Nitheesh NH

Introduction

Each report in our Sector Overview series analyzes a retail sector or consumer market. In this report, we dive into the US home and home improvement segment, including hardware stores and furniture and home goods companies. This report covers:- A discussion of key sector themes

- A review of retail sector momentum

- A summary of the sector landscape, including market shares for the top retailers in their respective categories

- Outlook for the sector

Themes We’re Watching

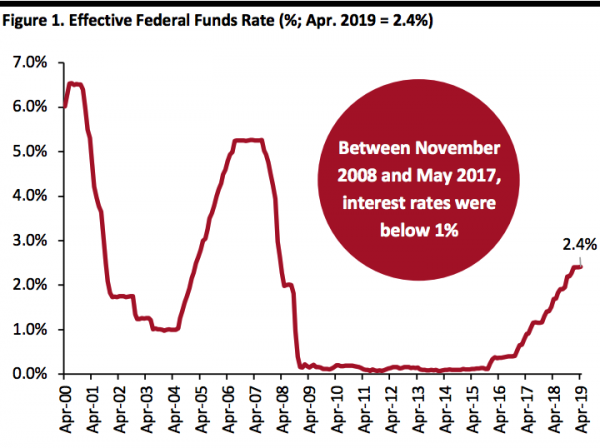

Interest Rates Set to Remain Stable After several years of near-0% interest rates aimed at combating the lingering effects of the global financial crisis, the US Federal Reserve (“the Fed”) embarked on a steady stream of interest rate increases, and early indications from the Fed were that the rise in interest rates would continue in 2019 and 2020. Against the context of a slowdown in growth, however, the Fed announced in its March 2019 meeting that it does not expect to increase interest rates for the rest of the year. Moreover, just one hike is currently anticipated for 2020, which is good news for the home and home improvement sector. The Fed’s announcement stands in stark contrast to its previous plan to raise interest rates three times in 2019, with subsequent increases in the years to follow. [caption id="attachment_89902" align="aligncenter" width="600"] Source: Board of Governors of the Federal Reserve System (US)[/caption]

Has US Consumer Confidence Peaked?

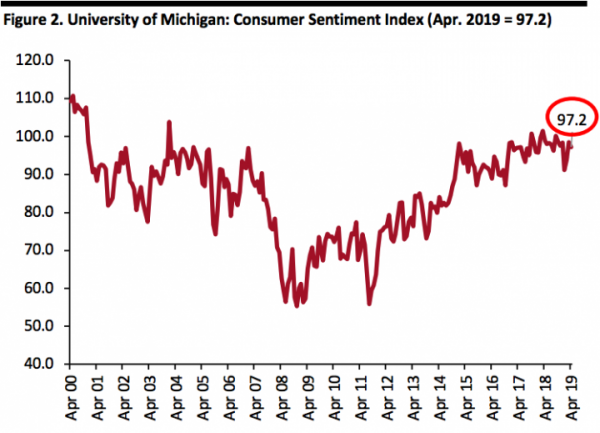

The University of Michigan Consumer Sentiment Index has been on the rise after dipping to a relative trough of 55.8 in August 2011. However, since reaching 101.4 in March 2018, the index has failed to set new highs and appears to have peaked. Moreover, the index has not crossed above the 100 threshold since September 2018.

In 2019, after a tepid start in January and February with scores of 91.2 and 93.8, respectively, the index rose to 98.4 in March but dipped to 97.2 in April.

Consumer spending experienced a slowdown in the first quarter and the Fed expects this weakness to continue through the year. This comes despite GDP growing at an annual rate of 3.2% during the quarter as reported by the US Bureau of Economic Analysis. The higher-than-anticipated GDP growth was significantly influenced by stronger state and local government spending, lower imports and higher business inventories. The Fed expects the GDP growth rate for 2019 to be 2.1% (down from 2.9% in 2018) and projects a 1.9% rate for 2020.

[caption id="attachment_89903" align="aligncenter" width="600"]

Source: Board of Governors of the Federal Reserve System (US)[/caption]

Has US Consumer Confidence Peaked?

The University of Michigan Consumer Sentiment Index has been on the rise after dipping to a relative trough of 55.8 in August 2011. However, since reaching 101.4 in March 2018, the index has failed to set new highs and appears to have peaked. Moreover, the index has not crossed above the 100 threshold since September 2018.

In 2019, after a tepid start in January and February with scores of 91.2 and 93.8, respectively, the index rose to 98.4 in March but dipped to 97.2 in April.

Consumer spending experienced a slowdown in the first quarter and the Fed expects this weakness to continue through the year. This comes despite GDP growing at an annual rate of 3.2% during the quarter as reported by the US Bureau of Economic Analysis. The higher-than-anticipated GDP growth was significantly influenced by stronger state and local government spending, lower imports and higher business inventories. The Fed expects the GDP growth rate for 2019 to be 2.1% (down from 2.9% in 2018) and projects a 1.9% rate for 2020.

[caption id="attachment_89903" align="aligncenter" width="600"] Source: University of Michigan[/caption]

Building Materials and Garden Equipment Stores Lead Retail Growth

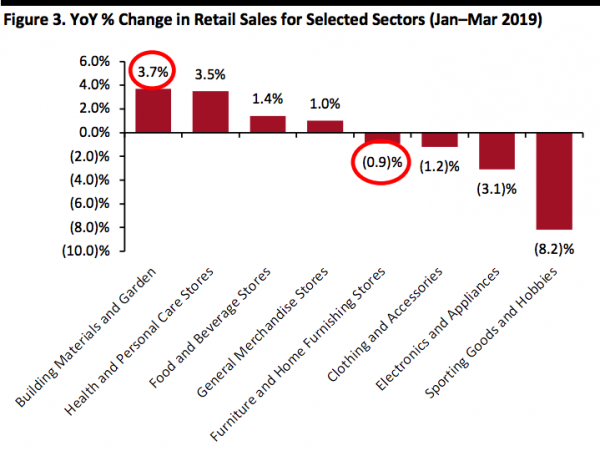

In the first three months of 2019, building materials and garden equipment was the strongest-performing retail sector, according to data from the US Census Bureau. Furniture and home furnishing stores declined by 0.9% year over year during the period against a backdrop of a general slowdown in consumer spending. In 2018, furniture and home furnishing stores were among the better-performing sectors, registering 3.5% growth.

[caption id="attachment_89904" align="aligncenter" width="600"]

Source: University of Michigan[/caption]

Building Materials and Garden Equipment Stores Lead Retail Growth

In the first three months of 2019, building materials and garden equipment was the strongest-performing retail sector, according to data from the US Census Bureau. Furniture and home furnishing stores declined by 0.9% year over year during the period against a backdrop of a general slowdown in consumer spending. In 2018, furniture and home furnishing stores were among the better-performing sectors, registering 3.5% growth.

[caption id="attachment_89904" align="aligncenter" width="600"] Source: US Census Bureau[/caption]

Data on Housing Permits, Starts and Completions Are Mixed but Remain at a High Level

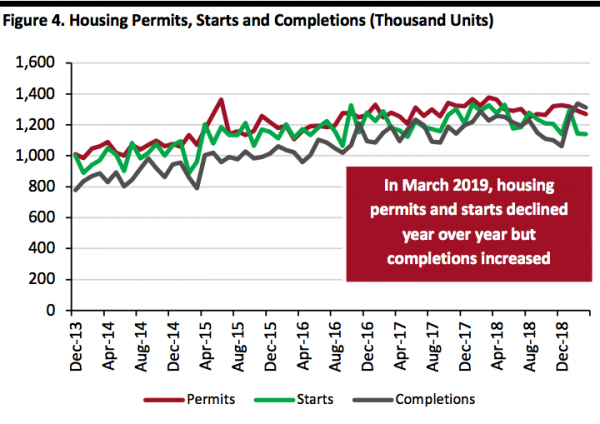

Data on new housing permits, starts and completions offer mixed results, with housing permits and starts down year over year and completions up during the same period.

In March, authorized housing permits declined 1.7% month over month and 7.8% year over year, according to US Census Bureau data. Housing starts fell 0.3% month to month but declined by 14.2% year over year. Housing completions, however, declined 1.9% month to month but grew by 6.8% year over year.

[caption id="attachment_89905" align="aligncenter" width="600"]

Source: US Census Bureau[/caption]

Data on Housing Permits, Starts and Completions Are Mixed but Remain at a High Level

Data on new housing permits, starts and completions offer mixed results, with housing permits and starts down year over year and completions up during the same period.

In March, authorized housing permits declined 1.7% month over month and 7.8% year over year, according to US Census Bureau data. Housing starts fell 0.3% month to month but declined by 14.2% year over year. Housing completions, however, declined 1.9% month to month but grew by 6.8% year over year.

[caption id="attachment_89905" align="aligncenter" width="600"] Source: US Census Bureau[/caption]

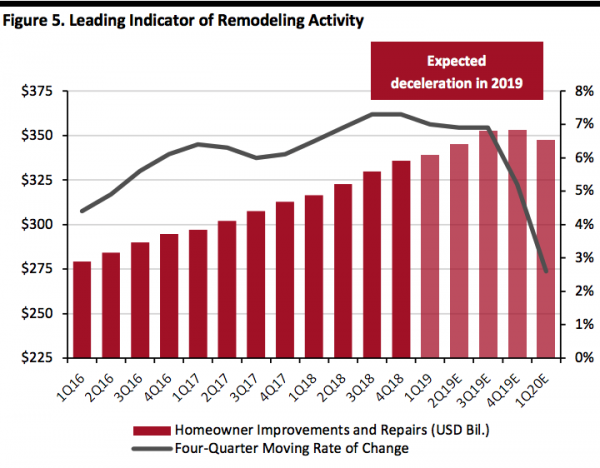

Growth Rate of Spending on Home Improvement Is Expected to Slow

Annual growth in spending on home improvement and repair is expected to decelerate in 2019, in light of cooling housing price gains and flat home sales, according to the Joint Center for Housing Studies of Harvard University. However, more favorable mortgage rates might give a fillip to home sales and refinancing over spring and summer this year and thereby boost spending in remodeling.

[caption id="attachment_89906" align="aligncenter" width="600"]

Source: US Census Bureau[/caption]

Growth Rate of Spending on Home Improvement Is Expected to Slow

Annual growth in spending on home improvement and repair is expected to decelerate in 2019, in light of cooling housing price gains and flat home sales, according to the Joint Center for Housing Studies of Harvard University. However, more favorable mortgage rates might give a fillip to home sales and refinancing over spring and summer this year and thereby boost spending in remodeling.

[caption id="attachment_89906" align="aligncenter" width="600"] Source: Joint Center for Housing Studies of Harvard University[/caption]

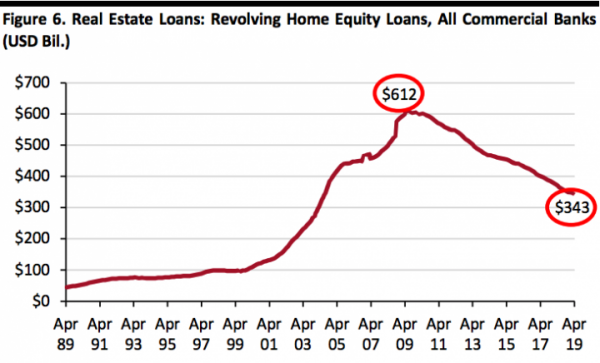

Total Home Equity Loans Still Declining from Peak in 2009

Total US home equity loans stood at $343 billion in April 2019, down 78.5% from the peak of $612 billion in May 2009, reflecting lower debt levels among US homeowners but offering additional firepower for future home improvements. Total US home equity loans are shown in the figure below.

[caption id="attachment_89907" align="aligncenter" width="600"]

Source: Joint Center for Housing Studies of Harvard University[/caption]

Total Home Equity Loans Still Declining from Peak in 2009

Total US home equity loans stood at $343 billion in April 2019, down 78.5% from the peak of $612 billion in May 2009, reflecting lower debt levels among US homeowners but offering additional firepower for future home improvements. Total US home equity loans are shown in the figure below.

[caption id="attachment_89907" align="aligncenter" width="600"] Source: Board of Governors of the Federal Reserve System (US)[/caption]

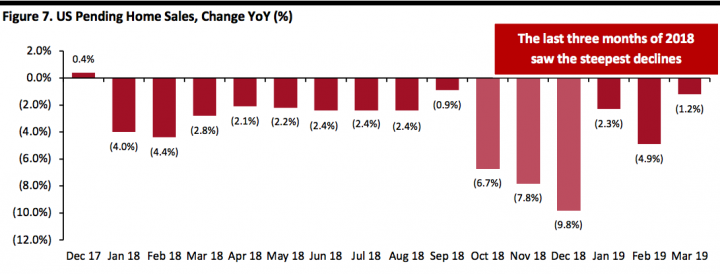

Slowdown Continues in US Existing Home Sales

Pending new home sales experienced a 1.2% decline in March 2019, the 14th consecutive month of decline since December 2017. Year-over-year declines were particularly steep in the last three months of 2018 likely due to elevated home prices and higher mortgage rates, keeping potential buyers on the sidelines. Despite a significant drop in mortgage rates since the start of 2019, the housing slowdown has continued. Following the Fed’s March announcement that it expects no more hikes this year, it remains to be seen what will become of the trend. The decline in existing home sales could dampen demand for home renovations and improvements.

[caption id="attachment_89908" align="aligncenter" width="720"]

Source: Board of Governors of the Federal Reserve System (US)[/caption]

Slowdown Continues in US Existing Home Sales

Pending new home sales experienced a 1.2% decline in March 2019, the 14th consecutive month of decline since December 2017. Year-over-year declines were particularly steep in the last three months of 2018 likely due to elevated home prices and higher mortgage rates, keeping potential buyers on the sidelines. Despite a significant drop in mortgage rates since the start of 2019, the housing slowdown has continued. Following the Fed’s March announcement that it expects no more hikes this year, it remains to be seen what will become of the trend. The decline in existing home sales could dampen demand for home renovations and improvements.

[caption id="attachment_89908" align="aligncenter" width="720"] Source: National Association of Realtors[/caption]

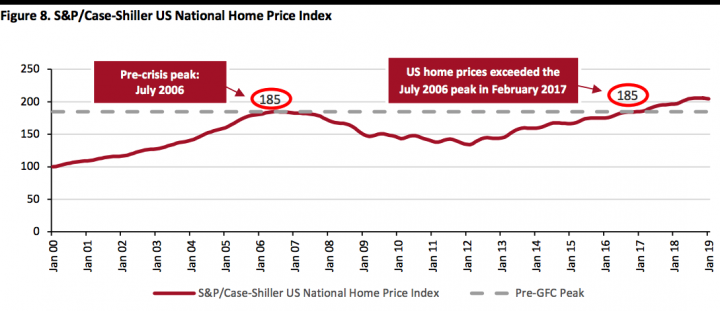

US Home Prices Exceed Pre-Global Financial Crisis Levels

In February 2017, US home prices, based on the S&P/Case-Shiller index, exceeded their pre-global financial crisis peak. The latest data release shows that the rate of increase in home prices is continuing to slow, with January reporting a year-over-year increase of 4.2%, compared with the 6.3% increase reported in January 2018.

[caption id="attachment_89909" align="aligncenter" width="720"]

Source: National Association of Realtors[/caption]

US Home Prices Exceed Pre-Global Financial Crisis Levels

In February 2017, US home prices, based on the S&P/Case-Shiller index, exceeded their pre-global financial crisis peak. The latest data release shows that the rate of increase in home prices is continuing to slow, with January reporting a year-over-year increase of 4.2%, compared with the 6.3% increase reported in January 2018.

[caption id="attachment_89909" align="aligncenter" width="720"] Note: Index Jan 2000=100; not seasonally adjusted

Note: Index Jan 2000=100; not seasonally adjustedSource: S&P Dow Jones Indices[/caption] Lowe’s Revamped Management Targets Operational Improvements Lowe’s experienced an overhaul of senior management in 2018. Chairman, President and CEO Robert Niblock announcing his retirement in March 2018, followed by CFO Marshall Croom in June 2018. The company named Marvin Ellison, former chairman and CEO of JCPenney, as its new president and CEO, effective July 2, 2018. David Denton, former EVP and CFO of CVS Health, was named CFO in August 2018. Upon assuming his new position, Ellison undertook a detailed reassessment of the business and started implementing process and technology improvement strategies to:

- Engage customers

- Drive merchandising excellence

- Deliver a seamless, omnichannel experience

- Maximize operational efficiency

- Total sales growth of 2% (versus 4% in 2018)

- Comparable store sales growth of 3% (compared to 2.5%)

- Operating margins to increase 235–250 basis points (compared with a decrease of 135–150 basis points)

- Adjusted EPS of $6.00–$6.10 (versus $5.08–$5.14), an increase of 17%–20%

Source: S&P Capital IQ[/caption]

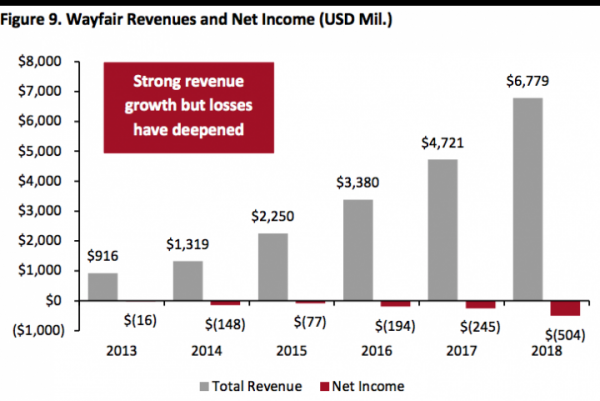

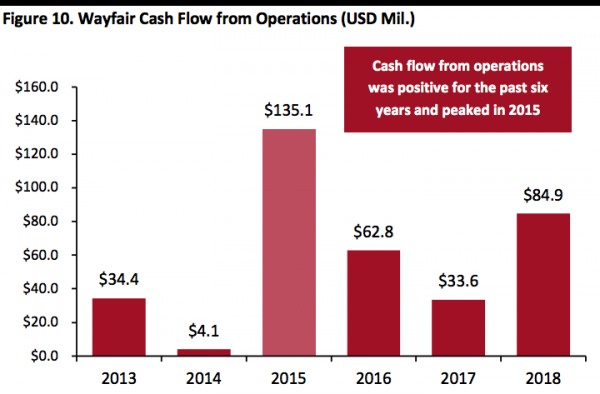

In our view, Wayfair continues to be in a position where it can afford its lack of profitability, though a lack of liquidity could limit the company’s future options. That said, capital markets remain open: Wayfair raised $319 million in its IPO and sold $375 million of convertible notes in September 2017. Moreover, there is more to the picture than just net income. Wayfair generated positive cash flow from operations for the past six years, including 2018.

[caption id="attachment_89911" align="aligncenter" width="600"]

Source: S&P Capital IQ[/caption]

In our view, Wayfair continues to be in a position where it can afford its lack of profitability, though a lack of liquidity could limit the company’s future options. That said, capital markets remain open: Wayfair raised $319 million in its IPO and sold $375 million of convertible notes in September 2017. Moreover, there is more to the picture than just net income. Wayfair generated positive cash flow from operations for the past six years, including 2018.

[caption id="attachment_89911" align="aligncenter" width="600"] Source: S&P Capital IQ[/caption]

Source: S&P Capital IQ[/caption]

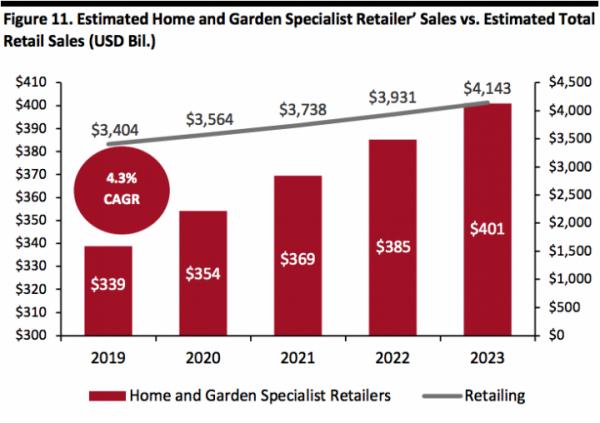

Sector Momentum

Sector Size and Growth The US retail market is expected to grow at 5% compound annual growth rate (CAGR) during 2019–2023, with Internet-based retail raising the aggregate average, according to data from Euromonitor International. During this period, the home and garden specialist sector is forecast to grow at a slightly slower 4.3% CAGR. [caption id="attachment_89912" align="aligncenter" width="600"] Source: Euromonitor International/Coresight Research[/caption]

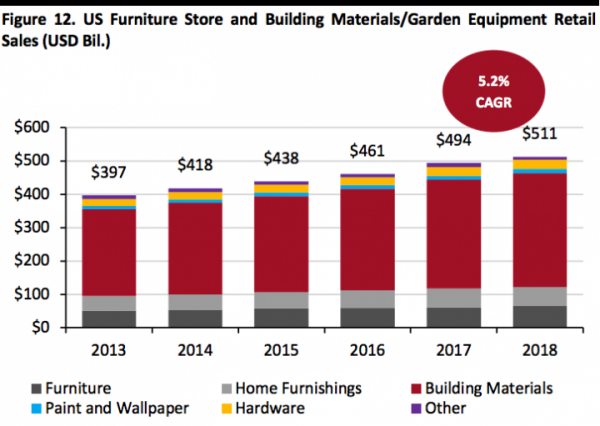

The graph below includes data for US furniture store and building materials/garden equipment retail sales, which together amounted

to $511 billion in 2018 and grew at a 5.2% CAGR during 2013–2018.

[caption id="attachment_89913" align="aligncenter" width="600"]

Source: Euromonitor International/Coresight Research[/caption]

The graph below includes data for US furniture store and building materials/garden equipment retail sales, which together amounted

to $511 billion in 2018 and grew at a 5.2% CAGR during 2013–2018.

[caption id="attachment_89913" align="aligncenter" width="600"] Source: US Census Bureau/Coresight Research[/caption]

Headwinds and Tailwinds

Sector Headwinds

Source: US Census Bureau/Coresight Research[/caption]

Headwinds and Tailwinds

Sector Headwinds

- The slowdown in consumer spending in the first quarter of 2019 and a dip in consumer confidence may mean that the sector may experience stunted growth.

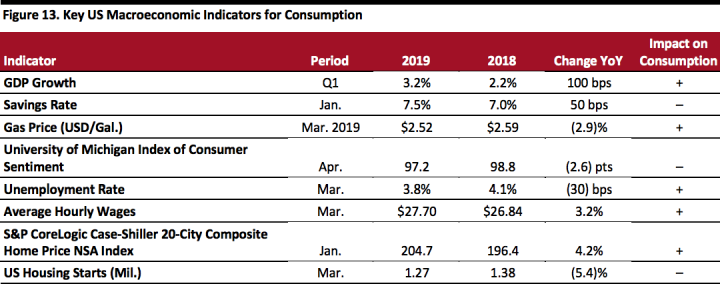

- US macroeconomic drivers remain generally strong for consumption, as shown by the multiple positive factors in the table below, although offset to some extent by unfavorable savings rates, consumer sentiment and housing starts.

- The Federal Reserve’s announcement in March that further hikes in interest rates this year are unlikely came as a welcome development for the home and home improvement sector.

Source: US Bureau of Labor Statistics/University of Michigan/US Energy Information Administration/S&P Dow Jones/US Bureau of Economic Analysis/Coresight Research[/caption]

Consumers continue to show a preference for experiences, and particularly upgrading their living conditions. This trend has existed for several years and is likely to persist, as it aligns with the preferences of millennials, whose incomes are increasing and who therefore have a growing influence on the consumer economy.

Source: US Bureau of Labor Statistics/University of Michigan/US Energy Information Administration/S&P Dow Jones/US Bureau of Economic Analysis/Coresight Research[/caption]

Consumers continue to show a preference for experiences, and particularly upgrading their living conditions. This trend has existed for several years and is likely to persist, as it aligns with the preferences of millennials, whose incomes are increasing and who therefore have a growing influence on the consumer economy.

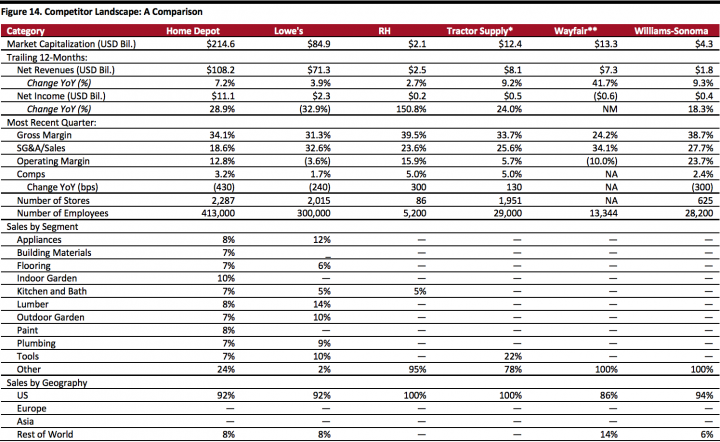

Competitive Landscape

Market Shares The table below evaluates retailers covered in this report based on revenues, margins, net income, and comps and compares their sales by segment and geography. [caption id="attachment_89915" align="aligncenter" width="720"] Note: *Quarter ended March 30, 2019;**Quarter ended March 31, 2019; other companies have not reported first quarter earnings.

Note: *Quarter ended March 30, 2019;**Quarter ended March 31, 2019; other companies have not reported first quarter earnings.Source: Company reports/S&P Capital IQ/Coresight Research[/caption] Innovators and Disruptors While a public company, Wayfair is a disruptor in the furniture market with its online business model, and it is set to open its first full-fledged brick-and-mortar store later this year. As in many other sectors, large e-commerce companies such as Amazon are aggressively increasing furniture offerings, and other big retailers with a substantial Internet presence are expanding online furniture offerings as well. Other potential competitors include:

- Houzz, which operates a platform that connects homeowners, home design enthusiasts, and home improvement professionals globally. Local businesses and national brands can offer to advertise on its platform, and professionals can increase their online presence with professional profiles.

- Thumbtack, which operates a US online marketplace to hire workers for painting, remodeling and a variety of other tasks.