albert Chan

Introduction

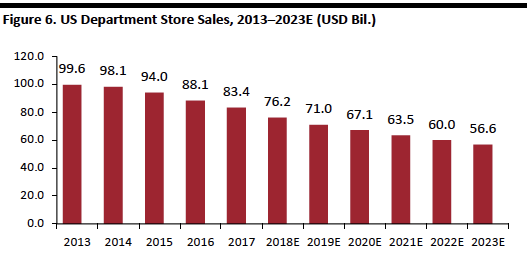

The $76.2 billion U.S. department store industry is going through some tough changes. Over the last five years, sales through U.S. department stores fell 23.5%, or $23.2 billion, from $96.6 billion in 2013 to $76.2 billion in 2018, according to Euromonitor International; these figures exclude online sales made by department store retailers. This dramatic decrease can be attributed to falling underlying sales combined with a substantial number of department store closures. Euromonitor expects the sector to continue shrinking at a compound annual growth rate of (5.8)% to 2023 to $56.6 billion. But the U.S. department store is not dead: The sector is transforming to keep up by rightsizing and adjusting to consumer preferences. The department store used to be a one-stop shop for the entire family. That model is shifting, and department stores are changing from very large mall anchor stores into smaller format stores, and by closing some stores, remodeling others and collaborating with other retailers.Themes We’re Watching

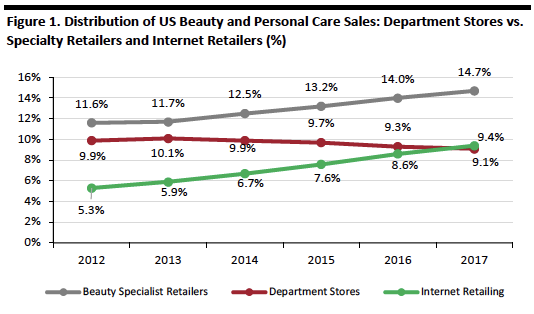

Revamped Beauty Departments to Compete with Specialty Retail and Internet Retail Department stores are revamping cosmetic departments to compete with other store-based retailers, such as specialty retailers including Ulta and Sephora, and nonstore retailers, including digitally focused, direct-to-consumer beauty brands. Department stores used to be a one-stop-shop for beauty products. Now, consumers have many alternatives for beauty products. Consumers are also looking for beauty products from other retail channels and want innovation from online brands. According to Euromonitor International, the share of U.S. beauty and personal care products captured by beauty specialty retailers grew from 11.6% in 2012 to 14.7% in 2017. The share of U.S. beauty and personal care products purchased through the Internet increased from 5.3% in 2012 to 9.1% in 2017, while department stores saw their share of the U.S. beauty and personal care market fall from 9.9% in 2012 to 9.1% in 2017. [caption id="attachment_76706" align="aligncenter" width="534"] Source: Euromonitor International[/caption]

Department stores are revamping their beauty departments to stay modern and competitive. They are modernizing departments, adding brands and beauty services, and overhauling entire floors.

Source: Euromonitor International[/caption]

Department stores are revamping their beauty departments to stay modern and competitive. They are modernizing departments, adding brands and beauty services, and overhauling entire floors.

- In September 2018, Bloomingdales launched Wellchemist, a clean beauty boutique, at its flagship store in New York as well as online and in nine other cities. The shop in shop targets the growing natural beauty consumer and adds 30 new brands to Bloomingdales that are free of sulfates, parabens and phthalates.

- In May 2018, Saks Fifth Avenue revamped the beauty floor at its flagship New York store and relocated it from the main floor to the second floor. The beauty floor is 32,000 square feet and includes more than 120 color cosmetics, skincare, fragrance and wellness brands - 58 of which are new. Saks Fifth Avenue’s new beauty floor is 40% larger and is focused on beauty experiences and includes 15 new spa rooms along with services such as medi-spa treatments, facials, massages, manicures, brow and floral services. Tracy Margolies, Chief Merchant, Saks Fifth Avenue, said the company plans to hold beauty and wellness workshops and panels in the new space.

- JCPenney has made a commitment to beauty, by adding Sephora stores to its department stores. Beginning in 2016, JCPenney started rolling out Sephora stores, and in 2017 added 70 more Sephora stores to its fleet, bringing the total to 642 – so Sephora is now in nearly 75% of its stores. The company plans to add Sephora to approximately 30 new stores in 2018. JCPenney reported that Sephora helped increase foot traffic, increase the frequency of store visits and attracted a younger audience. JCPenney is developing its beauty services offering, too. The company is rebranding its store salons as Salon by InStyle, as part of a collaboration with InStyle magazine. In 2018, JCPenney plans to rebrand and remodel another 100 salons to Salon by InStyle. Chairman and CEO, Marvin Ellison stated that when the retailer rebrands a salon, sales performance in these sales locations improves “on average by 400 basis points.” He also remarked that salon customers visit a store twice as often as non-salon customers.

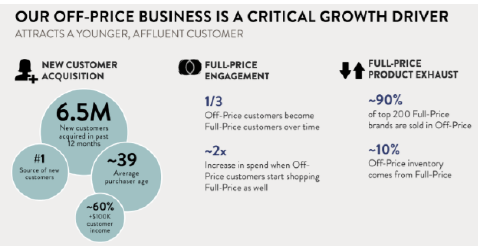

Department Stores are Focusing on Off-Price to Attract (Younger) Customers to Full Price

Department stores are expanding their off-price businesses with the hope that they will attract customers to full-price merchandise, too. Both Nordstrom and Macy’s reported they have expanded their off-price businesses, which in turn help their full-price business.- Nordstrom reported at its analyst day on July 10, 2018, that off-price revenues were approximately $5 billion, one-third of the company’s total revenues in 2017. Nordstrom says it doubled market share in off-price between 2012 and 2017. The company had 50 off-price stores in 2007, expanding to 232 by 2017, including Nordstrom Rack and Haute Look. As of July 10, 2018, the company had a total of 239 off-price stores. Nordstrom highlighted that for the next five years, off-price stores will be a key component of growth. The company emphasized that off-price is its number-one source of new customers and vendor partnerships. According to the company, the average age of the Nordstrom customer is 42, and the average age at its off-price banners is 39. Moreover, Nordstrom says its average off-price shopper is actually more affluent than its typical full-price customer. At the Goldman Sachs Investor Day conference, copresident Blake Nordstrom said the company’s digital off-price business is the fastest-growing business in the company's history and is also the biggest source of new customers at Nordstrom. Some 6.5 million new customers came to Nordstrom through its off-price business in 2018 and one-third of those customers became full-price customers over the year.

Nordstrom Investor Day Slides

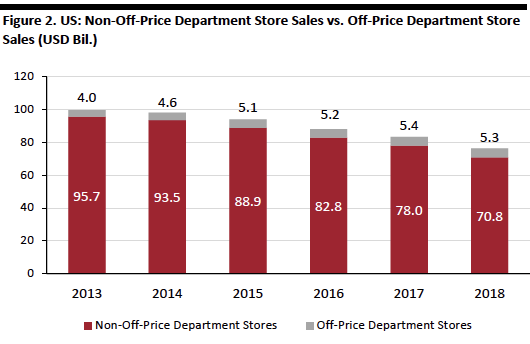

Nordstrom Investor Day SlidesSource: Company reports[/caption] Macy’s continues to increase its Backstage store departments, which are off-price departments that Macy’s has established within its eponymous department stores. On its November 14, 2018, earnings call, Macy’s announced it added 121 Backstage locations in 2018, including nearly 60 in the third quarter, and now has a total of 166 Backstage in-store locations. The company reported it is dialing up Backstage marketing with an emphasis on off-price product that is on-trend and arriving daily. Macy’s expects additional marketing will increase awareness of Backstage and bring new customers into the store. Management reported it continues to see a lift in sales across a Macy’s store when it adds a Backstage department to that store. Figure 2 shows the trend of U.S. off-price department store revenue compared to non-off-price department store revenue over the past five years. U.S. off-price department store revenues grew 35%, from $4.0 billion in 2013 to $5.3 billion in 2018, whereas non-off-price department store revenues decreased 26% from $95.7 billion in 2013 to $70.8 billion in 2018. [caption id="attachment_76708" align="aligncenter" width="530"]

Figure represent in-store sales only

Figure represent in-store sales onlySource: Euromonitor International[/caption] Department Stores are Launching Smaller Formats (and Finding Unique Partners) as Additional Revenue and Traffic Drivers In March 2018, Kohl’s announced it was rightsizing stores to a smaller format, from an average of approximately 90,000 square feet to 65,000 square feet. This format would allow the retailer to sub-lease space to complementary businesses to generate additional revenue and help to reformat stores. Kohl’s partnered with grocery discounter Aldi for the latter to take space for five to 10 of its smaller format stores. On its August 21, 2018, earnings call transcript, Kohl’s CEO Michelle Gass said that the company identified 500 department stores to be retrofitted to the smaller format and reported on the status of the store optimization strategy. She said:

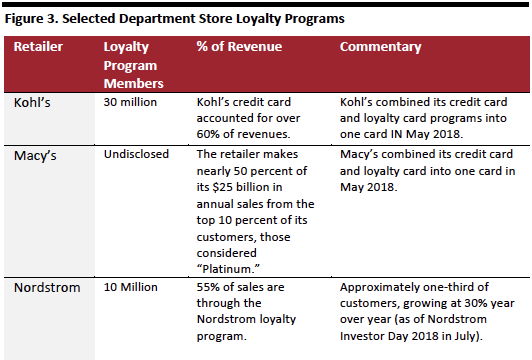

We continue to make significant progress on our standard to small initiative. With the most recent conversion of an additional 200 stores this quarter, we now have 500 standard to small stores operating in smaller stores. …This effort has been a key driver to inventory productivity and margin accretion. It is also providing a better and more localized experience for our customers, and importantly, paves the way for our rightsizing initiative to create and sub-lease space to complementary neighboring businesses.On a March 2018 conference call, Kohl’s then-CEO Kevin Mansell said that Aldi would be the company’s initial partner as it downsizes stores through carve-outs, but that it could lease excess space to other grocery retailers or service providers, such as fitness centers, in the future. Mansell identified such outlets as “traffic drivers” that Kohl’s knows it “can coexist together [with] for a long time.” Kohl’s also launched two partnerships with Amazon. First, Amazon opened 30 smart home boutiques in Kohl’s stores in which customers can purchase Amazon smart home devices. Additionally, approximately 100 Kohl’s stores allow consumers to return Amazon merchandise. Both partnerships are intended to drive more traffic into the store and diversify the shopper base. Loyalty Cards are Driving Customers to Shop Loyal card members are driving revenue across all retailers, and department stores are no exception. Department stores are consolidating loyalty programs and credit card programs into one program and offering tiered programs that offer points for and promotions and perks for events. For examples, Macy’s upgraded its loyalty program in 2018 so cardholders gain access to more benefits as they advance in loyalty status, depending on the dollar amount they spend. [caption id="attachment_76709" align="aligncenter" width="532"]

Source: Company reports[/caption]

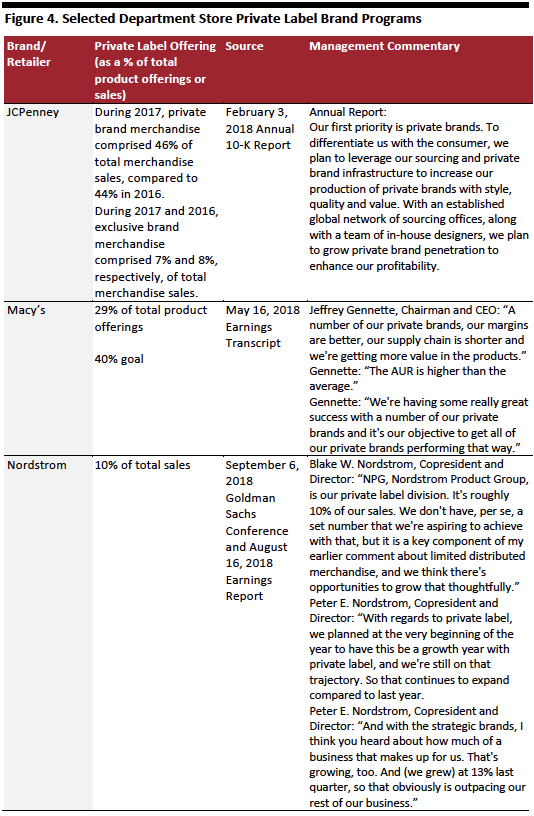

Department Stores Are Leveraging Private Label Brands and Strategic Brands

Department stores are leveraging private label brands because the profit margins are higher and exclusive – offering differentiation from competitors, and the speed to the customer is shorter in some cases. Macy’s and Nordstrom have both said private labels are priorities for them, with private-label products making up 29% of Macy’s total product offering as of September 2018. Management said the goal is to increase private label offerings to 40% of total product offerings. Nordstrom said its private label division accounted for 10% of sales, and the company is looking to expand and grow private label.

[caption id="attachment_76710" align="aligncenter" width="534"]

Source: Company reports[/caption]

Department Stores Are Leveraging Private Label Brands and Strategic Brands

Department stores are leveraging private label brands because the profit margins are higher and exclusive – offering differentiation from competitors, and the speed to the customer is shorter in some cases. Macy’s and Nordstrom have both said private labels are priorities for them, with private-label products making up 29% of Macy’s total product offering as of September 2018. Management said the goal is to increase private label offerings to 40% of total product offerings. Nordstrom said its private label division accounted for 10% of sales, and the company is looking to expand and grow private label.

[caption id="attachment_76710" align="aligncenter" width="534"] Source: Company reports[/caption]

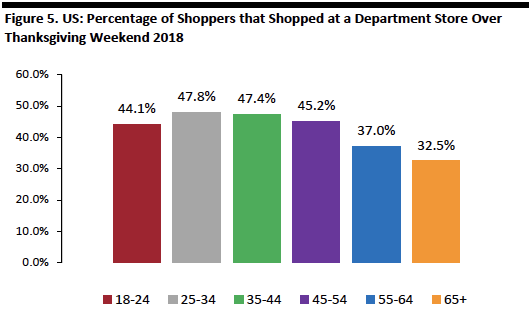

Millennials Are Shopping at Department Stores

The International Council of Shopping Centers (ICSC) found that 151 million people went to malls and shopping centers over Thanksgiving Day weekend in 2018, compared to 145 million in 2017, up 4.1% year over year. Of those 151 million mall-goers, millennials shopped at a department store more than any other age group. According to a Prosper Insights & Analytics Survey conducted on November 25, 2018, 42% of adults over 18 shopped at a department store over Thanksgiving weekend in 2018, with 47.8% of respondents between the ages of 25–34 responding that they shopped at a department store over the Thanksgiving weekend. More women than men shopped at department stores, with 44.8% of women shopping over the weekend and 39% of men responding that they shopped over the weekend.

[caption id="attachment_76711" align="aligncenter" width="530"]

Source: Company reports[/caption]

Millennials Are Shopping at Department Stores

The International Council of Shopping Centers (ICSC) found that 151 million people went to malls and shopping centers over Thanksgiving Day weekend in 2018, compared to 145 million in 2017, up 4.1% year over year. Of those 151 million mall-goers, millennials shopped at a department store more than any other age group. According to a Prosper Insights & Analytics Survey conducted on November 25, 2018, 42% of adults over 18 shopped at a department store over Thanksgiving weekend in 2018, with 47.8% of respondents between the ages of 25–34 responding that they shopped at a department store over the Thanksgiving weekend. More women than men shopped at department stores, with 44.8% of women shopping over the weekend and 39% of men responding that they shopped over the weekend.

[caption id="attachment_76711" align="aligncenter" width="530"] Base: 3,508 U.S. Internet users who shopped over Thanksgiving weekend 2018

Base: 3,508 U.S. Internet users who shopped over Thanksgiving weekend 2018Source: Prosper Insights & Analytics[/caption] One draw for millennials may be department stores creating more exciting merchandise content. For example, department stores are mixing merchandise selection to include a wide variety of designer labels from high-end to everyday brands to appeal to a broad audience, adding private label brands, designer exclusives that only the store carries (which may include “drops”) and even adding in-store events. Examples include:

- Nordstrom is mixing brand and designer offerings in its New York City men’s store to include a wide range of product offerings in all of its departments to appeal to a broad audience – many aimed at Gen Z and millennials – which include premium, high-end brands with price points in the four-digits, including Givenchy, Gucci and Valentino plus everyday brands such as Nike, The North Face, or UGGs Nike.

- In October 2017 U.S. luxury department store Barneys joined Highsnobiety, a fashion blog to host a weekend event aimed at millennials and Gen Z consumers called “thedrop@Barneys” which featured limited edition merchandise from streetwear designers and other trending brands.

- Kohl’s launched two pilot stores testing a customer service center concept which includes centralized checkout, a new “impulse merchandising” approach, self-checkout, self-service kiosks and BOPUS lockers. The store associates are also equipped with iPads to assist customers.

- Macy’s partnered with Marxent, a 3D product visualization company, to rollout 70 Macy’s virtual reality (VR) installations in its departments stores nationwide. The VR headsets help consumers visualize furniture selections before buying to help consumers make more informed buying decisions.

- Nordstrom launched “Nordstrom Local” a 3,000 square foot service hub designed to support Nordstrom customers in a “convenient and efficient manner.” The store is located in Los Angeles and offers on-site alterations and tailoring, fitting rooms to try buy-online, pickup in store items, styling services, return services, a nail salon and on-site refreshments.

Sector Landscape

In 2018, U.S. department store sales totaled $76.2 billion according to Euromonitor, and its analysts forecast sector sales to decrease at a compound annual growth rate of (5.8)% to 2023, to $56.6 billion; these figures represent store-based sales only so exclude online sales made by department store retailers. Over the last five years, department-store sales have fallen $23.2 billion, a 23.5% decrease. This can be attributed to declining sales and major department store closures – some with hundreds of stores. [caption id="attachment_76712" align="aligncenter" width="530"] Figure represent in-store sales only

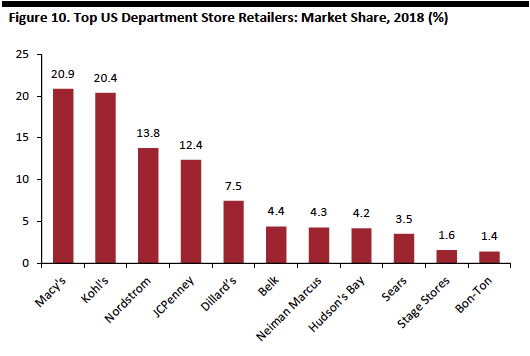

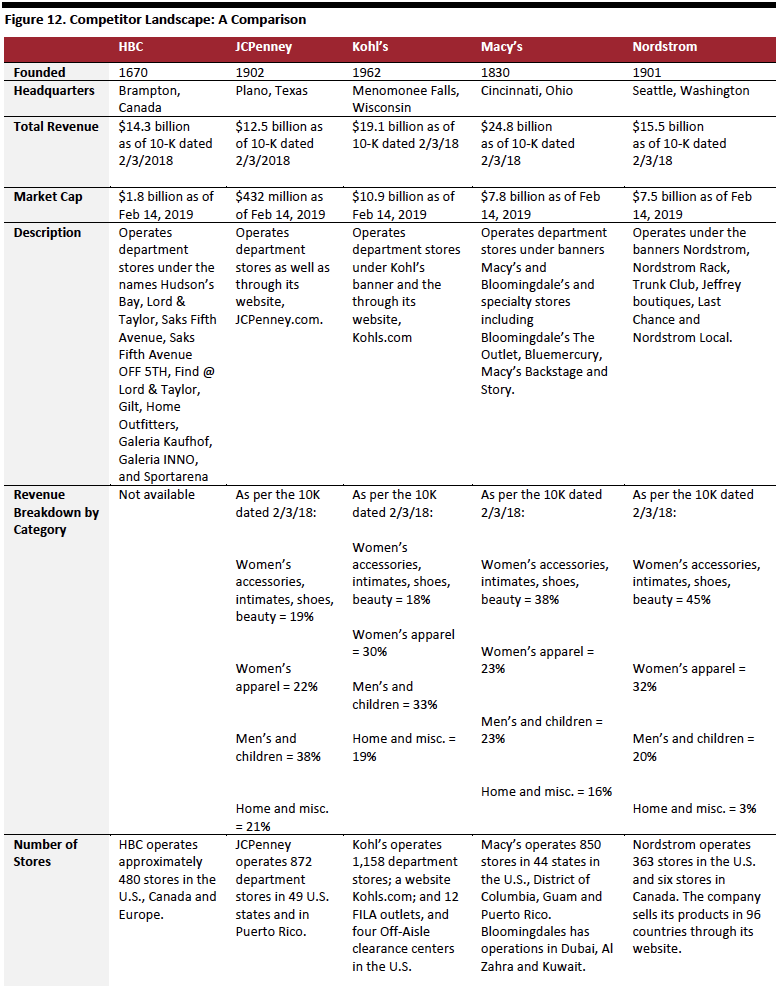

Figure represent in-store sales onlySource: Euromonitor International[/caption] There are five major department store companies in the U.S.: Macy’s, Kohl’s, Nordstrom, JCPenney, and Dillard’s. These five companies comprise 75.0% of the total U.S. department store sector, according to Euromonitor. Figure 10 highlights the market share of the top ten brands in the U.S. in 2018. [caption id="attachment_76713" align="aligncenter" width="530"]

Figure represent in-store sales only

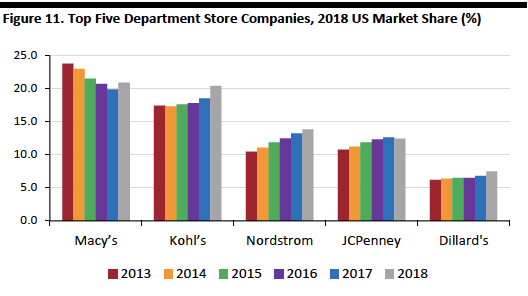

Figure represent in-store sales onlySource: Euromonitor International[/caption] Market Share: In 2018, Macy’s held the largest share of store-based department store sales, with a 20.9% share followed closely by Kohl’s at $20.4%. Kohl’s has been steadily increasing its share of store-based department store sales, from 17.4% in 2013 to 20.4% in 2018 whereas Macy’s saw its share fall from 23.8% in 2013 to 20.9% in 2018. Figure 11 highlights the top five brands’ market share trends from 2013 to 2018. Kohl’s, Nordstrom, and Dillard’s have been growing. Nordstrom held 10.5% of the market in 2013 and grew to 13.8% in 2018 and Kohl’s grew from 17.4% in 2013 to 20.4% in 2018. [caption id="attachment_76714" align="aligncenter" width="528"]

Figure represent in-store sales only

Figure represent in-store sales onlySource: Euromonitor International[/caption] [caption id="attachment_76715" align="aligncenter" width="776"]

Source: S&P Capital IQ/company reports[/caption]

Innovators and Disruptors

Marketplaces such as the Market @ Macy’s will continue to help the department store reinvent how it approaches new products. Short-term leasing spaces within department stores, such as b8ta’s innovative marketplaces, offer consumers a wide variety of new products for a limited time. This model helps department stores refresh product lifecycle from a wide variety of vendors and emerging designers using very little space. This will change buying patterns, how merchandise is selected and placed in the department store, with products selected, merchandised and refreshed constantly.

Source: S&P Capital IQ/company reports[/caption]

Innovators and Disruptors

Marketplaces such as the Market @ Macy’s will continue to help the department store reinvent how it approaches new products. Short-term leasing spaces within department stores, such as b8ta’s innovative marketplaces, offer consumers a wide variety of new products for a limited time. This model helps department stores refresh product lifecycle from a wide variety of vendors and emerging designers using very little space. This will change buying patterns, how merchandise is selected and placed in the department store, with products selected, merchandised and refreshed constantly.