Nitheesh NH

Introduction

The US drugstore retail sector has seen consolidation and several collaborations between traditional players and retailers in other sectors. In this report, we cover the following subjects:

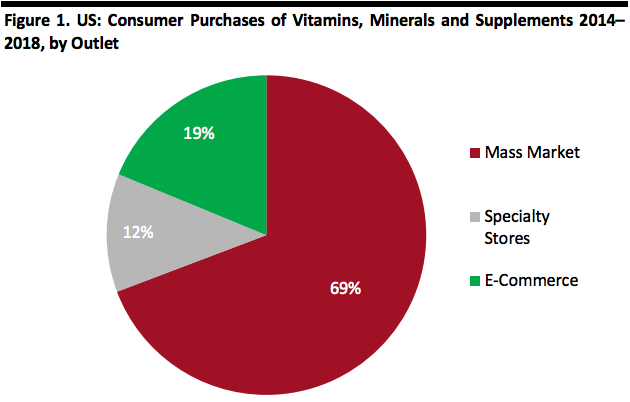

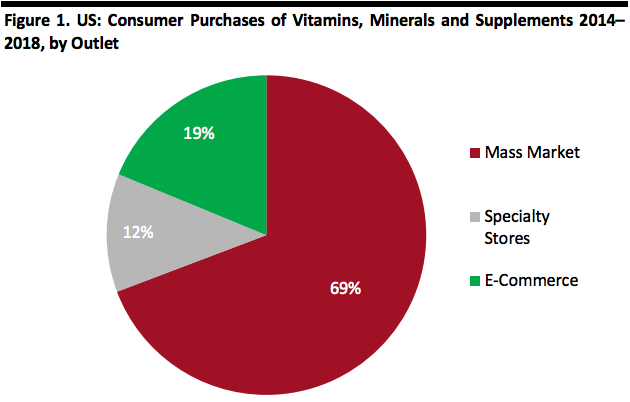

Source: TABS Analytics[/caption]

Adapting Drugstore Retail to Changing Demographics

Shopping has transformed from being merely an errand on a to-do list to an experiential journey. With a growing preference for e-commerce and shoppers spoiled for choice, bringing customers into stores has become more challenging than ever. Two demographic groups wielding considerable spending power are senior consumers (those aged 65 and over) and millennials (those born between 1980 and 2000).

Senior citizens now account for 16% of the total US population – but that figure will jump to 20% in 2030, according to the United Nations. Seniors exercise considerable clout as consumers, particularly in the healthcare category: Almost one-quarter of all spending by younger seniors (those under 75) is in retail. And within retail, US seniors spend heavily on functional items such as healthcare and housekeeping supplies.

Drugstores retailers are well-placed to cater to these consumers and market leaders CVS and Walgreens have already adapted elements of store design to cater them.

Sector Momentum

Sector Size and Growth

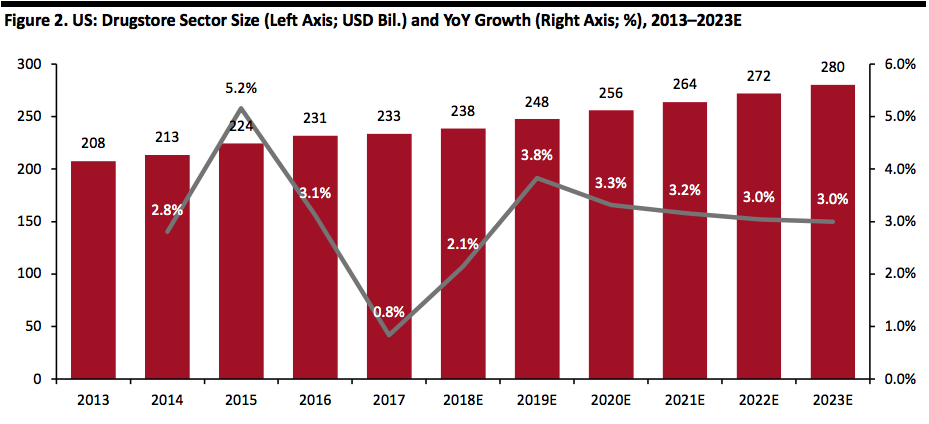

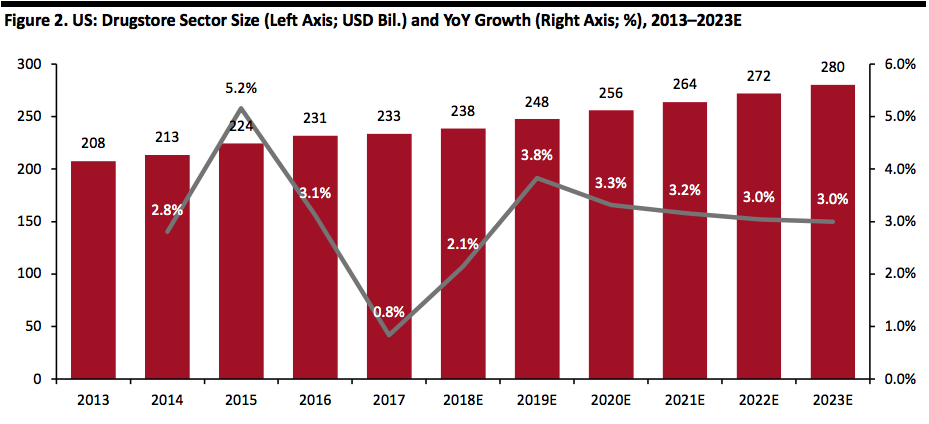

The US drugstore sector was worth $233 billion in 2017, according to data from Euromonitor International. It is estimated to have grown 2.1% to $238 billion in 2018.

Between 2013 and 2017, the sector saw a CAGR of 3.0% and over the years from 2018 to 2023, the market is expected to grow faster, at 4.1%.

[caption id="attachment_79376" align="aligncenter" width="800"]

Source: TABS Analytics[/caption]

Adapting Drugstore Retail to Changing Demographics

Shopping has transformed from being merely an errand on a to-do list to an experiential journey. With a growing preference for e-commerce and shoppers spoiled for choice, bringing customers into stores has become more challenging than ever. Two demographic groups wielding considerable spending power are senior consumers (those aged 65 and over) and millennials (those born between 1980 and 2000).

Senior citizens now account for 16% of the total US population – but that figure will jump to 20% in 2030, according to the United Nations. Seniors exercise considerable clout as consumers, particularly in the healthcare category: Almost one-quarter of all spending by younger seniors (those under 75) is in retail. And within retail, US seniors spend heavily on functional items such as healthcare and housekeeping supplies.

Drugstores retailers are well-placed to cater to these consumers and market leaders CVS and Walgreens have already adapted elements of store design to cater them.

Sector Momentum

Sector Size and Growth

The US drugstore sector was worth $233 billion in 2017, according to data from Euromonitor International. It is estimated to have grown 2.1% to $238 billion in 2018.

Between 2013 and 2017, the sector saw a CAGR of 3.0% and over the years from 2018 to 2023, the market is expected to grow faster, at 4.1%.

[caption id="attachment_79376" align="aligncenter" width="800"] Source: Euromonitor International/Coresight Research[/caption]

Headwinds and Tailwinds

Sector Headwinds

Source: Euromonitor International/Coresight Research[/caption]

Headwinds and Tailwinds

Sector Headwinds

Source: Euromonitor International[/caption]

Company Summaries

[caption id="attachment_79378" align="aligncenter" width="800"]

Source: Euromonitor International[/caption]

Company Summaries

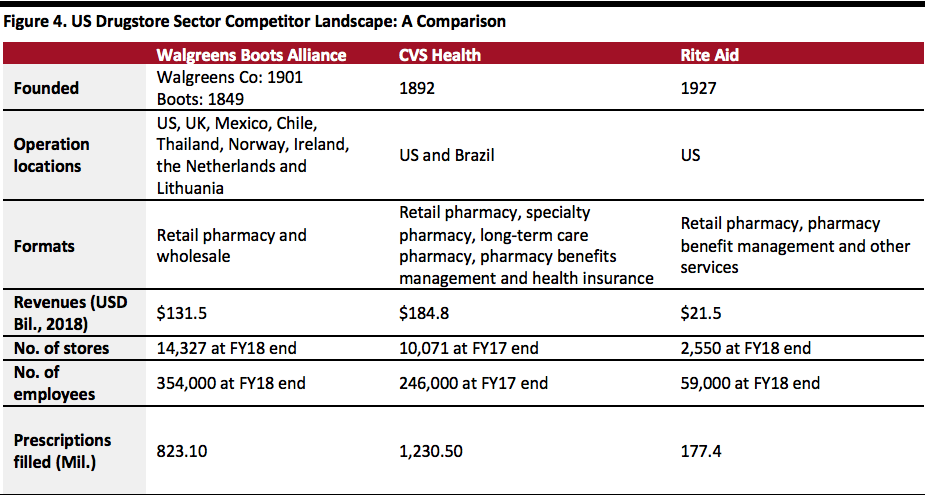

[caption id="attachment_79378" align="aligncenter" width="800"] Source: Company reports[/caption]

Innovators and Disruptors

One of the biggest disruptions to legacy US drugstores comes from online-only pharmacies and drug retailers. Amazon’s purchase of online pharmacy company PillPack for a reported $1 billion enables the e-commerce leader to enter the prescription drug industry for the first time. PillPack provides scheduled monthly deliveries and emergency overnight deliveries, for no delivery charge. With its ability to leverage Amazon’s logistics network, PillPack can develop its delivery services even further. Amazon already offers over-the-counter drugs, such as ibuprofen, for lower prices than CVS and Walgreens, so retailers will have to adapt quickly to avoid being challenged in the prescription medication market.

To increase store traffic and tap into the beauty segment, retailers are introducing innovative store concepts that position them as destinations of beauty. CVS has expanded and redesigned its beauty department to present it as a shop-in-shop, called BeautyIRL, with a fresh look and additional products and services, such as:

Source: Company reports[/caption]

Innovators and Disruptors

One of the biggest disruptions to legacy US drugstores comes from online-only pharmacies and drug retailers. Amazon’s purchase of online pharmacy company PillPack for a reported $1 billion enables the e-commerce leader to enter the prescription drug industry for the first time. PillPack provides scheduled monthly deliveries and emergency overnight deliveries, for no delivery charge. With its ability to leverage Amazon’s logistics network, PillPack can develop its delivery services even further. Amazon already offers over-the-counter drugs, such as ibuprofen, for lower prices than CVS and Walgreens, so retailers will have to adapt quickly to avoid being challenged in the prescription medication market.

To increase store traffic and tap into the beauty segment, retailers are introducing innovative store concepts that position them as destinations of beauty. CVS has expanded and redesigned its beauty department to present it as a shop-in-shop, called BeautyIRL, with a fresh look and additional products and services, such as:

- Key themes in the sector.

- Sector momentum in the US.

- Sector size, growth and market shares of key retailers.

- Outlook for the US drugstore retail sector.

Source: TABS Analytics[/caption]

Adapting Drugstore Retail to Changing Demographics

Shopping has transformed from being merely an errand on a to-do list to an experiential journey. With a growing preference for e-commerce and shoppers spoiled for choice, bringing customers into stores has become more challenging than ever. Two demographic groups wielding considerable spending power are senior consumers (those aged 65 and over) and millennials (those born between 1980 and 2000).

Senior citizens now account for 16% of the total US population – but that figure will jump to 20% in 2030, according to the United Nations. Seniors exercise considerable clout as consumers, particularly in the healthcare category: Almost one-quarter of all spending by younger seniors (those under 75) is in retail. And within retail, US seniors spend heavily on functional items such as healthcare and housekeeping supplies.

Drugstores retailers are well-placed to cater to these consumers and market leaders CVS and Walgreens have already adapted elements of store design to cater them.

Sector Momentum

Sector Size and Growth

The US drugstore sector was worth $233 billion in 2017, according to data from Euromonitor International. It is estimated to have grown 2.1% to $238 billion in 2018.

Between 2013 and 2017, the sector saw a CAGR of 3.0% and over the years from 2018 to 2023, the market is expected to grow faster, at 4.1%.

[caption id="attachment_79376" align="aligncenter" width="800"]

Source: TABS Analytics[/caption]

Adapting Drugstore Retail to Changing Demographics

Shopping has transformed from being merely an errand on a to-do list to an experiential journey. With a growing preference for e-commerce and shoppers spoiled for choice, bringing customers into stores has become more challenging than ever. Two demographic groups wielding considerable spending power are senior consumers (those aged 65 and over) and millennials (those born between 1980 and 2000).

Senior citizens now account for 16% of the total US population – but that figure will jump to 20% in 2030, according to the United Nations. Seniors exercise considerable clout as consumers, particularly in the healthcare category: Almost one-quarter of all spending by younger seniors (those under 75) is in retail. And within retail, US seniors spend heavily on functional items such as healthcare and housekeeping supplies.

Drugstores retailers are well-placed to cater to these consumers and market leaders CVS and Walgreens have already adapted elements of store design to cater them.

Sector Momentum

Sector Size and Growth

The US drugstore sector was worth $233 billion in 2017, according to data from Euromonitor International. It is estimated to have grown 2.1% to $238 billion in 2018.

Between 2013 and 2017, the sector saw a CAGR of 3.0% and over the years from 2018 to 2023, the market is expected to grow faster, at 4.1%.

[caption id="attachment_79376" align="aligncenter" width="800"] Source: Euromonitor International/Coresight Research[/caption]

Headwinds and Tailwinds

Sector Headwinds

Source: Euromonitor International/Coresight Research[/caption]

Headwinds and Tailwinds

Sector Headwinds

- The industry is likely to face continuing reimbursement pressure. Major drugstore retailers have seen declining reimbursement rates as insurance companies have engaged in aggressive price cutting and expanded preferred pharmacy networks. Federal and state programs aim to limit government healthcare spending and third-party payers also constantly seek to reduce costs.

- As e-commerce continues to make inroads into physical retail across sectors, we expect the drugstore sector as well to see declining store traffic.

- More generic drugs coming onto the market will benefit the industry as generic drugs tend to deliver higher margins than branded drugs.

- Consumers’ increasing interest in wellness products and therapies and beauty’s growing relevance could provide new opportunities for pharmacies to expand their service offerings outside traditional areas.

- A growing senior population will fuel the demand for prescriptions. On average, only about 12% of US adults use five or more prescription drugs in a month, according to the Centers for Disease Control and Prevention. But some 40% of US seniors (those ages 65 and over), tend to use five or more prescription drugs on a regular basis, according to research published in the Journal of the American Medical Association.

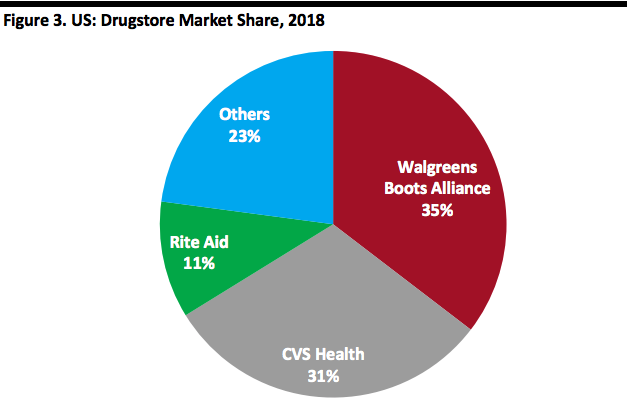

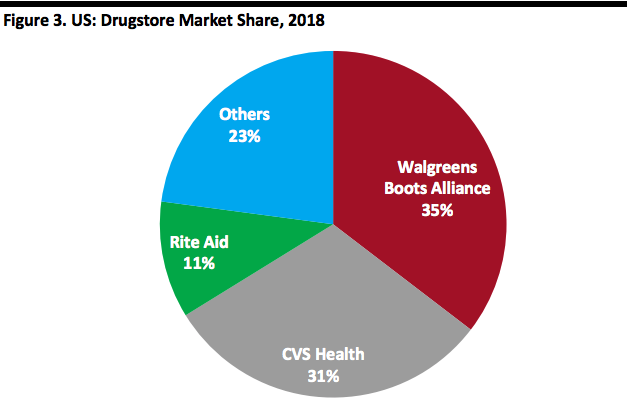

- Market share: The US drugstore sector has consolidated, and now just three players (Walgreens, CVS and Rite Aid) control over three-quarters of the market.

- Walgreens holds 35%, CVS 31% and Rite Aid 11% of the market, while others make up 23% of the market.

Source: Euromonitor International[/caption]

Company Summaries

[caption id="attachment_79378" align="aligncenter" width="800"]

Source: Euromonitor International[/caption]

Company Summaries

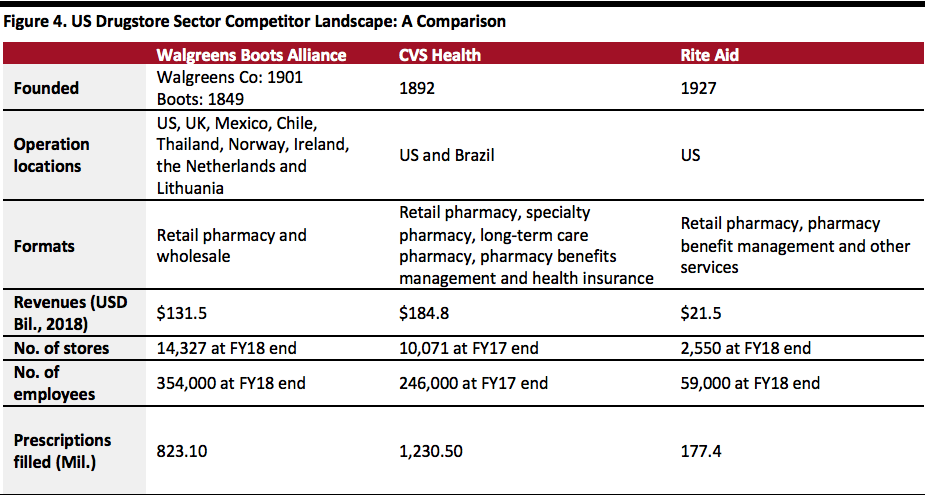

[caption id="attachment_79378" align="aligncenter" width="800"] Source: Company reports[/caption]

Innovators and Disruptors

One of the biggest disruptions to legacy US drugstores comes from online-only pharmacies and drug retailers. Amazon’s purchase of online pharmacy company PillPack for a reported $1 billion enables the e-commerce leader to enter the prescription drug industry for the first time. PillPack provides scheduled monthly deliveries and emergency overnight deliveries, for no delivery charge. With its ability to leverage Amazon’s logistics network, PillPack can develop its delivery services even further. Amazon already offers over-the-counter drugs, such as ibuprofen, for lower prices than CVS and Walgreens, so retailers will have to adapt quickly to avoid being challenged in the prescription medication market.

To increase store traffic and tap into the beauty segment, retailers are introducing innovative store concepts that position them as destinations of beauty. CVS has expanded and redesigned its beauty department to present it as a shop-in-shop, called BeautyIRL, with a fresh look and additional products and services, such as:

Source: Company reports[/caption]

Innovators and Disruptors

One of the biggest disruptions to legacy US drugstores comes from online-only pharmacies and drug retailers. Amazon’s purchase of online pharmacy company PillPack for a reported $1 billion enables the e-commerce leader to enter the prescription drug industry for the first time. PillPack provides scheduled monthly deliveries and emergency overnight deliveries, for no delivery charge. With its ability to leverage Amazon’s logistics network, PillPack can develop its delivery services even further. Amazon already offers over-the-counter drugs, such as ibuprofen, for lower prices than CVS and Walgreens, so retailers will have to adapt quickly to avoid being challenged in the prescription medication market.

To increase store traffic and tap into the beauty segment, retailers are introducing innovative store concepts that position them as destinations of beauty. CVS has expanded and redesigned its beauty department to present it as a shop-in-shop, called BeautyIRL, with a fresh look and additional products and services, such as:

- A Korean beauty section.

- A “Now Trending” wall that features popular brands.

- An accessories section for handbags and jewelry.

- A bath cart displaying bath bombs and other bath products made to look like sweet treats.

- A “Mini Must-Have” section for customers to put together their own bag of mini beauty products.