albert Chan

Introduction

The apparel and footwear industry has experienced severe disruption since 2000. Fashion trends, retail channels, connected consumers and globalization have all played a part in the industry’s rapid transformation. Apparel, more so than footwear, has seen dozens of brands rise and fall in less than a decade as industry barriers to entry were lowered with technology and new niche fashion brands entered the market, capturing the attention of consumers looking for something new and exciting with a new brand story. The contraction and consolidation of the traditional department store channel has impacted apparel brands as well. Some have responded with strong direct-to-consumer strategies of their own, while others have seen revenues contract with a shrinking footprint of the global department store landscape. Footwear, especially brands tied to sports activities and outdoor experiences, have fared better than apparel brands, but they too have been vulnerable to the vicissitudes of retail channels with bankruptcies and store closures. Footwear brands have enjoyed strong brand equity (Nike, Adidas, Vans) and the right sneaker is social currency for many youths around the world. Sportswear, spanning true performance athletic wear and sneakers to athleisure and athletic-inspired apparel for those who want to appear as though they are living a health and wellness lifestyle, are growth areas as they appeal to the persona the consumer aspires to, similar to the value proposition luxury brands offer consumers. Not surprisingly, we have seen numerous collaborations spanning luxury and sports as well as luxury brands adopting iconic sports attire in their collections (such as hoodies, sweats and sneakers). Digital disruption is bifurcating the traditional wholesale apparel and footwear market into those companies and brands with adequate brand power to go direct to the consumer and those that don’t have the brand relevancy to make it on their own. The alternative for those brands which lack the power to go it alone can use Amazon, Zappos, Alibaba and Tmall as well as other online marketplaces. But, customer data is king, and direct to consumer brands must also have retail, fulfilment and return expertise on top of a desirable brand at an attractive price. Industry margins have been impacted by growing consumer expectations and are likely to remain under pressure for all but the most sought-after apparel and footwear brands for the next few years. This report covers:- Key themes in the market.

- Global growth.

- Top industry participants.

- Retail channels.

Themes We’re Watching

Global Themes New digital marketplaces have made the apparel and footwear market truly global, giving consumers access to brands and products once available only by traveling. Farfetch, Net-A-Porter, moda operandi and more are bringing brands to neighborhoods that previously had very little access to the latest fashion trends. Amazon and Zappos too. Packages are arriving from all over the world filled with items. That said, up to 50% of online apparel and footwear purchases are returned, so companies need to understand that free shipping and free returns are today’s stable stakes in developed markets. Another challenge is that easy access can turn cherished products into commodities. We are witnessing the rapid commodification of many apparel categories and once loved brands – and growing ease of access and digitization of the marketplace has accelerated the process. Luxury brands were once out of reach for most middle-class consumers, but are now attainable via new forms of payment (such as Affirm), rental and subscription (such as Rent the Runway) and second-hand consignment (such as the RealReal and PoshMark). The availability of luxury brands at substantially lower prices is devaluing mid-priced apparel labels and turning fashion brands into commodities. Further exacerbating this commodification is fast fashion. In the past ten years fast fashion via H&M and Inditex has usurped leading positions once held by traditional apparel brands either directly, such as Gap Inc. or wholesale brands, such as Lauren Ralph Lauren. Fast fashion is one of the drivers causing unit growth to exceed value growth. Another industry driver is a global health and wellness trend, benefitting sports apparel brands such as adidas, Lululemon and Nike. According to Euromonitor, the top global apparel brands are Nike and adidas, which have become marketing powerhouses with strong alliances with leading athletes and celebrities. New Global Consumers The way consumers discover and shop for apparel and footwear has radically changed in the last decade. Technology and the Internet have leveled or democratized apparel and footwear, so that brands once unattainable are readily available with multiple alternatives: buy or rent, pick up in store, get the product shipped, pay now or in increments, buy new or resale, opt for a subscription or make a single purchase. With luxury more readily available via rental or consignment, many luxury brands have lost their aspirational appeal and have been replaced by sports brands, deemed more authentic, aspirational and at the same time, relatable. Health and wellness are the aspirational lifestyles, and leading sports brands, such as Nike, provide street cred and social currency as they heighten their fashion credentials via designer collaborations while deepening authenticity by using athletes as brand ambassadors. For today’s consumers, the following values matter and are impacting the apparel and footwear market:- Inclusivity

- Authenticity

- Personalization

- Transparency

- Sustainability

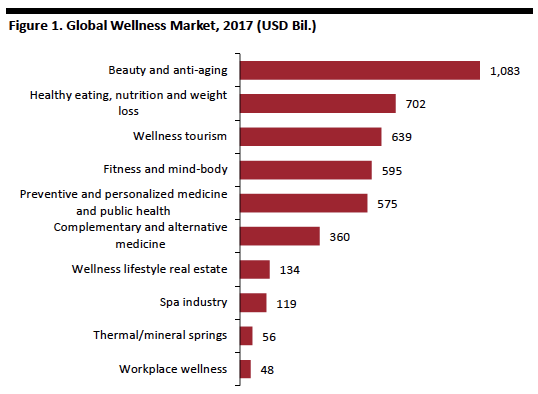

Source: Global Wellness Institute[/caption]

Wellness spans beauty to alternative medicine tourism to workplace, truly a lifestyle that is capturing the attention of young and old.

Casual lifestyles

Health and wellness, combined with the casualization of the workplace and the popularity of streetwear, have impacted global fashion trends since the Global Financial Crisis of 2009. Sports brands Nike, adidas are all offering products that can be worn on athletic fields – or in a nightclub. Bomber jackets with team graphics are daywear. Office wear for many is Lululemon yoga pants or leggings and a sweater top as dress codes are less formal or non-existent. Sneakers are the go-to shoe choice for fashionistas and athletes alike.

To remain relevant as casual silhouettes have replaced more traditional work attire, many brands have increased their sneaker assortments with price points ranging as high as $2,000 and are enjoying strong demand from youth as well as older generations hoping to emulate a millennial state of mind. Brands are also incorporating streetwear into their assortments to appeal to younger consumers.

Casual lifestyles have attracted higher-priced designer and luxury brands to the sneaker and streetwear categories, in which they compete with mid-priced athletic brands as well as lifestyle apparel brands such as Tommy Hilfiger. T-shirts, down jackets and sneakers were among the standout, ready-to-wear categories for luxury brands in 2017, according to Bain, growing by 25%, 15% and 10%, respectively. This is creating a democratization of luxury as these products are typically offered at lower price points than a Kiton suit, for example, and can attract a larger audience.

Farfetch, the luxury ecommerce platform that connects more than a million active luxury shoppers in 190 countries with 989 luxury sellers (375 of which are brands, and the remainder luxury retailers), has agreed to acquire Stadium Goods, the world’s premier sneaker and streetwear marketplace for $250 million, a testament to the blurring of streetwear, sneakers and luxury.

New Marketing Strategies: Collaborations and Drops

Out-of-the box collaborations such as Supreme and The North Face, Supreme and Vans, Supreme and Nike, Disney and Coach, Coach and artist Keith Haring, are just a few of recent collaborations that create new exclusive product that drives excitement and buzz while attracting new shoppers to both brands.

Cult brands like Supreme have employed “drops” as a way to mark the arrival of new product — in limited run — and brand advocates wait eagerly for hours (often overnight) for the sought-after product, which may sell online for three times (or more) the original purchase price in what has become a thriving resale market.

Private Label

Products that you can get everywhere will succumb to price promotion and ultimately commodification. Today’s shoppers want special, unique and different. Private label and exclusive products are one way to meet that desire.

Department stores and online retailers have increased private label programs to differentiate offerings with exclusive product that has an attractive price/value equation relative to national brands. Private label programs can enhance merchandise margins and profitability, while driving traffic due to the exclusive nature of the products. U.S. department store operator JC Penney private label offerings were 46% of 2017 sales, at Nordstrom, it is closer to 10% and at Macy’s, around 30%.

See our Sector Overview: US Department Stores for further analysis.

Amazon

More than a decade ago Jeff Bezos put his sight on the then $1 trillion global apparel market. Today many analysts think Amazon is fast approaching the leading position, and that’s with mostly commodity, basic apparel items such as underwear, sweats and socks. As retail channels adjust to digital commerce, many brands tied to traditional department store distribution have experienced sales erosion and store closures and bankruptcies. Amazon is the starting point for 54% of product searches according to Jumpshot, so brands that long avoided the commodification influence of Amazon’s marketplace are rethinking their Amazon strategies.

Amazon is only in the early stages of fashion offerings, but we see more brands testing the waters with limited assortments. Amazon is busy developing private label offerings, providing differentiation and value pricing. Coresight Research analysis shows that most of Amazon’s private labels, 66 of a total of 74, are in the apparel category. According to Jungle Scout, apparel represents 1% of Amazon’s private label sales as its private label strength is in batteries and CE accessories such as charging stations and cords, and its Echo and Fire Tablet products. Moreover, according to Jungle Scout data, women’s apparel trails men’s and Amazon’s women’s and girls’ private label brands are its worst performing private label brands, with 82% of its women’s clothing brands selling less than 100 units per month.

Prime Wardrobe, Amazon’s try before you buy program, could improve Amazon’s apparel sales. Shoppers get seven days to try on and decide if they want to purchase the items. Shipping both ways is free and Amazon doesn’t charge the customer until the trial window ends (so Amazon can avoid unnecessary credit card processing fees).

US-China Trade Tensions

The apparel industry anticipates the 25% tariffs expected to be levied on Chinese imports in 2019 will include clothing, and many have begun an exodus out of China to alternative sourcing countries, such as Vietnam, Cambodia and India as well as nearshoring and domestic sourcing.

This shuffling of sourcing partners is likely to have an impact on quality and cost as China is home to state-of-the-art factories and skilled labor. As firms shift production, capacity isn’t available, and this will likely create inefficiencies and dislocations in the supply chain near term.

Further, the potential of collateral damage resulting from these trade tensions could undermine U.S. apparel and footwear brand demand in China.

Sneakers as Social Currency

Source: Global Wellness Institute[/caption]

Wellness spans beauty to alternative medicine tourism to workplace, truly a lifestyle that is capturing the attention of young and old.

Casual lifestyles

Health and wellness, combined with the casualization of the workplace and the popularity of streetwear, have impacted global fashion trends since the Global Financial Crisis of 2009. Sports brands Nike, adidas are all offering products that can be worn on athletic fields – or in a nightclub. Bomber jackets with team graphics are daywear. Office wear for many is Lululemon yoga pants or leggings and a sweater top as dress codes are less formal or non-existent. Sneakers are the go-to shoe choice for fashionistas and athletes alike.

To remain relevant as casual silhouettes have replaced more traditional work attire, many brands have increased their sneaker assortments with price points ranging as high as $2,000 and are enjoying strong demand from youth as well as older generations hoping to emulate a millennial state of mind. Brands are also incorporating streetwear into their assortments to appeal to younger consumers.

Casual lifestyles have attracted higher-priced designer and luxury brands to the sneaker and streetwear categories, in which they compete with mid-priced athletic brands as well as lifestyle apparel brands such as Tommy Hilfiger. T-shirts, down jackets and sneakers were among the standout, ready-to-wear categories for luxury brands in 2017, according to Bain, growing by 25%, 15% and 10%, respectively. This is creating a democratization of luxury as these products are typically offered at lower price points than a Kiton suit, for example, and can attract a larger audience.

Farfetch, the luxury ecommerce platform that connects more than a million active luxury shoppers in 190 countries with 989 luxury sellers (375 of which are brands, and the remainder luxury retailers), has agreed to acquire Stadium Goods, the world’s premier sneaker and streetwear marketplace for $250 million, a testament to the blurring of streetwear, sneakers and luxury.

New Marketing Strategies: Collaborations and Drops

Out-of-the box collaborations such as Supreme and The North Face, Supreme and Vans, Supreme and Nike, Disney and Coach, Coach and artist Keith Haring, are just a few of recent collaborations that create new exclusive product that drives excitement and buzz while attracting new shoppers to both brands.

Cult brands like Supreme have employed “drops” as a way to mark the arrival of new product — in limited run — and brand advocates wait eagerly for hours (often overnight) for the sought-after product, which may sell online for three times (or more) the original purchase price in what has become a thriving resale market.

Private Label

Products that you can get everywhere will succumb to price promotion and ultimately commodification. Today’s shoppers want special, unique and different. Private label and exclusive products are one way to meet that desire.

Department stores and online retailers have increased private label programs to differentiate offerings with exclusive product that has an attractive price/value equation relative to national brands. Private label programs can enhance merchandise margins and profitability, while driving traffic due to the exclusive nature of the products. U.S. department store operator JC Penney private label offerings were 46% of 2017 sales, at Nordstrom, it is closer to 10% and at Macy’s, around 30%.

See our Sector Overview: US Department Stores for further analysis.

Amazon

More than a decade ago Jeff Bezos put his sight on the then $1 trillion global apparel market. Today many analysts think Amazon is fast approaching the leading position, and that’s with mostly commodity, basic apparel items such as underwear, sweats and socks. As retail channels adjust to digital commerce, many brands tied to traditional department store distribution have experienced sales erosion and store closures and bankruptcies. Amazon is the starting point for 54% of product searches according to Jumpshot, so brands that long avoided the commodification influence of Amazon’s marketplace are rethinking their Amazon strategies.

Amazon is only in the early stages of fashion offerings, but we see more brands testing the waters with limited assortments. Amazon is busy developing private label offerings, providing differentiation and value pricing. Coresight Research analysis shows that most of Amazon’s private labels, 66 of a total of 74, are in the apparel category. According to Jungle Scout, apparel represents 1% of Amazon’s private label sales as its private label strength is in batteries and CE accessories such as charging stations and cords, and its Echo and Fire Tablet products. Moreover, according to Jungle Scout data, women’s apparel trails men’s and Amazon’s women’s and girls’ private label brands are its worst performing private label brands, with 82% of its women’s clothing brands selling less than 100 units per month.

Prime Wardrobe, Amazon’s try before you buy program, could improve Amazon’s apparel sales. Shoppers get seven days to try on and decide if they want to purchase the items. Shipping both ways is free and Amazon doesn’t charge the customer until the trial window ends (so Amazon can avoid unnecessary credit card processing fees).

US-China Trade Tensions

The apparel industry anticipates the 25% tariffs expected to be levied on Chinese imports in 2019 will include clothing, and many have begun an exodus out of China to alternative sourcing countries, such as Vietnam, Cambodia and India as well as nearshoring and domestic sourcing.

This shuffling of sourcing partners is likely to have an impact on quality and cost as China is home to state-of-the-art factories and skilled labor. As firms shift production, capacity isn’t available, and this will likely create inefficiencies and dislocations in the supply chain near term.

Further, the potential of collateral damage resulting from these trade tensions could undermine U.S. apparel and footwear brand demand in China.

Sneakers as Social Currency

- “It” bags and must-have sneakers are the new social currency. Entering the 21st century, “It” bags were a marker of fashion status. Highly sought after in limited distribution, Fendi’s Baguette and Louis Vuitton’s Graffiti Bag are just two examples of bags that enjoyed demand that outstripped supply and gave the owner fashion cred. While Gucci enjoys cult-like status, many of today’s sought-after bags aren’t as well known as Gucci, Louis Vuitton, Fendi or Chanel, giving the owner a feeling of exclusivity (often at a lower price point than globally recognized luxury brands). Sneakers are just as popular, for both sexes and can cost as much as $2,000.

- High-priced puffer jackets are creating unease in some corners as they are obvious displays of wealth. Recently, high schools in London banned students from wearing Canada Goose and Moncler jackets, as this expensive outerwear was seen to create a sense of inequality and distraction among the student body. As social mores have adopted more inclusive and democratic aspects, such moves could be a harbinger of more difficult times ahead. Gen Zers tend to survey as more sensitive than their older peers and expect inclusivity and equality. These consumers could reject luxury purchases as a vote of solidarity with those less wealthy than themselves.

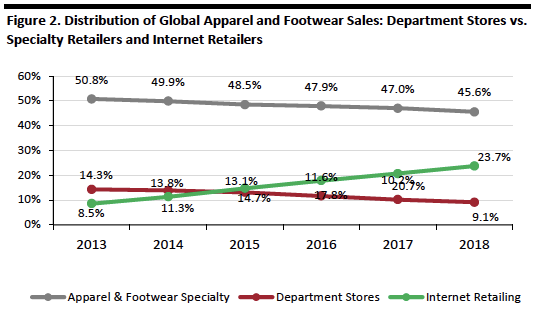

Source: Euromonitor International[/caption]

Recommerce, Rental and Subscription Models

A new breed of buyers is meeting new business models, such as resale (often termed recommerce or consignment), rentals and subscriptions.

Resale was a $20 billion market in the U.S. in 2017, with apparel capturing 49% or $9.8 billion according to ThredUp, one of the larger resale disruptors selling all brand tiers. It is rapidly growing, with approximately 70% of purchases on the ThredUp platform derived from first time resale customers. ThredUp is projecting the resale market to reach $41 billion by 2022, outpacing retail and apparel industry growth as more consumers become comfortable with resale.

Resale is big business in luxury too. One of the largest luxury consignment startups, The RealReal, is built on authenticating luxury products and eliminating the risk of counterfeit goods. At a recent industry conference, Rati Levesque, Chief Merchant at The RealReal, said the company has sold over eight million items since its 2011 beginning.

Rent the Runway’s CEO Jennifer Hyman recently shared the math on her company’s subscription model, Rent the Runway Unlimited, aimed at wardrobing professional working women. “75 million professional women in the U.S. spend $3,000 a year or more on clothing for work, and they’re getting $3,000 worth of value. Our subscribers spend $1,908 a year, and last year the average subscriber got $40,000 worth of value,” Hyman said in an October 2018 interview with The New Yorker. These figures seem high given the average per capita apparel spend is approximately $922 in the U.S., there is growing demand for rental apparel, and according to the same article, subscriptions have increased 150% year over year and currently account for half of the company’s revenue.

As resale rental and subscription become part of the new normal of acquiring apparel and footwear, consumer preferences and behavior will continue to change. Higher priced items that weren’t part of a middle-class consumer’s consideration set are now considered, either for rental, second hand or a splurge if there are savings relative to first-time retail purchase.

Source: Euromonitor International[/caption]

Recommerce, Rental and Subscription Models

A new breed of buyers is meeting new business models, such as resale (often termed recommerce or consignment), rentals and subscriptions.

Resale was a $20 billion market in the U.S. in 2017, with apparel capturing 49% or $9.8 billion according to ThredUp, one of the larger resale disruptors selling all brand tiers. It is rapidly growing, with approximately 70% of purchases on the ThredUp platform derived from first time resale customers. ThredUp is projecting the resale market to reach $41 billion by 2022, outpacing retail and apparel industry growth as more consumers become comfortable with resale.

Resale is big business in luxury too. One of the largest luxury consignment startups, The RealReal, is built on authenticating luxury products and eliminating the risk of counterfeit goods. At a recent industry conference, Rati Levesque, Chief Merchant at The RealReal, said the company has sold over eight million items since its 2011 beginning.

Rent the Runway’s CEO Jennifer Hyman recently shared the math on her company’s subscription model, Rent the Runway Unlimited, aimed at wardrobing professional working women. “75 million professional women in the U.S. spend $3,000 a year or more on clothing for work, and they’re getting $3,000 worth of value. Our subscribers spend $1,908 a year, and last year the average subscriber got $40,000 worth of value,” Hyman said in an October 2018 interview with The New Yorker. These figures seem high given the average per capita apparel spend is approximately $922 in the U.S., there is growing demand for rental apparel, and according to the same article, subscriptions have increased 150% year over year and currently account for half of the company’s revenue.

As resale rental and subscription become part of the new normal of acquiring apparel and footwear, consumer preferences and behavior will continue to change. Higher priced items that weren’t part of a middle-class consumer’s consideration set are now considered, either for rental, second hand or a splurge if there are savings relative to first-time retail purchase.

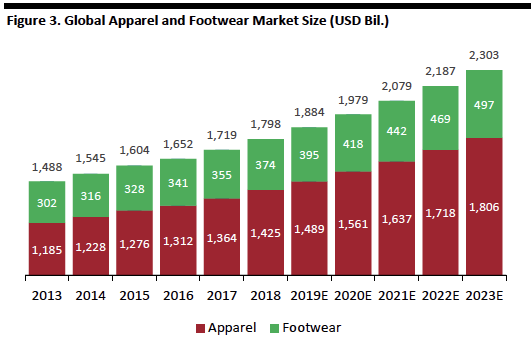

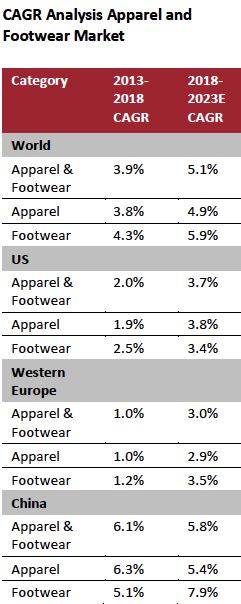

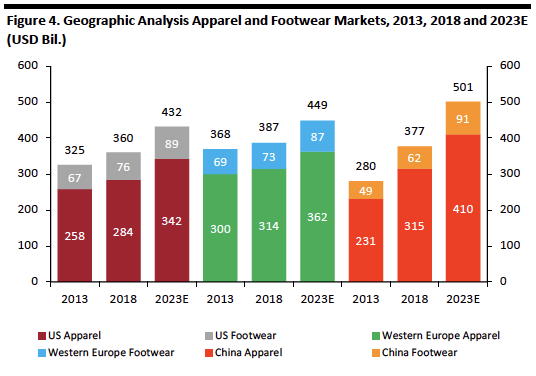

Sector Landscape

The global apparel and footwear market reached $1.80 trillion in 2018, up 4.6% year over year at constant exchange rates, according to Euromonitor. This was supported by a 5.2% gain in global footwear sales in 2018, while global apparel sales posted 4.5% year-over-year growth. At constant exchange rates, the five-year CAGR for the combined apparel and footwear market was 3.9% for the 2013-2018 period. Looking ahead, growth is on a positive trajectory, with Euromonitor forecasting a 5.1% five-year CAGR for the global apparel and footwear market (2018-2023), driven by a 5.8% five-year CAGR in China. [caption id="attachment_76816" align="aligncenter" width="532"] Data are at constant 2018 exchange rates.

Data are at constant 2018 exchange rates.Source: Euromonitor International/Coresight Research[/caption] [caption id="attachment_76838" align="aligncenter" width="241"]

Growth is at constant exchange rates.

Growth is at constant exchange rates.Source: Euromonitor International/

Coresight Research[/caption] China, Western Europe and the U.S. accounted for approximately 63% of the global apparel and footwear market in 2018. The China market is approximately 4.8% larger than the U.S. market, with these markets worth $377 billion and $360 billion, respectively. The Western European apparel and footwear market was the largest, at $387 billion. The global apparel and footwear market has been driven by the momentum in China, which grew at a 6.1% five-year CAGR during the 2013-2018 period. The U.S. market has achieved modest growth, and Western Europe even slower. Looking ahead, Euromonitor projects global apparel and footwear growth to grow at a 5.1% five-year CAGR (2018-2023), with China outpacing global trends, Europe growth accelerates to a 3.0% five-year CAGR (2018-2023), though still lagging global growth, as is the U.S., with a 3.7% five-year CAGR (2018-2023). [caption id="attachment_76816" align="aligncenter" width="536"]

Source: Euromonitor International[/caption]

Source: Euromonitor International[/caption]

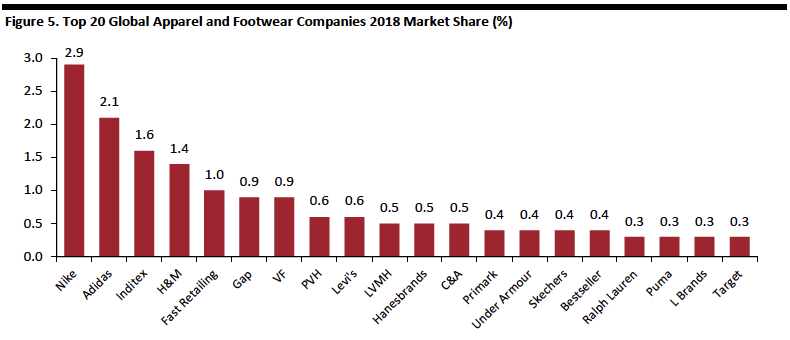

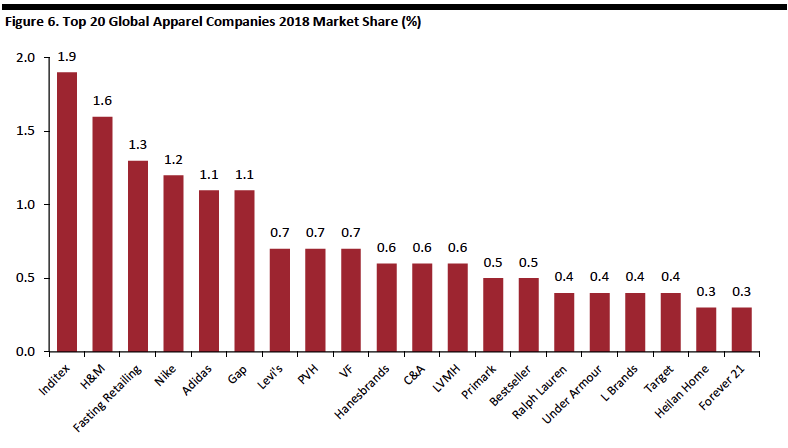

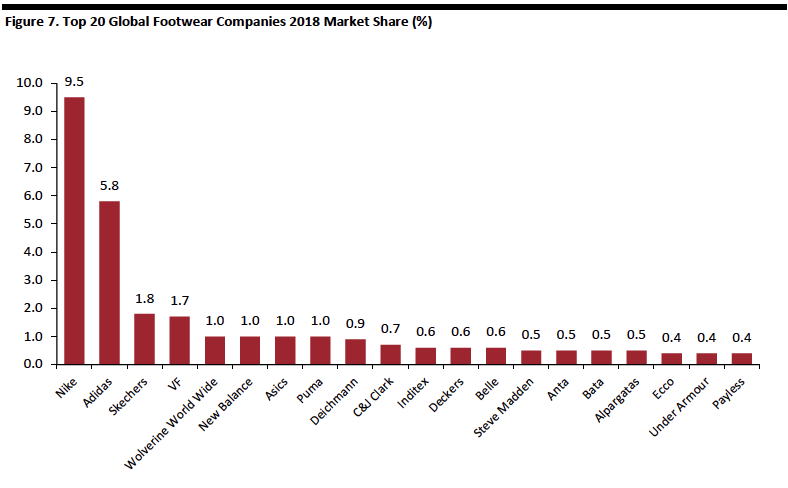

Competitive Landscape

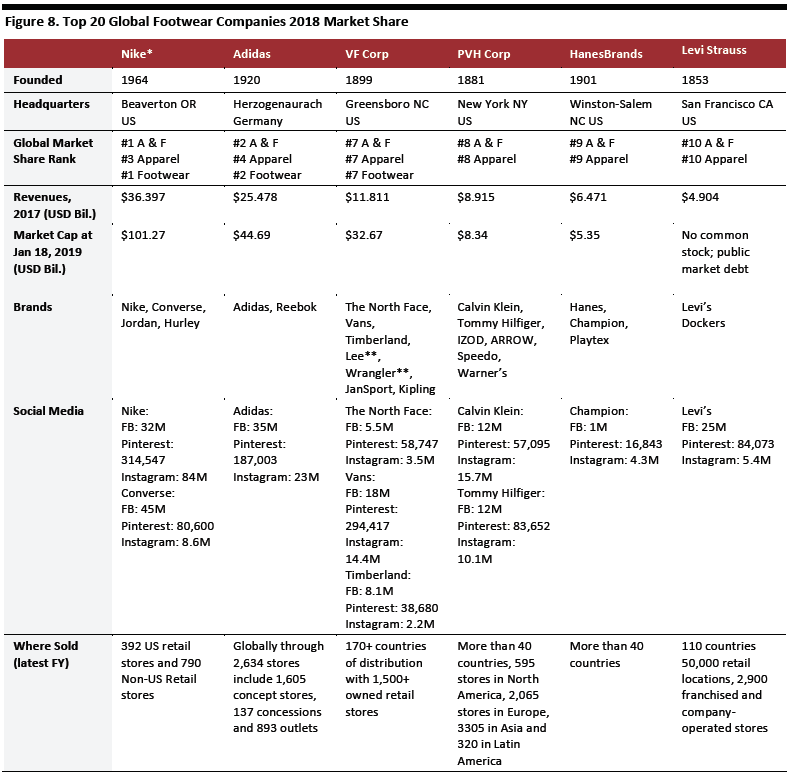

The combined apparel and footwear industry is relatively fragmented, with the top 20 companies accounting for around 16% of global sales in 2018. Nike holds 2.9% of the global apparel and footwear market, reflecting its leading position in the footwear industry, where it holds 9.5% of the global market. Footwear is relatively concentrated, with the top 20 companies accounting for 29.4% of global footwear sales, and the top two, Nike and adidas, 15.3%. Apparel is the more fragmented category, with the top 20 companies holding a combined 15.3% share. [caption id="attachment_76817" align="aligncenter" width="790"] Source: Euromonitor International[/caption]

[caption id="attachment_76818" align="aligncenter" width="788"]

Source: Euromonitor International[/caption]

[caption id="attachment_76818" align="aligncenter" width="788"] Source: Euromonitor International[/caption]

[caption id="attachment_76819" align="aligncenter" width="788"]

Source: Euromonitor International[/caption]

[caption id="attachment_76819" align="aligncenter" width="788"] Source: Euromonitor International[/caption]

[caption id="attachment_76820" align="aligncenter" width="788"]

Source: Euromonitor International[/caption]

[caption id="attachment_76820" align="aligncenter" width="788"] *Nike’s revenues for FY May 2018; part of planned April 2019 spin-off of Kontoor Brands

*Nike’s revenues for FY May 2018; part of planned April 2019 spin-off of Kontoor BrandsSource: Company reports/Coresight Research[/caption]

Innovators and Disruptors

- Allbirds. According to Joey Zwillinger, Cofounder and co-CEO of Allbirds, the company’s mission is to make shoes, making better things in a better way; comfortable and durable products with great customer service while using sustainable sources. Zwillinger claims Allbirds has the lowest carbon footprint in the footwear industry and that footwear is ready for disruption by consumer demand for sustainability given that approximately 20 billion pairs of shoes are made every year - that ultimately end up in a landfill. Allbirds focuses less on product development and more on fewer products with greater impact. Allbirds started with wool, moved to eucalyptus fiber, and then collaborated with a Brazilian company and created a foam shoe sole, removing petroleum from the process and replacing it with sugars. With its direct-to-consumer vertical model, Allbirds is taking profits typically reserved for retailers and investing them back into product quality and lower prices.

- Everlane. Michael Preysman, founder and CEO of Everlane, built his business on garments designed to last, partnering with ethical factories and providing pricing transparency to consumers. The genesis of Everlane was anti-fast fashion and a revelation of how the fashion industry really worked seven years ago. “A t-shirt that cost $7 to make was priced at $50 at retail, it felt wrong” Preysman said during a fireside chat at REMODE, an industry conference in November 2018. Online and direct to consumer, Everlane could offer the garment for $15 and a brand was born. But a sustainable supply chain isn’t as easy as pricing transparency. Picking the right factories and finding the right audit partners takes time. Everlane focuses on finding the right partners who are doing the right thing and pushing them forward. There are many incremental tasks that can change the sustainability of fashion, for instance, not using the plastic wrap that individually surrounds each article of clothing en route to the customers. At Everlane, taking control of the supply chain is a layer of incremental cost that they absorb, approximately 10%-15%, as Everlane takes a lead in pushing suppliers to offer sustainable options. Founded in 2010, Everlane has raised $1.2 million in funding and has $22.5 million in annual revenues, according to Crunchbase.

- M.gemi. Limited edition shoes, crafted and manufactured in small family-owned Italian workshops in which skills have been passed from generation to generation, are dropped Mondays at 10:00 AM and sold digitally, allowing M.gemi footwear to offer prices about 50-70% below comparable designer brands. CEO & founder Ben Fischman previously founded LIDS (an exclusive retailer of sports caps) and Rue la la (flash sale luxury ecommerce site). M.gemi has raised $58 million since its 2014 founding and annual revenues are estimated at $8.5 million, according to Crunchbase.

- Ministry of Supply. Founded in 2011 by MIT graduates, Ministry of Supply makes business apparel engineered to move and requiring no dry cleaning or ironing. Annual revenues are $6.5 million and the company has raised $9.2 million in funding. The company has a 3DPrint Knit shop that creates a custom-fit garment incorporating a unique body-mapped knit pattern that seamlessly puts ventilation where needed.

- Nike. Despite its 1964 founding, Nike continues to set the pace in innovation with new product introductions, new fabrications and new selling environments that engage the customer, and with marketing that spans apps to TV and product drops and exclusive collaborations that keep a growing consumer base engaged. The Nike New York flagship personalizes and customizes product and allows the shopper to interact with the brand and pay without involving a salesperson. Nike is the world’s largest footwear brand at $21 billion and the world’s largest athletic apparel brand at $9.6 billion, according to the company’s October 2017 Investor Day presentation. Digital tools in computational design are shortening lead times in commercialized innovation. Leveraging its flyknit technology, the company recently launched the FE/NOM bra, 30% lighter than its previous offerings and still providing maximum support.

- Innovative textiles. Fabrics that wick away moisture, or imbue fibers with coffee grinds to eliminate odors, are common in athletic wear, and becoming expected in daywear and everyday clothing as well. At Ministry of Supply, the polyester used in their Apollo shirt (employing phase-change materials originally developed for astronauts’ suits) adjusts to hot and cold via polymers that respond to temperatures.

- The new business models mentioned above have been disrupting apparel and footwear for the past five years. Recommerce sites, such as The RealReal, and rental and subscription models, such as Rent the Runway or jewelry rental startup Flont, are changing the ways consumers interact with apparel and accessories, providing access to brands once out of reach. They democratize the luxury marketplace. Items too precious to own can be rented or purchased “lightly used.” These digitally enabled business models can lengthen the lifespan of a luxury product, which in turn supports the creation of a more sustainable industry, and at the same time, enables more consumers to enjoy luxury products. The impact on moderately priced apparel and footwear is brands are more rapidly commoditized and relegated obsolete, reflected in lost brand equity and sales erosion.

- Several apparel and footwear companies have been innovative in their use of textiles and design, and digital design, allowing them to push boundaries and shorten lead times, bringing newness to consumers more rapidly. Now they are engaging in tech-driven research and development as well. Adidas just launched its new sports accelerator program Platform A at Station F, the largest start-up campus located in Paris. 13 startups have been selected to work with adidas on new business initiatives focusing on digital, global sales and community building and specifically, Open Source, a strategic pillar for adidas. As part of Open Source, adidas works with many athletes and creatives from the world of sports, fashion and entertainment around the world.

Sector Outlook

- As the retail environment continues to evolve, increasingly incorporating digital into the shopping experience, vendors in retail will adapt, evolve or die. Coresight Research expects a steady influx of new niche apparel and footwear brands capture the bulk of industry growth. Digital first will be the strategy used by most new entrants.

- New forms of ownership or usage will impact the fashion apparel and footwear segments, as newness and the latest fashion trends can be borrowed. Sports apparel and footwear brands will benefit from casual lifestyles and their ability to iterate innovations that make athletes better. This iteration provides a steady flow of new product that is better than the last, supports modest price increases and prevents commodification of the brand. Moreover, with exclusives and drops, athletic brands are providing the social currency that was reserved for luxury brands.

- After years of lackluster apparel demand in the developed world, the U.S. and Europe are positioned to see growth over the next five years. Despite retail evolution, new channels and business models, we expect to see new fashion designs reach consumers sooner with near shoring, 3D printing, faster design processes and supply chains. China will continue to post solid mid-digit growth propelled by more people entering the middle class.