albert Chan

Introduction

Each report in our Sector Overview series provides an analysis of a particular retail sector or consumer market. In this report, we cover the North American grocery sector, with a concentration on the U.S. market. Our coverage focuses on supermarket retailers, though we include some discussion of other grocery channels. We analyze mass merchandisers, warehouse clubs and discount stores in a separate Sector Overview report. This report includes:- A discussion of key themes in the U.S. grocery retail sector.

- A review of grocery sector momentum in the U.S. and Canada.

- A summary of the sector landscape, including market shares for the top U.S. grocery retailers.

- Shopper profiles, based on age and income, for the leading grocery retailers.

- The outlook for U.S. grocery retailing.

Themes We’re Watching

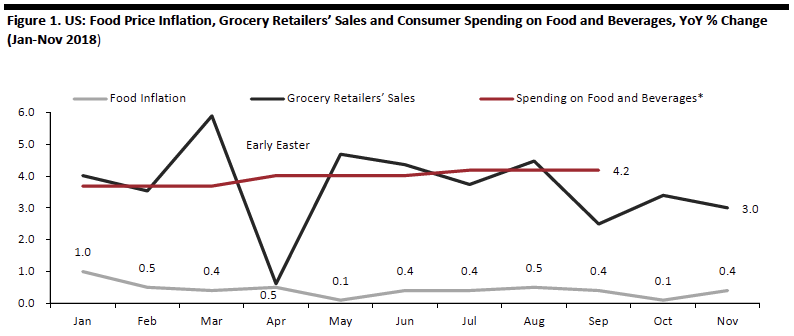

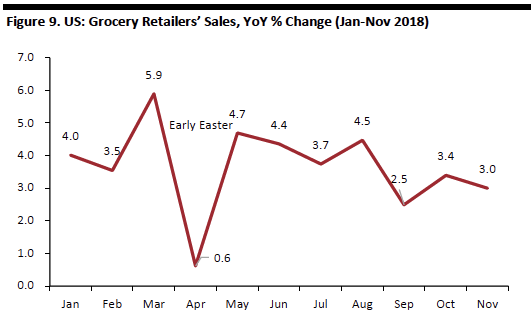

Grocery Sector Sales Remain Solid Despite Near-Zero Inflation U.S. food inflation was low at the start of 2018 and fell across the year. In spite of this, sales at grocery retailers and spending on food and beverages grew solidly, with each measure tracking at 3% or more year over year — though recent months have hinted at a slight slowdown in growth, as the graph below shows. Nevertheless, against low inflation, these trends translated into meaningful volume growth in grocery sales. Such solid growth is a measure of the liberal spending that marked the U.S. consumer economy in 2018. Grocery is typically a low-growth market in which inflation is the main driver of spending fluctuations. [caption id="attachment_68562" align="aligncenter" width="794"] Grocery retailers’ sales data are not seasonally adjusted; spending data are seasonally adjusted.

Grocery retailers’ sales data are not seasonally adjusted; spending data are seasonally adjusted.*Spending data are quarterly and are through 3Q18.

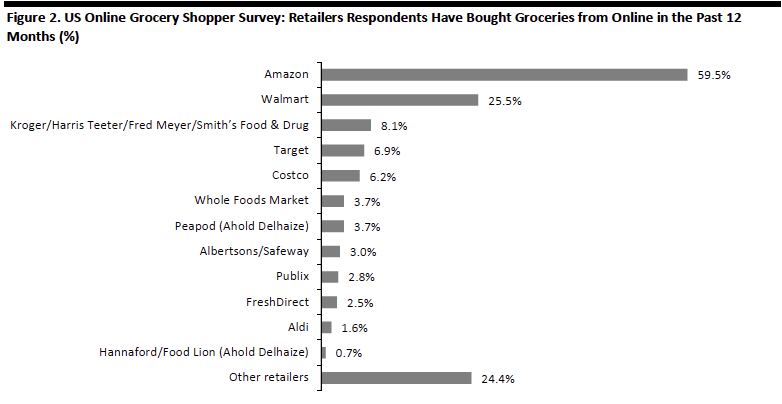

Source: U.S. Bureau of Labor Statistics/U.S. Census Bureau/U.S. Bureau of Economic Analysis/Coresight Research[/caption] On Kroger’s third-quarter 2018 earnings call in December, CFO John Michael Schlotman pointed to a “very benign environment” in terms of inflation. He added, “I know there’s a lot of noise in the marketplace about CPG companies pushing price increases through and the like. Over time, we’ll see where that goes and how everybody winds up reacting to it.” On Walmart’s third-quarter fiscal 2019 earnings call in November, Daniel Binder, VP of Investor Relations, noted, “We did see some cost inflation in the food category, let’s say, meat and dairy, more so, some produce, there was some offsets. But net-net, if you look at the retail inflation, that was pretty much nonexistent. … That was a function of price investment.” Grocery Heads Online E-commerce remains a tiny part of the U.S. grocery market. We estimate that only around 2.3 to 2.4% of almost $1 trillion in food and beverage retail sales were made online in 2018. By comparison, online retail sales accounted for 17.5% of all U.S. nonfood sales in 2018, according to our estimates. In early 2018, we conducted a survey of online grocery shoppers, and found that 23.1% of U.S. internet users — a sizable proportion — had bought groceries online in the past year, but that they typically spend very little of their grocery budgets online. Amazon is by far the most popular retailer for online grocery purchases, according to our survey, although its most popular services are not set up to serve large basket sizes. Otherwise, Walmart, Kroger, Target and Costco Wholesale are the only retailers with meaningful numbers of online grocery shoppers — and Walmart has a big lead among these other four retailers. [caption id="attachment_68563" align="aligncenter" width="782"]

Base: 435 U.S. internet users ages 18+ who had bought groceries online in the past 12 months, surveyed in January 2018

Base: 435 U.S. internet users ages 18+ who had bought groceries online in the past 12 months, surveyed in January 2018Survey question: Which retailers have you bought groceries from online in the past 12 months, including any purchases made through ordering/delivery services such as Instacart? Select all that apply.

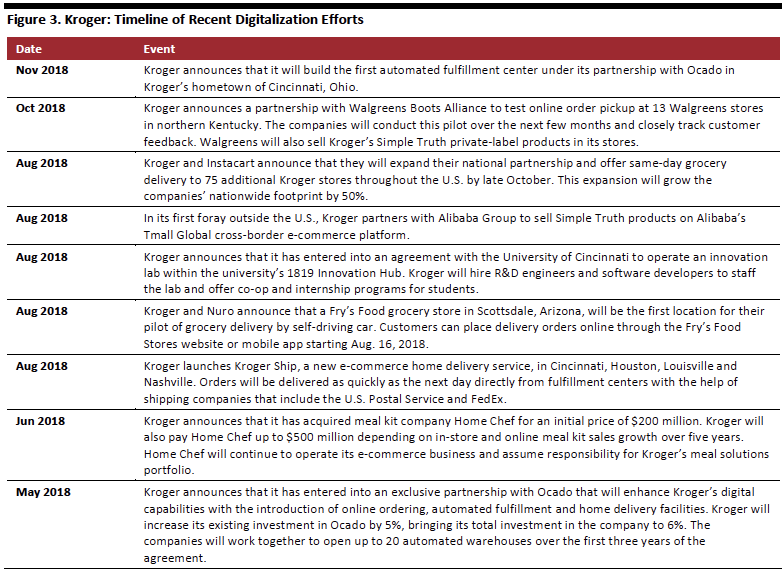

Source: Coresight Research[/caption] Kroger’s Ocado Deal Signals a Pivot to Home Delivery Walmart, Kroger and Amazon are racing to capture share of the still-nascent U.S. grocery e-commerce market. We note a number of Kroger’s recent announcements regarding its online efforts in the table below. The most significant of these is its May 2018 partnership with Ocado Group, which is expected to result in the construction of 20 robot-equipped fulfillment centers for grocery home delivery over three years. Kroger’s partnership with Ocado is notable not only because the planned automated fulfillment centers represent such a sizable commitment to grocery e-commerce, but also because it looks set to take Kroger into grocery home delivery in a major way. In recent years, the U.S. online grocery market has been inching toward an in-store collection model, as grocery retailers typically enjoy more beneficial economies from pickup services than from home delivery services due to the substantial fulfillment costs associated with delivery, which often cannot be fully passed on to price-sensitive customers. If Kroger’s pivot toward a blend of delivery and pickup services prompts major competitors such as Walmart to make similar moves, and consumers make a sustained shift from pickup to delivery, multichannel grocery operators could see long-term margin compression. [caption id="attachment_68566" align="aligncenter" width="782"]

Source: Company reports[/caption]

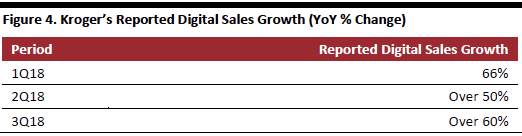

Kroger has seen very strong digital sales growth as it has established more store pickup points for collection of online grocery orders — and its partnership with Ocado has not even begun to bear fruit yet. On Kroger’s third-quarter 2018 earnings call in December, Chairman and CEO William Rodney McMullen referred specifically to the company’s digital growth, saying, “If you look at what was the biggest driver of the growth, it would certainly be continuing to add locations where customers can pick up and get delivery.”

[caption id="attachment_68567" align="aligncenter" width="522"]

Source: Company reports[/caption]

Kroger has seen very strong digital sales growth as it has established more store pickup points for collection of online grocery orders — and its partnership with Ocado has not even begun to bear fruit yet. On Kroger’s third-quarter 2018 earnings call in December, Chairman and CEO William Rodney McMullen referred specifically to the company’s digital growth, saying, “If you look at what was the biggest driver of the growth, it would certainly be continuing to add locations where customers can pick up and get delivery.”

[caption id="attachment_68567" align="aligncenter" width="522"] Source: Company reports[/caption]

In Canada, Ocado signed a deal in January 2018 to supply its technology to food retailer Sobeys and to work with Sobeys to open an initial customer fulfillment center in the Greater Toronto area within two years. Sobeys’ Canadian rival Loblaw began working with Instacart to offer grocery delivery in late 2017 (it already offered grocery pickup services at its stores). The Sobeys deal suggests that the race to online grocery that we have seen in the U.S. — including Kroger’s adoption of home delivery through its partnership with Ocado — will be echoed in Canada.

Amazon Heads Offline

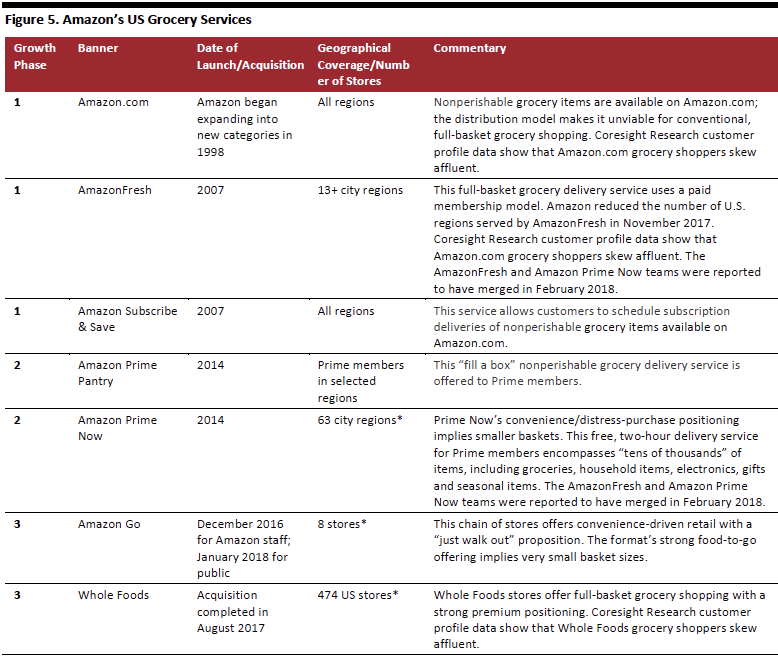

Amazon is so serious about cracking the grocery market that it has fundamentally altered its business model by making a major push into brick-and-mortar retail while paring back its online-only AmazonFresh service. Amazon Go and Whole Foods Market comprise the company’s two-pronged approach to brick-and-mortar grocery, and the launch of the former convenience format and the acquisition of the latter chain can be seen as the third phase in Amazon’s attempt to carve share in grocery. As brick-and-mortar businesses, these banners are fundamentally different from Amazon’s earlier efforts, which tried to work around the frictions of an online pure-play model.

[caption id="attachment_68568" align="aligncenter" width="778"]

Source: Company reports[/caption]

In Canada, Ocado signed a deal in January 2018 to supply its technology to food retailer Sobeys and to work with Sobeys to open an initial customer fulfillment center in the Greater Toronto area within two years. Sobeys’ Canadian rival Loblaw began working with Instacart to offer grocery delivery in late 2017 (it already offered grocery pickup services at its stores). The Sobeys deal suggests that the race to online grocery that we have seen in the U.S. — including Kroger’s adoption of home delivery through its partnership with Ocado — will be echoed in Canada.

Amazon Heads Offline

Amazon is so serious about cracking the grocery market that it has fundamentally altered its business model by making a major push into brick-and-mortar retail while paring back its online-only AmazonFresh service. Amazon Go and Whole Foods Market comprise the company’s two-pronged approach to brick-and-mortar grocery, and the launch of the former convenience format and the acquisition of the latter chain can be seen as the third phase in Amazon’s attempt to carve share in grocery. As brick-and-mortar businesses, these banners are fundamentally different from Amazon’s earlier efforts, which tried to work around the frictions of an online pure-play model.

[caption id="attachment_68568" align="aligncenter" width="778"] *As of December 14, 2018

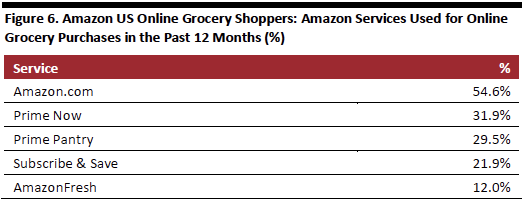

*As of December 14, 2018Source: Company reports[/caption] Amazon apparently struggled to pull in shoppers making full-basket grocery shops under its pure-play model. Our 2018 consumer survey found that Amazon’s regular site was by far its most widely used service for grocery purchases among those who had bought groceries through any of Amazon’s online channels in the past 12 months — and, as we noted above, Amazon.com is not a practical channel for a typical grocery shop. AmazonFresh, the company’s only Amazon-branded full-basket service, was its least-used service, according to our survey. Therefore, we think that, online, Amazon is predominantly capturing small, occasional food purchases rather than the big, regular grocery orders that comprise the bulk of the grocery market. [caption id="attachment_68569" align="aligncenter" width="522"]

Base: 251 U.S. internet users ages 18+ who had bought groceries online through Amazon in the past 12 months, surveyed in January 2018

Base: 251 U.S. internet users ages 18+ who had bought groceries online through Amazon in the past 12 months, surveyed in January 2018Survey question: You have indicated that you have bought groceries on Amazon. Which of the following Amazon services have you used for grocery purchases in the past 12 months? Select all that apply.

Source: Coresight Research[/caption] In late 2018, Bloomberg suggested that Amazon could open as many as 3,000 Amazon Go stores in the U.S. by 2021, while The Wall Street Journal reported that Amazon was testing the checkout-free technology used in Amazon Go stores in larger stores — which could imply an eventual rollout of the technology to Whole Foods stores. Around the same time, Reuters reported that Amazon was looking at bringing checkout-free stores to airports and that the company had opened a smaller-format Amazon Go convenience store in one of its own company offices in Seattle. Despite these reports speculating about the expansion of Amazon Go, we think that established grocery retailers worried about competing with Amazon can take some consolation from its entry points into brick-and-mortar grocery. Amazon Go looks positioned to cater to younger shoppers’ demand for greater convenience and Whole Foods is positioned to cater to demand for more healthy food choices (and we think Amazon could better tap the latter trend by making Whole Foods’ price points more accessible), but we see the two chains as holding somewhat limited relevance for midmarket, big-basket grocery shoppers, for two reasons:

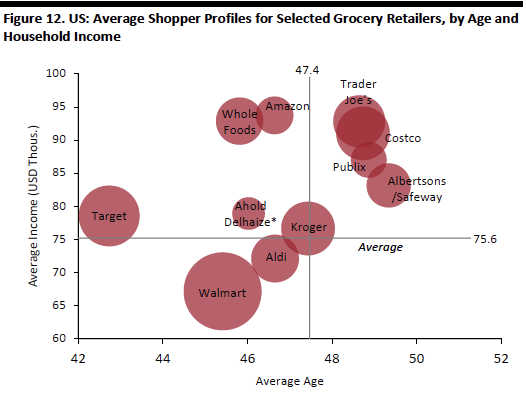

- Neither Amazon Go nor Whole Foods is positioned on value —which should minimize any margin-destructive price war in the near term. Our shopper profiles confirm that Amazon (online) grocery shoppers and Whole Foods shoppers are typically significantly more affluent than shoppers at many other grocery stores (for further detail, see the “US Shopper Demographics” section later in this report).

- Similarly, these store formats are not regular destinations for middle-income shoppers’ large-basket shopping trips, so even if Amazon expands the chains, they would likely peel away relatively few of the more established grocery companies’ core big-shop customers.

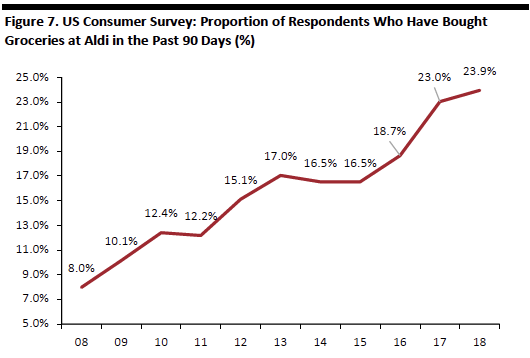

Base: 5,679+ internet users ages 18+, surveyed in August of each year

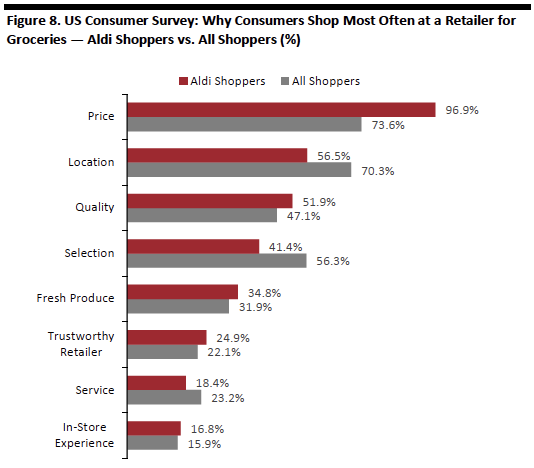

Base: 5,679+ internet users ages 18+, surveyed in August of each yearSource: Prosper Insights & Analytics[/caption] According to Euromonitor International, between 2009 (earliest available data) and 2018, Aldi’s U.S. sales grew by 150%, from $6.8 billion to $17 billion. In early 2017, Aldi announced plans to open 900 new stores over the next five years, to reach a target of 2,500 U.S. stores by 2022, which would make it the third-largest grocer in the country by number of stores. Between Jan. 25, 2018, and Dec. 12, 2018, Aldi increased its U.S. store count by 107, according to the store locator function on its website. As of mid-December 2018, the company operated 1,858 U.S. stores, per its site. Data from Prosper Insights & Analytics suggest that Aldi’s prices are, unsurprisingly, a major driver for its shoppers. But shoppers are also attracted by the quality of the company’s offering and its fresh produce. While low prices are a given at Aldi, its appeal is more broad-based. [caption id="attachment_68571" align="aligncenter" width="534"]

Base: 7,228 U.S. internet users ages 18+, including 369 who shop for groceries most often at Aldi

Base: 7,228 U.S. internet users ages 18+, including 369 who shop for groceries most often at AldiSource: Prosper Insights & Analytics[/caption] Discounters: After Early Challenges, Lidl’s Acquisition of Best Market Implies Renewed Confidence that It Has the Right Formula Aldi’s global rival, Lidl, entered the U.S. market in June 2017. But, in doing so, Lidl strayed from its long-standing format, most notably by choosing to operate much bigger stores than it operates in other markets. Lidl’s first U.S. stores typically have 21,000 square feet of net selling space, according to a February 2017 Washington Post interview with Brendan Proctor, who was Lidl’s U.S. CEO at the time. That is much larger than the typical store Lidl has recently opened in countries such as the U.K., where its newest stores average 14,000 square feet. These big U.S. stores carry around 4,000 SKUs, according to estimates from investment research and services firm Bernstein. Lidl offers about 2,000 SKUs in countries such as the U.K., and even fewer in stores in other markets in Europe. By comparison, Aldi offers only around 2,500 SKUs in its U.S. stores. Lidl appeared to struggle with this softer discount proposition in the U.S. The company severely undershot its original intention to open 100 stores on the East Coast by the summer of 2018. Our research found that 48 Lidl stores were open in the U.S. by late January 2018, and only 53 by the end of June 2018 and 61 by Dec. 11, 2018. The company has shifted its U.S. strategy, implying that management perceived its problems in the U.S. to be primarily related to real estate decisions. In January 2018, Klaus Gehrig, the CEO of Lidl’s parent firm, Schwarz Group, told Germany’s Manager Magazin, “If one recognizes a mistake, one must correct it.” According to German trade publication Lebensmittel Zeitung, Gehrig had been critical of the “glass palaces” that Lidl had planned for the U.S. since early 2017. In the year following its U.S. launch, the chain adjusted its real estate strategy:

- Seven months after its first U.S. store openings in June 2017, Lidl switched its real estate search to smaller stores in more densely populated areas. It is now advertising for sites of 15,000-25,000 square feet instead of the 36,000 square feet it originally planned.

- It is not just the size of Lidl’s planned stores that has changed, but also their locations. Lidl’s latest property advertisements ask for leased sites with “national cotenants” — in other words, the company is looking to lease stores in existing shopping centers rather than stand-alone sites. These centers include outdoor shopping centers as well as the newly extended Staten Island Mall in New York.

- Lidl is also refining its catchment areas. The company originally sought locations with high population densities within three miles, but it’s currently looking to locate stores in areas with high population densities within two miles.

Sector Momentum

Sector Size and Growth- U.S. consumers spent $937.7 billion (including sales tax) on food and beverages at retail stores in 2017, according to the U.S. Bureau of Economic Analysis. We estimate that this total rose 4%, to $975.3 billion, in 2018.

- U.S. grocery stores reported total sales of $639.2 billion (excluding sales tax) in 2017, according to the U.S. Census Bureau. We estimate that this total rose 3.7%, to $663.1 billion, in 2018. This sector total excludes food and grocery purchases made through mass merchandisers (such as Walmart Supercenters) and Internet-only retailers (such as Amazon excluding Whole Foods).

Data are not seasonally adjusted.

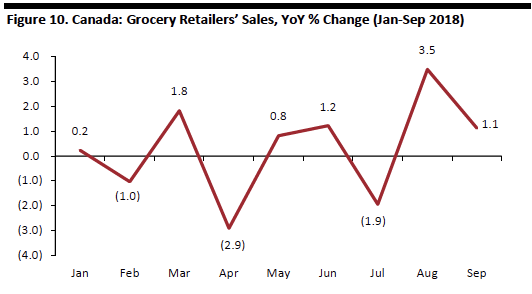

Data are not seasonally adjusted.Source: U.S. Census Bureau/Coresight Research[/caption] In contrast to the U.S., Canada saw exceptionally weak grocery sector sales growth in 2018. From January through September (latest available data), year-over-year sector growth averaged just 0.3% in Canada. This was well below the rate of inflation Statistics Canada recorded for food, which averaged 1.7% across the first nine months of 2018. It was also well below the rate of growth in consumer spending on food and beverages, which was up by an average of 2.7% year over year across the first three quarters of the year, according to Statistics Canada data. The weak performance by Canadian grocery stores therefore reflects a loss of share to alternative channels, which likely include mass merchandisers, warehouse clubs and online-only retailers. [caption id="attachment_68574" align="aligncenter" width="532"]

Data are not seasonally adjusted.

Data are not seasonally adjusted.Source: Statistics Canada/Coresight Research[/caption] Headwinds and Tailwinds Sector Headwinds

- U.S. retail could face an unwinding of growth following a strong run since the final quarter of 2017. In the final quarter of 2018, the retail sector began facing the annualization of that strong growth. In addition, media speculation about a possible economic slowdown or even a recession could prove self-fulfilling for the retail sector, should wary shoppers begin to spend more cautiously. Shoppers trading up to more expensive products is one of only two major drivers of real-terms grocery sales growth, and any dents to consumer confidence in the economy could soften that trend.

- The second major driver of above-inflation growth in grocery sales is population expansion. The U.S. Census Bureau currently forecasts population growth of 0.72% in 2019 and a consistent slowing of growth thereafter, with annual population growth by 2025 forecast at just 0.66%. U.S. grocery retailers therefore cannot rely on population growth to support a solid expansion in sales over the long term.

- Population change is not only about absolute numbers, but also about composition. An aging population implies slower underlying growth for grocery sales and higher costs to service demand, as older consumers tend to have smaller appetites. This depresses total expenditure and makes the economics of grocery retailing less attractive because smaller basket sizes are less economical for retailers to service.

- As discussed earlier, Amazon is moving further into brick-and-mortar grocery retailing, posing new challenges to legacy grocery retailers.

- A second force squeezing conventional supermarket retailers is the growth of discount retailers such as Aldi, Lidl and dollar stores, also discussed earlier. Dollar General has announced plans to open 975 stores in 2019, on top of 900 expected openings in 2018 that were announced in late 2017.

- Finally, very weak food-price inflation makes it harder for grocery retailers to turn in meaningful top-line growth. Any further slowdown in prices, including a move into deflation, would compound this challenge for U.S. grocers.

- As of December 2018, U.S. shoppers appeared to be retaining their willingness to grow their real-terms grocery spending, although there are hints that the growth rate is slowing.

- Over the medium term, increasing consumer demand for healthier foods, including organic foods, will provide opportunities for incremental revenue growth and margin expansion for those retailers that tap the demand. Organic foods, in particular, yield a price and margin premium.

- U.S. grocery retail is highly fragmented, so there are ample opportunities for major retailers to drive consolidation through mergers and acquisitions, which should, in turn, yield greater economies of scale, with a beneficial flow-through to margins. Two grocery retailers that have been seeking greater scale in the market in recent years are Albertsons, which acquired Safeway in 2015, and Ahold and Delhaize, which merged in 2016 to form Ahold Delhaize.

- Grocery retailers have opportunities to move into nonfood categories, such as apparel and housewares. Kroger did this by launching a new private-label line of clothing in 2018.

- Private-label grocery products, which yield higher margins than their branded equivalents, are underpenetrated in the U.S. compared with other countries. Retailers can grow private-label sales by tapping trends such as demand for more fresh foods and greater acceptance of private labels, particularly as own-brand-dominated Aldi and Lidl continue to expand.

Competitive Landscape

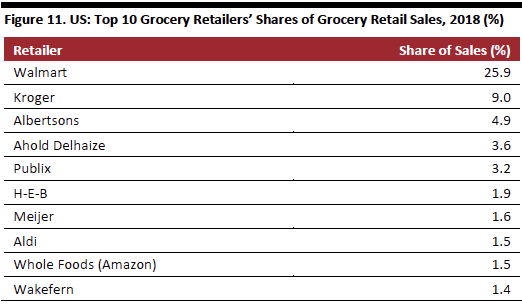

Market Shares Through its ownership of Whole Foods, Amazon is now America’s ninth-largest grocery retailer, having moved up from tenth place in 2017, according to Euromonitor International. Euromonitor’s rankings are based on grocery retailers’ sector shares and do not consider Amazon’s share of online grocery sales. The U.S. grocery market remains highly fragmented and regionalized, with only one retailer, Walmart, holding a double-digit share of sales and only one other retailer, Kroger, enjoying a share of more than 5%. [caption id="attachment_68575" align="aligncenter" width="522"] Source: Euromonitor International[/caption]

US Shopper Demographics

Our proprietary grocery shopper profiles charted below illustrate the following in-store shopper metrics:

Source: Euromonitor International[/caption]

US Shopper Demographics

Our proprietary grocery shopper profiles charted below illustrate the following in-store shopper metrics:

- Shoppers at mass merchandisers skew younger than average, and Target attracts notably younger grocery shoppers.

- The typical Kroger shopper is very close in age and income to the average grocery shopper.

- Shoppers at several supermarket chains skew older, as do Costco shoppers.

- Whole Foods shoppers are relatively affluent and Walmart shoppers tend to be on the opposite side of the income spectrum.

Base: U.S. internet users ages 18+, 1,813 of whom had bought groceries in-store in the past 12 months and 258 of whom had bought groceries online on Amazon in the past 12 months, surveyed in January 2018

Base: U.S. internet users ages 18+, 1,813 of whom had bought groceries in-store in the past 12 months and 258 of whom had bought groceries online on Amazon in the past 12 months, surveyed in January 2018Data represent in-store shoppers, with the exception of Amazon. Bubble size represents number of shoppers.

*The survey asked respondents if they had bought from Food Lion, Stop & Shop, Giant or Hannaford, all of which are Ahold Delhaize banners.

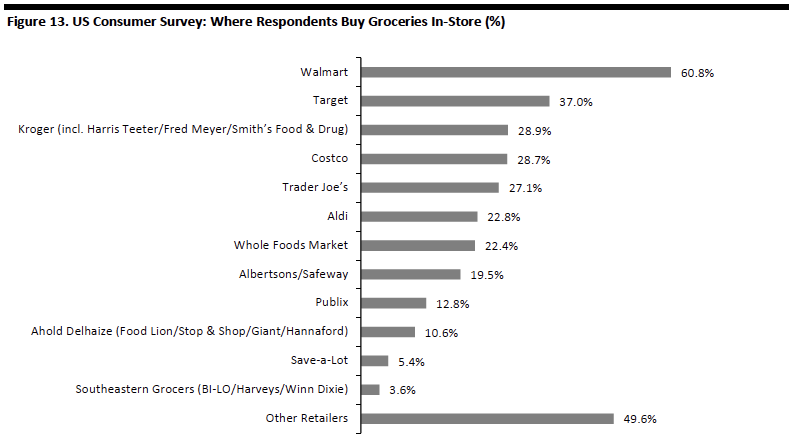

Source: Coresight Research[/caption] By number of shoppers, three of the top five grocery retailers — Walmart, Target and Costco — are nonspecialists. [caption id="attachment_68578" align="aligncenter" width="790"]

Base: 1,813 U.S. internet users ages 18+ who had bought groceries in-store in the past 12 months, surveyed in January 2018

Base: 1,813 U.S. internet users ages 18+ who had bought groceries in-store in the past 12 months, surveyed in January 2018Source: Coresight Research[/caption] Innovators and Disruptors As noted earlier, Amazon has the potential to erode supermarkets’ market share over the long term (even if an acceleration in that erosion is dependent on Amazon adjusting its grocery offering) and Aldi has grown significantly in the U.S. in terms of shopper numbers, stores and estimated revenues. In addition, Aldi, Lidl and the high-growth dollar stores are incrementally gaining share of grocery sales. These stores are notable for their typically smaller store formats and more limited offerings — trade-offs that a growing number of shoppers appear to be happy to make. Online, Ocado is emerging as a significant enabler of North American grocery e-commerce expansion. The company’s 2018 deals with Kroger in the U.S. and Sobeys in Canada offer exclusivity for Ocado’s technology in those markets — putting its highly automated offerings out of reach for competitors.

Sector Outlook

In the near term, if inflation does not tick up, shoppers’ willingness to grow their spend in real terms will drive grocery sector growth. Assuming such behavior continues throughout 2019, the major challenges for legacy supermarket retailers look to be longer term in nature, as these retailers will be pinched by digital players, including Amazon, and Ocado-equipped rivals on one side and by no-frills discounters on the other side.- Readers may also be interested in our Sector Overview: Mass Merchants report.