Source: Company reports

4Q15 RESULTS

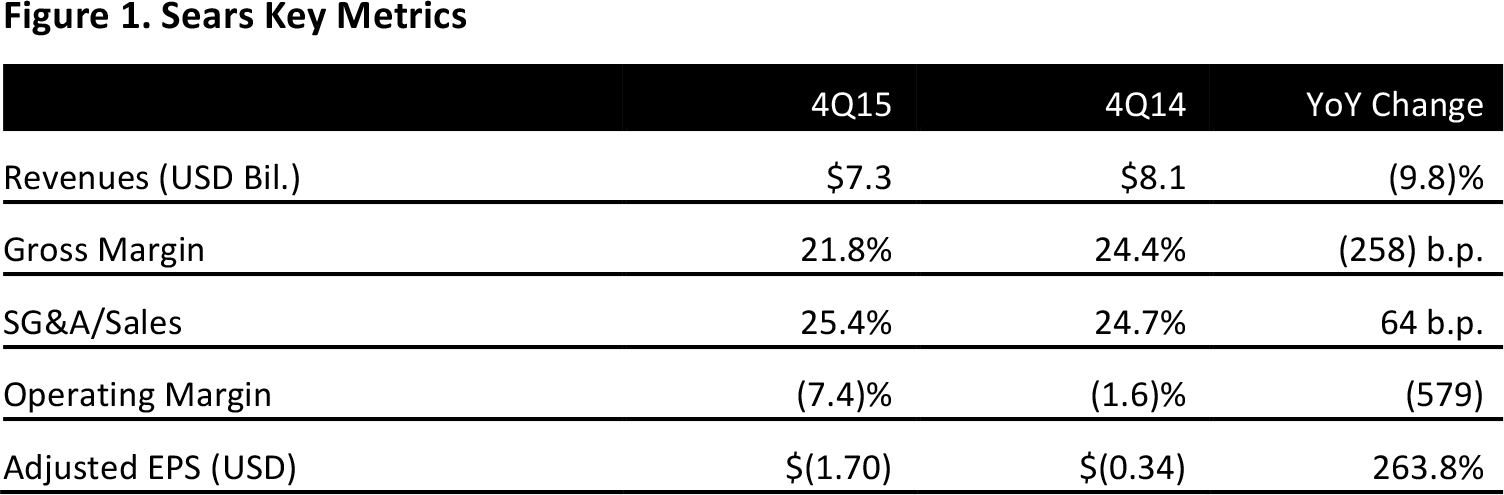

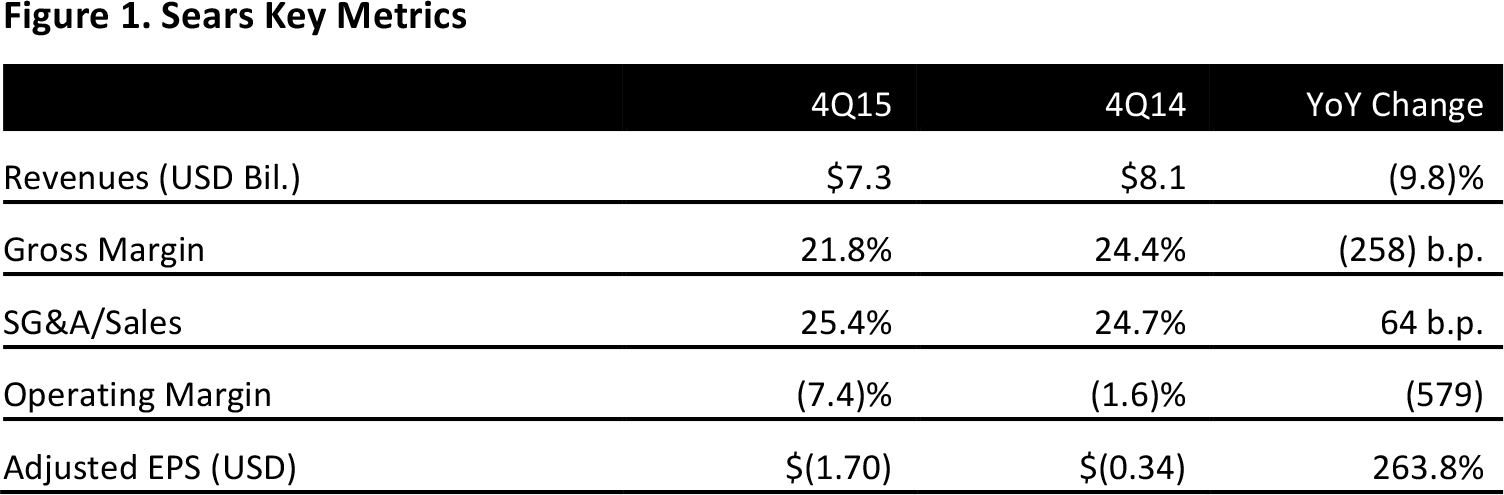

Sears’ 4Q15 revenues were $7.3 billion, comprising $3.1 billion from Kmart (down 8.8%) and $4.2 billion from Sears Domestic (down 8.2%). A decrease in store count accounted for $291 million of the year-over-year revenue decline.

Kmart saw comp decreases in the consumer electronics, apparel, grocery and household, and home categories, which were partially offset by positive comps in the seasonal, mattress and home appliance categories. Excluding consumer electronics, Kmart’s comps would have decreased by 5.0%. Sears Domestic’s comps were also hurt by consumer electronics; excluding consumer electronics, comps would have decreased by 4.8%, with the decline primarily driven by decreases in the apparel, footwear, home, tools and sporting goods categories and partially offset by increases in the mattress and home appliance categories.

Kmart’s gross margin declined by 250 basis points year over year, and Sears Domestic’s gross margin declined by 270 basis points, driven by the apparel and related softlines businesses.

Sears said that it reduced expenses by approximately $150 million year over year in the quarter.

Reported EPS was $(5.44), compared to $(1.50) a year ago.

2015 RESULTS

Full-year revenues were $25.1 billion, down 19.4% owing to actions taken to streamline operations and transform the company into a member-centric retailer. Revenues decreased by $2.1 billion due to the deconsolidation of Sears Canada, by $222 million due to the separation of the Lands’ End business and by $1.5 billion due to lower revenue following to the closure of Kmart and Sears full-line stores.

In 2015, comps declined by 9.2%, comprising a decrease of 7.3% at Kmart and a decrease of 11.1% at Sears Domestic.

Gross margin was fairly flat in the year at 23.1%, down 19 basis points. The operating margin for the year was (4.0)%, up 86 basis points.

Adjusted EPS for the year was $(8.94), compared to $(7.81) in 2014. Reported EPS was $(10.59) in 2015 versus $(15.82) in 2014.

The company reduced its net debt position, including pension and postretirement liabilities, by approximately $1.0 billion in 2015, and long-term debt stood at $2.2 billion as of January 30, 2016.

Outlook

In 2016, management remains committed to restoring Sears to profitability. In particular, management looks to generate positive adjusted EBITDA as it accelerates Sears’ transformation into a leading, member-centric, integrated retailer and takes action to improve its cost structure and gross margin.

Management plans to further reduce Sears’ costs by $550–$650 million, depending on overall sales volume.

The current 2016 consensus estimates are for revenues of $22.3 billion (down 11.2%) and adjusted EPS of $(15.20).