albert Chan

Introduction

Each report in our Sector Overview series analyzes a particular retail sector or consumer market. In this report, we dive into the diverse European retail sector and look specifically at the U.K., Germany and France. This report includes:

- A discussion of key sector themes.

- A review of retail sector momentum in the U.K., Germany and France.

- A summary of the sector landscape, including market shares for the top retailers in our three focus countries.

- The outlook for European retail.

Themes We’re Watching

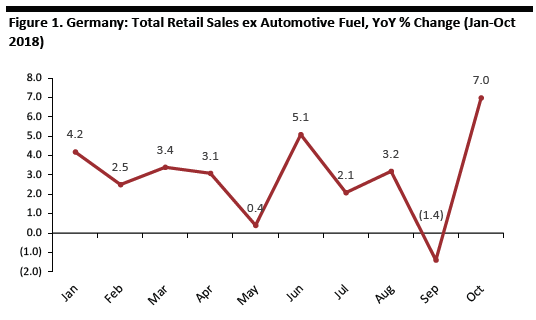

Weak Consumer Demand Hits German Retail

Apparently alarmed by world events such as Brexit and tariff wars, and in a context of slowly climbing inflation, German consumers have retrenched their discretionary spending. The latest available data from Destatis, the German national statistics office, show that retail sales across a number of sectors declined year over year in many (or, in some cases, all) of the first nine months of 2018. These sectors include department stores, clothing retailers, footwear specialists, electronics stores, floor-coverings retailers, appliance specialists and furniture retailers. Retail sales growth was tepid at best at DIY retailers over the period. The internet pure-play and mail-order sector saw growth slow from a double-digit average through most of 2017 to a mid-single-digit average for the first nine months of 2018. Nondiscretionary sectors such as grocery and pharmacy retail have underpinned total retail sales growth.

In turn, consumer caution dragged Germany’s economy into a decline in the third quarter of 2018: The country’s gross domestic product contracted by 0.2 percent quarter over quarter in real terms, in part due to a 0.3 percent contraction in total consumer spending on the same basis. Confirming shoppers’ caution, research firm GfK noted a decline in consumer confidence for the second consecutive month in November (latest available data) and forecast a further slippage for December.

German consumers are notoriously sensitive to macroeconomic and political events — indeed, the prospect of Brexit appears to be impacting German shoppers’ behavior much more than that of their British peers — and there has been a consequent cyclical pullback in German consumer spending. German retail is therefore likely to remain sluggish until we see greater security and certainty in world and European affairs.

Shortly before we went to press, Destatis reported unusually strong retail sales figures for October, following a year-over-year decline in September (see below). However, given the context, we are doubtful that this is the start of a sustained bounce back for German retail.

[caption id="attachment_58036" align="aligncenter" width="536"] Source: Destatis[/caption]

Source: Destatis[/caption]

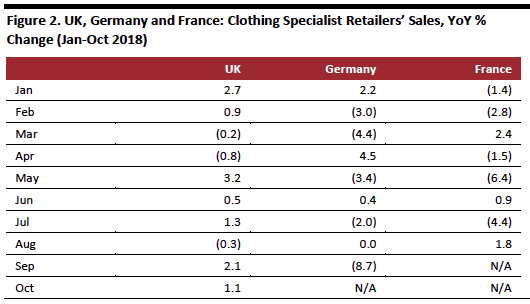

Warm Autumn Hits European Clothing Sales, but Underlying Softness Is a Structural Challenge

Unseasonably warm weather in September and October 2018 impacted many clothing retailers in Europe. However, as we show below, the clothing specialist sector in Germany and France saw meaningful declines well before autumn.

[caption id="attachment_58037" align="aligncenter" width="530"] Source: Office for National Statistics (ONS)/Destatis/INSEE/Coresight Research[/caption]

Source: Office for National Statistics (ONS)/Destatis/INSEE/Coresight Research[/caption]

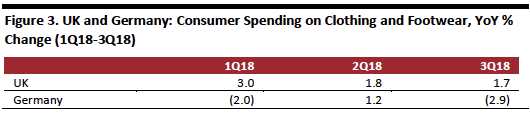

Internet pure plays such as Zalando SE and Amazon.com Inc. partially account for such weak sector performances (these pure plays are not included in the sector data for clothing specialists). Yet quarterly consumer spending data confirm underlying declines in total demand in Germany and show a 2.9 percent year-over-year decline in apparel spending in the third quarter of 2018 (latest available data) in the country. The weekly apparel sales index from trade publication TextilWirtschaft recorded a very weak September in Germany followed by a gradual recovery in October and then a mixed November marked by an apparent shift of demand to the week of Black Friday.

In the U.K., the ONS estimates that consumer spending on clothing and footwear continues to rise — though a slowing trend was evident across the first three quarters of 2018 (latest available data). In recent years, however, the ONS’s estimates for apparel spending have far outpaced the category growth reported by other sources, such as market measurement service Kantar Worldpanel.

A comparable quarterly breakout of spending is not available for France.

[caption id="attachment_58038" align="aligncenter" width="530"] Source: ONS/Destatis/Coresight Research[/caption]

Source: ONS/Destatis/Coresight Research[/caption]

We do not expect to see a near-term reversal of this weakness, for two main reasons: First, many younger consumers in Europe appear to have deprioritized spending on apparel. Second, shoppers have an abundance of price-competitive options, both online and offline, to choose from to reduce their spending on clothing. In this context, fashion-sensitive discounters and price-competitive internet-only retailers look set to continue to capture share.

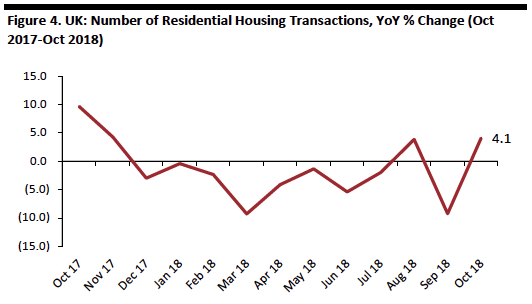

Soft Housing Market and Uncertainty Threaten to Drag on UK Big-Ticket Spending

The uncertainty surrounding Brexit negotiations has contributed to a sluggish U.K. housing market. But that is not the only factor affecting home sales: a 3 percent stamp duty (property transaction tax) on second homes enacted in 2016, changes to income tax relief for landlords phased in from the 2017-2018 tax year, and more stringent mortgage lending rules have all also suppressed growth in the buy-to-let segment of the housing market.

Reflecting these changes, in October 2018, the Royal Institution of Chartered Surveyors (RICS) said that the time it takes to complete a property sale had widened to 19 weeks, the longest duration since the organization began collecting data.

However, some signs point to a healthier, more sustainable mix in the U.K. property market as the balance tilts back toward owner-occupiers and away from investors. In August 2018 (latest available data), the number of mortgages completed for first-time buyers was up 2 percent year over year, while the number of new buy-to-let mortgages completed was down 13 percent, according to trade association UK Finance. Also, in February 2018, the number of first-time buyers hit a 10-year high.

[caption id="attachment_58039" align="aligncenter" width="532"] Source: HM Revenue & Customs[/caption]

Source: HM Revenue & Customs[/caption]

Official U.K. statistics do not (yet) suggest a negative flow-through from the housing market to big-ticket retail sectors. According to the ONS, third-quarter 2018 retail sales were up 6.4 percent at furniture stores and up 1.7 percent at electrical goods retailers. The ONS has also been reporting somewhat-improbable double-digit growth at DIY and hardware stores, and its data on the floor-coverings sector have long been wildly volatile: Accordingly, we do not consider the ONS’s data for either of these sectors to be a meaningful benchmark.

Over the medium term, a softer property market may impact big-ticket sales. However, viewed over the longer term, any tilting away from buy-to-let and second home sales in favor of first-time-buyer sales suggests greater sustainability in the U.K. housing market. After years of declining home ownership rates, an ongoing increase in sales to first-time buyers should funnel more owner-occupiers into big-ticket categories for decades to come.

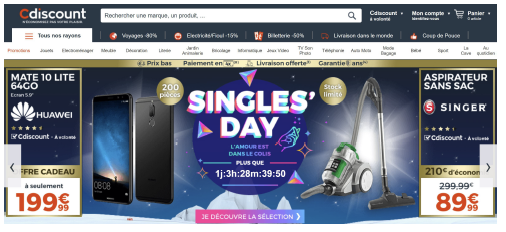

European Pure Plays Opt In to Singles’ Day

In 2018, the Singles’ Day shopping festival was bigger than ever in Asia, but European retailers’ participation in the event remained highly limited. In part, this was due to the shopping holiday falling on Nov. 11, which is Armistice Day, a day of remembrance, in a number of European countries. In addition, 2018 saw ceremonies marking the centenary of the First World War armistice on that day. Our retail channel checks suggest that Singles’ Day participation in Europe was wholly or largely confined to internet-only retailers in 2018.

In France, Cdiscount (owned by Casino Guichard Perrachon SA) offered deals on Huawei phones and Singer vacuum cleaners on Singles’ Day.

[caption id="attachment_58053" align="aligncenter" width="506"] Singles’ Day campaign

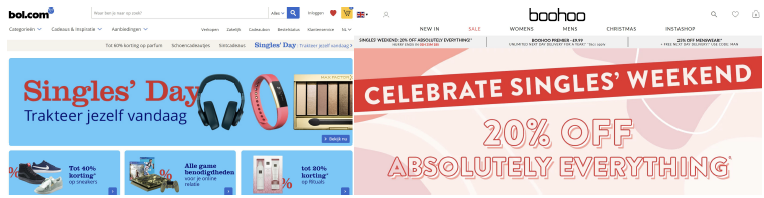

Singles’ Day campaignSource: Cdiscount.com[/caption] In the Netherlands, Bol.com (owned by Koninklijke Ahold Delhaize NV) offered promotions across various categories, including apparel, beauty and electronics. In the U.K., Boohoo.com (operated by Boohoo Group PLC) offered 20 percent off all women’s clothing across the Singles’ Day weekend. We did not observe rival Asos PLC offering discounts related to Singles’ Day. [caption id="attachment_58054" align="aligncenter" width="764"]

Singles’ Day campaigns

Singles’ Day campaignsSource: Bol.com/Boohoo.com[/caption]

Our checks of various European brick-and-mortar and multichannel retailers’ stores and websites found no evidence of participation in Singles’ Day, though our channel checks revealed widespread general discounting in apparel over the Nov. 10-11 weekend.

We expect European retailers’ participation in Singles’ Day to be highly limited in the near future, not least because the shopping event occurs shortly before Black Friday, which is still a relatively new event in the European retail calendar. Many retailers will be reluctant to introduce yet another margin-eroding discount shopping festival in the lead-up to the peak holiday trading period.

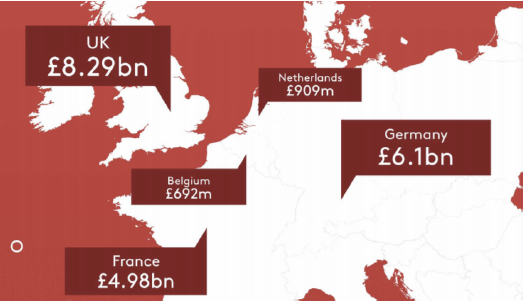

Black Friday May Have Peaked in the UK, but It’s Gaining Traction Elsewhere

Extended Discounting Period Means Less Emphasis on Black Friday in the UK

Just a few years after Black Friday took off in a big way in the U.K., the day’s popularity among Brits looks to have peaked. Research undertaken by the Centre for Retail Research for VoucherCodes.co.uk and published prior to Black Friday predicted a 10 percent year-over-year decline in internet retail sales in the U.K. on Black Friday 2018, but a jump of around one-quarter in such sales in Germany and France that day. Data published by Barclaycard after Black Friday showed a 12 percent year-over-year decline in the value of U.K. spending that day, although the number of transactions increased.

In our extensive U.K. channel checks on Black Friday, we saw more subdued shopper traffic at a number of retailers compared with 2017, including at House of Fraser, John Lewis and Currys PC World (owned by House of Fraser Ltd., John Lewis Partnership PLC and Dixons Carphone PLC, respectively). One likely reason for the decline in traffic and sales is that more retailers offered discounts over an extended period in 2018 — typically, the entire week through Black Friday — easing the emphasis on Black Friday itself.

Black Friday Is Growing in Germany

Black Friday remains a smaller event in France and Germany than in the U.K., though major French and German retail names are now participating in it. Ahead of Black Friday, German trade association Handelsverband Deutschland forecast sales of €2.4 billion (£2.1 billion) on Black Friday and Cyber Monday 2018, an increase of 15 percent year over year. Its consumer survey found that 31 percent of German shoppers planned to buy discounted products on Black Friday 2018, up from 24 percent a year earlier.

According to research by the Centre for Retail Research on behalf of VoucherCodes.co.uk, the Cyber Weekend period, which spans Black Friday through Cyber Monday, generates greater sales in the U.K. than it does in Germany or France.

[caption id="attachment_58035" align="aligncenter" width="524"] Estimated sales for Cyber Weekend (Black Friday-Cyber Monday) 2018

Estimated sales for Cyber Weekend (Black Friday-Cyber Monday) 2018Source: Centre for Retail Research/VoucherCodes.co.uk[/caption]

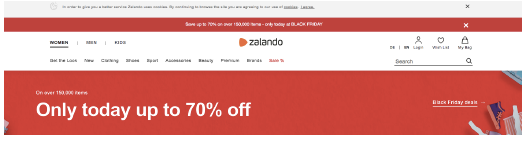

Zalando’s German e-commerce site, Zalando.de, promised up to 70 percent off on more than 150,000 items on Black Friday; on its U.K. site, the company offered 50 percent off a similar number of items. Zalando said that it acquired 220,000 new customers on Black Friday 2018, more than double the number on the same day in 2017. The company processed around 2 million orders and its order volumes peaked at 4,200 per minute, compared with 2,000 per minute on Black Friday in 2017. Our (admittedly anecdotal) experience suggests that Zalando struggled to cope with the surge in demand, as some U.K. deliveries took several days longer than usual to be dispatched.

[caption id="attachment_58061" align="aligncenter" width="524"] Zalando.de’s Black Friday banner

Zalando.de’s Black Friday bannerSource: Zalando.de[/caption]

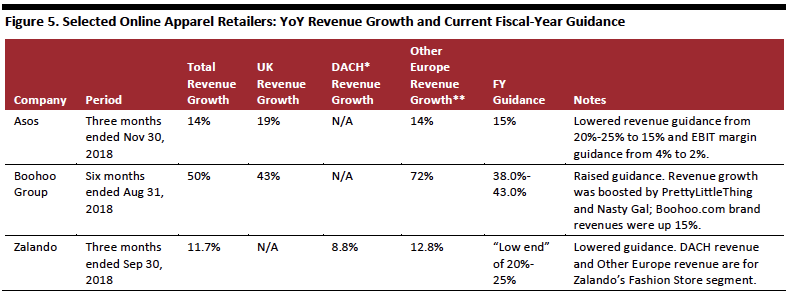

In Germany, MediaMarkt (operated by Media-Saturn-Holding GmbH) ran a “Red Friday” campaign, while its sister chain, Saturn, offered deals across “Black Weekend.” Hypermarket retailer Real GmbH ran a “Black Week” promotion focused on electronics and appliances on its German site.

[caption id="attachment_58050" align="aligncenter" width="754"] MediaMarkt’s Red Friday landing page and Real’s Black Week landing page

MediaMarkt’s Red Friday landing page and Real’s Black Week landing pageSource: MediaMarkt.de/Real.de[/caption]

In Germany, softness in consumer demand overall and in apparel demand in particular (given the warm autumn) likely encouraged retailers to participate in Black Friday in 2018 and to lengthen promotional periods and offer broader and deeper discounts for the shopping holiday.

Autumn Slowdown Hits Asos and Zalando

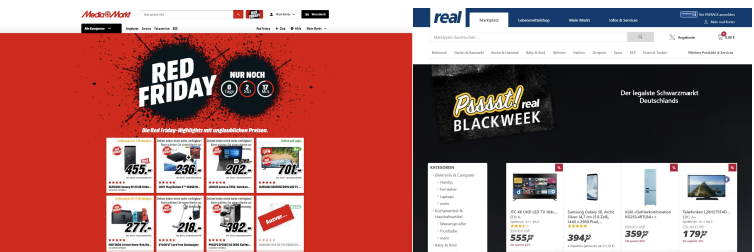

The major European fashion pure plays reported mixed trading in recent periods, though even disappointing growth equates to market share gains in tepid apparel markets:

- Asos issued a warning on full-year revenues and profits after a “significant deterioration” in trading in November 2018. Despite media coverage representing Asos’s downturn as an indication of a weakened U.K. market, it was actually driven by non-U.K. markets (although the company’s U.K. sales were helped by extra promotions). On an earnings call, CEO Nick Beighton said, “[The] U.K. has been a standout performer, still a plus 19 percent sales growth, but France, Germany and Australia have been particularly weak.”

- Boohoo Group exceeded expectations in its fiscal first half, reporting 50 percent revenue growth that was fueled by two brands that were consolidated in early 2017: PrettyLittleThing (consolidated at the start of 2017) grew revenues by 132 percent and Nasty Gal (consolidated at the start of March 2017) grew revenues by 111 percent. Following Asos’s profit warning, Boohoo Group issued a statement confirming that trading remained strong and in line with market expectations.

- Zalando’s fiscal-third-quarter revenue growth disappointed analysts and investors. The company said that extended warm weather in Europe had impacted sales. It lowered its guidance for full-year revenue growth to “the low end” of the 20 to 25 percent range it had previously provided.

*Germany (D), Austria (A) and Switzerland (CH)

*Germany (D), Austria (A) and Switzerland (CH)**At constant currency, except for Zalando

Source: Company reports[/caption]

We expect fulfillment costs to remain a major challenge for internet-only retailers. Zalando has repeatedly pointed to higher fulfillment cost ratios as it has invested in faster and more convenient delivery options. Asos has also seen fulfillment costs climb as a percentage of sales. Given consumers’ relentlessly increasing expectations regarding delivery speed and convenience, we think that there are questions about internet-only retailers’ aggregate ability to cap order fulfillment costs.

UK Store Closures Roundup

In 2018, major U.K. retail names such as House of Fraser, Carpetright PLC, New Look Group Ltd. and Mothercare PLC opted for company voluntary arrangements (CVAs) that allow them to close stores and reduce rents on remaining leases. Other retailers, including Marks & Spencer Group PLC (M&S), have announced plans for closures without a CVA.

As of the end of November, we had recorded 1,394 announced store closures and 783 announced store openings in 2018 in the U.K.; these compare with 1,012 announced closures and 952 announced openings in all of 2017. Our data represent only closures and openings that took place, or are expected to take place, in the calendar year, so our 2018 figures do not reflect closures already announced but set to occur in 2019 or beyond.

[caption id="attachment_58041" align="aligncenter" width="532"] *Includes retailers such as Argos, WHSmith and Poundworld

*Includes retailers such as Argos, WHSmith and Poundworld**Includes DIY retailer Homebase, furniture retailer Habitat, floor-coverings retailer

Carpetright, and electronics and appliances retailer Dixons Carphone

Source: Company reports/Coresight Research[/caption]

These announced closures do not reflect the health of retail demand, however, as British shoppers remained willing to spend across 2018, with retail sales holding up well as a result. We see two specific challenges prompting store closures:

- First, retailers have seen labor costs rise. This has been partly due to the tight labor market and partly due to high business rates. The migration of sales online, which prompts a deleveraging of the fixed costs of brick-and-mortar stores, compounds these pressures.

- Second, structural changes continue to squeeze legacy retailers hard. Major structural shifts — notably to the discount and e-commerce channels — have enabled legacy retailers’ competitors to steal share, while limiting traditional retailers’ ability to pass on higher costs to shoppers.

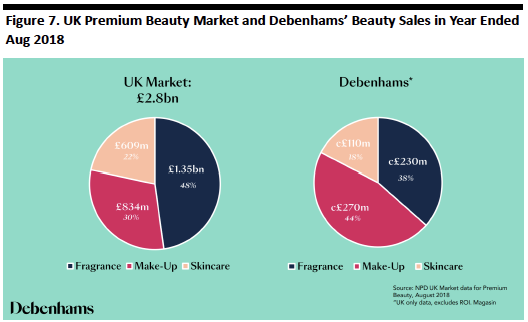

UK Department Stores Set to Yield Share in Beauty

Debenhams PLC and House of Fraser were among the retailers that announced store closures in 2018. In the autumn, Debenhams announced plans to close up to 50 stores in the next three to five years. House of Fraser plans to close an indeterminate number of stores (the closure numbers have been changing quickly). After Sports Direct International PLC bought the chain in August 2018, Sports Direct CEO Mike Ashley pledged to keep 47 of House of Fraser’s 59 U.K. stores open, implying 12 closures. In addition, M&S has said it will close 100 of its general merchandise stores by 2022.

All of these department store closures will liberate consumer spending across apparel and housewares, and rivals will fight for share of that spending. The Debenhams and House of Fraser closures will also free up spending on big-name brands in the premium beauty category. (M&S’s beauty offering is a mix of niche brands and private labels.)

We estimate that Debenhams’ and House of Fraser’s currently planned store closures will free up approximately £257 million in beauty sales. This represents 9 percent of all U.K. premium beauty sales, which totaled £2.8 billion as of August 2018, according to NPD Group data cited by Debenhams.

- Just over one-quarter of Debenhams’ sales derive from beauty products, giving it £610 million in beauty sales in the year ended August 2018. Based on average gross transaction value per store, the eventual closure of 50 stores out of a U.K. total of 164 would free up an estimated £186 million in beauty sales (at 2018 prices). We acknowledge that the stores penciled in for closure may turn over less than the average store.

- We think 12 House of Fraser store closures could free up around £71 million of beauty sales (at 2018 prices) for rivals to capture. This assumes that beauty items make up a similar proportion of sales at House of Fraser as they do at Debenhams and is based on average gross transaction value per store for the year ended January 2017 (latest available data).

Source: Company reports[/caption]

Source: Company reports[/caption]

The department stores specialize in the premium skincare, cosmetics and fragrance segments of the beauty market, so any loss of beauty sales would be heavily skewed toward these. John Lewis would likely peel off some of these sales, given its similar offering, though its limited store base would restrict the volume that it could capture. The Boots Company PLC would almost certainly gain, though, like most major beauty competitors, it lacks the prestige emphasis that the department stores enjoy.

Some consumers have long clamored for LVMH Moët Hennessy Louis Vuitton SA to launch the Sephora beauty chain in the U.K. Accordingly, we cautiously surmise that these department store closures may provide an opportunity for Sephora to make such a foray into the U.K. market.

Grocery Discounting: Impacts on UK Incumbents

In the U.K., the sustained growth of discounters Aldi Stores Ltd. and Lidl UK GmbH is reshaping the grocery landscape. Market leader Tesco PLC and second-place J Sainsbury PLC are fighting back on price — but we have our doubts about each of these retailers’ strategies.

In the autumn, Tesco launched its own discount format, Jack’s, named after Tesco founder Jack Cohen. The small-store format was launched in two locations on Sept. 19, 2018. Like Aldi and Lidl, Jack’s is built on a proposition of small stores, limited ranges, a private-label focus and a more basic service offering. We have reservations about the apparent positioning of Jack’s at the lowest end of the discount spectrum:

- Jack’s eschews the “fake brands” that customers see in Aldi and Lidl. Instead, all private-label products are offered under the Jack’s name — and we think that makes for an uninspiring shopping experience. If shoppers are happy to fill their carts with a single discount private label, they can do that at Tesco. Moreover, the single-label strategy could prevent shoppers from perceiving the products as brand-equivalent, a perception that Aldi and Lidl push heavily in their advertisements of their own offerings.

- Aldi and Lidl have developed very strong premium lines. By focusing on its core eponymous brand, Jack’s currently offers little opportunity for shoppers to trade up, although it does stock a range of major brands.

- Our final concern is the Jack’s claim that “8 out of 10 food and drink products will be grown, reared or made in Britain.” In the U.K., Aldi and Lidl have strongly pushed their British sourcing credentials — yet this push has largely been limited to fresh categories such as meat, dairy, fruit and vegetables, while imported products have made a significant contribution to the two grocers’ premium ranges. The Jack’s 80 percent British promise makes it difficult for the banner to cater to this demand for imports, and this challenge dovetails with the limited premium offering mentioned above.

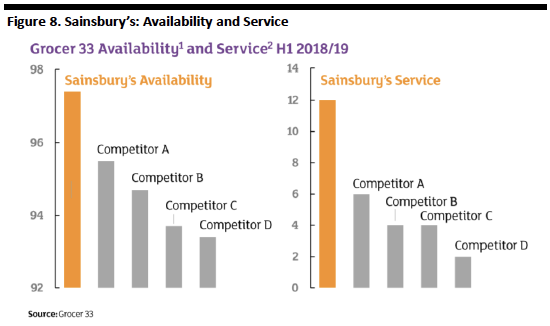

Sainsbury’s has been battling the discounters by continuing to strip out costs. However, the company announced in January that it would remove thousands of store-level management jobs by eliminating the roles of deputy manager, department manager, team leader and store supervisor — and this has undoubtedly had a deleterious effect on store standards. During our store visits, we have witnessed the impact of this decision on product availability, store standards and checkout lines, and we expect many other shoppers have noticed these effects, too.

Sainsbury’s management has pointed to comparatively strong availability and service levels, as represented in the slide below, taken from the company’s first-half results for fiscal 2019.

[caption id="attachment_58043" align="aligncenter" width="550"] The Grocer 33 is a weekly mystery shopping survey undertaken across various supermarket

The Grocer 33 is a weekly mystery shopping survey undertaken across various supermarketchains by The Grocer magazine.

1Grocer 33 average availability (percent) for the 28 weeks ended Sept. 22, 2018

2Grocer 33 service wins for the 28 weeks ended Sept. 22, 2018

Source: Company reports[/caption]

Nevertheless, the position of Sainsbury’s has always been firmly upscale of that of its biggest rivals — Tesco, Asda Group Ltd. and Wm Morrison Supermarkets PLC — and we think that that position is slipping. Sainsbury’s continues to face a significant challenge in heading off the discounters on price (at least to some extent) while maintaining its differentiated position, and it now seems to be sacrificing that differentiation in a bid to cut costs.

Sainsbury’s is seeking greater scale, too, through a merger with Asda. The U.K.’s Competition and Markets Authority is currently conducting the second phase of its investigation into the proposed merger and will issue its report by March 5, 2019.

Sector Momentum

Sector Size and Growth

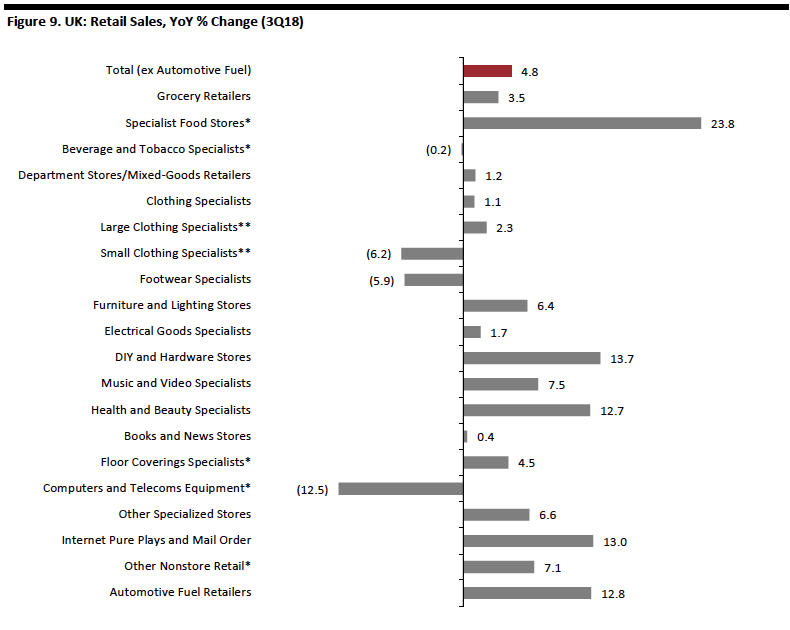

According to the ONS, U.K. retail sales have proved relatively solid, defying innumerable forecasts of a downturn ever since the country voted in 2016 to leave the EU. Volume (or real-terms) growth has driven the increase, as shop-price inflation eased as the effect of a weaker pound annualized.

U.K. retail growth softened in October before bouncing back in November, despite both Primark and Sports Direct cautioning that they had seen tough trading in November. John Lewis's weekly sales figures in November also indicated soft demand, with the exception of Black Friday week. Specialized and fragmented sectors supported the solid performance in November, according to the ONS. The monthly figures included a 21 percent rise in sales at specialist food stores, double-digit year-over-year growth for DIY and hardware retailers, and growth of more than 6 percent for furniture retailers and electrical goods retailers. These apparently strong performances in big-ticket sectors came in spite of the ongoing uncertainty surrounding Brexit.

[caption id="attachment_58044" align="aligncenter" width="790"] *A relatively small or fragmented sector, in which reported figures have traditionally been volatile.

*A relatively small or fragmented sector, in which reported figures have traditionally been volatile.**A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large

retailers.

Source: ONS/Coresight Research[/caption]

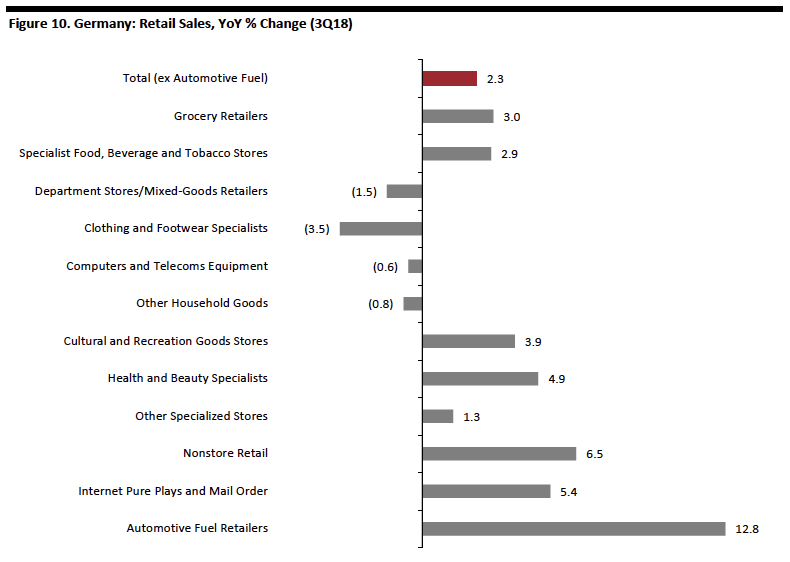

In Germany, retail sales have been weak, with the exception of a bounce in October following a decline in September. Total growth in the third quarter of 2018 was supported by food retailers and health and beauty stores, both of which include a substantial nondiscretionary element. Retailers in sectors that are more reliant on discretionary spending, such as apparel, department stores and household goods, saw sales decline year over year during the third quarter. This context of weak consumer demand aligns with the negative quarter-over-quarter GDP growth that Germany saw during the period.

[caption id="attachment_58045" align="aligncenter" width="790"] Source: Eurostat/Coresight Research[/caption]

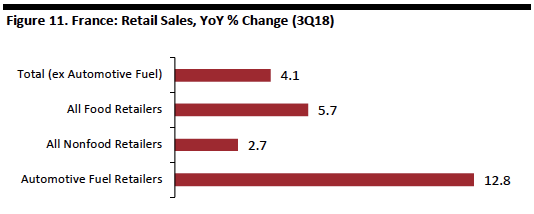

The French national statistics office, INSEE, and the European Commission’s statistics office, Eurostat, are slow to report detailed retail sales data for France, and the most recently released data cover only broad sectors, unlike the data reported by various statistics agencies for the U.K. and Germany. The French data showed a healthy, 4.1 percent increase in total retail sales in the third quarter, driven by food retailers. Retail sales growth in France across the first 10 months of 2018 (latest available data) was driven by an average 3.5 percent increase in volumes, according to Eurostat data.

[caption id="attachment_58046" align="aligncenter" width="534"]

Source: Eurostat/Coresight Research[/caption]

The French national statistics office, INSEE, and the European Commission’s statistics office, Eurostat, are slow to report detailed retail sales data for France, and the most recently released data cover only broad sectors, unlike the data reported by various statistics agencies for the U.K. and Germany. The French data showed a healthy, 4.1 percent increase in total retail sales in the third quarter, driven by food retailers. Retail sales growth in France across the first 10 months of 2018 (latest available data) was driven by an average 3.5 percent increase in volumes, according to Eurostat data.

[caption id="attachment_58046" align="aligncenter" width="534"] Source: Eurostat/Coresight Research[/caption]

Source: Eurostat/Coresight Research[/caption]

Headwinds and Tailwinds

UK Sector Headwinds

- In the U.K., uncertainty persists over the country’s exit from the EU. The U.K. Parliament’s vote on the Withdrawal Agreement was delayed from December 2018 until the week beginning Jan. 14, 2019, and the agreement still faces substantial opposition in the House of Commons — meaning that the lack of clarity is likely to persist and could last right up to the country’s departure from the EU on March 29, 2019. The tough retail trading reported by some retailers in November 2018 is likely a hint of the consumer caution we can expect in early 2019.Assuming the country finalizes its exit agreement, the U.K. and the EU will still need to agree on future trading arrangements, so businesses will still face uncertainty over the medium term. Even if Parliament does not approve of any iteration of an exit agreement, the U.K. is scheduled to leave the EU on March 29. The general expectation is that this would cause some disruption that would be reflected in softer consumer demand — though the U.K. and the EU would probably cooperate to minimize the near-term impacts.

- Future interest rate increases are a looming cloud for consumers. The Bank of England raised its interest rate to 0.75 percent in August 2018 and Bank Governor Mark Carney said that there would be further “gradual” and “limited” rate increases.

- We expect the U.K. retail sector to face sustained disruption from challengers, especially in the discount and e-commerce segments.

UK Sector Tailwinds

- The U.K. is enjoying near-record employment levels: The unemployment rate was 4.1 percent in the third quarter of 2018. Also, wages are growing faster than inflation.

- Consumer prices inflation has slowed as the impact of sterling depreciation has annualized.

- U.K. retail sales growth was robust across the first 11 months of 2018 (latest available data).

Germany Sector Headwinds

- Consumer prices inflation in Germany crept up across 2018, reaching 2.5 percent in October before easing a little to 2.3 percent in November (latest available data). German consumers tend to be more sensitive to price increases than their peers in some other countries are.

- German consumers have been retrenching their spending in the face of Brexit and tariff conflicts between the U.S. and the EU.

Germany Sector Tailwinds

- At the time of writing, Germany’s unemployment rate has shown a trend of falling to record lows. The rate showed a declining tendency over the first 10 months of 2018 and it stood at just 3.2 percent in October.

- Adjusted for inflation, German workers’ wages have been rising — albeit at a relatively slow pace.

France Sector Headwinds

- Consumer confidence is weak in France. Political discontent deepened in the final two months of 2018, causing disruption to retailers ahead of the Christmas peak. We think that this makes for a precarious near-term retail outlook.

- France has tended to lag the U.K. and Germany in terms of e-commerce penetration. This suggests that French brick-and-mortar retailers will face challenges from more sustained or more sudden online migration in the coming years.

- France’s 9.1 percent unemployment rate in the third quarter of 2018 was more than double the U.K.’s rate and almost triple Germany’s rate in the same period.

France Sector Tailwinds

- Retail sales growth in France was solid for the first 10 months of 2018 (latest available data).

- On a volume basis, France’s quarter-over-quarter GDP growth strengthened from 0.2 percent in the second quarter of 2018 to 0.4 percent in the third quarter (latest available data).

- France’s unemployment rate was down 0.5 percentage points in the third quarter.

- Consumer prices inflation has been low, at around 2 percent or less. Wages grew slightly faster than inflation in France in both the first and second quarters of 2018 (latest available data).

Competitive Landscape

Market Shares

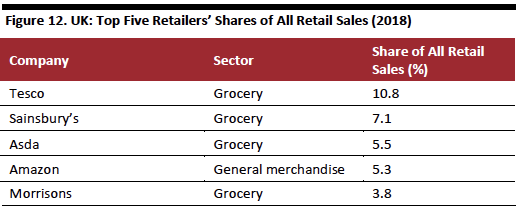

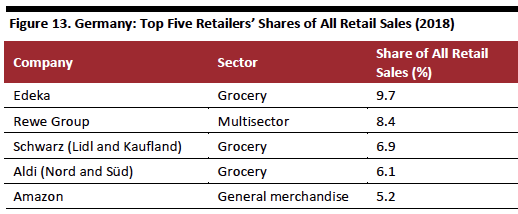

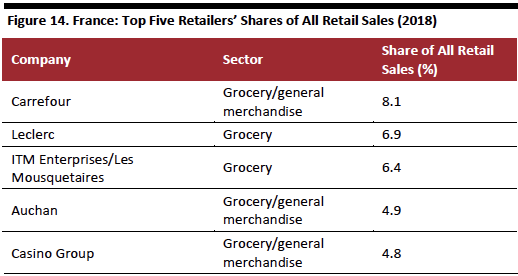

Amazon makes it into the top five retailers in terms of market share in the U.K. and Germany, according to Euromonitor International, although the company’s market shares include sales by third-party merchants.

[caption id="attachment_58047" align="aligncenter" width="516"] Source: Euromonitor International[/caption]

[caption id="attachment_58048" align="aligncenter" width="518"]

Source: Euromonitor International[/caption]

[caption id="attachment_58048" align="aligncenter" width="518"] Source: Euromonitor International[/caption]

[caption id="attachment_58049" align="aligncenter" width="518"]

Source: Euromonitor International[/caption]

[caption id="attachment_58049" align="aligncenter" width="518"] Source: Euromonitor International[/caption]

Source: Euromonitor International[/caption]

Innovators and Disruptors

Structural shifts to the online and discount channels continue to cause the biggest disruptions in European retail. The result is that undifferentiated, middle-ground brick-and-mortar retailers are experiencing an ongoing squeeze:

- Major internet pure plays such as Amazon, Asos and Zalando are set for sustained market share gains, and their growth will be underpinned by investments in convenience. Examples of these include Amazon’s launch of its Prime Wardrobe service in the U.K. in 2018 and Zalando’s extension of same-day and next-day delivery options.

- Sophisticated discount players are likely to continue to win share, too. Aside from grocery discounters, these include B&M European Value Retail SA, whose main operations are complemented by its Jawoll chain in Germany and its October 2018 acquisition of Babou, a 95-store French chain operated by Paminvest SAS. Primark (owned by Associated British Foods PLC) is another name likely to capture further market share in Europe. For the year ended September 2018, Primark noted underlying sales growth in Germany and “especially strong” growth in France.

Faced with the structural growth at e-commerce firms, more and more legacy retailers have looked to partner with technology firms:

- In June 2018, Carrefour SA announced a strategic partnership with Google LLC. The alliance is designed to help Carrefour digitally transform its operations by introducing technologies such as AI, cloud computing, the internet of things and new shopping interfaces.

- Also in June 2018, M&S and Microsoft Corp. launched a strategic partnership to “investigate and test the capabilities of technology and artificial intelligence in a retail environment.”

- In late 2017, Casino Group signed a deal with Ocado Group PLC for the latter to support Casino’s e-commerce service. Casino’s Monoprix banner started offering its products through Amazon Prime Now on Sept. 12, and in October, Casino management said that the number of orders placed through Prime Now had exceeded its projections.

Sector Outlook

UK

The U.K. leaves the EU on March 29, 2019, and sustained uncertainty surrounding that departure is likely to shape consumer spending in the near term.

In November, Sainsbury’s pointed to an “uncertain” consumer outlook, but the company has been underperforming rivals, so more negative commentary may be expected. On Next PLC’s second-quarter earnings call, CEO Simon Wolfson said, “We don’t think that people are not buying ties and blouses because of Brexit. Underlying, we think the consumer is in a healthier position than they were this time last year. You can see real rates of income are now rising.” Wolfson pointed to the sectoral shift of spending away from apparel and toward leisure services as the main drag on the company’s sector.

U.K. retail sales growth has generally been robust, but it slowed slightly in October (latest available data). Meanwhile, inflation has fallen, easing the pressure on consumers.

Germany

German discretionary retail has been weak as consumers have reacted to higher inflation and global political issues. We think there must be a shift on both fronts before German retailers enjoy meaningful momentum in discretionary sales.

France

There are signs of incremental improvements in France. In its third-quarter trading update, Carrefour noted “improving market trends.” Similarly, on L’Oréal SA’s third-quarter conference call, CEO Jean-Paul Agon identified “light at the end of the tunnel” for the first time “in several years” in France. The company had previously pointed to difficult trading conditions in the country.

Sustained volume growth drove solid retail sales gains in 2018 in France, according to Eurostat, suggesting that French shoppers are willing to spend in spite of dwindling consumer confidence.