Nitheesh NH

Introduction

Each report in our Sector Overview series analyzes a retail sector or consumer market. In this report, we dive into the food, drug and mass segment, including discount stores, mass merchandisers and warehouse clubs.

This report includes:

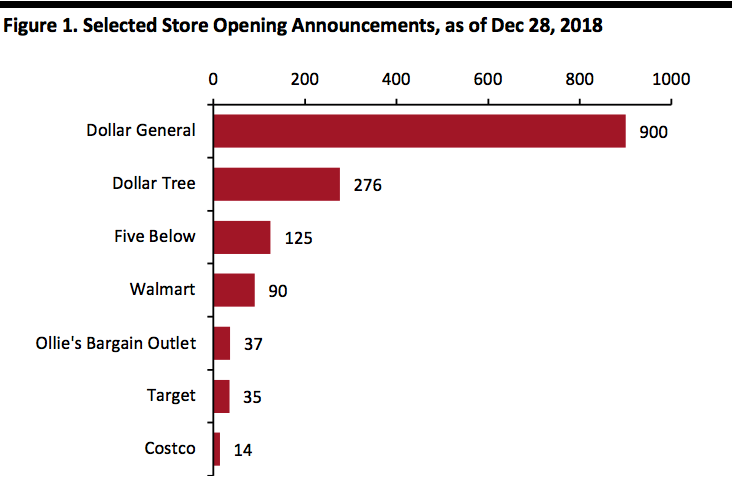

Source: Company reports/Coresight Research[/caption]

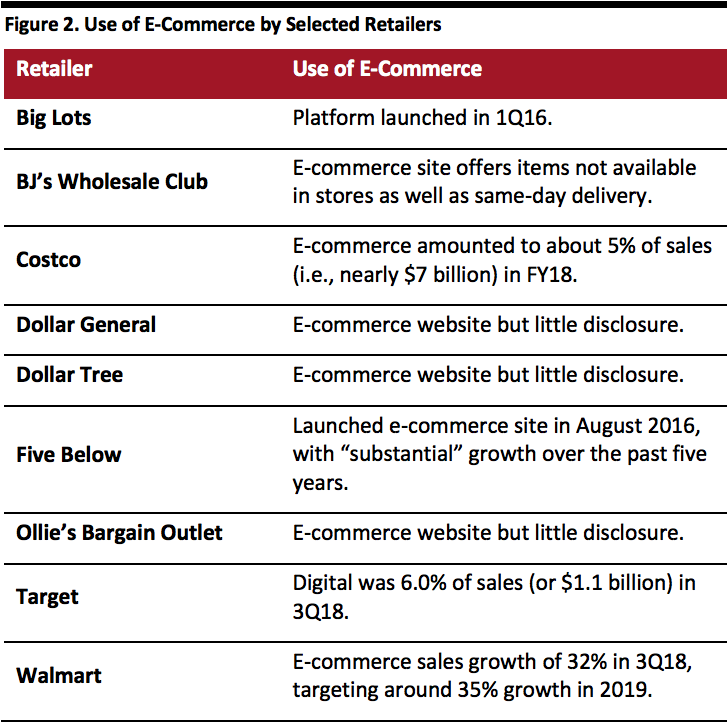

Relatively Light Use of E-Commerce

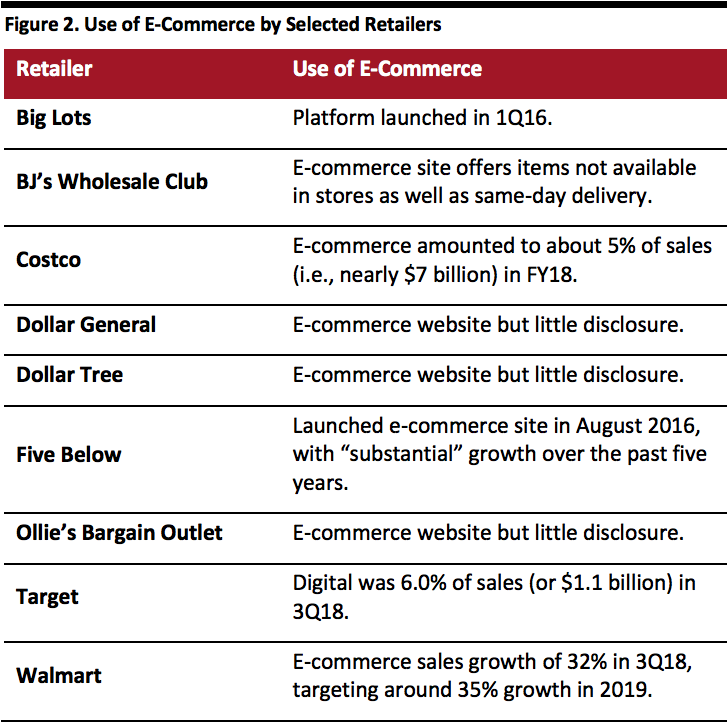

Whereas e-commerce is expected to account for 15% of U.S. retail sales in 2019 according to Euromonitor International, the proliferation of e-commerce among mass-market retailers is generally much lower (except Target and Walmart, which have made ecommerce a priority), and data reporting is sparse.

Warehouse club stores (and value-priced stores as well) believe they are well insulated against e-commerce, as they provide competitive prices, fresh food, differentiated service offerings including gasoline, and the “treasure hunt” experience. The clubs carry a narrow number of SKUs, focusing on daily needs and unusual items, which they can supplement with a virtually unlimited number of items available online.

The table below outlines use of e-commerce among the retailers discussed in this report.

[caption id="attachment_76857" align="aligncenter" width="580"]

Source: Company reports/Coresight Research[/caption]

Relatively Light Use of E-Commerce

Whereas e-commerce is expected to account for 15% of U.S. retail sales in 2019 according to Euromonitor International, the proliferation of e-commerce among mass-market retailers is generally much lower (except Target and Walmart, which have made ecommerce a priority), and data reporting is sparse.

Warehouse club stores (and value-priced stores as well) believe they are well insulated against e-commerce, as they provide competitive prices, fresh food, differentiated service offerings including gasoline, and the “treasure hunt” experience. The clubs carry a narrow number of SKUs, focusing on daily needs and unusual items, which they can supplement with a virtually unlimited number of items available online.

The table below outlines use of e-commerce among the retailers discussed in this report.

[caption id="attachment_76857" align="aligncenter" width="580"] Source: Company reports[/caption]

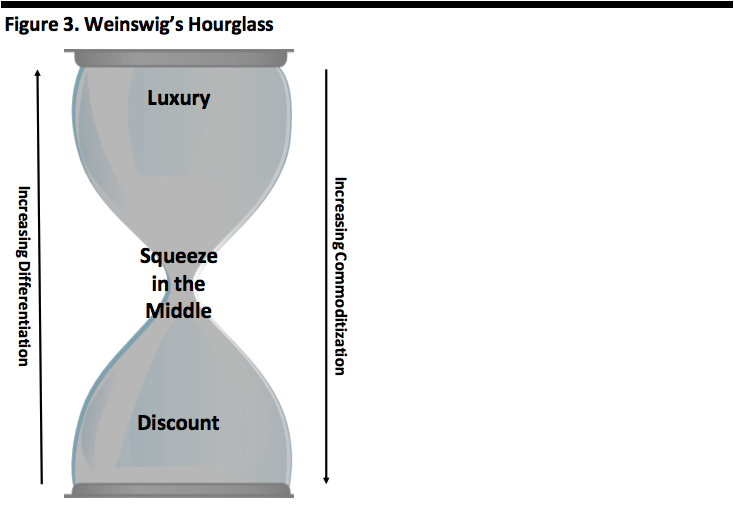

“Cheap Chic” Is Here to Stay

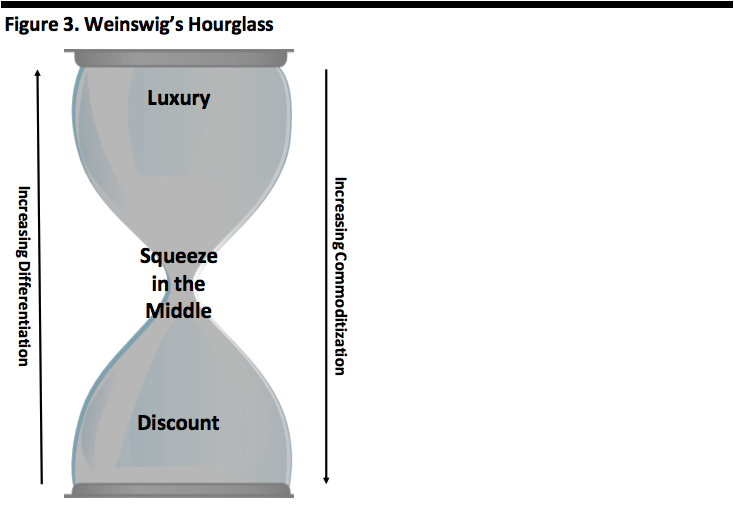

The U.S. consumer embraced value-priced stores (“cheap chic”) during the Global Economic Crisis of 2007–2008 and has remained in that segment. At the same time, sales of luxury goods remain healthy, with retailers in the middle getting squeezed. We have long termed this the “Weinswig’s Hourglass” model, and we represent this model below.

[caption id="attachment_76858" align="aligncenter" width="580"]

Source: Company reports[/caption]

“Cheap Chic” Is Here to Stay

The U.S. consumer embraced value-priced stores (“cheap chic”) during the Global Economic Crisis of 2007–2008 and has remained in that segment. At the same time, sales of luxury goods remain healthy, with retailers in the middle getting squeezed. We have long termed this the “Weinswig’s Hourglass” model, and we represent this model below.

[caption id="attachment_76858" align="aligncenter" width="580"] Source: Coresight Research[/caption]

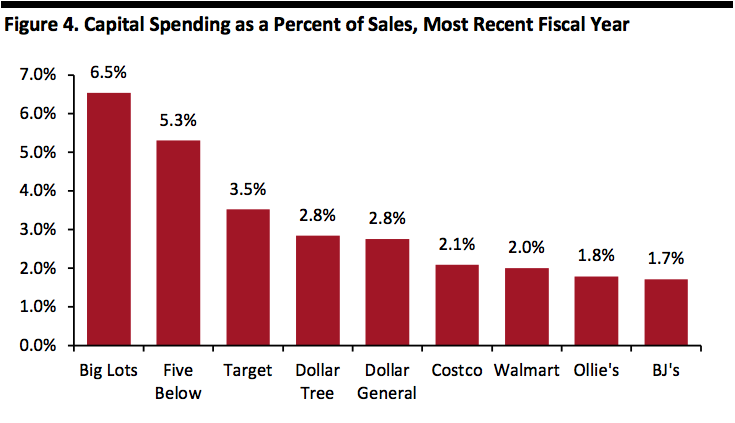

Technology Could Be a Decisive Factor

The mass merchandisers — Walmart and Target — are investing in new technology to gain advantage over competitors, in particular, Amazon. Walmart has deployed Walmart Pay, in-store payment kiosks, in-store robotic pickup kiosks, in addition to its incubator Store No. 8, and these moves add to the e-commerce technology obtained through its acquisition of Jet.com and its investment in Flipkart. Target is deploying in-store checkout tablets (similar to those used in the Apple Store) and is running an accelerator of its own in connection with Techstars, in addition to an accelerator in India.

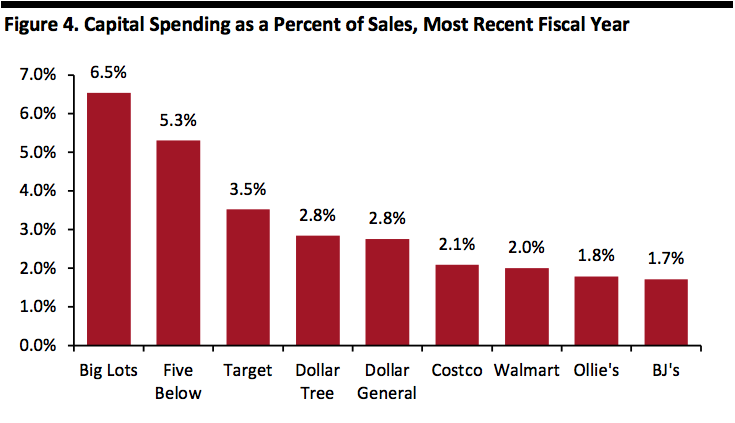

The graph below outlines capital spending for the companies covered in this report, which serves as a proxy for investment, including spending on technology.

[caption id="attachment_76859" align="aligncenter" width="580"]

Source: Coresight Research[/caption]

Technology Could Be a Decisive Factor

The mass merchandisers — Walmart and Target — are investing in new technology to gain advantage over competitors, in particular, Amazon. Walmart has deployed Walmart Pay, in-store payment kiosks, in-store robotic pickup kiosks, in addition to its incubator Store No. 8, and these moves add to the e-commerce technology obtained through its acquisition of Jet.com and its investment in Flipkart. Target is deploying in-store checkout tablets (similar to those used in the Apple Store) and is running an accelerator of its own in connection with Techstars, in addition to an accelerator in India.

The graph below outlines capital spending for the companies covered in this report, which serves as a proxy for investment, including spending on technology.

[caption id="attachment_76859" align="aligncenter" width="580"] Source: Company reports/S&P Capital IQ/Coresight Research[/caption]

The Coming Robot Army

Robots moved beyond the realm of science fiction and became a topic of discussion in the world of retail with Amazon’s acquisition of Kiva Systems for $775 million in March 2012. Since then, Amazon has leveraged robotic technology to augment humans, rather than replace them, with human-robot teams in fulfillment centers.

Walmart is also deploying robotics technology in several locations in its stores. The company is using technology from an Estonian company called Cleveron as the basis for the pickup towers in its stores, which use robotic technology to deliver goods purchased online for in-store pickup. Walmart deployed 200 pickup towers in its stores last year and is targeting deploying more than 700 towers in 2018, which is expected to cover nearly 40% of the U.S. population.

Walmart is also using robots from a company called Bossa Nova in dozens of its stores (as of midyear) to pass through the store aisles and determine which goods need to be replenished. According to Bossa Nova, these robots take inventory three times faster and are twice as accurately as human-based shelf checks, freeing up employees for more human-centric tasks such as helping customers and working with fresh foods.

Other applications of robots in include robot greeters, robots that lead customers to the stock or bring room-service items to hotel guests.

Clash of the Titans: Walmart Versus Amazon

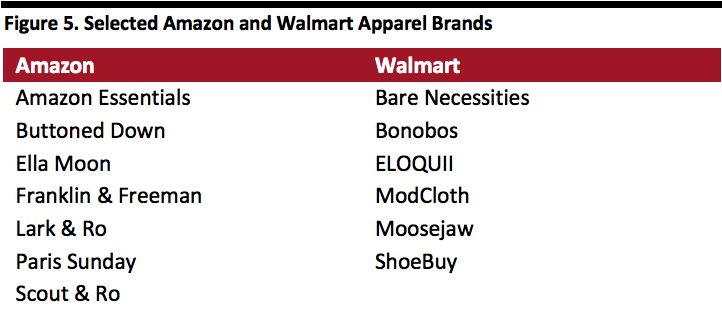

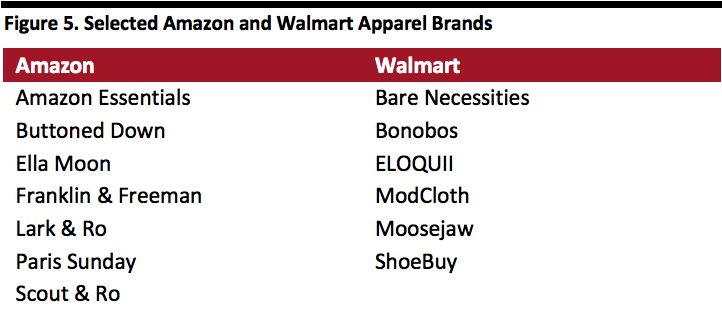

Walmart’s acquisition of Jet.com for $3.3 billion in cash and stock in September 2016 underscores its seriousness in competing in e-commerce, which was further amplified by its $16 billion acquisition of India’s Flipkart in August 2018 – taking the competition to a key, high-growth new geography. Moreover, Walmart’s acquisition of apparel companies parallels Amazon’s move into private-label apparel, i.e., Amazon Fashion, among its 80-plus private label brands. Despite the flood of publicity, Walmart is still believed to be the number-one U.S. retailer of apparel, while Amazon’s position in the apparel market, as ranked by sales, is unknown.

See also our reports Deep Dive: Amazon Apparel—US Survey and Deep Dive: Retail Revolution—US Apparel Shifts in 20 Charts.

The two companies’ efforts are illustrated in the table below.

[caption id="attachment_76860" align="aligncenter" width="580"]

Source: Company reports/S&P Capital IQ/Coresight Research[/caption]

The Coming Robot Army

Robots moved beyond the realm of science fiction and became a topic of discussion in the world of retail with Amazon’s acquisition of Kiva Systems for $775 million in March 2012. Since then, Amazon has leveraged robotic technology to augment humans, rather than replace them, with human-robot teams in fulfillment centers.

Walmart is also deploying robotics technology in several locations in its stores. The company is using technology from an Estonian company called Cleveron as the basis for the pickup towers in its stores, which use robotic technology to deliver goods purchased online for in-store pickup. Walmart deployed 200 pickup towers in its stores last year and is targeting deploying more than 700 towers in 2018, which is expected to cover nearly 40% of the U.S. population.

Walmart is also using robots from a company called Bossa Nova in dozens of its stores (as of midyear) to pass through the store aisles and determine which goods need to be replenished. According to Bossa Nova, these robots take inventory three times faster and are twice as accurately as human-based shelf checks, freeing up employees for more human-centric tasks such as helping customers and working with fresh foods.

Other applications of robots in include robot greeters, robots that lead customers to the stock or bring room-service items to hotel guests.

Clash of the Titans: Walmart Versus Amazon

Walmart’s acquisition of Jet.com for $3.3 billion in cash and stock in September 2016 underscores its seriousness in competing in e-commerce, which was further amplified by its $16 billion acquisition of India’s Flipkart in August 2018 – taking the competition to a key, high-growth new geography. Moreover, Walmart’s acquisition of apparel companies parallels Amazon’s move into private-label apparel, i.e., Amazon Fashion, among its 80-plus private label brands. Despite the flood of publicity, Walmart is still believed to be the number-one U.S. retailer of apparel, while Amazon’s position in the apparel market, as ranked by sales, is unknown.

See also our reports Deep Dive: Amazon Apparel—US Survey and Deep Dive: Retail Revolution—US Apparel Shifts in 20 Charts.

The two companies’ efforts are illustrated in the table below.

[caption id="attachment_76860" align="aligncenter" width="580"] Source: Company reports[/caption]

For more information on Amazon’s private-label strategy, see our report Deep Dive: Slicing and Dicing Amazon’s Private-Label Offering.

Walmart has articulated its broader acquisition strategy, dividing acquisitions into two categories:

Source: Company reports[/caption]

For more information on Amazon’s private-label strategy, see our report Deep Dive: Slicing and Dicing Amazon’s Private-Label Offering.

Walmart has articulated its broader acquisition strategy, dividing acquisitions into two categories:

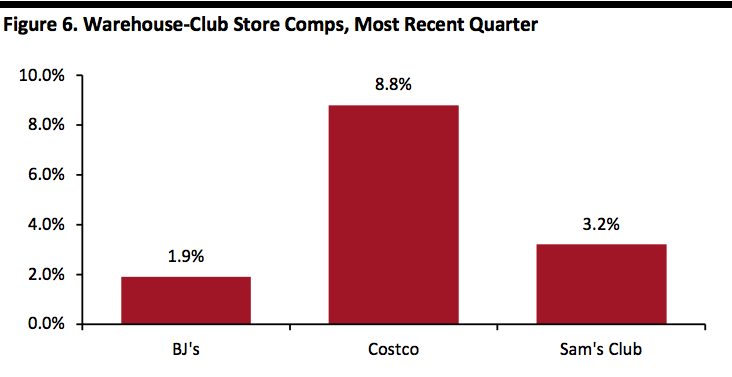

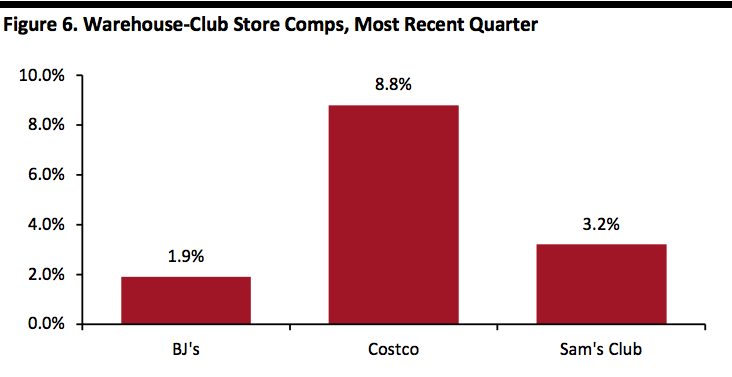

Note: BJ’s and Sam’s Club’s Q3 ended in October; Costco’s fiscal Q1 ended in November.

Note: BJ’s and Sam’s Club’s Q3 ended in October; Costco’s fiscal Q1 ended in November.

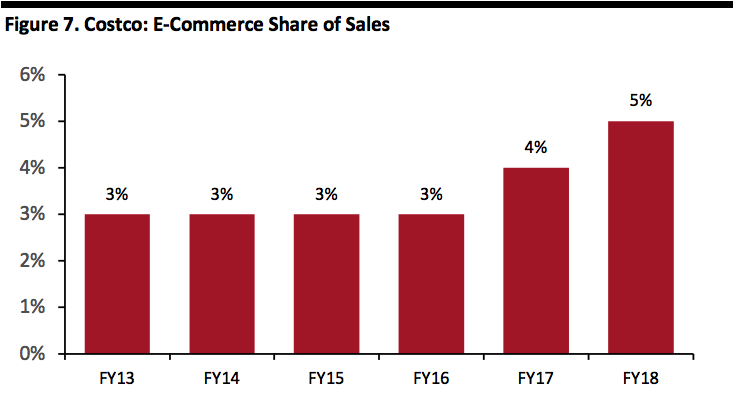

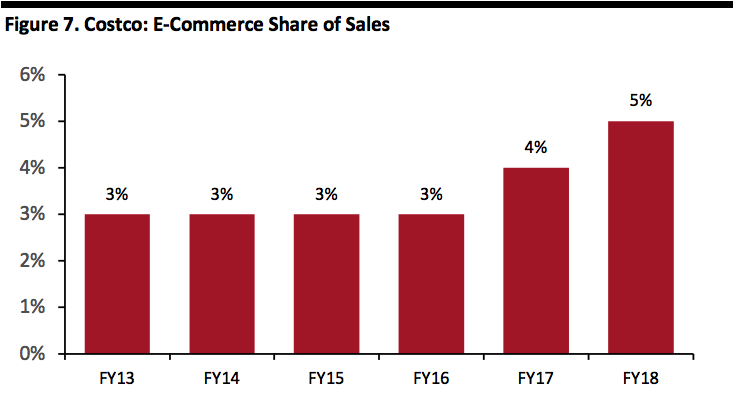

Source: Company reports[/caption] Dispelling the notion that e-commerce is killing mass-merchandising stores and warehouse clubs, Costco has been growing its e-commerce revenues. The graph below shows the acceleration in e-commerce sales as a percent of total sales, starting in FY17 (which builds upon its healthy revenue growth as well). [caption id="attachment_76863" align="aligncenter" width="580"] Source: Company reports[/caption]

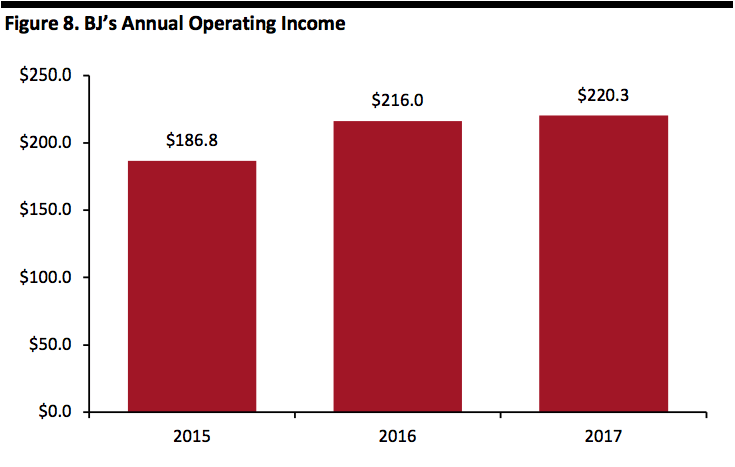

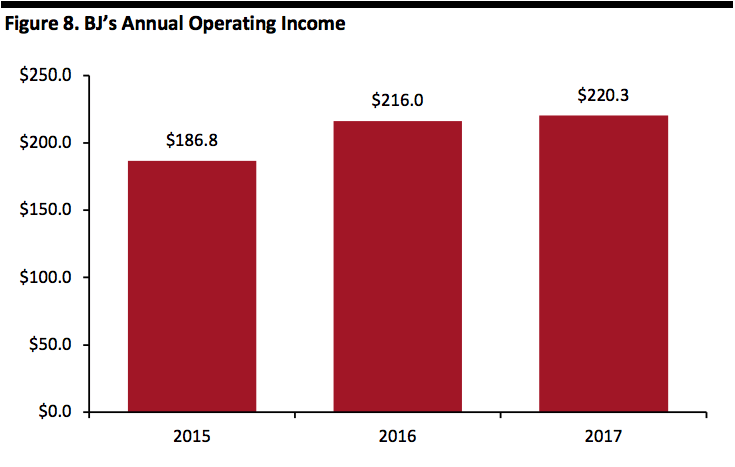

BJ’s Is Back

After being acquired by a group of private-equity firms for $2.8 billion in 2011, BJ’s returned as a public company, completing an initial public offering in June 2018. As a public company, BJ’s can access the public equity markets to raise capital to fund improvements and expand its store footprint.

Although BJ’s is the smallest warehouse club, the company has confidence in achieving the following points of its strategy:

Source: Company reports[/caption]

BJ’s Is Back

After being acquired by a group of private-equity firms for $2.8 billion in 2011, BJ’s returned as a public company, completing an initial public offering in June 2018. As a public company, BJ’s can access the public equity markets to raise capital to fund improvements and expand its store footprint.

Although BJ’s is the smallest warehouse club, the company has confidence in achieving the following points of its strategy:

Source: Company reports[/caption]

Sector Momentum

Sector Size and Growth

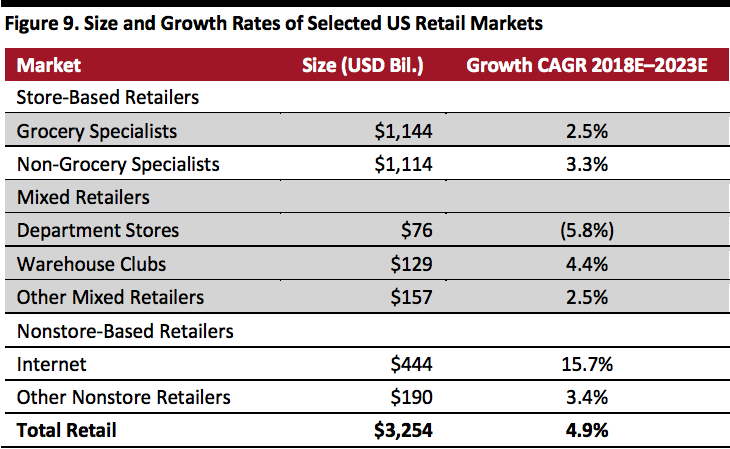

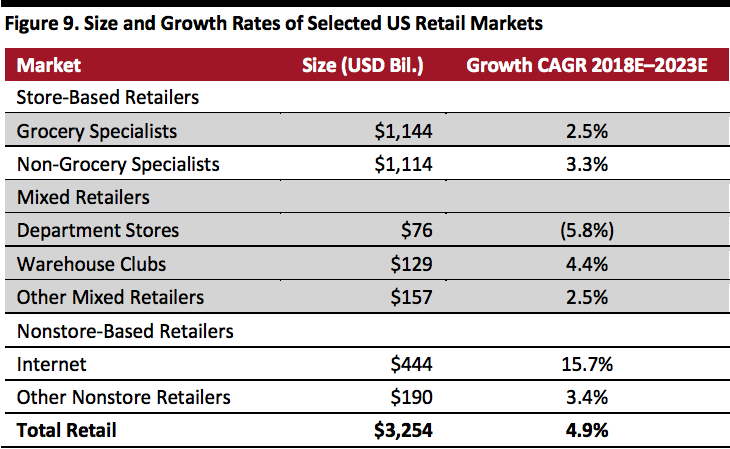

The U.S. retail market is estimated at $3.3 trillion in 2018 and expected to grow at a 4.9% CAGR during 2018–2023, with Internet-based retail raising the aggregate average, according to data from Euromonitor. During this period, store-based retail is forecast to grow at 2.7% (not included in the table below).

The companies discussed in this report sell primarily within the grocery and mixed-retail categories. (We cover food retail in a separate report.)

[caption id="attachment_76865" align="aligncenter" width="580"]

Source: Company reports[/caption]

Sector Momentum

Sector Size and Growth

The U.S. retail market is estimated at $3.3 trillion in 2018 and expected to grow at a 4.9% CAGR during 2018–2023, with Internet-based retail raising the aggregate average, according to data from Euromonitor. During this period, store-based retail is forecast to grow at 2.7% (not included in the table below).

The companies discussed in this report sell primarily within the grocery and mixed-retail categories. (We cover food retail in a separate report.)

[caption id="attachment_76865" align="aligncenter" width="580"] Source: Euromonitor International/Coresight Research[/caption]

Headwinds and Tailwinds

Sector Headwinds

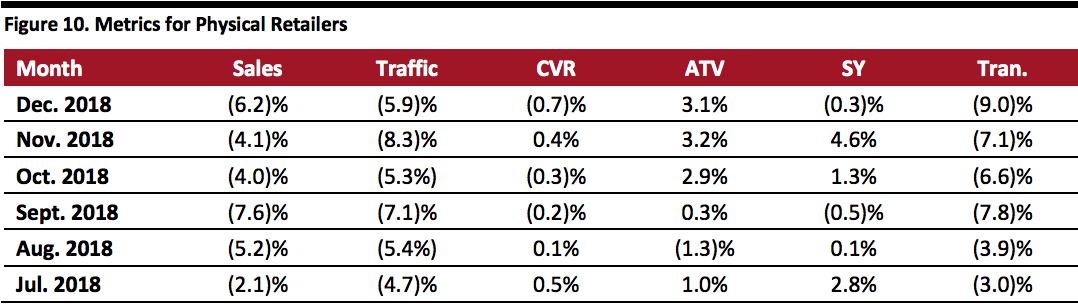

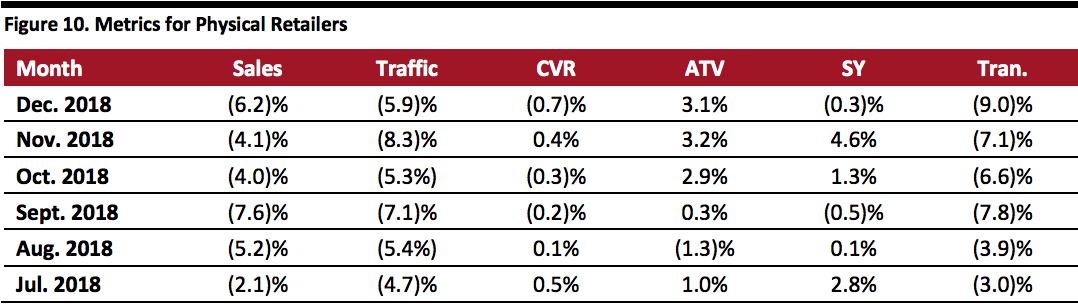

In-store sales and traffic remain negative, which hurts discount stores more due to their focus on low-price items and less-aggressive pursuit of e-commerce. In the table below, which shows sales traffic and other metrics for physical retailers for the past six months, sales and traffic have remained negative.

[caption id="attachment_76866" align="aligncenter" width="800"]

Source: Euromonitor International/Coresight Research[/caption]

Headwinds and Tailwinds

Sector Headwinds

In-store sales and traffic remain negative, which hurts discount stores more due to their focus on low-price items and less-aggressive pursuit of e-commerce. In the table below, which shows sales traffic and other metrics for physical retailers for the past six months, sales and traffic have remained negative.

[caption id="attachment_76866" align="aligncenter" width="800"] Note: Conv. = conversion rate; ATV = average transaction value; SY = shopper yield; Tran. = number of transactions

Note: Conv. = conversion rate; ATV = average transaction value; SY = shopper yield; Tran. = number of transactions

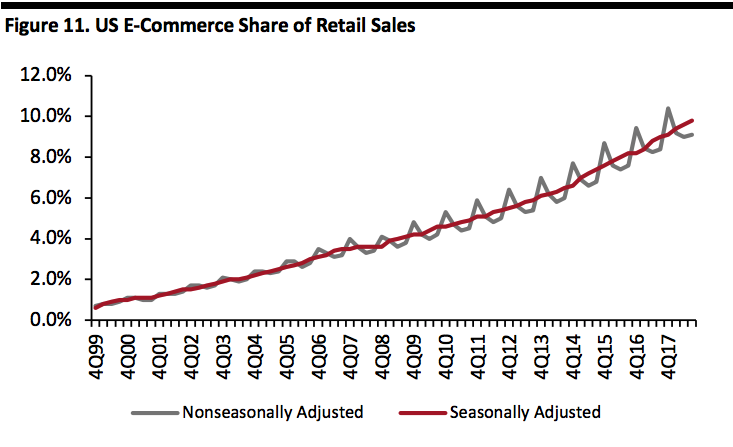

Source: RetailNext[/caption] The relentless growth of e-commerce continues to steal share from brick and mortar retailers, all along the luxury value spectrum. The figure below (which likely underestimates e-commerce penetration due to a broad-based denominator) shows that official e-commerce penetration is approaching 10% on a seasonally adjusted basis and growing 14.5% year over year, well outpacing U.S. retail sale growth. [caption id="attachment_76867" align="aligncenter" width="580"] Source: U.S. Census Bureau[/caption]

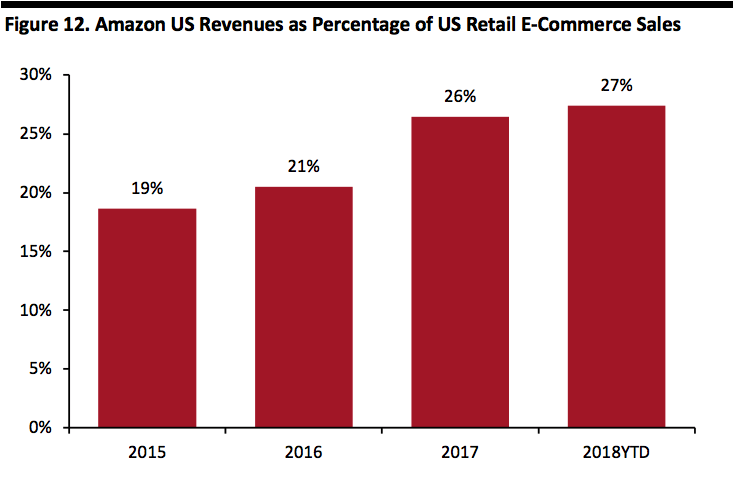

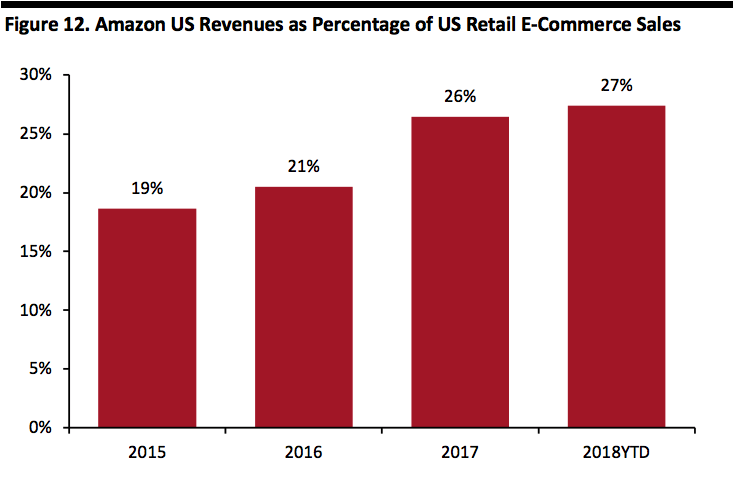

Amazon continues to grow at healthy rates, driving e-commerce and diverting sales from brick-and-mortar retailers, especially the dollar stores, which have not fully embraced e-commerce. The graph below shows the increasing share of Amazon’s U.S. segment revenue as a percentage of officially reported U.S. e-commerce sales.

[caption id="attachment_76872" align="aligncenter" width="580"]

Source: U.S. Census Bureau[/caption]

Amazon continues to grow at healthy rates, driving e-commerce and diverting sales from brick-and-mortar retailers, especially the dollar stores, which have not fully embraced e-commerce. The graph below shows the increasing share of Amazon’s U.S. segment revenue as a percentage of officially reported U.S. e-commerce sales.

[caption id="attachment_76872" align="aligncenter" width="580"] Source: U.S. Census Bureau/company reports/Coresight Research[/caption]

The steady decline in in-store traffic continues to hurt this sector more than other categories of retailers.

Sector Tailwinds

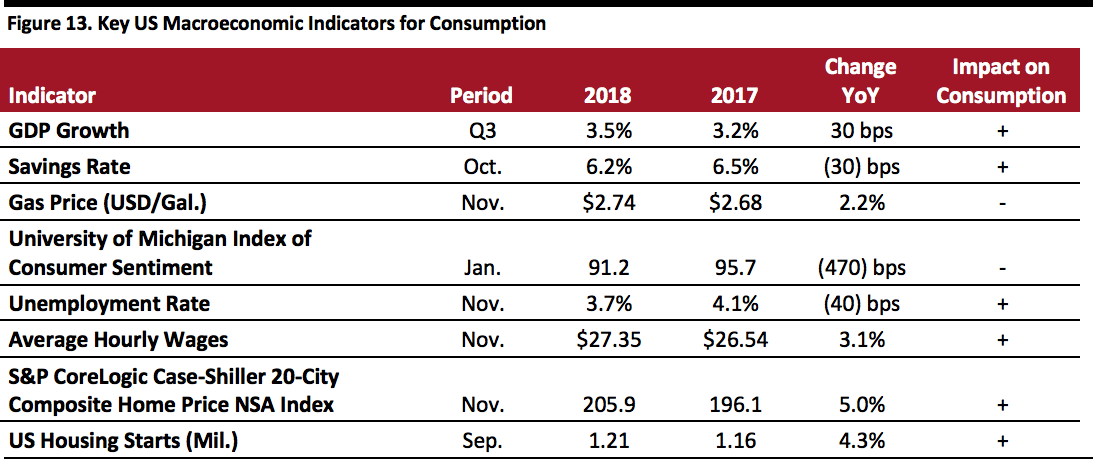

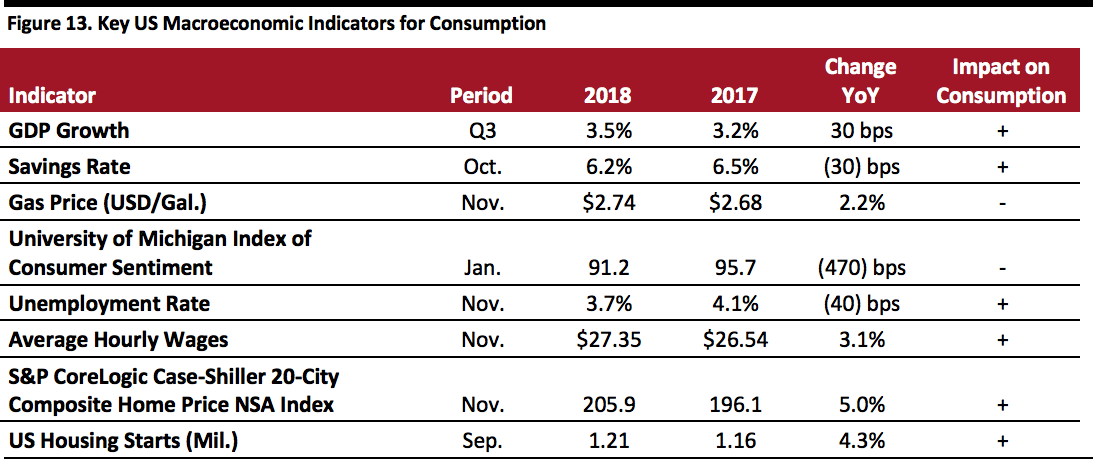

U.S. macroeconomic drivers remain generally strong for consumption, and the only negative — gasoline prices — is benign as shown by the abundance of positive factors in the table below.

[caption id="attachment_76873" align="aligncenter" width="800"]

Source: U.S. Census Bureau/company reports/Coresight Research[/caption]

The steady decline in in-store traffic continues to hurt this sector more than other categories of retailers.

Sector Tailwinds

U.S. macroeconomic drivers remain generally strong for consumption, and the only negative — gasoline prices — is benign as shown by the abundance of positive factors in the table below.

[caption id="attachment_76873" align="aligncenter" width="800"] Source: U.S. Bureau of Labor Statistics/University of Michigan/U.S. Energy Information Administration/S&P Dow Jones/U.S. Bureau of Economic Analysis/Coresight Research[/caption]

The dynamic retail environment continues to drive retailers to file for bankruptcy protection, and the bankruptcy filing of Sears and the liquidation of Toys “R” Us are likely to provide a lift to mass merchants and dollar stores.

Competitive Landscape

Market Shares

Discount Stores

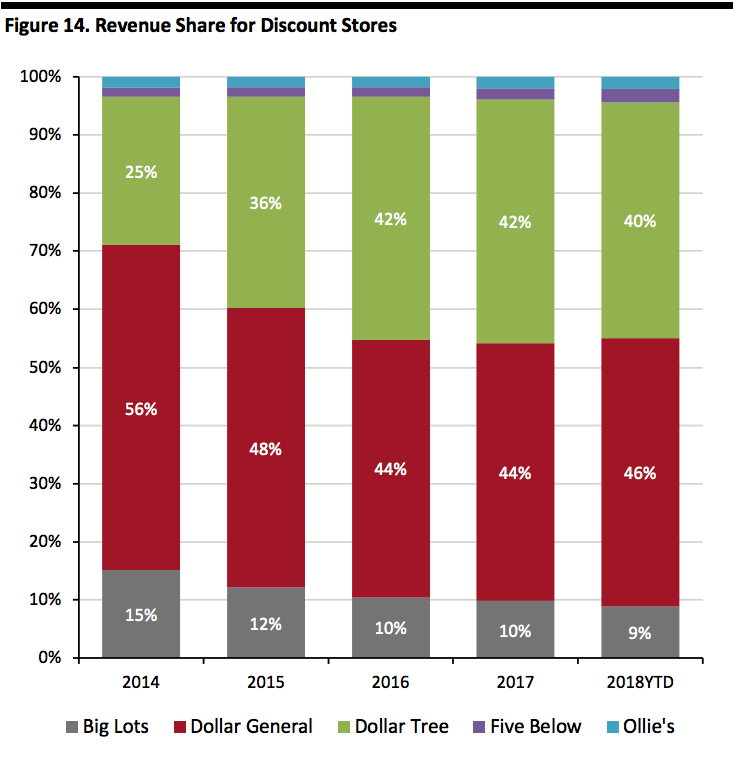

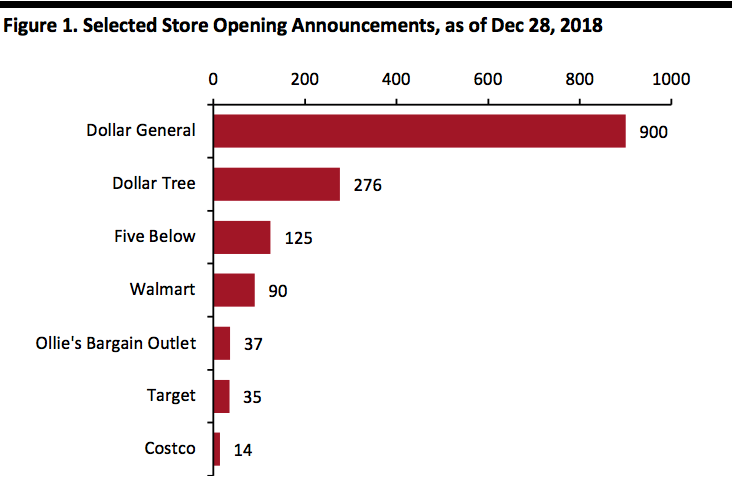

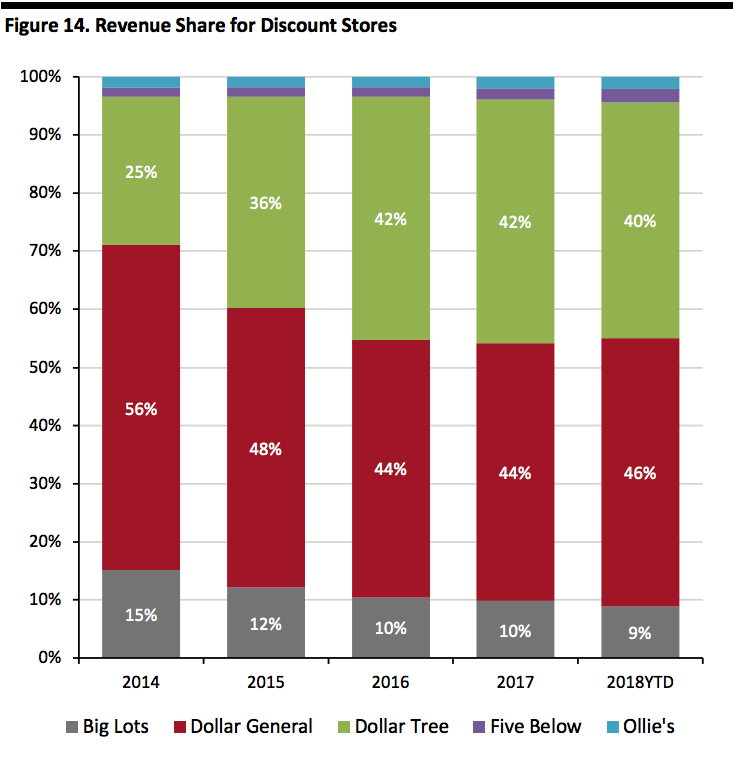

The graph below shows revenue shares for the discount stores, dominated by Dollar General and Dollar Tree. The apparent jump in share for Dollar Tree relates to the acquisition of Family Dollar, which closed on July 6, 2016.

[caption id="attachment_76875" align="aligncenter" width="580"]

Source: U.S. Bureau of Labor Statistics/University of Michigan/U.S. Energy Information Administration/S&P Dow Jones/U.S. Bureau of Economic Analysis/Coresight Research[/caption]

The dynamic retail environment continues to drive retailers to file for bankruptcy protection, and the bankruptcy filing of Sears and the liquidation of Toys “R” Us are likely to provide a lift to mass merchants and dollar stores.

Competitive Landscape

Market Shares

Discount Stores

The graph below shows revenue shares for the discount stores, dominated by Dollar General and Dollar Tree. The apparent jump in share for Dollar Tree relates to the acquisition of Family Dollar, which closed on July 6, 2016.

[caption id="attachment_76875" align="aligncenter" width="580"] Source: Company reports/S&P Capital IQ/Coresight Research[/caption]

Mass Merchandisers

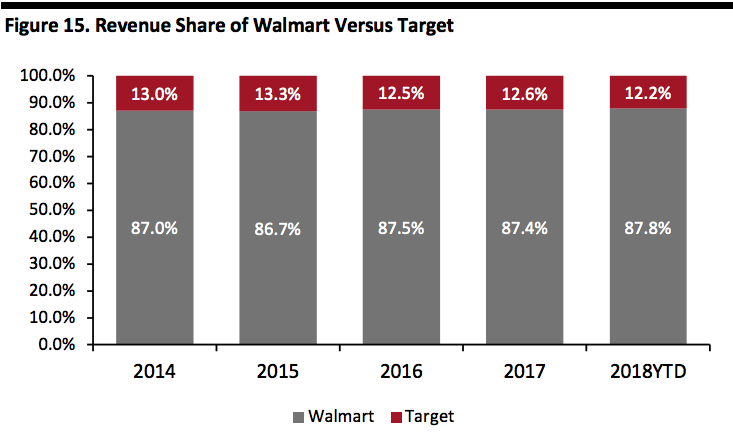

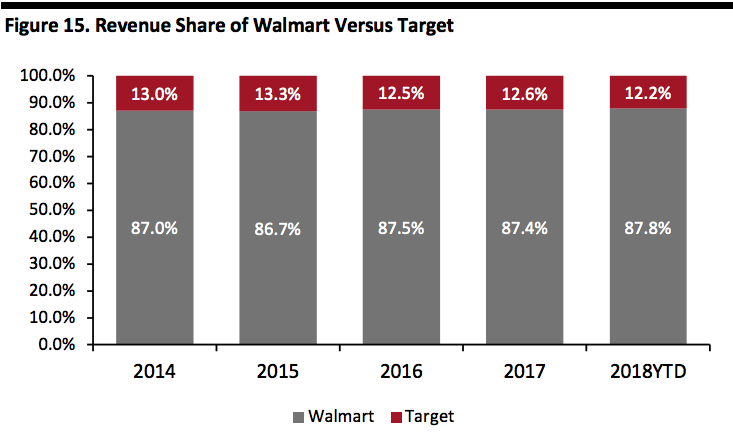

Although Target experienced an increase in its share of total revenue in 2015, Walmart regained share in 2016 and has again captured additional share year to date.

[caption id="attachment_76879" align="aligncenter" width="580"]

Source: Company reports/S&P Capital IQ/Coresight Research[/caption]

Mass Merchandisers

Although Target experienced an increase in its share of total revenue in 2015, Walmart regained share in 2016 and has again captured additional share year to date.

[caption id="attachment_76879" align="aligncenter" width="580"] Source: Company Reports/S&P Capital IQ/Coresight Research[/caption]

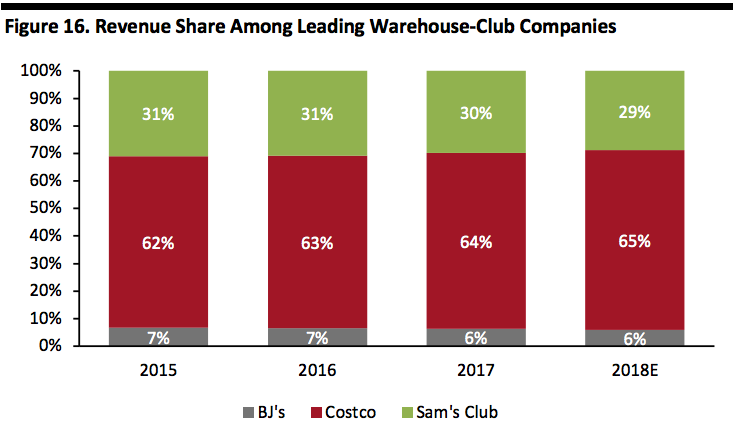

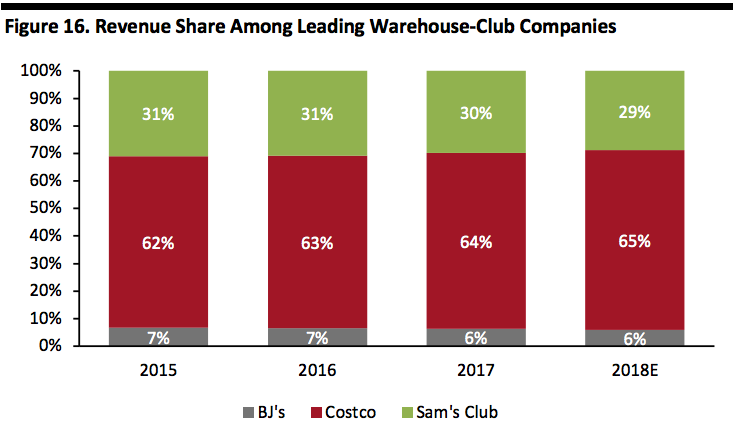

Warehouse Clubs

Costco remains the dominant warehouse-club company, with an estimated nearly two-thirds and more than three-quarters of the total companies’ revenues and operating income, respectively, in 2018, and Costco’s lead is widening. Market shares for the past three years plus an estimate for 2018 is shown in the figure below.

[caption id="attachment_76880" align="aligncenter" width="580"]

Source: Company Reports/S&P Capital IQ/Coresight Research[/caption]

Warehouse Clubs

Costco remains the dominant warehouse-club company, with an estimated nearly two-thirds and more than three-quarters of the total companies’ revenues and operating income, respectively, in 2018, and Costco’s lead is widening. Market shares for the past three years plus an estimate for 2018 is shown in the figure below.

[caption id="attachment_76880" align="aligncenter" width="580"] Source: Company reports/Coresight Research[/caption]

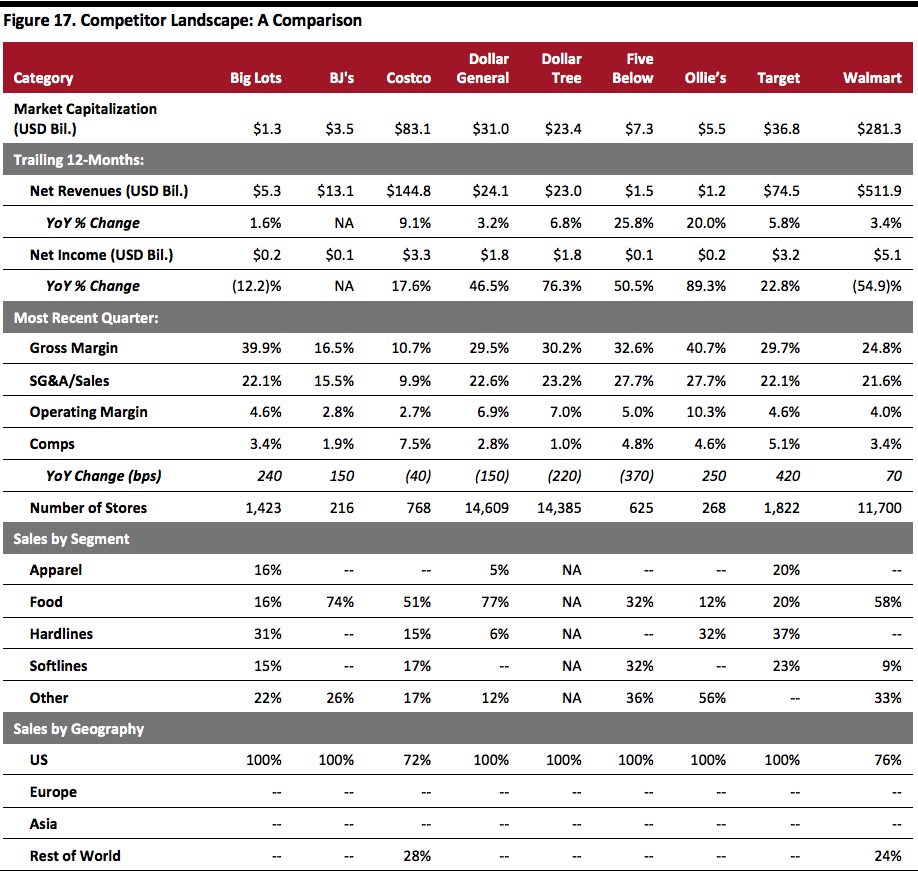

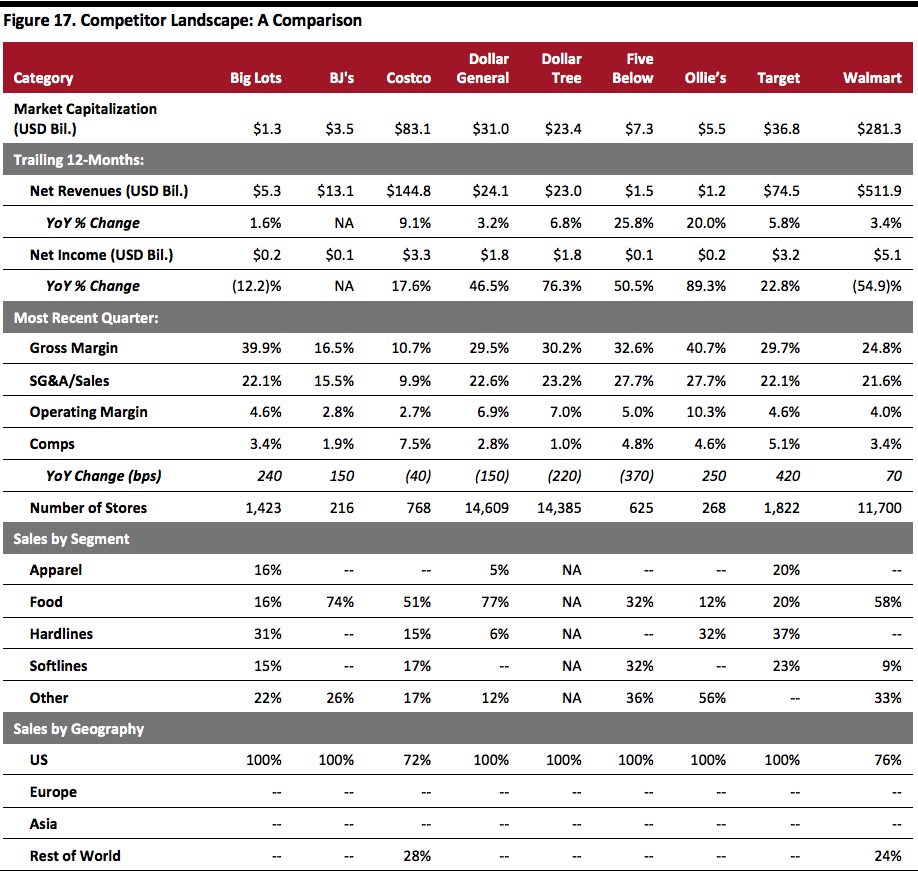

The table below evaluates retailers covered in this report based on revenues, margins, net income, comps and compares their sales by segment and geography.

Company Summaries

[caption id="attachment_76881" align="aligncenter" width="800"]

Source: Company reports/Coresight Research[/caption]

The table below evaluates retailers covered in this report based on revenues, margins, net income, comps and compares their sales by segment and geography.

Company Summaries

[caption id="attachment_76881" align="aligncenter" width="800"] Source: Company reports/S&P Capital IQ/Coresight Research[/caption]

Innovators and Disruptors

There are numerous startups and established companies (alongside the ever-present threat from Amazon) seeking to enter and disrupt the mass-merchandise segment, including the following:

Source: Company reports/S&P Capital IQ/Coresight Research[/caption]

Innovators and Disruptors

There are numerous startups and established companies (alongside the ever-present threat from Amazon) seeking to enter and disrupt the mass-merchandise segment, including the following:

- A discussion of key sector themes.

- A review of retail sector momentum for discount stores, mass merchandisers and warehouse clubs.

- A summary of the sector landscape, including market shares for the top retailers in their respective categories.

- The outlook for the sector.

Source: Company reports/Coresight Research[/caption]

Relatively Light Use of E-Commerce

Whereas e-commerce is expected to account for 15% of U.S. retail sales in 2019 according to Euromonitor International, the proliferation of e-commerce among mass-market retailers is generally much lower (except Target and Walmart, which have made ecommerce a priority), and data reporting is sparse.

Warehouse club stores (and value-priced stores as well) believe they are well insulated against e-commerce, as they provide competitive prices, fresh food, differentiated service offerings including gasoline, and the “treasure hunt” experience. The clubs carry a narrow number of SKUs, focusing on daily needs and unusual items, which they can supplement with a virtually unlimited number of items available online.

The table below outlines use of e-commerce among the retailers discussed in this report.

[caption id="attachment_76857" align="aligncenter" width="580"]

Source: Company reports/Coresight Research[/caption]

Relatively Light Use of E-Commerce

Whereas e-commerce is expected to account for 15% of U.S. retail sales in 2019 according to Euromonitor International, the proliferation of e-commerce among mass-market retailers is generally much lower (except Target and Walmart, which have made ecommerce a priority), and data reporting is sparse.

Warehouse club stores (and value-priced stores as well) believe they are well insulated against e-commerce, as they provide competitive prices, fresh food, differentiated service offerings including gasoline, and the “treasure hunt” experience. The clubs carry a narrow number of SKUs, focusing on daily needs and unusual items, which they can supplement with a virtually unlimited number of items available online.

The table below outlines use of e-commerce among the retailers discussed in this report.

[caption id="attachment_76857" align="aligncenter" width="580"] Source: Company reports[/caption]

“Cheap Chic” Is Here to Stay

The U.S. consumer embraced value-priced stores (“cheap chic”) during the Global Economic Crisis of 2007–2008 and has remained in that segment. At the same time, sales of luxury goods remain healthy, with retailers in the middle getting squeezed. We have long termed this the “Weinswig’s Hourglass” model, and we represent this model below.

[caption id="attachment_76858" align="aligncenter" width="580"]

Source: Company reports[/caption]

“Cheap Chic” Is Here to Stay

The U.S. consumer embraced value-priced stores (“cheap chic”) during the Global Economic Crisis of 2007–2008 and has remained in that segment. At the same time, sales of luxury goods remain healthy, with retailers in the middle getting squeezed. We have long termed this the “Weinswig’s Hourglass” model, and we represent this model below.

[caption id="attachment_76858" align="aligncenter" width="580"] Source: Coresight Research[/caption]

Technology Could Be a Decisive Factor

The mass merchandisers — Walmart and Target — are investing in new technology to gain advantage over competitors, in particular, Amazon. Walmart has deployed Walmart Pay, in-store payment kiosks, in-store robotic pickup kiosks, in addition to its incubator Store No. 8, and these moves add to the e-commerce technology obtained through its acquisition of Jet.com and its investment in Flipkart. Target is deploying in-store checkout tablets (similar to those used in the Apple Store) and is running an accelerator of its own in connection with Techstars, in addition to an accelerator in India.

The graph below outlines capital spending for the companies covered in this report, which serves as a proxy for investment, including spending on technology.

[caption id="attachment_76859" align="aligncenter" width="580"]

Source: Coresight Research[/caption]

Technology Could Be a Decisive Factor

The mass merchandisers — Walmart and Target — are investing in new technology to gain advantage over competitors, in particular, Amazon. Walmart has deployed Walmart Pay, in-store payment kiosks, in-store robotic pickup kiosks, in addition to its incubator Store No. 8, and these moves add to the e-commerce technology obtained through its acquisition of Jet.com and its investment in Flipkart. Target is deploying in-store checkout tablets (similar to those used in the Apple Store) and is running an accelerator of its own in connection with Techstars, in addition to an accelerator in India.

The graph below outlines capital spending for the companies covered in this report, which serves as a proxy for investment, including spending on technology.

[caption id="attachment_76859" align="aligncenter" width="580"] Source: Company reports/S&P Capital IQ/Coresight Research[/caption]

The Coming Robot Army

Robots moved beyond the realm of science fiction and became a topic of discussion in the world of retail with Amazon’s acquisition of Kiva Systems for $775 million in March 2012. Since then, Amazon has leveraged robotic technology to augment humans, rather than replace them, with human-robot teams in fulfillment centers.

Walmart is also deploying robotics technology in several locations in its stores. The company is using technology from an Estonian company called Cleveron as the basis for the pickup towers in its stores, which use robotic technology to deliver goods purchased online for in-store pickup. Walmart deployed 200 pickup towers in its stores last year and is targeting deploying more than 700 towers in 2018, which is expected to cover nearly 40% of the U.S. population.

Walmart is also using robots from a company called Bossa Nova in dozens of its stores (as of midyear) to pass through the store aisles and determine which goods need to be replenished. According to Bossa Nova, these robots take inventory three times faster and are twice as accurately as human-based shelf checks, freeing up employees for more human-centric tasks such as helping customers and working with fresh foods.

Other applications of robots in include robot greeters, robots that lead customers to the stock or bring room-service items to hotel guests.

Clash of the Titans: Walmart Versus Amazon

Walmart’s acquisition of Jet.com for $3.3 billion in cash and stock in September 2016 underscores its seriousness in competing in e-commerce, which was further amplified by its $16 billion acquisition of India’s Flipkart in August 2018 – taking the competition to a key, high-growth new geography. Moreover, Walmart’s acquisition of apparel companies parallels Amazon’s move into private-label apparel, i.e., Amazon Fashion, among its 80-plus private label brands. Despite the flood of publicity, Walmart is still believed to be the number-one U.S. retailer of apparel, while Amazon’s position in the apparel market, as ranked by sales, is unknown.

See also our reports Deep Dive: Amazon Apparel—US Survey and Deep Dive: Retail Revolution—US Apparel Shifts in 20 Charts.

The two companies’ efforts are illustrated in the table below.

[caption id="attachment_76860" align="aligncenter" width="580"]

Source: Company reports/S&P Capital IQ/Coresight Research[/caption]

The Coming Robot Army

Robots moved beyond the realm of science fiction and became a topic of discussion in the world of retail with Amazon’s acquisition of Kiva Systems for $775 million in March 2012. Since then, Amazon has leveraged robotic technology to augment humans, rather than replace them, with human-robot teams in fulfillment centers.

Walmart is also deploying robotics technology in several locations in its stores. The company is using technology from an Estonian company called Cleveron as the basis for the pickup towers in its stores, which use robotic technology to deliver goods purchased online for in-store pickup. Walmart deployed 200 pickup towers in its stores last year and is targeting deploying more than 700 towers in 2018, which is expected to cover nearly 40% of the U.S. population.

Walmart is also using robots from a company called Bossa Nova in dozens of its stores (as of midyear) to pass through the store aisles and determine which goods need to be replenished. According to Bossa Nova, these robots take inventory three times faster and are twice as accurately as human-based shelf checks, freeing up employees for more human-centric tasks such as helping customers and working with fresh foods.

Other applications of robots in include robot greeters, robots that lead customers to the stock or bring room-service items to hotel guests.

Clash of the Titans: Walmart Versus Amazon

Walmart’s acquisition of Jet.com for $3.3 billion in cash and stock in September 2016 underscores its seriousness in competing in e-commerce, which was further amplified by its $16 billion acquisition of India’s Flipkart in August 2018 – taking the competition to a key, high-growth new geography. Moreover, Walmart’s acquisition of apparel companies parallels Amazon’s move into private-label apparel, i.e., Amazon Fashion, among its 80-plus private label brands. Despite the flood of publicity, Walmart is still believed to be the number-one U.S. retailer of apparel, while Amazon’s position in the apparel market, as ranked by sales, is unknown.

See also our reports Deep Dive: Amazon Apparel—US Survey and Deep Dive: Retail Revolution—US Apparel Shifts in 20 Charts.

The two companies’ efforts are illustrated in the table below.

[caption id="attachment_76860" align="aligncenter" width="580"] Source: Company reports[/caption]

For more information on Amazon’s private-label strategy, see our report Deep Dive: Slicing and Dicing Amazon’s Private-Label Offering.

Walmart has articulated its broader acquisition strategy, dividing acquisitions into two categories:

Source: Company reports[/caption]

For more information on Amazon’s private-label strategy, see our report Deep Dive: Slicing and Dicing Amazon’s Private-Label Offering.

Walmart has articulated its broader acquisition strategy, dividing acquisitions into two categories:

- Category leaders with specialized expertise and assortments that can enhance the customer experience on Walmart.com and Jet.com (for example, Hayneedle, Moosejaw and Shoes.com).

- Digital brands that offer unique products customers cannot find anywhere else (for example, Bonobos, Modcloth, ELOQUII and Bare Necessities).

- George (updated) — Menswear

- Terra & Sky — Plus-sized women

- Time and Tru — Womenswear

- Wonder Nation — Children

- Heyday — Consumer electronics

- Made by Design — Home

- Opalhouse — Home

- Original Use — Young menswear

- Prologue — Low-priced womenswear

- Smartly — Consumer products

- Universal Thread — Denim

- Wild Fable — Womenswear

Note: BJ’s and Sam’s Club’s Q3 ended in October; Costco’s fiscal Q1 ended in November.

Note: BJ’s and Sam’s Club’s Q3 ended in October; Costco’s fiscal Q1 ended in November.Source: Company reports[/caption] Dispelling the notion that e-commerce is killing mass-merchandising stores and warehouse clubs, Costco has been growing its e-commerce revenues. The graph below shows the acceleration in e-commerce sales as a percent of total sales, starting in FY17 (which builds upon its healthy revenue growth as well). [caption id="attachment_76863" align="aligncenter" width="580"]

Source: Company reports[/caption]

BJ’s Is Back

After being acquired by a group of private-equity firms for $2.8 billion in 2011, BJ’s returned as a public company, completing an initial public offering in June 2018. As a public company, BJ’s can access the public equity markets to raise capital to fund improvements and expand its store footprint.

Although BJ’s is the smallest warehouse club, the company has confidence in achieving the following points of its strategy:

Source: Company reports[/caption]

BJ’s Is Back

After being acquired by a group of private-equity firms for $2.8 billion in 2011, BJ’s returned as a public company, completing an initial public offering in June 2018. As a public company, BJ’s can access the public equity markets to raise capital to fund improvements and expand its store footprint.

Although BJ’s is the smallest warehouse club, the company has confidence in achieving the following points of its strategy:

- Growing its membership base.

- Relentlessly focusing on the customer to drive sales.

- Improve its omnichannel offering.

- Expand its store footprint.

- Continue to enhance profitability.

Source: Company reports[/caption]

Sector Momentum

Sector Size and Growth

The U.S. retail market is estimated at $3.3 trillion in 2018 and expected to grow at a 4.9% CAGR during 2018–2023, with Internet-based retail raising the aggregate average, according to data from Euromonitor. During this period, store-based retail is forecast to grow at 2.7% (not included in the table below).

The companies discussed in this report sell primarily within the grocery and mixed-retail categories. (We cover food retail in a separate report.)

[caption id="attachment_76865" align="aligncenter" width="580"]

Source: Company reports[/caption]

Sector Momentum

Sector Size and Growth

The U.S. retail market is estimated at $3.3 trillion in 2018 and expected to grow at a 4.9% CAGR during 2018–2023, with Internet-based retail raising the aggregate average, according to data from Euromonitor. During this period, store-based retail is forecast to grow at 2.7% (not included in the table below).

The companies discussed in this report sell primarily within the grocery and mixed-retail categories. (We cover food retail in a separate report.)

[caption id="attachment_76865" align="aligncenter" width="580"] Source: Euromonitor International/Coresight Research[/caption]

Headwinds and Tailwinds

Sector Headwinds

In-store sales and traffic remain negative, which hurts discount stores more due to their focus on low-price items and less-aggressive pursuit of e-commerce. In the table below, which shows sales traffic and other metrics for physical retailers for the past six months, sales and traffic have remained negative.

[caption id="attachment_76866" align="aligncenter" width="800"]

Source: Euromonitor International/Coresight Research[/caption]

Headwinds and Tailwinds

Sector Headwinds

In-store sales and traffic remain negative, which hurts discount stores more due to their focus on low-price items and less-aggressive pursuit of e-commerce. In the table below, which shows sales traffic and other metrics for physical retailers for the past six months, sales and traffic have remained negative.

[caption id="attachment_76866" align="aligncenter" width="800"] Note: Conv. = conversion rate; ATV = average transaction value; SY = shopper yield; Tran. = number of transactions

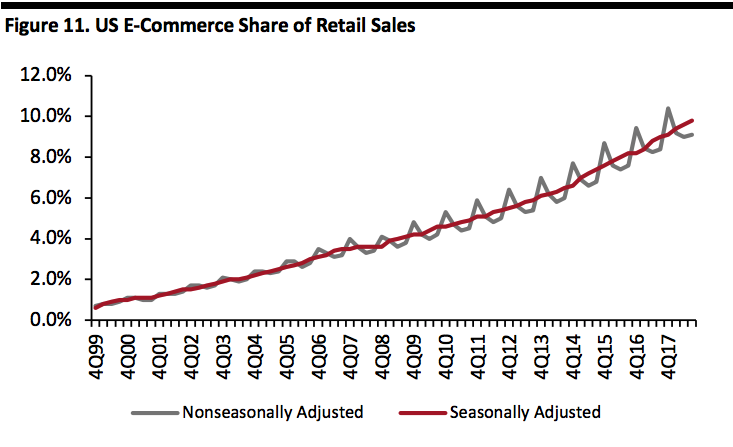

Note: Conv. = conversion rate; ATV = average transaction value; SY = shopper yield; Tran. = number of transactionsSource: RetailNext[/caption] The relentless growth of e-commerce continues to steal share from brick and mortar retailers, all along the luxury value spectrum. The figure below (which likely underestimates e-commerce penetration due to a broad-based denominator) shows that official e-commerce penetration is approaching 10% on a seasonally adjusted basis and growing 14.5% year over year, well outpacing U.S. retail sale growth. [caption id="attachment_76867" align="aligncenter" width="580"]

Source: U.S. Census Bureau[/caption]

Amazon continues to grow at healthy rates, driving e-commerce and diverting sales from brick-and-mortar retailers, especially the dollar stores, which have not fully embraced e-commerce. The graph below shows the increasing share of Amazon’s U.S. segment revenue as a percentage of officially reported U.S. e-commerce sales.

[caption id="attachment_76872" align="aligncenter" width="580"]

Source: U.S. Census Bureau[/caption]

Amazon continues to grow at healthy rates, driving e-commerce and diverting sales from brick-and-mortar retailers, especially the dollar stores, which have not fully embraced e-commerce. The graph below shows the increasing share of Amazon’s U.S. segment revenue as a percentage of officially reported U.S. e-commerce sales.

[caption id="attachment_76872" align="aligncenter" width="580"] Source: U.S. Census Bureau/company reports/Coresight Research[/caption]

The steady decline in in-store traffic continues to hurt this sector more than other categories of retailers.

Sector Tailwinds

U.S. macroeconomic drivers remain generally strong for consumption, and the only negative — gasoline prices — is benign as shown by the abundance of positive factors in the table below.

[caption id="attachment_76873" align="aligncenter" width="800"]

Source: U.S. Census Bureau/company reports/Coresight Research[/caption]

The steady decline in in-store traffic continues to hurt this sector more than other categories of retailers.

Sector Tailwinds

U.S. macroeconomic drivers remain generally strong for consumption, and the only negative — gasoline prices — is benign as shown by the abundance of positive factors in the table below.

[caption id="attachment_76873" align="aligncenter" width="800"] Source: U.S. Bureau of Labor Statistics/University of Michigan/U.S. Energy Information Administration/S&P Dow Jones/U.S. Bureau of Economic Analysis/Coresight Research[/caption]

The dynamic retail environment continues to drive retailers to file for bankruptcy protection, and the bankruptcy filing of Sears and the liquidation of Toys “R” Us are likely to provide a lift to mass merchants and dollar stores.

Competitive Landscape

Market Shares

Discount Stores

The graph below shows revenue shares for the discount stores, dominated by Dollar General and Dollar Tree. The apparent jump in share for Dollar Tree relates to the acquisition of Family Dollar, which closed on July 6, 2016.

[caption id="attachment_76875" align="aligncenter" width="580"]

Source: U.S. Bureau of Labor Statistics/University of Michigan/U.S. Energy Information Administration/S&P Dow Jones/U.S. Bureau of Economic Analysis/Coresight Research[/caption]

The dynamic retail environment continues to drive retailers to file for bankruptcy protection, and the bankruptcy filing of Sears and the liquidation of Toys “R” Us are likely to provide a lift to mass merchants and dollar stores.

Competitive Landscape

Market Shares

Discount Stores

The graph below shows revenue shares for the discount stores, dominated by Dollar General and Dollar Tree. The apparent jump in share for Dollar Tree relates to the acquisition of Family Dollar, which closed on July 6, 2016.

[caption id="attachment_76875" align="aligncenter" width="580"] Source: Company reports/S&P Capital IQ/Coresight Research[/caption]

Mass Merchandisers

Although Target experienced an increase in its share of total revenue in 2015, Walmart regained share in 2016 and has again captured additional share year to date.

[caption id="attachment_76879" align="aligncenter" width="580"]

Source: Company reports/S&P Capital IQ/Coresight Research[/caption]

Mass Merchandisers

Although Target experienced an increase in its share of total revenue in 2015, Walmart regained share in 2016 and has again captured additional share year to date.

[caption id="attachment_76879" align="aligncenter" width="580"] Source: Company Reports/S&P Capital IQ/Coresight Research[/caption]

Warehouse Clubs

Costco remains the dominant warehouse-club company, with an estimated nearly two-thirds and more than three-quarters of the total companies’ revenues and operating income, respectively, in 2018, and Costco’s lead is widening. Market shares for the past three years plus an estimate for 2018 is shown in the figure below.

[caption id="attachment_76880" align="aligncenter" width="580"]

Source: Company Reports/S&P Capital IQ/Coresight Research[/caption]

Warehouse Clubs

Costco remains the dominant warehouse-club company, with an estimated nearly two-thirds and more than three-quarters of the total companies’ revenues and operating income, respectively, in 2018, and Costco’s lead is widening. Market shares for the past three years plus an estimate for 2018 is shown in the figure below.

[caption id="attachment_76880" align="aligncenter" width="580"] Source: Company reports/Coresight Research[/caption]

The table below evaluates retailers covered in this report based on revenues, margins, net income, comps and compares their sales by segment and geography.

Company Summaries

[caption id="attachment_76881" align="aligncenter" width="800"]

Source: Company reports/Coresight Research[/caption]

The table below evaluates retailers covered in this report based on revenues, margins, net income, comps and compares their sales by segment and geography.

Company Summaries

[caption id="attachment_76881" align="aligncenter" width="800"] Source: Company reports/S&P Capital IQ/Coresight Research[/caption]

Innovators and Disruptors

There are numerous startups and established companies (alongside the ever-present threat from Amazon) seeking to enter and disrupt the mass-merchandise segment, including the following:

Source: Company reports/S&P Capital IQ/Coresight Research[/caption]

Innovators and Disruptors

There are numerous startups and established companies (alongside the ever-present threat from Amazon) seeking to enter and disrupt the mass-merchandise segment, including the following:

- Boxed is an e-commerce company that sells groceries, seasonal and pet products in bulk, which was launched in August 2013 and based in New York City. The company has raised a total of $243.6 million in five funding rounds.

- Wish.com, operated by ContextLogic Inc., was founded by two former Yahoo! employees in 2010 and claims more than 100 million users on the iOS and Android platforms. The company also operates four other specialized shopping apps: Geek (electronics), Mama (family), Cute (beauty), and Home (decor), as well as a local marketplace app called Wish Local.