Source: Company reports

2Q16 RESULTS

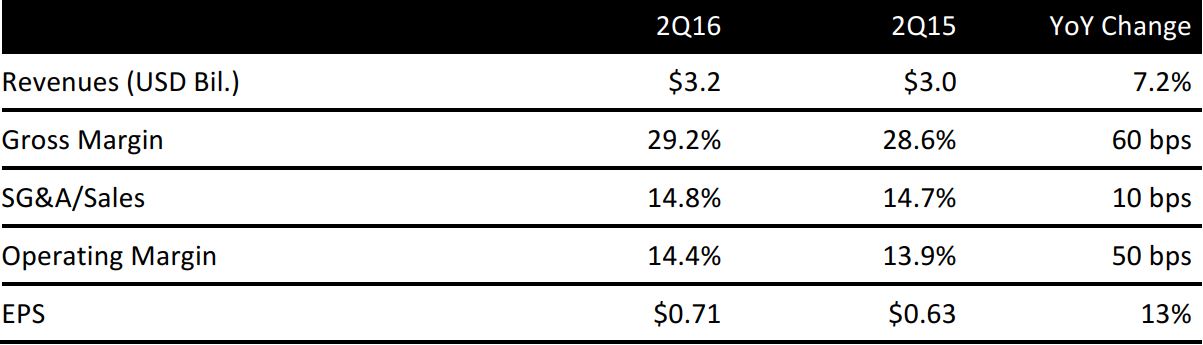

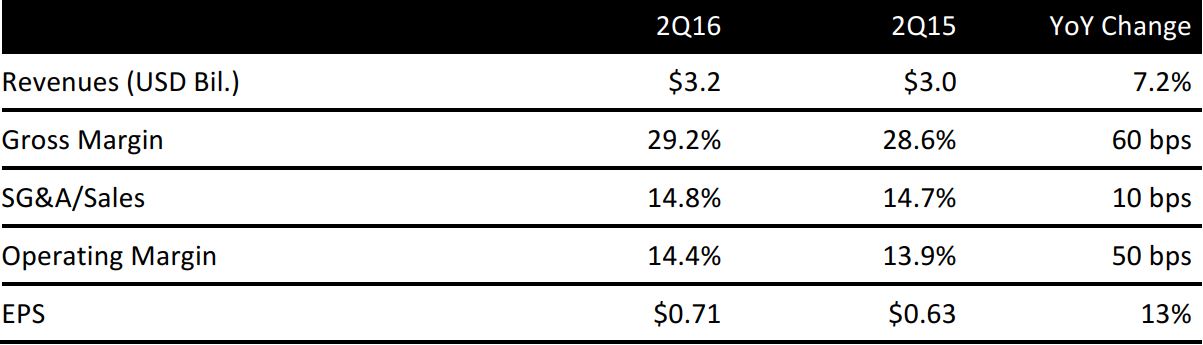

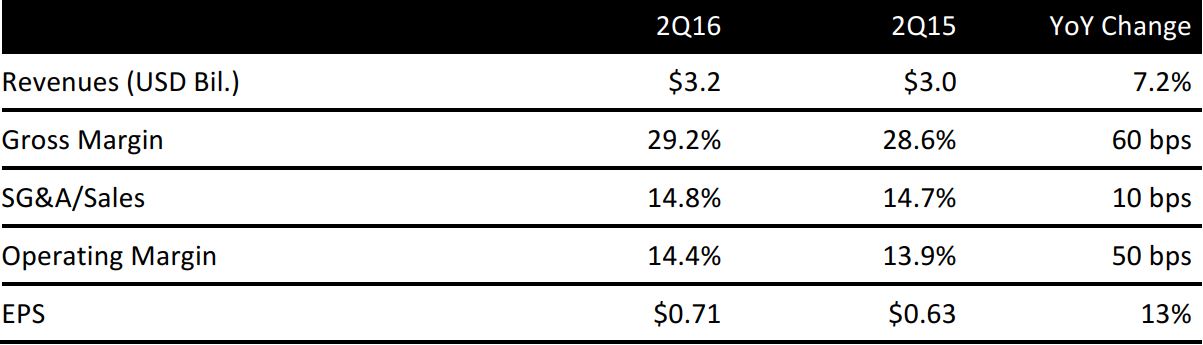

Ross Stores reported 2Q16 EPS of $0.71 and beat the consensus estimate of $0.67 and was up 13% from last year. Reported revenues were $3.2 billion, up 7% year over year and exceeded expectations of $3.1 billion. Both sales and earnings results were better than expected.

California and the Midwest were the strongest performing regions. Shoes and housewares were the strongest performing categories. July sales were slightly better than June and May. Inventories were up 3% and in-store inventories were down 1% compared to last year, and total sales grew at 7%.

The ladies apparel business saw some improvement but struggled in the spring. Total comps were up 4.1% and beat estimates of 2.1% and prior management guidance of 1%–2%, driven by increases in traffic and average basket size.

2016 OUTLOOK

Looking ahead, Ross Stores expects EPS of $0.52–$0.55 and comp sales growth of 1%–2% for 3Q16, both below consensus. Total sales are projected to grow 4%–5% for the quarter. For 4Q16, the company expects EPS of $0.73–$0.76 and comp sales growth of 1%–2%.

Management slightly lowered guidance for the fiscal year and guided for EPS of $2.69–$2.75 versus the prior guidance of $2.63–$2.72, up 14% from last year. In the long term, the firm will strive to achieve low double-digit EPS growth based on a 3%–4% comps target. Management said they provided relatively conservative guidance given the current challenging retail environment and macroeconomic uncertainties.

Management also shared the firm’s store expansion plan. The company is on track to open 70 new Ross stores and 20 dd’s DISCOUNTS stores in 2016. It opened 24 new Ross stores and 7 dd’s DISCOUNTs in 2Q16 and plans to add another 25 Ross stores and 9 dd’s DISCOUNTs locations in 3Q16. A key area of new expansion is the Midwest where the company has seen consistently strong sales for the past 1.5 years.

Ross Stores will continue to improve its merchandise offerings, particularly in the women’s apparel area. Management said they are confident there are plenty of products available in the marketplace which provide flexibility for the company to offer fashionable merchandise at bargain prices. Management also shared its plan to continue inventory reductions. Its inventory level is down 40% since the company started the initiative.

Rising labor costs, which increased 7%–10% year-to-date, is another headwind for Ross Stores. Going into 2017, improved business efficiencies and reduced labor-related costs will be an important part of the company’s business plan.