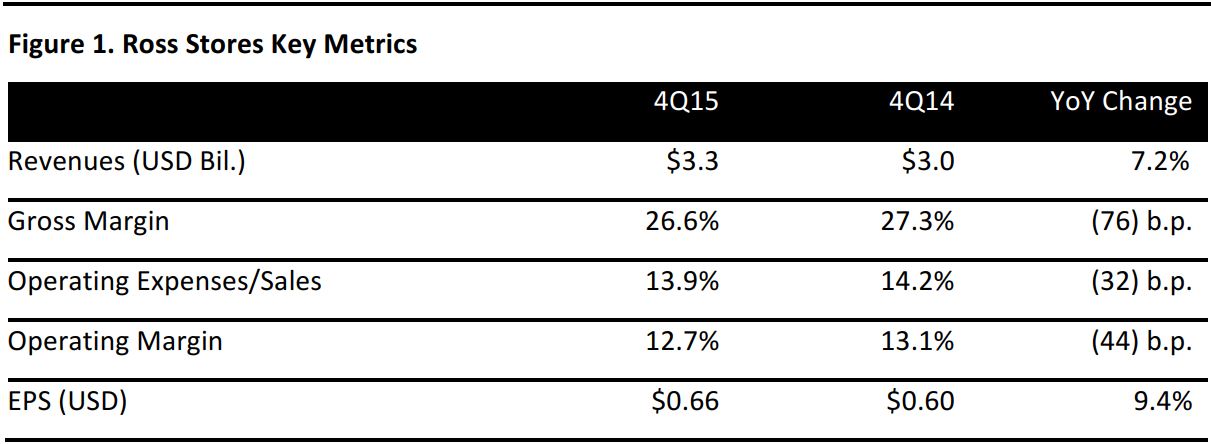

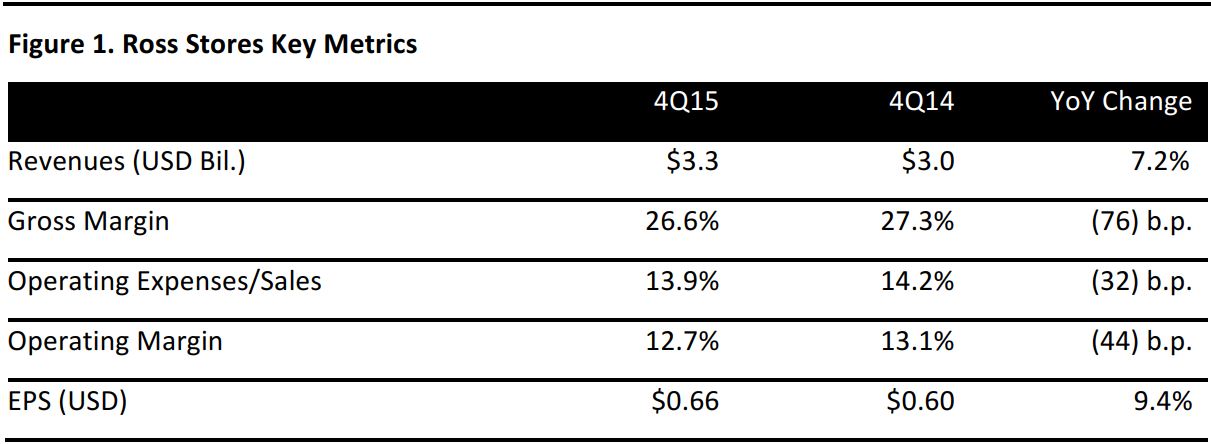

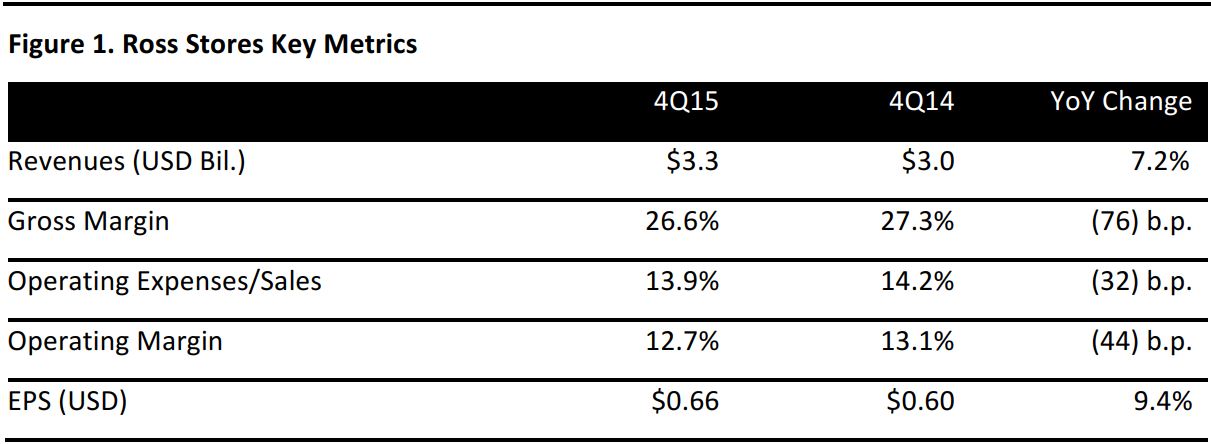

Source: Company reports

4Q15 RESULTS

Ross Stores’ 4Q15 revenues were $3.3 billion, up 7.2% from a year earlier. Sportswear was the top-performing category and the Midwest was the strongest geographic region.

Following an increase of 6% in 4Q14, total comps came in at 4% in 4Q15, which were significantly higher than the 1.4% estimate. Results were driven by both improved traffic and larger average basket size. Management commented that the results exceeded expectations. The operating margin declined to 12.7% from 13.1% due to higher merchandise margin and successful expense control, which were more than offset by the timing of pack away-related costs.

Reported EPS was $0.66, up from $0.60 in the year-ago period and above the $0.64 consensus estimate.

2015 RESULTS

Revenues for 2015 were $11.9 billion, up 8.1% from 2014, and comp sales grew by 4% during the year. EPS rose by 13.5%, to $2.51, following a strong trend seen during past years, and net earnings grew by 10%, to $1.0 billion.

GUIDANCE

While being cautious about its guidance, Ross Stores remains confident about the off-price sector, given that consumers are increasingly seeking value. The company’s caution stems from macroeconomic uncertainties and the competitive retail landscape.

For 2016, the company expects same-store sales growth of 1%–2% and EPS growth of 3%–8%, to $2.59–$2.71.

For the first quarter, the company also expects 1%–2% sales growth, with EPS growth of flat–4%, to $0.69–$0.72. In the year-ago quarter, comp growth was 5% and reported EPS was $0.69.

Guidance for 2016 and the first quarter is below consensus. Analysts expect EPS of $2.76 and $0.76 for the full year and first quarter, respectively, along with comp growth of 2.4% and 2.8% for the respective periods.

The company plans to open 22 new Ross Dress for Less stores and six dd’s Discount stores in the first quarter.