Source: Company reports/FGRT

2Q17 Results

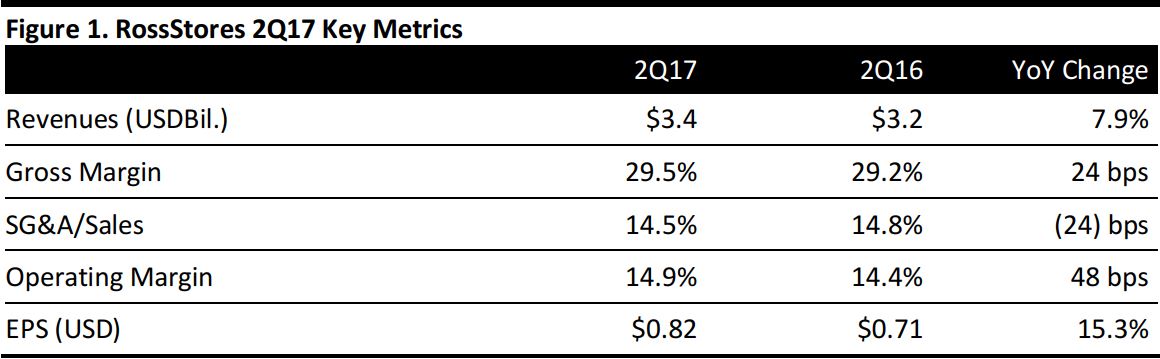

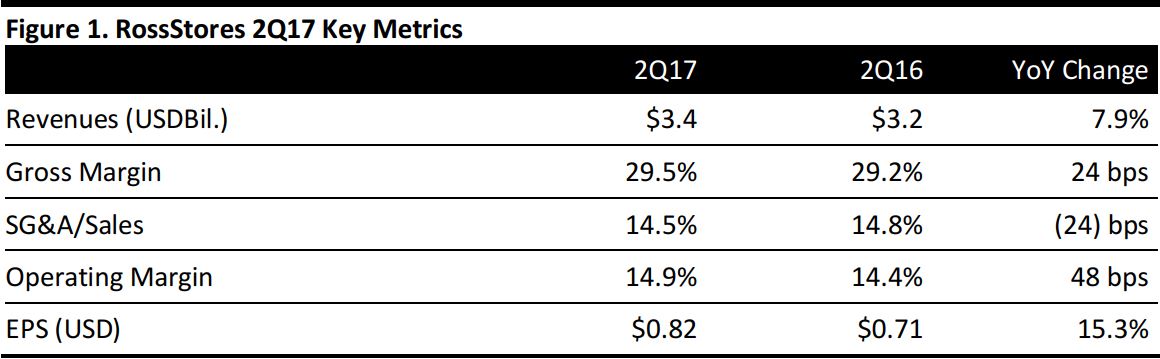

Ross Stores reported 2Q17 revenues of $3.43 billion, up 7.9% year over year and beating the $3.37 billion consensus estimate.

Comps increased by 4%, beating both the 2.0% consensus estimate and guidance of 1%–2%, following 4% comps in the year-ago quarter.

EPS was $0.82, up from $0.71 in the year-ago quarter and beating the $0.77 consensus estimate.

Management issued positive comments on strong sales and earnings growth and stated that the quarter’s 14.9% operating margin exceeded projections, mainly due to a combination of higher merchandise margin and sales leverage.

Details from the Quarter

- Merchandise sales trends were broad-based across all major geographic regions during the quarter.

- The Midwest and Southeast were the strongest regions.

- Shoes were the best-performing merchandise category at Ross Dress for Less (Ross).

- DD’s Discounts posted better-than-expected gains in both sales and operating profits.

- At the end of the quarter, consolidated inventories were up 3% year over year, with average in-store inventories up slightly. Packaway was 46% of total inventories, compared with 47% a year ago.

- The company opened 21 new Ross stores and seven DD’s Discounts locations in the quarter.

- For the 2017 fiscal year, the company plans to open a total of about 70 new Ross locations and 20 DD’s Discounts locations.

Outlook

Management commented that it is facing challenging year-over-year comparisons against a volatile retail backdrop in the second half of the year, which prompted its somewhat cautious outlook.

For 3Q17, the company expects:

- Comps of 1%–2%, following 7% comps in the year-ago quarter.

- EPS of $0.64–$0.67, up from $0.62 in the year-ago quarter and compared with consensus of $0.67.

For 4Q17, the company expects:

- Comps of 1%–2%, versus consensus of 1.5% and following 4% comps in the year-ago quarter.

- EPS of $0.88–$0.92, up from $0.77 in the year-ago quarter.

For FY17, the company expects:

- Adjusted EPS of $3.16–$3.23, up from prior guidance of $3.07–$3.17, in line with the consensus estimate of $3.17. This figure includes an $0.08 per share net gain due to a 53-week business year.