Nitheesh NH

Introduction

Each report in our Sector Overview series analyzes a particular retail sector or consumer market. In this report, we cover the e-commerce sector, with a focus on Alibaba’s operations in China and Amazon’s operations in the U.S. We also examine sector themes and dynamics, the competitive landscape and the sector outlook.

The global e-commerce sector has seen strong growth, but in the U.S. and China, where platform giants such as Amazon and Alibaba’s Tmall enjoy dominant shares, the sector is creeping into winner-takes-all territory. Many major platform operators are expanding offline and leveraging in-store technology, logistics improvements and big data to integrate the online and offline shopping experiences. The e-commerce giants are also entering new retail verticals.

Themes We’re Watching

The global e-commerce sector continues to consolidate as top players gain dominant market shares. In China and the U.S., the biggest e-commerce companies are disrupting traditional retail by expanding offline to enter new verticals and bring new experiences to consumers.

New Retail

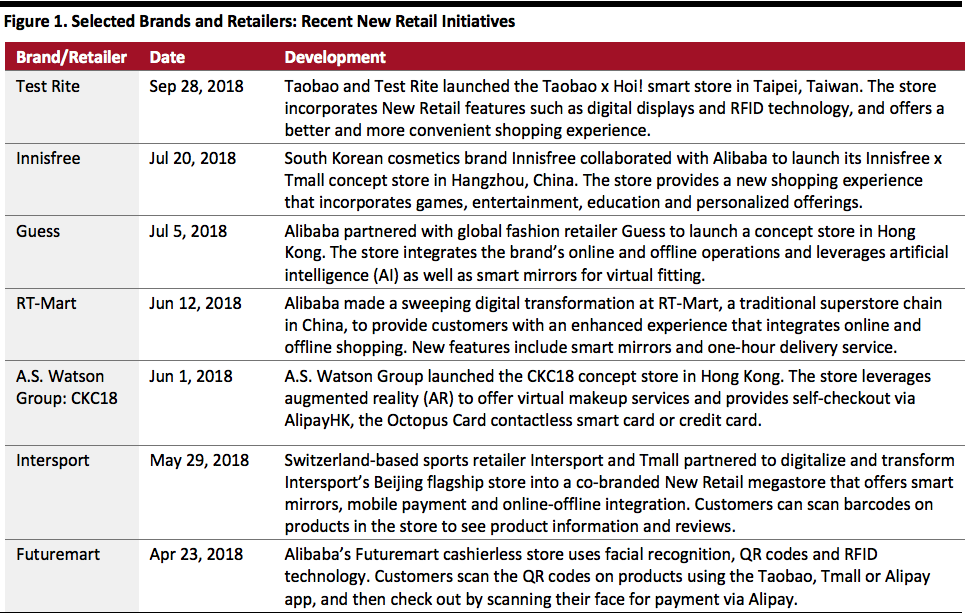

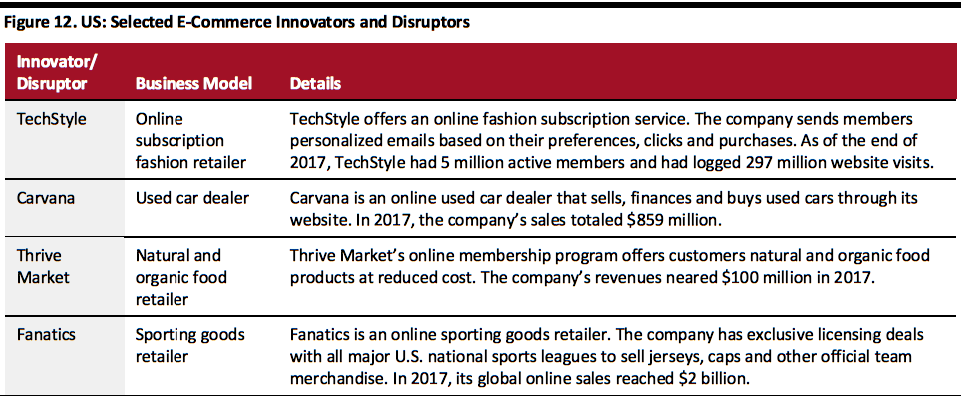

New Retail is a concept advocated by Alibaba Executive Chairman Jack Ma that refers to the integration of online and offline retail using in-store technology and digitalized operations and supply chains. This type of integration is occurring in both China and the U.S., but through different models. In terms of disrupting traditional retail, e-commerce companies in China appear to be focusing on leveraging in-store technology to enhance the shopping experience. In the U.S., e-commerce companies appear more focused on continuing their offline expansion onto traditional retailers’ turf.

In China, the leading online e-commerce retailers and platform operators have acquired or partnered with traditional retailers to bring a seamless shopping experience to consumers. Alibaba has been particularly active on this front, leveraging virtual reality, facial recognition and other technologies in stores to enhance the retail experience for Chinese consumers. The company’s “See Now, Buy Now, Play Now” interactive feature enables customers to interact with brands and purchase products in real time during livestreamed fashion shows on digital platforms such as Taobao, Tmall, Youku, Weibo and Beijing TV.

In the U.S., Amazon has continually expanded its offline operations through its bookstores, Amazon Go stores, Whole Foods Market stores, pop-ups, partnerships with offline retail chains and new concepts such as Amazon 4-star. The company launched the 4-star store format in New York City in September 2018. The store only sells items that customers have rated four stars or higher, are top sellers or that Amazon’s website data show are trending on the site. Amazon has since opened two more 4-Star stores, one in Berkeley, California, and in Lone Tree, Colorado, a suburb of Denver. Amazon also sells its electronic devices in its Whole Foods grocery stores and in Kohl’s department stores.

[caption id="attachment_78448" align="aligncenter" width="800"] Source: Company reports/Coresight Research[/caption]

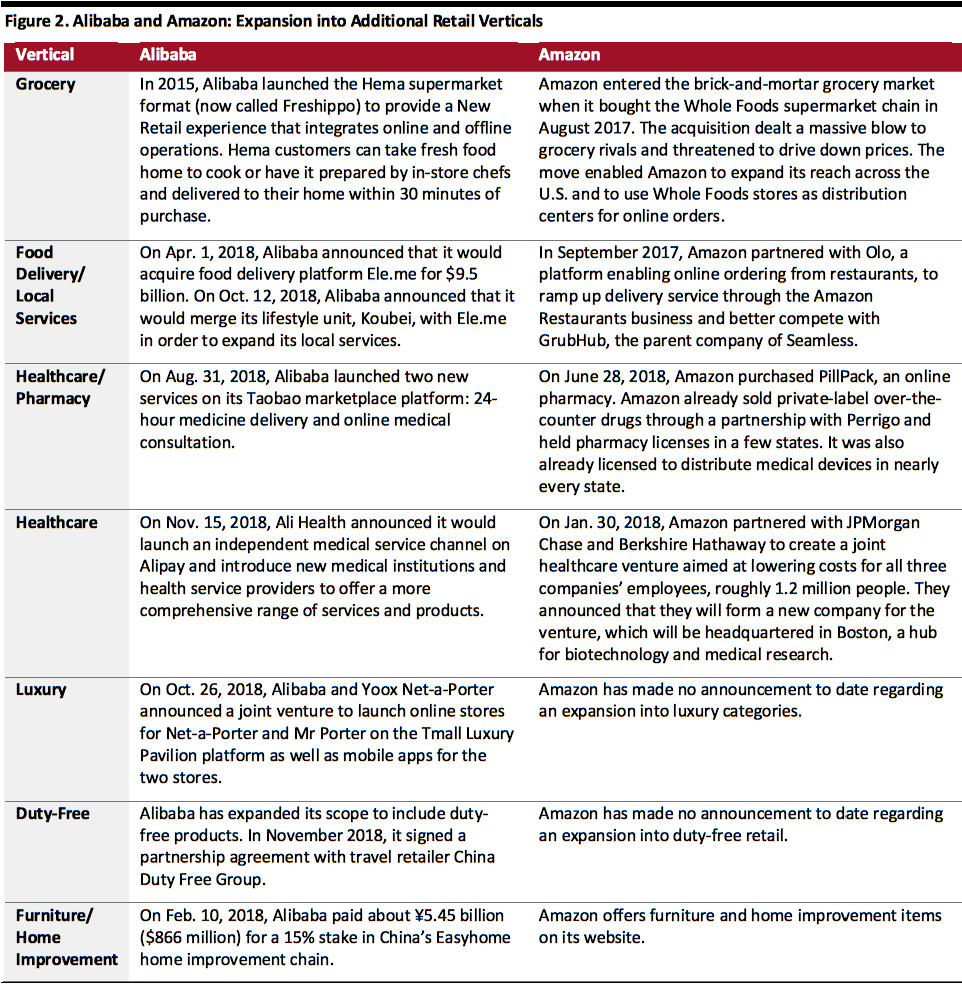

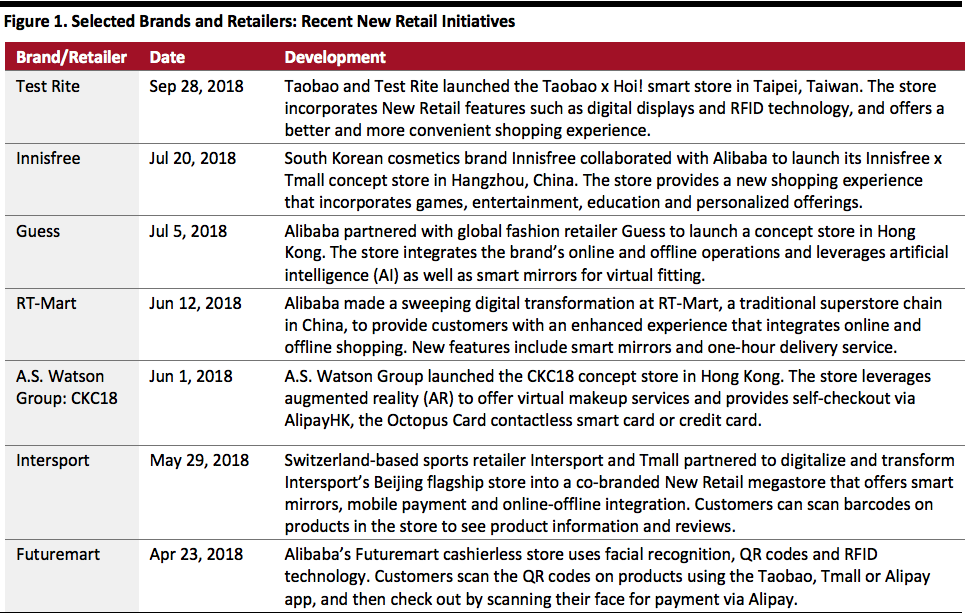

Expanding into New Verticals, with Grocery as the Primary Target

In China and the U.S., e-commerce platforms and online retailers are expanding into different verticals, including food delivery and healthcare. Grocery, however, is the major e-commerce players’ top target. In China, Alibaba launched the Hema (now called Freshippo) supermarket format in 2015 to provide a New Retail experience to customers, including home delivery service within 30 minutes. In the U.S., Amazon acquired Whole Foods in 2017 and integrated the chain with its logistics infrastructure to provide delivery for online orders.

[caption id="attachment_78449" align="aligncenter" width="800"]

Source: Company reports/Coresight Research[/caption]

Expanding into New Verticals, with Grocery as the Primary Target

In China and the U.S., e-commerce platforms and online retailers are expanding into different verticals, including food delivery and healthcare. Grocery, however, is the major e-commerce players’ top target. In China, Alibaba launched the Hema (now called Freshippo) supermarket format in 2015 to provide a New Retail experience to customers, including home delivery service within 30 minutes. In the U.S., Amazon acquired Whole Foods in 2017 and integrated the chain with its logistics infrastructure to provide delivery for online orders.

[caption id="attachment_78449" align="aligncenter" width="800"] Source: Company reports/Coresight Research[/caption]

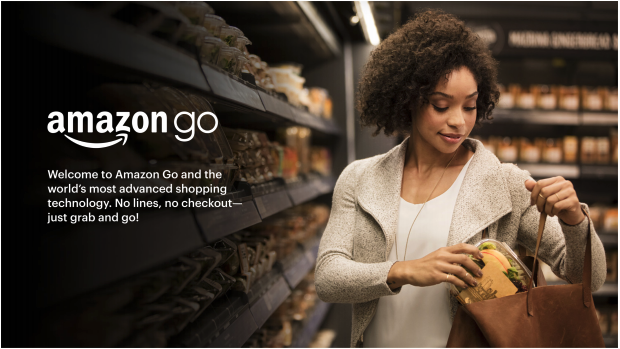

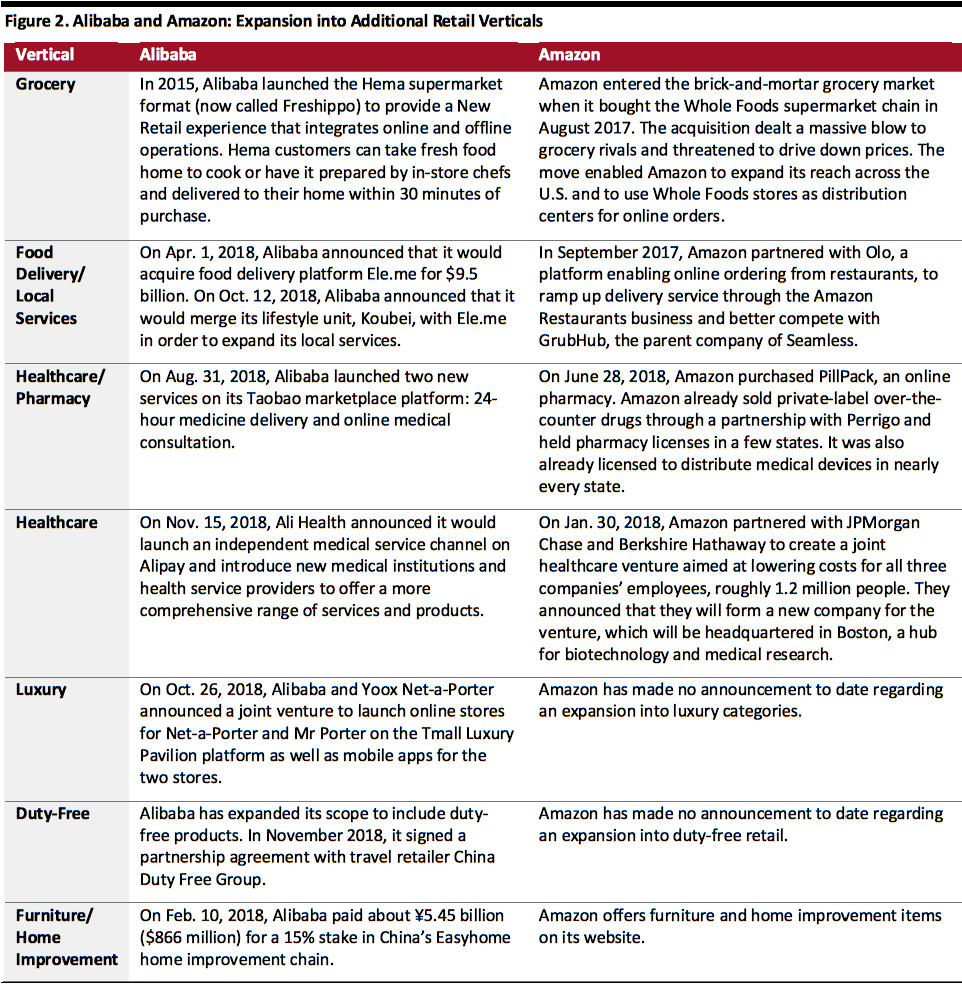

Amazon Go: 3,000 Cashierless Convenience Stores by 2021?

Amazon is planning to open up to 3,000 Amazon Go cashierless convenience stores across the U.S. by 2021, according to an unconfirmed Bloomberg report. If the company were to open that many stores, it would make Amazon Go one of the biggest convenience store chains in the country. As of mid-November 2018, Amazon operated six Amazon Go stores: one in San Francisco, two in Chicago and three in its hometown of Seattle. According to Bloomberg, the company planned to have about 10 locations by the end of 2018 and about 50 locations by the end of 2019.

Our long-standing view is that it is much more difficult to make internet pure-play retailing work in the grocery category than in nonfood categories, and this offline expansion plan makes perfect sense if Amazon truly wants to disrupt the grocery space. Yet we think opening 3,000 Amazon Go stores by 2021 would be a daunting challenge. In 2017, the U.S. convenience store sector added only 423 stores (net), according to trade association NACS, and 7-Eleven has taken many years and a franchise model to establish a network of over 7,000 stores in the U.S.

Although Amazon Go will limit its offerings to fresh prepared foods and a small range of groceries to keep operational costs low, Amazon may face challenges finding suitable, affordable locations for the format. So far, the company has targeted urban locations with heavy foot traffic for these stores. If Amazon continues to seek such locations, it will not enjoy the benefit of increasing mall vacancy rates and lower rents: Mall vacancies were up 5% between the second and third quarters of 2018 and rents which were down 0.3% in the same period, according to real estate research firm Reis. Instead, the company could be challenged by rising rents for open-air retail spaces. These rents rose almost 2% between the third quarter of 2017 and the third quarter of 2018, according to Reis, and such rising rates could make it more difficult for Amazon to find affordable store locations.

A further barrier to a mass rollout of Amazon Go is the cost of the technology that enables the stores to operate. The first four Amazon Go stores reportedly cost more than $1 million each in hardware alone – meaning the cost for the 3,000 new stores Amazon reportedly plans to open would be more than $3 billion. And that estimate assumes upfront spending is the only technology cost: Ongoing technology costs such as infrastructure maintenance and upgrades could add to that price tag. The caveat is that the estimate assumes cost per store remains the same, but we expect increased scale and falling technology prices may lower that cost somewhat.

[caption id="attachment_78450" align="aligncenter" width="580"]

Source: Company reports/Coresight Research[/caption]

Amazon Go: 3,000 Cashierless Convenience Stores by 2021?

Amazon is planning to open up to 3,000 Amazon Go cashierless convenience stores across the U.S. by 2021, according to an unconfirmed Bloomberg report. If the company were to open that many stores, it would make Amazon Go one of the biggest convenience store chains in the country. As of mid-November 2018, Amazon operated six Amazon Go stores: one in San Francisco, two in Chicago and three in its hometown of Seattle. According to Bloomberg, the company planned to have about 10 locations by the end of 2018 and about 50 locations by the end of 2019.

Our long-standing view is that it is much more difficult to make internet pure-play retailing work in the grocery category than in nonfood categories, and this offline expansion plan makes perfect sense if Amazon truly wants to disrupt the grocery space. Yet we think opening 3,000 Amazon Go stores by 2021 would be a daunting challenge. In 2017, the U.S. convenience store sector added only 423 stores (net), according to trade association NACS, and 7-Eleven has taken many years and a franchise model to establish a network of over 7,000 stores in the U.S.

Although Amazon Go will limit its offerings to fresh prepared foods and a small range of groceries to keep operational costs low, Amazon may face challenges finding suitable, affordable locations for the format. So far, the company has targeted urban locations with heavy foot traffic for these stores. If Amazon continues to seek such locations, it will not enjoy the benefit of increasing mall vacancy rates and lower rents: Mall vacancies were up 5% between the second and third quarters of 2018 and rents which were down 0.3% in the same period, according to real estate research firm Reis. Instead, the company could be challenged by rising rents for open-air retail spaces. These rents rose almost 2% between the third quarter of 2017 and the third quarter of 2018, according to Reis, and such rising rates could make it more difficult for Amazon to find affordable store locations.

A further barrier to a mass rollout of Amazon Go is the cost of the technology that enables the stores to operate. The first four Amazon Go stores reportedly cost more than $1 million each in hardware alone – meaning the cost for the 3,000 new stores Amazon reportedly plans to open would be more than $3 billion. And that estimate assumes upfront spending is the only technology cost: Ongoing technology costs such as infrastructure maintenance and upgrades could add to that price tag. The caveat is that the estimate assumes cost per store remains the same, but we expect increased scale and falling technology prices may lower that cost somewhat.

[caption id="attachment_78450" align="aligncenter" width="580"] Source: Amazon[/caption]

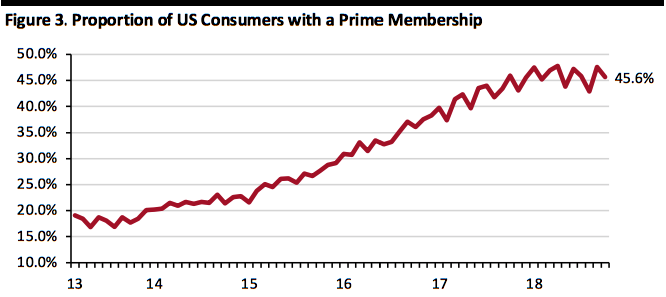

A Leveling Off in Amazon Prime Membership Rates Could Soften Growth at Amazon

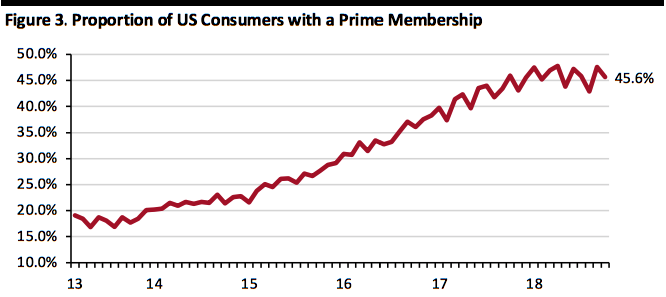

Amazon Prime has been a key support to Amazon’s retail sales growth in the past five years. According to data from Prosper Insights & Analytics, in the five years through October 2018, the proportion of U.S. consumers with a Prime membership rose from less than 20% to almost 46%. Amazon CEO Jeff Bezos stated in his 2018 letter to shareholders that there are more than 100 million Prime members across the globe. Though the subscription model has become a big success, consumer survey data from Prosper Insights & Analytics indicate that Prime member numbers plateaued in 2018, and if that trend persists, Amazon will lose the growth momentum that Prime previously provided.

[caption id="attachment_78451" align="aligncenter" width="580"]

Source: Amazon[/caption]

A Leveling Off in Amazon Prime Membership Rates Could Soften Growth at Amazon

Amazon Prime has been a key support to Amazon’s retail sales growth in the past five years. According to data from Prosper Insights & Analytics, in the five years through October 2018, the proportion of U.S. consumers with a Prime membership rose from less than 20% to almost 46%. Amazon CEO Jeff Bezos stated in his 2018 letter to shareholders that there are more than 100 million Prime members across the globe. Though the subscription model has become a big success, consumer survey data from Prosper Insights & Analytics indicate that Prime member numbers plateaued in 2018, and if that trend persists, Amazon will lose the growth momentum that Prime previously provided.

[caption id="attachment_78451" align="aligncenter" width="580"] Through October 2018

Through October 2018

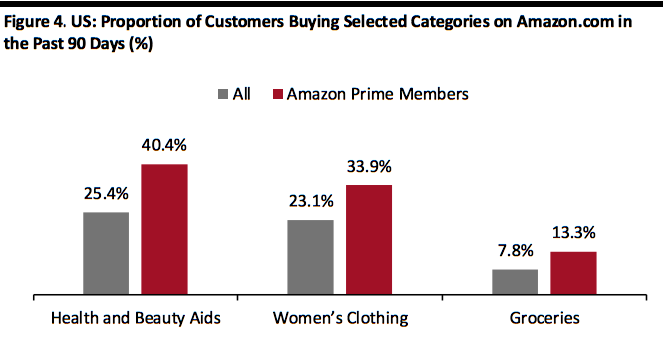

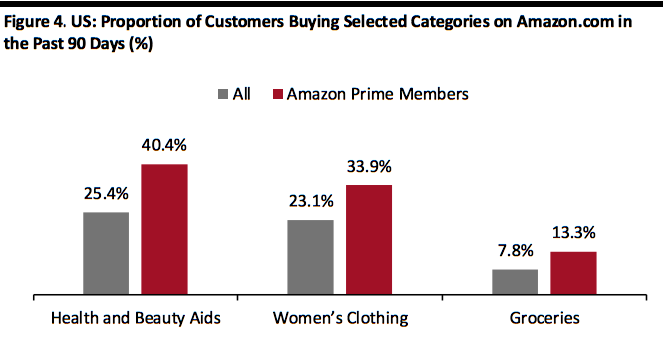

Source: Prosper Insights & Analytics/Coresight Research[/caption] The apparent leveling off in Prime membership is significant because Prime members drive the bulk of Amazon’s sales. In the U.S., Prime members are much more likely than non-members to buy non-traditional categories on Amazon. Prime members are naturally a self-selecting group of Amazon shoppers, because only regular customers would opt for membership, but we think that once customers become members, they see the value of buying types of products on the site that they may not traditionally associate with Amazon, such as groceries and clothing. The chart below shows the difference in rates of purchase for selected categories by Prime members and all Amazon customers in the U.S. [caption id="attachment_78452" align="aligncenter" width="580"] Base: 7,000+ U.S. internet users ages 18+, surveyed in November 2017 (health and beauty aids), April 2018 (women’s clothing) and August 2018 (groceries)

Base: 7,000+ U.S. internet users ages 18+, surveyed in November 2017 (health and beauty aids), April 2018 (women’s clothing) and August 2018 (groceries)

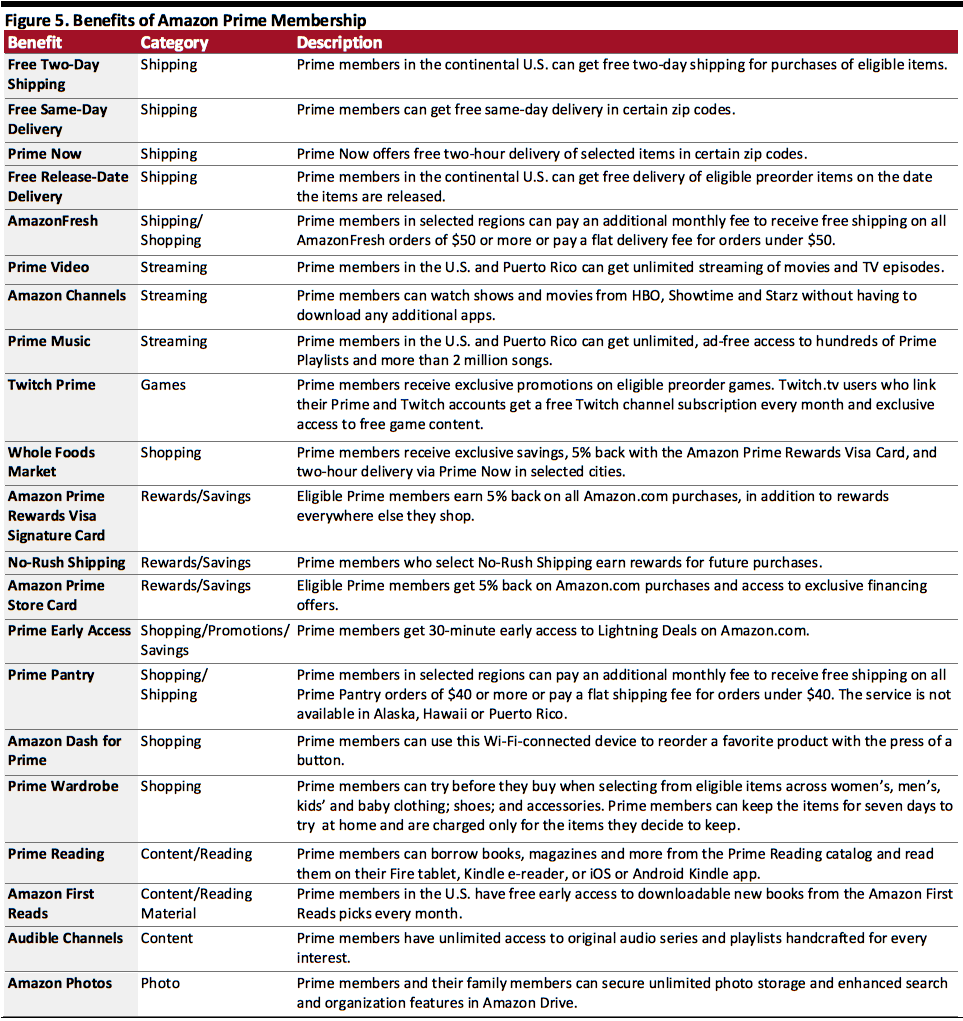

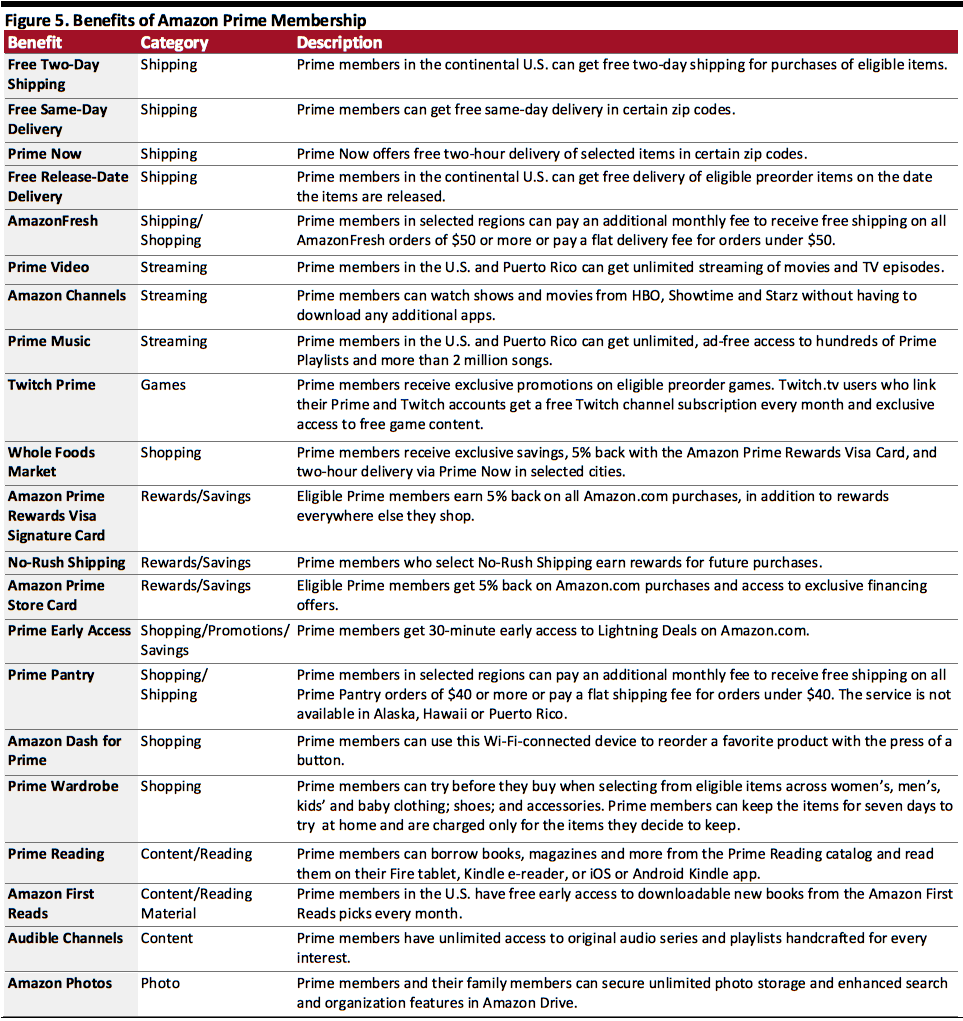

Source: Prosper Insights & Analytics[/caption] The popular Prime subscription program now offers a wide range of benefits, including shipping, video and music streaming services, games, e-books and shopping rewards. [caption id="attachment_78453" align="aligncenter" width="800"] Source: Amazon/Coresight Research[/caption]

Walmart Poised to Target Higher-Income Shoppers in Urban Areas

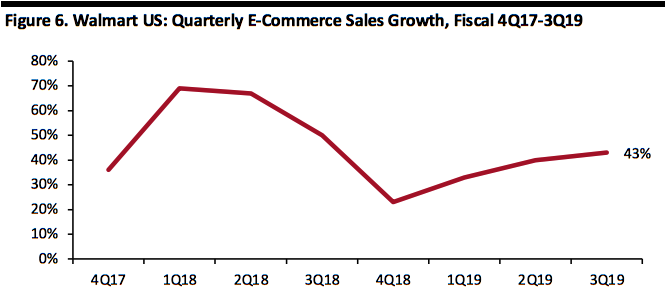

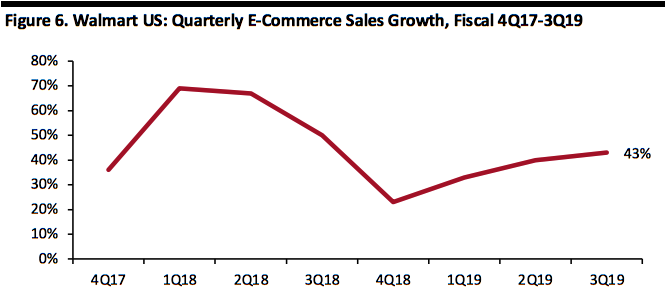

Although Amazon is dominating the U.S. e-commerce arena, Walmart’s e-commerce investments – especially its acquisition of Jet.com – and its consolidation of the e-commerce assets it has acquired have flowed through to strong e-commerce growth. Market research firm eMarketer forecast that Walmart would overtake Apple to become the third-largest e-commerce player in the U.S., after Amazon and eBay, by the end of 2018.

Walmart is looking to increase its competitiveness in cities, and New York City is at the top of its agenda to win over higher-income urban millennials. In 2018, Walmart linked Jet.com with Parcel, a delivery service startup the retailer acquired in 2017, to offer three-hour and same-day grocery delivery in New York City. The move is an attempt to compete against Amazon’s Prime Now, which offers same-day delivery of household essentials. Walmart is also leasing a fulfillment center in the Bronx borough of New York City to bolster same- and next-day delivery of Jet.com orders amid heightened competition in delivery speed.

We think Walmart will continue to beef up initiatives to target higher-income shoppers in urban areas, in part to counter Amazon’s expansion into the upscale grocery market via its Whole Foods acquisition. It remains unclear how Jet.com will continue to boost Walmart’s e-commerce sales growth, as Walmart has scaled back its marketing investments in the subsidiary. However, Walmart did see a significant increase in e-commerce sales growth in the quarters following the acquisition in September 2016 and Jet.com will likely remain an important e-commerce arm for Walmart in the near future, particularly in urban areas.

[caption id="attachment_78455" align="aligncenter" width="580"]

Source: Amazon/Coresight Research[/caption]

Walmart Poised to Target Higher-Income Shoppers in Urban Areas

Although Amazon is dominating the U.S. e-commerce arena, Walmart’s e-commerce investments – especially its acquisition of Jet.com – and its consolidation of the e-commerce assets it has acquired have flowed through to strong e-commerce growth. Market research firm eMarketer forecast that Walmart would overtake Apple to become the third-largest e-commerce player in the U.S., after Amazon and eBay, by the end of 2018.

Walmart is looking to increase its competitiveness in cities, and New York City is at the top of its agenda to win over higher-income urban millennials. In 2018, Walmart linked Jet.com with Parcel, a delivery service startup the retailer acquired in 2017, to offer three-hour and same-day grocery delivery in New York City. The move is an attempt to compete against Amazon’s Prime Now, which offers same-day delivery of household essentials. Walmart is also leasing a fulfillment center in the Bronx borough of New York City to bolster same- and next-day delivery of Jet.com orders amid heightened competition in delivery speed.

We think Walmart will continue to beef up initiatives to target higher-income shoppers in urban areas, in part to counter Amazon’s expansion into the upscale grocery market via its Whole Foods acquisition. It remains unclear how Jet.com will continue to boost Walmart’s e-commerce sales growth, as Walmart has scaled back its marketing investments in the subsidiary. However, Walmart did see a significant increase in e-commerce sales growth in the quarters following the acquisition in September 2016 and Jet.com will likely remain an important e-commerce arm for Walmart in the near future, particularly in urban areas.

[caption id="attachment_78455" align="aligncenter" width="580"] Source: Company reports/Coresight Research[/caption]

Trends to Watch in China

China’s consumption upgrade will be fueled by the growth of its middle class, which Alibaba Executive Chairman Jack Ma estimated will exceed 500 million by 2022, when he spoke at the Gateway ’17 Conference in Canada in 2017. The shift has driven e-commerce growth, as many Chinese consumers now aspire to purchase high-quality products from overseas to improve their quality of life.

Imports Are Key

Imports of high-quality products will be one of the top trends to watch as China’s consumption upgrade process continues. At the inaugural China International Import Expo in Shanghai in November 2018, President Xi Jinping said in his keynote address that China will import $30 trillion worth of goods and $10 trillion worth of services over the next 15 years. The Chinese government’s recent moves to open up e-commerce avenues to more international retailers are strong tailwinds for domestic e-commerce platforms, which are set to bring a wider array of foreign products to Chinese consumers.

At the same expo, Alibaba management announced that the company has committed to helping import $200 billion worth of goods from more than 120 countries over the next five years. Other Chinese e-commerce players made similar pledges. JD.com plans to help import nearly ¥100 billion worth of goods, Suning.com €15 billion, NetEase Kaola ¥20 billion, Vipshop ¥10 billion and Yangmatou (Ymatou) ¥100 million. Alibaba says the pledge underscores its long-term commitment to globalization and boosts its efforts to meet Chinese consumers’ rising demand for high-quality international products, which implies long-term secular growth for Chinese e-commerce platforms.

Cross-Border E-Commerce in China

Cross-border e-commerce in China is a major theme in global e-commerce, given the sheer size of the Chinese market and the country’s ongoing consumption upgrade. We described the huge opportunity in Chinese cross-border e-commerce in our reports Chinese Demand for Cross-Border E-Commerce Booms, but Looming Tax Reforms Are a Cloud on the Horizon and Cross-Border Retail Heads Offline with New Brick and Mortar Formats.

The Chinese government recently announced it would relax the cross-border e-commerce policy that was enacted in April 2016. According to a government press release, the new policy will:

Source: Company reports/Coresight Research[/caption]

Trends to Watch in China

China’s consumption upgrade will be fueled by the growth of its middle class, which Alibaba Executive Chairman Jack Ma estimated will exceed 500 million by 2022, when he spoke at the Gateway ’17 Conference in Canada in 2017. The shift has driven e-commerce growth, as many Chinese consumers now aspire to purchase high-quality products from overseas to improve their quality of life.

Imports Are Key

Imports of high-quality products will be one of the top trends to watch as China’s consumption upgrade process continues. At the inaugural China International Import Expo in Shanghai in November 2018, President Xi Jinping said in his keynote address that China will import $30 trillion worth of goods and $10 trillion worth of services over the next 15 years. The Chinese government’s recent moves to open up e-commerce avenues to more international retailers are strong tailwinds for domestic e-commerce platforms, which are set to bring a wider array of foreign products to Chinese consumers.

At the same expo, Alibaba management announced that the company has committed to helping import $200 billion worth of goods from more than 120 countries over the next five years. Other Chinese e-commerce players made similar pledges. JD.com plans to help import nearly ¥100 billion worth of goods, Suning.com €15 billion, NetEase Kaola ¥20 billion, Vipshop ¥10 billion and Yangmatou (Ymatou) ¥100 million. Alibaba says the pledge underscores its long-term commitment to globalization and boosts its efforts to meet Chinese consumers’ rising demand for high-quality international products, which implies long-term secular growth for Chinese e-commerce platforms.

Cross-Border E-Commerce in China

Cross-border e-commerce in China is a major theme in global e-commerce, given the sheer size of the Chinese market and the country’s ongoing consumption upgrade. We described the huge opportunity in Chinese cross-border e-commerce in our reports Chinese Demand for Cross-Border E-Commerce Booms, but Looming Tax Reforms Are a Cloud on the Horizon and Cross-Border Retail Heads Offline with New Brick and Mortar Formats.

The Chinese government recently announced it would relax the cross-border e-commerce policy that was enacted in April 2016. According to a government press release, the new policy will:

Source: U.S. Census Bureau/Analysys/Coresight Research[/caption]

Headwinds and Tailwinds

Sector Headwinds

Fluid Macroeconomic Environment

Trade tensions between the U.S. and China and currency and economic crises in markets such as Turkey, Argentina and Italy are causing macroeconomic uncertainty. These factors are contributing to a murky global economic outlook, and any economic slowdown in China or the U.S. could impact e-commerce operators.

In China, retail sales growth slowed to single digits in 2018 following a decade of double-digit growth. The growth rates released in May and October 2018 were the lowest since June 2003. Although official indicators have yet to show signs of an economic crisis in China, we have seen news reports that big factories have been laying off staff and reducing costs, partly due to uncertainty caused by trade conflicts, and more factories may follow suit amid trade tensions and a slowing economy. China’s National Bureau of Statistics recorded 6.6% GDP growth in 2018, the slowest growth in 28 years, while the International Monetary Fund forecast China’s GDP growth could slow further in 2019, to 6.2%.

There are also signs of a slowdown in the U.S. The latest federal data showed that U.S. soybean exports to China dropped 94% year over year amid ongoing trade tensions. Weak housing data have also raised concerns over the state of the U.S. economy. Housing starts increased by 1.5% month over month in October, to 1.2 million, but the increase was lower than the third quarter’s. The number of single-family home starts, the backbone of housing demand, declined 1.8% month over month in October after falling 1.0% in September. Also, building permits trended down between January and October 2018 and were down 8.3% in October from their March peak.

A weak global economy would certainly weigh on the growth of e-commerce platform operators, affecting consumer sentiment. The trade war may also have a strong impact on these companies, especially Alibaba, JD.com and Vipshop, which rely heavily on cross-border trading.

Sector Tailwinds

In China, the consumption upgrade has been the key growth driver for e-commerce. We expect the growing consumption power of the Chinese middle class and their demand for high-quality foreign goods to continue to support e-commerce growth in China, despite the fluid macroeconomic environment.

In the U.S., the transformation of traditional retail will continue as Amazon enters more retail verticals. The company has already expanded into the grocery, healthcare, cashierless convenience store, subscription and private-label spaces, and we expect it will further extend its reach. These initiatives bring consumers lower prices, new experiences and convenience, and will continue to boost the growth of the e-commerce sector in the U.S.

Competitive Landscape

Market Shares

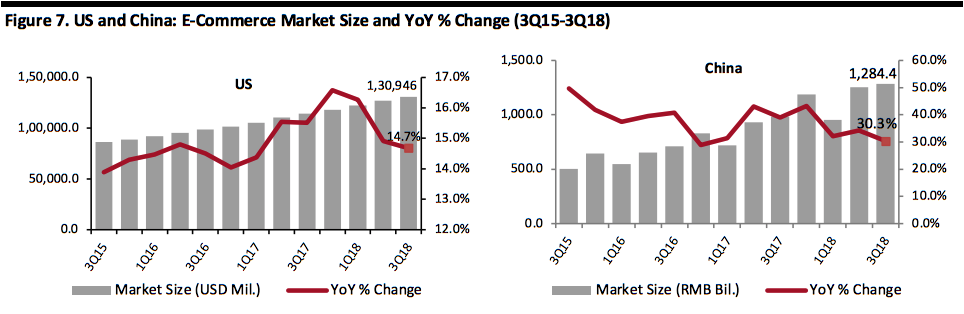

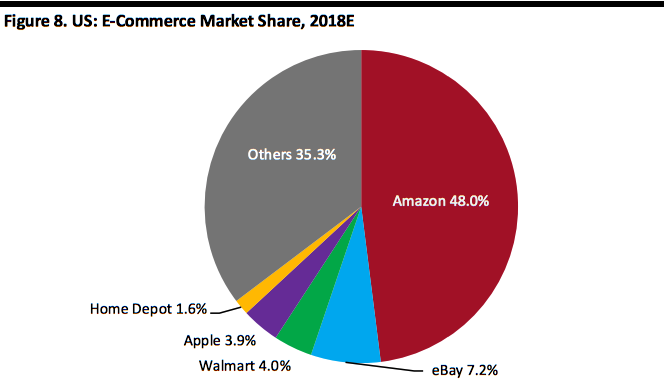

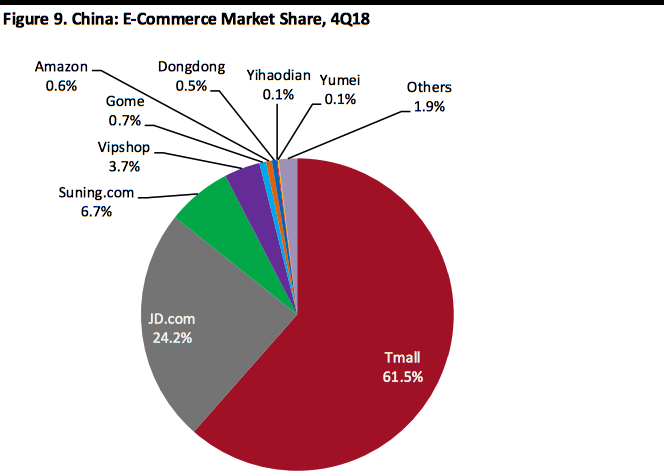

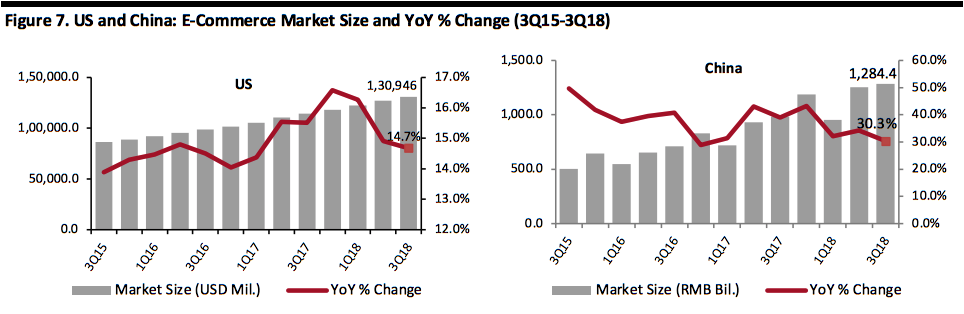

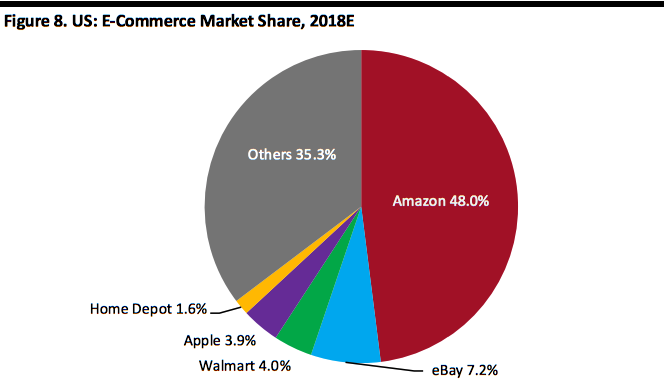

In the U.S. and China, the e-commerce market continues to consolidate, and market leaders in both countries are increasing their share of the market. In the U.S., Amazon’s market share grew from 43.1% in 2017 to 48.0% in 2018, according to estimates compiled by eMarketer in November2018. In China, Tmall and JD.com accounted for a combined 85.7% of online sales in the fourth quarter of 2018, with Tmall holding a 61.5% share and JD.com a 24.2% share, according to China-based data services company Analysys.

[caption id="attachment_78457" align="aligncenter" width="580"]

Source: U.S. Census Bureau/Analysys/Coresight Research[/caption]

Headwinds and Tailwinds

Sector Headwinds

Fluid Macroeconomic Environment

Trade tensions between the U.S. and China and currency and economic crises in markets such as Turkey, Argentina and Italy are causing macroeconomic uncertainty. These factors are contributing to a murky global economic outlook, and any economic slowdown in China or the U.S. could impact e-commerce operators.

In China, retail sales growth slowed to single digits in 2018 following a decade of double-digit growth. The growth rates released in May and October 2018 were the lowest since June 2003. Although official indicators have yet to show signs of an economic crisis in China, we have seen news reports that big factories have been laying off staff and reducing costs, partly due to uncertainty caused by trade conflicts, and more factories may follow suit amid trade tensions and a slowing economy. China’s National Bureau of Statistics recorded 6.6% GDP growth in 2018, the slowest growth in 28 years, while the International Monetary Fund forecast China’s GDP growth could slow further in 2019, to 6.2%.

There are also signs of a slowdown in the U.S. The latest federal data showed that U.S. soybean exports to China dropped 94% year over year amid ongoing trade tensions. Weak housing data have also raised concerns over the state of the U.S. economy. Housing starts increased by 1.5% month over month in October, to 1.2 million, but the increase was lower than the third quarter’s. The number of single-family home starts, the backbone of housing demand, declined 1.8% month over month in October after falling 1.0% in September. Also, building permits trended down between January and October 2018 and were down 8.3% in October from their March peak.

A weak global economy would certainly weigh on the growth of e-commerce platform operators, affecting consumer sentiment. The trade war may also have a strong impact on these companies, especially Alibaba, JD.com and Vipshop, which rely heavily on cross-border trading.

Sector Tailwinds

In China, the consumption upgrade has been the key growth driver for e-commerce. We expect the growing consumption power of the Chinese middle class and their demand for high-quality foreign goods to continue to support e-commerce growth in China, despite the fluid macroeconomic environment.

In the U.S., the transformation of traditional retail will continue as Amazon enters more retail verticals. The company has already expanded into the grocery, healthcare, cashierless convenience store, subscription and private-label spaces, and we expect it will further extend its reach. These initiatives bring consumers lower prices, new experiences and convenience, and will continue to boost the growth of the e-commerce sector in the U.S.

Competitive Landscape

Market Shares

In the U.S. and China, the e-commerce market continues to consolidate, and market leaders in both countries are increasing their share of the market. In the U.S., Amazon’s market share grew from 43.1% in 2017 to 48.0% in 2018, according to estimates compiled by eMarketer in November2018. In China, Tmall and JD.com accounted for a combined 85.7% of online sales in the fourth quarter of 2018, with Tmall holding a 61.5% share and JD.com a 24.2% share, according to China-based data services company Analysys.

[caption id="attachment_78457" align="aligncenter" width="580"] Source: eMarketer/Coresight Research[/caption]

[caption id="attachment_78458" align="aligncenter" width="580"]

Source: eMarketer/Coresight Research[/caption]

[caption id="attachment_78458" align="aligncenter" width="580"] Source: Analysys/Coresight Research[/caption]

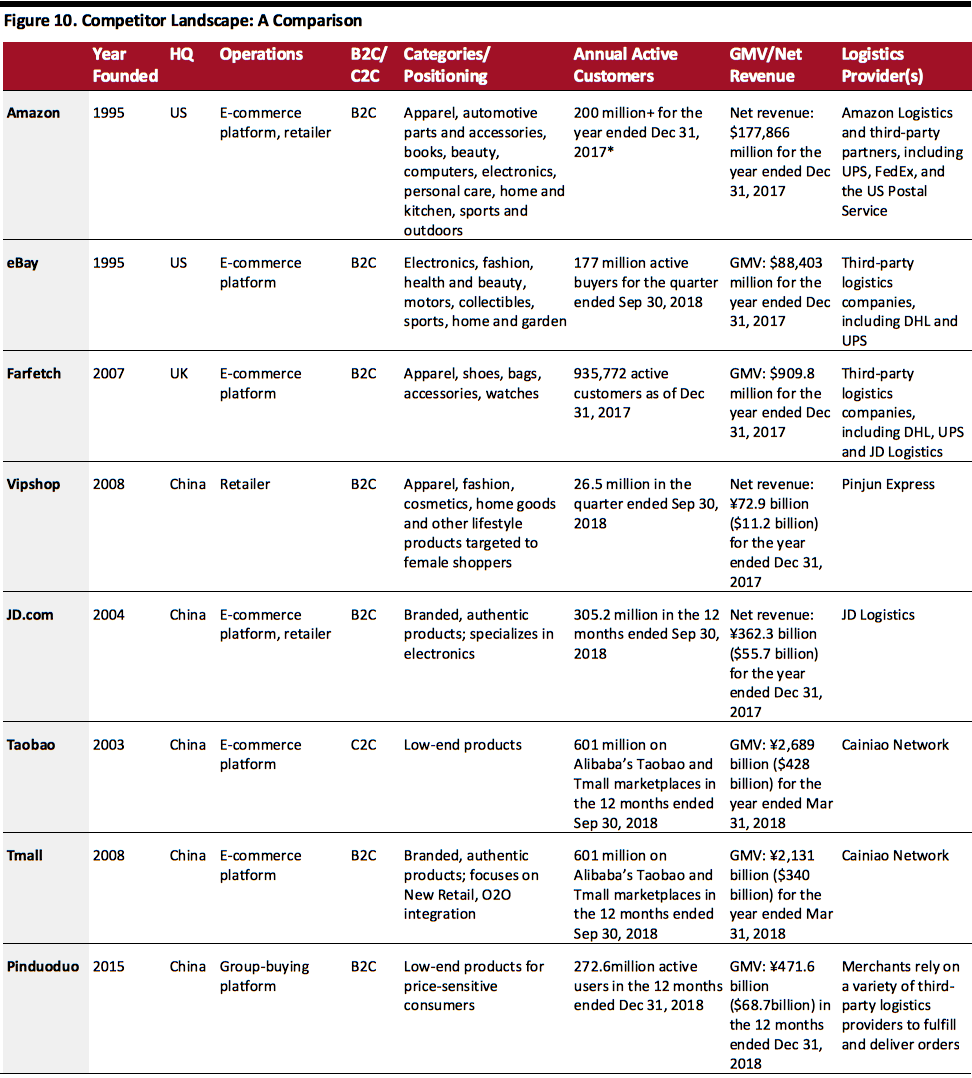

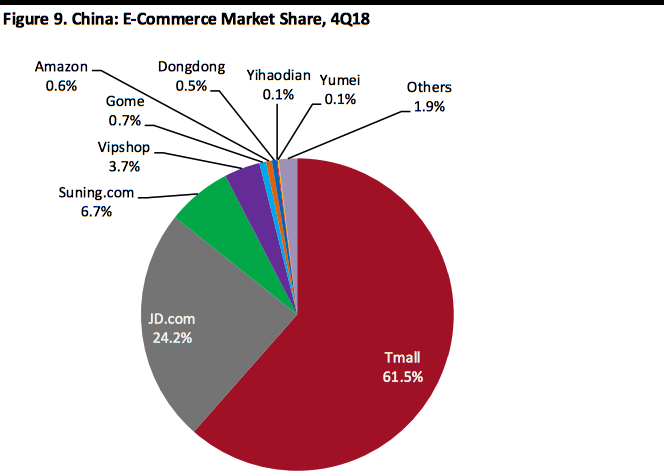

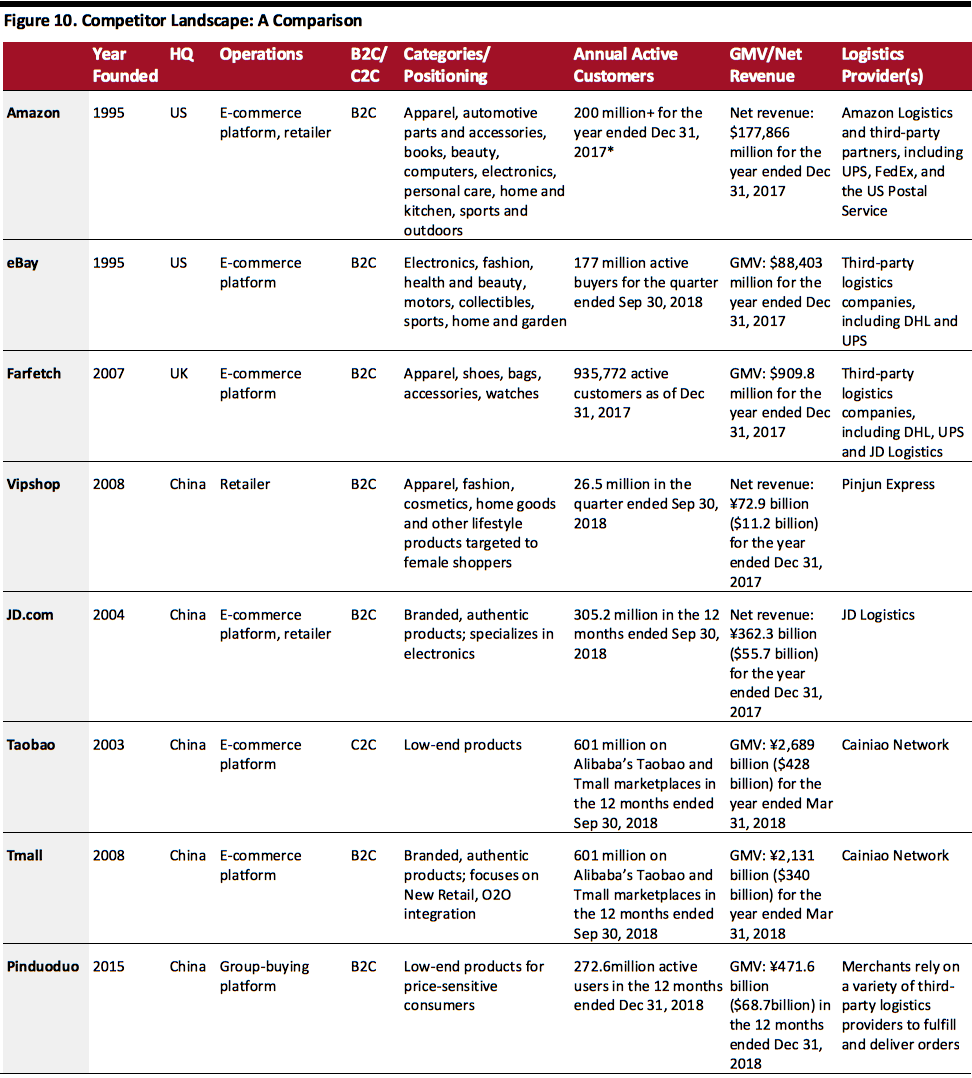

The following table compares the profiles of major e-commerce companies.

[caption id="attachment_78459" align="aligncenter" width="800"]

Source: Analysys/Coresight Research[/caption]

The following table compares the profiles of major e-commerce companies.

[caption id="attachment_78459" align="aligncenter" width="800"] *Coresight Research’s estimate

*Coresight Research’s estimate

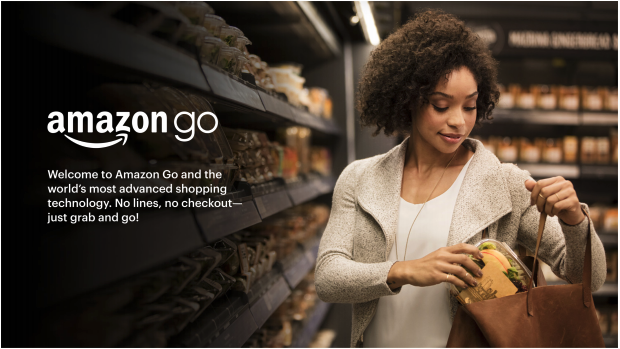

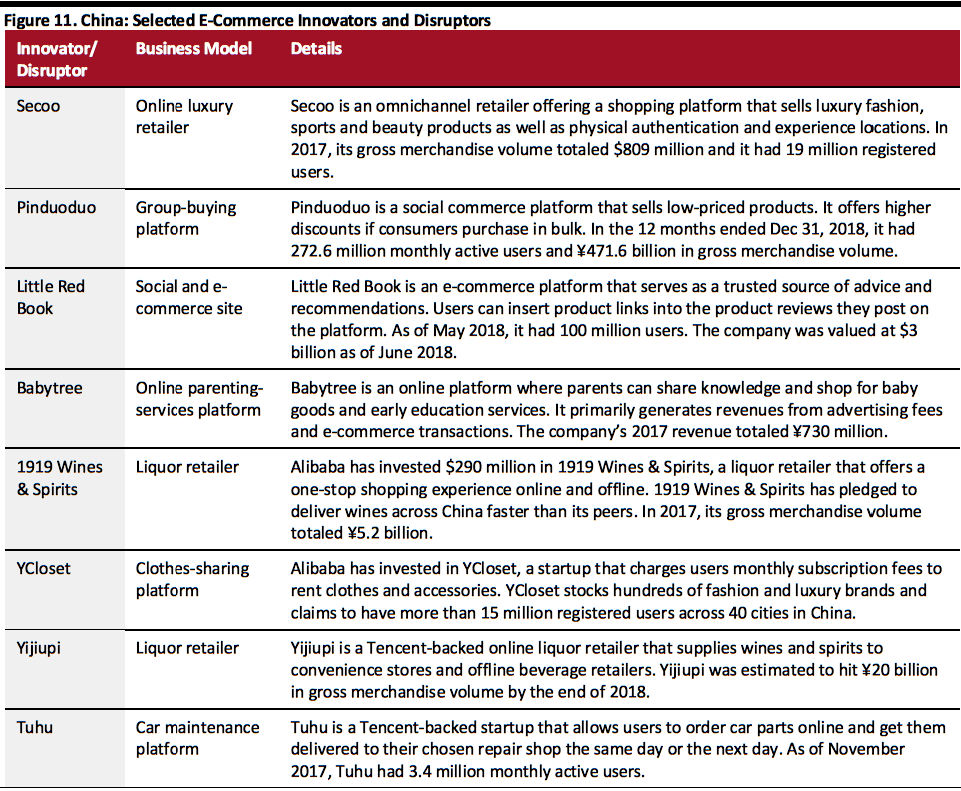

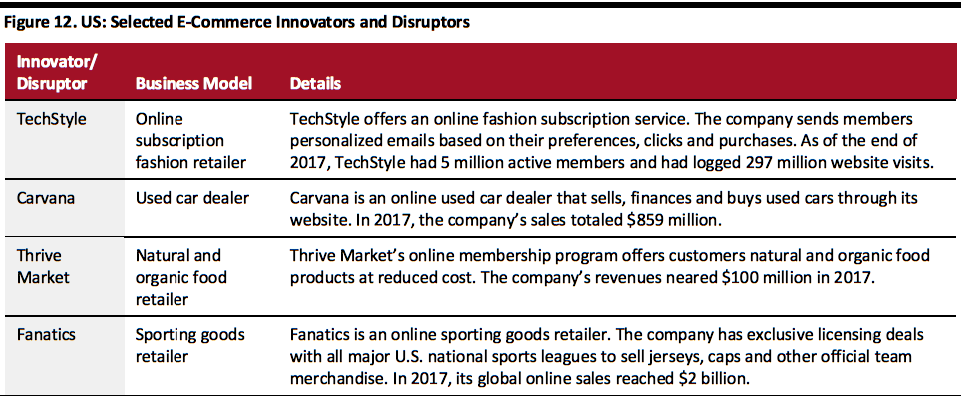

Source: Company reports/Coresight Research[/caption] Innovators and Disruptors Though the e-commerce market is becoming increasingly consolidated, some newcomers are aiming to take market share from the giants by targeting niche or new markets. Pinduoduo, Little Red Book and Secoo are three newer players that have seen much success. Source: Company reports[/caption]

[caption id="attachment_78465" align="aligncenter" width="800"]

Source: Company reports[/caption]

[caption id="attachment_78465" align="aligncenter" width="800"] Source: Company reports[/caption]

Sector Outlook

The e-commerce sector will continue to be driven by a healthy global economy, consumers shifting more of their spending online, online-offline integration and a consumption upgrade, primarily in China. However, recent events in markets across the globe have led to macroeconomic uncertainty and escalating trade conflicts may dampen the global economy. Joseph Tsai, Executive Vice Chairman of Alibaba, said he had taken note of the threat of rising interest rates, potential political and debt turmoil globally, decelerating GDP growth and weak Purchasing Managers’ Index readings in China during Alibaba’s 2Q19 earnings call in November 2018.

Macroeconomic uncertainty is affecting online sales of some categories more than others. JD.com CFO Sidney Huang said on the company’s third-quarter 2018 earnings call that slowing consumption had affected sales of big-ticket items, but that JD.com had seen healthy growth in general merchandise categories. Huang noted that the company was convinced its value proposition of offering quality products at everyday low prices along with better services will continue to win over customers.

In Pinduoduo’s 3Q18 earnings call on Dec. 26, 2018, Tian Xu, VP of Finance at Pinduoduo, commented that demand for value grows constantly, regardless of macroeconomic conditions. He said that Pinduoduo offers consumers in lower-tier cities in China better-quality goods than those available at their local stores at similar or lower prices.

Jack Ma commented at Alibaba’s Investor Day on Sept. 17, 2018, that when people have little money to spend, they head to the company’s Taobao marketplace, and that China still has more than 1 billion people living below the middle-income line, despite a growing middle-income population.

At Walmart’s 2018 Investment Community Meeting in October 2018, management announced that the company expects to grow e-commerce sales by around 40% in fiscal 2019 and by around 35% in fiscal 2020, supported by Walmart’s investments and acquisitions in e-commerce. At the meeting, Marc Lore, President and CEO of Walmart U.S. eCommerce, estimated Walmart U.S.’s online sales will total around $15 billion in fiscal 2019 and said the company will achieve same-day delivery for about 60% of Walmart’s customer base by fiscal 2020.

In the final quarter of 2018, Amazon saw slowing growth in its major North America segment and offered cautious guidance for total revenue growth in first quarter of 2019. Despite a weaker sales outlook, Amazon aims to step up investments in order to stay competitive as other international online retailers have upped their game in online operations.

E-commerce has been dominated by big tech companies in both the U.S. and China, although new entrants often attempt to challenge the status quo with innovative business models. As e-commerce giants such as Amazon and Alibaba are simultaneously developing new capabilities, continue to bolster their portfolios and improve their business models through partnerships and acquisitions, they are solidifying their positions and creating what we believe will be a winner-takes-all dynamic.

The deployment of in-store technology to upgrade the customer experience will continue to be a trend among brick-and-mortar retailers seeking to improve the retail experience and seamlessly integrate their stores with online retail.

Meanwhile, the global economic outlook remains fluid with ongoing trade tension between the U.S. and China, so consumer sentiment could soften – driving down growth in discretionary spending. However, China’s plan to bolster import volumes will provide long-term momentum, especially for Western brands going digital in China. We expect fluctuations in the near term but long-term sustained growth impetus.

Source: Company reports[/caption]

Sector Outlook

The e-commerce sector will continue to be driven by a healthy global economy, consumers shifting more of their spending online, online-offline integration and a consumption upgrade, primarily in China. However, recent events in markets across the globe have led to macroeconomic uncertainty and escalating trade conflicts may dampen the global economy. Joseph Tsai, Executive Vice Chairman of Alibaba, said he had taken note of the threat of rising interest rates, potential political and debt turmoil globally, decelerating GDP growth and weak Purchasing Managers’ Index readings in China during Alibaba’s 2Q19 earnings call in November 2018.

Macroeconomic uncertainty is affecting online sales of some categories more than others. JD.com CFO Sidney Huang said on the company’s third-quarter 2018 earnings call that slowing consumption had affected sales of big-ticket items, but that JD.com had seen healthy growth in general merchandise categories. Huang noted that the company was convinced its value proposition of offering quality products at everyday low prices along with better services will continue to win over customers.

In Pinduoduo’s 3Q18 earnings call on Dec. 26, 2018, Tian Xu, VP of Finance at Pinduoduo, commented that demand for value grows constantly, regardless of macroeconomic conditions. He said that Pinduoduo offers consumers in lower-tier cities in China better-quality goods than those available at their local stores at similar or lower prices.

Jack Ma commented at Alibaba’s Investor Day on Sept. 17, 2018, that when people have little money to spend, they head to the company’s Taobao marketplace, and that China still has more than 1 billion people living below the middle-income line, despite a growing middle-income population.

At Walmart’s 2018 Investment Community Meeting in October 2018, management announced that the company expects to grow e-commerce sales by around 40% in fiscal 2019 and by around 35% in fiscal 2020, supported by Walmart’s investments and acquisitions in e-commerce. At the meeting, Marc Lore, President and CEO of Walmart U.S. eCommerce, estimated Walmart U.S.’s online sales will total around $15 billion in fiscal 2019 and said the company will achieve same-day delivery for about 60% of Walmart’s customer base by fiscal 2020.

In the final quarter of 2018, Amazon saw slowing growth in its major North America segment and offered cautious guidance for total revenue growth in first quarter of 2019. Despite a weaker sales outlook, Amazon aims to step up investments in order to stay competitive as other international online retailers have upped their game in online operations.

E-commerce has been dominated by big tech companies in both the U.S. and China, although new entrants often attempt to challenge the status quo with innovative business models. As e-commerce giants such as Amazon and Alibaba are simultaneously developing new capabilities, continue to bolster their portfolios and improve their business models through partnerships and acquisitions, they are solidifying their positions and creating what we believe will be a winner-takes-all dynamic.

The deployment of in-store technology to upgrade the customer experience will continue to be a trend among brick-and-mortar retailers seeking to improve the retail experience and seamlessly integrate their stores with online retail.

Meanwhile, the global economic outlook remains fluid with ongoing trade tension between the U.S. and China, so consumer sentiment could soften – driving down growth in discretionary spending. However, China’s plan to bolster import volumes will provide long-term momentum, especially for Western brands going digital in China. We expect fluctuations in the near term but long-term sustained growth impetus.

Source: Company reports/Coresight Research[/caption]

Expanding into New Verticals, with Grocery as the Primary Target

In China and the U.S., e-commerce platforms and online retailers are expanding into different verticals, including food delivery and healthcare. Grocery, however, is the major e-commerce players’ top target. In China, Alibaba launched the Hema (now called Freshippo) supermarket format in 2015 to provide a New Retail experience to customers, including home delivery service within 30 minutes. In the U.S., Amazon acquired Whole Foods in 2017 and integrated the chain with its logistics infrastructure to provide delivery for online orders.

[caption id="attachment_78449" align="aligncenter" width="800"]

Source: Company reports/Coresight Research[/caption]

Expanding into New Verticals, with Grocery as the Primary Target

In China and the U.S., e-commerce platforms and online retailers are expanding into different verticals, including food delivery and healthcare. Grocery, however, is the major e-commerce players’ top target. In China, Alibaba launched the Hema (now called Freshippo) supermarket format in 2015 to provide a New Retail experience to customers, including home delivery service within 30 minutes. In the U.S., Amazon acquired Whole Foods in 2017 and integrated the chain with its logistics infrastructure to provide delivery for online orders.

[caption id="attachment_78449" align="aligncenter" width="800"] Source: Company reports/Coresight Research[/caption]

Amazon Go: 3,000 Cashierless Convenience Stores by 2021?

Amazon is planning to open up to 3,000 Amazon Go cashierless convenience stores across the U.S. by 2021, according to an unconfirmed Bloomberg report. If the company were to open that many stores, it would make Amazon Go one of the biggest convenience store chains in the country. As of mid-November 2018, Amazon operated six Amazon Go stores: one in San Francisco, two in Chicago and three in its hometown of Seattle. According to Bloomberg, the company planned to have about 10 locations by the end of 2018 and about 50 locations by the end of 2019.

Our long-standing view is that it is much more difficult to make internet pure-play retailing work in the grocery category than in nonfood categories, and this offline expansion plan makes perfect sense if Amazon truly wants to disrupt the grocery space. Yet we think opening 3,000 Amazon Go stores by 2021 would be a daunting challenge. In 2017, the U.S. convenience store sector added only 423 stores (net), according to trade association NACS, and 7-Eleven has taken many years and a franchise model to establish a network of over 7,000 stores in the U.S.

Although Amazon Go will limit its offerings to fresh prepared foods and a small range of groceries to keep operational costs low, Amazon may face challenges finding suitable, affordable locations for the format. So far, the company has targeted urban locations with heavy foot traffic for these stores. If Amazon continues to seek such locations, it will not enjoy the benefit of increasing mall vacancy rates and lower rents: Mall vacancies were up 5% between the second and third quarters of 2018 and rents which were down 0.3% in the same period, according to real estate research firm Reis. Instead, the company could be challenged by rising rents for open-air retail spaces. These rents rose almost 2% between the third quarter of 2017 and the third quarter of 2018, according to Reis, and such rising rates could make it more difficult for Amazon to find affordable store locations.

A further barrier to a mass rollout of Amazon Go is the cost of the technology that enables the stores to operate. The first four Amazon Go stores reportedly cost more than $1 million each in hardware alone – meaning the cost for the 3,000 new stores Amazon reportedly plans to open would be more than $3 billion. And that estimate assumes upfront spending is the only technology cost: Ongoing technology costs such as infrastructure maintenance and upgrades could add to that price tag. The caveat is that the estimate assumes cost per store remains the same, but we expect increased scale and falling technology prices may lower that cost somewhat.

[caption id="attachment_78450" align="aligncenter" width="580"]

Source: Company reports/Coresight Research[/caption]

Amazon Go: 3,000 Cashierless Convenience Stores by 2021?

Amazon is planning to open up to 3,000 Amazon Go cashierless convenience stores across the U.S. by 2021, according to an unconfirmed Bloomberg report. If the company were to open that many stores, it would make Amazon Go one of the biggest convenience store chains in the country. As of mid-November 2018, Amazon operated six Amazon Go stores: one in San Francisco, two in Chicago and three in its hometown of Seattle. According to Bloomberg, the company planned to have about 10 locations by the end of 2018 and about 50 locations by the end of 2019.

Our long-standing view is that it is much more difficult to make internet pure-play retailing work in the grocery category than in nonfood categories, and this offline expansion plan makes perfect sense if Amazon truly wants to disrupt the grocery space. Yet we think opening 3,000 Amazon Go stores by 2021 would be a daunting challenge. In 2017, the U.S. convenience store sector added only 423 stores (net), according to trade association NACS, and 7-Eleven has taken many years and a franchise model to establish a network of over 7,000 stores in the U.S.

Although Amazon Go will limit its offerings to fresh prepared foods and a small range of groceries to keep operational costs low, Amazon may face challenges finding suitable, affordable locations for the format. So far, the company has targeted urban locations with heavy foot traffic for these stores. If Amazon continues to seek such locations, it will not enjoy the benefit of increasing mall vacancy rates and lower rents: Mall vacancies were up 5% between the second and third quarters of 2018 and rents which were down 0.3% in the same period, according to real estate research firm Reis. Instead, the company could be challenged by rising rents for open-air retail spaces. These rents rose almost 2% between the third quarter of 2017 and the third quarter of 2018, according to Reis, and such rising rates could make it more difficult for Amazon to find affordable store locations.

A further barrier to a mass rollout of Amazon Go is the cost of the technology that enables the stores to operate. The first four Amazon Go stores reportedly cost more than $1 million each in hardware alone – meaning the cost for the 3,000 new stores Amazon reportedly plans to open would be more than $3 billion. And that estimate assumes upfront spending is the only technology cost: Ongoing technology costs such as infrastructure maintenance and upgrades could add to that price tag. The caveat is that the estimate assumes cost per store remains the same, but we expect increased scale and falling technology prices may lower that cost somewhat.

[caption id="attachment_78450" align="aligncenter" width="580"] Source: Amazon[/caption]

A Leveling Off in Amazon Prime Membership Rates Could Soften Growth at Amazon

Amazon Prime has been a key support to Amazon’s retail sales growth in the past five years. According to data from Prosper Insights & Analytics, in the five years through October 2018, the proportion of U.S. consumers with a Prime membership rose from less than 20% to almost 46%. Amazon CEO Jeff Bezos stated in his 2018 letter to shareholders that there are more than 100 million Prime members across the globe. Though the subscription model has become a big success, consumer survey data from Prosper Insights & Analytics indicate that Prime member numbers plateaued in 2018, and if that trend persists, Amazon will lose the growth momentum that Prime previously provided.

[caption id="attachment_78451" align="aligncenter" width="580"]

Source: Amazon[/caption]

A Leveling Off in Amazon Prime Membership Rates Could Soften Growth at Amazon

Amazon Prime has been a key support to Amazon’s retail sales growth in the past five years. According to data from Prosper Insights & Analytics, in the five years through October 2018, the proportion of U.S. consumers with a Prime membership rose from less than 20% to almost 46%. Amazon CEO Jeff Bezos stated in his 2018 letter to shareholders that there are more than 100 million Prime members across the globe. Though the subscription model has become a big success, consumer survey data from Prosper Insights & Analytics indicate that Prime member numbers plateaued in 2018, and if that trend persists, Amazon will lose the growth momentum that Prime previously provided.

[caption id="attachment_78451" align="aligncenter" width="580"] Through October 2018

Through October 2018Source: Prosper Insights & Analytics/Coresight Research[/caption] The apparent leveling off in Prime membership is significant because Prime members drive the bulk of Amazon’s sales. In the U.S., Prime members are much more likely than non-members to buy non-traditional categories on Amazon. Prime members are naturally a self-selecting group of Amazon shoppers, because only regular customers would opt for membership, but we think that once customers become members, they see the value of buying types of products on the site that they may not traditionally associate with Amazon, such as groceries and clothing. The chart below shows the difference in rates of purchase for selected categories by Prime members and all Amazon customers in the U.S. [caption id="attachment_78452" align="aligncenter" width="580"]

Base: 7,000+ U.S. internet users ages 18+, surveyed in November 2017 (health and beauty aids), April 2018 (women’s clothing) and August 2018 (groceries)

Base: 7,000+ U.S. internet users ages 18+, surveyed in November 2017 (health and beauty aids), April 2018 (women’s clothing) and August 2018 (groceries)Source: Prosper Insights & Analytics[/caption] The popular Prime subscription program now offers a wide range of benefits, including shipping, video and music streaming services, games, e-books and shopping rewards. [caption id="attachment_78453" align="aligncenter" width="800"]

Source: Amazon/Coresight Research[/caption]

Walmart Poised to Target Higher-Income Shoppers in Urban Areas

Although Amazon is dominating the U.S. e-commerce arena, Walmart’s e-commerce investments – especially its acquisition of Jet.com – and its consolidation of the e-commerce assets it has acquired have flowed through to strong e-commerce growth. Market research firm eMarketer forecast that Walmart would overtake Apple to become the third-largest e-commerce player in the U.S., after Amazon and eBay, by the end of 2018.

Walmart is looking to increase its competitiveness in cities, and New York City is at the top of its agenda to win over higher-income urban millennials. In 2018, Walmart linked Jet.com with Parcel, a delivery service startup the retailer acquired in 2017, to offer three-hour and same-day grocery delivery in New York City. The move is an attempt to compete against Amazon’s Prime Now, which offers same-day delivery of household essentials. Walmart is also leasing a fulfillment center in the Bronx borough of New York City to bolster same- and next-day delivery of Jet.com orders amid heightened competition in delivery speed.

We think Walmart will continue to beef up initiatives to target higher-income shoppers in urban areas, in part to counter Amazon’s expansion into the upscale grocery market via its Whole Foods acquisition. It remains unclear how Jet.com will continue to boost Walmart’s e-commerce sales growth, as Walmart has scaled back its marketing investments in the subsidiary. However, Walmart did see a significant increase in e-commerce sales growth in the quarters following the acquisition in September 2016 and Jet.com will likely remain an important e-commerce arm for Walmart in the near future, particularly in urban areas.

[caption id="attachment_78455" align="aligncenter" width="580"]

Source: Amazon/Coresight Research[/caption]

Walmart Poised to Target Higher-Income Shoppers in Urban Areas

Although Amazon is dominating the U.S. e-commerce arena, Walmart’s e-commerce investments – especially its acquisition of Jet.com – and its consolidation of the e-commerce assets it has acquired have flowed through to strong e-commerce growth. Market research firm eMarketer forecast that Walmart would overtake Apple to become the third-largest e-commerce player in the U.S., after Amazon and eBay, by the end of 2018.

Walmart is looking to increase its competitiveness in cities, and New York City is at the top of its agenda to win over higher-income urban millennials. In 2018, Walmart linked Jet.com with Parcel, a delivery service startup the retailer acquired in 2017, to offer three-hour and same-day grocery delivery in New York City. The move is an attempt to compete against Amazon’s Prime Now, which offers same-day delivery of household essentials. Walmart is also leasing a fulfillment center in the Bronx borough of New York City to bolster same- and next-day delivery of Jet.com orders amid heightened competition in delivery speed.

We think Walmart will continue to beef up initiatives to target higher-income shoppers in urban areas, in part to counter Amazon’s expansion into the upscale grocery market via its Whole Foods acquisition. It remains unclear how Jet.com will continue to boost Walmart’s e-commerce sales growth, as Walmart has scaled back its marketing investments in the subsidiary. However, Walmart did see a significant increase in e-commerce sales growth in the quarters following the acquisition in September 2016 and Jet.com will likely remain an important e-commerce arm for Walmart in the near future, particularly in urban areas.

[caption id="attachment_78455" align="aligncenter" width="580"] Source: Company reports/Coresight Research[/caption]

Trends to Watch in China

China’s consumption upgrade will be fueled by the growth of its middle class, which Alibaba Executive Chairman Jack Ma estimated will exceed 500 million by 2022, when he spoke at the Gateway ’17 Conference in Canada in 2017. The shift has driven e-commerce growth, as many Chinese consumers now aspire to purchase high-quality products from overseas to improve their quality of life.

Imports Are Key

Imports of high-quality products will be one of the top trends to watch as China’s consumption upgrade process continues. At the inaugural China International Import Expo in Shanghai in November 2018, President Xi Jinping said in his keynote address that China will import $30 trillion worth of goods and $10 trillion worth of services over the next 15 years. The Chinese government’s recent moves to open up e-commerce avenues to more international retailers are strong tailwinds for domestic e-commerce platforms, which are set to bring a wider array of foreign products to Chinese consumers.

At the same expo, Alibaba management announced that the company has committed to helping import $200 billion worth of goods from more than 120 countries over the next five years. Other Chinese e-commerce players made similar pledges. JD.com plans to help import nearly ¥100 billion worth of goods, Suning.com €15 billion, NetEase Kaola ¥20 billion, Vipshop ¥10 billion and Yangmatou (Ymatou) ¥100 million. Alibaba says the pledge underscores its long-term commitment to globalization and boosts its efforts to meet Chinese consumers’ rising demand for high-quality international products, which implies long-term secular growth for Chinese e-commerce platforms.

Cross-Border E-Commerce in China

Cross-border e-commerce in China is a major theme in global e-commerce, given the sheer size of the Chinese market and the country’s ongoing consumption upgrade. We described the huge opportunity in Chinese cross-border e-commerce in our reports Chinese Demand for Cross-Border E-Commerce Booms, but Looming Tax Reforms Are a Cloud on the Horizon and Cross-Border Retail Heads Offline with New Brick and Mortar Formats.

The Chinese government recently announced it would relax the cross-border e-commerce policy that was enacted in April 2016. According to a government press release, the new policy will:

Source: Company reports/Coresight Research[/caption]

Trends to Watch in China

China’s consumption upgrade will be fueled by the growth of its middle class, which Alibaba Executive Chairman Jack Ma estimated will exceed 500 million by 2022, when he spoke at the Gateway ’17 Conference in Canada in 2017. The shift has driven e-commerce growth, as many Chinese consumers now aspire to purchase high-quality products from overseas to improve their quality of life.

Imports Are Key

Imports of high-quality products will be one of the top trends to watch as China’s consumption upgrade process continues. At the inaugural China International Import Expo in Shanghai in November 2018, President Xi Jinping said in his keynote address that China will import $30 trillion worth of goods and $10 trillion worth of services over the next 15 years. The Chinese government’s recent moves to open up e-commerce avenues to more international retailers are strong tailwinds for domestic e-commerce platforms, which are set to bring a wider array of foreign products to Chinese consumers.

At the same expo, Alibaba management announced that the company has committed to helping import $200 billion worth of goods from more than 120 countries over the next five years. Other Chinese e-commerce players made similar pledges. JD.com plans to help import nearly ¥100 billion worth of goods, Suning.com €15 billion, NetEase Kaola ¥20 billion, Vipshop ¥10 billion and Yangmatou (Ymatou) ¥100 million. Alibaba says the pledge underscores its long-term commitment to globalization and boosts its efforts to meet Chinese consumers’ rising demand for high-quality international products, which implies long-term secular growth for Chinese e-commerce platforms.

Cross-Border E-Commerce in China

Cross-border e-commerce in China is a major theme in global e-commerce, given the sheer size of the Chinese market and the country’s ongoing consumption upgrade. We described the huge opportunity in Chinese cross-border e-commerce in our reports Chinese Demand for Cross-Border E-Commerce Booms, but Looming Tax Reforms Are a Cloud on the Horizon and Cross-Border Retail Heads Offline with New Brick and Mortar Formats.

The Chinese government recently announced it would relax the cross-border e-commerce policy that was enacted in April 2016. According to a government press release, the new policy will:

- Extend the current cross-border e-commerce policy framework. Imported items will continue to be viewed as “personal use” items and will not require registration, filing or first-import-license approval.

- Extend the tax benefits for imported items and add 63 product types to the list.

- Expand the number of cross-border e-commerce pilot cities by 22, including Beijing, Shenyang and Nanjing.

- Increase the personal transaction limit from ¥2,000 to ¥5,000 for a single transaction and from ¥20,000 to ¥26,000 annually.

- Retail sector growth is slowing in China. The country’s retail sales growth was the weakest in 15 years in 2018. Year-over-year retail growth was particularly sluggish in May and October, when sales increased by 8.5% and 8.6%, respectively. Those rates were the lowest since June 2003, according to China’s National Bureau of Statistics.

- Other online shopping festivals have gained traction. Alibaba’s Singles’ Day event remains the largest online shopping festival, but other e-commerce platforms have introduced their own online shopping events. Consumers are now offered discounts almost every quarter, meaning Singles’ Day is not the only time to find promotions. Consumers have become familiar with the promotional cadence of the various e-commerce platforms and appear to be adjusting their plans to take advantage of multiple shopping festivals throughout the year.

Source: U.S. Census Bureau/Analysys/Coresight Research[/caption]

Headwinds and Tailwinds

Sector Headwinds

Fluid Macroeconomic Environment

Trade tensions between the U.S. and China and currency and economic crises in markets such as Turkey, Argentina and Italy are causing macroeconomic uncertainty. These factors are contributing to a murky global economic outlook, and any economic slowdown in China or the U.S. could impact e-commerce operators.

In China, retail sales growth slowed to single digits in 2018 following a decade of double-digit growth. The growth rates released in May and October 2018 were the lowest since June 2003. Although official indicators have yet to show signs of an economic crisis in China, we have seen news reports that big factories have been laying off staff and reducing costs, partly due to uncertainty caused by trade conflicts, and more factories may follow suit amid trade tensions and a slowing economy. China’s National Bureau of Statistics recorded 6.6% GDP growth in 2018, the slowest growth in 28 years, while the International Monetary Fund forecast China’s GDP growth could slow further in 2019, to 6.2%.

There are also signs of a slowdown in the U.S. The latest federal data showed that U.S. soybean exports to China dropped 94% year over year amid ongoing trade tensions. Weak housing data have also raised concerns over the state of the U.S. economy. Housing starts increased by 1.5% month over month in October, to 1.2 million, but the increase was lower than the third quarter’s. The number of single-family home starts, the backbone of housing demand, declined 1.8% month over month in October after falling 1.0% in September. Also, building permits trended down between January and October 2018 and were down 8.3% in October from their March peak.

A weak global economy would certainly weigh on the growth of e-commerce platform operators, affecting consumer sentiment. The trade war may also have a strong impact on these companies, especially Alibaba, JD.com and Vipshop, which rely heavily on cross-border trading.

Sector Tailwinds

In China, the consumption upgrade has been the key growth driver for e-commerce. We expect the growing consumption power of the Chinese middle class and their demand for high-quality foreign goods to continue to support e-commerce growth in China, despite the fluid macroeconomic environment.

In the U.S., the transformation of traditional retail will continue as Amazon enters more retail verticals. The company has already expanded into the grocery, healthcare, cashierless convenience store, subscription and private-label spaces, and we expect it will further extend its reach. These initiatives bring consumers lower prices, new experiences and convenience, and will continue to boost the growth of the e-commerce sector in the U.S.

Competitive Landscape

Market Shares

In the U.S. and China, the e-commerce market continues to consolidate, and market leaders in both countries are increasing their share of the market. In the U.S., Amazon’s market share grew from 43.1% in 2017 to 48.0% in 2018, according to estimates compiled by eMarketer in November2018. In China, Tmall and JD.com accounted for a combined 85.7% of online sales in the fourth quarter of 2018, with Tmall holding a 61.5% share and JD.com a 24.2% share, according to China-based data services company Analysys.

[caption id="attachment_78457" align="aligncenter" width="580"]

Source: U.S. Census Bureau/Analysys/Coresight Research[/caption]

Headwinds and Tailwinds

Sector Headwinds

Fluid Macroeconomic Environment

Trade tensions between the U.S. and China and currency and economic crises in markets such as Turkey, Argentina and Italy are causing macroeconomic uncertainty. These factors are contributing to a murky global economic outlook, and any economic slowdown in China or the U.S. could impact e-commerce operators.

In China, retail sales growth slowed to single digits in 2018 following a decade of double-digit growth. The growth rates released in May and October 2018 were the lowest since June 2003. Although official indicators have yet to show signs of an economic crisis in China, we have seen news reports that big factories have been laying off staff and reducing costs, partly due to uncertainty caused by trade conflicts, and more factories may follow suit amid trade tensions and a slowing economy. China’s National Bureau of Statistics recorded 6.6% GDP growth in 2018, the slowest growth in 28 years, while the International Monetary Fund forecast China’s GDP growth could slow further in 2019, to 6.2%.

There are also signs of a slowdown in the U.S. The latest federal data showed that U.S. soybean exports to China dropped 94% year over year amid ongoing trade tensions. Weak housing data have also raised concerns over the state of the U.S. economy. Housing starts increased by 1.5% month over month in October, to 1.2 million, but the increase was lower than the third quarter’s. The number of single-family home starts, the backbone of housing demand, declined 1.8% month over month in October after falling 1.0% in September. Also, building permits trended down between January and October 2018 and were down 8.3% in October from their March peak.

A weak global economy would certainly weigh on the growth of e-commerce platform operators, affecting consumer sentiment. The trade war may also have a strong impact on these companies, especially Alibaba, JD.com and Vipshop, which rely heavily on cross-border trading.

Sector Tailwinds

In China, the consumption upgrade has been the key growth driver for e-commerce. We expect the growing consumption power of the Chinese middle class and their demand for high-quality foreign goods to continue to support e-commerce growth in China, despite the fluid macroeconomic environment.

In the U.S., the transformation of traditional retail will continue as Amazon enters more retail verticals. The company has already expanded into the grocery, healthcare, cashierless convenience store, subscription and private-label spaces, and we expect it will further extend its reach. These initiatives bring consumers lower prices, new experiences and convenience, and will continue to boost the growth of the e-commerce sector in the U.S.

Competitive Landscape

Market Shares

In the U.S. and China, the e-commerce market continues to consolidate, and market leaders in both countries are increasing their share of the market. In the U.S., Amazon’s market share grew from 43.1% in 2017 to 48.0% in 2018, according to estimates compiled by eMarketer in November2018. In China, Tmall and JD.com accounted for a combined 85.7% of online sales in the fourth quarter of 2018, with Tmall holding a 61.5% share and JD.com a 24.2% share, according to China-based data services company Analysys.

[caption id="attachment_78457" align="aligncenter" width="580"] Source: eMarketer/Coresight Research[/caption]

[caption id="attachment_78458" align="aligncenter" width="580"]

Source: eMarketer/Coresight Research[/caption]

[caption id="attachment_78458" align="aligncenter" width="580"] Source: Analysys/Coresight Research[/caption]

The following table compares the profiles of major e-commerce companies.

[caption id="attachment_78459" align="aligncenter" width="800"]

Source: Analysys/Coresight Research[/caption]

The following table compares the profiles of major e-commerce companies.

[caption id="attachment_78459" align="aligncenter" width="800"] *Coresight Research’s estimate

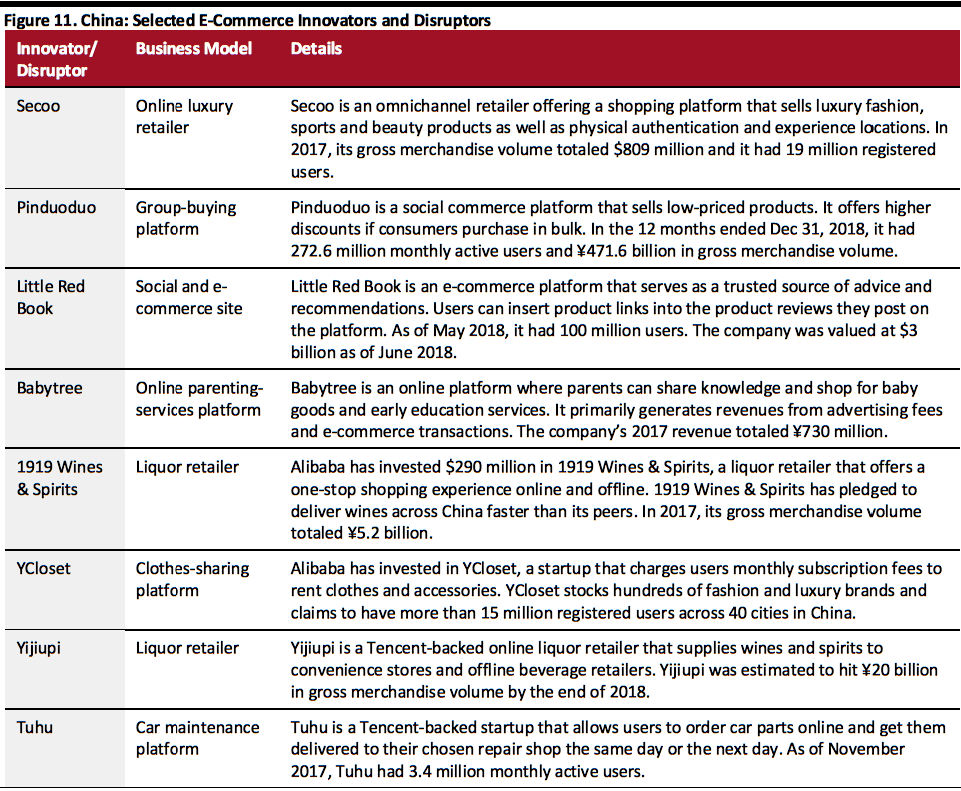

*Coresight Research’s estimateSource: Company reports/Coresight Research[/caption] Innovators and Disruptors Though the e-commerce market is becoming increasingly consolidated, some newcomers are aiming to take market share from the giants by targeting niche or new markets. Pinduoduo, Little Red Book and Secoo are three newer players that have seen much success.

- Pinduoduo leverages social media platforms, predominantly WeChat in China, to enable users to share good deals among friends. The company focuses on low-priced products and targets the lower-income population. As of April 2018, Pinduoduo had grown its share of the Chinese e-commerce market to 5.2% in less than three years. Its gross merchandise volume for the 12 months ended Dec. 31, 2018, was ¥6billion ($68.7 billion). The company’s average monthly active users grew by 1,717% between Mar. 31, 2017, and Dec. 31, 2018, from 15.0 million to 272.6 million.

- Little Red Book is an e-commerce platform that a community of fashion and beauty lovers turn to as a trusted source of advice and recommendations. Users can insert links to product pages in the product reviews they write on the platform. The platform had 100 million users as of May 2018. Little Red Book has disrupted the e-commerce industry in China by providing access to authentic and trustworthy recommendations and by leveraging powerful influencers to promote brands.

- Secoo is an omnichannel operator with a shopping platform that offers luxury fashion, sports and beauty products. The company also operates offline experience centers and authentication centers in prime locations such as Beijing, Shanghai, Hong Kong, Milan and Malaysia. These centers provide superior customer service and ensure that all products sold on the Secoo platform are genuine. In China, Secoo accounts for 25% of total online luxury gross merchandise volume. The company’s 2017 revenues totaled $575 million, up 44% year over year.

Source: Company reports[/caption]

[caption id="attachment_78465" align="aligncenter" width="800"]

Source: Company reports[/caption]

[caption id="attachment_78465" align="aligncenter" width="800"] Source: Company reports[/caption]

Sector Outlook

The e-commerce sector will continue to be driven by a healthy global economy, consumers shifting more of their spending online, online-offline integration and a consumption upgrade, primarily in China. However, recent events in markets across the globe have led to macroeconomic uncertainty and escalating trade conflicts may dampen the global economy. Joseph Tsai, Executive Vice Chairman of Alibaba, said he had taken note of the threat of rising interest rates, potential political and debt turmoil globally, decelerating GDP growth and weak Purchasing Managers’ Index readings in China during Alibaba’s 2Q19 earnings call in November 2018.

Macroeconomic uncertainty is affecting online sales of some categories more than others. JD.com CFO Sidney Huang said on the company’s third-quarter 2018 earnings call that slowing consumption had affected sales of big-ticket items, but that JD.com had seen healthy growth in general merchandise categories. Huang noted that the company was convinced its value proposition of offering quality products at everyday low prices along with better services will continue to win over customers.

In Pinduoduo’s 3Q18 earnings call on Dec. 26, 2018, Tian Xu, VP of Finance at Pinduoduo, commented that demand for value grows constantly, regardless of macroeconomic conditions. He said that Pinduoduo offers consumers in lower-tier cities in China better-quality goods than those available at their local stores at similar or lower prices.

Jack Ma commented at Alibaba’s Investor Day on Sept. 17, 2018, that when people have little money to spend, they head to the company’s Taobao marketplace, and that China still has more than 1 billion people living below the middle-income line, despite a growing middle-income population.

At Walmart’s 2018 Investment Community Meeting in October 2018, management announced that the company expects to grow e-commerce sales by around 40% in fiscal 2019 and by around 35% in fiscal 2020, supported by Walmart’s investments and acquisitions in e-commerce. At the meeting, Marc Lore, President and CEO of Walmart U.S. eCommerce, estimated Walmart U.S.’s online sales will total around $15 billion in fiscal 2019 and said the company will achieve same-day delivery for about 60% of Walmart’s customer base by fiscal 2020.

In the final quarter of 2018, Amazon saw slowing growth in its major North America segment and offered cautious guidance for total revenue growth in first quarter of 2019. Despite a weaker sales outlook, Amazon aims to step up investments in order to stay competitive as other international online retailers have upped their game in online operations.

E-commerce has been dominated by big tech companies in both the U.S. and China, although new entrants often attempt to challenge the status quo with innovative business models. As e-commerce giants such as Amazon and Alibaba are simultaneously developing new capabilities, continue to bolster their portfolios and improve their business models through partnerships and acquisitions, they are solidifying their positions and creating what we believe will be a winner-takes-all dynamic.

The deployment of in-store technology to upgrade the customer experience will continue to be a trend among brick-and-mortar retailers seeking to improve the retail experience and seamlessly integrate their stores with online retail.

Meanwhile, the global economic outlook remains fluid with ongoing trade tension between the U.S. and China, so consumer sentiment could soften – driving down growth in discretionary spending. However, China’s plan to bolster import volumes will provide long-term momentum, especially for Western brands going digital in China. We expect fluctuations in the near term but long-term sustained growth impetus.

Source: Company reports[/caption]

Sector Outlook

The e-commerce sector will continue to be driven by a healthy global economy, consumers shifting more of their spending online, online-offline integration and a consumption upgrade, primarily in China. However, recent events in markets across the globe have led to macroeconomic uncertainty and escalating trade conflicts may dampen the global economy. Joseph Tsai, Executive Vice Chairman of Alibaba, said he had taken note of the threat of rising interest rates, potential political and debt turmoil globally, decelerating GDP growth and weak Purchasing Managers’ Index readings in China during Alibaba’s 2Q19 earnings call in November 2018.

Macroeconomic uncertainty is affecting online sales of some categories more than others. JD.com CFO Sidney Huang said on the company’s third-quarter 2018 earnings call that slowing consumption had affected sales of big-ticket items, but that JD.com had seen healthy growth in general merchandise categories. Huang noted that the company was convinced its value proposition of offering quality products at everyday low prices along with better services will continue to win over customers.

In Pinduoduo’s 3Q18 earnings call on Dec. 26, 2018, Tian Xu, VP of Finance at Pinduoduo, commented that demand for value grows constantly, regardless of macroeconomic conditions. He said that Pinduoduo offers consumers in lower-tier cities in China better-quality goods than those available at their local stores at similar or lower prices.

Jack Ma commented at Alibaba’s Investor Day on Sept. 17, 2018, that when people have little money to spend, they head to the company’s Taobao marketplace, and that China still has more than 1 billion people living below the middle-income line, despite a growing middle-income population.

At Walmart’s 2018 Investment Community Meeting in October 2018, management announced that the company expects to grow e-commerce sales by around 40% in fiscal 2019 and by around 35% in fiscal 2020, supported by Walmart’s investments and acquisitions in e-commerce. At the meeting, Marc Lore, President and CEO of Walmart U.S. eCommerce, estimated Walmart U.S.’s online sales will total around $15 billion in fiscal 2019 and said the company will achieve same-day delivery for about 60% of Walmart’s customer base by fiscal 2020.

In the final quarter of 2018, Amazon saw slowing growth in its major North America segment and offered cautious guidance for total revenue growth in first quarter of 2019. Despite a weaker sales outlook, Amazon aims to step up investments in order to stay competitive as other international online retailers have upped their game in online operations.

E-commerce has been dominated by big tech companies in both the U.S. and China, although new entrants often attempt to challenge the status quo with innovative business models. As e-commerce giants such as Amazon and Alibaba are simultaneously developing new capabilities, continue to bolster their portfolios and improve their business models through partnerships and acquisitions, they are solidifying their positions and creating what we believe will be a winner-takes-all dynamic.

The deployment of in-store technology to upgrade the customer experience will continue to be a trend among brick-and-mortar retailers seeking to improve the retail experience and seamlessly integrate their stores with online retail.

Meanwhile, the global economic outlook remains fluid with ongoing trade tension between the U.S. and China, so consumer sentiment could soften – driving down growth in discretionary spending. However, China’s plan to bolster import volumes will provide long-term momentum, especially for Western brands going digital in China. We expect fluctuations in the near term but long-term sustained growth impetus.