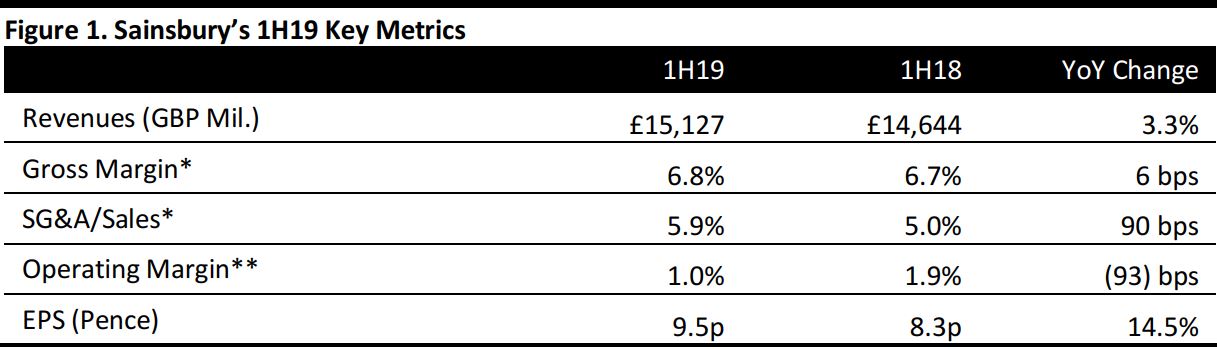

*Sainsbury’s includes some selling and general expenses within cost of sales rather than SG&A.

**Statutory

Source: Company reports/Coresight Research

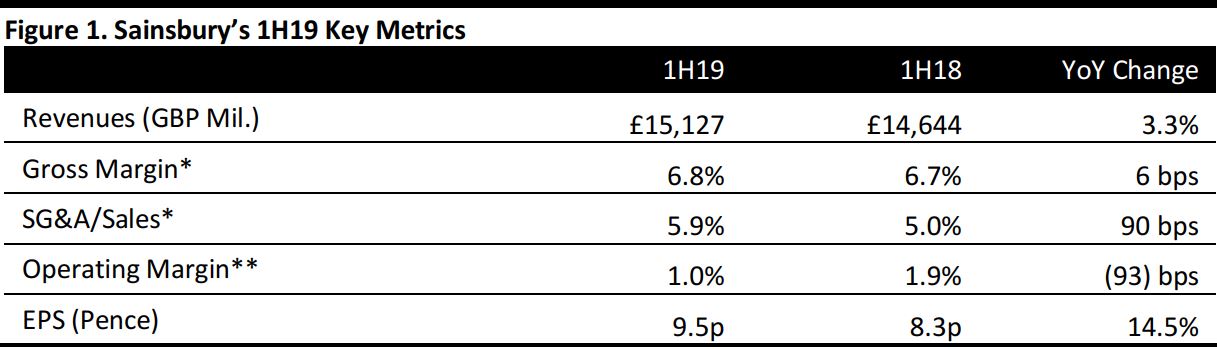

*Sainsbury’s includes some selling and general expenses within cost of sales rather than SG&A.

**Statutory

Source: Company reports/Coresight Research

1H19 Results

Sainsbury’s, the UK’s second-biggest grocery retailer, reported that comparable sales were up 0.6% in 1H19, split as 0.2% in 1Q19 and 1.0% in 2Q19. That 2Q19 comp was in line with the consensus estimate reported by StreetAccount.

Total group retail sales excluding fuel and the impact of the company’s sale of its pharmacy business were up 1.2% in 1H19. Grocery sales were up 1.2% and general merchandise sales were up 1.5%, while clothing sales were down 1.0%. Total revenues of £15.1 billion came in ahead of the consensus estimate of £14.6 billion.

Adjusted operating profit rose by 14.7% year over year, to £351 million. This adjusted metric strips out costs related to the integration of both Sainsbury’s Bank and Argos, retail restructuring costs, transaction costs associated with the Asda merger, and property-related costs. However, statutory operating profit slumped by 46.3% year over year, to £152 million, yielding the sharp decline in operating margin shown in the table above.

Adjusted pretax profit of £302 million was ahead of expectations of £287 million. Statutory net profit was down 13.3% year over year, impacted by the costs noted above.

Management Commentary

Management noted “continued pressure on general merchandise margins” and said that clothing sales at Sainsbury’s fell in 1H19 due to changes in promotion phasing. Online grocery sales increased by nearly 7% year over year and convenience store sales were up by more than 4%.

Management pointed to efforts to maximize productivity in Sainsbury’s stores, which included repurposing food space and adding Argos stores inside Sainsbury’s stores: the company opened 60 Argos stores in Sainsbury’s supermarkets in 1H19.

The company delivered Argos EBITDA synergies of £63 million in 1H19, bringing the cumulative total for synergies to £150 million in EBITDA. Management further remarked that since the end of 1H19, the company has realized the £160 million Argos EBITDA synergy target, nine months ahead of schedule.

Outlook

Management remarked that the consumer outlook is “uncertain” and that the grocery, general merchandise and clothing markets continue to be highly competitive and promotional. Management confirmed that it is on track to deliver the consensus expectation of adjusted pretax profit of £634 million in FY19.

For FY19, analysts expect Sainsbury’s to grow revenues by 1.3%, to £28.8 billion, according to S&P Capital IQ.

*Sainsbury’s includes some selling and general expenses within cost of sales rather than SG&A.

**Statutory

Source: Company reports/Coresight Research

*Sainsbury’s includes some selling and general expenses within cost of sales rather than SG&A.

**Statutory

Source: Company reports/Coresight Research