Nitheesh NH

Introduction

Each report in our Sector Overview series analyzes a particular retail sector or consumer market. In this report, we cover convenience stores globally, with a focus on the U.S., Japan and China. We examine key themes and dynamics as well as the competitive landscape and sector outlook.

The convenience store sector is undergoing tremendous changes as it adapts to consumers who live in an increasingly digitalized world and demand high-quality offerings and more convenience. It is also facing disruption from leading e-commerce, hypermarket and supermarket operators, which are opening smaller retail formats. While the sector as a whole is seeing modest growth, top players continue to capture sizable market shares. We expect to see further consolidation within the sector as M&A activity continues.

Themes We’re Watching

Convenience store operators in major markets are driving store traffic and growth by offering food and beverages that are prepared on-site and by digitalizing operations to provide omnichannel and pickup services that enhance the customer experience and improve efficiency. In addition, many convenience store operators are introducing loyalty programs to retain customers and expanding market share through M&A.

Driving Store Traffic and Sales with Food and Beverages Prepared On-Site

Convenience stores have been strengthening their prepared-on-site food and beverage offerings to drive store traffic. Consumers, particularly urban consumers, demand high-quality food and drinks as well as fresh offerings. Alimentation Couche-Tard, which operates more than 4,500 stores in North America and 2,000 in Europe under various banners, offers freshly delivered or baked-on-site doughnuts, pastries, muffins, croissants and cookies across almost 60% of its store network. The company’s bakery offerings are tailored to local tastes and complement its coffee sales through its Simply Great Coffee program, which allows shoppers to customize drinks.

In Japan, the government has made efforts to drive down smoking rates and the proportion of people who smoke in the country decreased from about 26% in 2008 to about 18% in 2017, according to Euromonitor International. This has adversely affected foot traffic at convenience stores in the country, and Lawson, FamilyMart and 7-Eleven are among the chains pushing freshly brewed coffee to counter falling traffic due to shrinking cigarette sales. 7-Eleven is adding latte machines in its Japanese outlets and has already seen sales increase at stores where the machines have been piloted, according to a November 2018 Bloomberg Intelligence report.

Seven & i Holdings, 7-Eleven’s parent company, reported on its fiscal third-quarter 2019 earnings call in January 2019 that sales growth across foods such as sandwiches, noodles and deli products had contributed to same-store sales growth at its convenience stores in Japan. During the earnings call, the company also announced its plan to convert 2,000 convenience stores in Japan to new layouts by the end of February 2019. The company said the redesigned outlets will feature expanded counters and fast and frozen food offerings in a bid to boost food sales.

Though freshly prepared food offerings cater to consumers’ needs, striking a good balance between freshness and speed is challenging for convenience stores. Companies must be agile and strategic when choosing between made-to-order and grab-and-go approaches to ensure that stores in bustling areas don’t overly compromise freshness in an effort to keep checkout times short.

Deciding which prepared foods to offer is also a challenge. Consumers are increasingly health-conscious, so convenience stores need to offer some healthy and organic options as part of their on-the-go ranges. To meet growing demand for vegetarian products in Sweden, Alimentation Couche-Tard launched a new offering of on-the-go cold vegetarian dishes in its Swedish convenience stores. The line increased traffic and also drove sales of non-vegetarian products, according to the company’s 2018 annual report. Seven & i has worked to develop products that appeal to the health-conscious and currently offers preservative-free dairy products and emulsifier-free bread and pastry products.

Loyalty Programs

In the convenience store sector, customer retention is as important as customer acquisition. A 2018 report from loyalty program operator Excentus found that 43% of shoppers visit a convenience store because it offers a loyalty program and 51% would shop more frequently at stores or chains where they are loyalty members than at other convenience stores where they are not loyalty members.

In 2016, Alimentation Couche-Tard subsidiary Circle K introduced a digital loyalty program called OK Stamp It in Hong Kong in collaboration with the city’s widely accepted Octopus contactless payment card. The OK Stamp It app allows members to automatically load loyalty stamps to the app when they pay with the Octopus card. In the first 18 months postlaunch, the app registered 1.1 million users, around 14% of Hong Kong’s population, and succeeded in driving more traffic to participating Circle K stores.

[caption id="attachment_77265" align="aligncenter" width="580"] Circle K’s OK Stamp It app

Circle K’s OK Stamp It app

Source: Google Play[/caption] 7-Eleven launched its 7Rewards points program in 2015, enabling customers to receive points for selected purchases and then redeem them for products in participating stores. The company expanded the loyalty program in 2017 and then ran a Million Points Sweepstakes Giveaway in the U.S. in early 2018 to promote it. During the promotion, customers who scanned the 7Rewards app when shopping at 7-Eleven five times were entered into a drawing to win 1 million points, which could be redeemed for top-selling food and drinks at selected stores. 7-Eleven also awarded exclusive weekly prizes such as tickets to sports and music events and even overseas trips during the promotional period. “Our strategy to make every customer’s interaction with 7-Eleven valuable and delightful just got bigger and better. The enhanced 7Rewards app gives customers more ways to earn and redeem points in order to get free stuff,” said 7-Eleven Chief Digital Officer and CIO Gurmeet Singh in March 2018. U.S. convenience store operator Casey’s General Stores does not currently have a loyalty program, but plans to launch one by the end of April 2019. CFO William Walljasper said on the company’s fiscal second-quarter 2019 earnings call in December 2018 that the program will cover three areas: fuel, grocery and general merchandise, and prepared food offerings. Staffless Stores Another Frontier to Be Explored Enabled by mobile payments and supported by an array of advanced technologies, including facial and voice recognition, staffless convenience stores are one of the latest trends in retail. Amazon opened its first Amazon Go staffless format to the public in Seattle in January 2018. Customers scan the store’s mobile app at a gate at the front of the store to enter, and then cameras and sensors track what they remove from the shelves inside the store. Shoppers’ accounts are automatically debited when they leave the premises. The company had opened seven Amazon Go stores as of Dec. 14, 2018, and reportedly plans to operate 3,000 locations by 2021. [caption id="attachment_77266" align="aligncenter" width="580"] An Amazon Go staffless store

An Amazon Go staffless store

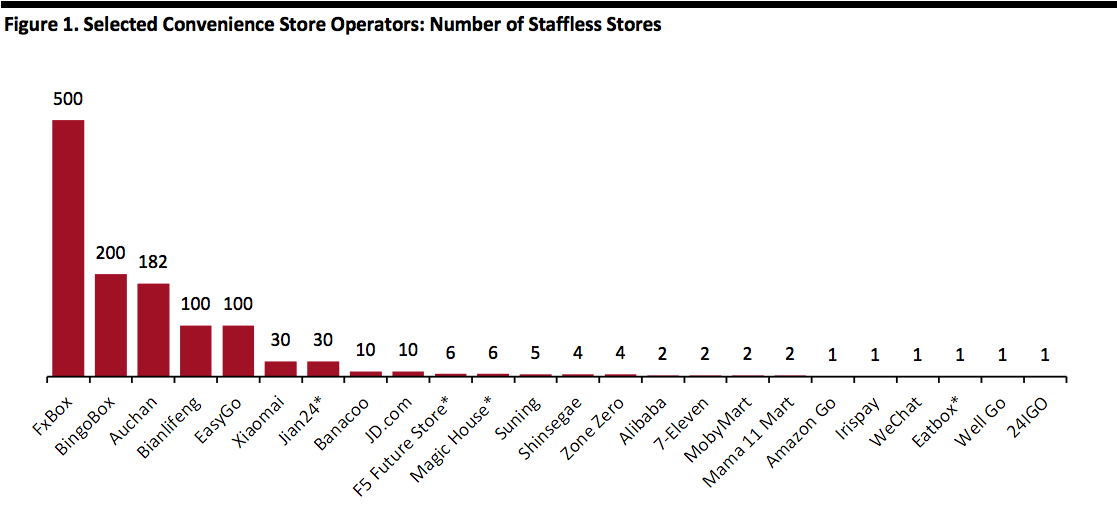

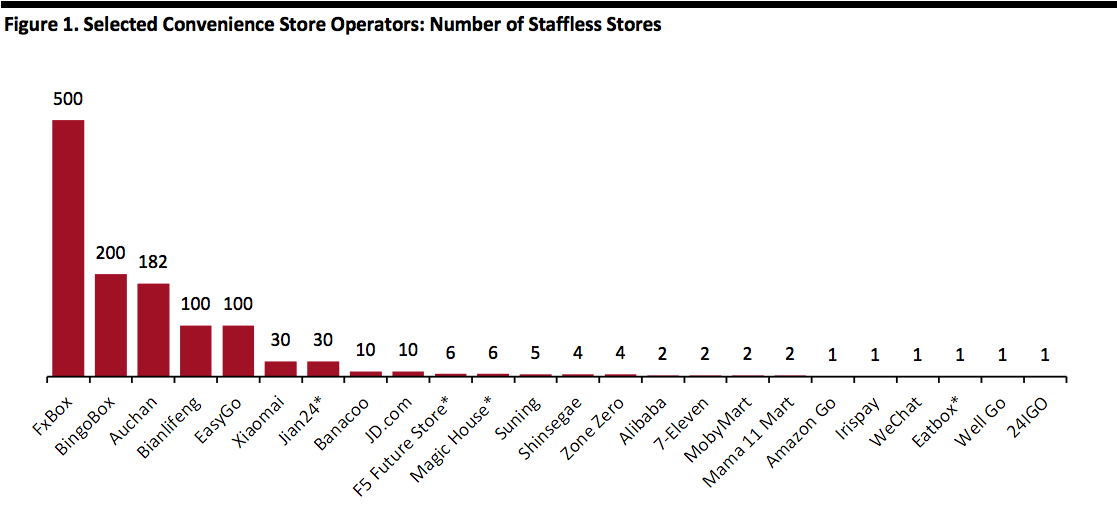

Source: Amazon[/caption] In China, about 70 companies, including major e-commerce marketplace operators, are currently running about 1,000 staffless stores. Alibaba opened its first staffless store, called Tao Café, in July 2017 in China. JD.com followed suit, launching its JD X-Mart staffless format in China in January 2018 and then expanding the format to Indonesia in August 2018. Some Chinese online retail players have also launched their own unstaffed outlets. [caption id="attachment_77267" align="aligncenter" width="800"] As of June 28, 2018

As of June 28, 2018

*Estimate based on prior company statements

Source: Company reports[/caption] [caption id="attachment_77268" align="aligncenter" width="580"] Alibaba’s Tao Café staffless store

Alibaba’s Tao Café staffless store

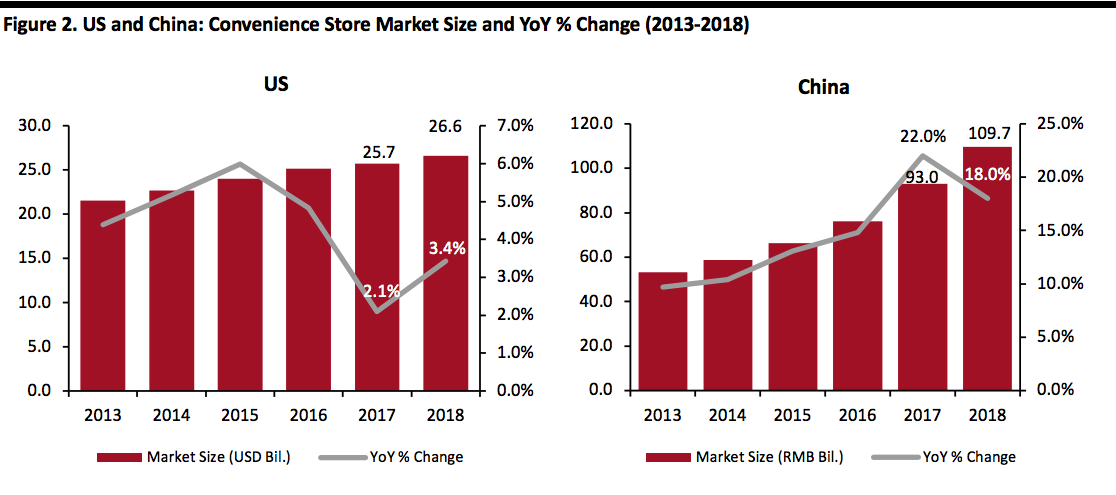

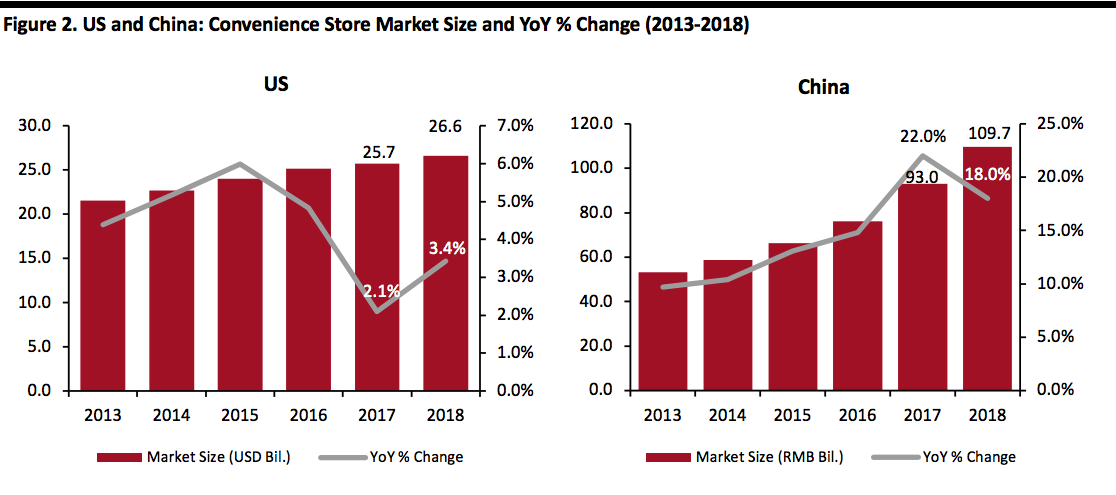

Source: Alibaba[/caption] Convenience store players in other markets are also exploring and testing staffless and automated stores. Supporting the growth of automated stores are technology enablers such as artificial intelligence (AI) and computer vision and business drivers such as increased efficiencies and lower operational costs. In Europe, Alimentation Couche-Tard operates automated fuel stations. Although the stations sell only fuel, they may represent the first step in the development of further unstaffed formats. In Japan, Seven & i began testing a minimally staffed convenience store in Tokyo in December 2018. Located inside a building where an NEC group company has offices, the store is not entirely staffless, as employees are needed to place orders and stock shelves. Facial recognition technology enables quick store entry and convenient payments. The store is open only to NEC group employees who have preregistered to shop there, but it could signal the eventual debut of completely staffless stores in Japan. We expect more retailers to explore unstaffed convenience store formats in underserved areas, where staffed convenience stores are unviable due to low foot traffic. Retailers are likely to provide services such as click-and-collect in these locations in addition to food and other typical convenience store products. M&A Activity Continues M&A deals are one of the key ways convenience store operators have expanded market share, and we expect this trend to continue. In January 2018, 7-Eleven acquired around 1,000 of Sunoco’s convenience stores in 17 states across the U.S. for approximately $3.3 billion. 7-Eleven said it will stock these stores with proprietary products, including its iconic Slurpee, Big Bite and Big Gulp items, healthy and indulgent fresh food options, and selected other brands. In its 2018 annual report, 7-Eleven indicated it had acquired Sunoco’s stores to achieve its goals of reaching average daily merchandise sales of $5,000 per store, operating 10,000 stores by the end of February 2020, strengthening its merchandising capabilities, expanding its store network and improving profitability. President and CEO Joe DePinto said in an October 2018 interview with Convenience Store Decisions magazine that he liked the Sunoco stores’ assets and operations. In June 2017, Circle K parent Alimentation Couche-Tard closed a $4.4 billion merger with CST Brands, giving Alimentation Couche-Tard an additional 1,300 stores in the U.S. and Canada and helping the company shift toward in-store sales of fresh food. More recently, in December 2018, Circle K acquired four convenience stores in Illinois from Carls Oil. Alimentation Couche-Tard has been able to expand its market share, penetrate new markets and increase economies of scale through acquisitions, and the company considers them a significant part of its growth strategy, as well as a means of consolidation in the fragmented convenience store sector. It also claims acquisitions should create value and not necessarily favor store count growth at the expense of profitability. In February 2018, Casey’s General Stores acquired five convenience stores in Wisconsin from Frawley Oil Co. Casey’s said it aims to acquire at least 20 stores and build 60 new stores by the end of April 2019. CEO Terry Handley said in an August 2018 interview with Retail Merchandiser magazine that Casey’s sees smaller acquisitions, such as single-store operators, as appealing targets because it’s easier to assimilate them into the company’s overall operations. Casey’s has reserved $318 million for acquisitions and new store construction in its 2019 fiscal year, according to its 2018 annual report. Convenience Stores Offering Delivery and Omnichannel Fulfillment Digitalization has transformed consumers’ behavior and is increasingly impacting the convenience store sector. Some convenience stores are now delivering orders to customers’ doorsteps and leveraging store networks to integrate delivery operations with third-party delivery providers. In Japan, 7-Eleven has offered delivery service through its Seven-Meal subsidiary since 2000, but in 2016, it expanded the program to deliver lunch to customers who face difficulty in getting out to shop, such as elderly customers and mothers with young children. Members of the program can order in-store, online or on their smartphone. In 2017, the company trialed a Net Convenience Store service in Japan that enables customers to order items by phone and have them delivered to their doorstep. 7-Eleven plans to extend the service to all stores in the city of Hokkaido by February 2019 and to all stores across Japan by February 2020. Circle K drives store traffic in Hong Kong by using its extensive network of physical stores as pickup locations for orders made through the FingerShopping.com online shopping platform. Customers ordering through the platform can pay by cash, Octopus card or credit card at a Circle K outlet, or pay online with a credit card or Alipay. Digitalizing Business Operations and Leveraging Technology to Enhance Customer Satisfaction and Improve Efficiency To keep up with consumers’ increasing preference for online shopping, convenience store operators are investing in digitalization initiatives. The key players in the sector are hiring digital talent, personalizing the customer experience and creating digital strategies to cut costs and improve efficiency. In April 2017, Alimentation Couche-Tard hired its first CIO, Deborah Hall Lefevre, to lead efforts to consolidate the company’s diverse data sets, which are based on approximately nine million daily store visits. The company’s overall goal is to use the data to better understand its vast global customer base. In April 2018, Casey’s General Stores hired its first Chief Marketing Officer, Chris Jones, to lead its Digital Engagement Program in collaboration with Deloitte Digital, its e-commerce integration partner. The major convenience store companies are collecting and analyzing customer data to market with precision. Seven & i’s digital strategy is increasingly determined by data-driven consumer insights rather than by a corporate-led, top-down approach. In June 2018, Seven & i introduced apps that enable its individual banners and stores to send product and service recommendations tailored to customers’ personal preferences. The suggestions are based on a variety of purchasing data that the company has collected and analyzed. Convenience store operators are also using digitalization and technology to train staff and improve operational efficiency. For example, Alimentation Couche-Tard implemented a new payroll and human resources management system called Workday in late 2018. President and CEO Brian Hannasch said in a July 2018 interview with Convenience Store News that Workday “will create a better experience and training environment” for all store employees. A top Japan Franchise Association official noted in a September 2018 interview with Japanese daily The Mainichi that operating a convenience store requires skill in many areas, including “customer service, ordering products and managing stock.” Better training systems can help staff learn skills more quickly, thereby reducing operating costs. In Japan, 7-Eleven has introduced an in-store system for product inspection that relies on RFID technology and a new process that distributes products to stores more efficiently. The chain started using RFID tags on room-temperature items in 2017 and expanded their use to perishable products in 2018. 7-Eleven Japan plans to roll out RFID-based inspections to all of its stores in Hokkaido by the end of its current fiscal year. In addition, 7-Eleven Japan plans to establish a new organizational structure in fiscal 2019 to oversee digital strategy and to partner with other companies to collect and analyze customer data. The chain also plans to provide new, more seamless settlement methods to customers in Japan by the end of spring this year. Casey’s General Stores has formulated a detailed digital strategy that will guide it through its 2021 fiscal year. The plan includes launching an enhanced website and mobile app, deploying in-store technology, and upgrading enterprise infrastructure. The strategy should enable Casey’s to offer a seamless customer experience that includes new digital product categories and personalized marketing and rewards. Increased Competition from Retail Players in Other Sectors Many retailers that are dominant in other formats are trying to enter the convenience store space. Meanwhile, we’re seeing a trend toward smaller store formats, as shoppers increasingly seek convenience and do not want to spend time navigating large stores. In January 2017, Walmart opened a 2,500-square-foot convenience store in Crowley, Texas. The store offers hot dogs sizzling on a roller, beer stacked in a walk-in refrigerator and a counter where pizza is sold whole and by the slice. In addition, the store sells six types of coffee and a range of healthy foods, including fruit cups and yogurt. French supermarket retailer Carrefour opened its first Carrefour Easy store in China in 2015 and followed it with nine more openings in Shanghai in the first nine months of 2017. These stores range from about 1,076 to 2,691 square feet and offer daily food items and services such as on-site catering, mobile payment, Wi-Fi, lottery tickets and photo printing. Carrefour says the shopping experience “combines convenience, practicality and freshness.” Sector Dynamics The U.S. convenience store market reached $25.7 billion in 2017, according to data from Euromonitor International, and grew 3.4%, to $26.6 billion, in 2018. The firm estimated that the market reached ¥93.0 billion in China in 2017 and grew 18.0%, to ¥109.7 billion, in 2018. [caption id="attachment_77270" align="aligncenter" width="800"] Source: Euromonitor International/Coresight Research[/caption]

Headwinds and Tailwinds

Sector Headwinds

The convenience store sector currently faces headwinds in the form of trade tensions between the U.S. and China, Brexit uncertainty, and currency and economic crises in markets such as Turkey, Argentina and Italy. These will continue to rumble on this year, weighing on consumer sentiment and spending. Although convenience stores focus on nondiscretionary categories, store traffic could be impacted if wary consumers cut back on unnecessary shopping trips.

For convenience store operators in North America and Japan, national stop-smoking campaigns and increased regulations on cigarettes, e-cigarettes and vaping products have cut sales volumes and, to some extent, store traffic. Increased regulation of these products has also led to price increases. Although convenience stores may pass those costs on to consumers, they may in turn see reduced sales volumes. In California, the cigarette excise tax rose from $0.87 per pack to $2.87 per pack on Apr. 1, 2017. The tax hike led to a 0.9% increase in all cigarette sales but a 4.4% decline in sales volume over the four-week period ended Nov. 4, 2017. In Japan, the tobacco tax went up one yen per cigarette on Oct. 1, 2018, which led to a year-over-year sales decline for 7-Eleven in Japan that month.

In North America, the convenience store sector is also facing increased costs for food commodities such as cheese and coffee. In addition, rising minimum wages have led to increased operational costs and pricing pressure across the sector. Hurricanes in Texas and Florida last year led to volatility in consumer demand and product prices, impacted fuel and merchandise supplies, and led to large populations moving away from affected areas, all of which impacted convenience stores in the two states.

Sector Tailwinds

Globally, the convenience store sector continues to be supported by the urbanization trend, as consumers in densely populated areas are highly receptive to the convenience store format. Consumers in urban areas shop more often than their peers in other areas, but for fewer items at a time, and they prefer shorter trips to smaller stores. This preference for convenience stores and smaller retail formats is brightening the outlook for the sector, as is the global trend toward smaller households. The number of single-person and two-person households is growing, and these households tend to buy smaller amounts at higher frequency instead of buying in bulk.

In China, growing consumption among younger consumers ages 18-35 will continue to underpin convenience store sales growth. Boston Consulting Group’s China 2015 Consumption Survey found that urban consumption in China among those ages 18-35 will rise from $1.5 trillion in 2016 to $2.6 trillion in 2021, representing an 11% CAGR, compared with a 5% CAGR for consumers ages 36 and older.

Competitive Landscape

Market Shares

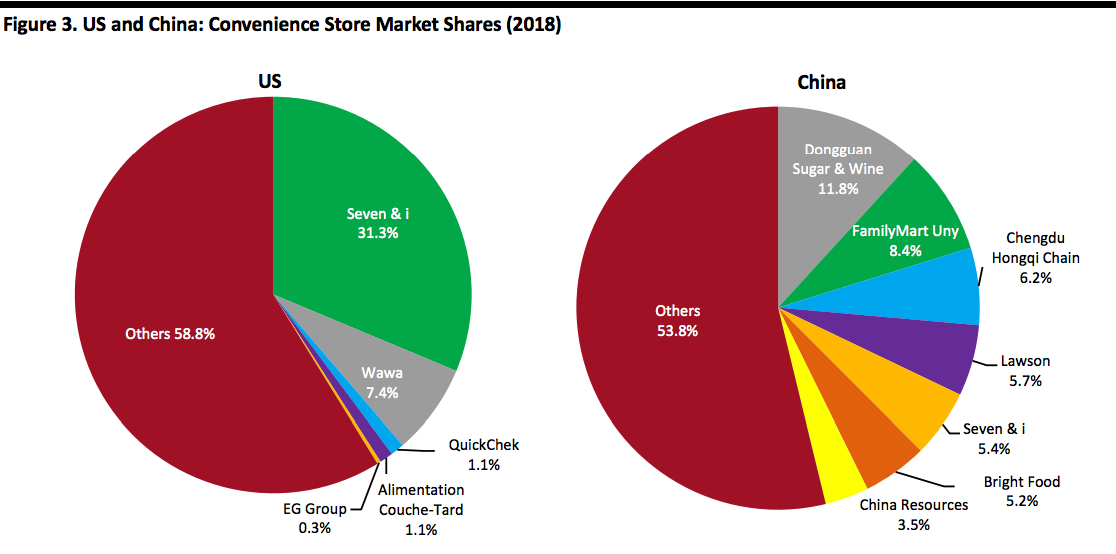

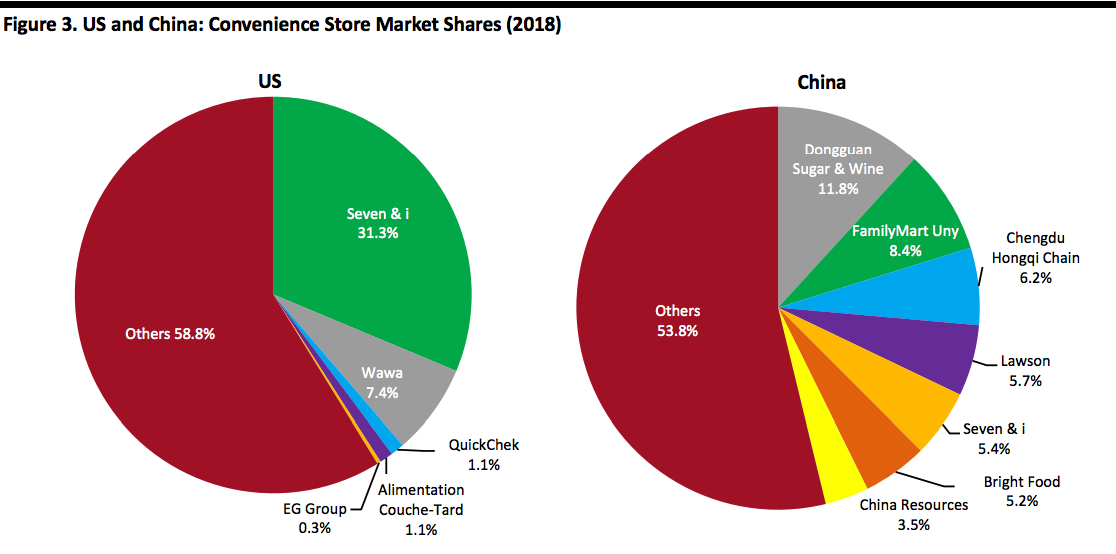

Although top players capture the bulk of the convenience store market, the sector remains relatively fragmented and there is room for further consolidation and new entrants. In the U.S., Seven & i holds the largest market share, 31.3%, and is well ahead of Alimentation Couche-Tard, which holds only a 1.1% share, according to Euromonitor International. In China, the top players are also capturing sizable market shares, but not dominant shares, according to Euromonitor. Seven & i accounts for 5.4% of the convenience store market in China, lagging Dongguan Sugar & Wine (11.8%), FamilyMart Uny (8.4%), Chengdu Hongqi Chain (6.2%) and Lawson (5.7%).

[caption id="attachment_77272" align="aligncenter" width="800"]

Source: Euromonitor International/Coresight Research[/caption]

Headwinds and Tailwinds

Sector Headwinds

The convenience store sector currently faces headwinds in the form of trade tensions between the U.S. and China, Brexit uncertainty, and currency and economic crises in markets such as Turkey, Argentina and Italy. These will continue to rumble on this year, weighing on consumer sentiment and spending. Although convenience stores focus on nondiscretionary categories, store traffic could be impacted if wary consumers cut back on unnecessary shopping trips.

For convenience store operators in North America and Japan, national stop-smoking campaigns and increased regulations on cigarettes, e-cigarettes and vaping products have cut sales volumes and, to some extent, store traffic. Increased regulation of these products has also led to price increases. Although convenience stores may pass those costs on to consumers, they may in turn see reduced sales volumes. In California, the cigarette excise tax rose from $0.87 per pack to $2.87 per pack on Apr. 1, 2017. The tax hike led to a 0.9% increase in all cigarette sales but a 4.4% decline in sales volume over the four-week period ended Nov. 4, 2017. In Japan, the tobacco tax went up one yen per cigarette on Oct. 1, 2018, which led to a year-over-year sales decline for 7-Eleven in Japan that month.

In North America, the convenience store sector is also facing increased costs for food commodities such as cheese and coffee. In addition, rising minimum wages have led to increased operational costs and pricing pressure across the sector. Hurricanes in Texas and Florida last year led to volatility in consumer demand and product prices, impacted fuel and merchandise supplies, and led to large populations moving away from affected areas, all of which impacted convenience stores in the two states.

Sector Tailwinds

Globally, the convenience store sector continues to be supported by the urbanization trend, as consumers in densely populated areas are highly receptive to the convenience store format. Consumers in urban areas shop more often than their peers in other areas, but for fewer items at a time, and they prefer shorter trips to smaller stores. This preference for convenience stores and smaller retail formats is brightening the outlook for the sector, as is the global trend toward smaller households. The number of single-person and two-person households is growing, and these households tend to buy smaller amounts at higher frequency instead of buying in bulk.

In China, growing consumption among younger consumers ages 18-35 will continue to underpin convenience store sales growth. Boston Consulting Group’s China 2015 Consumption Survey found that urban consumption in China among those ages 18-35 will rise from $1.5 trillion in 2016 to $2.6 trillion in 2021, representing an 11% CAGR, compared with a 5% CAGR for consumers ages 36 and older.

Competitive Landscape

Market Shares

Although top players capture the bulk of the convenience store market, the sector remains relatively fragmented and there is room for further consolidation and new entrants. In the U.S., Seven & i holds the largest market share, 31.3%, and is well ahead of Alimentation Couche-Tard, which holds only a 1.1% share, according to Euromonitor International. In China, the top players are also capturing sizable market shares, but not dominant shares, according to Euromonitor. Seven & i accounts for 5.4% of the convenience store market in China, lagging Dongguan Sugar & Wine (11.8%), FamilyMart Uny (8.4%), Chengdu Hongqi Chain (6.2%) and Lawson (5.7%).

[caption id="attachment_77272" align="aligncenter" width="800"] Source: Euromonitor International/Coresight Research[/caption]

Innovators and Disruptors

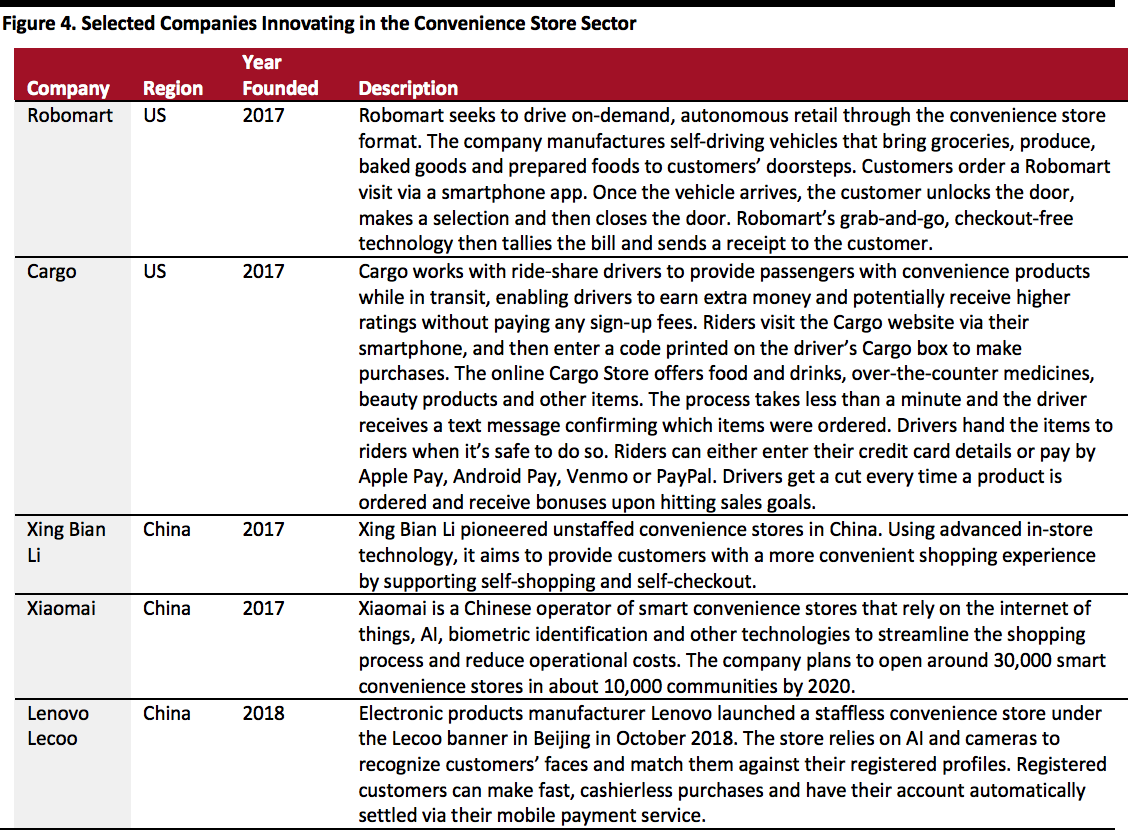

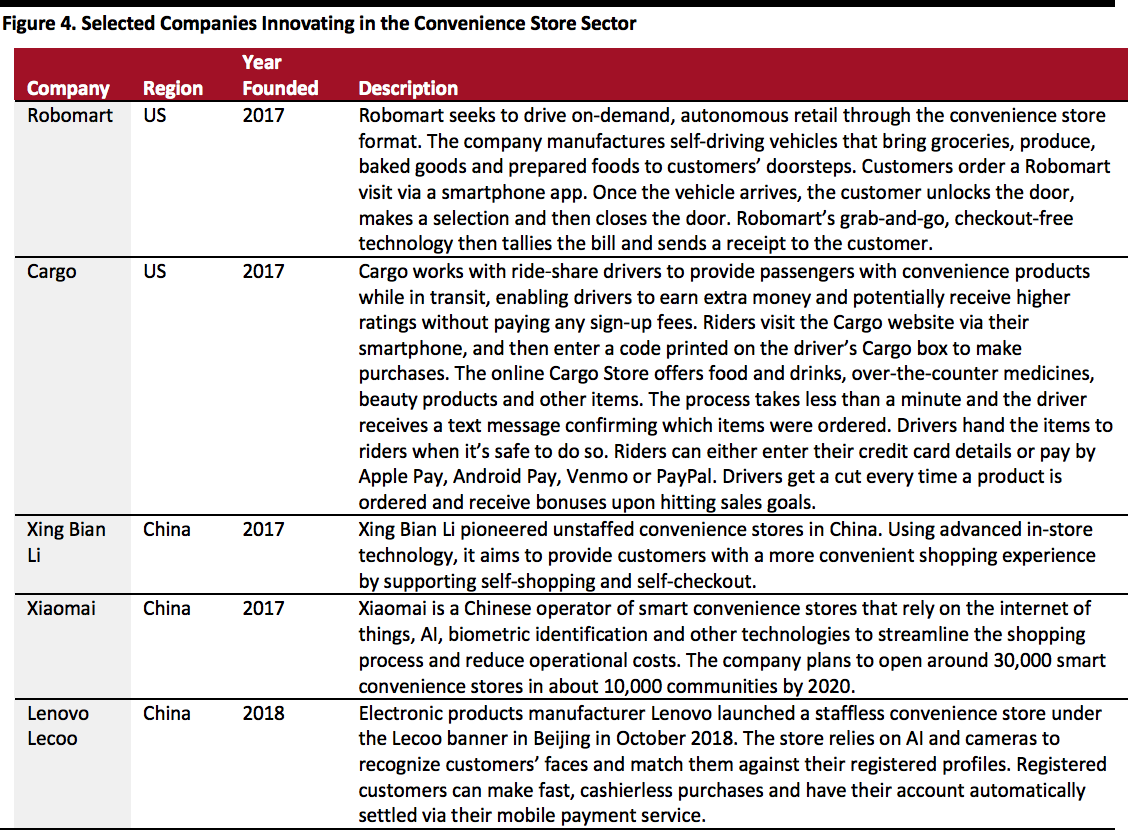

Innovation in the convenience store sector shows no signs of slowing. Amazon is leading the charge into staffless convenience stores in the U.S., while other dominant players are executing a variety of innovation strategies. Several startups and companies from other retail sectors are also striving to innovate in the sector, as highlighted in the table below.

[caption id="attachment_77273" align="aligncenter" width="800"]

Source: Euromonitor International/Coresight Research[/caption]

Innovators and Disruptors

Innovation in the convenience store sector shows no signs of slowing. Amazon is leading the charge into staffless convenience stores in the U.S., while other dominant players are executing a variety of innovation strategies. Several startups and companies from other retail sectors are also striving to innovate in the sector, as highlighted in the table below.

[caption id="attachment_77273" align="aligncenter" width="800"] Source: Company reports/Coresight Research[/caption]

In Japan, Seven & i is striving to make not only shopping, but also emergency alert systems and even reconstruction efforts more convenient and efficient. Japan often experiences earthquakes and severe weather events, and in April 2018, Seven & i launched a system named Seven View that provides disaster information via web-based maps. The system collects information, including disaster updates and road traffic information, from public agencies, business partners and Seven & i subsidiaries, enabling the company to build social infrastructure and restore supply chains in the aftermath of disasters.

7-Eleven is innovating work structure in Japan, allowing full-time employees to choose their preferred starting time. The chain has also introduced a diversity and inclusion project in Japan to attract talent from different backgrounds to ensure fairness in hiring and encourage employee engagement. According to the Japan Franchise Association, the convenience store industry faces a serious labor shortage, and initiatives such as these can help alleviate that shortage.

In China, online retail giants are working to transform the convenience store landscape. Alibaba has rolled out a retail management platform named Ling Shou Tong that offers sales analytics to help store owners modernize layouts, optimize product procurement and boost sales. To access the platform, operators must agree to use their storefronts as fulfillment-and-delivery centers and provide customer shopping data to the platform. Alibaba rival JD.com plans to open 1 million convenience stores in China by 2021, half of them in rural areas. The company also set a target to open 1,000 convenience stores per day across China, including checkout-free formats.

Sector Outlook

The convenience store sector has seen significant change as consumer preferences and lifestyles have shifted. We expect to see continued digital integration, consolidation through M&A and innovation in the sector. Although global economic and political uncertainties weigh on consumer sentiment and spending, the global trends toward urbanization and smaller households are likely to support modest growth in the sector.

Source: Company reports/Coresight Research[/caption]

In Japan, Seven & i is striving to make not only shopping, but also emergency alert systems and even reconstruction efforts more convenient and efficient. Japan often experiences earthquakes and severe weather events, and in April 2018, Seven & i launched a system named Seven View that provides disaster information via web-based maps. The system collects information, including disaster updates and road traffic information, from public agencies, business partners and Seven & i subsidiaries, enabling the company to build social infrastructure and restore supply chains in the aftermath of disasters.

7-Eleven is innovating work structure in Japan, allowing full-time employees to choose their preferred starting time. The chain has also introduced a diversity and inclusion project in Japan to attract talent from different backgrounds to ensure fairness in hiring and encourage employee engagement. According to the Japan Franchise Association, the convenience store industry faces a serious labor shortage, and initiatives such as these can help alleviate that shortage.

In China, online retail giants are working to transform the convenience store landscape. Alibaba has rolled out a retail management platform named Ling Shou Tong that offers sales analytics to help store owners modernize layouts, optimize product procurement and boost sales. To access the platform, operators must agree to use their storefronts as fulfillment-and-delivery centers and provide customer shopping data to the platform. Alibaba rival JD.com plans to open 1 million convenience stores in China by 2021, half of them in rural areas. The company also set a target to open 1,000 convenience stores per day across China, including checkout-free formats.

Sector Outlook

The convenience store sector has seen significant change as consumer preferences and lifestyles have shifted. We expect to see continued digital integration, consolidation through M&A and innovation in the sector. Although global economic and political uncertainties weigh on consumer sentiment and spending, the global trends toward urbanization and smaller households are likely to support modest growth in the sector.

Circle K’s OK Stamp It app

Circle K’s OK Stamp It appSource: Google Play[/caption] 7-Eleven launched its 7Rewards points program in 2015, enabling customers to receive points for selected purchases and then redeem them for products in participating stores. The company expanded the loyalty program in 2017 and then ran a Million Points Sweepstakes Giveaway in the U.S. in early 2018 to promote it. During the promotion, customers who scanned the 7Rewards app when shopping at 7-Eleven five times were entered into a drawing to win 1 million points, which could be redeemed for top-selling food and drinks at selected stores. 7-Eleven also awarded exclusive weekly prizes such as tickets to sports and music events and even overseas trips during the promotional period. “Our strategy to make every customer’s interaction with 7-Eleven valuable and delightful just got bigger and better. The enhanced 7Rewards app gives customers more ways to earn and redeem points in order to get free stuff,” said 7-Eleven Chief Digital Officer and CIO Gurmeet Singh in March 2018. U.S. convenience store operator Casey’s General Stores does not currently have a loyalty program, but plans to launch one by the end of April 2019. CFO William Walljasper said on the company’s fiscal second-quarter 2019 earnings call in December 2018 that the program will cover three areas: fuel, grocery and general merchandise, and prepared food offerings. Staffless Stores Another Frontier to Be Explored Enabled by mobile payments and supported by an array of advanced technologies, including facial and voice recognition, staffless convenience stores are one of the latest trends in retail. Amazon opened its first Amazon Go staffless format to the public in Seattle in January 2018. Customers scan the store’s mobile app at a gate at the front of the store to enter, and then cameras and sensors track what they remove from the shelves inside the store. Shoppers’ accounts are automatically debited when they leave the premises. The company had opened seven Amazon Go stores as of Dec. 14, 2018, and reportedly plans to operate 3,000 locations by 2021. [caption id="attachment_77266" align="aligncenter" width="580"]

An Amazon Go staffless store

An Amazon Go staffless storeSource: Amazon[/caption] In China, about 70 companies, including major e-commerce marketplace operators, are currently running about 1,000 staffless stores. Alibaba opened its first staffless store, called Tao Café, in July 2017 in China. JD.com followed suit, launching its JD X-Mart staffless format in China in January 2018 and then expanding the format to Indonesia in August 2018. Some Chinese online retail players have also launched their own unstaffed outlets. [caption id="attachment_77267" align="aligncenter" width="800"]

As of June 28, 2018

As of June 28, 2018*Estimate based on prior company statements

Source: Company reports[/caption] [caption id="attachment_77268" align="aligncenter" width="580"]

Alibaba’s Tao Café staffless store

Alibaba’s Tao Café staffless storeSource: Alibaba[/caption] Convenience store players in other markets are also exploring and testing staffless and automated stores. Supporting the growth of automated stores are technology enablers such as artificial intelligence (AI) and computer vision and business drivers such as increased efficiencies and lower operational costs. In Europe, Alimentation Couche-Tard operates automated fuel stations. Although the stations sell only fuel, they may represent the first step in the development of further unstaffed formats. In Japan, Seven & i began testing a minimally staffed convenience store in Tokyo in December 2018. Located inside a building where an NEC group company has offices, the store is not entirely staffless, as employees are needed to place orders and stock shelves. Facial recognition technology enables quick store entry and convenient payments. The store is open only to NEC group employees who have preregistered to shop there, but it could signal the eventual debut of completely staffless stores in Japan. We expect more retailers to explore unstaffed convenience store formats in underserved areas, where staffed convenience stores are unviable due to low foot traffic. Retailers are likely to provide services such as click-and-collect in these locations in addition to food and other typical convenience store products. M&A Activity Continues M&A deals are one of the key ways convenience store operators have expanded market share, and we expect this trend to continue. In January 2018, 7-Eleven acquired around 1,000 of Sunoco’s convenience stores in 17 states across the U.S. for approximately $3.3 billion. 7-Eleven said it will stock these stores with proprietary products, including its iconic Slurpee, Big Bite and Big Gulp items, healthy and indulgent fresh food options, and selected other brands. In its 2018 annual report, 7-Eleven indicated it had acquired Sunoco’s stores to achieve its goals of reaching average daily merchandise sales of $5,000 per store, operating 10,000 stores by the end of February 2020, strengthening its merchandising capabilities, expanding its store network and improving profitability. President and CEO Joe DePinto said in an October 2018 interview with Convenience Store Decisions magazine that he liked the Sunoco stores’ assets and operations. In June 2017, Circle K parent Alimentation Couche-Tard closed a $4.4 billion merger with CST Brands, giving Alimentation Couche-Tard an additional 1,300 stores in the U.S. and Canada and helping the company shift toward in-store sales of fresh food. More recently, in December 2018, Circle K acquired four convenience stores in Illinois from Carls Oil. Alimentation Couche-Tard has been able to expand its market share, penetrate new markets and increase economies of scale through acquisitions, and the company considers them a significant part of its growth strategy, as well as a means of consolidation in the fragmented convenience store sector. It also claims acquisitions should create value and not necessarily favor store count growth at the expense of profitability. In February 2018, Casey’s General Stores acquired five convenience stores in Wisconsin from Frawley Oil Co. Casey’s said it aims to acquire at least 20 stores and build 60 new stores by the end of April 2019. CEO Terry Handley said in an August 2018 interview with Retail Merchandiser magazine that Casey’s sees smaller acquisitions, such as single-store operators, as appealing targets because it’s easier to assimilate them into the company’s overall operations. Casey’s has reserved $318 million for acquisitions and new store construction in its 2019 fiscal year, according to its 2018 annual report. Convenience Stores Offering Delivery and Omnichannel Fulfillment Digitalization has transformed consumers’ behavior and is increasingly impacting the convenience store sector. Some convenience stores are now delivering orders to customers’ doorsteps and leveraging store networks to integrate delivery operations with third-party delivery providers. In Japan, 7-Eleven has offered delivery service through its Seven-Meal subsidiary since 2000, but in 2016, it expanded the program to deliver lunch to customers who face difficulty in getting out to shop, such as elderly customers and mothers with young children. Members of the program can order in-store, online or on their smartphone. In 2017, the company trialed a Net Convenience Store service in Japan that enables customers to order items by phone and have them delivered to their doorstep. 7-Eleven plans to extend the service to all stores in the city of Hokkaido by February 2019 and to all stores across Japan by February 2020. Circle K drives store traffic in Hong Kong by using its extensive network of physical stores as pickup locations for orders made through the FingerShopping.com online shopping platform. Customers ordering through the platform can pay by cash, Octopus card or credit card at a Circle K outlet, or pay online with a credit card or Alipay. Digitalizing Business Operations and Leveraging Technology to Enhance Customer Satisfaction and Improve Efficiency To keep up with consumers’ increasing preference for online shopping, convenience store operators are investing in digitalization initiatives. The key players in the sector are hiring digital talent, personalizing the customer experience and creating digital strategies to cut costs and improve efficiency. In April 2017, Alimentation Couche-Tard hired its first CIO, Deborah Hall Lefevre, to lead efforts to consolidate the company’s diverse data sets, which are based on approximately nine million daily store visits. The company’s overall goal is to use the data to better understand its vast global customer base. In April 2018, Casey’s General Stores hired its first Chief Marketing Officer, Chris Jones, to lead its Digital Engagement Program in collaboration with Deloitte Digital, its e-commerce integration partner. The major convenience store companies are collecting and analyzing customer data to market with precision. Seven & i’s digital strategy is increasingly determined by data-driven consumer insights rather than by a corporate-led, top-down approach. In June 2018, Seven & i introduced apps that enable its individual banners and stores to send product and service recommendations tailored to customers’ personal preferences. The suggestions are based on a variety of purchasing data that the company has collected and analyzed. Convenience store operators are also using digitalization and technology to train staff and improve operational efficiency. For example, Alimentation Couche-Tard implemented a new payroll and human resources management system called Workday in late 2018. President and CEO Brian Hannasch said in a July 2018 interview with Convenience Store News that Workday “will create a better experience and training environment” for all store employees. A top Japan Franchise Association official noted in a September 2018 interview with Japanese daily The Mainichi that operating a convenience store requires skill in many areas, including “customer service, ordering products and managing stock.” Better training systems can help staff learn skills more quickly, thereby reducing operating costs. In Japan, 7-Eleven has introduced an in-store system for product inspection that relies on RFID technology and a new process that distributes products to stores more efficiently. The chain started using RFID tags on room-temperature items in 2017 and expanded their use to perishable products in 2018. 7-Eleven Japan plans to roll out RFID-based inspections to all of its stores in Hokkaido by the end of its current fiscal year. In addition, 7-Eleven Japan plans to establish a new organizational structure in fiscal 2019 to oversee digital strategy and to partner with other companies to collect and analyze customer data. The chain also plans to provide new, more seamless settlement methods to customers in Japan by the end of spring this year. Casey’s General Stores has formulated a detailed digital strategy that will guide it through its 2021 fiscal year. The plan includes launching an enhanced website and mobile app, deploying in-store technology, and upgrading enterprise infrastructure. The strategy should enable Casey’s to offer a seamless customer experience that includes new digital product categories and personalized marketing and rewards. Increased Competition from Retail Players in Other Sectors Many retailers that are dominant in other formats are trying to enter the convenience store space. Meanwhile, we’re seeing a trend toward smaller store formats, as shoppers increasingly seek convenience and do not want to spend time navigating large stores. In January 2017, Walmart opened a 2,500-square-foot convenience store in Crowley, Texas. The store offers hot dogs sizzling on a roller, beer stacked in a walk-in refrigerator and a counter where pizza is sold whole and by the slice. In addition, the store sells six types of coffee and a range of healthy foods, including fruit cups and yogurt. French supermarket retailer Carrefour opened its first Carrefour Easy store in China in 2015 and followed it with nine more openings in Shanghai in the first nine months of 2017. These stores range from about 1,076 to 2,691 square feet and offer daily food items and services such as on-site catering, mobile payment, Wi-Fi, lottery tickets and photo printing. Carrefour says the shopping experience “combines convenience, practicality and freshness.” Sector Dynamics The U.S. convenience store market reached $25.7 billion in 2017, according to data from Euromonitor International, and grew 3.4%, to $26.6 billion, in 2018. The firm estimated that the market reached ¥93.0 billion in China in 2017 and grew 18.0%, to ¥109.7 billion, in 2018. [caption id="attachment_77270" align="aligncenter" width="800"]

Source: Euromonitor International/Coresight Research[/caption]

Headwinds and Tailwinds

Sector Headwinds

The convenience store sector currently faces headwinds in the form of trade tensions between the U.S. and China, Brexit uncertainty, and currency and economic crises in markets such as Turkey, Argentina and Italy. These will continue to rumble on this year, weighing on consumer sentiment and spending. Although convenience stores focus on nondiscretionary categories, store traffic could be impacted if wary consumers cut back on unnecessary shopping trips.

For convenience store operators in North America and Japan, national stop-smoking campaigns and increased regulations on cigarettes, e-cigarettes and vaping products have cut sales volumes and, to some extent, store traffic. Increased regulation of these products has also led to price increases. Although convenience stores may pass those costs on to consumers, they may in turn see reduced sales volumes. In California, the cigarette excise tax rose from $0.87 per pack to $2.87 per pack on Apr. 1, 2017. The tax hike led to a 0.9% increase in all cigarette sales but a 4.4% decline in sales volume over the four-week period ended Nov. 4, 2017. In Japan, the tobacco tax went up one yen per cigarette on Oct. 1, 2018, which led to a year-over-year sales decline for 7-Eleven in Japan that month.

In North America, the convenience store sector is also facing increased costs for food commodities such as cheese and coffee. In addition, rising minimum wages have led to increased operational costs and pricing pressure across the sector. Hurricanes in Texas and Florida last year led to volatility in consumer demand and product prices, impacted fuel and merchandise supplies, and led to large populations moving away from affected areas, all of which impacted convenience stores in the two states.

Sector Tailwinds

Globally, the convenience store sector continues to be supported by the urbanization trend, as consumers in densely populated areas are highly receptive to the convenience store format. Consumers in urban areas shop more often than their peers in other areas, but for fewer items at a time, and they prefer shorter trips to smaller stores. This preference for convenience stores and smaller retail formats is brightening the outlook for the sector, as is the global trend toward smaller households. The number of single-person and two-person households is growing, and these households tend to buy smaller amounts at higher frequency instead of buying in bulk.

In China, growing consumption among younger consumers ages 18-35 will continue to underpin convenience store sales growth. Boston Consulting Group’s China 2015 Consumption Survey found that urban consumption in China among those ages 18-35 will rise from $1.5 trillion in 2016 to $2.6 trillion in 2021, representing an 11% CAGR, compared with a 5% CAGR for consumers ages 36 and older.

Competitive Landscape

Market Shares

Although top players capture the bulk of the convenience store market, the sector remains relatively fragmented and there is room for further consolidation and new entrants. In the U.S., Seven & i holds the largest market share, 31.3%, and is well ahead of Alimentation Couche-Tard, which holds only a 1.1% share, according to Euromonitor International. In China, the top players are also capturing sizable market shares, but not dominant shares, according to Euromonitor. Seven & i accounts for 5.4% of the convenience store market in China, lagging Dongguan Sugar & Wine (11.8%), FamilyMart Uny (8.4%), Chengdu Hongqi Chain (6.2%) and Lawson (5.7%).

[caption id="attachment_77272" align="aligncenter" width="800"]

Source: Euromonitor International/Coresight Research[/caption]

Headwinds and Tailwinds

Sector Headwinds

The convenience store sector currently faces headwinds in the form of trade tensions between the U.S. and China, Brexit uncertainty, and currency and economic crises in markets such as Turkey, Argentina and Italy. These will continue to rumble on this year, weighing on consumer sentiment and spending. Although convenience stores focus on nondiscretionary categories, store traffic could be impacted if wary consumers cut back on unnecessary shopping trips.

For convenience store operators in North America and Japan, national stop-smoking campaigns and increased regulations on cigarettes, e-cigarettes and vaping products have cut sales volumes and, to some extent, store traffic. Increased regulation of these products has also led to price increases. Although convenience stores may pass those costs on to consumers, they may in turn see reduced sales volumes. In California, the cigarette excise tax rose from $0.87 per pack to $2.87 per pack on Apr. 1, 2017. The tax hike led to a 0.9% increase in all cigarette sales but a 4.4% decline in sales volume over the four-week period ended Nov. 4, 2017. In Japan, the tobacco tax went up one yen per cigarette on Oct. 1, 2018, which led to a year-over-year sales decline for 7-Eleven in Japan that month.

In North America, the convenience store sector is also facing increased costs for food commodities such as cheese and coffee. In addition, rising minimum wages have led to increased operational costs and pricing pressure across the sector. Hurricanes in Texas and Florida last year led to volatility in consumer demand and product prices, impacted fuel and merchandise supplies, and led to large populations moving away from affected areas, all of which impacted convenience stores in the two states.

Sector Tailwinds

Globally, the convenience store sector continues to be supported by the urbanization trend, as consumers in densely populated areas are highly receptive to the convenience store format. Consumers in urban areas shop more often than their peers in other areas, but for fewer items at a time, and they prefer shorter trips to smaller stores. This preference for convenience stores and smaller retail formats is brightening the outlook for the sector, as is the global trend toward smaller households. The number of single-person and two-person households is growing, and these households tend to buy smaller amounts at higher frequency instead of buying in bulk.

In China, growing consumption among younger consumers ages 18-35 will continue to underpin convenience store sales growth. Boston Consulting Group’s China 2015 Consumption Survey found that urban consumption in China among those ages 18-35 will rise from $1.5 trillion in 2016 to $2.6 trillion in 2021, representing an 11% CAGR, compared with a 5% CAGR for consumers ages 36 and older.

Competitive Landscape

Market Shares

Although top players capture the bulk of the convenience store market, the sector remains relatively fragmented and there is room for further consolidation and new entrants. In the U.S., Seven & i holds the largest market share, 31.3%, and is well ahead of Alimentation Couche-Tard, which holds only a 1.1% share, according to Euromonitor International. In China, the top players are also capturing sizable market shares, but not dominant shares, according to Euromonitor. Seven & i accounts for 5.4% of the convenience store market in China, lagging Dongguan Sugar & Wine (11.8%), FamilyMart Uny (8.4%), Chengdu Hongqi Chain (6.2%) and Lawson (5.7%).

[caption id="attachment_77272" align="aligncenter" width="800"] Source: Euromonitor International/Coresight Research[/caption]

Innovators and Disruptors

Innovation in the convenience store sector shows no signs of slowing. Amazon is leading the charge into staffless convenience stores in the U.S., while other dominant players are executing a variety of innovation strategies. Several startups and companies from other retail sectors are also striving to innovate in the sector, as highlighted in the table below.

[caption id="attachment_77273" align="aligncenter" width="800"]

Source: Euromonitor International/Coresight Research[/caption]

Innovators and Disruptors

Innovation in the convenience store sector shows no signs of slowing. Amazon is leading the charge into staffless convenience stores in the U.S., while other dominant players are executing a variety of innovation strategies. Several startups and companies from other retail sectors are also striving to innovate in the sector, as highlighted in the table below.

[caption id="attachment_77273" align="aligncenter" width="800"] Source: Company reports/Coresight Research[/caption]

In Japan, Seven & i is striving to make not only shopping, but also emergency alert systems and even reconstruction efforts more convenient and efficient. Japan often experiences earthquakes and severe weather events, and in April 2018, Seven & i launched a system named Seven View that provides disaster information via web-based maps. The system collects information, including disaster updates and road traffic information, from public agencies, business partners and Seven & i subsidiaries, enabling the company to build social infrastructure and restore supply chains in the aftermath of disasters.

7-Eleven is innovating work structure in Japan, allowing full-time employees to choose their preferred starting time. The chain has also introduced a diversity and inclusion project in Japan to attract talent from different backgrounds to ensure fairness in hiring and encourage employee engagement. According to the Japan Franchise Association, the convenience store industry faces a serious labor shortage, and initiatives such as these can help alleviate that shortage.

In China, online retail giants are working to transform the convenience store landscape. Alibaba has rolled out a retail management platform named Ling Shou Tong that offers sales analytics to help store owners modernize layouts, optimize product procurement and boost sales. To access the platform, operators must agree to use their storefronts as fulfillment-and-delivery centers and provide customer shopping data to the platform. Alibaba rival JD.com plans to open 1 million convenience stores in China by 2021, half of them in rural areas. The company also set a target to open 1,000 convenience stores per day across China, including checkout-free formats.

Sector Outlook

The convenience store sector has seen significant change as consumer preferences and lifestyles have shifted. We expect to see continued digital integration, consolidation through M&A and innovation in the sector. Although global economic and political uncertainties weigh on consumer sentiment and spending, the global trends toward urbanization and smaller households are likely to support modest growth in the sector.

Source: Company reports/Coresight Research[/caption]

In Japan, Seven & i is striving to make not only shopping, but also emergency alert systems and even reconstruction efforts more convenient and efficient. Japan often experiences earthquakes and severe weather events, and in April 2018, Seven & i launched a system named Seven View that provides disaster information via web-based maps. The system collects information, including disaster updates and road traffic information, from public agencies, business partners and Seven & i subsidiaries, enabling the company to build social infrastructure and restore supply chains in the aftermath of disasters.

7-Eleven is innovating work structure in Japan, allowing full-time employees to choose their preferred starting time. The chain has also introduced a diversity and inclusion project in Japan to attract talent from different backgrounds to ensure fairness in hiring and encourage employee engagement. According to the Japan Franchise Association, the convenience store industry faces a serious labor shortage, and initiatives such as these can help alleviate that shortage.

In China, online retail giants are working to transform the convenience store landscape. Alibaba has rolled out a retail management platform named Ling Shou Tong that offers sales analytics to help store owners modernize layouts, optimize product procurement and boost sales. To access the platform, operators must agree to use their storefronts as fulfillment-and-delivery centers and provide customer shopping data to the platform. Alibaba rival JD.com plans to open 1 million convenience stores in China by 2021, half of them in rural areas. The company also set a target to open 1,000 convenience stores per day across China, including checkout-free formats.

Sector Outlook

The convenience store sector has seen significant change as consumer preferences and lifestyles have shifted. We expect to see continued digital integration, consolidation through M&A and innovation in the sector. Although global economic and political uncertainties weigh on consumer sentiment and spending, the global trends toward urbanization and smaller households are likely to support modest growth in the sector.