Source: Company reports/Fung Global Retail & Technology

FY17 Results

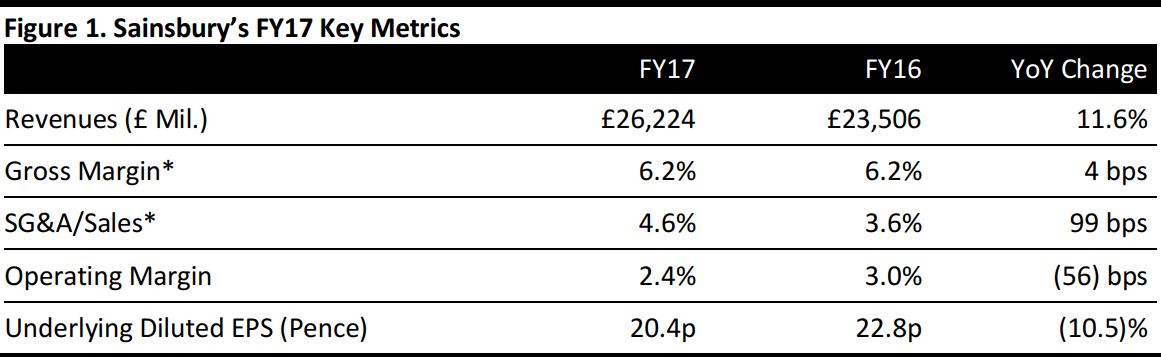

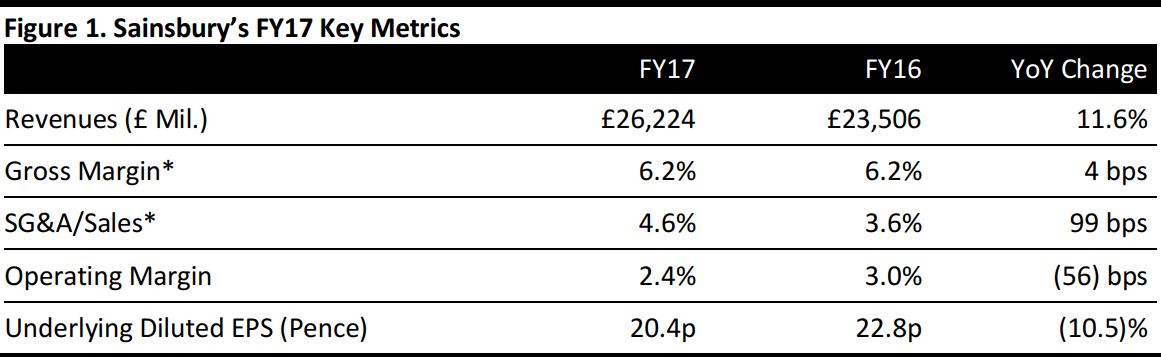

Sainsbury’s, the UK’s second-biggest grocery retailer, reported topline numbers that were slightly ahead of consensus and EPS that was inline with consensus. Nevertheless, it was a weak year for the group, whose scale had been boosted by the acquisition of Argos in September 2016. The figures below relate to the combined entity.

- Group revenues were up 11.6%. Argos contributed 14.5% to group revenue growth, while negative comps at Sainsbury’s, declining fuel sales and the disposal of pharmacy operations dragged on topline results.

- Operating profit tumbled 9.2%, and missed consensus. Operating profitability was impacted by lower comps, unspecified “investment in the customer offer” and cost inflation.

- The company said that retail underlying operating profit fell by 1.4%. This measure excludes financial services.

- Underlying diluted EPS fell by 10.5%.

The Sainsbury’s grocery chain saw comps excluding fuel fall by 0.6% in FY17, with such comps down 1% in 1H17 and down 0.1% in 2H17. Total online grocery sales rose by 8% and convenience-store sales rose by 6%. The company noted that the trend of consumers buying groceries across channels and formats “place[s] pressure on volumes” in its supermarkets.

The Sainsbury’s chain grew general merchandise sales by “over 2%” and clothing sales by “over 4%,” implying meaningful declines in its grocery sales.

Argos comparable sales were up 4.1% in 2H17 (1H17 comps were not declared, as Argos was not acquired until 2H17). Argos contributed £3.11 billion of sales (including VAT) and £77 million of underlying profit before tax. To provide fuller information, the company said that Argos made a loss in the pre-acquisition first half, and that its full-year profit contribution would have been £45 million.

Outlook

In FY18, Sainsbury’s expects group underlying profit to be higher in the second half, due to the consolidation of the first-half Argos operating loss (put simply, the chain makes its profits at Christmas), the annualization of FY17 price investment and the recent step-up in cost inflation.

In FY18, the company expects cost inflation in the 2%–3% range and efficiency savings of around £145 million. Sainsbury’s says it remains on track to deliver savings of £500 million over three years by the end of FY18, and that it is developing plans to deliver a further £500 million in cost savings over the three years beginning FY19. The company expects depreciation and amortization of around £700 million, an increase of around £70 million, as a result of the consolidation of a full year of Argos.

The company reported a reduction in net debt and high levels of liquidity in FY17. Net debt was £1,477 million at year-end, down £349 million in the year.

For FY18, analysts expect the company to grow revenues by 7.7%, but for EBIT to fall a further 1.7% and for underlying diluted EPS to decline by 4%.