Source: Company reports/Fung Global Retail & Technology

1Q17 Results

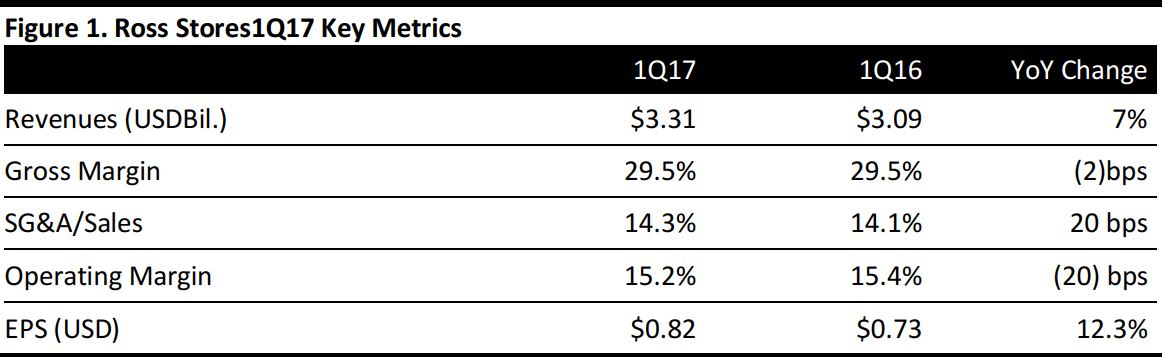

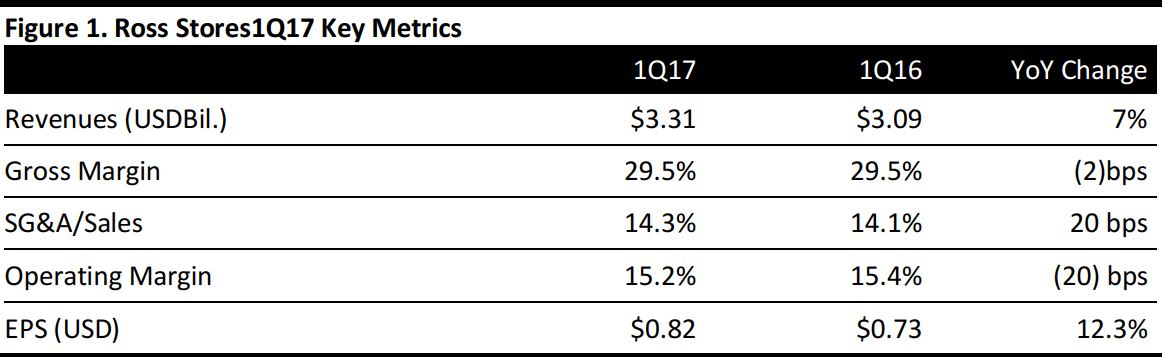

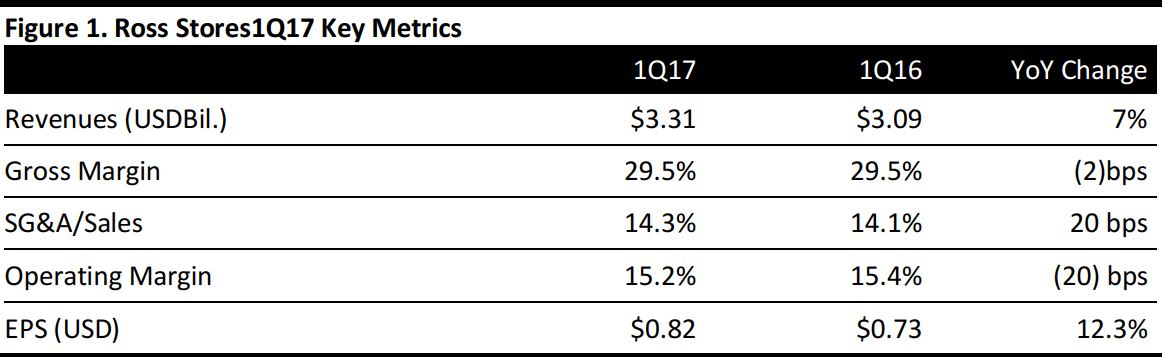

Ross Stores reported 1Q17 EPS of $0.82, up 12.3% from the year-ago quarter and above the $0.80 consensus estimate. Total revenues were $3.31 billion, up 7% year over year and exceeding analysts’ expectations of $3.27 billion.

Total comps increased by 3% for the quarter, beating the 2.4% consensus estimate; comp growth was driven by higher traffic as well as an increase in average basket size. The company saw sales gains across most merchandise categories and geographic regions. Southeast Florida and the Midwest were the top-performing regions. The DD’s Discounts banner saw continued solid growth in same-store sales and operating profits in the first quarter.

The company reported an operating margin of 15.2%, driven by merchandise margins that improved by 15 basis points.Inventories were up 6%and in-store inventories were down slightly compared with the same quarter last year.

Ross Stores’ store expansion program remained on track, and the company added 23 new Ross Dress for Less stores and five DD’s Discounts stores during the quarter. Management noted that it faced a difficult prior-year comparison and uncertainty in the political, macroeconomic and retail climates, but that over the longer term, the off-price sector will remain a strong retail performer, as consumers will continue to seek value.

FY17 Outlook

The company raised its FY17 EPS guidance to $3.07–$3.17 from $3.02–$3.15, compared with EPS of $2.83 in FY16; consensus calls for full-year EPS of $3.15. The EPS forecast includes an approximate benefit of $0.08 per share due to the 53rd week in FY17.

Ross Stores expects 2Q17 EPS of $0.73–$0.76, slightly below the $0.78 consensus estimate and compared with $0.71 last year. The company expects 2Q17 comps to increase by 1%–2% on top of a 4% gain last year. The company expects a 2Q17 operating margin of 13.9%–14.1%, down from 14.4% in the year-ago period, reflecting management’s forecast for higher freight and wage costs.

Ross Stores will continue its store expansion program. The company plans to open a total of 90 new locations in FY17 (70 Ross Dress for Less stores and 20 DD’s Discounts stores).