DIpil Das

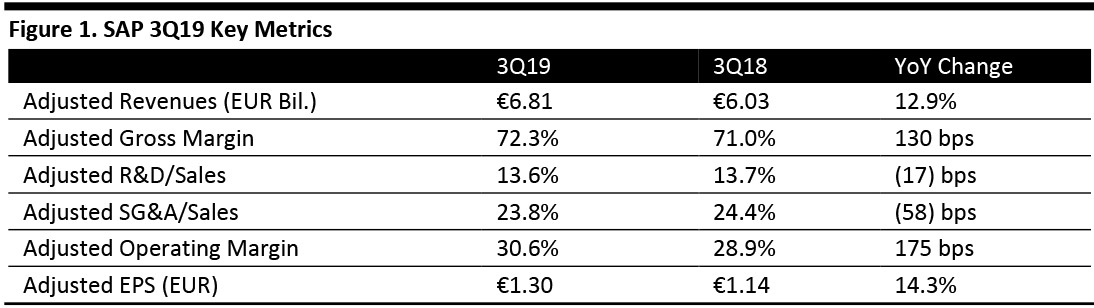

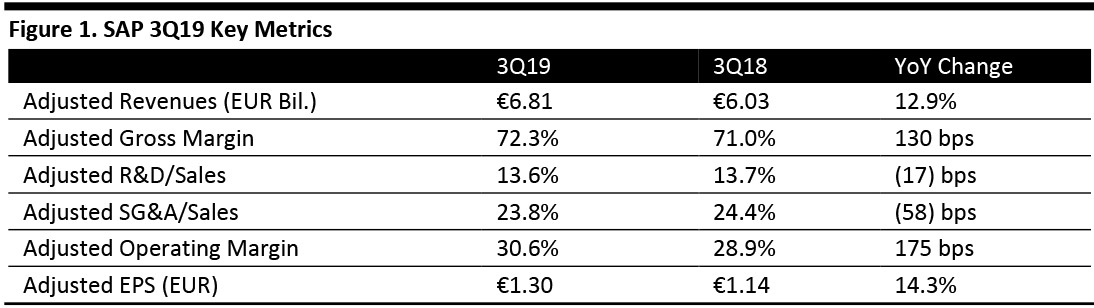

[caption id="attachment_98354" align="aligncenter" width="700"] Adjusted results are not compliant with International Financial Reporting Standards (IFRS)

Adjusted results are not compliant with International Financial Reporting Standards (IFRS)

Source: Company reports/Coresight Research [/caption] 3Q19 Results SAP reported adjusted 3Q19 revenues of €6.81 billion, up 12.9% year over year and in line with the pre-released figure. Adjusted EPS was €1.30, up 14.3% and beating the €1.19 consensus estimate. Reported EPS (which is compliant with International Financial Reporting Standards) was €1.04, compared to €0.81 in the year-ago quarter. On October 11, SAP announced that CEO Bill McDermott decided not to renew his contract and named Executive Board members Jennifer Morgan and Christian Klein as co-CEOs, effective immediately. McDermott will remain in an advisory capacity until the end of the year to aid the transition. Performance by Segment Applications, Technology & Services (AT&S) Revenues were €5.5 billion, up 9% year over year and up 6% in constant currency. Components of growth were the following:

Adjusted results are not compliant with International Financial Reporting Standards (IFRS)

Adjusted results are not compliant with International Financial Reporting Standards (IFRS) Source: Company reports/Coresight Research [/caption] 3Q19 Results SAP reported adjusted 3Q19 revenues of €6.81 billion, up 12.9% year over year and in line with the pre-released figure. Adjusted EPS was €1.30, up 14.3% and beating the €1.19 consensus estimate. Reported EPS (which is compliant with International Financial Reporting Standards) was €1.04, compared to €0.81 in the year-ago quarter. On October 11, SAP announced that CEO Bill McDermott decided not to renew his contract and named Executive Board members Jennifer Morgan and Christian Klein as co-CEOs, effective immediately. McDermott will remain in an advisory capacity until the end of the year to aid the transition. Performance by Segment Applications, Technology & Services (AT&S) Revenues were €5.5 billion, up 9% year over year and up 6% in constant currency. Components of growth were the following:

- SAP S/4HANA: The company’s enterprise resource planning (ERP) software for large companies optimized for its in-memory database HANA. SAP added 500 customers in the quarter, and adoption grew to more than 12,000 customers, up 25% year over year. Approximately 40% of the additional S/4HANA customers were net new customers.

- Human Capital Management Solutions: The company’s total workforce management platform for permanent and contingent labor, which includes the flagship SAP SuccessFactors Employee Central platform, added more than 150 customers in the quarter to hit 3,500 customers globally.

- Business Technology Platform: Includes a combination of SAP’s leading technologies such as SAP HANA, SAP Cloud Platform, SAP Data Warehouse Cloud, SAP Analytics Cloud, SAP Data Intelligence and SAP Intelligent Robotic Process Automation, all bundled into one single reference architecture. New customers include Nippon Express, Impossible Foods and Amazonas & Roraima Energia.

- SAP C/4HANA: Solutions that serve both B2C and B2B and enable businesses to manage the front office in real time, this function includes sales, commerce, service, customer and data. New customers include E.ON, Swift, and Cintac Mining.

- Experience Management Solutions (Qualtrics): With Qualtrics, SAP offers end-to-end operational power in 25 industries and to more than 11,100 customers. New customers include Slack Technologies, U-Haul, Sharper Image, Stanley Black & Decker, Garmin International and Dish Networks.

- New cloud bookings increased 39% year over year to €572 million and were up 51% excluding Infrastructure-as-a-Service (IaaS). A new partnership with Microsoft contributed 18 percentage points to the new cloud bookings growth, with a term of three years and revenue recognition starting in 4Q2019.

- IFRS cloud revenue hit nearly €1.8 billion, up 37%.

- More-predictable revenue grew by two percentage points year over year to 69% of total revenues.

- Adjusted cloud revenue of €6.7-7.0 billion (up 33-39%) and total adjusted cloud and software revenue of €22.4-22.7 billion (up 8.4-9.9%).

- Adjusted operating profit of €7.85-8.05 billion, up 9.5-12.5% (at constant currencies).

- Adjusted cloud revenue of €8.6-9.1 billion and total adjusted cloud and software revenue of €26.8-29.2 billion.

- Adjusted operating profit of €8.8-9.1 billion.

- Adjusted cloud revenue of about €15 billion and adjusted revenue of more than €35 billion.

- Adjusted operating margins by one percentage point a year, representing an expansion of 500 basis points to 39.5% from 34.3% in 2018.