the period ending January 30, 2021.

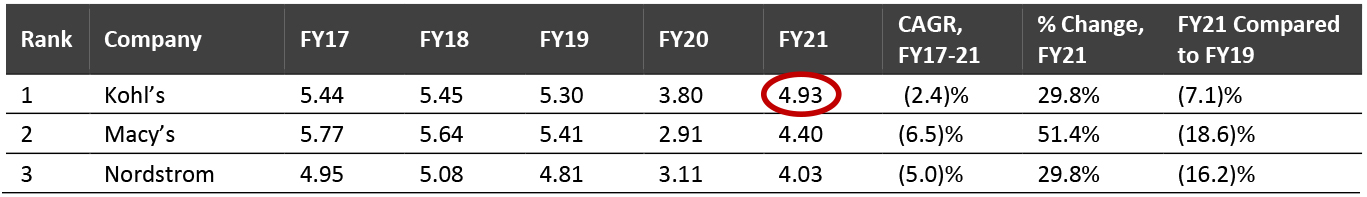

Department store fiscal years end on the Saturday closest to January 31 of the following calendar year, i.e,. fiscal year 2021 is the period ending January 29, 2022, and fiscal year 2020 is the period ending January 30, 2021. Source: Company reports/Coresight Research [/caption] Kohl’s Overtakes Macy’s in Fiscal Year 2020 To Lead in Women’s Apparel Kohl’s holds the largest share of women’s apparel revenue in fiscal year 2021 across the three retailers with $4.93 billion compared to Macy’s $4.40 billion as shown in Figure 2. Prior to Covid-19, Macy’s held the largest share in women’s apparel in fiscal year 2019. Macy’s women’s category was significantly impacted by the pandemic in 2020, declining by 46.2% compared to Kohl’s women’s category, which declined by 28.4% during the same year. We attribute this to Kohl’s more active and casual apparel assortment. Both retailers are investing in their women’s categories. At Nordstrom’s, women’s apparel is the retailer’s largest portfolio category, equaling 28% of its total revenues (its next largest category is shoes totaling 25%). This highlights the importance of women’s apparel to the Nordstrom department store.

Figure 2. US Major Department Store Sector Retailers’ Women’s Apparel Revenues (USD Bil.) [caption id="attachment_146695" align="aligncenter" width="701"]

Source: Company reports/Coresight Research[/caption]

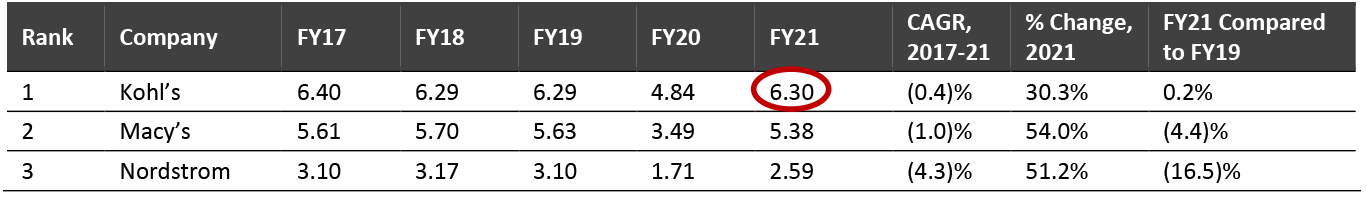

Kohl’s also holds the largest share of men’s and children’s apparel revenue in fiscal year 2021 across the three retailers with $6.30 billion, up 0.2% compared to fiscal year 2019. Men’s and children’s apparel is an opportunity for Macy’s and Nordstrom, as Kohl’s continues to strengthen its active, athleisure and casualwear apparel position with revenues nearly $1.0 billion over Macy’s in this category and over twice the men’s and children’s apparel revenues at Nordstrom.

Source: Company reports/Coresight Research[/caption]

Kohl’s also holds the largest share of men’s and children’s apparel revenue in fiscal year 2021 across the three retailers with $6.30 billion, up 0.2% compared to fiscal year 2019. Men’s and children’s apparel is an opportunity for Macy’s and Nordstrom, as Kohl’s continues to strengthen its active, athleisure and casualwear apparel position with revenues nearly $1.0 billion over Macy’s in this category and over twice the men’s and children’s apparel revenues at Nordstrom.

Figure 3. US Major Department Store Sector Retailers’ Men’s and Children’s Apparel Revenues (USD Bil.) [caption id="attachment_146696" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Casualization Will Propel Growth in Athleisure by 7% in 2022

The pandemic changed apparel needs significantly because consumers’ lives have dramatically altered. As many individuals still work remotely or within a hybrid model, apparel demands are forever changed. Consumers are seeking more casual and versatile attire that is multifunctional and comfortable. Office environments were becoming more casual even prior to Covid-19; the pandemic flipped all traditional rules of dressing on their head with consumers working remotely and many occasions and events on hold until recently. Consumers are increasingly investing in athleisure, athletic wear and casual wear. We define athleisure as a category of sportswear that can be worn for casual purposes and any sportswear item (excluding professional sports items) can be characterized as athleisure wear. Over the past several years, athleisure has gained popularity driven by fitness activities and the increasing demand for comfortable casual wear, including in the workplace. Consumers are wearing athleisure and sports apparel as everyday apparel, which is helping to further the category’s growth momentum. Coresight Research expects athleisure to continue to show promising growth opportunities. We expect the market (represented by both sports clothing and footwear) to grow 7% in 2022, reaching $142.0 billion, and to grow at a CAGR of 8.0% between 2020 and 2026 as discussed in more detail in our report on the US athleisure market.

Pandemic Weight Gains and Focus on Health and Wellness Drive Category Sales

More than half, 61%, of Americans reported weight increases since the start of the Covid-19 pandemic, according to The Harris Poll for the American Psychological Association conducted in February 2021. This will drive apparel sales in athleisure, casualwear and sportswear categories as we expect consumers will be seeking out new sizes and some may seek out activewear as they engage in activities to lose weight. We expect inclusive sizing to be a differentiator for all retailers in 2022.

Consumers have also been increasingly focused on health and wellness, which is a key driver of demand for athleisure products, and many consumers are participating in at-home fitness classes or in activities in outdoor public spaces. Consumers are showcasing their healthy lifestyles on social media, posting photos of themselves dressed in activewear, participating in healthy activities and preparing healthy meals.

Kohl’s Expands Active Portfolio and Revamps Women’s Casual Wear

Kohl’s announced in October 2020 that it wanted to be the “active and casual destination” for the entire family, growing its active and casual from 20% to 30% of its portfolio. Kohl’s is aggressively pursuing its active and casual penetration through national brand partnerships. The company reported at its Investor Day presentation on March 8, 2022 that it has increased its active sales from $2.7 billion in 2016 to $4.4 billion in 2021 and from 14% of sales penetration to 24% of sales penetration, a 10% CAGR. The company has been investing in national brands, with sales penetration of national brands increasing from 50% in fiscal 2010 to 66% in fiscal 2021. Kohl’s reported that its top three national brands are NIKE, Adidas and Under Armour. Kohl’s also sells Champion, Columbia and Land’s End. The company launched three national brand partnerships in the active, athleisure and casualwear space since January 2020 and launched FLX, a private-label athleisure performance brand for men and women. Kohl’s is dedicating more floor space in its stores for active and casual brands.

In 2022, the company is focusing on repositioning its women’s business with the aims to grow its women’s casual business, grow its dress business, expand outerwear and swimwear and amplify its inclusivity offerings. Within women’s casual, Kohl’s plans to expand its denim offering; Kohl’s is the number one retailer of Levi’s and plans to expand its premium denim offering through Buffalo Jeans in 2022 and an offering through Levi’s premium jeans also in 2022. In addition, the company plans to expand its casual dress offerings and increase its footprint by 75%. Casual dresses are a category the company reported has been a number one search category and an area which it has been underpenetrated. Finally, the company plans to expand into outerwear in the fall and swimwear in the spring, and expand into inclusivity to include more diversity, equity, and inclusivity in its products. For example, management said it has an opportunity to expand its plus size offerings across its proprietary brands and in 2022 the retailer is launching an exclusive brand, Intempo, focused on a younger, more diverse consumer.

Source: Company reports/Coresight Research[/caption]

Casualization Will Propel Growth in Athleisure by 7% in 2022

The pandemic changed apparel needs significantly because consumers’ lives have dramatically altered. As many individuals still work remotely or within a hybrid model, apparel demands are forever changed. Consumers are seeking more casual and versatile attire that is multifunctional and comfortable. Office environments were becoming more casual even prior to Covid-19; the pandemic flipped all traditional rules of dressing on their head with consumers working remotely and many occasions and events on hold until recently. Consumers are increasingly investing in athleisure, athletic wear and casual wear. We define athleisure as a category of sportswear that can be worn for casual purposes and any sportswear item (excluding professional sports items) can be characterized as athleisure wear. Over the past several years, athleisure has gained popularity driven by fitness activities and the increasing demand for comfortable casual wear, including in the workplace. Consumers are wearing athleisure and sports apparel as everyday apparel, which is helping to further the category’s growth momentum. Coresight Research expects athleisure to continue to show promising growth opportunities. We expect the market (represented by both sports clothing and footwear) to grow 7% in 2022, reaching $142.0 billion, and to grow at a CAGR of 8.0% between 2020 and 2026 as discussed in more detail in our report on the US athleisure market.

Pandemic Weight Gains and Focus on Health and Wellness Drive Category Sales

More than half, 61%, of Americans reported weight increases since the start of the Covid-19 pandemic, according to The Harris Poll for the American Psychological Association conducted in February 2021. This will drive apparel sales in athleisure, casualwear and sportswear categories as we expect consumers will be seeking out new sizes and some may seek out activewear as they engage in activities to lose weight. We expect inclusive sizing to be a differentiator for all retailers in 2022.

Consumers have also been increasingly focused on health and wellness, which is a key driver of demand for athleisure products, and many consumers are participating in at-home fitness classes or in activities in outdoor public spaces. Consumers are showcasing their healthy lifestyles on social media, posting photos of themselves dressed in activewear, participating in healthy activities and preparing healthy meals.

Kohl’s Expands Active Portfolio and Revamps Women’s Casual Wear

Kohl’s announced in October 2020 that it wanted to be the “active and casual destination” for the entire family, growing its active and casual from 20% to 30% of its portfolio. Kohl’s is aggressively pursuing its active and casual penetration through national brand partnerships. The company reported at its Investor Day presentation on March 8, 2022 that it has increased its active sales from $2.7 billion in 2016 to $4.4 billion in 2021 and from 14% of sales penetration to 24% of sales penetration, a 10% CAGR. The company has been investing in national brands, with sales penetration of national brands increasing from 50% in fiscal 2010 to 66% in fiscal 2021. Kohl’s reported that its top three national brands are NIKE, Adidas and Under Armour. Kohl’s also sells Champion, Columbia and Land’s End. The company launched three national brand partnerships in the active, athleisure and casualwear space since January 2020 and launched FLX, a private-label athleisure performance brand for men and women. Kohl’s is dedicating more floor space in its stores for active and casual brands.

In 2022, the company is focusing on repositioning its women’s business with the aims to grow its women’s casual business, grow its dress business, expand outerwear and swimwear and amplify its inclusivity offerings. Within women’s casual, Kohl’s plans to expand its denim offering; Kohl’s is the number one retailer of Levi’s and plans to expand its premium denim offering through Buffalo Jeans in 2022 and an offering through Levi’s premium jeans also in 2022. In addition, the company plans to expand its casual dress offerings and increase its footprint by 75%. Casual dresses are a category the company reported has been a number one search category and an area which it has been underpenetrated. Finally, the company plans to expand into outerwear in the fall and swimwear in the spring, and expand into inclusivity to include more diversity, equity, and inclusivity in its products. For example, management said it has an opportunity to expand its plus size offerings across its proprietary brands and in 2022 the retailer is launching an exclusive brand, Intempo, focused on a younger, more diverse consumer.

Figure 4. Kohl’s Active, Athleisure and Casual Brand Launches Since January 1, 2021 [wpdatatable id=1941 table_view=regular]

Source: Company reports/Coresight Research Macy’s Focuses on Inclusive Women’s Casual Wear for Younger Women The majority of Macy’s brand launches have centered on women’s casual wear, with five of its eight launches catering to women. Most of its launches also cater to younger woman, with designer collaborations that include influencers from social media to appeal to young women. Three of its recent launches have been limited edition private-label brand collaborations, which we expect is a way to test consumer response to casual styles and collections. The retailer is also focusing on inclusivity, with five of its eight brand launches offering inclusive sizing since January 2020. Macy’s also launched a national brand partnership with Fanatics which offers licensed sports apparel, as did Nordstrom, and Macy’s reported the partnership helped to drive average unit retail in each of its categories. The Fanatics partnership is also geared to a younger target consumer.

Figure 5. Macy’s Active, Athleisure, and Casual Brand Launches Since January 1, 2021 [wpdatatable id=1942 table_view=regular]

Source: Company reports/Coresight Research Nordstrom Features Sports Equipment and Apparel as Well as Denim Nordstrom has had the fewest brand launches, but they are diverse in terms of offerings. The retailer is expanding its active, athleisure and casualwear category through branded partnerships and even entered into the sports equipment category with a collaboration with Tonal in 50 of its stores. The company also entered a partnership with Fanatics to sell licensed sports products. On its fourth-quarter earnings call, the company said that denim has always been an important category and highlighted it plans to showcase denim as a destination category for Nordstrom. The company piloted a women’s denim destination shop and plans to build on this in 2022.

Figure 6. Nordstrom Active, Athleisure, and Casual Brand Launches Since January 1, 2021 [wpdatatable id=1943 table_view=regular]

Source: Company reports/Coresight Research JCPenney Focuses On Inclusive-Sizing for Everyone with Seven Collections JCPenney has launched seven major permanent collections. Most notably, six of the seven collections have inclusive sizing as a differentiator. The company launched four private label brands, three national brand partnerships and a national brand partnership. It is also notable that in our March 2022 Coresight Research survey 31.4% of consumers made a purchase at JCPenney within the past three months, making it the third most frequented department store after its recent relaunch. The company is also invested in its denim, as it launched a private label brand denim brand for men.

Figure 7. JCPenney Active, Athleisure, and Casual Brand Launches Since January 1, 2021 [wpdatatable id=1944 table_view=regular]

Source: Company reports/Coresight Research

What We Think

Activewear, athleisure and casual wear are the new normal and fashion essentials instead of fashion supplements. We believe that this “apparel reversal” toward more casual, which was happening pre-pandemic but was supercharged due to remote and hybrid work, means that department store apparel portfolios need to reflect this new consumer lifestyle and provide relevant options. Implications for Brands/Retailers Apparel Portfolios Will Become More Casual- We expect this shift toward growing categories will be a boost for department stores. We also expect some other apparel categories will begin to return to growth when consumers begin to resume regular life activities including events that require occasion wear and some dressier categories. We anticipate that consumer demand for some dressier work wear categories may not reach pre-pandemic levels as many consumers will continue to work remotely or will dress more casually onsite.

- Kohl’s has been investing in its active and casual wear for several years and has a competitive advantage in terms of its active, athleisure and casualwear portfolio; Kohl’s apparel was the most resilient among three largest department stores during the Covid-19 pandemic.

- We expect Nordstrom and Macy’s to further diversify their apparel assortments, particularly with more emphasis on casual wear and athleisure with styles that appeal to the continued shift in how consumers are working and living.

- We expect fierce competition in the women’s category in 2022. Kohl’s, Macy’s and Nordstrom each had between $4.0 billion and $5.0 billion in revenue in women’s apparel in fiscal year 2020 and Kohl’s overtook Macy’s in women’s apparel in fiscal year 2021, while Nordstrom’s women’s apparel is its largest portfolio category.

- Each is investing in its women’s apparel; Kohl’s is revamping its women’s category with four initiatives with aims to return the category to growth and five of eight Macy’s brand launches have been focused on women.

- We expect inclusive-sized collections to perform well in 2022 as consumers have reported unwanted weight gain due to Covid-19 and plus-size categories have been underpenetrated.

- We expect JCPenney and Macy’s to both perform in this category, particularly JCPenney as it has inclusive-sized offerings for the entire family.

- We expect announcements of retail shop-in-shop partnerships given the success of Sephora at Kohl’s and other retail partnerships across the retail industry.

- There are opportunities for real estate firms to work with department stores and retailers to identify growth opportunities.