Nitheesh NH

Introduction

What’s the Story? Total addressable markets (TAMs), also known as total available markets, refer to the whole revenue prospects foreseen for specific products or services. TAMs help retailers prioritize the available customer segments, target geography, business prospects and products or services by linking the potential for revenue and profit generation. In this report, we analyze how US apparel and footwear specialty retailers are growing their TAMs through organic means, such as entering new geographies and expanding product categories, consumer segments and distribution channels, as well as through inorganic means, such as mergers and acquisitions (M&A). Why It Matters The Covid-19 pandemic has prompted many apparel and footwear specialty retailers to rethink their strategies and business models to recover from the crisis and thrive on an ongoing basis. One crucial tactic retailers are adopting now is growing their TAMs—the companies’ annual revenues if they sell their products to everyone in their target markets. Targeting a larger TAM has become important in the current highly competitive US apparel and footwear retail landscape—where retailers are fiercely competing to increase their market penetrations through the launch of new product categories and adding new customers to their target audiences, as well as developing markets by expanding their geographic reach, both domestically and internationally. In addition, aiming for a larger TAM makes sense as we expect the overall US apparel and footwear specialty retail sector, although continuing to remain strong in 2022, to see an almost flat sales CAGR from 2022 to 2026: From 2022 to 2026, Coresight Research estimates the US apparel, footwear and accessories specialty sector will experience a sales CAGR of 0.4%, reaching $325 billion by 2026. Expanding their TAMs can help retailers effectively increase the maximum amount of revenue they can possibly attain by grabbing market shares from the current incumbents in both the domestic and international markets. For instance, while Victoria’s Secret remains dominant in the women’s underwear category, the retailer is growing its TAM by expanding its assortments, including activewear and dresses, where the company holds a minor presence in terms of market share. A smaller TAM can limit growth even if the retailer becomes the leading player in it. However, retailers looking to expand their TAMs must take into consideration the current mix of macroeconomic situations, supply chain disturbances and geopolitical uncertainty.Seizing New Opportunities in Fashion: Coresight Research Analysis

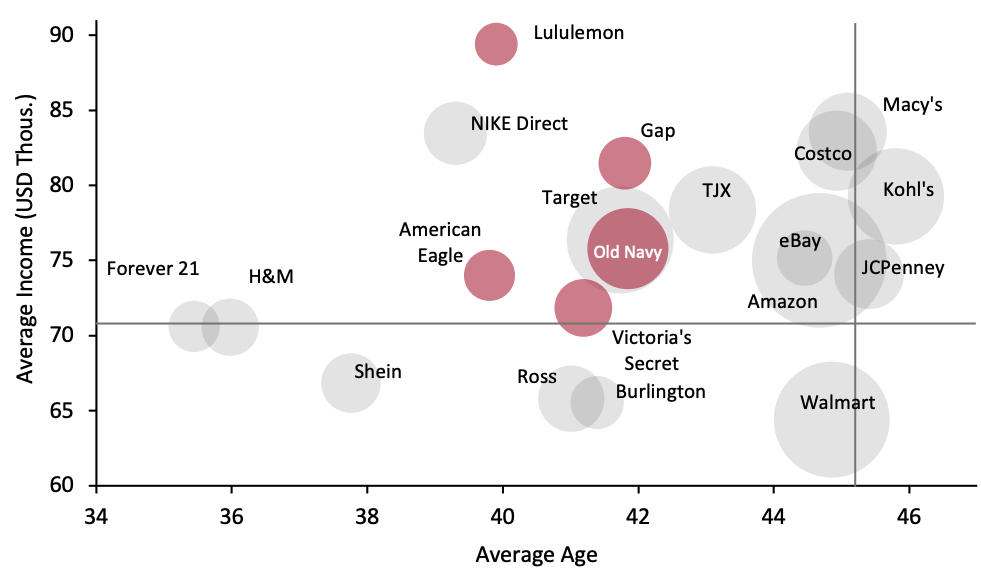

In the following sections, we focus on shopper profiles and strategies adopted by five leading US-focused apparel and footwear specialty retailers—American Eagle Outfitters, Gap Inc., Foot Locker, Lululemon Athletica and Victoria’s Secret—to expand their TAMs. These retailers sell a wide range of apparel, footwear and accessories, including activewear, athleisure, bottoms, casualwear, dresses, intimates, leather shoes, loungewear, nightwear, swimwear and tops. Shopper Profiles In this section, we assess the target audiences of American Eagle Outfitters, Gap Inc., Foot Locker, Lululemon Athletica and Victoria’s Secrets in detail. Analyzing a target audience is at the core of any retailer’s TAM growth because target audiences are what drives the companies’ product expansion and effective marketing strategies, elevates brand equity and eventually improves a retailer’s topline and bottom line. American Eagle Outfitters: American Eagle Outfitters’ customers are, on average, younger but slightly less affluent than Gap Inc. and Lululemon’s customers, according to Coresight Research analysis. The average age of American Eagle (AE) banner’s 18+ customers is the late 30s, with an average annual income of nearly $75,000, according to Coresight Research’s analysis of our February 2022 survey of US clothing and footwear shoppers; note that our survey was conducted only among those aged 18+, which is likely to skew the average higher versus actual shoppers, which will include some element of under 18s. As compared to AE, Aerie banner consumers are much younger—the average age of the Aerie brand’s customers is 20, according to company reports. Although American Eagle Outfitters is expanding its geographic reach, including opening new stores in India, for the purposes of growing its TAM, its target audience, especially for the Aerie banner, remains narrow as compared to other specialists such as Gap Inc. We believe the company should pursue opportunities, including launching new categories, to widen its target audience and cater to customers of all ages, instead of just focusing on younger consumers. Gap Inc.: Gap Inc.’s customers are more affluent compared to American Eagle Outfitters, and this is likely to be, in part, a reflection of the age profile. The average age of Gap and Old Navy banners is in the early 40s, with an average annual income of more than $80,000 and $75,000, respectively, according to Coresight Research’s February 2022 survey data. Lately, Gap has taken notable initiatives to broaden its customer base. For instance, in 2021 and year-to-date in 2022, Gap, in strategic collaboration with Kanye West’s streetwear brand Yeezy and Spanish luxury fashion company Balenciaga, launched several new apparel collections, which is helping the specialty retailer to acquire new customers, mainly Gen Z. We discuss these strategic partnerships in more detail later in the report. Foot Locker: Foot Locker mainly targets younger audiences and the average age of its customers is 25, according to the company reports. In its recent earnings calls, the retailer noted that it is broadening its customer base by expanding its apparel offerings, including through the launch of two private-label apparel brands, LCKR and Cozi, in late 2021. In addition, in the first quarter of the fiscal 2022 earnings call held in May 2022, Foot Locker noted that WSS (a US-based athletic apparel retailer acquired by Foot Locker in December 2021) brings an expanded and distinct shopper base rooted in an increasingly Hispanic community to the company. Lululemon: Like AE, Lululemon’s customers are also in the late 30s, but are more affluent than not only AE, but also the customers of Gap and Old Navy banners—the average annual income of Lululemon’s customers is nearly $90,000, according to Coresight Research analysis. At its Analyst Day, held in April 2022, the retailer noted that it is looking to widen its global customer base by expanding its golf apparel and footwear categories, and growing its presence in the Chinese apparel and footwear retail market. Victoria’s Secret: Like Gap and Old Navy banners, Victoria’s Secret’s customers are in their early 40s, older than AE’s customers; however, as compared to AE, Gap and Old Navy, Victoria’s Secret’s customers are less affluent, with an average annual income of slightly over $70,000, according to Coresight Research’s February 2022 survey data. In addition, Victoria’s Secret’s customers are older than Aerie’s customers (Victoria’s Secret’s key competitor in the women’s underwear category), but the former is taking substantial steps to attract younger consumers. For instance, in April 2022, Victoria’s Secret launched a new online-only underwear sub-brand Happy Nation for pre-teens aged 8–13. Narrowing their focus to a core target audience helps retailers to develop effective product, pricing and promotion strategies—that in turn drives topline growth. However, to maintain the strong growth momentum—both in domestic and international markets—retailers should also pursue opportunities to expand their target audience by boosting product innovations and growing their merchandise categories. In the next section, we evaluate key strategies adopted by US apparel and footwear specialty retailers—with a focus on American Eagle Outfitters, Gap Inc., Foot Locker, Lululemon and Victoria’s Secret—which will help them to reach their goals of widening their customer bases and expanding their TAMs.Figure 1. Apparel/Footwear Shopper Profiles for American Eagle, Gap, Lululemon, Old Navy and Victoria’s Secret vs. Selected Competitors: Average Age and Average Annual Household Income (USD Thous.) [caption id="attachment_149681" align="aligncenter" width="700"]

Base: 1,998 US respondents aged 18+ that had bought clothing or footwear in the past 12 months, surveyed in February 2022

Base: 1,998 US respondents aged 18+ that had bought clothing or footwear in the past 12 months, surveyed in February 2022Bubble sizes represent the number of shoppers; cross-hairs represent the average of all those who had bought clothing or footwear in the past 12 months; all averages exclude under-18s; averages calculated using midpoints of age/income bands

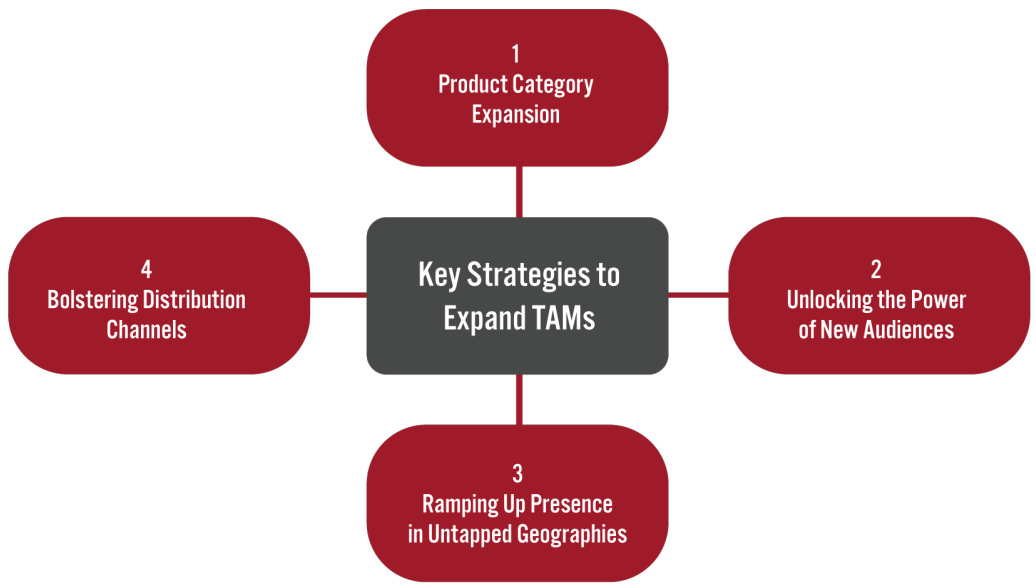

Source: Coresight Research[/caption] Key Strategies to Expand TAMs We assess four key strategies that US apparel and footwear specialty retailers are adopting to expand their TAMs. We summarize these strategies in Figure 2 and discuss each in detail below, with recent examples.

Figure 2. Key Strategies Adopted by Apparel and Footwear Specialists to Expand Their TAMs [caption id="attachment_149683" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

1. Product Category Expansion

US apparel and footwear specialty retailers are expanding their reach to more of the market by growing new product categories, mainly a complimentary segment where these retailers are able to sell to the same type of shoppers with the same go-to-market team. We believe that this can help retailers acquire new customers while selling more products to the existing customers.

Below, we provide case examples of three US-focused apparel and footwear specialists that are expanding their category offerings to boost their revenues and profit potential.

Source: Coresight Research[/caption]

1. Product Category Expansion

US apparel and footwear specialty retailers are expanding their reach to more of the market by growing new product categories, mainly a complimentary segment where these retailers are able to sell to the same type of shoppers with the same go-to-market team. We believe that this can help retailers acquire new customers while selling more products to the existing customers.

Below, we provide case examples of three US-focused apparel and footwear specialists that are expanding their category offerings to boost their revenues and profit potential.

- Footwear specialty retailer Foot Locker is rapidly growing its apparel category to gain a share of the market. US clothing store sales continue to remain strong so far in 2022. We expect clothing store sales to increase by an approximate mid-single-digit percentage year over year to reach nearly $210 billion in 2022. Foot Locker sees private labels as a means to expand its clothing business, such as by unveiling its first private-label apparel brand, LCKR by Foot Locker, in October 2021 after a three-year break from launching new footwear brands. Two months after revealing LCKR, Foot Locker debuted another private label, a womenswear brand called Cozi in December 2021. The company is seeing strong growth momentum in its apparel business. In the first quarter of the fiscal 2022 earnings call held in May 2022, Foot Locker’s CEO Richard Johnson stated Our efforts to grow our apparel and accessories business continue to yield results with the categories well outpacing footwear once again, comping up over 10% despite difficult year-over-year comparisons. Private label continues to be an important driver of our apparel business with Locker and Cozi continuing to gain traction in their early days and co-created brands like All City and Melody Ehsani performing well with new drops in March and April. In addition, the company’s focus on acquisitions, such as that of US-based clothing retailer Eurostar (WSS) for $750 billion in September 2021, will help it to expand its presence in the apparel category.

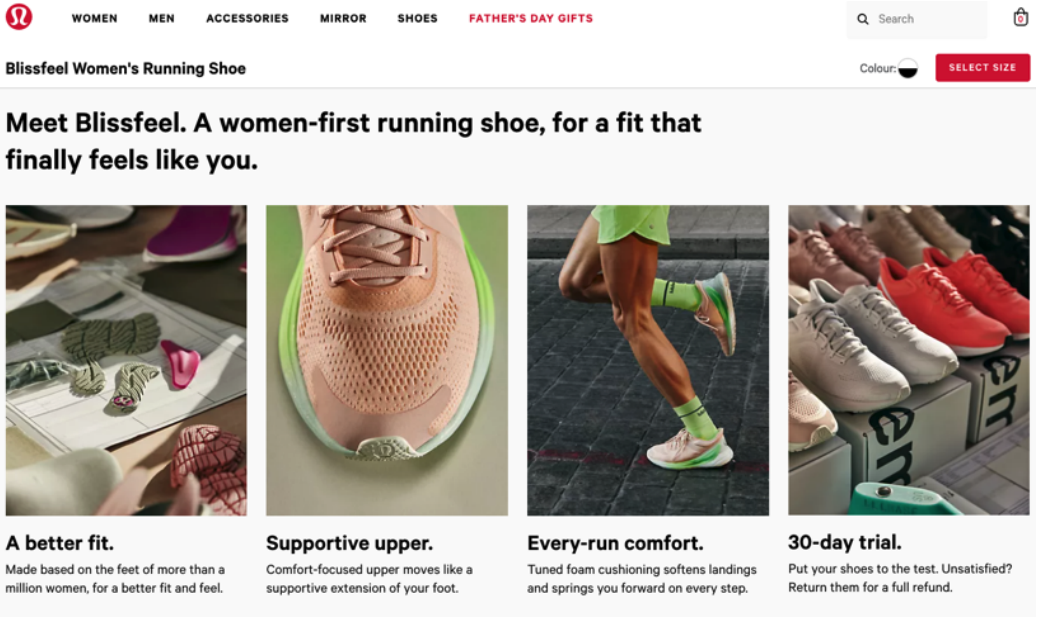

- Apparel specialist Lululemon Athletica aims to expand its TAM by growing its newer categories, including footwear, as stated by the company at its Analyst Day event, held in April 2022. Coresight Research estimates that sales by US footwear specialists will be almost flat at about $39 billion in 2022. From 2022 to 2025, we expect the sector to witness a stabilized sales CAGR of 1.3%. Lululemon Athletica plans to ramp up its private labels to grow its footwear business. For instance, in March 2022, the company launched Blissfeel, Lululemon Athletica’s first-ever owned sneakers for women—available across selected stores in the US, the UK and China. Moreover, Lululemon Athletica plans to launch men’s Blissfeel shoes in 2023.

Lululemon Athletica launched its first-ever owned sneakers for women in March 2022.

Lululemon Athletica launched its first-ever owned sneakers for women in March 2022.Source: Lululemon Athletica[/caption]

- Victoria’s Secret has also expanded into various new product categories recently. In October 2021, Victoria’s Secret launched its first mastectomy bra for women who undergo mastectomies due to breast cancer. Prior to that, in August 2021, Victoria’s Secret launched its Bare Infinity Flex bra with an innovative gel wire technology that helps the bra extend and retract to adapt to breast shape and structure as it fluctuates daily or monthly. Earlier, in July 2021, the company launched its first maternity bra and sold 100,000 units in one week. We believe that product category extensions by retailers will help them to substantially expand their TAMs and will give them an edge against competitors—mainly against those retailers that primarily focus on niche businesses and do not maintain versatility. However, we suggest retailers looking to expand their product categories take into account overhead expenses, such as sales, general, administrative and distribution expenses, in addition to potential revenues.

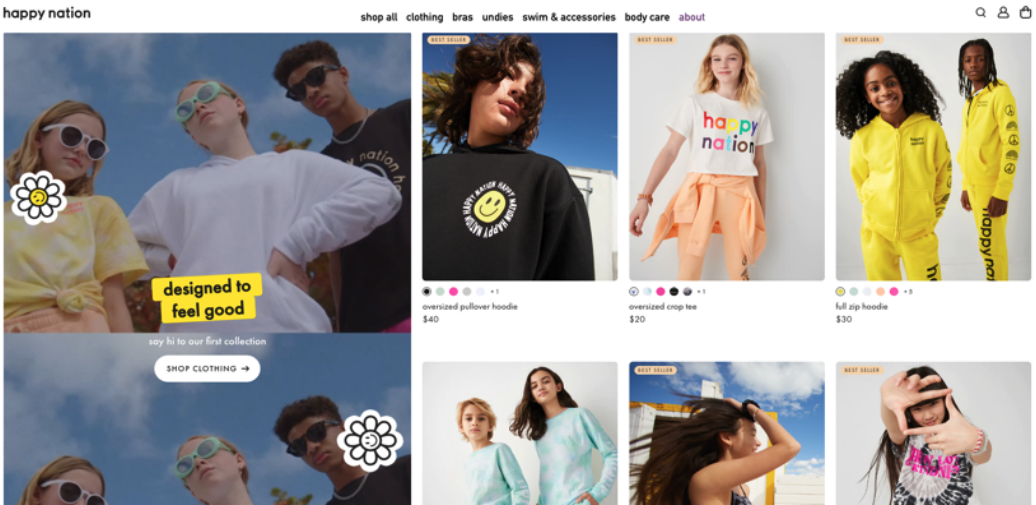

Victoria’s Secret launched Happy Nation, a sub-brand, in April 2022 to tap into the tween market.

Victoria’s Secret launched Happy Nation, a sub-brand, in April 2022 to tap into the tween market.Source: Happy Nation[/caption] Likewise, Gap Inc.’s recent launches of new apparel collections, in collaboration with Kanye West’s streetwear brand Yeezy, have helped the retailer acquire new customers. In the third quarter of fiscal 2021 earnings call held in November 2021, Gap Inc.’s management said that more than 70% of the customers buying the Yeezy x Gap collection were new to the company, particularly Gen Z and Gen X consumers from diverse backgrounds. In addition, in February 2022, Gap and Yeezy, in partnership with the Spanish luxury fashion company Balenciaga, launched a new collection, Yeezy x Gap by Balenciaga—which gained strong traction among Gap’s customer bases. In the first quarter of the fiscal 2022 earnings call held in May 2022, Gap noted that Yeezy x Gap by Balenciaga has created a huge brand buzz and driven urgency among shoppers—generating 6.6 billion media impressions in the first quarter. The Gap–Yeezy collaboration is a 10-year deal signed by the two companies in June 2020. The deal has a renewal option in June 2025—within five years of signing the agreement. At the five-year point, Gap Inc. expects the Yeezy x Gap collection to generate $1 billion in annual sales. While unlocking the power of new audiences, apparel and footwear specialty retailers must keep in mind that the new consumer segment may have different expectations of product quality and customer service than the existing customer segment. Nevertheless, retailers can capitalize on market presence and awareness in one consumer segment to launch into another. 3. Ramping Up Presence in Untapped Geographies Apparel and footwear specialty retailers are expanding their geographic reach into untapped zones, both domestically and internationally, through new store openings as well as joint venture agreements. Below, we provide examples of four retailers who are ramping up their international expansions.

- In May 2022, American Eagle Outfitters announced a plan to expand in India, with the opening of 50 new AE stores in the next three years. Consumer spending on apparel in India is witnessing considerable recovery. Coresight Research estimates that consumer spending on apparel in India increased by an estimated 7.5% to reach $74.8 billion in fiscal 2022 (ended March 31, 2022). We expect to see increased consumer spending in the years following, with a return to pre-pandemic growth levels by fiscal 2025: We estimate that consumer spending on apparel will reach $97.1 billion by fiscal 2025, at a CAGR of 9.1% between fiscal 2022 and fiscal 2025.

- In March 2022, Gap, in a joint venture with the UK-based apparel specialist Next Plc, opened the first Gap-branded shop-in-shop store within Next’s largest store in Central London, with the retail space covering more than 4,000 square feet. The joint venture, officially announced in September 2021, is a significant part of Gap’s strategy to expand its presence in the UK and the Republic of Ireland. The UK’s apparel and footwear specialty retail sector is seeing substantial recovery. Coresight Research estimates the UK’s apparel and footwear specialty retail sales to see 10.0% growth in 2022, reaching $65 billion. We estimate that between 2022 and 2026, the sector will grow at a more stabilized rate, at a 2.5% CAGR, reaching $72 billion by 2026.

In March 2022, Gap Inc., through a joint venture agreement with Next, opened its first UK shop-in-shop store.

In March 2022, Gap Inc., through a joint venture agreement with Next, opened its first UK shop-in-shop store.Source: Gap Inc.[/caption]

- Lululemon plans to massively expand its presence in mainland China in the next five years, growing its store numbers from 70 stores in fiscal year 2021 to 220 stores by fiscal year 2026, making the country its second-largest market after North America by fiscal year 2026. Coresight Research estimates that China’s apparel and footwear specialty sector sales will reach $219 billion by 2026, at a sales CAGR of 2.4% between 2023 and 2026. In 2022, we expect the sector’s sales to see a decline of 6.5% to reach $199 billion due to the impact of strict pandemic-related restrictions.

- Victoria’s Secret has active plans to expand internationally, focusing on its key foreign regions, such as China and the UK. In January 2022, Victoria’s Secret entered a $45 million joint venture deal with China-based intimate apparel company Regina Miracle International. Under the terms of the alliance, Victoria’s Secret holds a 51% stake, while Regina Miracle holds a 49% stake. Regina Miracle has been a supplier of Victoria’s Secret for more than 20 years, and we believe that this joint venture will enhance Victoria’s Secret’s business in China.

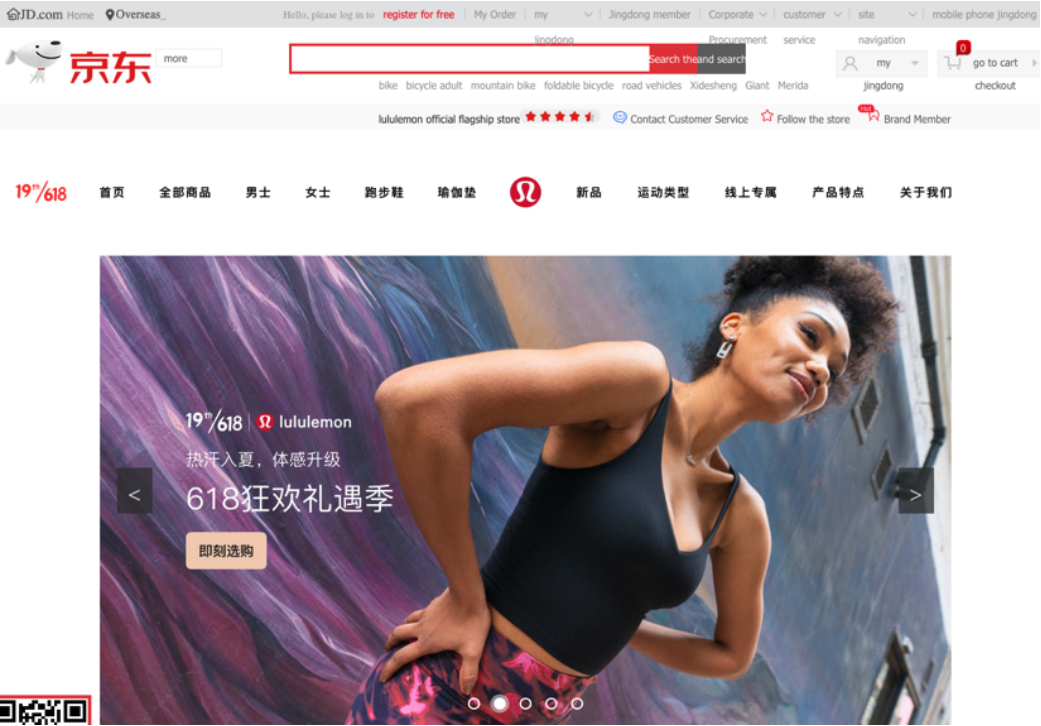

- In addition to store expansions in China (as mentioned earlier), Lululemon Athletica is also intensified its e-commerce presence in China by entering the JD.com marketplace in May 2022, following its recent success on Alibaba’s Tmall platform. The company also plans to tap into the social commerce opportunity in China through WeChat Mini programs and develop its dot cn (the country code top-level domain for China).

In May 2022, Lululemon Athletica debuted on the JD.com platform.

In May 2022, Lululemon Athletica debuted on the JD.com platform.Source: JD.com[/caption]

- Victoria’s Secret also expanded its digital channel through the launch of its new direct-to-consumer (DTC) sub-brand Happy Nation in April 2022.

What We Think

While the US apparel and footwear specialty retail sector continues to remain strong in 2022, Coresight Research estimates the sector will see almost flat sales CAGR from 2022 to 2026. We think that the time is right for retailers to develop strategies to grow their TAMs in order to expand their revenue prospects and acquire market shares from the current incumbents in both the domestic and international markets. Although expanding domestically is usually cheaper (in terms of overhead expense) than international expansion, we believe that retailers may reach a saturation point in their highly competitive home markets and need to expand internationally. In terms of international expansion, we see steady long-term revenue prospects in China, India and the UK for US-based apparel and footwear specialists. Implications for Brands/Retailers- We believe that retailers’ businesses may be suitable for expansion if their revenue streams are growing in the current target market. However, retailers should not make assumptions about their potential to succeed in a new market (locally or globally) solely on the basis of their current business growth—taking on additional overhead must be a strategic decision, which is driven by potential new sales, a reduction in overall expenses or providing a competitive edge to make the retailer a standout.

- We expect to see more strategic collaborations among global retailers and brands in the apparel and footwear retail industry in 2022 and beyond. Strategic collaborations can be vital in terms of business transformation and expansion as well as gaining long-term strategic advantage.

- We expect M&A activities involving apparel and footwear companies to be substantial in the near term. M&A can help retailers to access new technologies and expand into new consumer segments to enhance their market shares.