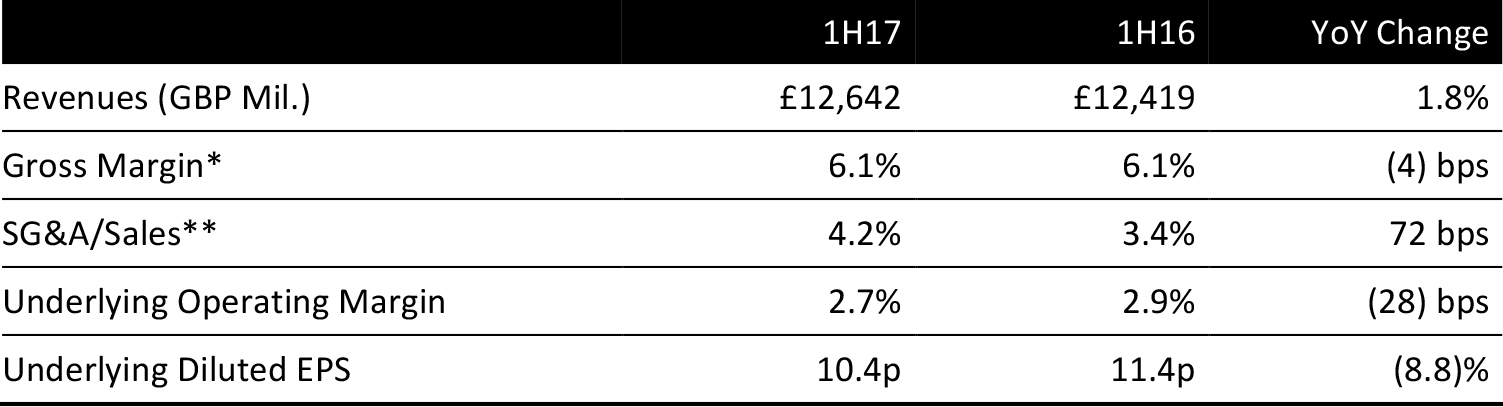

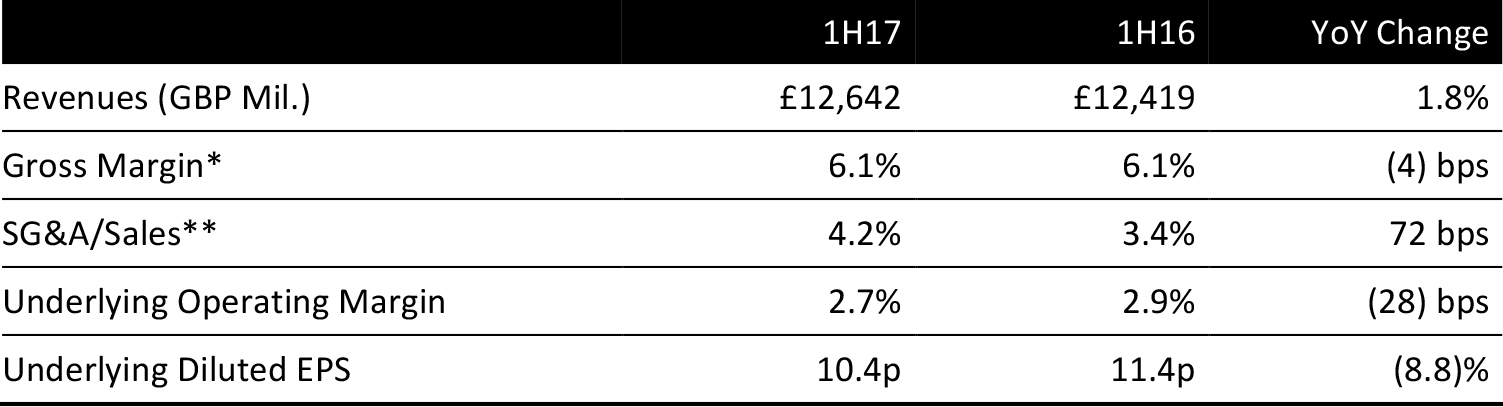

*Cost of sales consists of all costs to the point of sale including warehouse and transportation costs and all the costs of operating retail outlets.

**Administrative expenses only.

Source: Company reports/Fung Global Retail & Technology

1H17 RESULTS

UK grocery retailer Sainsbury’s reported 1H17 revenues of £12.6 billion, ahead of consensus of £12.4 billion recorded by S&P Capital IQ. The results covered the 28 weeks ended September 24. Revenues included £235 million of sales from Argos, which Sainsbury’s acquired during the quarter, and which may not have been factored in to all analysts’ estimates.

From this, we can infer that Sainsbury’s-only revenues were £12,407 in 1H17, representing year-over-year growth of (0.1)%.

Excluding one-off items such as profits on disposal of property, operating profit fell 7.9%, pre-tax profit fell 10.1% and diluted EPS fell 8.8%. Underlying diluted EPS of 10.4 pence was ahead of analysts’ expectations of 10.2 pence.

On a reported basis, including one-off items, pre-tax profit climbed 9.7% and EPS jumped 8.8%.

NONFINANCIAL METRICS

Sainsbury’s reported the following:

- It lost 6 basis points of market share in grocery on a 52-week rolling basis.

- It grew general merchandise by nearly 5%.

- In a tough apparel market, the company grew clothing sales by nearly 1%.

- Online grocery sales grew by 8%, with e-commerce contributing around £1.3 billion of annualized sales.

- Same-day grocery deliveries will be available from 30 stores by Christmas.

- Sainsbury’s convenience stores grew sales by more than 5%, with these stores contributing around £2.4 billion of annualized sales.

ARGOS

On September 2, around three weeks before the end of 1H17, Sainsbury’s acquired Home Retail Group (HRG), whose principal operation was general merchandiser Argos. Argos brings around £4.1 billion in annual sales to the Sainsbury’s group. We highlight some metrics reported by the company:

- Argos contributed £235 million of sales during the period.

- The acquired company contributed £1 million of underlying profit before tax during the period.

- Net cash included in the HRG transaction helped reduce Sainsbury’s net debt by £485 million to £1.3 billion in 1H17.

Sainsbury’s expects the following synergies to arise from its acquisition over the next three years:

- Some £75 million will be gained by relocating Argos stores into Sainsbury’s supermarkets, and from additional sales made through new concessions in Sainsbury’s supermarkets.

- Cost synergies from central and support functions will save around £70 million.

- Other synergies, such as selling Sainsbury’s brand nongrocery ranges at Argos, will yield gains of £15 million.

However, the integration will result in £130 million of exceptional costs and £140 million of exceptional capital expenditure over the three-year period.

OUTLOOK

Sainsbury’s company noted that the UK grocery market remains competitive and that “pricing pressures continue to impact margins.” It said that the full impact of the devaluation of the British pound on retail prices is currently uncertain.

The company expects its full-year underlying profit for the combined group to be in line with current consensus. Analysts expect the following for the full year:

- Group sales, including Argos, will rise 9.5% to £25.7 billion.

- Pre-tax profits will rise 13.9%.

- Underlying diluted EPS will fall from 22.8 pence to 20.1 pence.

Sainsbury’s said it anticipates 2H17 underlying profit (excluding the impact of Argos) to be lower than that achieved in the 1H, due to “continued price investment and a step-up in cost inflation in the 2H.” Argos is expected to deliver an underlying profit contribution to the group of £55–75 million in 2H17. Sainsbury’s expects FY17 net debt to be around £1.5bn.

�