Source: Company reports/Fung Global Retail & Technology

FY16 Results

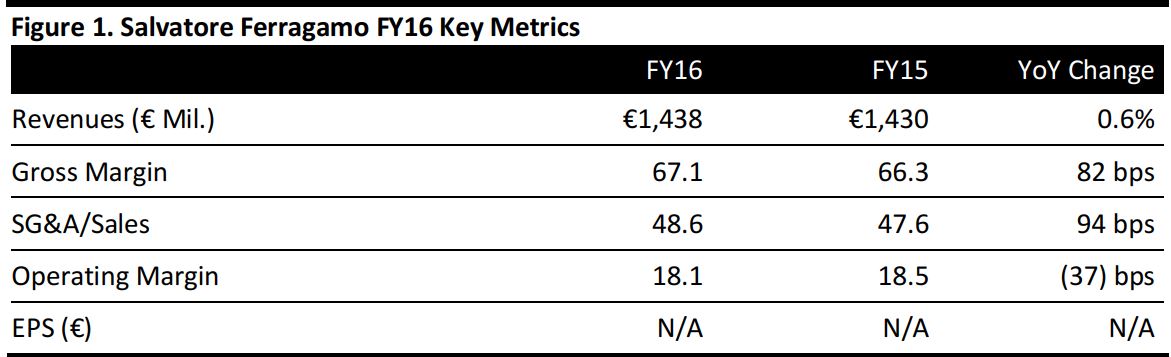

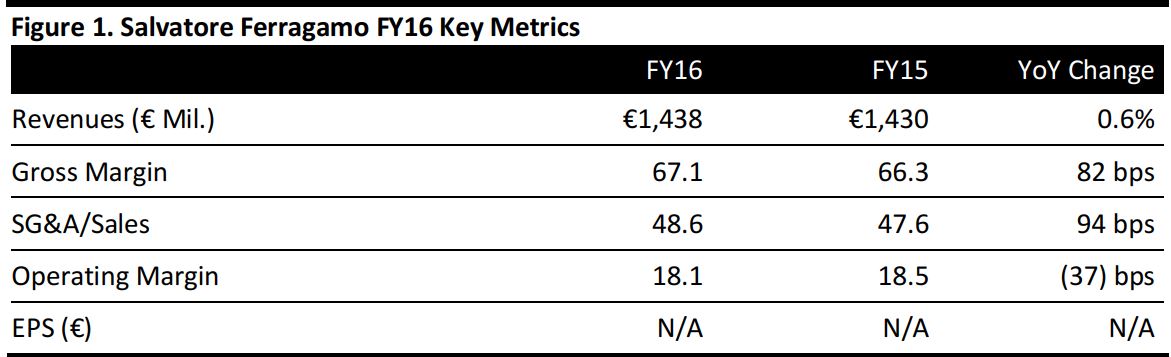

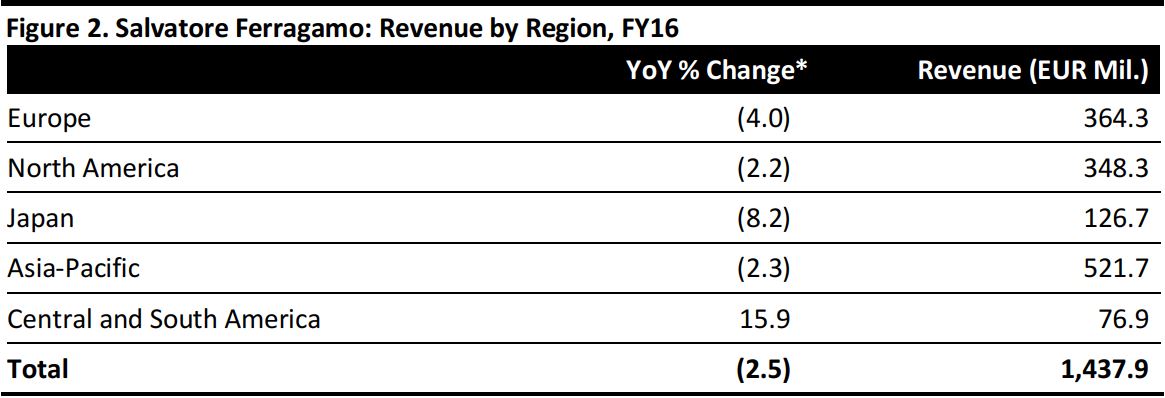

Salvatore Ferragamo posted FY16 revenue growth of just 0.6% as reported, or down 2.5% at constant exchange rates. This was broadly in line with analysts’ expectations, but was nevertheless disappointing, particularly in relation to high-end rivals such as Kering, which recently posted FY16 revenue growth of 6.9%. Weakness was seen across almost all regions and product categories.

Salvatore Ferragamo’s top line did improve sequentially, with 4Q16 revenues growing by 4%, or by 2% at constant exchange rates.

Expenses “linked to the management change process” were blamed for a 3.1% increase in FY16 operating costs. This disproportionate increase meant that the operating margin contracted to 18.1% from 18.5% the prior year and that operating profit came in a little behind expectations.

A substantial reduction in the tax rate, from 30.6% in FY15 to 19.3% in FY16, prompted a one-off jump in net profit, despite the weak performance in the line items noted above.The decline in the tax rate was attributed to the company opting for the “Patent Box regime,” which is a tax relief for firms that license intellectual properties to third parties. This means that Salvatore Ferragamo will have a lower tax rate until 2019, when the company can file for a five-year renewal. The company noted the following:

For fiscal year 2015, the tax benefit is calculated exempting from taxation 30% of the income attributable to the use of intangibles that fall within the scope of the regime; for fiscal year 2016, the quota shall be equal to 40%; and for fiscal years 2017–2019, equal to 50%. The tax benefit for both fiscal years 2015 and 2016, estimated in ca. 32 million euros, has been accounted for in the financial statements for year 2016 and will be used in one go for the payment of the income taxes due for the same year.

The company does not report EPS.

Performance by Region

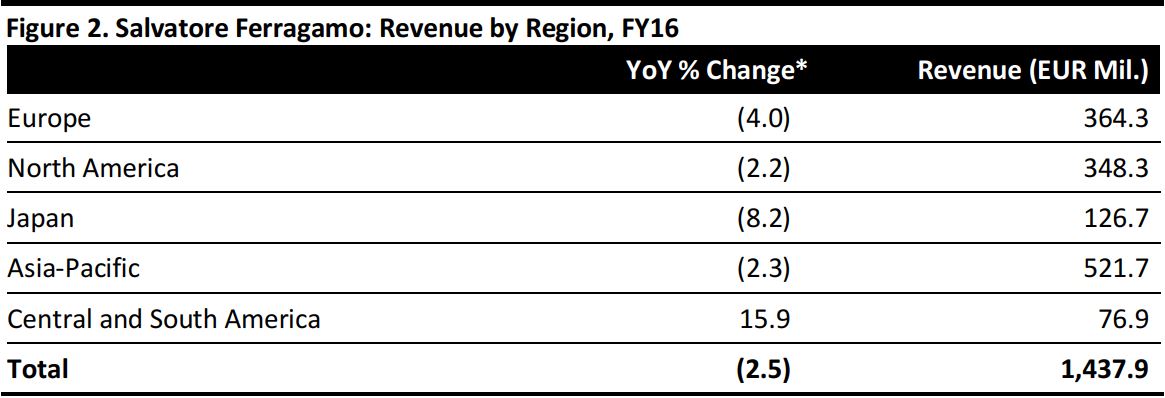

The company saw a weak year across all regions except Central and South America:

- The decline in Europe was attributed to lower tourist flows as a result of terrorist attacks.

- The company said the weak performance in North America was due to the strong dollar hitting tourist numbers. The region improved in 4Q16.

- In the Asia-Pacific region, the company noted the “still weak business in Hong Kong, which remained negative.”

- The Japan, Asia-Pacific, and Central and South America regions all saw growth improve in the final quarter.

Source: Company reports/Fung Global Retail & Technology

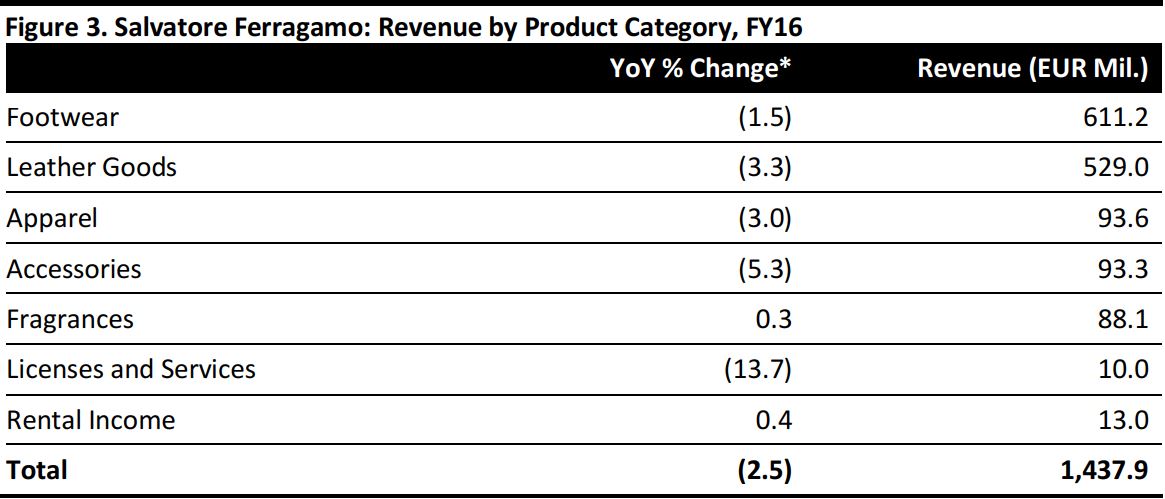

Performance by Segment

In FY16, the retail distribution channel posted consolidated revenues that were up by 2.3% as reported, but down 0.8% at constant exchange rates.

The wholesale channel saw revenues decline by 2.1% as reported and decline by 5.1% at constant exchange rates.

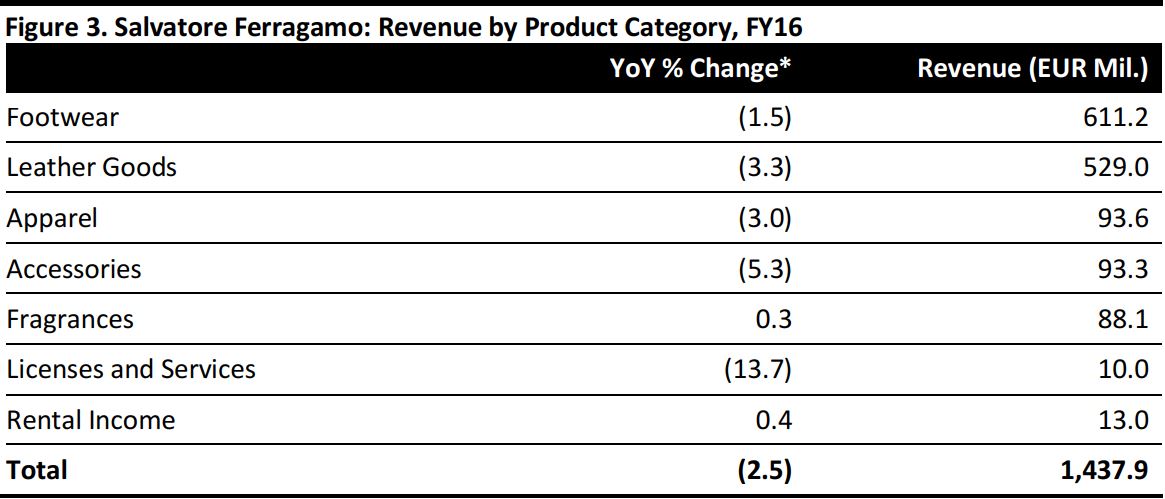

It was a disappointing year across almost all product categories, as shown in the table below.

Source: Company reports/Fung Global Retail & Technology

Outlook

The company offered no guidance beyond stating that“the Salvatore Ferragamo brand positioning, the consolidated international presence and the new planned activities may confirm expectations for another positive year.”

For FY17, analysts expect revenue to increase by 4.8%, EBIT to increase by 7.2% and net profit to increase by 5.9%. These estimates were collated before the latest results were reported.