albert Chan

Introduction

The CPG sector is increasingly competitive and emerging markets are the major battlefields for CPG companies. As shoppers across the globe increasingly focus on digital channels and show more concern over their health and wellness, companies in the industry are becoming more agile and innovative to adapt to their needs. In this report, we focus on two major CPG subcategories: personal care and home care. We cover the adjacent beauty category in detail in a separate Sector Overview report, and we exclude packaged food and over-the-counter healthcare products from our coverage here. Our analysis here focuses on six major names in the CPG space: Procter & Gamble (P&G), Colgate-Palmolive, Clorox, Kimberly-Clark, Unicharm and Unilever.Themes We’re Watching

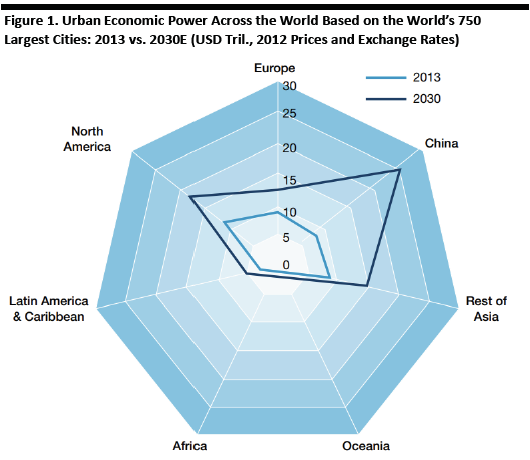

In this section, we focus on some of the factors and trends affecting the CPG sector, including changing demographics and consumer needs, and detail what the above-named companies are doing to remain competitive. Tapping into Emerging Markets As developed markets become saturated, emerging markets become growth avenues, and therefore, major battlefields, for CPG companies. Unilever has set its sights on generating 75% of its revenues in emerging markets by 2020. These markets have been leading growth for Unilever, and they accounted for 58% of the company’s total turnover in 2017, up from 34% in 2001. At Unilever’s Investor Event in December 2018, CFO Graeme Pitkethly said that the company is currently the largest fast-moving consumer goods company in India and that it is leading beauty and personal care sales in India and Brazil. Sandeep Kohli, Head of Beauty and Personal Care for India, said at the event that 35,000 bottles of Clinic Plus, one of Unilever’s haircare products for preteen girls, are sold every minute in India. Kimberly-Clark plans to increase the presence of its product portfolio in emerging markets. It sees China as the world’s largest diaper market, and expects it to continue to grow. In its third-quarter 2018 results, the company reported that Brazil and Argentina had seen revenue growth in the high teens and that ASEAN countries had delivered strong double-digit growth in personal care sales during the quarter. Unicharm saw its baby care sales grow 30% in China in 2017 and reported high and sustainable growth in Indonesia and India. Meanwhile, Latin America has become a strong source of revenue for Colgate-Palmolive. As emerging markets urbanize, demand for household products, such as bathroom and kitchen consumables, and personal care and hygiene products will continue to accelerate. According to forecasting and analysis firm Oxford Economics, by 2030, there will be 800 million more people in emerging markets and China’s urban economic power will surpass North America’s. These demographic and population changes will create huge demand for CPG products and China, India and Brazil will remain the top growth engines for CPG companies. [caption id="attachment_79261" align="aligncenter" width="530"] Source: Oxford Economics[/caption]

CPG Companies Respond to Consumers’ Health and Wellness Concerns

Consumers are increasingly taking ownership of their health and wellness and seeking information on products and services that can help improve their well-being. In response, many CPG companies are expanding into health and wellness products and also cooperating with communities to deliver wellness initiatives.

Clorox expanded its health and wellness portfolio by acquiring Burt’s Bees, Renew Life and, more recently, dietary supplements leader Nutranext. Unilever acquired the GlaxoSmithKline (GSK’s) healthy drinks portfolio in India, Bangladesh and 20 other predominantly Asian markets. Unilever has also invested $1.14 billion in the high-growth natural products space since 2015.

In addition to acquisitions and product launches in the health and wellness category, CPG companies have launched a number of initiatives to raise public awareness of health issues or address them directly. Colgate-Palmolive’s worldwide community health initiative, “Bright Smiles, Bright Futures,” for example, provides children across the globe with free dental screenings and helps educate people about brushing their teeth and oral health.

[caption id="attachment_79262" align="aligncenter" width="798"]

Source: Oxford Economics[/caption]

CPG Companies Respond to Consumers’ Health and Wellness Concerns

Consumers are increasingly taking ownership of their health and wellness and seeking information on products and services that can help improve their well-being. In response, many CPG companies are expanding into health and wellness products and also cooperating with communities to deliver wellness initiatives.

Clorox expanded its health and wellness portfolio by acquiring Burt’s Bees, Renew Life and, more recently, dietary supplements leader Nutranext. Unilever acquired the GlaxoSmithKline (GSK’s) healthy drinks portfolio in India, Bangladesh and 20 other predominantly Asian markets. Unilever has also invested $1.14 billion in the high-growth natural products space since 2015.

In addition to acquisitions and product launches in the health and wellness category, CPG companies have launched a number of initiatives to raise public awareness of health issues or address them directly. Colgate-Palmolive’s worldwide community health initiative, “Bright Smiles, Bright Futures,” for example, provides children across the globe with free dental screenings and helps educate people about brushing their teeth and oral health.

[caption id="attachment_79262" align="aligncenter" width="798"] Source: Company reports[/caption]

Consolidation and M&A Activity Continues

Mergers and acquisitions continue to be a key theme in the CPG sector, driving consolidation in the market and leading to increased market share for companies undertaking M&A activities. According to KPMG’s 2018 Global CEO Outlook, 38% of U.S. retail and CPG CEOs say M&As will be their company’s primary growth driver over the next three years, helping them accelerate growth, expand into new global markets, expand their product portfolios and pursue newer paths to innovation.

GSK and Pfizer announced on Dec. 19, 2018, that they would merge their consumer healthcare units to create a new market leader with almost $13.2 billion in annual sales. The combined entity will include brands such as GSK’s Sensodyne toothpaste and Pfizer’s Centrum vitamins.

At Unilever’s 2018 Investor Event in December, Alan Jope, President of Personal Care, noted that Unilever had acquired 25 companies in the last four years, including 13 beauty and personal care companies. These acquisitions are driving 11% comparable sales growth for Unilever.

The company also built its Prestige division from acquisitions, spending about €2 billion ($2.3 billion) to acquire six businesses: Dermalogica, Murad, Ren, Kate Somerville, Living Proof and Hourglass. Unilever’s Prestige division was growing at a 12% rate year to date as of early December 2018, and the company expected it to pass the €500 million ($571.8 million) mark by 2018, according to Jope.

Japanese personal care group Unicharm purchased Southeast Asian diaper maker DSG International (Thailand) for $530 million in September 2018. The acquisition bolstered Unicharm’s lineup of low- and midpriced diapers in Southeast Asia and added to its production capacity.

Digital Consumers

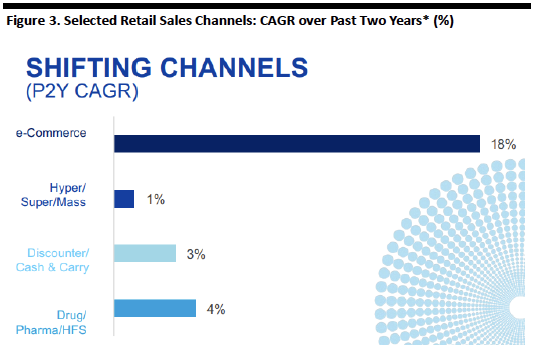

Digital commerce has been the most prominent trend in retail in recent years. In 2018, P&G CFO Jon Moeller stated that worldwide e-commerce had grown at a CAGR of 18% for the past two years, outpacing hypermarkets, supermarkets and mass merchandisers. The emergence of e-commerce, which offers low prices, free shipping and price transparency, has challenged traditional retailers, while enabling brands to sell directly to consumers.

[caption id="attachment_79263" align="aligncenter" width="536"]

Source: Company reports[/caption]

Consolidation and M&A Activity Continues

Mergers and acquisitions continue to be a key theme in the CPG sector, driving consolidation in the market and leading to increased market share for companies undertaking M&A activities. According to KPMG’s 2018 Global CEO Outlook, 38% of U.S. retail and CPG CEOs say M&As will be their company’s primary growth driver over the next three years, helping them accelerate growth, expand into new global markets, expand their product portfolios and pursue newer paths to innovation.

GSK and Pfizer announced on Dec. 19, 2018, that they would merge their consumer healthcare units to create a new market leader with almost $13.2 billion in annual sales. The combined entity will include brands such as GSK’s Sensodyne toothpaste and Pfizer’s Centrum vitamins.

At Unilever’s 2018 Investor Event in December, Alan Jope, President of Personal Care, noted that Unilever had acquired 25 companies in the last four years, including 13 beauty and personal care companies. These acquisitions are driving 11% comparable sales growth for Unilever.

The company also built its Prestige division from acquisitions, spending about €2 billion ($2.3 billion) to acquire six businesses: Dermalogica, Murad, Ren, Kate Somerville, Living Proof and Hourglass. Unilever’s Prestige division was growing at a 12% rate year to date as of early December 2018, and the company expected it to pass the €500 million ($571.8 million) mark by 2018, according to Jope.

Japanese personal care group Unicharm purchased Southeast Asian diaper maker DSG International (Thailand) for $530 million in September 2018. The acquisition bolstered Unicharm’s lineup of low- and midpriced diapers in Southeast Asia and added to its production capacity.

Digital Consumers

Digital commerce has been the most prominent trend in retail in recent years. In 2018, P&G CFO Jon Moeller stated that worldwide e-commerce had grown at a CAGR of 18% for the past two years, outpacing hypermarkets, supermarkets and mass merchandisers. The emergence of e-commerce, which offers low prices, free shipping and price transparency, has challenged traditional retailers, while enabling brands to sell directly to consumers.

[caption id="attachment_79263" align="aligncenter" width="536"] *As of November 8, 2018

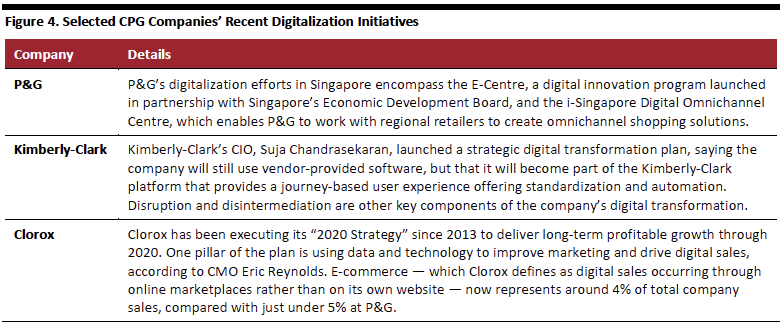

*As of November 8, 2018Source: P&G[/caption] In response to the growing demand, CPG companies are increasingly adapting to the e-commerce channel. Unilever prioritizes e-commerce as a fast-growth channel and uses it for both sales and brand building, according to Jope, the company’s head of Personal Care. Between January and September 2018, Unilever’s e-commerce sales grew by more than 70% year over year, and the company expects such sales to account for 10% of its total turnover by 2023. In some areas, online demand is unusually strong. For example, in Tamil Nadu, the southernmost state of India, a big market for Unilever’s home care products, e-commerce platforms represent around 40% of Unilever’s total sales in the state. According to data from Colgate-Palmolive’s presentation at the 2018 Barclays Global Consumer Staples Conference, Colgate’s e-commerce sales have nearly tripled since 2014 and the company’s U.S. e-commerce sales doubled in 2017 alone. Colgate has expanded into the Chinese e-commerce market by partnering with Alibaba to sell the Elmex toothpaste brand on Alibaba’s e-commerce platforms. Kimberly-Clark’s online sales have been growing at double-digit rates, and the company is investing to improve its e-commerce capabilities through targeted and direct digital marketing programs. Kimberly-Clark plans to innovate in terms of dealing with its e-commerce channel partners and to leverage technology to make sure it presents shoppers, particularly mothers, with the right offers and product mix whenever they shop online. Major CPG companies are also shifting their marketing away from traditional advertising channels toward digital channels. Clorox spent 49% of its media budget on digital channels in 2018 and expects that figure to be above 50% in 2019, versus 34% in 2015. To educate consumers on its products prepurchase, Colgate uses a combination of paid and organic search optimization, ensuring its offerings feature prominently on the first page of major shopping websites. The company also designs packaging specifically for products sold online, which helps it maintain high online product ratings and enabled it to achieve market leadership online in the U.S., the U.K. and China in 2017. Colgate has also set up an online oral care center that provides information for consumers. The company works to ensure that all of its online content is presented in a mobile-friendly format. Digitalized and Technology-Enabled Business For CPG companies, digitalization can drastically improve operational efficiency and also have a significant impact on marketing, product design, supply chain and decision making. Unilever has been digitalizing all aspects of its business in order to grow with data-driven insights. The company has deployed artificial intelligence and bots to automate over 250 processes to date, increasing speed and accuracy and reducing costs. The company says that these efforts have already saved over 120,000 human work hours. Unilever has also built its own digital agency, U-Studio, which specializes in creating relevant content for social media and digital ads. U-Studio creates content for brand teams faster and for about 30% less than external agencies using a “quick fixes, easy and digital” approach. The in-house agency has expanded to 14 countries. In addition, Unilever uses a “mass customization” model that personalizes marketing for each customer in a bid to drive conversion rates during promotional campaigns. The company captures and analyzes customer data, so it can engage shoppers in a more meaningful and relevant way. For example, in Thailand, Unilever has executed a successful precision marketing strategy by using data on 37 million personally identifiable customers to gauge their preferences accurately. P&G launched a “neighborhood analytics” program in the U.S., Europe, Latin America and the Asia-Pacific region to ensure it serves the right stores with right quantities of product. In China, P&G created a platform named Golden Eye that allows the company to leverage crowdsourcing and artificial intelligence to capture insights for store operations. The platform can capture and analyze, in real time, more than 1 million images monthly from 40,000 stores using image recognition technologies. Golden Eye enables P&G to decide more quickly what changes are needed in stores. [caption id="attachment_79264" align="aligncenter" width="780"]

Source: Company reports/Coresight Research[/caption]

Product Differentiation and Challenges from Private Labels

CPG companies are facing challenges from private labels as products become increasingly commoditized. According to a November 2018 survey by market research firm IRI, about eight out of 10 Americans buy private-label products frequently or occasionally to save money and about two-thirds plan to buy more private-label goods in the coming six months. Brand owners face heightened competition from own-brand-dominated discounters Aldi and Lidl, new private labels launched by major retailers (such as Target’s Smartly household brand, which launched in October 2018) and Amazon’s ongoing expansion into private labels, including in CPG categories.

The globally established CPG giants are developing differentiated products to avoid pure price competition with private labels and convince consumers to stick with their brands. P&G aims to deliver superior products, especially through packaging. For example, its Tide bag-in-a-box packaging features a twist-to-open pour spout, a pullout stand to raise the box for easier pouring and a measuring cup, making laundry more simple. The liquid formula, which contains less water than normal Tide, comes in a sealed bag. The package does not require additional layers of cardboard boxing or bubble wrap, and it’s lighter and takes up less space in a delivery truck, improving shipping efficiency and making it easier for consumers to pick up and carry the product.

[caption id="attachment_79265" align="aligncenter" width="498"]

Source: Company reports/Coresight Research[/caption]

Product Differentiation and Challenges from Private Labels

CPG companies are facing challenges from private labels as products become increasingly commoditized. According to a November 2018 survey by market research firm IRI, about eight out of 10 Americans buy private-label products frequently or occasionally to save money and about two-thirds plan to buy more private-label goods in the coming six months. Brand owners face heightened competition from own-brand-dominated discounters Aldi and Lidl, new private labels launched by major retailers (such as Target’s Smartly household brand, which launched in October 2018) and Amazon’s ongoing expansion into private labels, including in CPG categories.

The globally established CPG giants are developing differentiated products to avoid pure price competition with private labels and convince consumers to stick with their brands. P&G aims to deliver superior products, especially through packaging. For example, its Tide bag-in-a-box packaging features a twist-to-open pour spout, a pullout stand to raise the box for easier pouring and a measuring cup, making laundry more simple. The liquid formula, which contains less water than normal Tide, comes in a sealed bag. The package does not require additional layers of cardboard boxing or bubble wrap, and it’s lighter and takes up less space in a delivery truck, improving shipping efficiency and making it easier for consumers to pick up and carry the product.

[caption id="attachment_79265" align="aligncenter" width="498"] Source: Company reports[/caption]

For its SK-II prestige cosmetics brand, P&G leveraged a packaging decoration technology designed to entice shoppers to purchase limited-edition products. P&G also offers a line of SK-II products that include a proprietary ingredient called Pitera, which the company says facilitates the skin’s natural rejuvenation process. Jennifer Davis, President of P&G Global Feminine Care, claimed that P&G’s Discreet feminine care product is strongly preferred among customers, compared with similar products from competing companies, due to its strong protection and odor control and thinner, more discreet design.

[caption id="attachment_79266" align="aligncenter" width="502"]

Source: Company reports[/caption]

For its SK-II prestige cosmetics brand, P&G leveraged a packaging decoration technology designed to entice shoppers to purchase limited-edition products. P&G also offers a line of SK-II products that include a proprietary ingredient called Pitera, which the company says facilitates the skin’s natural rejuvenation process. Jennifer Davis, President of P&G Global Feminine Care, claimed that P&G’s Discreet feminine care product is strongly preferred among customers, compared with similar products from competing companies, due to its strong protection and odor control and thinner, more discreet design.

[caption id="attachment_79266" align="aligncenter" width="502"] Source: Company reports[/caption]

CPG companies also battle private-label makers in terms of innovation in ingredients. Clorox is continually innovating its Scentiva range of household cleaning products to offer interesting new scents, such as “Fresh Brazilian Blossoms,” which private labels do not offer. In its pet food products, Unicharm uses ingredients designed to provide an ideal nutritional balance for each pet in light of its age, physical attributes and condition, and taste preferences, a proposition that private labels cannot currently match. To produce pet toiletry products that provide clean and hygienic environments for pets and their owners, Unicharm uses non-woven fabrics, absorbent material processing and molding technologies.

Sector Dynamics

Sector Size and Growth

This report focuses on the personal care and home care segments of the CPG sector. Although the beauty category is included in most estimates of the CPG market size, as detailed below, we exclude it from our analysis in this report because we cover it in detail in another Sector Overview. We also exclude packaged food and over-the-counter healthcare products from our coverage here.

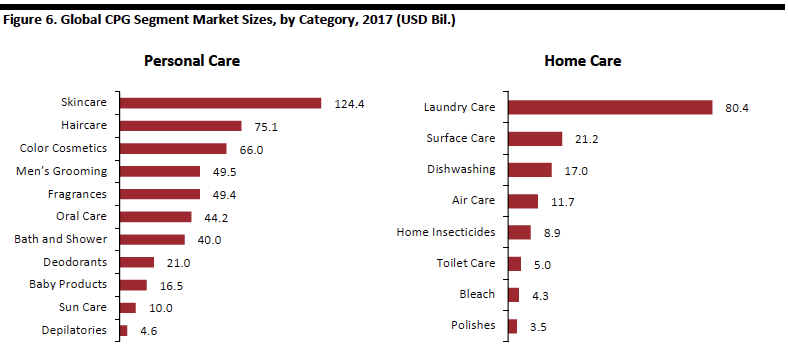

The beauty and personal care segment includes depilatories, fragrances, color cosmetics and deodorants, as well as baby care, sun care, bath and shower, oral care, men’s grooming, haircare and skincare products. According to Bloomberg, Euromonitor International and our own estimates:

Source: Company reports[/caption]

CPG companies also battle private-label makers in terms of innovation in ingredients. Clorox is continually innovating its Scentiva range of household cleaning products to offer interesting new scents, such as “Fresh Brazilian Blossoms,” which private labels do not offer. In its pet food products, Unicharm uses ingredients designed to provide an ideal nutritional balance for each pet in light of its age, physical attributes and condition, and taste preferences, a proposition that private labels cannot currently match. To produce pet toiletry products that provide clean and hygienic environments for pets and their owners, Unicharm uses non-woven fabrics, absorbent material processing and molding technologies.

Sector Dynamics

Sector Size and Growth

This report focuses on the personal care and home care segments of the CPG sector. Although the beauty category is included in most estimates of the CPG market size, as detailed below, we exclude it from our analysis in this report because we cover it in detail in another Sector Overview. We also exclude packaged food and over-the-counter healthcare products from our coverage here.

The beauty and personal care segment includes depilatories, fragrances, color cosmetics and deodorants, as well as baby care, sun care, bath and shower, oral care, men’s grooming, haircare and skincare products. According to Bloomberg, Euromonitor International and our own estimates:

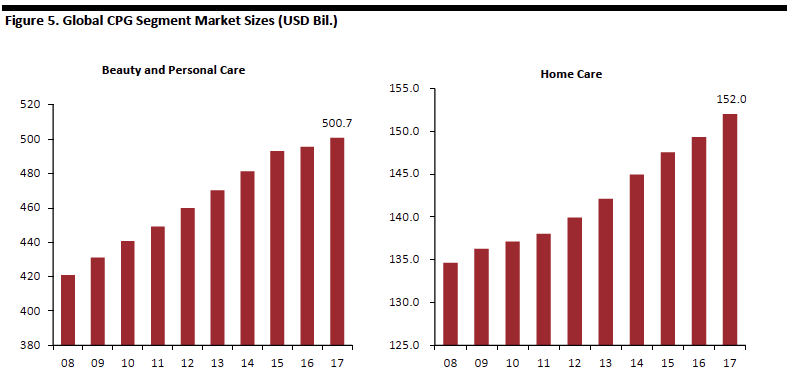

- The global beauty and personal care market reached $500.7 billion in 2017, showing modest growth of 1% year over year.

- Skincare is the largest category within personal care, at $124.0 billion, followed by haircare at $75.1 billion and color cosmetics at $66.0 billion.

- The global home care market grew 1.8% year over year in 2017, to $152.0 billion.

- Laundry care is the largest category within home care, at $80.4 billion, followed by surface care at $21.2 billion and dishwashing products at $17.0 billion.

Source: Bloomberg/Euromonitor International/Coresight Research[/caption]

[caption id="attachment_79268" align="aligncenter" width="788"]

Source: Bloomberg/Euromonitor International/Coresight Research[/caption]

[caption id="attachment_79268" align="aligncenter" width="788"] Source: Bloomberg/Euromonitor International/Coresight Research[/caption]

Headwinds and Tailwinds

Sector Headwinds

The CPG sector faces significant headwinds in early 2019. Trade tensions between the U.S and China, Brexit uncertainty, and currency and economic crises in Turkey, Argentina and Italy will continue to rumble on this year. In 2018, the Turkish lira lost 25% of its value while the Argentine peso lost more than 50%. Such currency collapses in emerging markets are strong headwinds for multinational CPG companies that do business in those countries.

Even in China, one of the main growth drivers of emerging-market economies in recent years, retail sales have slowed amid trade tensions with the U.S. Chinese retail sales slowed to a single-digit growth of 8.1% in November 2018, and the growth rate figures released in May, October and November 2018 were each the lowest since June 2003. Also, we are seeing reports that big factories in China are laying off staff and reducing costs, partly due to uncertainty caused by trade tensions, which may lead to a slowing economy and further job cuts.

Sector Tailwinds

Despite lingering economic uncertainties, the demand side of the CPG sector is supported by a strong secular trend: A flood of consumers will enter the middle class, and therefore upgrade their consumption, in the years to come. According to World Bank estimates on middle-class population and spending, and P&G’s forecasts on global income levels presented at its 2018 Investor Day:

Source: Bloomberg/Euromonitor International/Coresight Research[/caption]

Headwinds and Tailwinds

Sector Headwinds

The CPG sector faces significant headwinds in early 2019. Trade tensions between the U.S and China, Brexit uncertainty, and currency and economic crises in Turkey, Argentina and Italy will continue to rumble on this year. In 2018, the Turkish lira lost 25% of its value while the Argentine peso lost more than 50%. Such currency collapses in emerging markets are strong headwinds for multinational CPG companies that do business in those countries.

Even in China, one of the main growth drivers of emerging-market economies in recent years, retail sales have slowed amid trade tensions with the U.S. Chinese retail sales slowed to a single-digit growth of 8.1% in November 2018, and the growth rate figures released in May, October and November 2018 were each the lowest since June 2003. Also, we are seeing reports that big factories in China are laying off staff and reducing costs, partly due to uncertainty caused by trade tensions, which may lead to a slowing economy and further job cuts.

Sector Tailwinds

Despite lingering economic uncertainties, the demand side of the CPG sector is supported by a strong secular trend: A flood of consumers will enter the middle class, and therefore upgrade their consumption, in the years to come. According to World Bank estimates on middle-class population and spending, and P&G’s forecasts on global income levels presented at its 2018 Investor Day:

- The middle-class population in the Asia-Pacific region will reach 1.7 billion by 2020 and 3.2 billion by 2030.

- China will account for 13% of global middle-class spending in 2020, but India will be the top middle-class spender in 2030, accounting for 23% of global middle-class consumption.

- Global income per capita increased from $5,100 in 2007 to $6,000 in 2018, and is forecast to reach $7,400 by 2028.

- The number of middle- and upper-income households increased by 65% from 2007 to 2018, and will increase by a further 50% by 2028.

Competitive Landscape

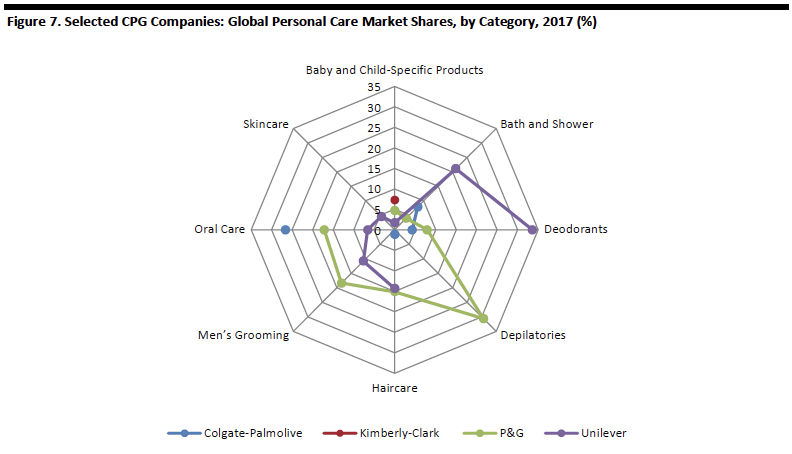

In the CPG sector, certain companies dominate particular categories. In the personal care segment, Colgate-Palmolive accounts for 26.6% of the global oral care market. Kimberly-Clark holds a 7.3% share of the market for baby and child-specific products. Unilever holds 33.6% of the deodorant market and 21.1% of the market for bath and shower products. P&G holds a 30.6% share of the depilatories market and Unilever and P&G each hold a sizable share of the haircare, men’s grooming and oral care markets. [caption id="attachment_79269" align="aligncenter" width="792"] Source: Bloomberg/Euromonitor International/Coresight Research[/caption]

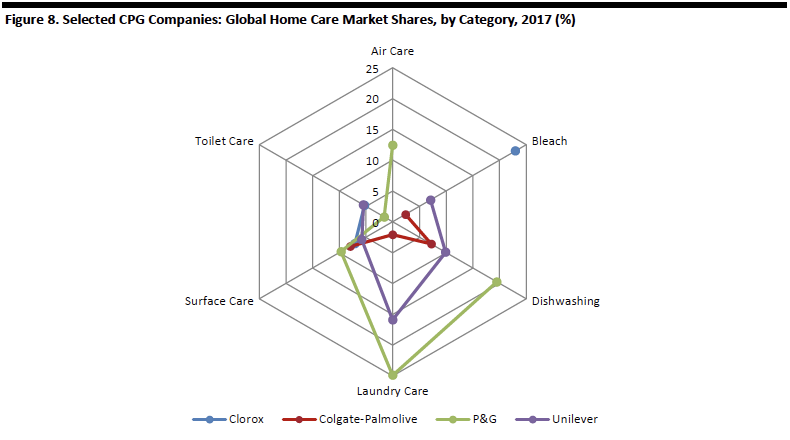

In terms of home care, Clorox holds a dominant share of the bleach market, but has not been able to extend that dominance into other home care categories. P&G has the highest market share across home care products, followed by Unilever.

According to data from Euromonitor International, Clorox held a 23.0% market share in bleach in 2017 and a sizable share in both surface care, at 7.1%, and toilet care, at 5.3%. P&G held a 19.5% share of the dishwashing products market and a 24.9% share of the laundry care market in 2017, versus Unilever’s 9.9% dishwashing share and 15.9% laundry care share.

[caption id="attachment_79270" align="aligncenter" width="790"]

Source: Bloomberg/Euromonitor International/Coresight Research[/caption]

In terms of home care, Clorox holds a dominant share of the bleach market, but has not been able to extend that dominance into other home care categories. P&G has the highest market share across home care products, followed by Unilever.

According to data from Euromonitor International, Clorox held a 23.0% market share in bleach in 2017 and a sizable share in both surface care, at 7.1%, and toilet care, at 5.3%. P&G held a 19.5% share of the dishwashing products market and a 24.9% share of the laundry care market in 2017, versus Unilever’s 9.9% dishwashing share and 15.9% laundry care share.

[caption id="attachment_79270" align="aligncenter" width="790"] Source: Bloomberg/Euromonitor International/Coresight Research[/caption]

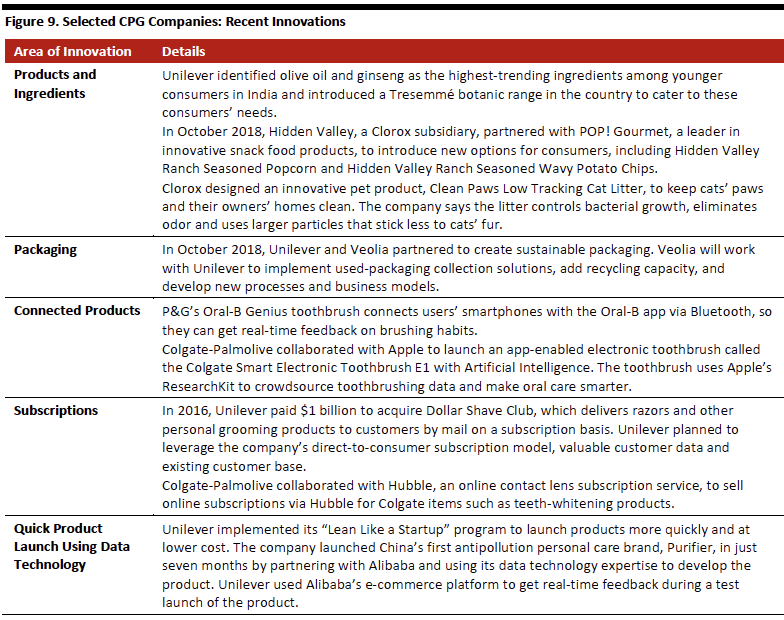

Innovators and Disruptors

The CPG sector is increasingly competitive for both multinational companies and local brands. Top players are fighting for share in emerging markets and domestic brands are always present. At P&G’s 2018 Investor Day event in November, CFO Jon Moeller gave an indication of the scale of the competition when he noted that 450 haircare brands were launched via flagship stores on China’s Tmall marketplace in 2017 alone and that 990 haircare brands were available online in China as of end of 2017.

Two notable local CPG brands in China are Blue Moon and Yunnan Baiyao:

Source: Bloomberg/Euromonitor International/Coresight Research[/caption]

Innovators and Disruptors

The CPG sector is increasingly competitive for both multinational companies and local brands. Top players are fighting for share in emerging markets and domestic brands are always present. At P&G’s 2018 Investor Day event in November, CFO Jon Moeller gave an indication of the scale of the competition when he noted that 450 haircare brands were launched via flagship stores on China’s Tmall marketplace in 2017 alone and that 990 haircare brands were available online in China as of end of 2017.

Two notable local CPG brands in China are Blue Moon and Yunnan Baiyao:

- Blue Moon manufactures a hyperconcentrated liquid laundry detergent called Zhizun that enables consumers to conserve more water and electricity compared with traditional liquid detergent. In addition to containing environmentally friendly ingredients, Zhizun has an innovative package design that pumps instead of pours detergent into washing machines, reducing wastage.

- Yunnan Baiyao, meaning “Yunnan white powder,” is a leading traditional Chinese medicine brand. The company originally sold only powdered medicines, but later extended its product offerings to include bandages, ointments and toothpaste. Yunnan Baiyao differentiates itself from competitors by incorporating medicinal ingredients into its products and by charging customers premium prices by marketing its offerings as “medicated.”

Source: Company reports[/caption]

Source: Company reports[/caption]

Sector Outlook

Although macroeconomic conditions have become more uncertain recently, CPG sector growth will continue to be driven by premiumization in consumption, companies’ agility in responding to consumer needs, growth in emerging markets, digitalization and growth in middle-income households. In earnings calls and at conferences, senior managers at some of the major CPG companies have recently provided the following comments regarding the sector outlook:- Kimberly-Clark COO Michael Hsu stated that he has concerns about commodity inflation and currency volatility, which could negatively impact the company’s adjusted operating profit.

- Clorox CMO Eric Reynolds commented that consumers’ purchase behavior is changing and that companies need to be more nimble than ever before to succeed.

- Colgate-Palmolive COO Noel Wallace stated that Asian consumers have moved toward premiumization over the last couple of years, noting that the company’s premium SKUs and brands have grown exponentially faster than mainstream brands.

- Unilever CFO Graeme Pitkethly observed that growth remains strong in India and Turkey and that e-commerce will continue to be the key driver of market growth for the CPG sector in China.

- P&G CFO Jon Moeller commented that the consumer products industry will benefit more from population, income and middle-income household growth in the next decade than at any time in the past.

- • Readers may also be interested in our Sector Outlook: Beauty Brands and Retailers report.