DIpil Das

[caption id="attachment_95124" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

2Q20 Results

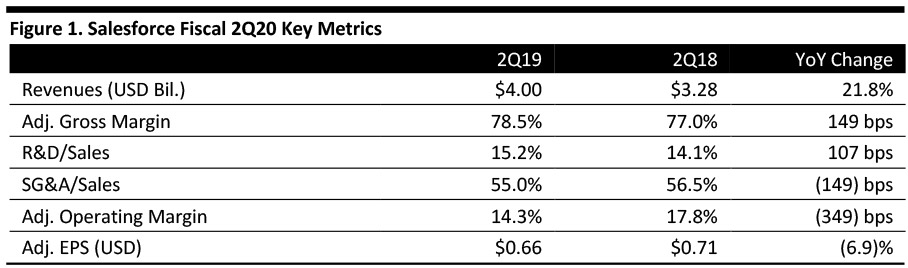

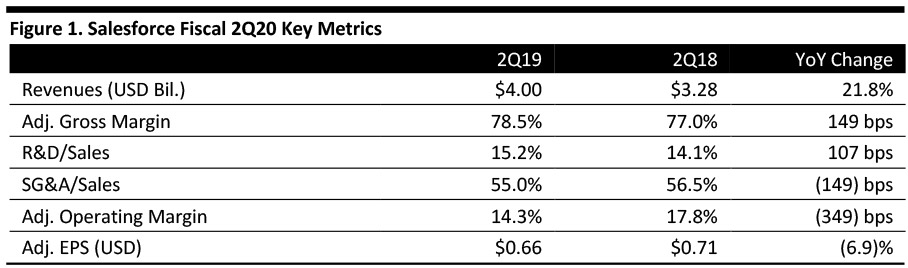

Salesforce reported fiscal 2Q20 revenues of $4.00 billion, up 21.8% (up 23% in constant currency) and in line with the $3.96 billion consensus estimate.

Adjusted EPS was $0.66,down 6.9% year over year and beating the $0.47 consensus estimate. This figure includes adjustments for stock compensation expense, amortization of intangibles and the resulting income-tax effects. GAAP EPS was $0.11, compared with $0.39 in the year-ago quarter.

Results by Segment

By type:

Source: Company reports/Coresight Research[/caption]

2Q20 Results

Salesforce reported fiscal 2Q20 revenues of $4.00 billion, up 21.8% (up 23% in constant currency) and in line with the $3.96 billion consensus estimate.

Adjusted EPS was $0.66,down 6.9% year over year and beating the $0.47 consensus estimate. This figure includes adjustments for stock compensation expense, amortization of intangibles and the resulting income-tax effects. GAAP EPS was $0.11, compared with $0.39 in the year-ago quarter.

Results by Segment

By type:

Source: Company reports/Coresight Research[/caption]

2Q20 Results

Salesforce reported fiscal 2Q20 revenues of $4.00 billion, up 21.8% (up 23% in constant currency) and in line with the $3.96 billion consensus estimate.

Adjusted EPS was $0.66,down 6.9% year over year and beating the $0.47 consensus estimate. This figure includes adjustments for stock compensation expense, amortization of intangibles and the resulting income-tax effects. GAAP EPS was $0.11, compared with $0.39 in the year-ago quarter.

Results by Segment

By type:

Source: Company reports/Coresight Research[/caption]

2Q20 Results

Salesforce reported fiscal 2Q20 revenues of $4.00 billion, up 21.8% (up 23% in constant currency) and in line with the $3.96 billion consensus estimate.

Adjusted EPS was $0.66,down 6.9% year over year and beating the $0.47 consensus estimate. This figure includes adjustments for stock compensation expense, amortization of intangibles and the resulting income-tax effects. GAAP EPS was $0.11, compared with $0.39 in the year-ago quarter.

Results by Segment

By type:

- Subscription and support revenues were $3.75 billion, up 22.4% year over year.

- Professional services and other revenues were $252 million, up 14.0% year over year.

- Sales cloud revenues were $1.13 billion, up 12.5% year over year.

- Service cloud revenues were $1.09 billion, up 2.19% year over year.

- Salesforce platform and other revenues were $912 million, up 28.1% year over year.

- Marketing and commerce cloud revenues were $616 million, up 36.3% year over year.

- Americas revenues were $2.82 billion, up 20.4% year over year.

- Europe revenues were $786 million, up 25.0% year over year.

- Asia Pacific revenues were $395 million, up 25.8% year over year.

- Management commented that an enormous wave of digital transformation is sweeping every industry, and Salesforce aims to help propel that growth.

- New customers in the quarter include AXA, FedEx and UniCredit. Other notable customers were Union Pacific Railroad and Airbnb.

- Salesforce believes its Customer 360 platform forms the heart of the Fourth Industrial Revolution, in which everyone and everything will be connected.

- The Customer 360 platform supports sales, service, marketing, commerce, communities, integration and apps, with services such as artificial intelligence and support for vision and voice, mobility and security, available to every customer, every app and everywhere.

- Product milestones include four million sales opportunities, 4.3 million leads generated, 77 million service-case interactions logged, 4.1 billion messages and e-mails sent, 4.2 million orders processed, 53 million reports and dashboards and 700 million e-commerce pages created every day.

- Salesforce’s AI offerings include Einstein, Salesforce Einstein and Customer 360, and the platform now generates 8.6 billion Einstein predictions a day, and Einstein Voice and Einstein Vision are available to every Salesforce app.

- Revenues of $16.75-16.90 billion (up 26%-27% year over year).

- Adjusted EPS of $2.82-2.84 (up 5% year over year) and down from the previous $2.88-2.90 guidance.

- Revenues of $4.44-4.45 billion (up 31%).

- Adjusted EPS of $0.65-0.66 (up 7-8%).