DIpil Das

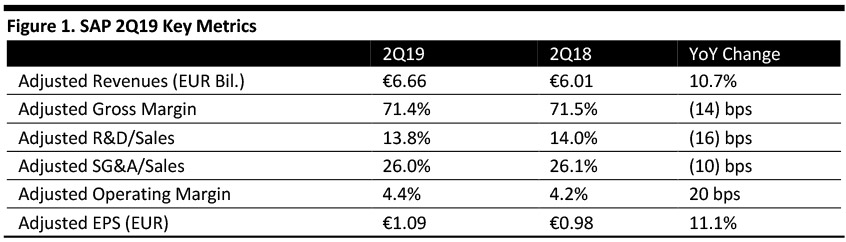

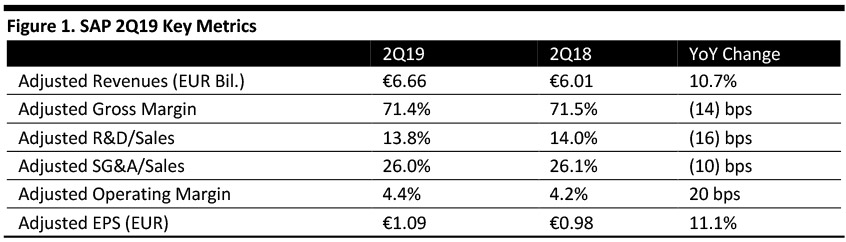

[caption id="attachment_93288" align="aligncenter" width="700"] Adjusted results are not compliant with International Financial Reporting Standards (IFRS)

Adjusted results are not compliant with International Financial Reporting Standards (IFRS)

Source: Company reports/Coresight Research[/caption] 2Q19 Results SAP reported 2Q19 adjusted revenues of €6.66 billion, up 10.7% year over year and missing the €6.71 billion consensus estimate. Adjusted EPS was €1.09, up 11.1% and missing the €1.11 consensus estimate. Reported EPS (which is compliant with International Financial Reporting Standards) was €0.48, compared to €0.60 in the year-ago quarter. Performance by Segment Applications, Technology & Services (AT&S) Revenues were €5.4 billion, up 6% year over year and up 4% in constant currency. Components of growth are the following:

Adjusted results are not compliant with International Financial Reporting Standards (IFRS)

Adjusted results are not compliant with International Financial Reporting Standards (IFRS)Source: Company reports/Coresight Research[/caption] 2Q19 Results SAP reported 2Q19 adjusted revenues of €6.66 billion, up 10.7% year over year and missing the €6.71 billion consensus estimate. Adjusted EPS was €1.09, up 11.1% and missing the €1.11 consensus estimate. Reported EPS (which is compliant with International Financial Reporting Standards) was €0.48, compared to €0.60 in the year-ago quarter. Performance by Segment Applications, Technology & Services (AT&S) Revenues were €5.4 billion, up 6% year over year and up 4% in constant currency. Components of growth are the following:

- SAP S/4HANA: The company’s enterprise resource planning (ERP) software for large companies optimized for its in-memory database HANA. SAP added 600 customers in the quarter, and adoption grew to more than 11,500 customers, up 29% year over year. Approximately 50% of the additional S/4HANA customers were net new customers.

- Human Capital Management Solutions: The company’s total workforce management platform for permanent and contingent labor, which includes the flagship SAP SuccessFactors Employee Central platform, added more than 180 customers in the quarter to hit 3,350 customers globally.

- SAP Leonardo: Combines cutting-edge technologies such as artificial intelligence (AI), machine learning, Internet of Things (IoT), big data, advanced analytics and blockchain technology. Patentes Talgo was a new customer, and Döhler GmbH went live.

- Digital Platform: Includes SAP Cloud Platform and SAP Data Management Solutions and facilitates new app development, extensions and integration. In the quarter, SAP launched HANA Cloud Services , which provides low total cost of ownership, elasticity, serverless principles, high availability, resilience and autonomous capabilities. New customers include the State of Illinois and Grupo Energia Bogota.

- SAP C/4HANA: Solutions that serve both B2C and B2B and enable businesses to manage the front office in real time, this function includes sales, commerce, service, customer and data. New customers include Aritzia, Hamburg Commercial Bank and NH Hotel Group.

- Experience Management Solutions (Qualtrics): With Qualtrics, SAP offers end-to-end operational power in 25 industries and more than 10,500 customers. New customers include Chalhoub Group and the US Department of State.

- IFRS cloud revenue hit nearly €1.7 billion, up 40%.

- More-predictable revenue grew by three percentage points to 69% of total revenues.

- Adjusted cloud revenue of €6.7-7.0 billion (up 33-39%) and total adjusted cloud and software revenue of €22.4-22.7 billion (up 8.4-9.9%).

- Adjusted operating profit of €7.85-8.05 billion (from €7.7-8.0 billion), up 9.5-12.5% (at constant currencies).

- Adjusted cloud revenue of €8.6-9.1 billion and total adjusted cloud and software revenue of €26.8-29.2 billion.

- Adjusted operating profit of €8.8-9.1 billion (from €8.5-9.0 billion).

- Adjusted cloud revenue of about €15 billion and adjusted revenue of more than €35 billion.

- Adjusted operating margins by one percentage point a year, representing an expansion of 500 basis points to 39.5% from 34.3% in 2018.