Nitheesh NH

The story of Sears is one of the greatest retail tales of our age: Richard Warren Sears and Alvah Curtis Roebuck founded the company in 1893, it was reincorporated by Richard Sears and new partner Julius Rosenwald in 1906 and over the next century came to represent retail in America, becoming the biggest retailer in the US by revenue. The company’s market capitalization reached US$96 billion during the mid-1960s. The company’s famous catalog-oriented business thrived for years, but in 1993 the retailer discontinued them.

Sears had all the ingredients to be one of the leading US retailers of today, but it didn’t connect the dots. Sears had a strong customer database from its catalog business, and the distribution centers and mailing capabilities that today underpin e-commerce capabilities. More surprisingly, Sears was using buy online and pick up in store (BOPIS) in the late 1990s. Most retailers have introduced BOPIS only in recent years.

But Sears struggled over the years. Sears had not managed annual revenue growth since 2005, the year Edward Lampert purchased Sears and merged the embattled retailer with mass merchandiser Kmart. The company’s last reported net profit was in fiscal 2010, when it recorded net income of $133 million.

On October 15, 2018, Sears filed for chapter 11 bankruptcy, announcing plans to close around 142 stores by . This was in addition to the 46 closures announced in August 2018. At the time of filing, Sears operated around 687 Sears and Kmart stores. Sears CEO Edward Lampert announced he would step down as the CEO but remain chairman.

In February 2019, Sears emerged out of bankruptcy when the US Bankruptcy Court for the Southern District of New York approved a $5.2 billion bid, made by Lampert, saving the retailer from closure. In this report, we review the events that led to the decline of Sears and its bankruptcy.

Long-Term Debt

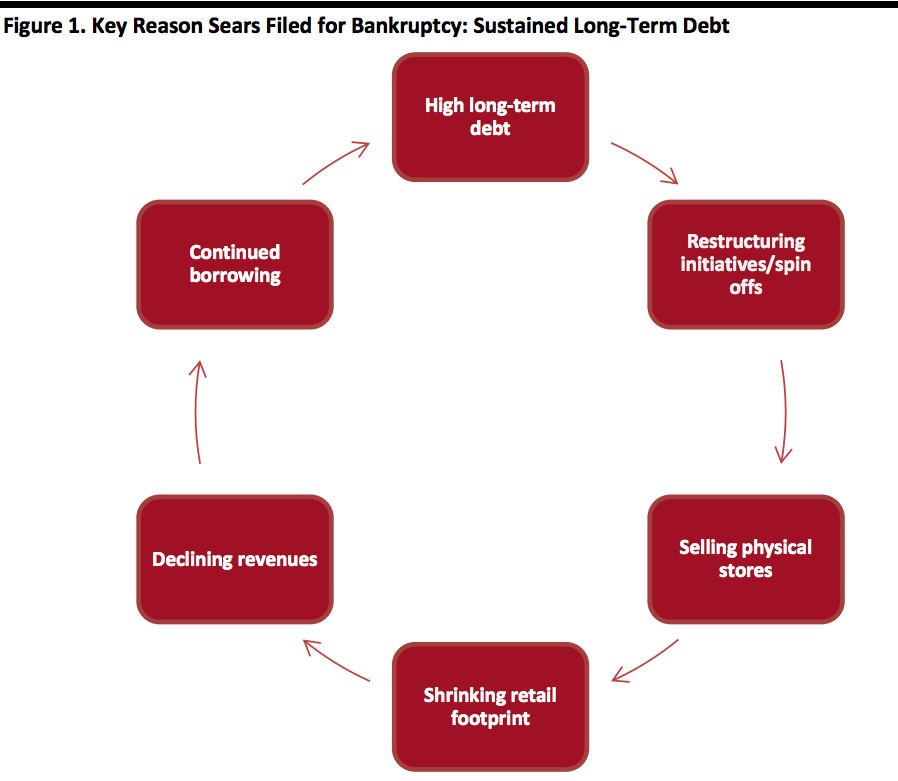

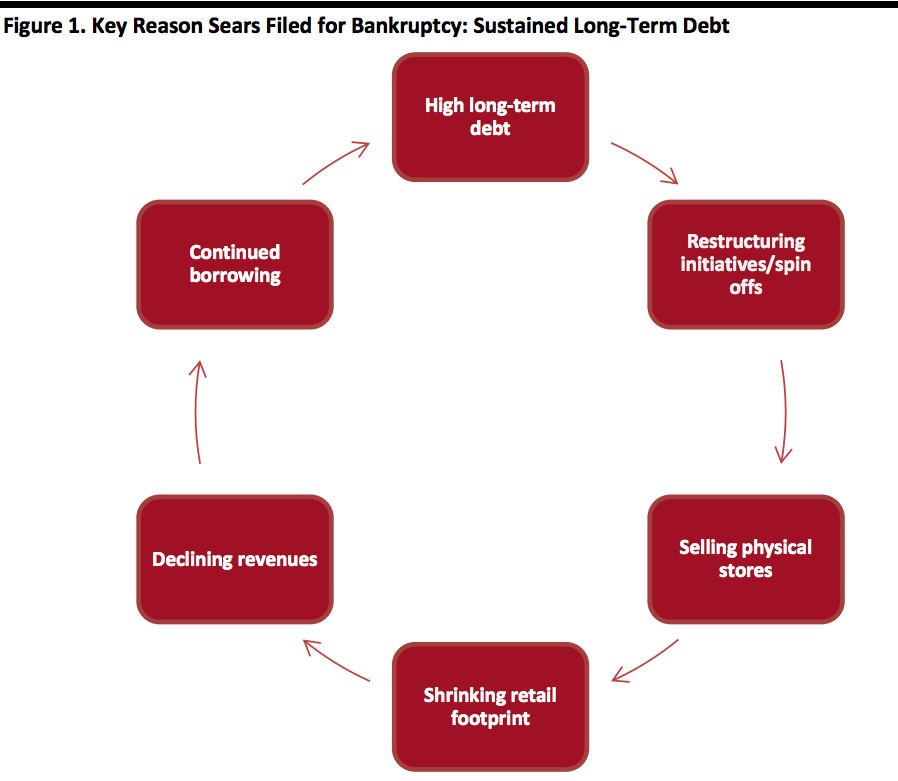

Not all debt is “bad,” but in the case of Sears, it was bad debt that led to its hastened downfall: Debts for which interest payments and the principal exceed future earnings. That, and poor management decisions such as lackluster investment and uninspiring management of existing stores, led to the slow but steady decline.

Sears sustained high levels of long-term debt, and restructuring is geared to reduce long-term debt than meaningful investments in remaining stores. This is not new, and also contributed to the company’s downfall: The majority of Sears divestments in the 10 years leading to 2000 were directed to restructuring debt. Moreover, the company did not service its long-term debt as quickly as it should have. Sears had long-term debt of $3.7 billion outstanding on April 29, 2017, and even after repayments, the debt remained unchanged at $3.7 billion as of August 4, 2018. In February 2016, rating agency Moody’s downgraded Sears’ long-term debt to Caa1 with a negative outlook from stable.

[caption id="attachment_95942" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Key Events Leading to the Decline of Sears

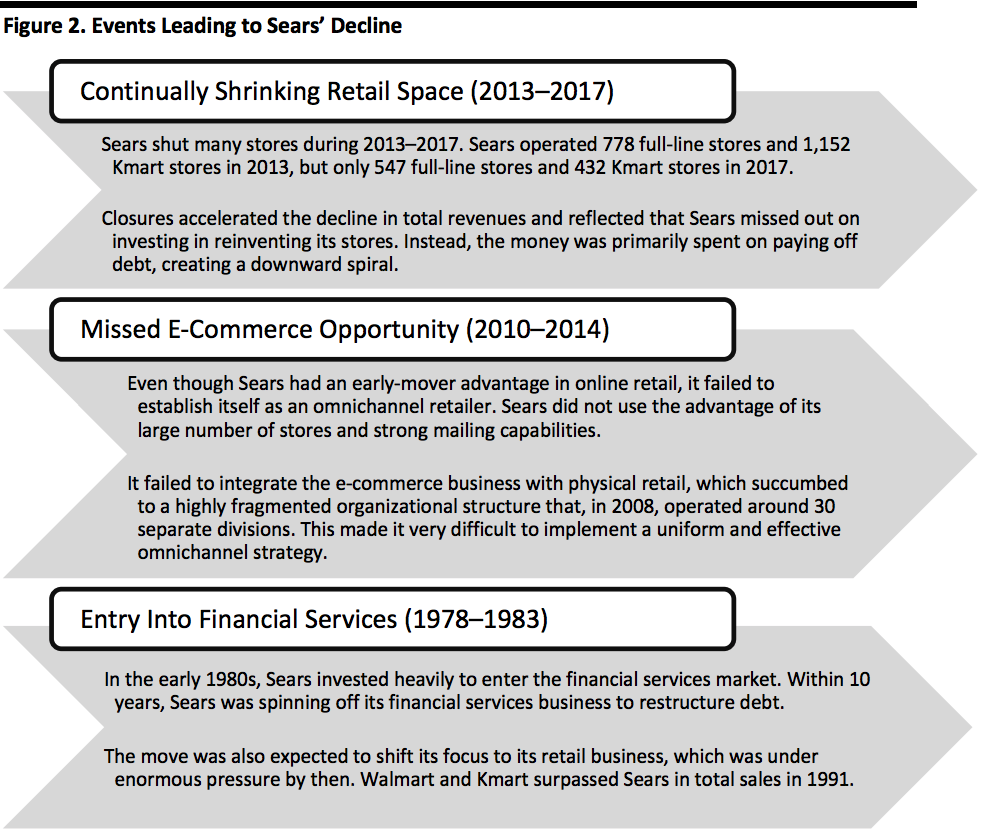

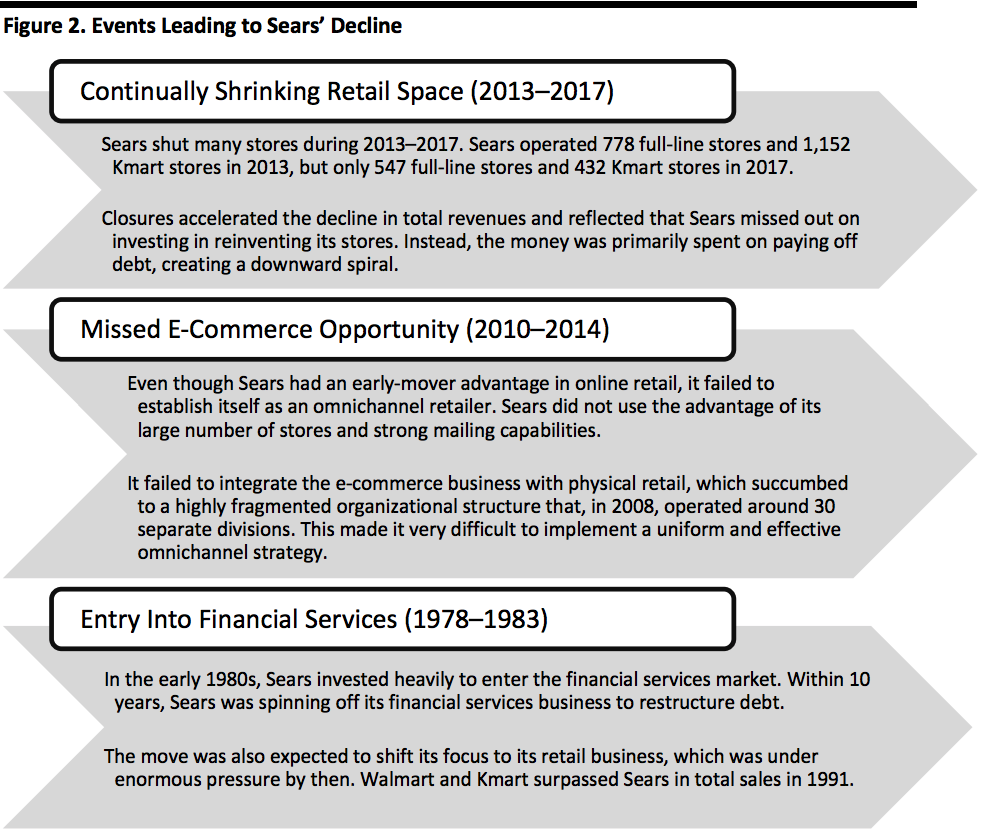

Sears slowdown started in the late 1970s when it diversified into financial services, and it has not been able to reverse the downward spiral since. Sears held onto financial services for only around 10 years, but this led to its retail business taking a hit. Sears’ market value shrank 66% in 1988, in comparison to its peak valuation in 1965. Sears could also not keep up with competitors, and its e-commerce strategy never took off. At a time when retailers such as Walmart, Macy’s and Target were extensively leveraging store space to integrate physical and digital business, Sears has been shutting stores.

Sears stores have not been able to keep pace with changing shopper preferences, especially around the store “experience.” The declining store footprint cost the company its revenue base while its shopper base now prefers shopping at discount stores. Sears lost its brand value, which it may never regain.

[caption id="attachment_95943" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Key Events Leading to the Decline of Sears

Sears slowdown started in the late 1970s when it diversified into financial services, and it has not been able to reverse the downward spiral since. Sears held onto financial services for only around 10 years, but this led to its retail business taking a hit. Sears’ market value shrank 66% in 1988, in comparison to its peak valuation in 1965. Sears could also not keep up with competitors, and its e-commerce strategy never took off. At a time when retailers such as Walmart, Macy’s and Target were extensively leveraging store space to integrate physical and digital business, Sears has been shutting stores.

Sears stores have not been able to keep pace with changing shopper preferences, especially around the store “experience.” The declining store footprint cost the company its revenue base while its shopper base now prefers shopping at discount stores. Sears lost its brand value, which it may never regain.

[caption id="attachment_95943" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Key Events Timeline at Sears

[wpdatatable id=22]

[caption]Source: Company reports/Coresight Research[/caption]

What We Think

By the time Sears entered bankruptcy, that process seemed inevitable given the long-term debt saddling the company. With so many resources diverted to debt servicing, little was left for strategic growth. As losses mounted, the company serviced debt by selling assets, eventually running out of the real estate and brands to spin off.

Lampert has been able to keep the business afloat but has not made it profitable. In our opinion, it will take a lot of investment and in-store innovation for the retailer to last three to five more years. This does not seem plausible given that Sears’ liabilities were almost 1.5 times its assets at the time of bankruptcy filing. may be a case of “too little too late” for Sears.

Source: Coresight Research[/caption]

Key Events Timeline at Sears

[wpdatatable id=22]

[caption]Source: Company reports/Coresight Research[/caption]

What We Think

By the time Sears entered bankruptcy, that process seemed inevitable given the long-term debt saddling the company. With so many resources diverted to debt servicing, little was left for strategic growth. As losses mounted, the company serviced debt by selling assets, eventually running out of the real estate and brands to spin off.

Lampert has been able to keep the business afloat but has not made it profitable. In our opinion, it will take a lot of investment and in-store innovation for the retailer to last three to five more years. This does not seem plausible given that Sears’ liabilities were almost 1.5 times its assets at the time of bankruptcy filing. may be a case of “too little too late” for Sears.

Source: Coresight Research[/caption]

Key Events Leading to the Decline of Sears

Sears slowdown started in the late 1970s when it diversified into financial services, and it has not been able to reverse the downward spiral since. Sears held onto financial services for only around 10 years, but this led to its retail business taking a hit. Sears’ market value shrank 66% in 1988, in comparison to its peak valuation in 1965. Sears could also not keep up with competitors, and its e-commerce strategy never took off. At a time when retailers such as Walmart, Macy’s and Target were extensively leveraging store space to integrate physical and digital business, Sears has been shutting stores.

Sears stores have not been able to keep pace with changing shopper preferences, especially around the store “experience.” The declining store footprint cost the company its revenue base while its shopper base now prefers shopping at discount stores. Sears lost its brand value, which it may never regain.

[caption id="attachment_95943" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Key Events Leading to the Decline of Sears

Sears slowdown started in the late 1970s when it diversified into financial services, and it has not been able to reverse the downward spiral since. Sears held onto financial services for only around 10 years, but this led to its retail business taking a hit. Sears’ market value shrank 66% in 1988, in comparison to its peak valuation in 1965. Sears could also not keep up with competitors, and its e-commerce strategy never took off. At a time when retailers such as Walmart, Macy’s and Target were extensively leveraging store space to integrate physical and digital business, Sears has been shutting stores.

Sears stores have not been able to keep pace with changing shopper preferences, especially around the store “experience.” The declining store footprint cost the company its revenue base while its shopper base now prefers shopping at discount stores. Sears lost its brand value, which it may never regain.

[caption id="attachment_95943" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Key Events Timeline at Sears

[wpdatatable id=22]

[caption]Source: Company reports/Coresight Research[/caption]

What We Think

By the time Sears entered bankruptcy, that process seemed inevitable given the long-term debt saddling the company. With so many resources diverted to debt servicing, little was left for strategic growth. As losses mounted, the company serviced debt by selling assets, eventually running out of the real estate and brands to spin off.

Lampert has been able to keep the business afloat but has not made it profitable. In our opinion, it will take a lot of investment and in-store innovation for the retailer to last three to five more years. This does not seem plausible given that Sears’ liabilities were almost 1.5 times its assets at the time of bankruptcy filing. may be a case of “too little too late” for Sears.

Source: Coresight Research[/caption]

Key Events Timeline at Sears

[wpdatatable id=22]

[caption]Source: Company reports/Coresight Research[/caption]

What We Think

By the time Sears entered bankruptcy, that process seemed inevitable given the long-term debt saddling the company. With so many resources diverted to debt servicing, little was left for strategic growth. As losses mounted, the company serviced debt by selling assets, eventually running out of the real estate and brands to spin off.

Lampert has been able to keep the business afloat but has not made it profitable. In our opinion, it will take a lot of investment and in-store innovation for the retailer to last three to five more years. This does not seem plausible given that Sears’ liabilities were almost 1.5 times its assets at the time of bankruptcy filing. may be a case of “too little too late” for Sears.