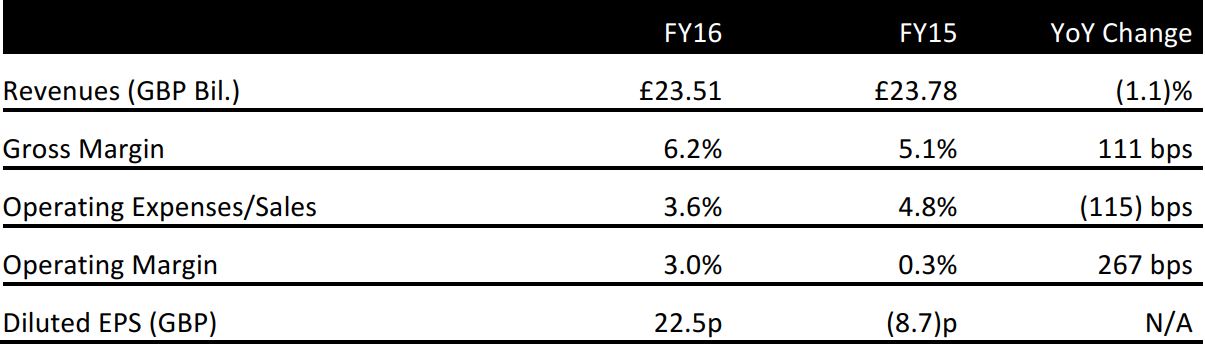

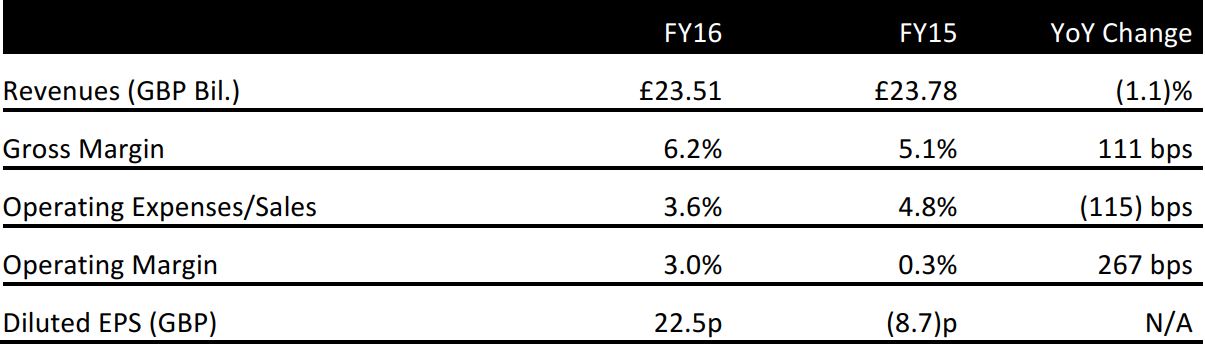

FY16 ended March 12, 2016. FY15 ended March 14, 2015.

Source: Company reports

FY16 RESULTS

Year-over-year changes in J Sainsbury’s FY16 profit measures were impacted by its substantial, £628 million write-downs on its store pipeline in FY15. Stripping out this impairment charge, the company reported the following for FY16:

- Operating margins declined by 31 basis points, from 3.3% in FY15 to 3.0% in FY16.

- Basic EPS declined by 8.3%, from 26.4 pence in FY15 to 24.2 pence in FY16.

Sector deflation and the pressure to invest in lower prices proved to drag on the top line in FY16, with comps down 0.9%, excluding fuel. CEO Mike Coupe noted that J Sainsbury grew volumes and transaction numbers year over year. Price pressures, coupled with operating cost inflation, fed through to lower operating margins, net profit, and EPS on an underlying basis.

Revenues, net profit, and EPS all marginally undershot the consensus estimates recorded by S&P Capital IQ.

The nonfood category proved a bright spot, with clothing sales up 8.5% and general merchandise sales up 3.5%. The recently announced acquisition of Argos will add around £4.1 billion to J Sainsbury’s nongrocery sales. The acquisition is expected to be completed in 3Q16.

GUIDANCE

The company predicted that grocery sector deflation will persist into the second half of the year. Cost inflation is expected to be at the lower end of the 2%–3% range. Net new space is expected to be around 1%, reflecting a slowing of new property openings.

Analysts expect J Sainsbury’s revenues to rise by 0.8% in FY17. The consensus is for net profit to fall by 8 .2% and for diluted EPS to fall by 13.2%.