DIpil Das

On November 12, 2019, SAP held a well-attended annual capital markets day in its offices in the Hudson Yards area of New York City.

Implications for Retail

SAP is expanding beyond its origins in managing manufacturing to assemble what it calls the number one platform in enterprise experience management, which includes ERP, human capital management, supply-chain management, procurement and CRM. The merger with SAP gives Qualtrics a global platform and a platform for managing enterprise experiences.

Key Insights from the Meeting

The event began with introductions by the new Co-CEOs, who embarked on a listing tour following their appointment to solicit feedback from customers and investors.

Management outlined areas in which SAP can improve and grow:

Source: Company reports [/caption]

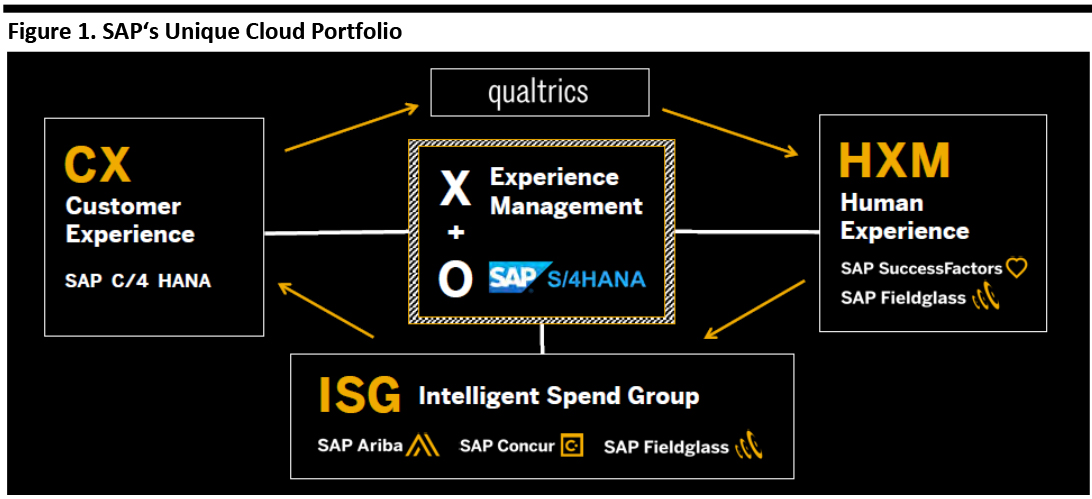

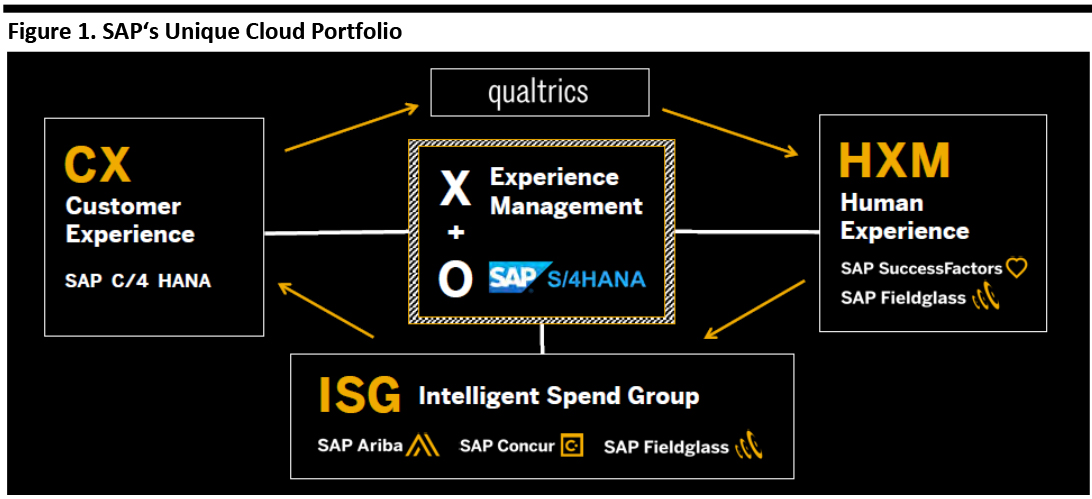

Within the portfolio, management highlighted the following components:

Source: Company reports [/caption]

Within the portfolio, management highlighted the following components:

Source: Company reports [/caption]

SAP’s Next Chapters: Growth and (Improved) Profitability

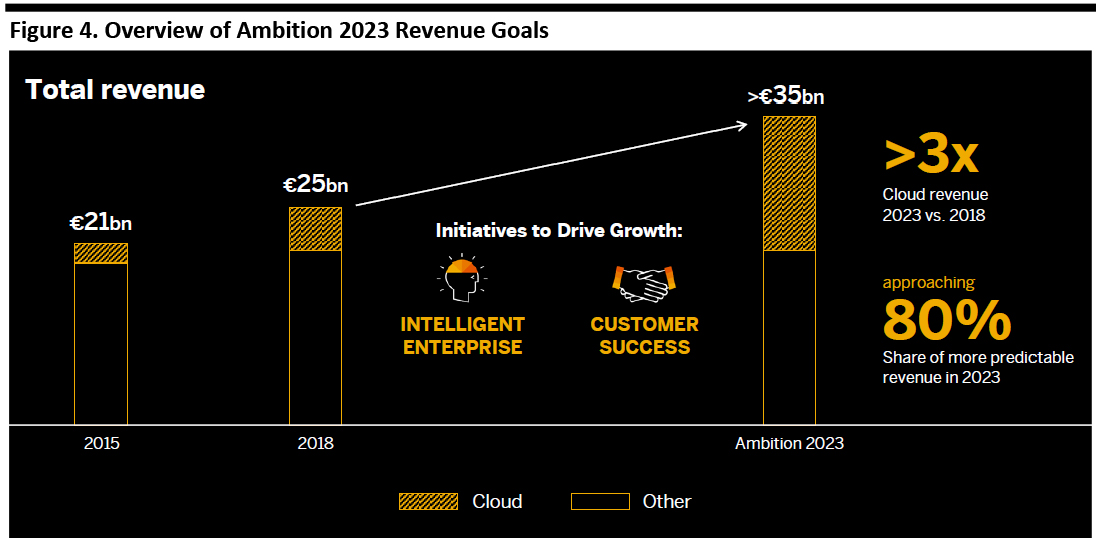

Management then turned to future growth drivers for the company: the cloud. Cloud revenue grew at a 30% CAGR during 2015-2018, and predictable revenue accounted for 65% of revenues in 2018.

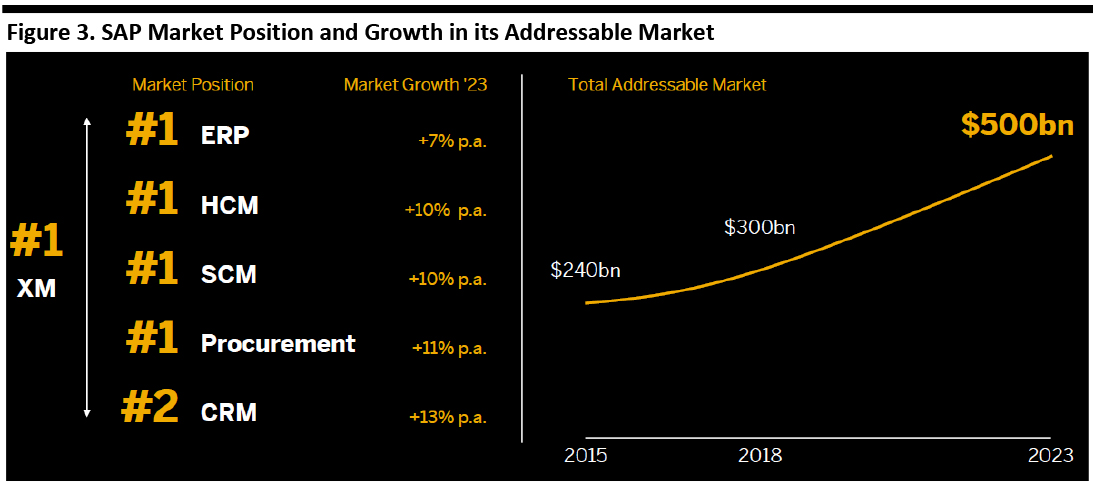

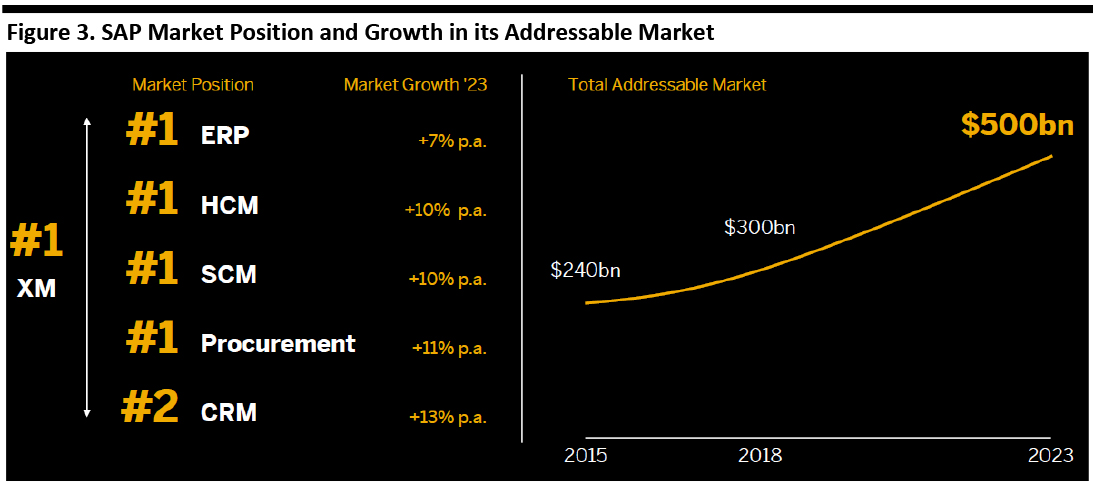

Management commented that SAP is in the right markets at the right time and lauded its strengths, claiming the number one position in experience management (XM). SAP expects its total addressable market to double in 2023 versus 2015.

[caption id="attachment_99579" align="aligncenter" width="700"]

Source: Company reports [/caption]

SAP’s Next Chapters: Growth and (Improved) Profitability

Management then turned to future growth drivers for the company: the cloud. Cloud revenue grew at a 30% CAGR during 2015-2018, and predictable revenue accounted for 65% of revenues in 2018.

Management commented that SAP is in the right markets at the right time and lauded its strengths, claiming the number one position in experience management (XM). SAP expects its total addressable market to double in 2023 versus 2015.

[caption id="attachment_99579" align="aligncenter" width="700"] Source: Company reports/Gartner/IDC[/caption]

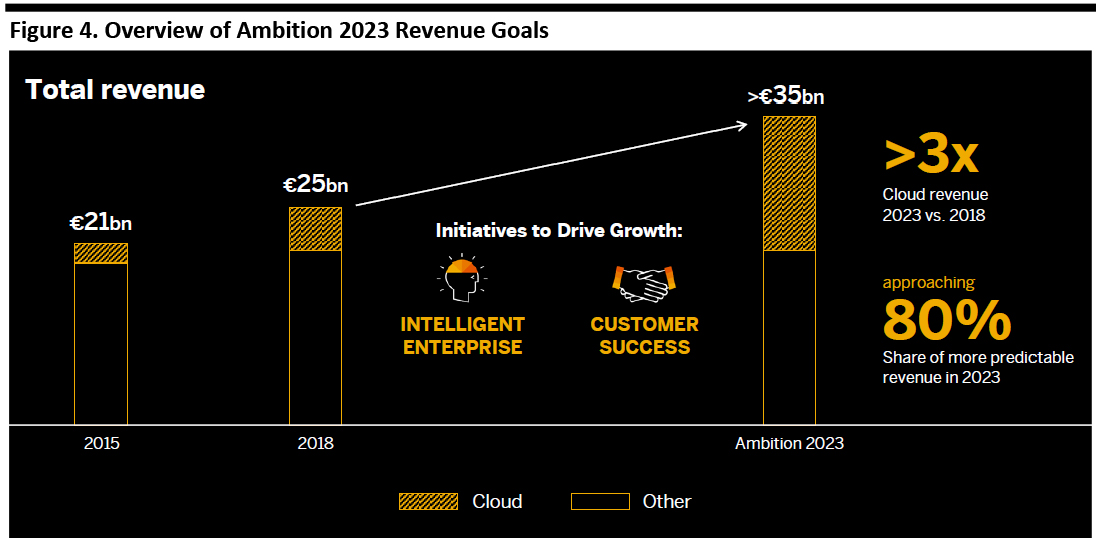

As part of its Ambition 2023 goals, SAP aims to hit €35 billion in revenue, including a more than tripling of cloud revenue during 2018-2023 and increasing the share of predictable revenue by 2023.

[caption id="attachment_99580" align="aligncenter" width="700"]

Source: Company reports/Gartner/IDC[/caption]

As part of its Ambition 2023 goals, SAP aims to hit €35 billion in revenue, including a more than tripling of cloud revenue during 2018-2023 and increasing the share of predictable revenue by 2023.

[caption id="attachment_99580" align="aligncenter" width="700"] Source: Company reports[/caption]

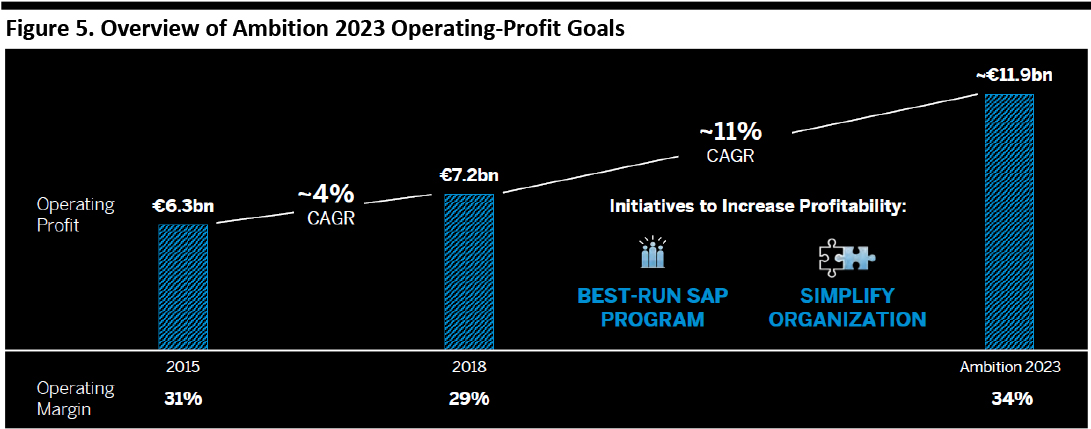

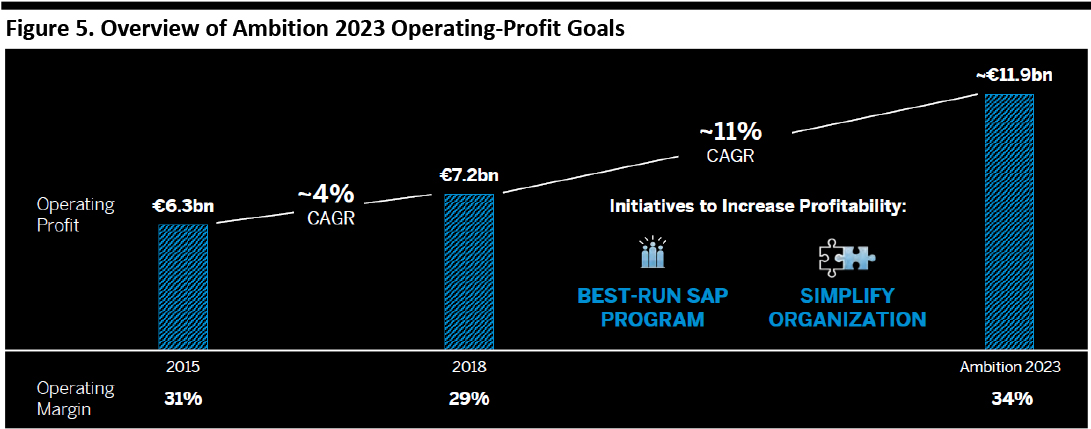

At is drives growth, SAP aims to improve profitability by reducing expenses, as part of the company’s goal to improve operating margins by one point per year, during 2018-2023, for five points total. If achieved, this steady margin increase would result in a 11% CAGR and €4.7 billion increase in operating profit during the period, as shown below.

[caption id="attachment_99581" align="aligncenter" width="700"]

Source: Company reports[/caption]

At is drives growth, SAP aims to improve profitability by reducing expenses, as part of the company’s goal to improve operating margins by one point per year, during 2018-2023, for five points total. If achieved, this steady margin increase would result in a 11% CAGR and €4.7 billion increase in operating profit during the period, as shown below.

[caption id="attachment_99581" align="aligncenter" width="700"] Source: Company reports[/caption]

Management outlined two sources of profit improvement:

Source: Company reports[/caption]

Management outlined two sources of profit improvement:

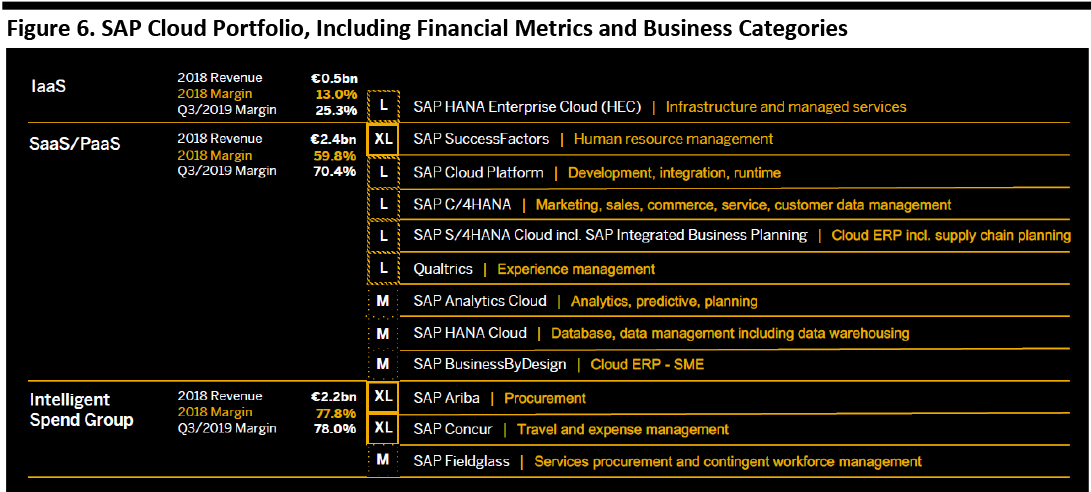

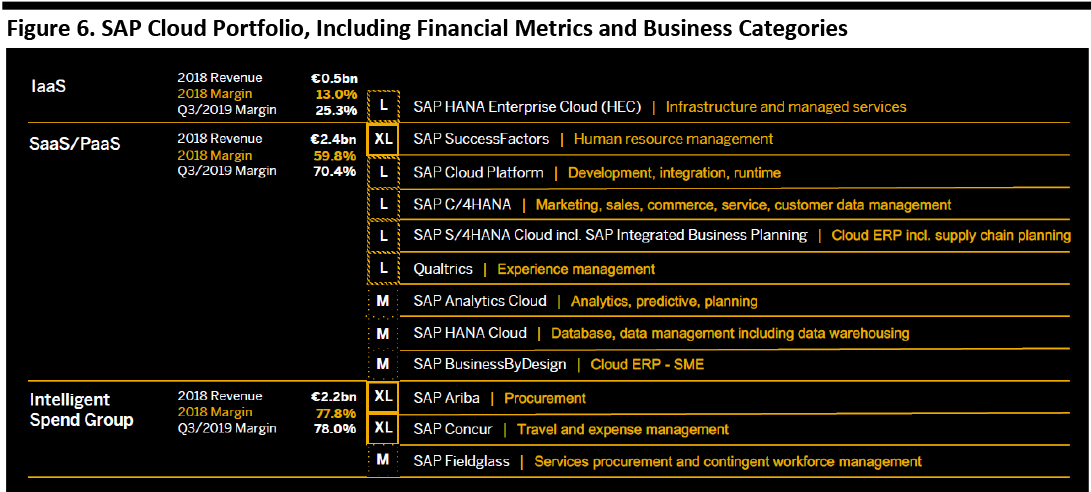

Note: XL = >€1 billion run rate, L = >€100 million run rate, M = <€100 million run rate Source: Company reports [/caption]

Qualtrics Update

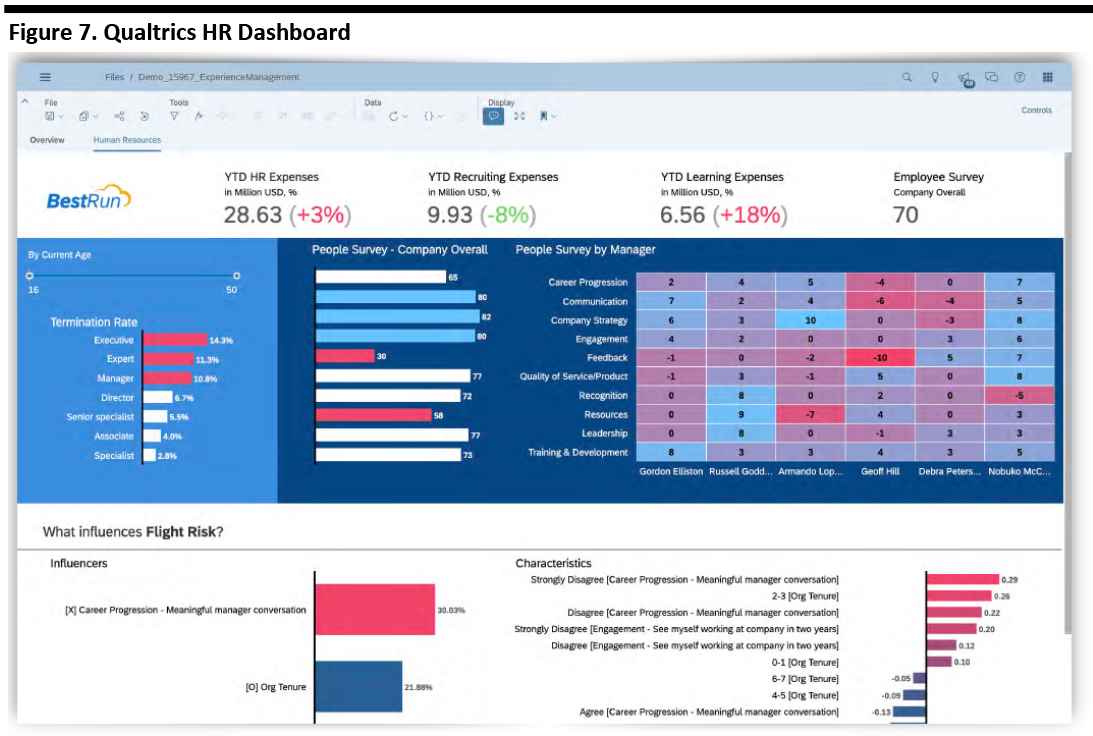

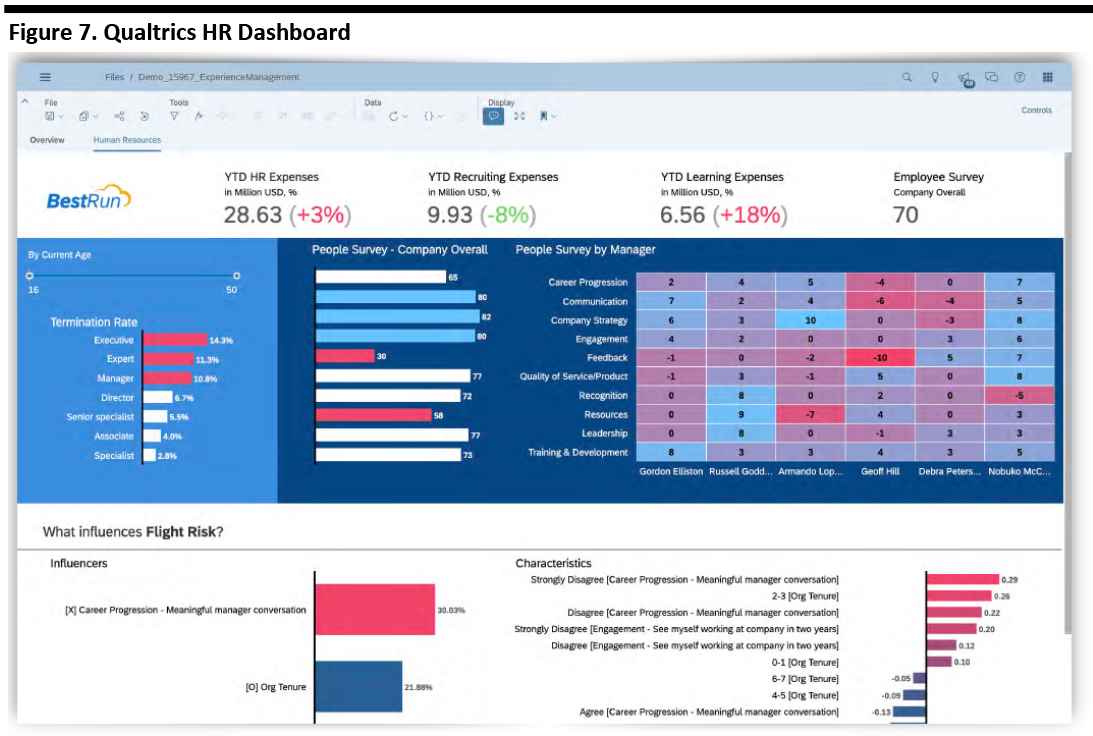

Management provided an update on Qualtrics, nearly a year after its acquisition, in January 2019, for $8 billion. The company offers a technology platform to collect, manage and act on experience data, used by teams, departments, and organizations to manage core business experiences: customer, product, employee and brand, all on one platform. At the time of the announcement, Qualtrics was days away from completing an IPO.

Since the acquisition:

Note: XL = >€1 billion run rate, L = >€100 million run rate, M = <€100 million run rate Source: Company reports [/caption]

Qualtrics Update

Management provided an update on Qualtrics, nearly a year after its acquisition, in January 2019, for $8 billion. The company offers a technology platform to collect, manage and act on experience data, used by teams, departments, and organizations to manage core business experiences: customer, product, employee and brand, all on one platform. At the time of the announcement, Qualtrics was days away from completing an IPO.

Since the acquisition:

Source: Company reports[/caption]

CFO Comments

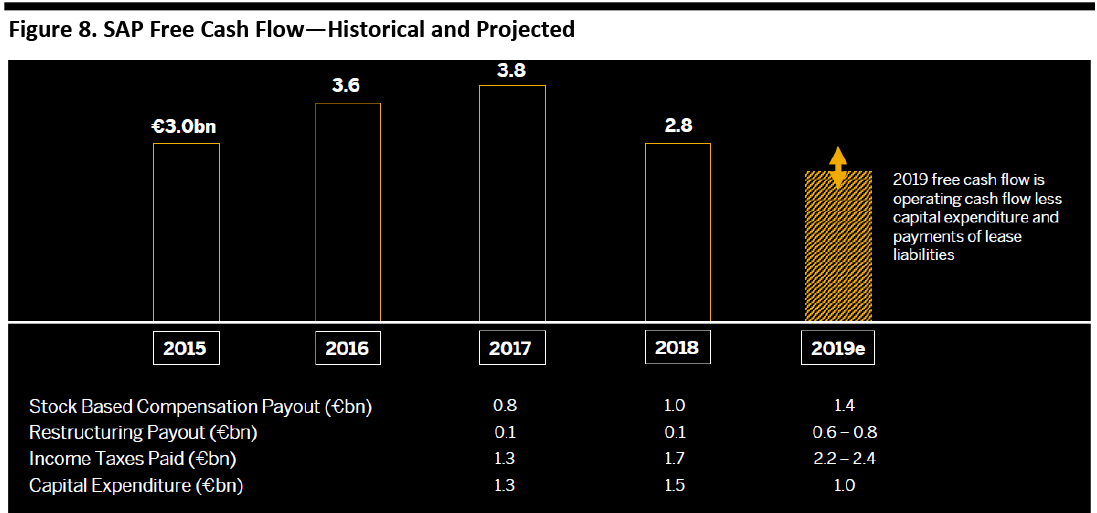

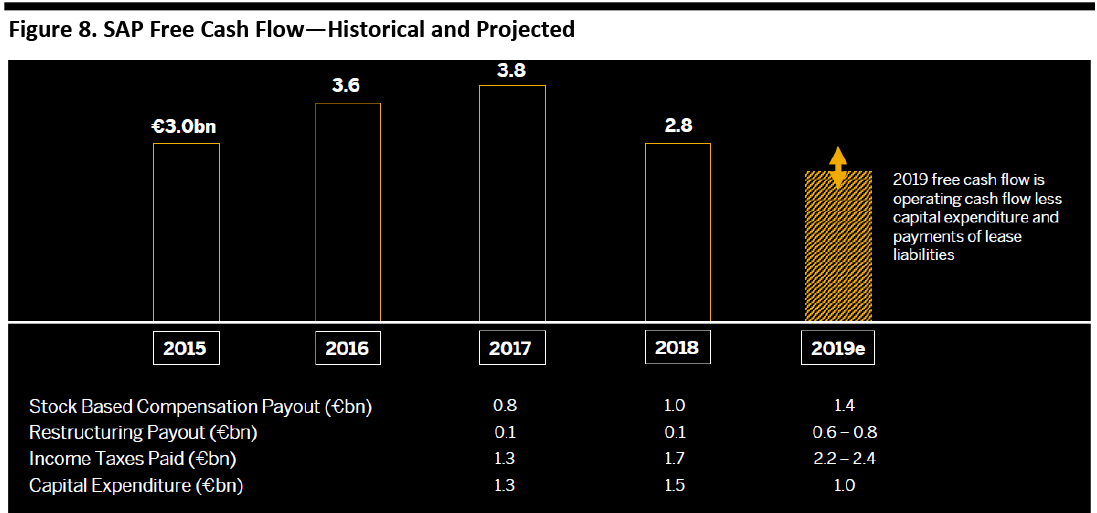

The figure below shows free cash flow from 2015-2019E.

[caption id="attachment_99584" align="aligncenter" width="700"]

Source: Company reports[/caption]

CFO Comments

The figure below shows free cash flow from 2015-2019E.

[caption id="attachment_99584" align="aligncenter" width="700"] Source: Company reports[/caption]

Management commented cash flow in 2020 onward should be higher due to higher profitability, lower stock compensation (which was elevated due to the Qualtrics acquisition), lower debt expense and lower capital expenditures due to leveraging hyperscale cloud-service platforms such as AWS, Alibaba Cloud, Microsoft Azure and the Google Cloud Platform.

Source: Company reports[/caption]

Management commented cash flow in 2020 onward should be higher due to higher profitability, lower stock compensation (which was elevated due to the Qualtrics acquisition), lower debt expense and lower capital expenditures due to leveraging hyperscale cloud-service platforms such as AWS, Alibaba Cloud, Microsoft Azure and the Google Cloud Platform.

- Starting and ending with the customer.

- Defining one set of priorities for the company.

- Ensuring focus based on clear priorities.

- Reviewing the business through three realities (market, product and financial).

- Driving accountability through focus.

Source: Company reports [/caption]

Within the portfolio, management highlighted the following components:

Source: Company reports [/caption]

Within the portfolio, management highlighted the following components:

- Qualtrics, which is expanding its list of more than 11,000 customers, driving synergies within the SAP portfolio and nearly doubling its list of more than $1 million customers.

- Human experience management (HXM), which consists of the SAP SuccessFactors (human capital management) and SAP Fieldglass (vendor management system) products.

- Customer experience (CX), which runs on the SAP C/4 HANA real-time ERP platform and combines X (experience) and O (operations) data for a single source of truth.

- Intelligent spend group (ISG), which includes SAP Ariba (procurement and supply chain), SAP Concur (expense management, travel and invoices) and SAP Fieldglass.

- The SAP + Microsoft partnership, which offers SAP S/4 HANA and the SAP Cloud Platform on Microsoft Azure.

Source: Company reports [/caption]

SAP’s Next Chapters: Growth and (Improved) Profitability

Management then turned to future growth drivers for the company: the cloud. Cloud revenue grew at a 30% CAGR during 2015-2018, and predictable revenue accounted for 65% of revenues in 2018.

Management commented that SAP is in the right markets at the right time and lauded its strengths, claiming the number one position in experience management (XM). SAP expects its total addressable market to double in 2023 versus 2015.

[caption id="attachment_99579" align="aligncenter" width="700"]

Source: Company reports [/caption]

SAP’s Next Chapters: Growth and (Improved) Profitability

Management then turned to future growth drivers for the company: the cloud. Cloud revenue grew at a 30% CAGR during 2015-2018, and predictable revenue accounted for 65% of revenues in 2018.

Management commented that SAP is in the right markets at the right time and lauded its strengths, claiming the number one position in experience management (XM). SAP expects its total addressable market to double in 2023 versus 2015.

[caption id="attachment_99579" align="aligncenter" width="700"] Source: Company reports/Gartner/IDC[/caption]

As part of its Ambition 2023 goals, SAP aims to hit €35 billion in revenue, including a more than tripling of cloud revenue during 2018-2023 and increasing the share of predictable revenue by 2023.

[caption id="attachment_99580" align="aligncenter" width="700"]

Source: Company reports/Gartner/IDC[/caption]

As part of its Ambition 2023 goals, SAP aims to hit €35 billion in revenue, including a more than tripling of cloud revenue during 2018-2023 and increasing the share of predictable revenue by 2023.

[caption id="attachment_99580" align="aligncenter" width="700"] Source: Company reports[/caption]

At is drives growth, SAP aims to improve profitability by reducing expenses, as part of the company’s goal to improve operating margins by one point per year, during 2018-2023, for five points total. If achieved, this steady margin increase would result in a 11% CAGR and €4.7 billion increase in operating profit during the period, as shown below.

[caption id="attachment_99581" align="aligncenter" width="700"]

Source: Company reports[/caption]

At is drives growth, SAP aims to improve profitability by reducing expenses, as part of the company’s goal to improve operating margins by one point per year, during 2018-2023, for five points total. If achieved, this steady margin increase would result in a 11% CAGR and €4.7 billion increase in operating profit during the period, as shown below.

[caption id="attachment_99581" align="aligncenter" width="700"] Source: Company reports[/caption]

Management outlined two sources of profit improvement:

Source: Company reports[/caption]

Management outlined two sources of profit improvement:

- Transformation to an intelligent enterprise: Driving further cloud gross-margin expansion, implementing process automation and optimization and removing overlaps in the product portfolio.

- Simplifying the organization: Simplifying SAP’s face to the customer, removing overlapping functions and making the company less hierarchical.

Note: XL = >€1 billion run rate, L = >€100 million run rate, M = <€100 million run rate Source: Company reports [/caption]

Qualtrics Update

Management provided an update on Qualtrics, nearly a year after its acquisition, in January 2019, for $8 billion. The company offers a technology platform to collect, manage and act on experience data, used by teams, departments, and organizations to manage core business experiences: customer, product, employee and brand, all on one platform. At the time of the announcement, Qualtrics was days away from completing an IPO.

Since the acquisition:

Note: XL = >€1 billion run rate, L = >€100 million run rate, M = <€100 million run rate Source: Company reports [/caption]

Qualtrics Update

Management provided an update on Qualtrics, nearly a year after its acquisition, in January 2019, for $8 billion. The company offers a technology platform to collect, manage and act on experience data, used by teams, departments, and organizations to manage core business experiences: customer, product, employee and brand, all on one platform. At the time of the announcement, Qualtrics was days away from completing an IPO.

Since the acquisition:

- The number of Qualtrics clients increased to 11,000 from 10,000.

- The number of $100,000 customers grew almost 50% and is approaching 1,000.

- The number of $1 million customers almost doubled.

- The speed of client adoption increased 20%.

- About one third of the Qualtrics R4Q pipeline featured a contribution from SAP.

Source: Company reports[/caption]

CFO Comments

The figure below shows free cash flow from 2015-2019E.

[caption id="attachment_99584" align="aligncenter" width="700"]

Source: Company reports[/caption]

CFO Comments

The figure below shows free cash flow from 2015-2019E.

[caption id="attachment_99584" align="aligncenter" width="700"] Source: Company reports[/caption]

Management commented cash flow in 2020 onward should be higher due to higher profitability, lower stock compensation (which was elevated due to the Qualtrics acquisition), lower debt expense and lower capital expenditures due to leveraging hyperscale cloud-service platforms such as AWS, Alibaba Cloud, Microsoft Azure and the Google Cloud Platform.

Source: Company reports[/caption]

Management commented cash flow in 2020 onward should be higher due to higher profitability, lower stock compensation (which was elevated due to the Qualtrics acquisition), lower debt expense and lower capital expenditures due to leveraging hyperscale cloud-service platforms such as AWS, Alibaba Cloud, Microsoft Azure and the Google Cloud Platform.