albert Chan

[caption id="attachment_85905" align="aligncenter" width="660"] Figures are statutory

Figures are statutory

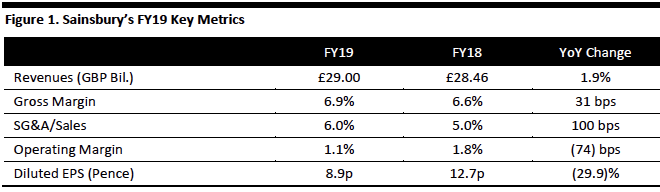

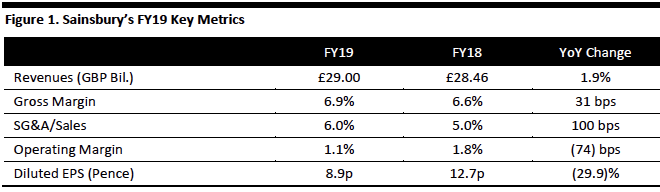

Source: Company reports/Coresight Research[/caption] FY19 Results Sainsbury’s reported FY19 adjusted profits ahead of expectations, but comparable sales continued to slide in the final quarter. Following the company’s abandonment of a merger with rival Asda, management outlined plans to invest in stores and technology. Adjusted Retail EBIT of £692 million was up 10.7% and ahead of the consensus estimate of £661 million recorded by StreetAccount. Adjusted pretax profit of £635 million was up 7.8% and versus consensus of £626 million. Excluding adjustments, operating profit was down nearly 40% and pretax profit was down nearly 42%. Net profit declined 29.2%, resulting in a near-30% fall in statutory diluted EPS. Adjustments included £118 million related to defined-benefit pension expenses due to the need to equalize historical pensions between men and women; £81 million in restructuring costs related to changes in management and store colleague structures and working practices; £70 million in Sainsbury’s Bank costs related to transitioning to a new platform; £46 million related to transaction costs for the failed Asda merger; £40 million in Argos integration costs, which concludes the three-year cost of integrating Argos; £22 million in property-related costs; plus, £19 million in other costs. Group revenue of £29.01 billion was up 1.9% and came in marginally ahead of expectations of £28.9 billion. However, comparable sales continued to slide: Comps were down 0.9% in the final quarter versus down 1.1% in 3Q19. Full-year comp growth came in at (0.2)%. For FY19, total sales were up 0.6% in grocery (helped by a small number of openings of supermarkets and convenience stores), flat in general merchandise and down 0.8% in clothing. Total retail sales ex fuel were up 0.4% for the full year. By channel, total sales were up 1.0% in supermarkets, up 3.7% in convenience stores and up 6.9% online. Following the failure of the Sainsbury’s-Asda merger, Sainsbury’s is under pressure to outline how it will improve its top-line performance. In its FY19 results, management said the company will invest to improve over 400 supermarkets in FY20 and will increase investment in technology to improve convenience for shoppers. It also made a new commitment to reduce net debt by at least £500 million over the next three years. Management pointed to the company’s existing five-pronged strategy:

Figures are statutory

Figures are statutorySource: Company reports/Coresight Research[/caption] FY19 Results Sainsbury’s reported FY19 adjusted profits ahead of expectations, but comparable sales continued to slide in the final quarter. Following the company’s abandonment of a merger with rival Asda, management outlined plans to invest in stores and technology. Adjusted Retail EBIT of £692 million was up 10.7% and ahead of the consensus estimate of £661 million recorded by StreetAccount. Adjusted pretax profit of £635 million was up 7.8% and versus consensus of £626 million. Excluding adjustments, operating profit was down nearly 40% and pretax profit was down nearly 42%. Net profit declined 29.2%, resulting in a near-30% fall in statutory diluted EPS. Adjustments included £118 million related to defined-benefit pension expenses due to the need to equalize historical pensions between men and women; £81 million in restructuring costs related to changes in management and store colleague structures and working practices; £70 million in Sainsbury’s Bank costs related to transitioning to a new platform; £46 million related to transaction costs for the failed Asda merger; £40 million in Argos integration costs, which concludes the three-year cost of integrating Argos; £22 million in property-related costs; plus, £19 million in other costs. Group revenue of £29.01 billion was up 1.9% and came in marginally ahead of expectations of £28.9 billion. However, comparable sales continued to slide: Comps were down 0.9% in the final quarter versus down 1.1% in 3Q19. Full-year comp growth came in at (0.2)%. For FY19, total sales were up 0.6% in grocery (helped by a small number of openings of supermarkets and convenience stores), flat in general merchandise and down 0.8% in clothing. Total retail sales ex fuel were up 0.4% for the full year. By channel, total sales were up 1.0% in supermarkets, up 3.7% in convenience stores and up 6.9% online. Following the failure of the Sainsbury’s-Asda merger, Sainsbury’s is under pressure to outline how it will improve its top-line performance. In its FY19 results, management said the company will invest to improve over 400 supermarkets in FY20 and will increase investment in technology to improve convenience for shoppers. It also made a new commitment to reduce net debt by at least £500 million over the next three years. Management pointed to the company’s existing five-pronged strategy:

- Differentiate through quality, value and service. Management said customers rate Sainsbury’s food quality as market-leading and that it outperforms in premium private label. It aims to offer distinctive and exclusive grocery products.

- Grow sales in general merchandise and clothing. In FY19, Argos grew sales by an unspecified amount while Sainsbury’s general merchandise sales declined as it streamlined its ranges in favor of Argos. The company combined its Sainsbury’s and Argos General Merchandise teams in FY19. The company’s clothing brand, Tu, saw sales decline in FY19 as Sainsbury’s removed a key promotional event; full-price brand sales grew 12%.

- Offer customers easy access to financial services. Customer numbers increased 5% at Sainsbury’s Bank and 6% at Argos Financial Services in FY19.

- Generate efficiencies to invest in its digital future. One example of efficiencies has been integrating Argos, which has yielded £220 million of cost savings. The creation of one general merchandise team in FY19 will drive further efficiencies in the supply chain, management said. The company is developing new technologies for customers and colleagues: It has rolled out SmartShop self-scan to more than 100 stores and is trialing a checkout-free store in London.

- Strengthen the balance sheet. As noted above, the company introduced a new target of reducing net debt by at least £600 million over the next three years, which the company says it will achieve through a disciplined approach to cash generation and capital allocation.