Nitheesh NH

Introduction

For more than a decade, the luxury industry appeared relatively immune to the disruption underway in most consumer industries. But rapidly changing consumer attitudes, sophistication, demands and expectations have shaken the status quo and propelled luxury purveyors into the tech-savvy and social-media-savvy 21st century. Those that aren’t keeping pace with the new luxury consumers are being left behind. Luxury brands steeped in heritage have stories to tell, and digital platforms are increasingly the means of brand discovery and communication, if not the actual purchase transaction. Luxury brands can use technology to romance potential shoppers and entice them to a brand experience in store.

This Sector Overview covers the following subjects:

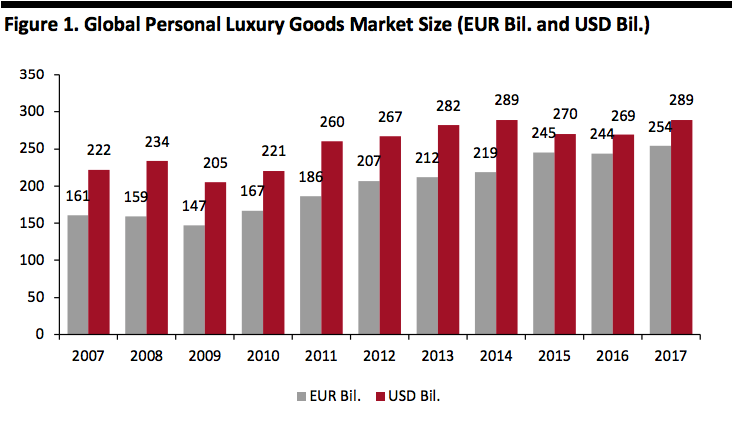

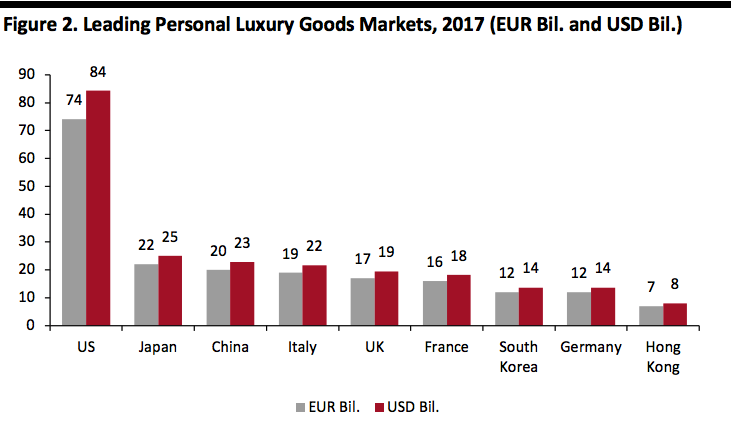

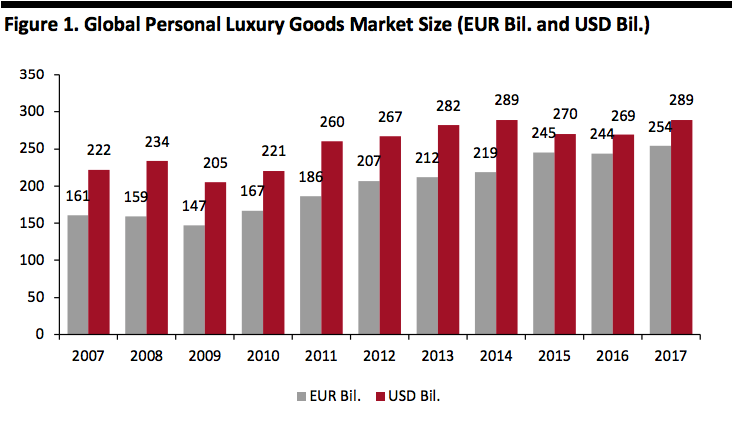

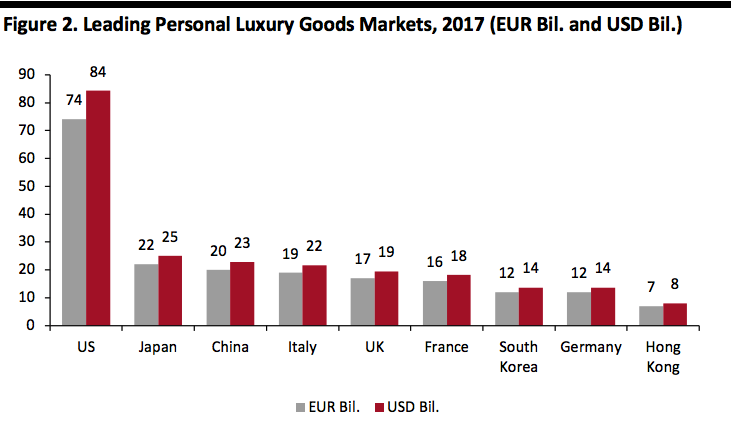

Euro-denominated data are as report by Bain, at constant exchange rates. Conversions to U.S. dollars have been made at current exchange rates.

Euro-denominated data are as report by Bain, at constant exchange rates. Conversions to U.S. dollars have been made at current exchange rates.

Source: Bain & Company/Coresight Research[/caption] [caption id="attachment_75919" align="aligncenter" width="580"] Source: Bain & Company/Coresight Research[/caption]

Competitive Landscape

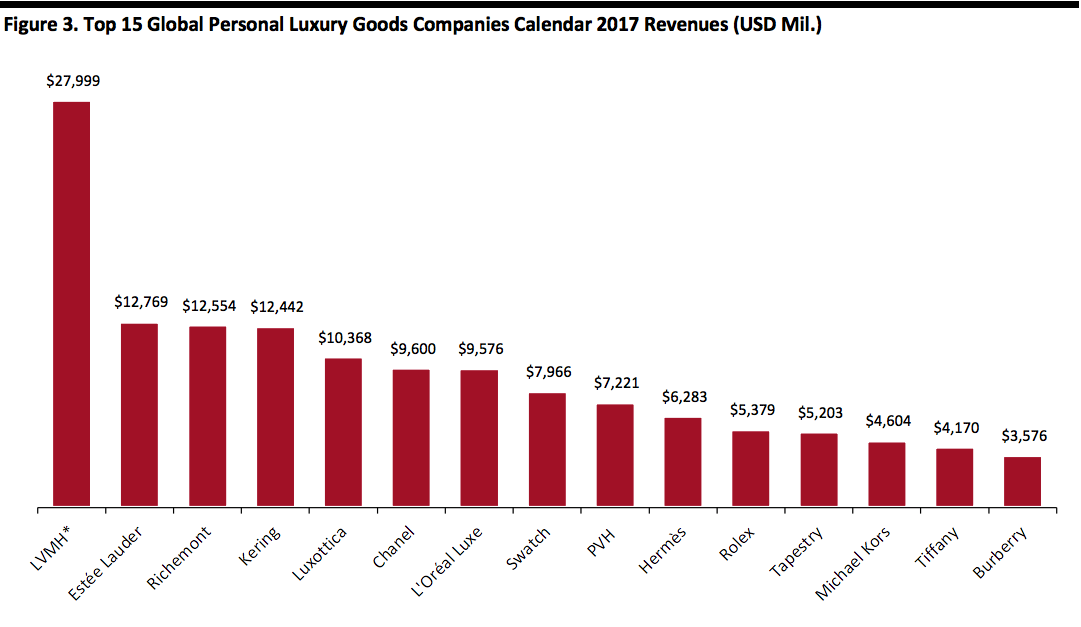

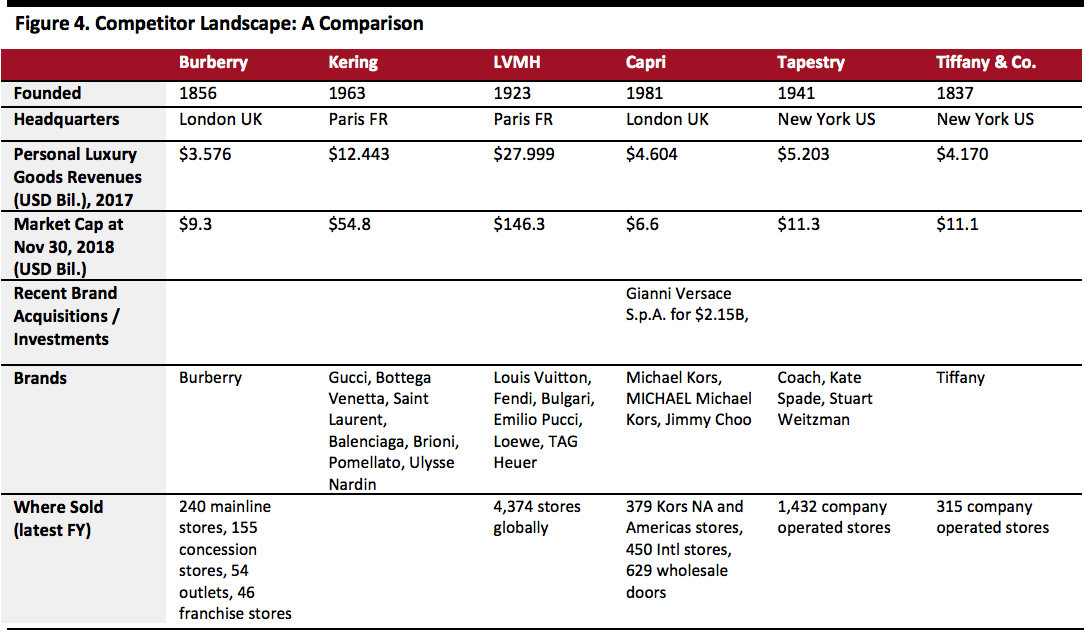

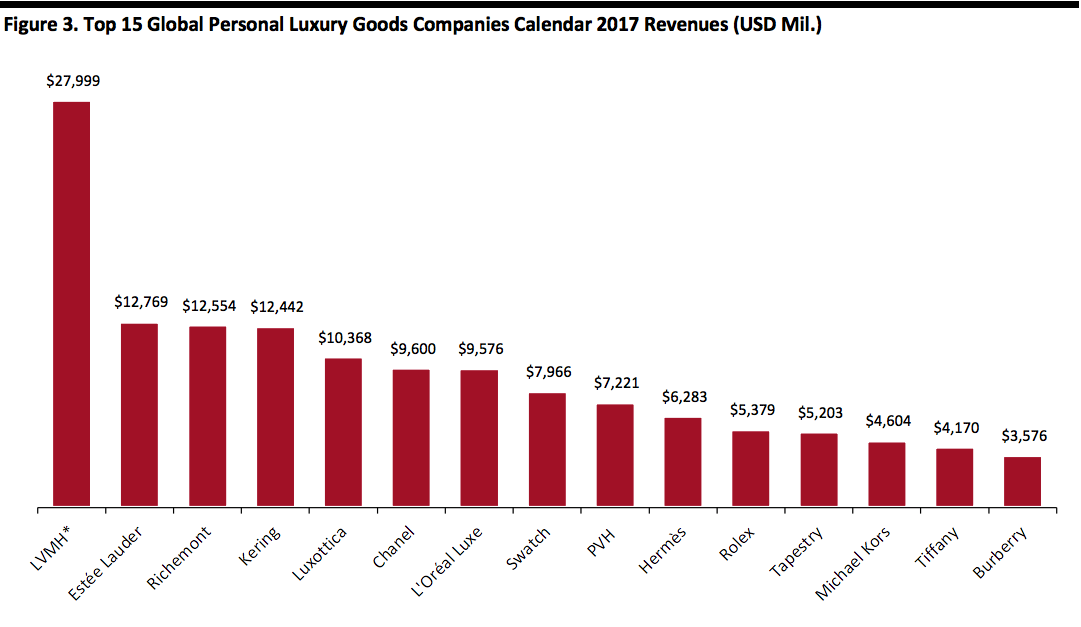

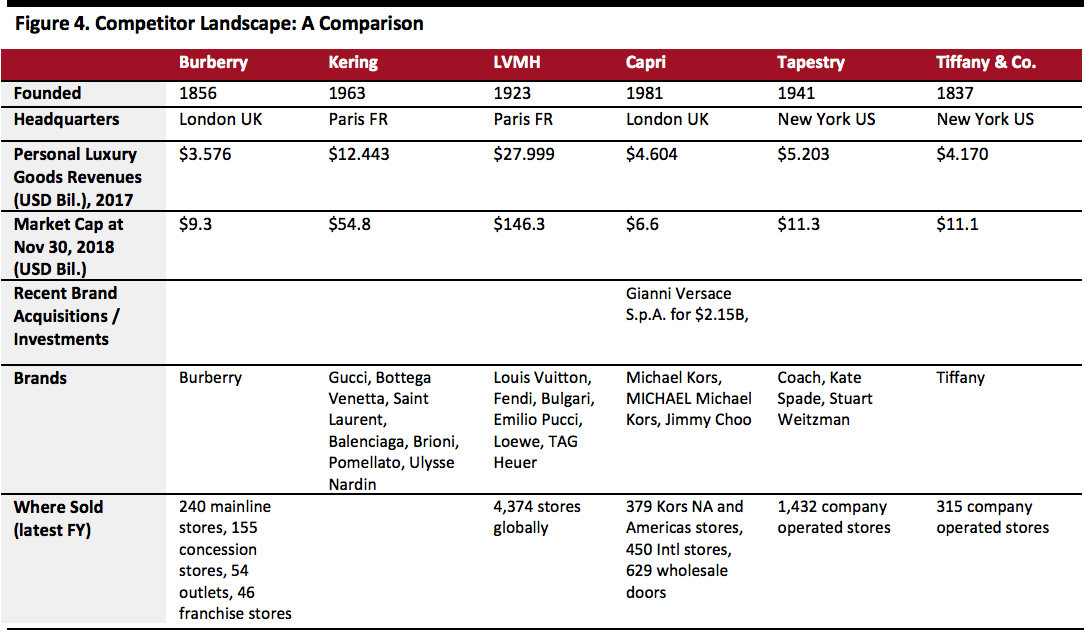

The luxury industry is relatively consolidated, with the top 15 companies driving close to 50% of industry sales. The top five companies are multi-branded companies, the result of acquisitions and/or licensing over many decades. LVMH, Richemont, Kering and more recently, Tapestry and Michael Kors, are pursuing business models of independent, decentralized luxury “maisons” that can react with agility and in an entrepreneur-like manner in response to their consumer markets.

[caption id="attachment_75920" align="aligncenter" width="800"]

Source: Bain & Company/Coresight Research[/caption]

Competitive Landscape

The luxury industry is relatively consolidated, with the top 15 companies driving close to 50% of industry sales. The top five companies are multi-branded companies, the result of acquisitions and/or licensing over many decades. LVMH, Richemont, Kering and more recently, Tapestry and Michael Kors, are pursuing business models of independent, decentralized luxury “maisons” that can react with agility and in an entrepreneur-like manner in response to their consumer markets.

[caption id="attachment_75920" align="aligncenter" width="800"] *LVMH’s Fashion and Leather Goods, Perfumes and Cosmetics, and Watches and Jewelry maisons

*LVMH’s Fashion and Leather Goods, Perfumes and Cosmetics, and Watches and Jewelry maisons

Source: Company reports/Coresight Research[/caption] [caption id="attachment_75921" align="aligncenter" width="800"] Source: Company reports/Coresight Research[/caption]

Innovators and Disruptors

Source: Company reports/Coresight Research[/caption]

Innovators and Disruptors

- Key themes in the sector.

- A look at global growth.

- Top industry participants.

- Retail channels.

- Innovative, creative, unique and appealing products

- Exclusivity

- Tightly controlled distribution

- A distinct brand identity

- Premium pricing

- Premium quality

- Heritage of craftsmanship

- Global reputation

- Inclusivity

- Authenticity

- Transparency

- Sustainability

- Egalitarian or democratic

- Out-of-the-box collaborations

- Young consumers drive fashion and cultural changes. Millennials and Gen Zers are fueling growth of the global personal luxury goods sector and by 2025, Bain posits that 45% of luxury sales will be to these two cohorts. Deloitte says it will be more than 40%. So, their influence is growing. The casualization of the workplace and the popularity of streetwear began with youth and subsequently was adopted by older generations hoping to emulate a millennial state of mind. Using iconography such as emojis and cartoon characters, luxury brands can attract youth, make older consumers feel young again, and transform a brand persona.

- Chinese youth are avid luxury shoppers. More than half of China’s luxury shoppers are under 30 years old, and 26% are 18-20 years old, according to joint research from Tencent and Boston Consulting Group. Chinese youth will shape the luxury market for the coming decade.

- Traditional luxury shoppers were Americans, Europeans and Japanese. The expanding Chinese middle class and developing nations around the world, and easy access to everything, has changed the profile of the luxury consumer. More and more, established luxury consumers will cede share to the growing middle classes of developing nations. In the last three years, Chinese luxury spending in China contributed twice as much growth as Chinese luxury spending abroad, according to Bain. This trend is likely to continue. Moreover, Chinese luxury shoppers have become increasingly sophisticated, expecting more than logo-adorned product to luxury brands that are more understated, along with higher levels of brand engagement. By offering limited editions of short duration and exclusive products, widely distributed brands such as Louis Vuitton and Gucci can continue to appeal to a luxury sophisticate.

- Some have pointed to Chinese luxury consumers focusing more on experiences at the expense of spending on luxury goods. Our 2018 survey of Chinese outbound tourists found a sharp decline in average spend on shopping per trip, and we think the shift of spending to experiences contributed to this fall.

- Chinese Demand for Cross-Border E-Commerce Booms but Looming Tax Reforms are a Cloud on the Horizon

- Chinese Cross-Border Retail Heads Offline with New Brick-and-Mortar Formats

- A shift to online/offline Integration. Online has been the driver of revenue growth for most luxury brands, achieving strong double-digit annual gains while still accounting for a modest 10% or so of total sales, according to Coresight Research analysis. While Bain expects online to grow to around 25% penetration by 2025, most if not all luxury sales will be influenced by online interactions. Online/offline integration means luxury brands can be where the customer is.

- “It” bags and must-have sneakers are the new social currency. Entering the 21st century, “It” bags were a marker of fashion status. Highly sought after in limited distribution, Fendi’s Baguette and Louis Vuitton’s Graffiti Bag are just two examples of bags that enjoyed demand that outstripped supply and afforded the owner fashion cred. While Gucci is enjoying a cult-like status, many of today’s sought-after bags aren’t as well known as Gucci, Louis Vuitton, Fendi or Chanel, giving the owner a claim to exclusivity (often at a lower price point than globally recognized luxury brands). Sneakers are just as popular, for both sexes and can cost as much as $2,000.

- High-priced puffer jackets are creating unease in some places as they are obvious statements of wealth. Recently, high schools in London banned students from wearing Canada Goose and Moncler, as this expensive outerwear was perceived to create a sense of inequality among students. As social mores have adopted more inclusive and democratic aspects, such moves could be a harbinger of more difficult times ahead. Gen Zers tend to survey as more sensitive than their older peers and expect inclusivity and equality as a norm. They could say no to luxury purchases as a vote of solidarity with those less wealthy than themselves.

Euro-denominated data are as report by Bain, at constant exchange rates. Conversions to U.S. dollars have been made at current exchange rates.

Euro-denominated data are as report by Bain, at constant exchange rates. Conversions to U.S. dollars have been made at current exchange rates.Source: Bain & Company/Coresight Research[/caption] [caption id="attachment_75919" align="aligncenter" width="580"]

Source: Bain & Company/Coresight Research[/caption]

Competitive Landscape

The luxury industry is relatively consolidated, with the top 15 companies driving close to 50% of industry sales. The top five companies are multi-branded companies, the result of acquisitions and/or licensing over many decades. LVMH, Richemont, Kering and more recently, Tapestry and Michael Kors, are pursuing business models of independent, decentralized luxury “maisons” that can react with agility and in an entrepreneur-like manner in response to their consumer markets.

[caption id="attachment_75920" align="aligncenter" width="800"]

Source: Bain & Company/Coresight Research[/caption]

Competitive Landscape

The luxury industry is relatively consolidated, with the top 15 companies driving close to 50% of industry sales. The top five companies are multi-branded companies, the result of acquisitions and/or licensing over many decades. LVMH, Richemont, Kering and more recently, Tapestry and Michael Kors, are pursuing business models of independent, decentralized luxury “maisons” that can react with agility and in an entrepreneur-like manner in response to their consumer markets.

[caption id="attachment_75920" align="aligncenter" width="800"] *LVMH’s Fashion and Leather Goods, Perfumes and Cosmetics, and Watches and Jewelry maisons

*LVMH’s Fashion and Leather Goods, Perfumes and Cosmetics, and Watches and Jewelry maisons Source: Company reports/Coresight Research[/caption] [caption id="attachment_75921" align="aligncenter" width="800"]

Source: Company reports/Coresight Research[/caption]

Innovators and Disruptors

Source: Company reports/Coresight Research[/caption]

Innovators and Disruptors

- The new business models mentioned above have been disrupting luxury for the past five years. Recommerce sites, such as The RealReal, and rental and subscription models, such as Rent the Runway or jewelry rental startup Flont, are changing the ways consumers interact with luxury brands. They democratize the luxury marketplace. Items too precious to own can be rented or purchased “lightly used.” These digitally enabled business models can lengthen the lifespan of a luxury product, which in turn supports the creation of a more sustainable industry, and at the same time, enables more consumers to enjoy luxury products.

- Many luxury brands have been innovative in their use of textiles and design, pushing boundaries. Now they are engaging in tech-driven research and development as well. In April 2018, LVMH joined the world’s largest startup incubator, Station F, with the launch of La Maison des Startups, where it will welcome 50 international startups per annum. Its mission: reinvent luxury. These startups will receive personalized coaching and support from LVMH group experts to accelerate collaboration with the LVMH maisons with a key focus on seven themes: AI, Internet of Things, retail and e-commerce, AR and VR, blockchain and anti-counterfeiting, personalization/social and content, and raw materials and sustainability. LVMH also nurtures intrapreneurs with its Disrupt, Act, Risk to be an Entrepreneur (DARE) initiative.

- In June 2018, Tiffany opened a jewelry design and innovation workshop, an open-plan, 17,000-square-foot space designed to remove organizational barriers and encourage creativity, problem-solving and collaboration, and increase the pace of innovation.

- Ten years into an economic recovery is enough of a reason for many to posit a slowdown in the global economy and ergo, the global personal luxury goods Bernard Arnault, CEO and Chairman at LVMH warned of a slowdown entering 2017, which didn’t come to pass. Nearly two years later, the possibility of a slowdown in the luxury industry seems more likely. However, on the company’s 3Q fiscal 2018 call with investors, LVMH CFO Jean-Jacques Guiony spoke of an expected slowdown in Japan, from mid-teens to mid-single digit and a little slowdown among Chinese customers from high-teens to mid-teens with increased strength in the Mainland China business.

- China and the Chinese luxury shopper were mentioned 68 times on Tiffany’s 3Q fiscal 2018 conference call in November 2018. Similar to Guiony’s comment, Tiffany’s CEO, Alessandro Bogliolo, spoke of a shift in Chinese tourism and spending in 3Q, declining in some important non-Chinese markets while accelerating from a double-digit growth rate of the first half in 3Q.