Source: Company reports/FGRT

3Q17 Results

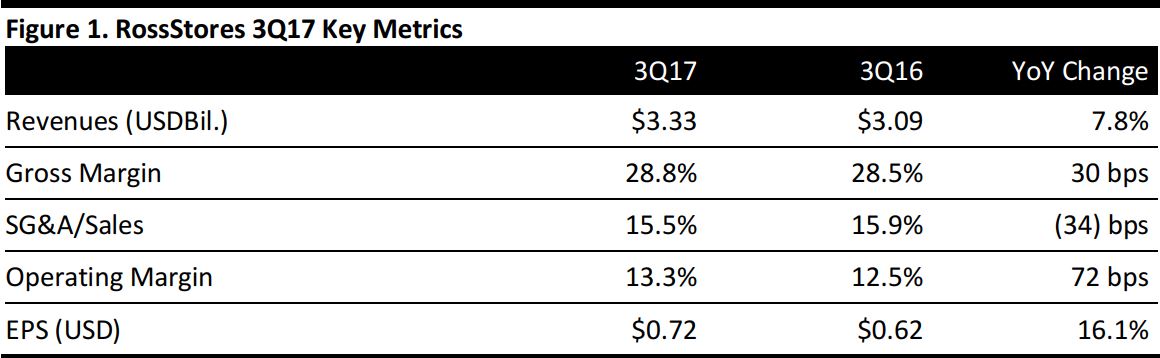

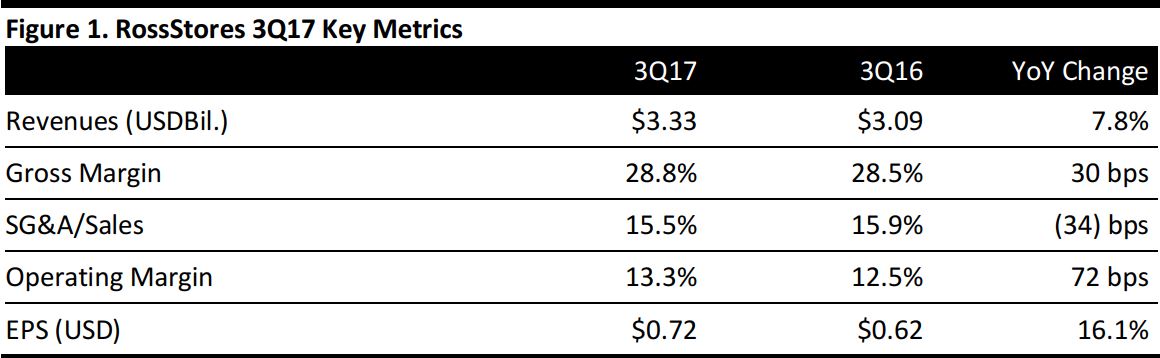

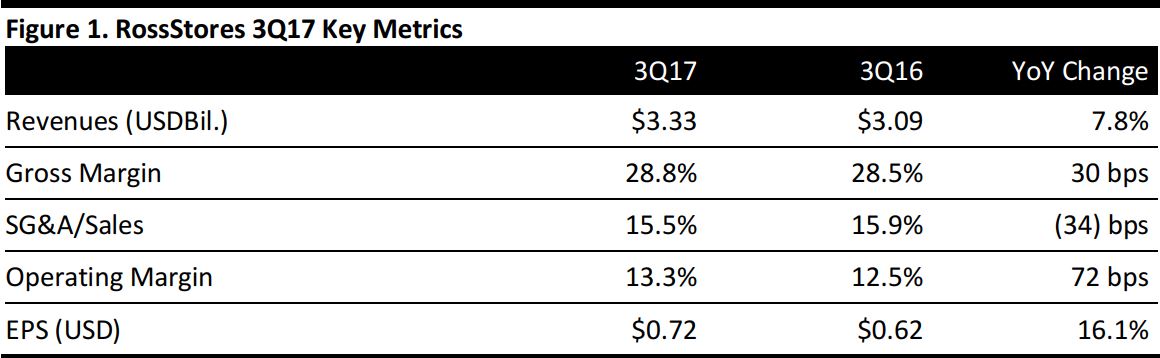

Ross Stores reported 3Q17 EPS of $0.72, up 16.1% from the year-ago quarter and beating the $0.67 consensus estimate. Revenues rose by 7.8% year over year, to $3.33 billion, ahead of the $3.26 billion consensus estimate.

Comp sales increased by 4% on top of a 4% gain in the year-ago quarter and ahead of the 2% consensus estimate.Children’s was the best-performing merchandise category at Ross Dress for Less.

Merchandise sales trends were consistent across all major geographic regions during the quarter.The Midwest was the strongest-performing region.

DD’s Discounts posted better-than-expected gains in both sales and operating profit. At the end of the quarter, consolidated inventories were up 4% year over year, while average in-store inventories were flat. Packaway accounted for 46% of total inventories, compared with 45% in the year-ago period.

Management stated that the quarter’s 13.3% operating margin exceeded its projections, mainly due to a combination of higher merchandise margin and sales leverage.

The company opened 30 new Ross Dress for Less stores and 10 DD’s Discounts locations in the quarter.

Outlook

The company guided for 4Q17 comp growth of 2%–3% versus 1%–2% previously and the consensus estimate of 2.5%. The company expects fourth-quarter EPS of $0.88–$0.92, up from $0.77 in the prior-year period and versus the $0.92 consensus estimate.

Ross Stores raised its full-year EPS guidance range to $3.24–$3.28 from $3.16–$3.23 previously. The consensus estimate calls for FY17 EPS of $3.23.

The company’s guidance for both the fourth quarter and full year includes an approximate $0.08 benefit from the additional week in fiscal 2017.