Nitheesh NH

Introduction

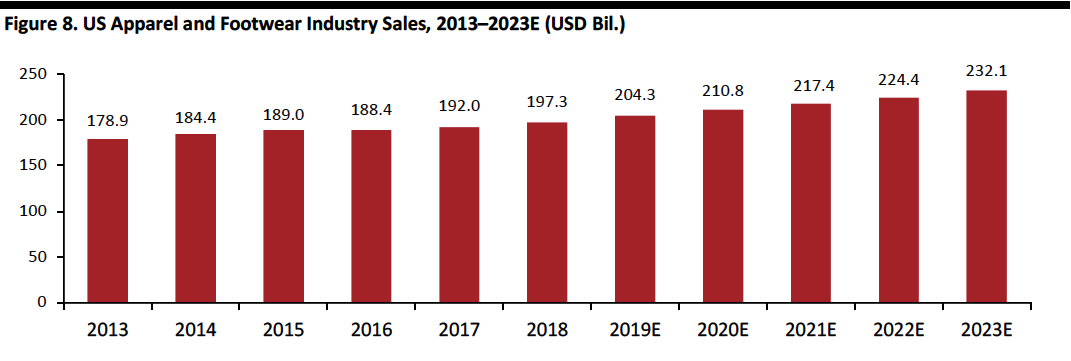

In 2018, U.S. apparel and footwear specialty retailers’ sales totaled $197 billion, according to Euromonitor International, and its analysts forecast sector sales will grow at a CAGR of 3.3% to 2023, reaching $232 billion. Relative to the recent past, 2018’s results were strong. Sportswear and athleisure are driving specialty apparel and footwear sales. We see areas of opportunity in the lingerie and plus-size categories. We expect specialty retailers to continue exploring collaborations, partnerships and global expansion – particularly into China and India.Specialty Retailers Are Launching Loyalty Programs and Using Program Data to Personalize and Offer Special Access

Specialty retailers are launching and revamping loyalty programs to personalize offerings, provide access to special events, offer free shipping, and provide further to retain members. Retailers are upgrading and tying loyalty programs to events and other retailer apps to further engage customers, and personalizing offerings using customer data. Athletic retailer Lululemon announced the test of loyalty app in the third quarter of 2018: Consumers pay $128 annually for the program and receive expedited shipping, access to curated workout events, and a pair of shorts or pants. Below are highlights from selected retailers’ revamped or relaunched loyalty programs.- American Eagle Outfitters – The company reported it launched a revamped loyalty program for its 16 million members, offering an upgraded experience. Specifically, the company reported its new loyalty program is fully digital and builds in more levels of rewards and perks for items such as jeans and bras. The program offers exclusive member access to concerts, festivals, and special events.

- Foot Locker – The company said it is creating a better customer experience to drive improved customer engagement while repositioning its loyalty program away from a transactional coupon-based plan to be more experiential, oriented around strategic brand moments.

- Nike – The company says it has over 100 million members in its free membership program, NikePlus, and the company hopes to grow this number 400% by 2023, according to a company presentation delivered at a Euromonitor International event. NikePlus rewards its members based on spending and fitness app usage. Members fill out a profile that includes birthday, favorite sports and styles, and Nike combines this data with members’ shopping habits.

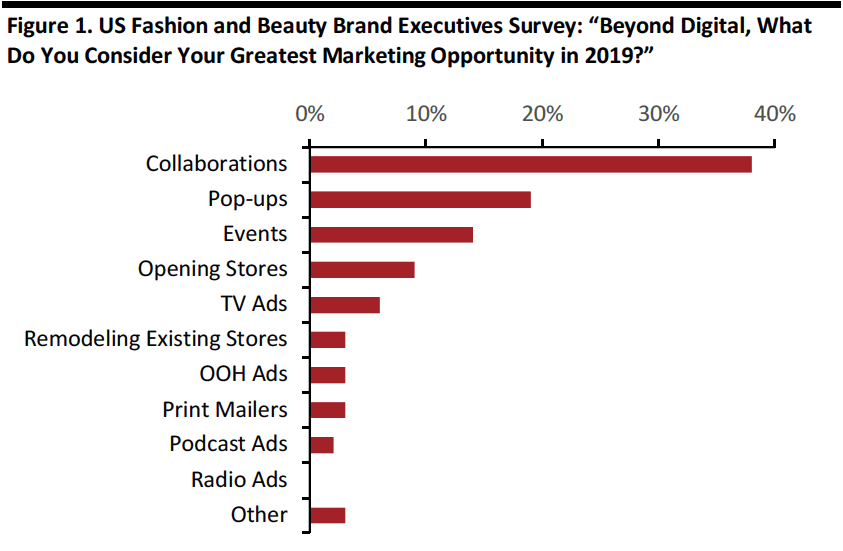

Specialty Retailers and Brands Are Launching Collaborations

Retailers and brands are launching collaborations to reach new audiences and drive sales. Retailers and brands are turning to collaborations to offer something unique, unexpected and new for customers. For example, designer Anna Sui collaborated with retailer Urban Outfitters in September 2018 to design an eight-piece collection that was priced under $175, a price point lower than Sui’s designer collection, and blended with the style of Urban Outfitter’s Bohemian look. The collection modernized signature pieces from Sui’s 1994 collection while maintaining a 1990s vibe. The collaboration included updated silhouettes such as miniskirts and baby tees and incorporated plaid and mesh textures. This is why brands, retailers and even customers like collaborations.- Collaborations increase audience size by combining two unexpected and diverse brands or retailers.

- Typically, collaborations are limited edition, which creates a sense of urgency for the consumer.

- Collaborations are exclusive, meaning products may be difficult to obtain, or the customer may be able to purchase only in a store, which creates excitement.

- Some collaborations are surprises, which adds brand buzz and cache on social media – particularly for large collaborations.

Base: 117 brand executives surveyed in December 2018

Base: 117 brand executives surveyed in December 2018Source: Glossy[/caption]

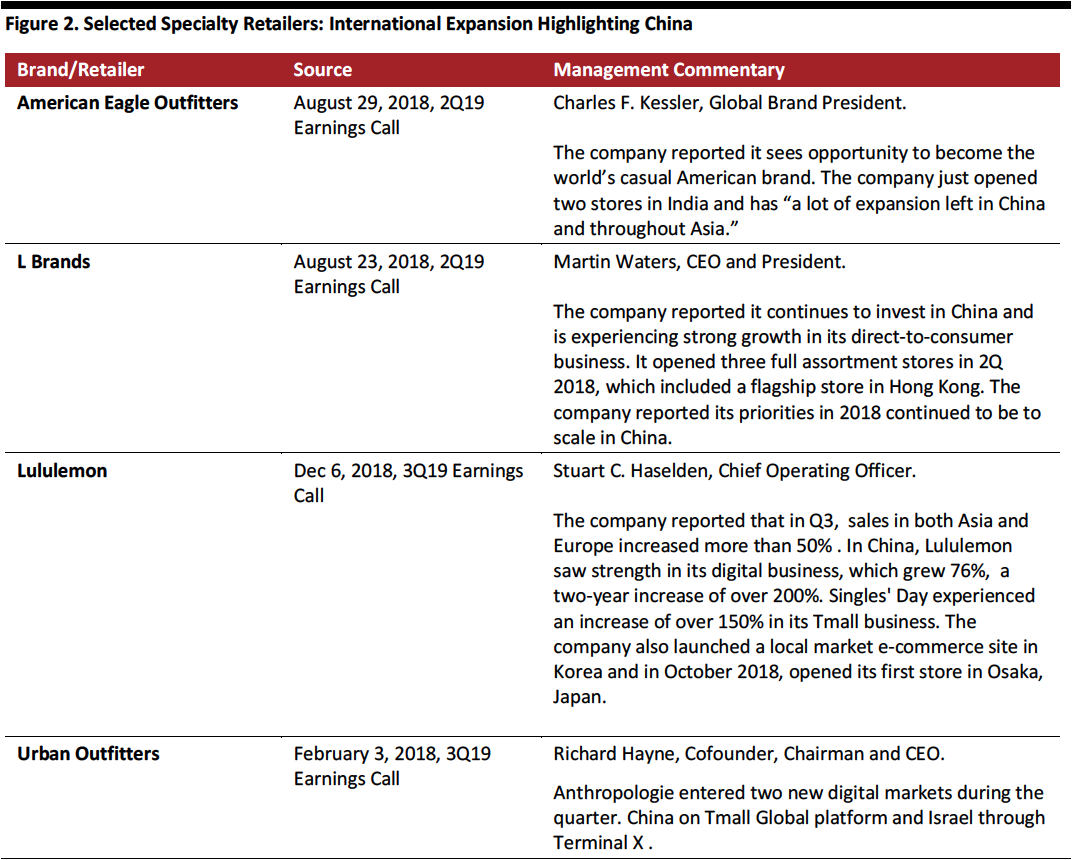

Specialty Retailers will Continue to Expand Their Global Footprint into International Markets – Especially China

Retailers are seeking new markets to grow revenue and attract new audiences. Specialty retailers are expanding into, and investing in, the China market through digital and physical storefronts. According to Azoya Consulting, a company specializing in cross-border ecommerce, “fashion” is the top category consumers shop for on cross border e-commerce. Some 22% of Chinese online shoppers buy fashion products through cross-border e-commerce at least once a month. Figure 2 highlights selected U.S. specialty retailers’ intentions to expand internationally, particularly in China. [caption id="attachment_68960" align="aligncenter" width="800"] Source: Company reports[/caption]

Source: Company reports[/caption]

Traditional Women’s Underwear Category Is Ready for Disruption

Victoria’s Secret is the top women’s underwear retailer in the U.S. with 28.8% of the market in 2017. However, Victoria’s Secret market share has gradually declined since 2013. The subsequent four U.S. women’s underwear brands have each lost market share between 2013 and 2017 as shown in Figure 3. The total combined market share of the top five women’s underwear retailers/brands in 2013 was 51.6%, but slipped to 47.0% by 2017. [caption id="attachment_68965" align="aligncenter" width="600"] Source: Euromonitor International[/caption]

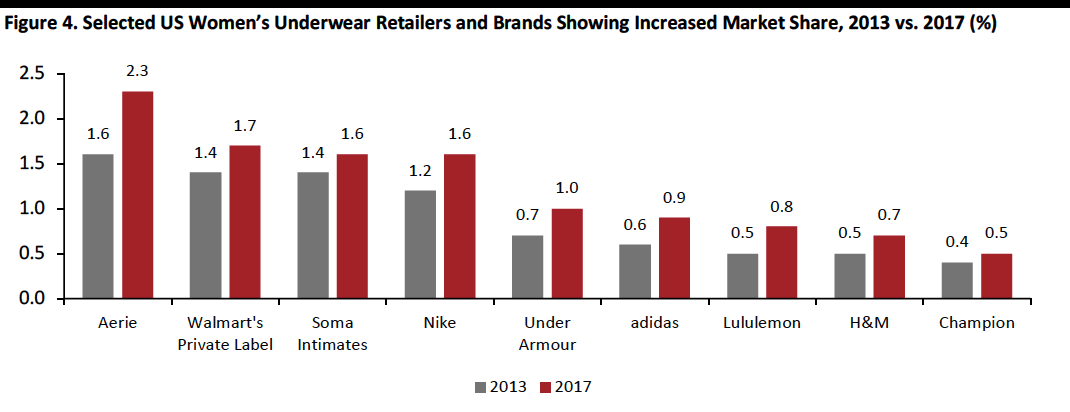

The U.S. women’s underwear industry is beginning to change, and the lines for where women shop for underwear are blurring. Women are looking for underwear from less traditional retailers and brands, including athletic retailers such as Under Armour, Nike, Adidas, and fast fashion brands such as H&M and Zara. Women are also looking to teen retailers such as Aerie and mass retailers such as Walmart and Target, and online brands such as ThirdLove and AdoreMe.

The chart below highlights selected U.S. women’s underwear retailers showing gradual growth from 2013 to 2017. In aggregate, these nine retailers and brands grew market share 2.8 percentage points, from 8.3% in 2013 to 11.1% in 2017.

American Eagle Outfitter’s teen-focused brand, Aerie, showed the most significant growth, from 1.6% of the market in 2013 to 2.3% in 2017. Aerie’s slogan is #AerieREAL and its underwear brand is focused on body positivity for “every girl.” It focuses on girl power and encourages women to post photos of themselves for Aerie to post (untouched) on its website to show the “real Aerie girl.” Its merchandise is available in 30 sizes.

[caption id="attachment_68973" align="aligncenter" width="800"]

Source: Euromonitor International[/caption]

The U.S. women’s underwear industry is beginning to change, and the lines for where women shop for underwear are blurring. Women are looking for underwear from less traditional retailers and brands, including athletic retailers such as Under Armour, Nike, Adidas, and fast fashion brands such as H&M and Zara. Women are also looking to teen retailers such as Aerie and mass retailers such as Walmart and Target, and online brands such as ThirdLove and AdoreMe.

The chart below highlights selected U.S. women’s underwear retailers showing gradual growth from 2013 to 2017. In aggregate, these nine retailers and brands grew market share 2.8 percentage points, from 8.3% in 2013 to 11.1% in 2017.

American Eagle Outfitter’s teen-focused brand, Aerie, showed the most significant growth, from 1.6% of the market in 2013 to 2.3% in 2017. Aerie’s slogan is #AerieREAL and its underwear brand is focused on body positivity for “every girl.” It focuses on girl power and encourages women to post photos of themselves for Aerie to post (untouched) on its website to show the “real Aerie girl.” Its merchandise is available in 30 sizes.

[caption id="attachment_68973" align="aligncenter" width="800"] Source: Euromonitor International[/caption]

Five of the nine U.S. underwear brands and retailers that grew market share from 2013 to 2017 are athletic brands: Nike, Under Armour, Adidas, Lululemon and Champion. Two of the U.S. underwear retailers which grew market share from 2013 to 2017 offer value: Walmart’s private label and H&M.

More direct-to-consumer brands are entering this growing space. According to Euromonitor International, the “Other” category grew from 28.5% of the market in 2013 to 31.3% of the market in 2017. One example is Thirdlove, a digitally native e-commerce lingerie store that invented half cup sizes and offers over 70 bra sizes, compared to 30 offered by most underwear brands. The company is online only, and it relies on customer data to inform product design.

Source: Euromonitor International[/caption]

Five of the nine U.S. underwear brands and retailers that grew market share from 2013 to 2017 are athletic brands: Nike, Under Armour, Adidas, Lululemon and Champion. Two of the U.S. underwear retailers which grew market share from 2013 to 2017 offer value: Walmart’s private label and H&M.

More direct-to-consumer brands are entering this growing space. According to Euromonitor International, the “Other” category grew from 28.5% of the market in 2013 to 31.3% of the market in 2017. One example is Thirdlove, a digitally native e-commerce lingerie store that invented half cup sizes and offers over 70 bra sizes, compared to 30 offered by most underwear brands. The company is online only, and it relies on customer data to inform product design.

Specialty Retailers Will See Growth by Adding Plus Sizes to Current Collections

The average American woman wears a size 16–18 and Center for Disease Control and Prevention data indicate the rate of obesity among American women is 38%. From these data and average apparel spending data, we estimate that the U.S. plus-size apparel market is potentially worth $46.4 billion — assuming women classified as “obese” spend the same amount on clothing as the average woman and based on the total womenswear market size in 2016. If the U.S. obesity rate increases to 50% by 2021, as Euromonitor forecasts, the plus-size market will represent a $61.0 billion opportunity. Specialty retailers and brands are beginning to understand the retail opportunity and that this consumer wants to shop the same trendy merchandise from the same stores, just in their own size. Specifically, this consumer does not want to be singled out as “plus size” and have a special section or store labeled for her: She just wants collections in her size. In response, specialty retailers are launching or redesigning plus size apparel collections. Here are some examples; we expect more in 2019.- Crew collaborated with Universal Standard: Specialty retailer J. Crew collaborated with Universal Standard, a brand that focuses on size inclusivity, on several collections to offer women styles in sizes ranging from XXS to 5X.

- Ann Taylor Loft created Loft Plus extended sizes in February 2018: Ann Taylor Loft, a specialty retailer under Ascena (a company known for plus sized fashion with Lane Bryant and Catherines brands), launched a plus size line in February 2018 with Loft Plus, which expanded sizes from 16 to 26. Loft conducted customer surveys and focus groups to accurately translate the Loft’s style into the new sizes. The Loft worked with Gwynnie Bee, a plus size online subscription brand, on a collection in 2017 which the company said helped to inform its Loft Plus collection. The Loft Plus was rolled out in a 50-store pilot using popup shops.

- Eloquii acquired by Walmart in October 2018: Eloquii, a digitally native vertical women’s brand focusing on sizes 14 and above, was sold to Walmart in October 2018. Eloquii was founded in 2011 as part of The Limited and relaunched online in 2014 as a direct-to-consumer brand. Walmart said in its October 2018 press release that the plus-size market is important because these customers have historically been underserved, with clothing limited by its lack of fashion, lack of fit, or both.

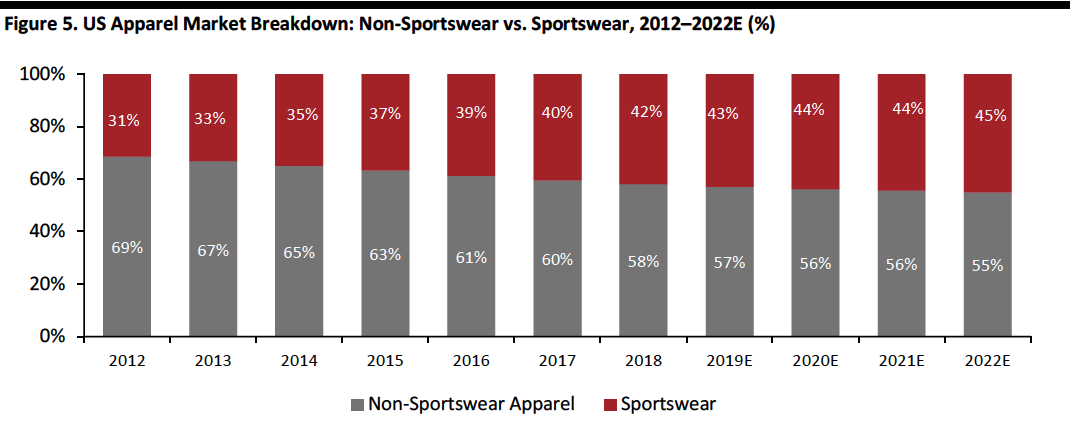

Sportswear and Athleisure Will Continue to Drive Apparel and Footwear Sales in 2019, with New Opportunities in Men’s

In 2018, athleisure apparel and sportswear were drivers of apparel and footwear sales. With fitness and health consciousness on the rise, consumers are wearing athleisure apparel and performance-wear for daily activities, and even to work.

Relaxed dress codes have played a role in rise of athleisure and sportswear, with consumers seeking casual, non-suiting ‘performance’ clothing for work and are many seek multi-purpose clothing that can function for daily activities and fitness activities with innovative, performance materials.

Of the $277 million U.S. apparel market in 2018, the sportswear market accounted for 42% or $116 billion of the market and we expect it to grow at a CAGR of 5.2% from 2018 to 2022 to $142 billion by 2022 and to account for 55% of the total apparel market.

[caption id="attachment_68996" align="aligncenter" width="800"] Source: Euromonitor International[/caption]

Of the top 10 apparel and footwear brands, three are sportswear brands: Nike holds the number one spot with 6.7% of the market, Adidas holds the sixth spot with 1.8% and Under Armour the ninth spot with 1.4%. Men’s sportswear and performance wear is an area of particular opportunity for specialty retailers and brands because men are become increasingly more invested in fashion. Specialty retailers and brands are expanding offerings,specializing in performance materials and offering more niche products.

Source: Euromonitor International[/caption]

Of the top 10 apparel and footwear brands, three are sportswear brands: Nike holds the number one spot with 6.7% of the market, Adidas holds the sixth spot with 1.8% and Under Armour the ninth spot with 1.4%. Men’s sportswear and performance wear is an area of particular opportunity for specialty retailers and brands because men are become increasingly more invested in fashion. Specialty retailers and brands are expanding offerings,specializing in performance materials and offering more niche products.

- Gap’s Athleta launched Hill City in September 2018, a brand that features mostly performance athletic wear, outerwear, shorts and tops, and features transitional pieces that men can wear outside of the gym or to the office such as shirts and “performance pants.”

- Lululemon reported its men’s category continues to “be an exciting growth story for us, posting some of our highest overall category increases. As we've mentioned previously, we are effectively ahead of schedule to reach our $1 billion sales goal for men's in 2020.”

- A number of innovative men’s athleisure and sportswear brands of all sizes are entering this space. A few examples include: Olivers Apparel, a California-based athleisure and activewear brand focusing on performance fabrics; Vuori Clothing, a California-based activewear apparel brand; and, Chubbies Shorts, a brand centered around athletic shorts. This shows the segment is becoming more specialized and innovative as retailers use different fabrics that stretch, wick sweat, and move four ways (for example); employ sustainable production methods in some cases; and, target different consumers.

Specialty Retailers are Selling Through Multiple Retail Channels

The lines are becoming blurred as specialty retailers are selling through multiple retails outside their own retail channel. Just as specialty retailers are thinking creatively about partnerships and collaborations, we expect specialty retailers to continue to think creatively about where they are selling. Specialty Brands are Selling on Amazon’s Marketplace: Previously, Amazon was thought of as the competition, but today, specialty retailers and brands increasingly view Amazon as another channel to sell merchandise.- Specialty retailers and brands are selling selected items on Amazon’s marketplace. Within the past year, Chico’s and J.Crew announced plans to sell on Amazon. Other retailers and brands selling on Amazon include American Eagle, Ann Taylor, Ann Taylor Loft, J. Crew, Lou & Grey, Reebok, Levi’s, Nike and Under Armour. When asked about its relationship with Amazon, Ascena’s CEO and Chairman, David Jaffe, said on its Q4 2018 Earnings call on September 24, 2018, that the company had a test with its Maurices brand, that it has been inclusive and that they were exploring different possibilities. He said, “They are too big to be ignored. But we are also, as I say, looking at other marketplaces.”

- In April 2018, New York & Company launched a monthly subscription rental service for a flat fee monthly fee. On the three-garment plan, for $49.95, consumers receive three garments and can exchange merchandise as many times as they want. The company offers sizes 0-20 (sizes XS-XXL).

- Ann Taylor began selling as a subscription clothing service in November 2017 called Infinite Style. Consumers rent an unlimited amount of clothing, three pieces at a time, for $95 a month.

- In 2017, Gap launched three subscription services: Old Navy Superbox, a quarterly subscription box for children, BabyGap Bedtime Box, a quarterly baby subscription box focusing on bedding, and BabyGap Outfit Box, a quarterly baby subscription clothing box. Gap shut down all three subscription boxes in 2018.

Off-Price Retailers Continue to Win in Specialty Retail

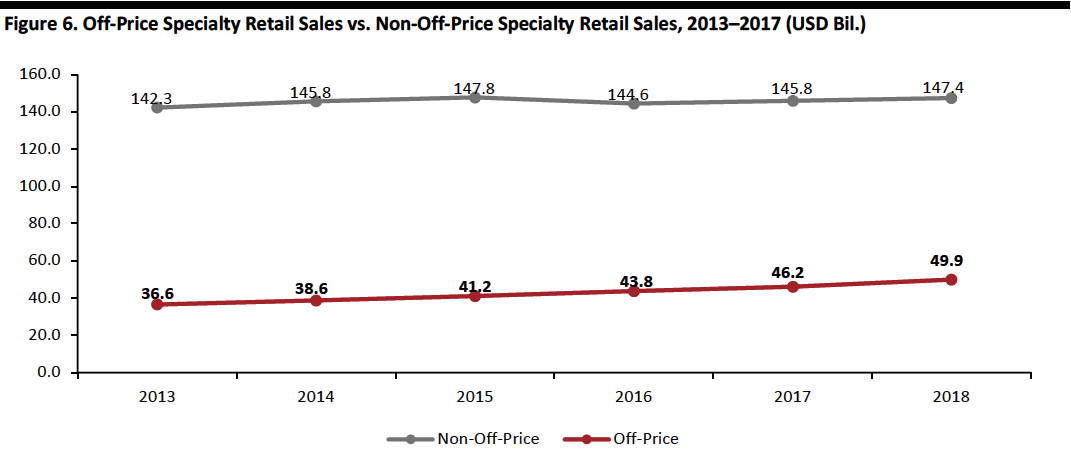

Four of the five top specialty footwear and apparel retailers are off-price retailers, accounting for $49.9 billion, 25% of the $197.3 billion market in 2018. The U.S. off-price specialty retail industry grew at a CAGR of 6.4% since 2013 while the U.S. non-off-price specialty industry grew at a CAGR of 0.7% over the same period. [caption id="attachment_69017" align="aligncenter" width="800"] Source: Euromonitor International[/caption]

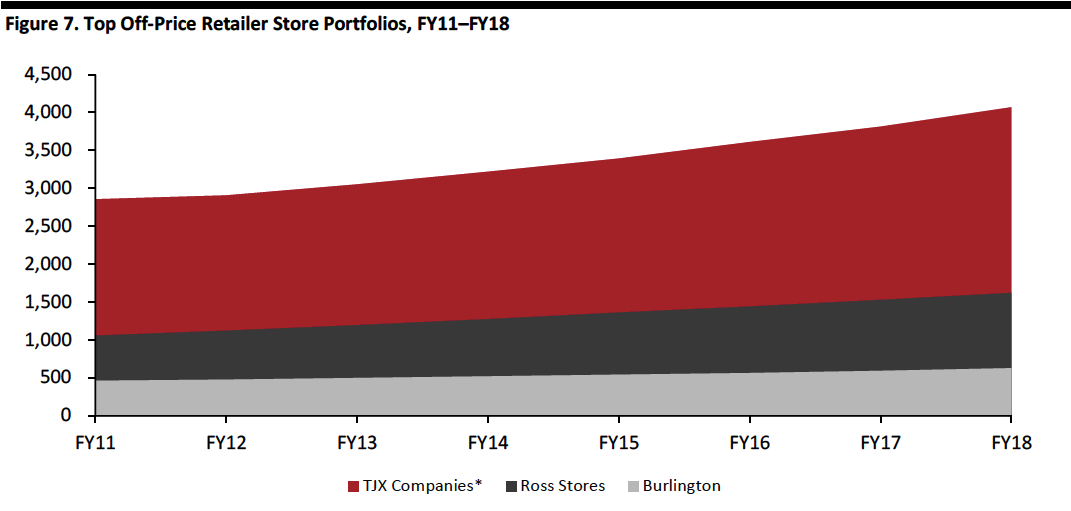

The four biggest off-price retailer chains, Ross, T.J. Maxx, Marshalls, and Burlington Coat Factory are also continuing to open stores.

What is driving the success of the off-price business? Off price combines one, or some, of the elements that we believe consumers look for today:

Source: Euromonitor International[/caption]

The four biggest off-price retailer chains, Ross, T.J. Maxx, Marshalls, and Burlington Coat Factory are also continuing to open stores.

What is driving the success of the off-price business? Off price combines one, or some, of the elements that we believe consumers look for today:

- Value

- Product uniqueness

- Local heritage by sourcing products from all over the world

- Quality

- The thrill of telling the story of how one got a deal.

*Includes international stores

*Includes international storesSource: S&P Capital IQ/company reports[/caption]

Sector Landscape

In 2018, U.S. apparel and footwear specialist retailers’ industry sales totaled $197.3 billion, according to Euromonitor International, and predict sector sales will increase at a compound annual growth rate of 3.3% to 2023, to reach $232.1 billion. [caption id="attachment_69024" align="aligncenter" width="800"] Source: Euromonitor International[/caption]

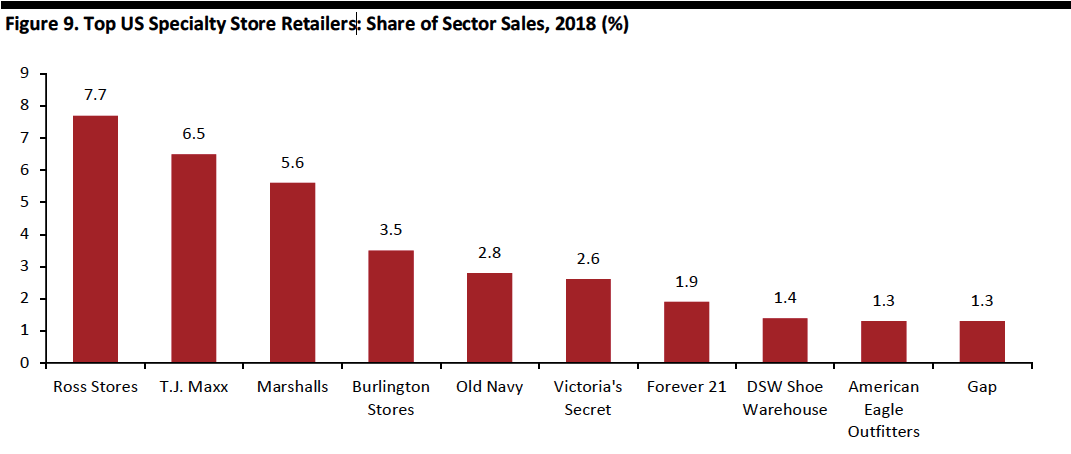

The top 10 specialty retailers held 34.6% of total sector sales in 2018. The top three specialty retailers in 2018 were Ross Stores, T.J. Maxx, and Marshalls. Combined, these three specialty retailers held 19.8% of the market.

[caption id="attachment_69028" align="aligncenter" width="800"]

Source: Euromonitor International[/caption]

The top 10 specialty retailers held 34.6% of total sector sales in 2018. The top three specialty retailers in 2018 were Ross Stores, T.J. Maxx, and Marshalls. Combined, these three specialty retailers held 19.8% of the market.

[caption id="attachment_69028" align="aligncenter" width="800"] Source: Euromonitor International[/caption]

Market Share: In 2018, Ross Stores held the largest market share in the U.S., at $15.3 billion in revenue and 7.7% market share. T.J. Maxx holds second position, at 6.5% market share and $12.8 billion. Marshalls, another retailer under the TJX Cos, holds third position with $10.9 billion in revenue.

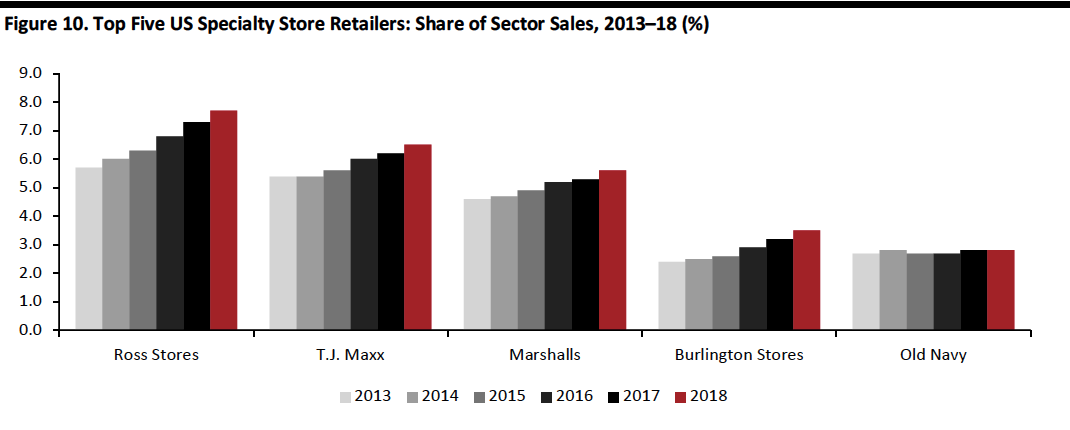

Figure 10 highlights the top five U.S. apparel and footwear specialty retailers market share trends from 2013 to 2018. Each grew share of sector sales in that period.

[caption id="attachment_69031" align="aligncenter" width="800"]

Source: Euromonitor International[/caption]

Market Share: In 2018, Ross Stores held the largest market share in the U.S., at $15.3 billion in revenue and 7.7% market share. T.J. Maxx holds second position, at 6.5% market share and $12.8 billion. Marshalls, another retailer under the TJX Cos, holds third position with $10.9 billion in revenue.

Figure 10 highlights the top five U.S. apparel and footwear specialty retailers market share trends from 2013 to 2018. Each grew share of sector sales in that period.

[caption id="attachment_69031" align="aligncenter" width="800"] Source: Euromonitor International[/caption]

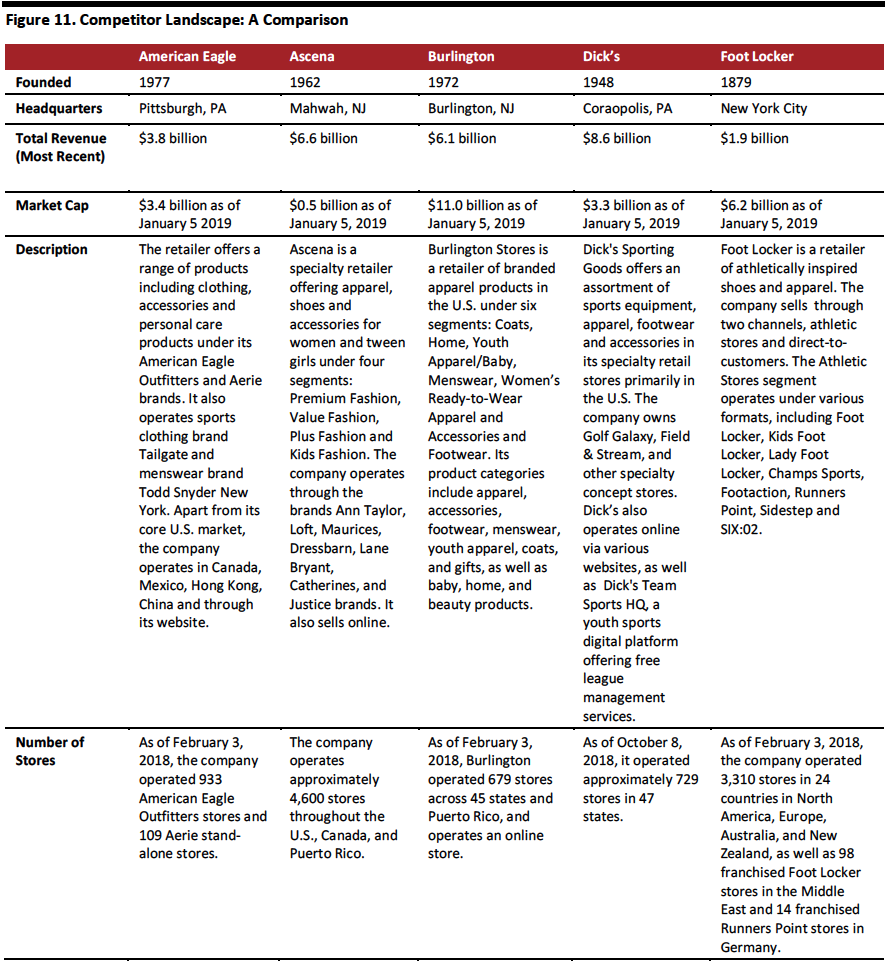

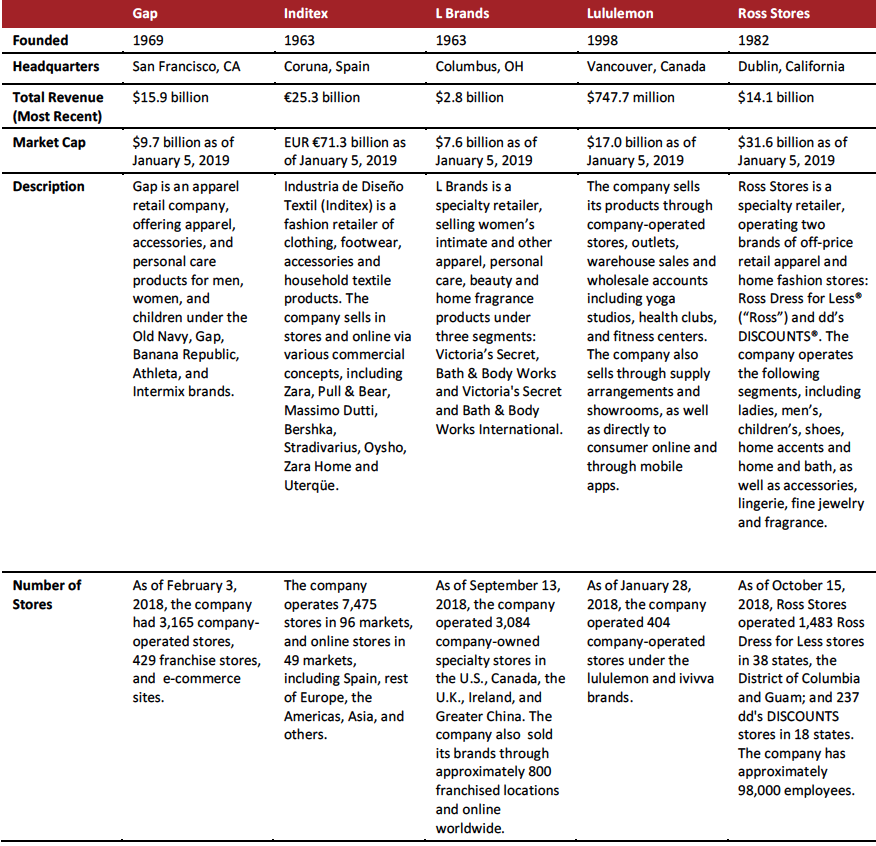

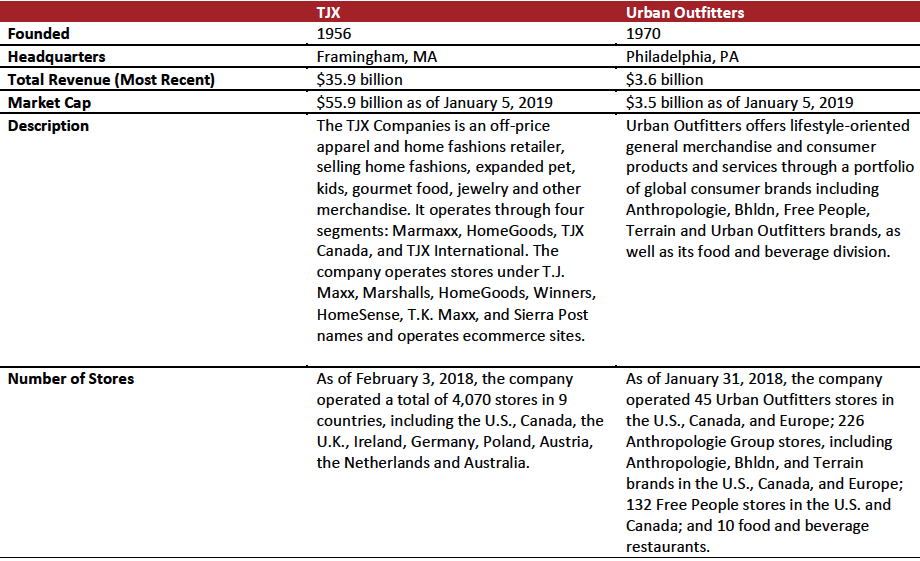

Figure 11 provides a competitive landscape of the brands in the U.S. apparel and footwear sector among Coresight 100 companies. The table provides a quick snapshot description of each company, market capitalization, revenue, description, and stores in fleet. The table is updated quarterly as a reference.

Source: Euromonitor International[/caption]

Figure 11 provides a competitive landscape of the brands in the U.S. apparel and footwear sector among Coresight 100 companies. The table provides a quick snapshot description of each company, market capitalization, revenue, description, and stores in fleet. The table is updated quarterly as a reference.

[caption id="attachment_69034" align="aligncenter" width="800"]

[caption id="attachment_69034" align="aligncenter" width="800"] Source: S&P Capital IQ/company reports[/caption]

Source: S&P Capital IQ/company reports[/caption]