DIpil Das

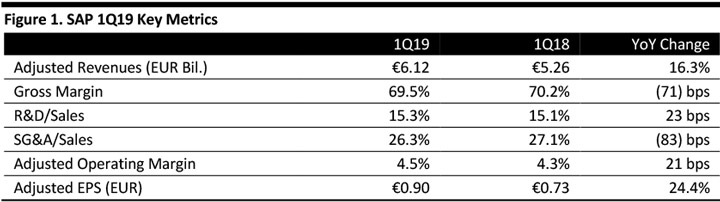

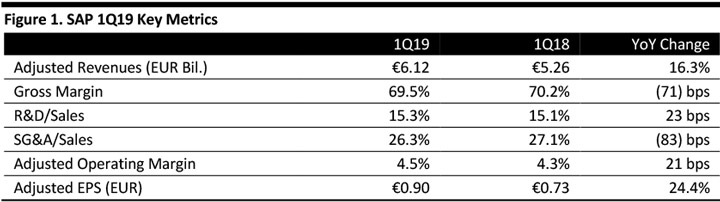

[caption id="attachment_85184" align="aligncenter" width="720"] Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Adjusted results are non-International Financial Reporting Standards (IFRS) [/caption] 1Q19 Results SAP reported 1Q19 revenues of €6.12 billion, up 16.3% year over year and beating the €5.95 billion consensus estimate. Reported results were hurt by €886 million for restructuring in 2019, as well as acquisition-related charges and stock compensation from the Qualtrics acquisition (which closed January 23). Adjusted EPS was €0.90, up 24.4% and beating the €0.83 consensus estimate. Reported (International Financial Reporting Standards) EPS was €(0.10), compared to €0.59 in the year-ago quarter Performance by Segment Revenues in the company’s applications, technology & services (AT&S) business were €4.99 billion, up 12% year over year and up 9% in constant currencies. Contributors to growth included the following:

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Adjusted results are non-International Financial Reporting Standards (IFRS) [/caption] 1Q19 Results SAP reported 1Q19 revenues of €6.12 billion, up 16.3% year over year and beating the €5.95 billion consensus estimate. Reported results were hurt by €886 million for restructuring in 2019, as well as acquisition-related charges and stock compensation from the Qualtrics acquisition (which closed January 23). Adjusted EPS was €0.90, up 24.4% and beating the €0.83 consensus estimate. Reported (International Financial Reporting Standards) EPS was €(0.10), compared to €0.59 in the year-ago quarter Performance by Segment Revenues in the company’s applications, technology & services (AT&S) business were €4.99 billion, up 12% year over year and up 9% in constant currencies. Contributors to growth included the following:

- SAP S/4HANA: The company’s enterprise resource planning (ERP) software for large companies optimized for its in-memory database HANA. Adoption grew 30% to more than 10,900 customers, and 40% of new customers in the quarter were first-time customers. Puma and German bank Banksparkasse Schwäbisch Hall started running on the platform during the quarter.

- Human Capital Management Solutions: The company’s total workforce management platform for permanent and contingent labor, which includes the flagship SAP SuccessFactors Employee Central platform, added more than 150 customers in the quarter to hit 3,200 customers globally.

- SAP Leonardo: Combines cutting-edge technologies such as artificial intelligence (AI), machine learning, Internet of Things (IoT), big data, advanced analytics and blockchain technology. New customers included Bumble Bee Foods and Premier Foods.

- Digital Platform: Includes SAP Cloud Platform and SAP Data Management Solutions and facilitates new app development, extensions and integration. New customers include Kontinental Hockey League.

- SAP C/4HANA: Solutions that serve both B2C and B2B and enable businesses to manage the front office in real time, this function includes sales, commerce, service, customer and data. Customers include Isuzu Motors South Africa, Groupe PSA Brazil and AmerisourceBergen.

- Experience Management Solutions (Qualtrics): With the acquisition of Qualtrics, SAP bought a business that combines experience management with end-to-end operational power to focus on four key areas: brand, customer, product and employee. New customers in the quarter include CVS Health and Cirque de Soleil.

- Reiterated adjusted cloud revenue of €6.7-7.0 billion (up 33-39%).

- Reiterated total adjusted cloud and software revenue of €22.4-22.7 billion (up 8.4-9.9%).

- Raised adjusted operating profit to €7.85-8.05 billion (from €7.7-8.0 billion), up 9.5-12.5% (at constant currencies).

- Reiterated adjusted cloud revenue of €8.6-9.1 billion.

- Reiterated total adjusted cloud and software revenue of €26.8-29.2 billion.

- Raised adjusted operating profit to €8.8-9.1 billion (from €8.5-9.0 billion).

- Adjusted cloud revenue of about €15 billion.

- Adjusted revenue of more than €35 billion.