Source: Company reports/Fung Global Retail & Technology

9M16 RESULTS

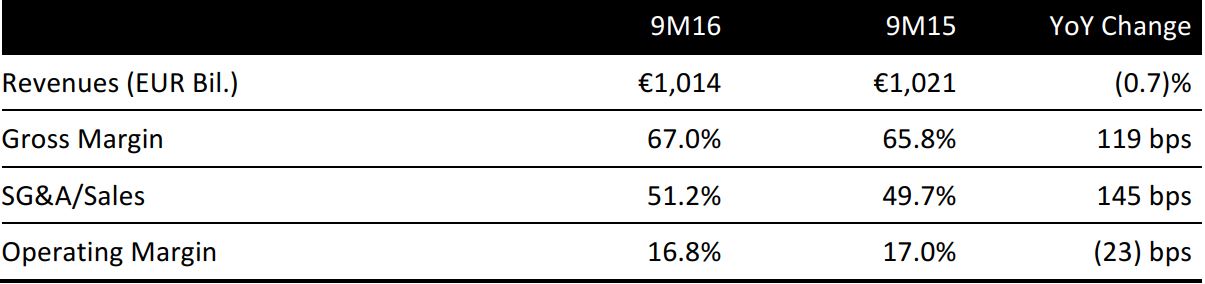

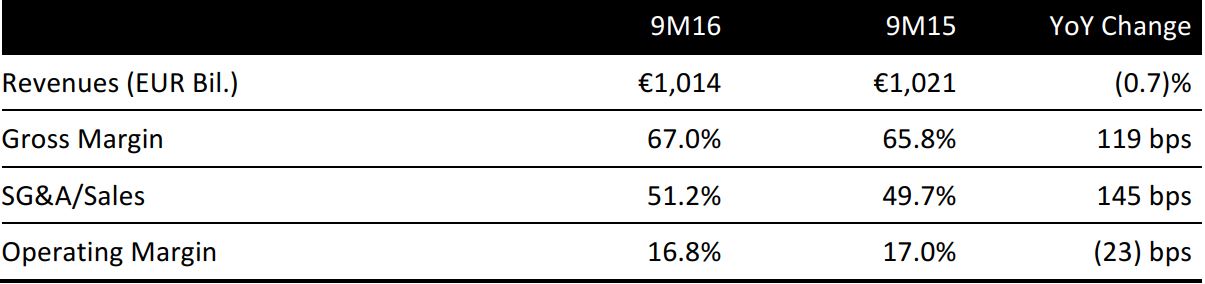

Luxury group Salvatore Ferragamo reported 9M16 revenues of €1,014 million, virtually in line with the consensus estimate of €1,017 million.

Operating costs rose by 2.2%, in part due to managerial charges pushing costs up by 7% in 3Q16. Dwindling sales and higher costs resulted in operating margins slipping by 23 basis points.

Pretax profit fell by 3.9%, coming in at €158 million, below consensus of €165 million. Similarly, net income of €110 million was below the expected €115 million.

The company did not report earnings per share.

PERFORMANCE BY SEGMENT

All data below are at constant exchange rates.

By region, the company noted the following revenue trends in 9M16:

- Europe fell by 4.8% and the US fell by 3.9%.

- Japan tumbled 9.1% while the rest of the Asia-Pacific region, which is the largest contributor to group sales, dropped 4.1%. The company observed that “business in Hong Kong remained negative, even if less negative than in the past,” while Chinese revenues were up 3%, including an acceleration in 3Q16.

- These declines were only partially offset by a 12.8% jump in Central and South America; this region contributed just 5% of group revenues.

By channel, the company reported the following:

- Retail sales fell by 2.1%. Retail sales contributed 63% of group revenues.

- Wholesale revenues declined by 7.3%, mirroring the weak wholesale performances reported by other luxury firms in recent months, including Burberry last week. Wholesale contributed 35% of group revenue.

- Revenue from licenses and services fell by 4.5%, while rental income grew by 0.1%. These segments each contributed 1% or less of group revenue.

Finally, by product category, Salvatore Ferragamo noted the following revenue performances:

- Footwear sales fell by 2.7%. Footwear is the company’s largest category, contributing 43% of revenue.

- Leather goods sales declined by 4.7%, and contributed 36% of total revenue.

- Apparel sales and accessories sales each slid by 7.0%.

- Fragrances declined by 3.0%.

3Q16 RESULTS

The company provided only a top-line update for the third quarter:

- Total revenues rose by 1.7%, to €304 million, but at constant exchange rates, revenues fell by 6.2%. Analysts had penciled in revenues of €307 million.

- At constant exchange rates, the retail business grew revenues by 0.1% in 3Q16, a better performance than in 1H16. However, wholesale fell sharply, by 18.6%, and this marked a severe sequential weakening from a 3.0% decline in 1H16.

- Europe saw retail sales fall by 6% and wholesale revenues fall by 12%. Wholesale weakened from 1H16.

- North America posted a total revenue decline of 7% at constant exchange rates, with wholesale plunging 26% and retail up 7%.

- Asia-Pacific ex Japan revenues were down 3% in 3Q16. In Hong Kong, retail declines eased to (15)% from (24)% in 1H16, at constant exchange rates. In China, retail revenue growth accelerated to 11% in 3Q16, at constant exchange rates. No wholesale figures were provided for these regions.

- Japan revenues fell by 17% at constant exchange rates, with the company noting demanding comparatives from 3Q15. No wholesale/retail split was provided.

- Central and South America revenues jumped 15% at constant exchange rates. No wholesale/retail split was provided.

OUTLOOK

The company offered no guidance. For FY16, analysts expect total revenues to nudge up 0.6%, to €1.44 billion. Consensus calls for EBIT to rise by 2.3% and GAAP EPS to climb by 3.7%, according to S&P Capital IQ.